US Healthcare/Hospital Food Services Market: Growth, Size, Share, and Trends

US Healthcare/Hospital Food Services Market by Type (Patient Dining (Clinical Nutrition, Regular Diet), Retail Services, Vending), Settings (Acute Hospitals, ASC, Long-term care Facilities, Skilled Nursing Facilities, Physician Office) - Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The US healthcare/hospital food services market is projected to reach USD 33.57 billion by 2029 from USD 19.84 billion in 2024, at a CAGR of 11.1% during the forecast period. The U.S. hospital food services market is driven by growing emphasis on food safety, hygiene, and nutrition standards within healthcare facilities. Rising regulatory requirements, increasing patient demand for safe and high-quality meals, and the adoption of advanced food handling and monitoring technologies are expected to propel market growth over the forecast period

KEY TAKEAWAYS

-

BY TYPEBased on type, the US healthcare/hospital food services market is segmented into patient & dining services, retail services, vending & shops (micro-markets), and other services. The patient & dining services setting segment is the largest in the US healthcare/hospital food service market, because of their prime position in patient care, satisfaction, and recovery

-

BY SETTINGBased on setting, the US healthcare/hospital food services market is segmented into acute care settings, post-acute care settings, and non-acute care settings. The acute care settings segment accounted for the largest share of the US healthcare/hospital food services market in 2023, fueled by high patient volumes, extended inpatient stays, and the critical nature of dietary management

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies including partnerships and collaborations. For instance,In November 2024, Sodexo acquired CRH Catering, further accelerating convenience growth in North America in the first half of 2025. This move will help Sodexo tap into the fast-growing USD 30 billion convenience food market in the US, where people are looking for easy, quick, and ready-to-eat meal solutions.

A combination of demographic, medical, and lifestyle factors is fueling growth in the U.S. hospital food services market. An aging patient population, rising prevalence of diet-related chronic conditions, and increasing focus on food safety and nutrition are driving demand for advanced meal preparation, hygiene, and technology-driven food service solutions across healthcare facilities.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The U.S. hospital food services market is undergoing significant transformation, driven by emerging trends and technological disruptions. Personalized nutrition programs tailored to patient health needs, integration of AI and digital platforms for menu planning and operational efficiency, and a growing focus on sustainable, eco-friendly food sourcing and waste reduction are reshaping how hospitals deliver safe, high-quality meals while optimizing costs and patient satisfaction.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing prevalence of and awareness about chronic diseases

-

Growing focus on improved patient food experience

Level

-

Reluctance among OPD patients to pay for food services

-

Staff shortages

Level

-

Rising adoption of diverse food menus

-

Low adoption of food service outsourcing by healthcare settings

Level

-

Complexity of patient nutritional issues

-

Managing operational efficiency

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing prevalence of and awareness about chronic diseases

The rising prevalence and awareness of chronic diseases are the primary factors propelling the US healthcare or hospital food services market, as healthcare facilities focus on nutritional interventions to promote patient recovery and long-term health management. Due to chronic diseases such as diabetes, cardiovascular diseases, obesity, hypertension, and kidney disorders requiring tailored dietary plans with respect to medical treatments, hospitals have developed specialized diet chains. Growing recognition of the role of diet in the prevention and treatment of diseases has focused attention on therapeutic nutrition, with hospitals building hospital menus designed by dietitians and nutritionists to meet the diverse needs of patients. This is followed by the rising public knowledge of preventive healthcare. Hospitals will undertake healthier food offerings, portion pole strategies, and nutrient-dense meal plans for the benefit of patients and visitors alike.

Restraint: Reluctance among OPD patients to pay for food services

One of the major constraints for hospital food services in the US is OPD patients’ aversion toward food services. Unlike inpatients, OPD members are accustomed to receiving meals free of charge when they undergo hospitalization. Generally, OPD patients visit hospitals for very short periods and do not view hospital food services as a necessary expense. Many prefer taking their food from home, eating outside hospitals, or eating from vending machines or fast-food outlets. Such a situation limits the demand for hospital meal services that can be bought. The patients opting for less expensive dining alternatives that can be used most frequently are that they are discouraged from spending on hospital meals. They cannot pay either on account of no coverage or reimbursement by any insurance over OPD meals. Moreover, the average perception by outpatients is that food is of poor quality, reinforced by the knowledge that the primary purpose of food is to support dietary restrictions on inpatients; therefore, this inhibits the adoption of outpatient food services.

Opportunity: Rising adoption of diverse food menus

The growing emphasis on standardized menus presents a significant opportunity for the US healthcare and hospital food service markets, as hospitals recognize the importance of accommodating diverse dietary needs, cultural preferences, and patient expectations. This includes adding to the list the role of nutrition in recovery, expanding menus to plant-based meals, gluten-free options, allergen-aware choices, and world cuisines to appeal to their various patient populations. There is also rising demand for personalized meal plans catering to specific medical conditions such as diet for diabetes, heart diseases, renal disorders, cost-effectiveness, etc. The restaurant-style dining experience allows guests to order meals on demand, offering a variety of food options that can satisfy individual tastes and preferences while supporting adherence to prescribed dietary plans.

Challenge: Complexity of patient nutritional issues

The complexity of nutritional assessment and intervention for hospitalized patients will act as the biggest constraint in this market. A customized, multidisciplinary approach to meal planning and delivery should be implemented. The dietary needs of patients in healthcare facilities vary greatly, influenced by factors such as medical conditions, age, allergies, cultural preferences, and personal dietary restrictions. Due to various factors such as diabetes, cardiovascular diseases, kidney issues, and malnutrition, adhering to a proper dietary plan can be quite challenging. Meals must be carefully planned to achieve therapeutic goals while still providing flavor and variety. Additionally, there are complex dietary considerations related to dysphagia; some patients may require careful tube feeding or have specific post-surgery diets. Furthermore, certain patients might be immunocompromised, which necessitates additional dietary precautions. Therefore, it is essential to ensure careful meal preparation methods and very strict safety measures in food handling. Shortened hospital stays and rapid patient turnover complicate food service operations even further; they require a seamless interplay among dietitians, kitchen staff, and healthcare providers to enable timely and effective meal schedule changes

US Healthcare/Hospital Food Services Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Patient-focused nutrition programs and digital patient engagement (menu personalization, nutrition tracking) | Improved patient satisfaction, more personalized meal delivery, alignment of food with clinical nutrition goals. |

|

Room-service/“Positive Impressions” patient experience platform and large system transitions (e.g., Cleveland Clinic, cafe renovations) | Higher patient satisfaction scores, streamlined room-service operations, increased retail sales after café upgrades. |

|

Chef-driven, hospitality-led foodservice programs for hospitals (patient ambassador programs, chef-led menus) | Enhanced patient experience, improved food quality, stronger patient & staff perception of hospitality in care |

|

Turnkey hospital dining transformations (menu redesign, increased outreach to community, data dashboards) | Increased meals served, better food safety compliance, measurable cost savings. |

|

Senior nutrition programs and tailored meal solutions for Medicaid/Medicare populations | Solutions tailored to senior nutrition needs, expansion into home-delivered and managed care meal programs, improved access for vulnerable populations |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem of US healthcare/hospital food services consists of diverse service providers, including large multinational corporations, regional food service companies, and specialized healthcare food management firms. These companies are crucial in delivering patient nutrition, cafeteria services, dietary management, and food safety compliance in hospitals and long-term care facilities. The market operates under different business models, primarily the Direct Service Operational Model, where food service providers manage on-site hospital kitchens, meal preparation, and patient dietary programs, and the Franchise-led Model, where services are provided through third-party vendors or contracted food service operators.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

US Healthcare/Hospital Food Services Market, By Type

Patient and dining services are the largest contributor to the US healthcare/hospital food services market since they are key components of patient care, recovery, and the overall experience in the hospital. High-quality, customized meal service is becoming very much part of treatment in hospitals; they acknowledge that proper nutrition directly affects patient outcomes, quality of life, and satisfaction. Rising chronic diseases, including diabetes, cardiovascular conditions, and obesity, trigger demand for specialized diet programs: low-sodium, diabetic-friendly, and protein-rich diets that are designed to meet individual health needs.

US Healthcare/Hospital Food Services Market, By Setting

Acute care settings hold the largest share of the US healthcare/hospital food services market due to the large number of patients supported by acute hospitals in high-risk situations. Acute care hospitals, including large medical centers, trauma centers, and specialized hospitals, provide services to patients with severe, urgent, and life-threatening conditions that require round-the-clock medical attention and structured nutritional support. These types of patients often have very complicated dieting needs, which in some cases include recovery from surgery, intensive treatments such as chemotherapy, and/or management of diabetes, cardiovascular disease, or kidney disorders. Hence, to be legitimized, hospitals will need to provide more personalized therapeutic meal plans to meet medical prescriptions, dietary restrictions, and recovery goals, which are responsible for driving the demand for highly specialized food service operations.

REGION

US to grow at high rate during forecast period

The United States dominates the healthcare food services market, driven by increasing patient demands for high-quality, healthy meals, rigorous hospital regulations, and food safety and sustainability developments. Leading service providers like Compass Group, Sodexo, and Aramark have capitalized on this demand by offering creative meal solutions that meet dietary requirements, medical conditions, and wellness programs. The heightened emphasis on farm-to-hospital schemes, vegetarianism, and tailored nutrition has also altered the landscape, promoting fresh, local foods.

US Healthcare/Hospital Food Services Market: COMPANY EVALUATION MATRIX

In the U.S. hospital food services market matrix, Compass Group PLC (Star) leads with a strong brand presence, comprehensive offerings across patient meal programs, dietary planning, and facility food management, and deep operational expertise in healthcare settings. The company's continued investment in technology-driven meal solutions, personalized nutrition programs, sustainability initiatives, and workforce training, combined with its nationwide footprint, reinforces its market leadership and premium positioning. AVI Foodsystems, Inc. (Emerging Leader) is rapidly expanding its presence through service diversification, strategic partnerships with healthcare providers, and a growing regional footprint. With focused efforts on high-quality patient meals, food safety, sustainability, and enhanced dining services, AVI Foodsystems is increasingly establishing itself as a competitive force within the hospital food services sector. While Compass Group maintains its dominance through innovation, regulatory compliance, and large-scale operational capability, AVI Foodsystems shows strong potential to move toward the leaders’ quadrant by capitalizing on rising demand for safe, nutritious, and high-quality patient meals across U.S. healthcare facilities

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2023 (Value) | USD 17.91 BN |

| Market Forecast in 2029 (Value) | USD 33.57 BN |

| Growth Rate | CAGR of 11.1% from 2024-2029 |

| Years Considered | 2022-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By type: patient & dining services, retail services, vending & shops (micro-markets), and other services I By Setting: acute care settings, post-acute care settings, and non-acute care settings |

| Regions Covered | US |

WHAT IS IN IT FOR YOU: US Healthcare/Hospital Food Services Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Services Analysis | Additional deliverable encompassing custom data such as decision making process for food services in post-acute care facilities in US Healthcare/Hospital Food Services Market was delivered to the client. | Identify the appropriate stakeholders inorder to reach out for increasing the client's business |

RECENT DEVELOPMENTS

- January 2024 : Compass Group PLC (LSE: CPG) signed an agreement to acquire CH&CO, a premium contract and hospitality service provider in the UK and Ireland. The company currently generates annual revenues of USD 570 million and operates across a range of sectors, including business & industry, sports & leisure, education, and healthcare.

- January 2024 : Aramark launched a new telehealth program to digitally connect hospital inpatients with clinical nutrition services.

- February 2024 : Sodexo reinforced its 5-year contract for Food and Facilities Management Services with AstraZeneca in the UK, Sweden, Denmark, Finland, and Norway.

- October 2024 : Aramark Refreshments announced the acquisition of Heathland Hospitality Group, a company renowned for its client-focused, entrepreneurial, restaurant-based approach to dining services in various sectors, including corporate, education, and healthcare.

- October 2024 : Aramark announced a new partnership with Asbury Communities, a national leader in senior living. This will bring Aramark’s SeniorLife+ dining services to five of Asbury’s continuing care retirement communities, elevating life experiences through dining and hospitality services.

- November 2024 : Sodexo acquired CRH Catering, further accelerating convenience growth in North America in the first half of 2025. This move will help Sodexo tap into the fast-growing USD 30 billion convenience food market in the US, where people are looking for easy, quick, and ready-to-eat meal solutions.

- February 2023 : Aramark announced an exclusive new partnership with the Healthcare Plus Solutions Group (HPSG), led by healthcare visionaries Quint Studer and Dan Collard, a strategy to drive innovative, evidence-based improvement for hospitals.

Table of Contents

Methodology

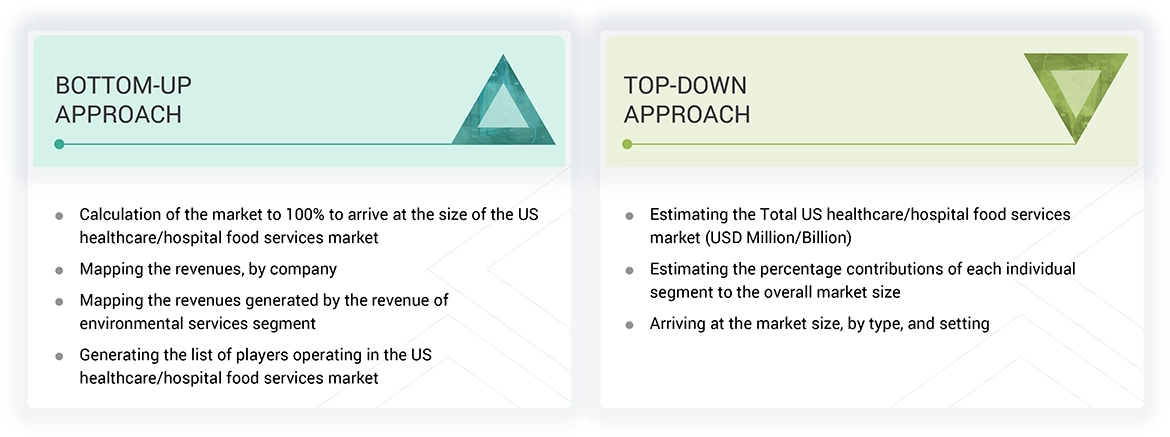

The study involved four major activities to estimate the current size of the US healthcare/hospital food services market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to to identify and collect information for the study of US healthcare/hospital food services market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply side and other participants were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, EVS directors, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the US healthcare environmental services market. The primary sources from the other participants group including, hospital and other health facility EVS staff, cleaning staff, health facility personnel. And others including, private consultants, and officials from government regulatory bodies.

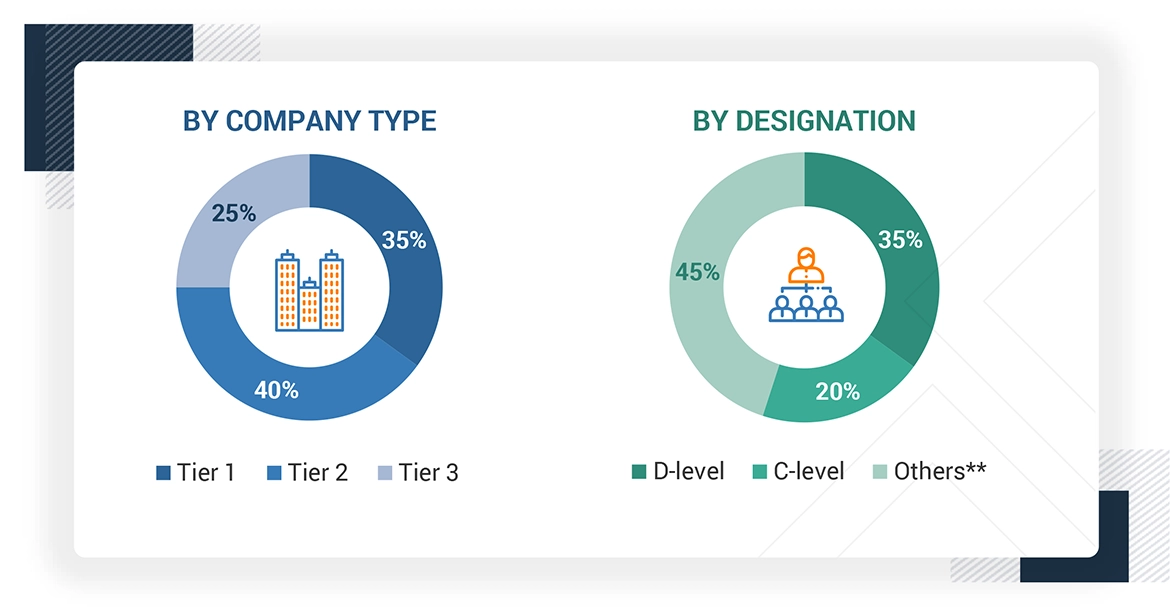

The following is a breakdown of the primary respondents:

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Other primaries include sales managers, marketing managers, and product managers.

Note 3: Companies are classified into tiers based on their total revenue.

As of 2023: Tier 1=>USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, Tier 3= < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (segmental analysis of major segments) and top-down approach (assessment of utilization/adoption/penetration trends, by type, and setting).

Global US healthcare/hospital food services market Size: Bottom -Up Approach & Top – down approach

Data Triangulation

The market was split into several segments and subsegments after arriving at the overall market size—using the market size estimation processes. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment. The data was triangulated by studying various factors and trends from both the demand and supply sides in the US healthcare/hospital food services market.

Market Definition

Healthcare/hospital food service refers to catering services or providing food in healthcare industry. There are various companies in the catering business which provide services such as dining services, room service, online food delivery and retail services to patients, hospital staff (including doctors, residents, and interns), and visitors. Food service companies also provide packaged food service as well as real-time food service.

Hospitals and other healthcare food service providers, provide cafeterias and other retail outlets for visitors and employees, as well as nutrition services for patients. Both aspects are managed by the same food and nutrition team, typically a director of food and nutrition, dieticians, chefs, and other staff.

Stakeholders

- Healthcare foodservice companies

- Hospitals and clinics

- Nursing homes

- Assisted living facilities

- Healthcare insurance providers

- Market research and consulting firms

- Venture capitalists and investors

- Acute hospitals

- Military treatment facilities

- Ambulatory surgery centers

- Academic medical centers

- Children’s hospitals

- Long-term acute facilities

- Skilled nursing facilities

- Rehabilitation hospitals

- Psychiatric hospitals

- Physician offices

- Clinics

- Laboratories

- Pharmacies

Report Objectives

- To define, describe, and forecast the US healthcare/hospital food services market by product, cancer type, procedure, end user and region

- To provide detailed information regarding the major factors influencing the growth of this market (such as drivers, restraints, challenges, and opportunities)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall US healthcare/hospital food services market

- To analyze the opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to US

- To profile the key players and analyze their market shares and core competencies2

- To track and analyze competitive developments such as product launches & approvals, acquisitions, expansions, partnerships, deployments, agreements, and collaborations in the overall US healthcare/hospital food services market

- To benchmark players within the market using the proprietary Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Key Questions Addressed by the Report

- Patient & Dining Services

- Regular Diets

- Clinical Nutrition

- Retail Services

- Vending & Shops

- Other Services

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the US Healthcare/Hospital Food Services Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in US Healthcare/Hospital Food Services Market

Joseph

Jun, 2022

What are the challenges in Hospital Food Services Market?.

James

Jun, 2022

What are the major growth strategies prevalent in the in Hospital Food Services Market?.

Manuel

Jun, 2022

How emerging markets offering revenue expansion opportunities in Hospital Food Services Market?.