Syntactic Foam Market

Syntactic Foam Market by Product Type (Macro-sphere, Micro-sphere), Matrix Type (Metal, Polymer, Ceramic), Filler Type (Glass and Ceramic Micro-spheres), Foam (Block, Sheet & Rod), Chemistry (Epoxy, Polypropylene), End-use Industry & Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

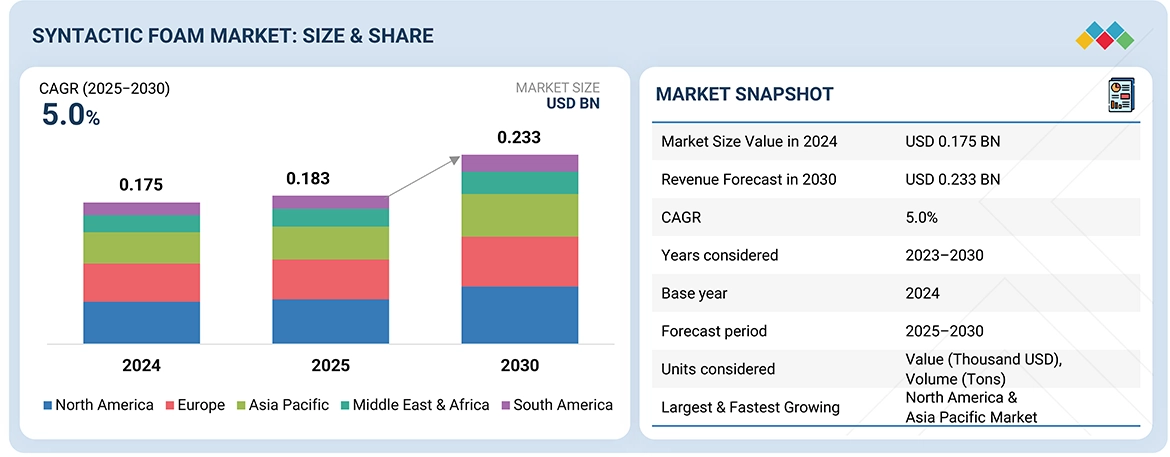

The market for syntactic foam is anticipated to grow from USD 0.183 billion in 2025 to USD 0.233 billion by 2030, at a CAGR of 5.0%, owing to increased utilization in offshore oil & gas, marine, aerospace, and defense industries. Increasing deepwater exploration, as well as the demand for lightweight materials with high strength, will fuel market growth. The increased applications of syntactic foam in subsea pipelines, buoyancy modules, and ROVs will also contribute to sustaining market growth. Furthermore, new advancement in the materials have improved thermal insulation, compressive strength, and durability, making syntactic foam to be useful in applications in aerospace and defense for lightweight components, while also contributing to performance and fuel efficiencies. Overall, the market for syntactic foam is expected to experience moderate growth with increases across multiple industrial segments.

KEY TAKEAWAYS

-

BY TYPEThe syntactic foam market by type includesthin micro-sphere, and macro-sphere. The micro-sphere dominates the market in terms of demand, as they offer low density, high strength, and excellent buoyancy. These charactertics are widely utilized broadly for offshore oil and gas, marine, defense, aerospace, and automotive applications as buoyancy modules, riser insulation, underwater vehicles, and lightweight structural components.

-

BY MATRIX TYPEThe Matrix Type market by substrate includes polymer, metal, and ceramic. The polymer matrix segment held the largest market share in the syntactic foam market due to their charactertics of cost-effecitiveness, and flexibility they are use across offshore oil and gas, marine, aerospace, automotive, and defense.

-

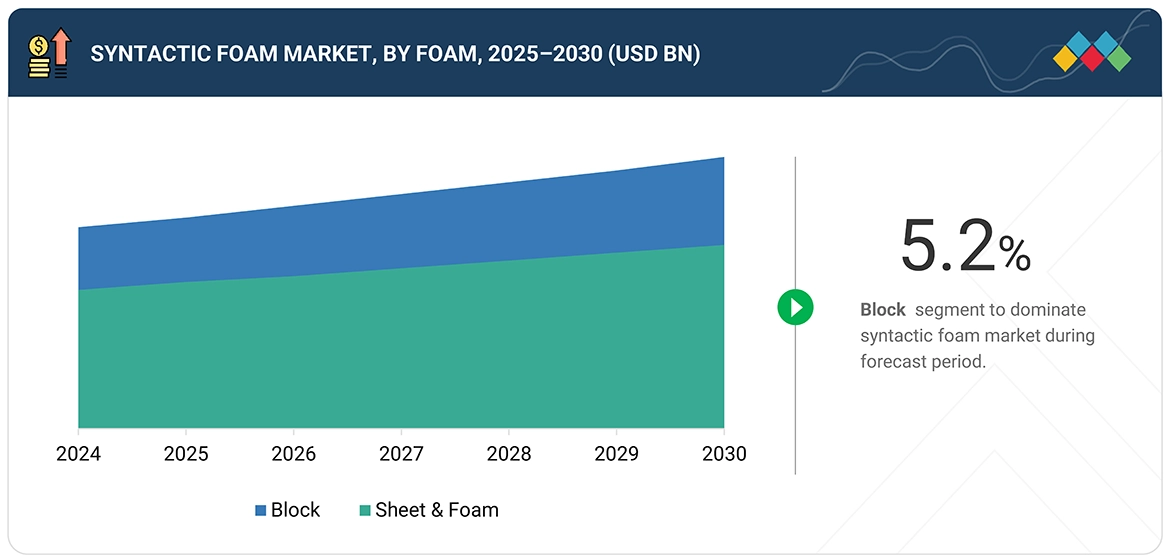

BY FORMThe syntactic foam market by form includes bloack, and sheet & rod. The Block syntactic foam is the largest segment in the global syntactic foam market due to its extensive usage in marine, offshore, defense, and industrial applications, where high strength, low density, and excellent buoyancy is essential. Block syntactic foams are an integral part of buoyancy modules, ROVs, AUVs, and riser systems in the deepwater and ultra-deepwater oil and gas markets.

-

BY FILLER TYPEThe syntacticfoam market by filler type includes glass micro spheres, ceramic micro spheres, and others. The glass micro sphere syntactic foam is the largest segment in the global syntactic foam market, driven by its excellent strength-to-weight ratio, buoyancy and wide range of industrial applications.

-

BY CHEMISTRYThe syntactic foam market by chemistry includes epoxy, polypropylene and others. Epoxy-based syntactic foams represent the fastest growing chemical segment globally, owing to the characteristics including strength, resistance to chemicals and water, and use in challenging applications.

-

BY END USE INDUSTRYThe syntactic foam market by end use industry includes marine & subsea, aerospace & defence, sports & lesiure, automotive & transportation and others. The marine and subsea segment is the end-use industry that is expected to grow the fastest among all other end-use industries in the global syntactic foam market.

-

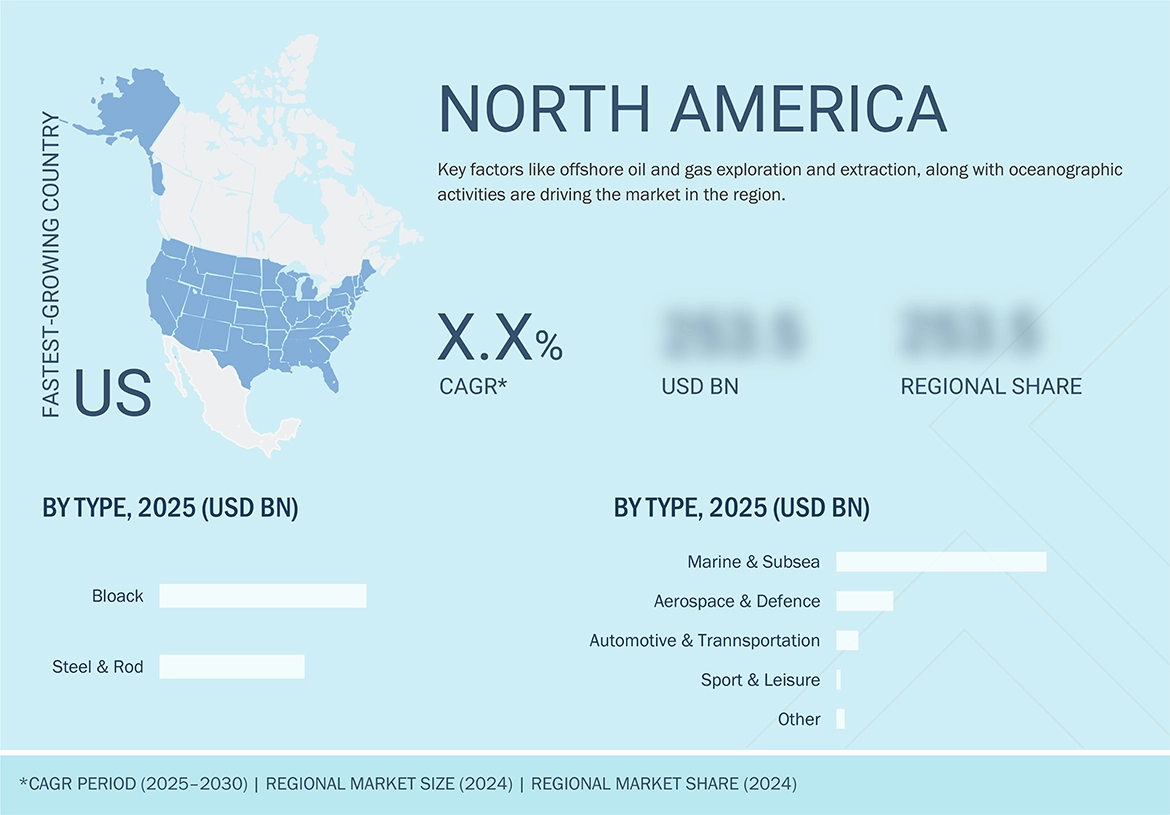

BY REGIONThe Asia Pacific are expected to grow fastest, with a CAGR of 5.4%, driven by growing urbanization, the growth of industrialization, growing offshore exploration and production of oil and gas, and increased expenditures in defense, maritime, and aerospace sectors in China, India, South Korea, and Japan.

-

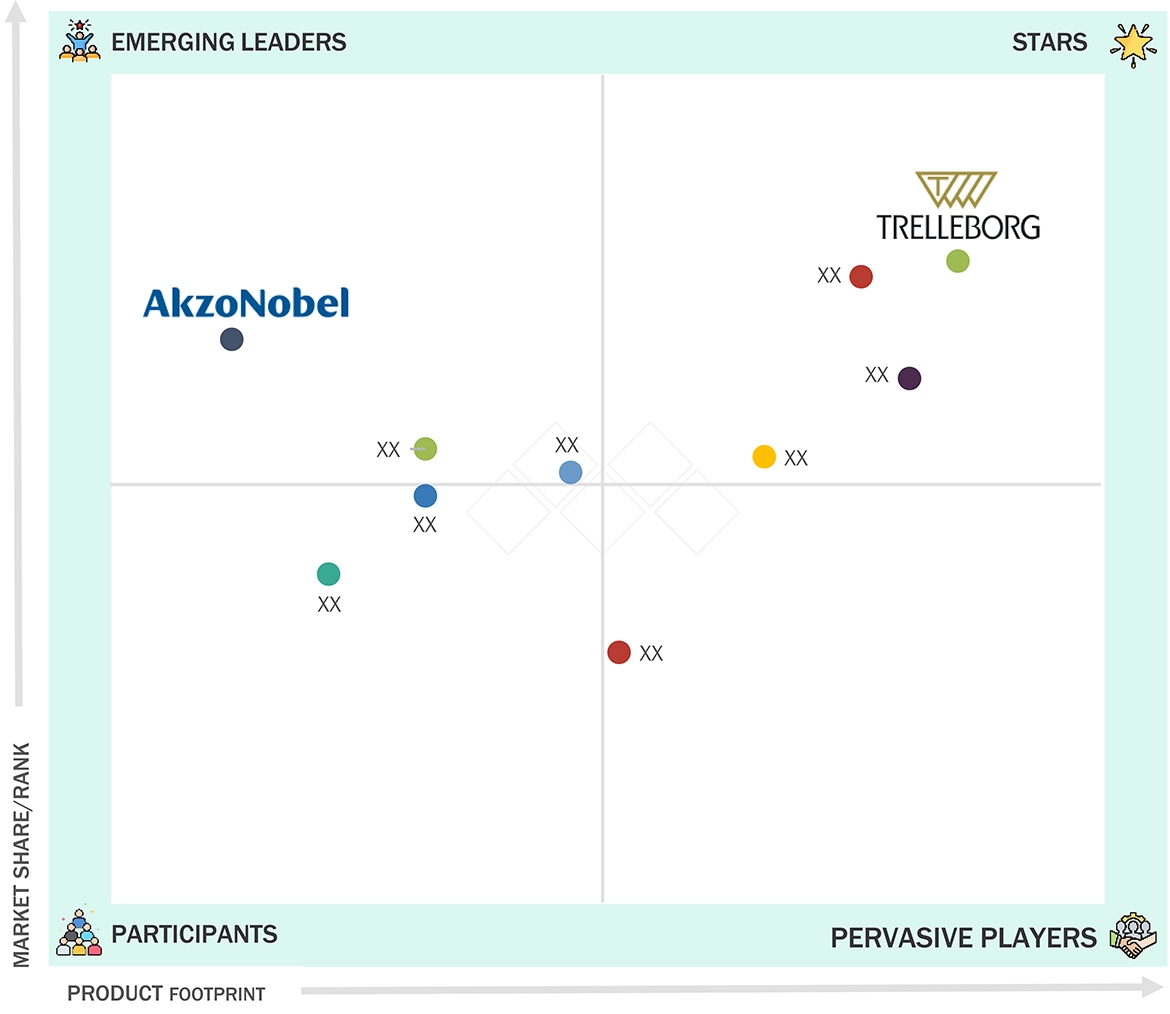

COMPETITIVE LANDSCAPEAkzo Nobel N.V. (Netherlands), ALCEN (France), Trelleborg AB (Sweden), Resinex Trading S.r.l. (Italy), ESCO Technologies Inc. (US), Matrix Composites & Engineering are leading companies of syntactic foam market. These companies are pursuing both organic and inorganic growth strategies, such as product launches, acquisitions, and expansions, to increase their market presence.

Syntactic foam growth is largely attributed to the increased demand from the offshore oil and gas, marine, aerospace and defense industries. Lightweight, high-strength materials are critical materials used in deepwater operations and during extreme pressure conditions. The applications of syntactic foam are increasing in subsea pipelines, buoyancy modules and remotely operated vehicles (ROVs) as improvements in material formulations have stabilized thermal insulation, along with compressive strength and durability thereby broadening its industrial uses. In aerospace and defense, these materials are utilized for lightweight, structural components that promote constituent performance and fuel efficiency, as well as improve operational safety. Moreover, a continuing growth in offshore exploration, marine research, and subsea infrastructure projects are expected to enhance sustainable demand, fostering syntactic foam development throughout multiple high-growth industrial segments.

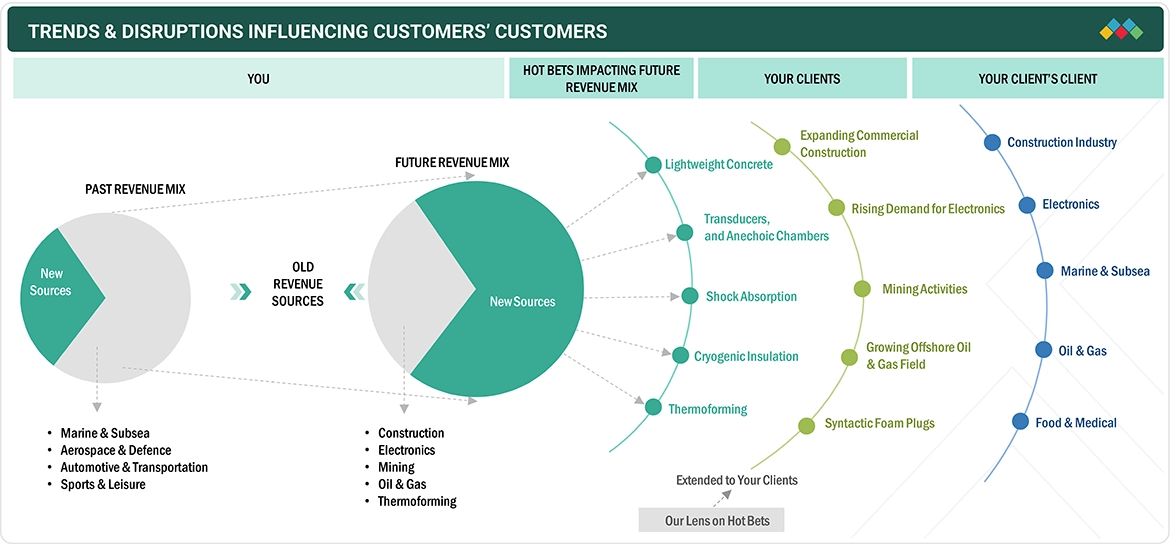

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ business emerges from customer trends or disruptions. Hot belts are the clients of syntactic foam manufacturers, and target applications are the clients of syntactic foam manufacturers. Shifts, which are changing trends or disruptions, will impact the revenues of end users. The revenue impact on end users will affect the revenue of hotbeds, which will further affect the revenues of syntactic foam manufacturers

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

§Rising offshore oil and gas production

-

§Demand from oceanography activities

Level

-

§Fluctuations in natural gas demand and prices

-

§Environmental and recycling concerns

Level

-

§Development of eco-friendly syntactic foam

-

§Use of syntactic foam in construction

Level

-

§Limitations of syntactic foam material

-

§Transportation & logistic costs

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver – Increasing Offshore Oil & Gas Production:

Global demand in syntactic foam market is being driven primarily by the increasing production of offshore oil and gas which requires advanced materials within the deepwater and ultra-deepwater arena. Syntactic foams are widely employed for buoyancy modules, riser insulation, pipeline protection and underwater vehicles as a result of their lightweight structure, high compressive strength, and performance under extreme pressure. As offshore exploration continues to expand in the Gulf of Mexico, North Sea, and Asia Pacific regions, the demand for syntactic foams will also expand, helping to enable the creation of more advanced, efficient, and reliable subsea infrastructure. Moreover, increasing funding in subsea renewable energy - principally offshore wind farms, is contributing to this growth in demand. Technological advancements with foam formulation involving the use of structurally enhanced polymer matrices, and microsphere technology, is boosting durability and operational performance experienced with these advanced materials. With this increasing adoption in a growing number of subsea applications, and increased productive projects, syntactic foam is establishing itself as a critical material in the offshore energy industry.

Restraint – Fluctuations in Natural Gas Demand and Prices:

The syntactic foam market is restrained by fluctuation in the demand and prices for natural gas. Volatility in energy markets creates a direct influence on the investment of the offshore exploration and production, as operators may delay or reduce expenditures if prices are low or demand is poor. The uncertainty in the prices delays the purchasing of syntactic foams, introducing uncertainty into market growth and making it difficult for market makers to manage production and supply. Price fluctuations may also cause the end-user to invest cautiously, including limiting the use of syntactic foams to large-scale use. Manufacturers may have difficulty securing long-term commitments with offshore operators due to an unpredictable energy market.

Opportunity – Development of Eco-Friendly Syntactic Foam:

The rising demand for environmentally friendly syntactic foam provides a growth opportunity for the sector. Manufacturers are exploring bio-based polymers, recyclable microspheres, and green manufacturing processes to fulfill sustainability and compliance standards. These solutions helps to the environmental impact while expanding into new applications in marine, aerospace, and defense sectors. Furthermore, an increasing global focus on reducing carbon footprints and marine pollution is also increasing demand for sustainable materials. Moreover, closer partnerships and collaborations between material scientists and industrial manufacturers are also speeding up the commercialization of green syntactic foams, ultimately differentiating them in competitive markets and securing larger market share.

Challenge – Transport and Logistic Costs:

High transportation and logistics costs present a significant concern for the syntactic foam market sector. Products made from syntactic foam are heavy, bulky, and delicate, necessitating more sophisticated packaging, transportation, and logistics in order to safely handle the product to offshore locations, marine installations. The added cost of transport can impact profit margins, increase project-related costs, and inhibit greater adoption of syntactic foams (and syntactic foam solutions) - especially for smaller projects or less developed infrastructure projects. Similarly, sites located at environmentally remote offshore locations and marine environments, may create challenges delivering products on schedule and potentially increase the risk of damage during transport. In many circumstances, these types of and costs lead to increased project expenses, which lead to less syntactic foam products being pursued by smaller or cost-sensitive end users.

Syntactic Foam Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

An offshore oil company in Brazil urgently required 316 buoyancy modules in various sizes and operational depths. The solution needed to be quickly delivered, easy to install, and easily removable after operations. | AIS supplied buoyancy modules with rotary moulded protective outer shells. The buoyancy modules had tough outer shells made using rotary moulding and were filled with cast syntactic foam, which is strong enough to handle deep-water pressure at depths of 2000 to 3000 meters. This special foam was chosen because regular foam would collapse under such pressure. The modules were custom-made to match the exact depth needs of the project |

|

Crown Plastics, a leading supplier of plastic lighting enclosures, was utilizing an aluminum tool to thermoform deep-drawn, clear acrylic parts. However, this approach resulted in visible chill marks. The company required a solution that could deliver high-quality results for a critical, short-run application. | Collaborating with a CMT Europe BV’S Process Specialist, Crown Plastics transitioned from the aluminum tooling to HYTAC WFT, a thermoset syntactic foam infused with PTFE. This material was selected for its optimal density and temperature resistance properties. The PTFE impregnation provided a low-stick surface, reducing material buildup and facilitating easier release of the formed parts. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The syntactic foam market operates within a vertically integrated framework, spanning from raw material sourcing to deployment in end-use applications across industries such as marine, aerospace, automotive, and defense. Key components like hollow microspheres, resins, and additives are formulated to deliver critical properties such as low density, high compressive strength, buoyancy, and thermal insulation. Manufacturers rigorously test these formulations to ensure durability and compliance with safety and performance standards. Processing methods such as molding, casting, and machining enable precise fabrication tailored to demanding environments. Regulatory frameworks, sustainability initiatives, and technological advancements in materials and production processes drive innovation and market adoption. This integration enhances efficiency, reliability, and performance across the value chain, supporting the growing demand for lightweight, high-performance materials in advanced engineering applications. to deployment in end-use applications across various industries. Key raw materials, including resins, fillers, and additives, are sourced and formulated to meet specific fire protection standards. Coating manufacturers develop and optimize formulations to enhance char formation, adhesion, and thermal insulation properties. These formulations undergo rigorous testing for fire resistance, durability, and compliance with building and safety regulations. Application techniques such as spraying, brushing, or rolling ensure uniform coverage on substrates like structural steel, wood, and cast iron. Finished coatings are then customized to meet the performance requirements of different end-use industries, including construction, transportation, and industrial facilities. Regulatory frameworks, sustainability initiatives, and evolving building codes influence production, innovation, and adoption. The integration of technological advancements in application methods and materials enhances efficiency, safety, and compliance across the value chain

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Syntactic Foam Market, By Product Type

In 2024, Syntactic foam that is microsphere-based is the fastest-growing segment in the market because of low density, high strength, and excellent buoyancy. They are utilized broadly for offshore oil and gas, marine, defense, aerospace, and automotive applications as buoyancy modules, riser insulation, underwater vehicles, and lightweight structural components. Advancements in microsphere technology and its advantage of cost-effectiveness and flexibility in processing will further drive the growth for the segment in the market for syntactic foam.

Syntactic Foam Market, By Matrix Type

Polymer matrix syntactic foam is the fastest-growing matrix segment in the worldwide market, fuelled by the usage and cost-effectiveness across offshore oil and gas, marine, aerospace, automotive, and defense. They are manufactured using thermosetting or thermoplastic resins, combined with hollow microspheres, leading to an optimal balance of low weight/high strength/buoyancy. Application development around resin, and microsphere technology advancements, will additionally provide enhancing mechanical and thermal features that enable the use of polymer matrix syntactic foam in more demanding applications. Their ease of processing, design and material flexibility, and cost advantages make polymer matrix syntactic foam a growing choice for buoyancy modules, underwater vehicles, and lightweight structural components. Hence, there is rapid growth in this segment of the foam market.

Syntactic Foam Market, By Form

In 2024, Block syntactic foam is the largest segment in the global syntactic foam market owing to its extensive usage in marine, offshore, defense, and industrial applications, where high strength, low density, and excellent buoyancy is essential. Block syntactic foams are an integral part of buoyancy modules, ROVs, AUVs, and riser systems in the deepwater and ultra-deepwater oil and gas markets. In the defense industry, block foams are used in sonar domes, hull structures, and as acoustic insulation; while machinability and durability leads to usage in aerospace and construction applications. Ongoing advances in polymer and microsphere technology continues to improve their performance and fortify block syntactic foam's status as the leading foam segment in the global syntactic foam market.

Syntactic Foam Market, By Filer Type

Glass filler represents the fastest growing segment by filler type in the global syntactic foam market, driven by its excellent strength-to-weight ratio, buoyancy and wide range of industrial applications. Low density glass microspheres offer a high resistance to compressive strength and a high resistance to thermal and chemical exposure; therefore, they can be utilized in offshore/marine/aerospace/automotive/and defense applications. Their use has expanded into buoyancy modules, riser insulation systems, underwater vehicles, and lightweight structural components. With consistent quality, good processability, and relative cost relative to the use of ceramic or metal fillers, advances in microsphere technology are increasing the growth rate of glass microspheres in syntactic foams at an unnatural speed.

Syntactic Foam Market, By Chemistry

In 2024, Epoxy-based syntactic foams represent the fastest growing chemical segment globally, owing to the characteristics including strength, resistance to chemicals and water, and use in challenging applications. Foams combined with hollow microspheres and epoxy resins gives low density foams with high compressive strength and superior thermal stability, making it suitable for offshore oil and gas buoyancy modules, deepwater riser insulation, and underwater vehicles. In the aerospace and automotive sectors, epoxy foams are increasingly used for lightweight structural components that improve fuel efficiency and performance. Continual enhancements of epoxy formulations and compatibility of microsphere and epoxy foams foster durability, processability, and geometry in production ware, including more complex shapes. Finally, their cost advantage, durability during service, and reliability performance during extreme conditions is considerable and enhances their growth as the fastest growing chemical segment globally.

Syntactic Foam Market, By End Use Industry

In 2024, The marine and subsea segment is the end-use industry that is expected to grow the fastest among all other end-use industries in the global syntactic foam market. This is due to increasing offshore oil and gas exploration, defense modernization, and expanding underwater infrastructure projects. Syntactic foams are widely used in the marine and subsea segment for buoyancy modules, deepwater riser systems, pipeline insulation, remotely operated vehicles (ROVs), autonomous underwater vehicles (AUVs), and anything used in underwater environments. Low density, high compressive strength, and resistance to water absorption are critical properties of materials used in underwater applications. Rising demand from offshore and subsea activities, combined with increasing demand for low-weight, high-strength materials, and advanced technology will contribute to the marine and subsea segment as the fastest growing end-use industry.

REGION

Asia Pacific's Urban Growth and Regulations Drive Intumescent Coatings Demand

The Asia Pacific region is becoming the fastest growing market for syntactic foam, driven by rapid industrialization, growing offshore exploration and production of oil and gas, and increased expenditures in defense, maritime, and aerospace sectors in China, India, South Korea, and Japan. The expansion in deepwater and ultra-deepwater exploration in the South China Sea and Indian Ocean is affecting the demand for syntactic foam. With increasing government interest in developing their naval capabilities, and improvements to underwater installations using syntactic foam in defense capabilities, interest in commercialized applications are driving the demand around syntactic foam use, in submarines, autonomous underwater vehicles, and surveillance. The growing automotive and aerospace industries are also investing in lightweight high performance materials have increased demand for fuel efficiency and structural integrity. Favorable government policies, increases in foreign investment, and the establishment of local manufacturing and support chain are creating a strong regional supply chain, to accompany increases in R&D and tech collaboration, Asia Pacific is positioned to be the fastest growing and most dynamic market, globally.

Syntactic Foam Market: COMPANY EVALUATION MATRIX

In the syntactic foam market matrix, Trellerborg AB (Star), leads the market. The company has developed a strong position in construction and energy, utilizing a complete product range, long-standing technical reputation, and global supply chains to impact the market. Akzo Nobel N.V. is an emerging leader that is developing momentum through R&D efforts, and technical innovation.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Akzo Nobel N.V. (Netherlands)

- ALCEN (France)

- Trelleborg AB (Sweden)

- Resinex Trading S.r.l. (Italy)

- ESCO Technologies Inc. (US)

- Matrix Composites & Engineering (Australia)

- DIAB Group (Sweden)

- PPG Industries, Inc. (US)

- DeepWater Buoyancy Inc. (US)

- Balmoral Group (Scotland)

- Acoustic Polymers Ltd (UK)

- Taizhou Cbm-future New Materials S&T Co.,Ltd. (China)

- Precision Acoustics Ltd. (UK)

- Oriental Ocean Tech (China)

- AIS (England)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.175 Billion |

| Market Forecast in 2030 (Value) | USD 0.233 Billion |

| Growth Rate | CAGR of 5.0% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (Thousand USD), Volume (Tons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered | By Product Type, Block, Sheet & Rod By Type, Micro-sphere, Macro-sphere By Matrix Type, Polymer, Metal, Ceramic By Filler Type, Glass micro-sphere, Ceramic micro-sphere, and others By Chemistry, Epoxy, Polypropylene, and others By End-use Industry: Marine & Subsea, Aerospace & Defence, Sports & Lesiure, Automotive & Transportation and Others. |

| Regions Covered | North America, Asia Pacific, Europe, South America, the Middle East & Africa |

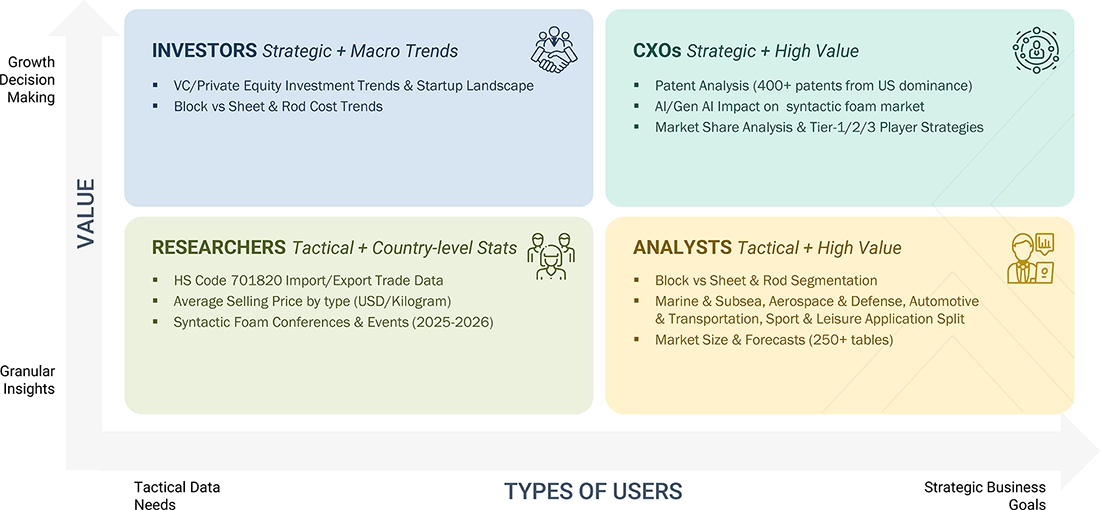

WHAT IS IN IT FOR YOU: Syntactic Foam Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Syntactic Foam | • Detailed company profiles of syntactic foam competitors (financials, product portfolio) • Market segmentation by form (block, sheet & rod) • Market segmentation by end-use industry (marine & subsea, aerospace & defence, sports & lesiure, and automotive & transportatio) | • Identified & profiled key players for syntactic foam companies • Track adoption trends in high-growth APAC industries (marine & subsea, aerospace & defence, sports & lesiure, and automotive & transportation) |

RECENT DEVELOPMENTS

- December 2024 : Trelleborg AB planned to launch a new production facility near Ahmedabad, India. This includes the expansion of production of their marine and infrastructure products. Thereby, it will help in increasing the company’s global presence.

- July 2024 : Akzo Nobel N.V. invested USD 15.15 million to upgrade its Suzhou facility in China, aiming to double the plant's capacity for marine and protective coatings by 2025.

- July 2024 : Matrix Composites & Engineering collaborated with Subsea Innovation Cluster Australia (SICA), Western Australian Government (Australia), & Baker Hughes Company (US), to develop the Matrix Deepwater Hyperbaric Common User Facility. this state-of-the-art facility enables comprehensive testing and compliance verification for subsea equipment, such as subsea control modules, within Australia.

- November 2023, : Resinex Trading S.r.l. partnered with University of Southern Denmark (SDU) to supply them with syntactic foam blocks for research purpose in the Japan trench. This showcases company’s expanding usage of products for various applications.

- April 2023, : ESCO Technologies Inc.’s subsidiary, Globe Composite Solutions LLC, has enlarged its operations by launching a new facility to accommodate the needs of Defense and Industrial clients, effectively doubling the space for production and logistics.

Table of Contents

Methodology

The study involved four major activities to estimate the current global size of the syntactic foam market. Exhaustive secondary research was conducted to gather information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of syntactic foam through primary research. Both top-down and bottom-up approaches were employed to estimate the overall size of the syntactic foam market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, sources such as Business Standard, Bloomberg, World Bank, and Factiva were referred to, to identify and collect information for this study on the syntactic foam market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

Various primary sources from both the supply and demand sides of the syntactic foam market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the syntactic foam industry. The breakdown of the profiles of primary respondents is as follows:

Breakdown of Primary Interviews

Notes: Companies are classified based on their revenue–Tier 1 = >USD 7 billion, Tier 2 = USD 500 million to USD 7 billion, and Tier 3 = < USD 500 million.

Others include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the global size of the syntactic foam market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players, along with extensive interviews with key officials, such as directors and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments of the syntactic foam market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

In addition, the market size was validated by using both the top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there are three sources—top-down approach, bottom-up approach, and expert interviews. The data were assumed to be correct when the values arrived at from the three sources matched.

Market Definition

Syntactic foam is a lightweight, high-strength composite material made by incorporating micro or macro-spheres within a matrix. The spheres are made from glass or ceramic or metal. The matrix can be made from polymer, ceramic, and metal. Most of the syntactic foam is made using glass micro-spheres and polymer matrix. It is used in marine and subsea applications for buoyancy purposes.

Stakeholders

- Syntactic Foam Manufacturers

- Syntactic Foam Distributors

- Raw Material Suppliers

- Research & Development Entities

- Industry Associations And Regulatory Bodies

- End Users

- Government bodies

Report Objectives

- To estimate and forecast the syntactic foam market, in terms of value and volume

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To define, describe, and forecast the market size, based on product type, matrix type, filler type, foam, chemistry, end-use industry, and region

- To forecast the market size along with segments and submarkets, in key regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America along with their key countries

- To strategically analyze micro markets, for individual growth trends, prospects, and their contribution to the total market

- To analyze growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments, such as merger & acquisition, expansion & investment, and agreements in the syntactic foam market

Key Questions Addressed by the Report

What are the major drivers influencing the growth of the syntactic foam market?

Rising offshore crude oil production and demand from oceanography activities.

What are the major challenges in the syntactic foam market?

Limitations of syntactic foam material and transportation & logistics costs.

What are the restraining factors in the syntactic foam market?

Fluctuations in natural gas demand and prices, and environmental and recycling concerns.

What is the key opportunity in the syntactic foam market?

Development of eco-friendly syntactic foam, use in construction, and rising demand for thermoforming applications.

Who are the key players in the syntactic foam market?

Akzo Nobel N.V. (Netherlands), ALCEN (France), Trelleborg AB (Sweden), Resinex Trading S.r.l. (Italy), ESCO Technologies Inc. (US), Matrix Composites & Engineering (Australia), DIAB Group (Sweden), PPG Industries, Inc. (US), DeepWater Buoyancy Inc. (US), Balmoral Group (Scotland).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Syntactic Foam Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Syntactic Foam Market