Polyurethane Foam Market by Type (Rigid foam, Flexible Foam, Spray Foam), End-use Industry (Building & Construction, Bedding & Furniture, Automotive, Electronics, Footwear, Packaging, Other (Appliances, Textile)) and Region - Global Forecast to 2028

Updated on : July 17, 2025

Polyurethane Foam Market

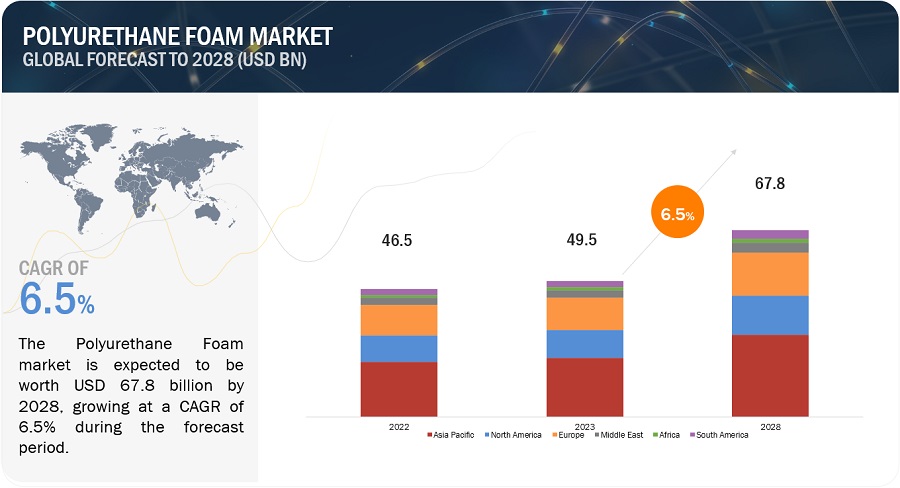

The global polyurethane foam market was valued at USD 49.5 billion in 2023 and is projected to reach USD 67.8 billion by 2028, growing at 6.5% cagr from 2023 to 2028. The major reasons for the growth of the polyurethane foams market is the demand for energy-efficient solutions. Polyurethane foam is an excellent thermal insulator, used in construction for insulation purposes. With increasing concerns about energy conservation and sustainability, builders and homeowners are turning to Polyurethane foam to enhance the energy efficiency of buildings, reducing heating and cooling cost.

Attractive Opportunities in the Polyurethane Foam Market

To know about the assumptions considered for the study, Request for Free Sample Report

Polyurethane Foam Market Dynamics

Driver: Increased use of polyurethane foams in building insulations for energy conservation

PU foam contributes to sound insulation, making buildings more comfortable by reducing noise from the exterior and between rooms. This feature is particularly important in urban environments, where noise pollution is a prevalent concern. As the construction industry continues to prioritize energy-efficient and environmentally sustainable practices, Polyurethane foam remains an integral material in achieving these goals, ensuring comfortable, well-insulated, and eco-friendly structures.

Restraint: Stringent environmental regulations related to manufacturing of polyurethane foams

The major restraining factor in the polyurethane foam market is government regulations. These regulations play a crucial role in governing the manufacturing of foam products, including polyurethane foam, due to various environmental, safety, and health considerations. These regulations can vary from country to country and can cover a wide range of aspects related to foam production.

Opportunity: Rise in production of bio-based polyols

Polyols are majorly used to manufacture polyurethane foams. The rise in bio-based polyols represents a significant and promising trend in the polyurethane industry. Bio polyols are derived from renewable resources such as plant-based oils, agricultural residues, or even waste materials, offering a more sustainable and environmentally friendly alternative to traditional petroleum-based polyols. This shift towards bio polyols is driven by growing environmental concerns, increased awareness of the carbon footprint, and a desire for more sustainable manufacturing practices.

Challenge: High raw material costs

The price volatility of isocyanates and polyols, driven by factors such as fluctuations in crude oil prices, supply and demand imbalances, and geopolitical tensions, directly impacts the overall cost of polyurethane foam. Additionally, stringent environmental regulations, sustainability initiatives, and the desire for more eco-friendly alternatives have prompted the exploration of bio-based and renewable raw materials, which can further contribute to higher production costs.

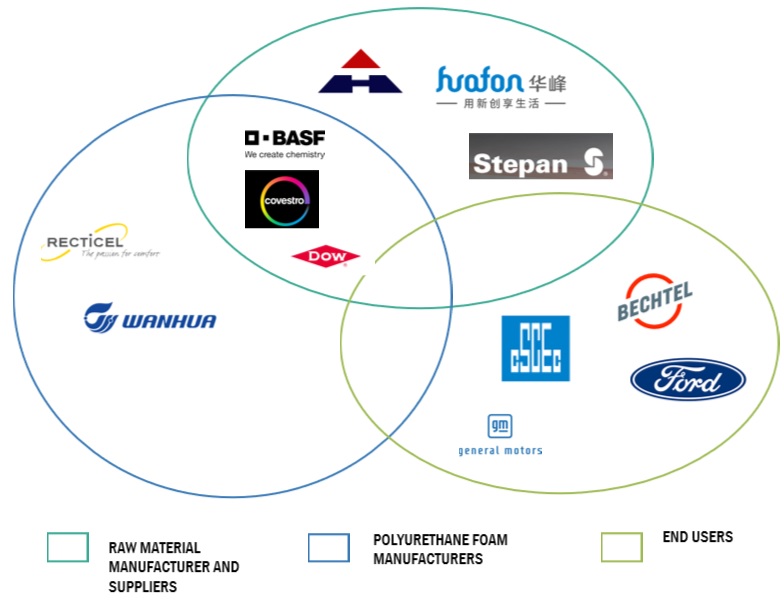

Polyurethane Foam Market Ecosystem

Based on the type, Spray foam is projected to grow at the highest CAGR during the forecast period.

Based on the type, Spray foam is anticipated to grow at the highest CAGR. Spray foams are primarily used IN the construction sector to enhance energy efficiency and improve building performance. It is applied as a liquid mixture that expands and hardens into a rigid foam, forming a seamless and airtight barrier when properly installed. This insulation method helps buildings retain heat in cold weather and stay cool during hot seasons, resulting in reduced heating and cooling costs. Increasing demand for spray foams from the global building & construction industry is expected to drive the growth of the spray foam segment of the polyurethane foam market during the forecast period.

Based on End-user, the automotive segment is projected to grow at the highest CAGR during the forecast period.

Polyurethane foam is used in numerous applications in the building & construction end-use industry. Polyurethane foam is widely used for various automotive applications, including seating, interior components, insulation, and soundproofing. Its lightweight nature helps improve fuel efficiency, while its superior cushioning properties enhance driver and passenger comfort. Polyurethane foam’s excellent insulation capabilities also contribute to vehicle temperature control and reduce noise transmission, resulting in quieter and more energy-efficient automobiles.

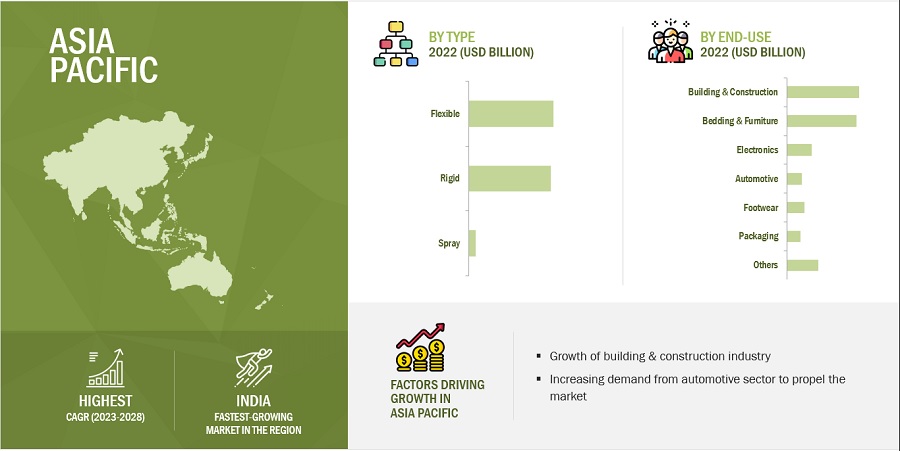

Asia Pacific is projected to grow at the highest CAGR during the forecast period.

Asia Pacific is projected to be the fastest-growing market for polyurethane foam during the forecast period. Factors like the growing demand for polyurethane foams from various industries and the rising footprint of the global players dealing in polyurethane foams are expected to drive the polyurethane foams market in the region.

Source: Expert Interviews, Secondary Research, Whitepapers, Journals, Magazines, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Polyurethane Foam Market Players

Some of the key players in the market include Covestro AG (Germany), BASF SE (Germany), Wanhua Chemical Group Co., Ltd. (China), Dow(US), Huntsman Corporation (US), Sekisui Chemical Co., Ltd. (Japan), Saint-Gobain (France), are some of the leading players operating in the polyurethane foam market.

Read More: Polyurethane Foam Companies

Polyurethane Foam Market Report Scope

|

Report Metric |

Details |

|

Market Size Available for Years |

2018–2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD Million and USD Billion) and Volume (Kilotons) |

|

Segments Covered |

Type, End-use Industry, and Region |

|

Geographies Covered |

Asia Pacific, North America, Europe, Middle East, South America, and Africa |

|

Companies Covered |

The major market players include Covestro AG (Germany), BASF SE (Germany), Wanhua Chemical Group Co., Ltd. (China), Dow (US), Huntsman Corporation (US), Sekisui Chemical Co., Ltd. (Japan), Saint-Gobain (France), DuPont (US), Recticel NV/SA (Belgium), and Rogers Corporation (US) and so on. |

This research report categorizes the polyurethane foam market based on type, end-use industry, and region.

Based on End-use Industry, the polyurethane foam market has been segmented as follows:

- Bedding & Furniture

- Building & Construction

- Automotive

- Electronics

- Footwear

- Packaging

- Others (Appliances, Textiles & Apparel, and Transportation)

Based on Type, the polyurethane foam market has been segmented as follows:

- Rigid Foam

- Flexible Foam

- Spray Foam

Based on Region, the polyurethane foam market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East

- Africa

- South America

Recent Developments

- In January 2021, BASF chose BTC Europe GmbH (BTC) as the new distributor for aromatic isocyanates and polyols for polyurethane applications in Europe.

- In March 2022, Huntsman collaborated with Joe Nimble and Footwear Innovation GmbH to offer polyurethane foam for extra shoe comfort with the product DALTOPED.

- In July 2020, Dow and Eco-mobilier (French mattress and furniture EFR) announced a collaboration for collecting and supplying post-consumer polyurethane foam for the RENUCA mattress recycling program. The recovered foam will be converted to new valuable polyurethane raw materials (polyols).

Frequently Asked Questions (FAQ):

What is Polyurethane Foam?

Polyurethane foam is a porous, cellular-structured, synthetic material made from the reaction of diisocyanates and polyols. Its structure is a composite of a solid phase and a gas phase. The solid phase is made from polyurethane elastomer while the gas phase is air brought about by blowing agents.

What is the current size of the global polyurethane foam market?

The global polyurethane foam market is estimated to be USD 49.5 billion in 2023 and projected to reach USD 67.8 billion by 2028, at a CAGR of 6.5%.

Who are the winners in the global polyurethane foam market?

Companies such as Covestro AG, BASF SE, Wanhua Chemical Group Co., Ltd., Dow, and Huntsman Corporation fall under the winners’ category. These are leading global players in the polyurethane foams market and are some of the leading players operating in the polyurethane foams market. These players have adopted the strategies of expansions, agreements, mergers & acquisitions, partnerships, new product launches, joint ventures, investments & contracts, collaborations, and new technology & new process developments to increase their presence in the global market.

What are the key regions in the global Polyurethane Foam market?

In terms of region, the highest consumption was observed to be in Asia Pacific. This is primarily due to growing demand from the construction and automotive industries.

What is the major type of Polyurethane Foam used in the global market?

In terms of type, the highest consumption is of rigid foam as the rigid polyurethane foam contributes to sound insulation, making buildings more comfortable by reducing noise from the exterior and between rooms. This feature is particularly important in urban environments, where noise pollution is a prevalent concern. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growth of various end-use industries in emerging economies- Increased use of polyurethane foams in building insulation for energy conservation- Versatility and unique physical properties of polyurethane foamsRESTRAINTS- Stringent environmental regulations related to manufacturing of polyurethane foamsOPPORTUNITIES- Rise in production of bio-based polyolsCHALLENGES- High raw material costs

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSBARGAINING POWER OF SUPPLIERSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 MACROECONOMIC INDICATORSCONSTRUCTION INDUSTRYMANUFACTURING

-

5.5 PRICING ANALYSISINTRODUCTION

-

5.6 PATENT ANALYSISLIST OF MAJOR PATENTS FOR PU FOAM

- 5.7 KEY CONFERENCES & EVENTS IN 2024−2025

-

5.8 REGULATORY LANDSCAPEINTRODUCTIONREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.9 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 METHYLENE DIPHENYL DIISOCYANATE (MDI)

- 6.2 TOLUENE DIISOCYANATE (TDI)

- 6.3 POLYOLS

- 7.1 INTRODUCTION

- 7.2 MICROCELLULAR POLYURETHANE FOAMS

- 7.3 NANOCELLULAR POLYURETHANE FOAMS

- 8.1 INTRODUCTION

-

8.2 LOW-DENSITY POLYURETHANE FOAMRETICULATED POLYURETHANE FOAMPOLYESTER FOAMPOLYETHER FOAM

- 8.3 MEDIUM-DENSITY POLYURETHANE FOAM

- 8.4 HIGH-DENSITY POLYURETHANE FOAM

- 9.1 INTRODUCTION

-

9.2 FLEXIBLE FOAMINCREASING POPULATION LEADING TO GROWTH OF FLEXIBLE FOAM SEGMENTKEY APPLICATIONS OF FLEXIBLE FOAMS- Cushioning- Apparel padding- Filtration- Other applications

-

9.3 RIGID FOAMSURGING DEMAND FOR INSULATION IN RESIDENTIAL AND COMMERCIAL BUILDINGS FUELING GROWTHKEY APPLICATIONS OF RIGID FOAMS- Building and transport insulation- Appliances insulation (refrigerators and freezers)- Buoyancy and in-fill

-

9.4 SPRAY FOAMSEXCELLENT HEAT, SOUND, AND WATER INSULATION PROPERTIES OF SPRAY FOAMS TO DRIVE CONSUMPTIONKEY APPLICATIONS OF SPRAY FOAMS- Building insulation- Attics- Roofing- Interior wall cavities- Industrial cool stores- Marine

- 10.1 INTRODUCTION

-

10.2 BEDDING & FURNITUREASIA PACIFIC TO LEAD POLYURETHANE FOAM MARKET IN BEDDING & FURNITURE SEGMENTPOLYURETHANE FOAM FOR BEDDING & FURNITURE- Mattress & pillows- Medical- Carpet cushioning- Seating- Office furniture

-

10.3 BUILDING & CONSTRUCTIONSTRINGENT REGULATIONS REGARDING ENERGY SAVINGS IN BUILDING & CONSTRUCTION TO FUEL DEMANDPOLYURETHANE FOAM FOR BUILDING & CONSTRUCTION- Thermal insulation- Air sealing

-

10.4 ELECTRONICSINCREASED USE OF RIGID, FLEXIBLE, AND SPRAY POLYURETHANE FOAMS AS INSULATORS TO DRIVE MARKETPOLYURETHANE FOAM FOR ELECTRONICS- Sealing- Insulation

-

10.5 AUTOMOTIVEHIGH DEMAND FOR LIGHTWEIGHT VEHICLES PROMOTING USE OF POLYURETHANE FOAMSPOLYURETHANE FOAM FOR AUTOMOTIVE- Cushion overlays- Seat foams- Door panels- Energy absorbers- Sound absorption and vibration dampening- Others

-

10.6 FOOTWEARINCREASED USE OF POLYURETHANE FOAMS AS EFFICIENT ADHESIVES IN FOOTWEAR TO PROPEL MARKETPOLYURETHANE FOAM FOR FOOTWEAR- Shoe midsoles- Shoe bottoms- Shoe upper materials

-

10.7 PACKAGINGASIA PACIFIC DOMINATED POLYURETHANE FOAM MARKET IN PACKAGINGPOLYURETHANE FOAM FOR PACKAGING- Foam packaging- Composite packaging

- 10.8 OTHERS

- 11.1 INTRODUCTION

-

11.2 ASIA PACIFICIMPACT OF RECESSIONCHINA- Bedding & furniture to be largest end user of polyurethane foams in ChinaJAPAN- Increasing production of onsite spray foams for construction sector to support market growthMALAYSIA- Increasing awareness about eco-friendly and energy-efficient polyurethane foams to drive demandINDIA- Improving socio-economic conditions and industrialization to promote market growthSOUTH KOREA- Ongoing industrialization to drive polyurethane foam marketTHAILAND- Remodeling of existing infrastructures to contribute to market growthSINGAPORE- Flourishing building & construction sector to lead to growth of polyurethane foam marketINDONESIA- Surging demand in construction applications to contribute to market growthREST OF ASIA PACIFIC

-

11.3 EUROPEGERMANY- Ongoing advancements in polyurethane foam technologies to support market growthFRANCE- Surging demand for rigid foams to contribute to growth of polyurethane foam marketITALY- Efforts to reduce greenhouse gas emissions and increase energy efficiency of buildings to support marketUKRUSSIA- Surging production of slabstock flexible polyurethane foams to drive marketTURKEY- Flexible polyurethane foam to dominate market during forecast periodPOLAND- Flourishing furniture industry to fuel demand for polyurethane foamREST OF EUROPE

-

11.4 NORTH AMERICAUS- Increasing energy costs driving demand for polyurethane foams in building insulationMEXICO- Expanding construction sector to support polyurethane foam marketCANADA- Surging use of flexible foams in automotive industry to boost demand

-

11.5 MIDDLE EASTUAE- Growing building & construction and bedding & furniture industries to drive demandSAUDI ARABIA- Surging demand for flexible polyurethane foams to fuel market during forecast periodREST OF MIDDLE EAST

-

11.6 AFRICAEGYPT- Flourishing infrastructure sector to drive growth of polyurethane foam marketSOUTH AFRICA- Growing construction and manufacturing sectors to fuel polyurethane foam marketREST OF AFRICA

-

11.7 SOUTH AMERICABRAZIL- Building & construction to be largest consumer of polyurethane foam in BrazilARGENTINA- Surging demand for flexible foams to drive polyurethane foam marketCHILE- Flexible foam segment to dominate market during forecast periodREST OF SOUTH AMERICA

- 12.1 INTRODUCTION

- 12.2 STRATEGIES ADOPTED BY KEY MARKET PLAYERS

-

12.3 MARKET SHARE ANALYSISRANKING OF KEY MARKET PLAYERS, 2022MARKET SHARE OF KEY PLAYERSREVENUE ANALYSIS OF TOP PLAYERS IN POLYURETHANE FOAM MARKET

-

12.4 COMPANY FOOTPRINTCOMPANY PRODUCT TYPE FOOTPRINTCOMPANY END-USE INDUSTRY FOOTPRINTCOMPANY REGION FOOTPRINT

-

12.5 COMPANY EVALUATION MATRIX (TIER 1), 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

12.6 STARTUP/SME EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESDYNAMIC COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKS

- 12.7 COMPETITIVE BENCHMARKING

- 12.8 COMPETITIVE SCENARIO

-

13.1 KEY PLAYERSBASF SE- Business overview- Products offered- Recent developments- MnM viewHUNTSMAN CORPORATION- Business overview- Products offered- Recent Developments- MnM viewDOW- Business overview- Products offered- Recent developments- MnM viewCOVESTRO AG- Business overview- Products offered- Recent developments- MnM viewSAINT-GOBAIN- Business overview- Products offered- MnM viewWANHUA CHEMICAL GROUP CO., LTD.- Business overview- Products offered- Recent developments- MnM viewRECTICEL NV/SA- Business overview- Products offered- Recent developmentsROGERS CORPORATION- Business overview- Products offered- Recent DevelopmentsSEKISUI CHEMICAL CO., LTD.- Business overview- Products offeredTRELLEBORG AB- Business overview- Products offered- Recent DevelopmentsLANXESS- Business overview- Products offered- Recent developmentsDUPONT- Business overview- Products offeredINOAC CORPORATION- Business overview- Products offered- Recent developmentsARMACELL- Business overview- Products offered- Recent developmentsUFP TECHNOLOGIES, INC.- Business overview- Products offeredFUTURE FOAM, INC.- Business overview- Products offered- Recent developmentsFXI- Business overview- Products offered- Recent developmentsWOODBRIDGE FOAM CORPORATION- Business overview- Products offered- Recent developmentsNEVEON HOLDING GMBH- Business overview- Products offeredFOAMCRAFT, INC.- Business overview- Products offered

-

13.2 OTHER PLAYERSCARPENTER CO.INTERFOAM LIMITEDHEUBACH CORPORATIONINTERPLASPFOAM SUPPLIES, INC.REMPAC FOAM, LLC.AMERICAN FOAM PRODUCTSHENKEL POLYBIT INDUSTRIES LTD.ADIENT PLC

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 POLYURETHANE FOAM MARKET: INCLUSIONS & EXCLUSIONS, BY PROCESS

- TABLE 2 POLYURETHANE FOAM MARKET: INCLUSIONS & EXCLUSIONS, BY END-USE INDUSTRY

- TABLE 3 POLYURETHANE FOAM MARKET: INCLUSIONS & EXCLUSIONS, BY REGION

- TABLE 4 EUROPE: CONSTRUCTION INDUSTRY GROWTH (%), BY COUNTRY, 2016–2020

- TABLE 5 ASIA PACIFIC: CONSTRUCTION INDUSTRY GROWTH (%), BY COUNTRY, 2016–2020

- TABLE 6 PU FOAM MARKET: CONFERENCES & EVENTS

- TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 11 KEY BUYING CRITERIA, BY TOP THREE APPLICATIONS

- TABLE 12 TYPES OF MDI

- TABLE 13 TYPES OF TDI

- TABLE 14 POLYURETHANE FOAM MARKET SIZE, BY TYPE, 2018–2022 (KILOTON)

- TABLE 15 POLYURETHANE FOAMS MARKET SIZE, BY TYPE, 2023–2028 (KILOTON)

- TABLE 16 POLYURETHANE FOAM MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 17 POLYURETHANE FOAMS MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 18 FLEXIBLE POLYURETHANE FOAM MARKET SIZE, BY REGION, 2018–2022 (KILOTON)

- TABLE 19 FLEXIBLE POLYURETHANE FOAMS MARKET SIZE, BY REGION, 2023–2028 (KILOTON)

- TABLE 20 FLEXIBLE POLYURETHANE FOAM MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 21 FLEXIBLE POLYURETHANE FOAMS MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 RIGID POLYURETHANE FOAM MARKET SIZE, BY REGION, 2018–2022 (KILOTON)

- TABLE 23 RIGID POLYURETHANE FOAMS MARKET SIZE, BY REGION, 2023–2028 (KILOTON)

- TABLE 24 RIGID POLYURETHANE FOAM MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 25 RIGID POLYURETHANE FOAMS MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 SPRAY POLYURETHANE FOAM MARKET SIZE, BY REGION, 2018–2022 (KILOTON)

- TABLE 27 SPRAY POLYURETHANE FOAMS MARKET SIZE, BY REGION, 2023–2028 (KILOTON)

- TABLE 28 SPRAY POLYURETHANE FOAM MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 29 SPRAY POLYURETHANE FOAMS MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 POLYURETHANE FOAM MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 31 POLYURETHANE FOAMS MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 32 POLYURETHANE FOAM MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 33 POLYURETHANE FOAMS MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 34 POLYURETHANE FOAM MARKET SIZE IN BEDDING & FURNITURE, BY REGION, 2018–2022 (KILOTON)

- TABLE 35 POLYURETHANE FOAMS MARKET SIZE IN BEDDING & FURNITURE, BY REGION, 2023–2028 (KILOTON)

- TABLE 36 POLYURETHANE FOAM MARKET SIZE IN BEDDING & FURNITURE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 37 POLYURETHANE FOAMS MARKET SIZE IN BEDDING & FURNITURE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 POLYURETHANE FOAM MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2018–2022 (KILOTON)

- TABLE 39 POLYURETHANE FOAMS MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2023–2028 (KILOTON)

- TABLE 40 POLYURETHANE FOAM MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2018–2022 (USD MILLION)

- TABLE 41 POLYURETHANE FOAMS MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 POLYURETHANE FOAM MARKET SIZE IN ELECTRONICS, BY REGION, 2018–2022 (KILOTON)

- TABLE 43 POLYURETHANE FOAMS MARKET SIZE IN ELECTRONICS, BY REGION, 2023–2028 (KILOTON)

- TABLE 44 POLYURETHANE FOAM MARKET SIZE IN ELECTRONICS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 45 POLYURETHANE FOAMS MARKET SIZE IN ELECTRONICS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 POLYURETHANE FOAM MARKET SIZE IN AUTOMOTIVE, BY REGION, 2018–2022 (KILOTON)

- TABLE 47 POLYURETHANE FOAMS MARKET SIZE IN AUTOMOTIVE, BY REGION, 2023–2028 (KILOTON)

- TABLE 48 POLYURETHANE FOAM MARKET SIZE IN AUTOMOTIVE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 49 POLYURETHANE FOAMS MARKET SIZE IN AUTOMOTIVE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 POLYURETHANE FOAM MARKET SIZE IN FOOTWEAR, BY REGION, 2018–2022 (KILOTON)

- TABLE 51 POLYURETHANE FOAMS MARKET SIZE IN FOOTWEAR, BY REGION, 2023–2028 (KILOTON)

- TABLE 52 POLYURETHANE FOAM MARKET SIZE IN FOOTWEAR, BY REGION, 2018–2022 (USD MILLION)

- TABLE 53 POLYURETHANE FOAMS MARKET SIZE IN FOOTWEAR, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 POLYURETHANE FOAM MARKET SIZE IN PACKAGING, BY REGION, 2018–2022 (KILOTON)

- TABLE 55 POLYURETHANE FOAMS MARKET SIZE IN PACKAGING, BY REGION, 2023–2028 (KILOTON)

- TABLE 56 POLYURETHANE FOAM MARKET SIZE IN PACKAGING, BY REGION, 2018–2022 (USD MILLION)

- TABLE 57 POLYURETHANE FOAMS MARKET SIZE IN PACKAGING, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 POLYURETHANE FOAM MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2022 (KILOTON)

- TABLE 59 POLYURETHANE FOAMS MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2023–2028 (KILOTON)

- TABLE 60 POLYURETHANE FOAM MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2022 (USD MILLION)

- TABLE 61 POLYURETHANE FOAMS MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 POLYURETHANE FOAM MARKET SIZE, BY REGION, 2018–2022 (KILOTON)

- TABLE 63 POLYURETHANE FOAMS MARKET SIZE, BY REGION, 2023–2028 (KILOTON)

- TABLE 64 POLYURETHANE FOAM MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 65 POLYURETHANE FOAMS MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 ASIA PACIFIC: POLYURETHANE FOAM MARKET SIZE, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 67 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 68 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 69 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 70 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2018–2022 (KILOTON)

- TABLE 71 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2023–2028 (KILOTON)

- TABLE 72 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 73 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 74 ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 75 ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 76 ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 77 ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 78 CHINA: POLYURETHANE FOAM MARKET SIZE, BY TYPE, 2018–2022 (KILOTON)

- TABLE 79 CHINA: MARKET SIZE, BY TYPE, 2023–2028 (KILOTON)

- TABLE 80 CHINA: MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 81 CHINA: MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 82 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 83 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 84 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 85 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 86 JAPAN: POLYURETHANE FOAM MARKET SIZE, BY TYPE, 2018–2022 (KILOTON)

- TABLE 87 JAPAN: MARKET SIZE, BY TYPE, 2023–2028 (KILOTON)

- TABLE 88 JAPAN: MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 89 JAPAN: MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 90 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 91 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 92 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 93 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 94 MALAYSIA: POLYURETHANE FOAM MARKET SIZE, BY TYPE, 2018–2022 (KILOTON)

- TABLE 95 MALAYSIA: MARKET SIZE, BY TYPE, 2023–2028 (KILOTON)

- TABLE 96 MALAYSIA: MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 97 MALAYSIA: MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 98 MALAYSIA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 99 MALAYSIA: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 100 MALAYSIA: POLYURETHANE FOAM MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 101 MALAYSIA: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 102 INDIA: POLYURETHANE FOAM MARKET SIZE, BY TYPE, 2018–2022 (KILOTON)

- TABLE 103 INDIA: MARKET SIZE, BY TYPE, 2023–2028 (KILOTON)

- TABLE 104 INDIA: MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 105 INDIA: MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 106 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 107 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 108 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 109 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 110 SOUTH KOREA: POLYURETHANE FOAM MARKET SIZE, BY TYPE, 2018–2022 (KILOTON)

- TABLE 111 SOUTH KOREA: MARKET SIZE, BY TYPE, 2023–2028 (KILOTON)

- TABLE 112 SOUTH KOREA: MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 113 SOUTH KOREA: MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 114 SOUTH KOREA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 115 SOUTH KOREA: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 116 SOUTH KOREA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 117 SOUTH KOREA: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 118 THAILAND: POLYURETHANE FOAM MARKET SIZE, BY TYPE, 2018–2022 (KILOTON)

- TABLE 119 THAILAND: MARKET SIZE, BY TYPE, 2023–2028 (KILOTON)

- TABLE 120 THAILAND: MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 121 THAILAND: MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 122 THAILAND: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 123 THAILAND: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 124 THAILAND: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 125 THAILAND: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 126 SINGAPORE: POLYURETHANE FOAM MARKET SIZE, BY TYPE, 2018–2022 (KILOTON)

- TABLE 127 SINGAPORE: MARKET SIZE, BY TYPE, 2023–2028 (KILOTON)

- TABLE 128 SINGAPORE: MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 129 SINGAPORE: MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 130 SINGAPORE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 131 SINGAPORE: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 132 SINGAPORE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 133 SINGAPORE: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 134 INDONESIA: POLYURETHANE FOAM MARKET SIZE, BY TYPE, 2018–2022 (KILOTON)

- TABLE 135 INDONESIA: MARKET SIZE, BY TYPE, 2023–2028 (KILOTON)

- TABLE 136 INDONESIA: MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 137 INDONESIA: MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 138 INDONESIA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 139 INDONESIA: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 140 INDONESIA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 141 INDONESIA: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 142 REST OF ASIA PACIFIC: POLYURETHANE FOAM MARKET SIZE, BY TYPE, 2018–2022 (KILOTON)

- TABLE 143 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2023–2028 (KILOTON)

- TABLE 144 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 145 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 146 REST OF ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 147 REST OF ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 148 REST OF ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 149 REST OF ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 150 EUROPE: POLYURETHANE FOAM MARKET SIZE, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 151 EUROPE: MARKET SIZE, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 152 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 153 EUROPE: MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 154 EUROPE: MARKET SIZE, BY TYPE, 2018–2022 (KILOTON)

- TABLE 155 EUROPE: MARKET SIZE, BY TYPE, 2023–2028 (KILOTON)

- TABLE 156 EUROPE: MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 157 EUROPE: MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 158 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 159 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 160 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 161 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 162 GERMANY: POLYURETHANE FOAM MARKET SIZE, BY TYPE, 2018–2022 (KILOTON)

- TABLE 163 GERMANY: MARKET SIZE, BY TYPE, 2023–2028 (KILOTON)

- TABLE 164 GERMANY: MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 165 GERMANY: MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 166 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 167 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 168 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 169 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 170 FRANCE: POLYURETHANE FOAM MARKET SIZE, BY TYPE, 2018–2022 (KILOTON)

- TABLE 171 FRANCE: MARKET SIZE, BY TYPE, 2023–2028 (KILOTON)

- TABLE 172 FRANCE: MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 173 FRANCE: MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 174 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 175 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 176 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 177 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 178 ITALY: POLYURETHANE FOAM MARKET SIZE, BY TYPE, 2018–2022 (KILOTON)

- TABLE 179 ITALY: MARKET SIZE, BY TYPE, 2023–2028 (KILOTON)

- TABLE 180 ITALY: MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 181 ITALY: MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 182 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 183 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 184 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 185 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 186 UK: POLYURETHANE FOAM MARKET SIZE, BY TYPE, 2018–2022 (KILOTON)

- TABLE 187 UK: MARKET SIZE, BY TYPE, 2023–2028 (KILOTON)

- TABLE 188 UK: MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 189 UK: MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 190 UK: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 191 UK: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 192 UK: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 193 UK: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 194 RUSSIA: POLYURETHANE FOAM MARKET SIZE, BY TYPE, 2018–2022 (KILOTON)

- TABLE 195 RUSSIA: MARKET SIZE, BY TYPE, 2023–2028 (KILOTON)

- TABLE 196 RUSSIA: MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 197 RUSSIA: MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 198 RUSSIA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 199 RUSSIA: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 200 RUSSIA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 201 RUSSIA: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 202 TURKEY: POLYURETHANE FOAM MARKET SIZE, BY TYPE, 2018–2022 (KILOTON)

- TABLE 203 TURKEY: MARKET SIZE, BY TYPE, 2023–2028 (KILOTON)

- TABLE 204 TURKEY: MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 205 TURKEY: MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 206 TURKEY: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 207 TURKEY: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 208 TURKEY: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 209 TURKEY: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 210 POLAND: POLYURETHANE FOAM MARKET SIZE, BY TYPE, 2018–2022 (KILOTON)

- TABLE 211 POLAND: MARKET SIZE, BY TYPE, 2023–2028 (KILOTON)

- TABLE 212 POLAND: MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 213 POLAND: MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 214 POLAND: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 215 POLAND: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 216 POLAND: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 217 POLAND: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 218 REST OF EUROPE: POLYURETHANE FOAM MARKET SIZE, BY TYPE, 2018–2022 (KILOTON)

- TABLE 219 REST OF EUROPE: MARKET SIZE, BY TYPE, 2023–2028 (KILOTON)

- TABLE 220 REST OF EUROPE: MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 221 REST OF EUROPE: MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 222 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 223 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 224 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 225 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 226 NORTH AMERICA: POLYURETHANE FOAM MARKET SIZE, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 227 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 228 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 229 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 230 NORTH AMERICA: MARKET SIZE, BY TYPE, 2018–2022 (KILOTON)

- TABLE 231 NORTH AMERICA: MARKET SIZE, BY TYPE, 2023–2028 (KILOTON)

- TABLE 232 NORTH AMERICA: MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 233 NORTH AMERICA: MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 234 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 235 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 236 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 237 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 238 US: POLYURETHANE FOAM MARKET SIZE, BY TYPE, 2018–2022 (KILOTON)

- TABLE 239 US: MARKET SIZE, BY TYPE, 2023–2028 (KILOTON)

- TABLE 240 US: MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 241 US: MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 242 US: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 243 US: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 244 US: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 245 US: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 246 MEXICO: POLYURETHANE FOAM MARKET SIZE, BY TYPE, 2018–2022 (KILOTON)

- TABLE 247 MEXICO: MARKET SIZE, BY TYPE, 2023–2028 (KILOTON)

- TABLE 248 MEXICO: MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 249 MEXICO: MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 250 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 251 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 252 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 253 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 254 CANADA: POLYURETHANE FOAM MARKET SIZE, BY TYPE, 2018–2022 (KILOTON)

- TABLE 255 CANADA: MARKET SIZE, BY TYPE, 2023–2028 (KILOTON)

- TABLE 256 CANADA: MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 257 CANADA: MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 258 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 259 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 260 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 261 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 262 MIDDLE EAST: POLYURETHANE FOAM MARKET SIZE, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 263 MIDDLE EAST: MARKET SIZE, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 264 MIDDLE EAST: MARKET SIZE, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 265 MIDDLE EAST: MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 266 MIDDLE EAST: MARKET SIZE, BY TYPE, 2018–2022 (KILOTON)

- TABLE 267 MIDDLE EAST: MARKET SIZE, BY TYPE, 2023–2028 (KILOTON)

- TABLE 268 MIDDLE EAST: MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 269 MIDDLE EAST: MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 270 MIDDLE EAST: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 271 MIDDLE EAST: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 272 MIDDLE EAST: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 273 MIDDLE EAST: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 274 UAE: POLYURETHANE FOAM MARKET SIZE, BY TYPE, 2018–2022 (KILOTON)

- TABLE 275 UAE: MARKET SIZE, BY TYPE, 2023–2028 (KILOTON)

- TABLE 276 UAE: MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 277 UAE: MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 278 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 279 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 280 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 281 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 282 SAUDI ARABIA: POLYURETHANE FOAM MARKET SIZE, BY TYPE, 2018–2022 (KILOTON)

- TABLE 283 SAUDI ARABIA: MARKET SIZE, BY TYPE, 2023–2028 (KILOTON)

- TABLE 284 SAUDI ARABIA: MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 285 SAUDI ARABIA: MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 286 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 287 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 288 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 289 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 290 REST OF MIDDLE EAST: POLYURETHANE FOAM MARKET SIZE, BY TYPE, 2018–2022 (KILOTON)

- TABLE 291 REST OF MIDDLE EAST: MARKET SIZE, BY TYPE, 2023–2028 (KILOTON)

- TABLE 292 REST OF MIDDLE EAST: MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 293 REST OF MIDDLE EAST: MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 294 REST OF MIDDLE EAST: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 295 REST OF MIDDLE EAST: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 296 REST OF MIDDLE EAST: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 297 REST OF MIDDLE EAST: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 298 AFRICA: POLYURETHANE FOAM MARKET SIZE, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 299 AFRICA: MARKET SIZE, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 300 AFRICA: MARKET SIZE, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 301 AFRICA: MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 302 AFRICA: MARKET SIZE, BY TYPE, 2018–2022 (KILOTON)

- TABLE 303 AFRICA: MARKET SIZE, BY TYPE, 2023–2028 (KILOTON)

- TABLE 304 AFRICA: MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 305 AFRICA: MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 306 AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 307 AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 308 AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 309 AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 310 EGYPT: POLYURETHANE FOAM MARKET SIZE, BY TYPE, 2018–2022 (KILOTON)

- TABLE 311 EGYPT: MARKET SIZE, BY TYPE, 2023–2028 (KILOTON)

- TABLE 312 EGYPT: MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 313 EGYPT: MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 314 EGYPT: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 315 EGYPT: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 316 EGYPT: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 317 EGYPT: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 318 SOUTH AFRICA: POLYURETHANE FOAM MARKET SIZE, BY TYPE, 2018–2022 (KILOTON)

- TABLE 319 SOUTH AFRICA: MARKET SIZE, BY TYPE, 2023–2028 (KILOTON)

- TABLE 320 SOUTH AFRICA: MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 321 SOUTH AFRICA: MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 322 SOUTH AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 323 SOUTH AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 324 SOUTH AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 325 SOUTH AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 326 REST OF AFRICA: POLYURETHANE FOAM MARKET SIZE, BY TYPE, 2018–2022 (KILOTON)

- TABLE 327 REST OF AFRICA: MARKET SIZE, BY TYPE, 2023–2028 (KILOTON)

- TABLE 328 REST OF AFRICA: MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 329 REST OF AFRICA: MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 330 REST OF AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 331 REST OF AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 332 REST OF AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 333 REST OF AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 334 SOUTH AMERICA: POLYURETHANE FOAM MARKET SIZE, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 335 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 336 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 337 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 338 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2018–2022 (KILOTON)

- TABLE 339 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2023–2028 (KILOTON)

- TABLE 340 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 341 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 342 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 343 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 344 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 345 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 346 BRAZIL: POLYURETHANE FOAM MARKET SIZE, BY TYPE, 2018–2022 (KILOTON)

- TABLE 347 BRAZIL: MARKET SIZE, BY TYPE, 2023–2028 (KILOTON)

- TABLE 348 BRAZIL: MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 349 BRAZIL: MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 350 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 351 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 352 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 353 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 354 ARGENTINA: POLYURETHANE FOAM MARKET SIZE, BY TYPE, 2018–2022 (KILOTON)

- TABLE 355 ARGENTINA: MARKET SIZE, BY TYPE, 2023–2028 (KILOTON)

- TABLE 356 ARGENTINA: MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 357 ARGENTINA: MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 358 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 359 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 360 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 361 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 362 CHILE: POLYURETHANE FOAM MARKET SIZE, BY TYPE, 2018–2022 (KILOTON)

- TABLE 363 CHILE: MARKET SIZE, BY TYPE, 2023–2028 (KILOTON)

- TABLE 364 CHILE: MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 365 CHILE: MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 366 CHILE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 367 CHILE: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 368 CHILE: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 369 CHILE: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 370 REST OF SOUTH AMERICA: POLYURETHANE FOAM MARKET SIZE, BY TYPE, 2018–2022 (KILOTON)

- TABLE 371 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2023–2028 (KILOTON)

- TABLE 372 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 373 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 374 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (KILOTON)

- TABLE 375 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 376 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 377 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 378 STRATEGIES ADOPTED BY KEY PLAYERS IN POLYURETHANE FOAM MARKET

- TABLE 379 POLYURETHANE FOAM MARKET: DEGREE OF COMPETITION

- TABLE 380 POLYURETHANE FOAM MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 381 POLYURETHANE FOAM MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 382 POLYURETHANE FOAM MARKET: PRODUCT LAUNCHES, 2018–2022

- TABLE 383 POLYURETHANE FOAM MARKET: DEALS, 2018–2022

- TABLE 384 POLYURETHANE FOAM MARKET: OTHERS, 2018–2022

- TABLE 385 BASF SE: COMPANY OVERVIEW

- TABLE 386 HUNTSMAN INTERNATIONAL LLC: COMPANY OVERVIEW

- TABLE 387 DOW: COMPANY OVERVIEW

- TABLE 388 COVESTRO AG: COMPANY OVERVIEW

- TABLE 389 SAINT-GOBAIN: COMPANY OVERVIEW

- TABLE 390 WANHUA CHEMICAL GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 391 RECTICEL NV/SA: COMPANY OVERVIEW

- TABLE 392 ROGERS CORPORATION: COMPANY OVERVIEW

- TABLE 393 SEKISUI CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 394 TRELLEBORG AB: COMPANY OVERVIEW

- TABLE 395 LANXESS: COMPANY OVERVIEW

- TABLE 396 DUPONT: COMPANY OVERVIEW

- TABLE 397 INOAC CORPORATION: COMPANY OVERVIEW

- TABLE 398 ARMACELL: COMPANY OVERVIEW

- TABLE 399 UFP TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 400 FUTURE FOAM, INC.: COMPANY OVERVIEW

- TABLE 401 FXI: COMPANY OVERVIEW

- TABLE 402 WOODBRIDGE FOAM CORPORATION: COMPANY OVERVIEW

- TABLE 403 NEVEON HOLDING GMBH: COMPANY OVERVIEW

- TABLE 404 FOAMCRAFT, INC.: COMPANY OVERVIEW

- FIGURE 1 POLYURETHANE FOAM MARKET SEGMENTATION

- FIGURE 2 POLYURETHANE FOAM MARKET: RESEARCH DESIGN

- FIGURE 3 BASE NUMBER CALCULATION: APPROACH 1

- FIGURE 4 BASE NUMBER CALCULATION: APPROACH 2

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 7 POLYURETHANE FOAM MARKET: DATA TRIANGULATION

- FIGURE 8 BUILDING & CONSTRUCTION SEGMENT TO ACCOUNT FOR LARGEST SHARE OF POLYURETHANE FOAM MARKET

- FIGURE 9 RIGID FOAM SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF POLYURETHANE FOAM MARKET IN 2022, IN TERMS OF VALUE

- FIGURE 11 INCREASING USE OF POLYURETHANE FOAMS IN DIFFERENT APPLICATIONS TO DRIVE MARKET

- FIGURE 12 ASIA PACIFIC TO BE LARGEST POLYURETHANE FOAM MARKET FROM 2023 TO 2028

- FIGURE 13 CHINA ACCOUNTED FOR LARGEST MARKET SHARE

- FIGURE 14 FLEXIBLE FOAM TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 15 BEDDING & FURNITURE TO BE LARGEST END-USE INDUSTRY OF POLYURETHANE FOAM

- FIGURE 16 POLYURETHANE FOAM MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 PORTER’S FIVE FORCES ANALYSIS: POLYURETHANE FOAM MARKET

- FIGURE 18 GLOBAL FLEXIBLE FOAM PRICES REGISTERED DECLINE FROM 2016 TO 2022

- FIGURE 19 RIGID FOAM PRICES REGISTERED DECLINE IN SOME NATIONS IN 2022

- FIGURE 20 KCI LICENSING INC. REGISTERED HIGHEST NUMBER OF PATENTS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 22 KEY BUYING CRITERIA, BY APPLICATION

- FIGURE 23 SPRAY FOAM SEGMENT TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 24 BUILDING & CONSTRUCTION TO ACCOUNT FOR LARGEST SHARE OF POLYURETHANE FOAM MARKET

- FIGURE 25 INDIA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 26 ASIA PACIFIC: POLYURETHANE FOAM MARKET SNAPSHOT

- FIGURE 27 EUROPE: POLYURETHANE FOAM MARKET SNAPSHOT

- FIGURE 28 NORTH AMERICA: POLYURETHANE FOAM MARKET SNAPSHOT

- FIGURE 29 ENERGY CONSUMPTION IN US, BY END-USE SECTOR, 2020

- FIGURE 30 RANKING OF TOP FIVE PLAYERS IN POLYURETHANE FOAM MARKET, 2022

- FIGURE 31 BASF SE LED POLYURETHANE FOAM MARKET IN 2022

- FIGURE 32 REVENUE ANALYSIS OF TOP PLAYERS (2018–2022)

- FIGURE 33 POLYURETHANE FOAM MARKET: COMPANY OVERALL FOOTPRINT

- FIGURE 34 COMPANY EVALUATION MATRIX: POLYURETHANE FOAM MARKET (TIER 1)

- FIGURE 35 STARTUP/SME EVALUATION MATRIX: POLYURETHANE FOAM MARKET

- FIGURE 36 BASF SE: COMPANY SNAPSHOT

- FIGURE 37 HUNTSMAN CORPORATION: COMPANY SNAPSHOT

- FIGURE 38 DOW: COMPANY SNAPSHOT

- FIGURE 39 COVESTRO AG: COMPANY SNAPSHOT

- FIGURE 40 SAINT-GOBAIN: COMPANY SNAPSHOT

- FIGURE 41 WANHUA CHEMICAL GROUP CO., LTD.: COMPANY SNAPSHOT

- FIGURE 42 RECTICEL NV/SA: COMPANY SNAPSHOT

- FIGURE 43 ROGERS CORPORATION: COMPANY SNAPSHOT

- FIGURE 44 SEKISUI CHEMICAL CO., LTD.: COMPANY SNAPSHOT

- FIGURE 45 TRELLEBORG AB: COMPANY SNAPSHOT

- FIGURE 46 DUPONT: COMPANY SNAPSHOT

- FIGURE 47 ARMACELL: COMPANY SNAPSHOT

- FIGURE 48 UFP TECHNOLOGIES, INC.: COMPANY SNAPSHOT

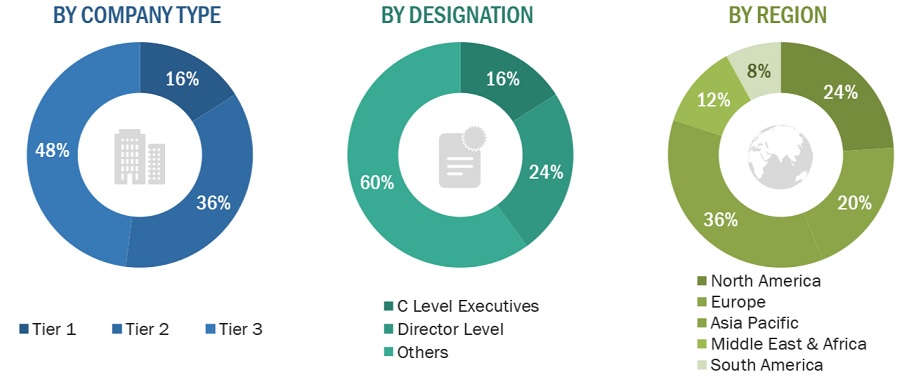

The study involved four major activities in estimating the current polyurethane foam market size—exhaustive secondary research collected information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and measures with industry experts across the value chain of polyurethane foam through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were used to estimate the size of the segments and sub-segments of the market.

Secondary Research

The research methodology used to estimate and forecast the access control market begins with capturing data on the revenues of key vendors in the market through secondary research. In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, Factiva, World Bank, and Industry Journals, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, notifications by regulatory bodies, trade directories, and databases. Vendor offerings have also been taken into consideration to determine market segmentation.

Primary Research

The polyurethane foam market comprises several stakeholders in the supply chain, such as service providers, equipment manufacturers, traders, associations, and regulatory organizations. The demand side of this market is characterized by the development of bedding & furniture, building & construction, automotive, electronics, footwear, packaging, and other end-use industries. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents:

Note: “Others” includes sales, marketing, and product managers

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the polyurethane market. These methods were also used extensively to determine the market size of various segments. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the polyurethane foam market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Global Polyurethane Foam Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Polyurethane Foam Market Size: Top-Down Approach

Data Triangulation

The market was split into several segments and sub-segments after arriving at the overall market size using the market size estimation processes as explained above. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The market size was calculated globally by summing up the country-level and regional-level data.

Market Definition

Polyurethane foams combine diisocyanates with one or more short-chain or long-chain diols. Various polyurethane foam grades and blends used in commercial applications are developed through the reaction of several combinations of these chemical compounds. Polyurethane foams are commonly used for padding and insulation in furniture and clothing and for manufacturing resins used in adhesives, elastomers, and fillers.

Various types of polyurethane foams are available in the market, including rigid, flexible, and spray foams. These foams are used in various end-use industries such as bedding & furniture, building & construction, electronics, automotive, footwear, and packaging.

Key Stakeholder

- Polyurethane Foam Manufacturers

- Distributors and Suppliers of Polyurethane Foam.

- Manufacturers of automobiles, electronics, and furniture.

- Associations and Industrial Bodies such as the American Chemistry Council (ACC), Polyurethane Foam Association (PFA), Flexible Polyurethane Foam Alliance (FPFA, National Insulation Association (NIA), Thermal Insulation Association of Canada (TIAC) and Others

- NGOs, Governments, Investment Banks, Venture Capitalists, and Private Equity Firms

Report Objectives:

- To define, describe, and forecast the size of the global polyurethane foam market in terms of value and volume

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the polyurethane foam market

- To analyze and forecast the size of various segments (type and end-user) of the polyurethane foam market based on five major regions—North America, Europe, Asia Pacific, South America, Middle East, and Africa—along with key countries in each of these regions

- To analyze recent developments and competitive strategies, such as expansions, new product developments, partnerships, and acquisitions, to draw the competitive landscape of the market

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the report:

- Additional country-level analysis of the polyurethane foam market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Polyurethane Foam Market