The research study involved the extensive use of secondary sources, directories, and databases (annual reports or presentations of companies, industry association publications, directories, technical handbooks, World Economic Outlook (WEO), trade websites, Hoovers, Bloomberg Businessweek, Factiva, and OneSource) to identify and collect information useful for this technical, market-oriented, and commercial study of the system-on-chip (SoC) market. Primary sources mainly comprise several experts from the core and related industries, along with preferred suppliers, manufacturers, distributors, service providers, system providers, technology developers, alliances, and standards and certification organizations related to various phases of this industry's value chain.

Secondary Research

In the secondary research process, various secondary sources were used to identify and collect information for this study. These include annual reports, press releases, and investor presentations of companies, whitepapers, certified publications, and articles from recognized associations and government publishing sources. Research reports from a few consortiums and councils were also consulted to structure qualitative content. Secondary sources included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; Journals and certified publications; articles by recognized authors; gold-standard and silver-standard websites; directories; and databases. Data was also collected from secondary sources, such as the International Trade Centre (ITC) (Switzerland), and the International Monetary Fund (IMF).

Primary Research

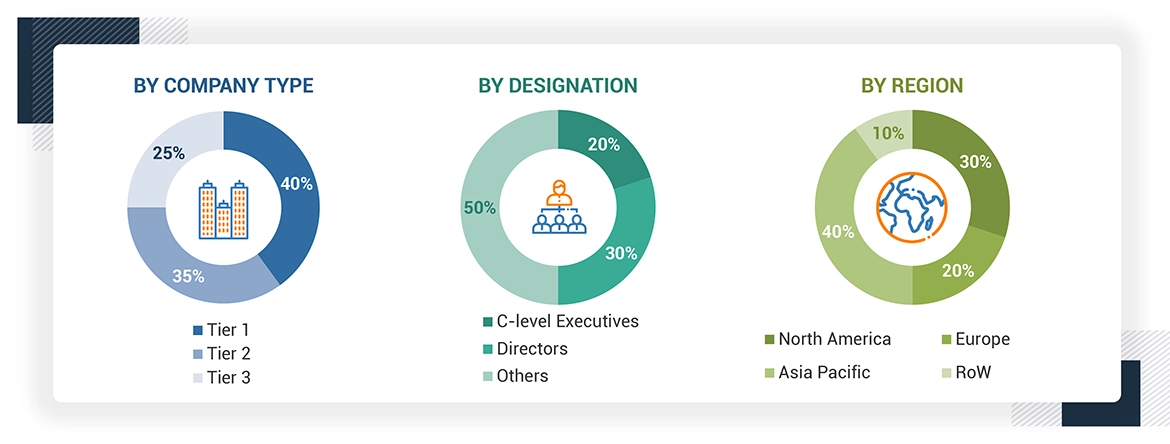

Extensive primary research was accomplished after understanding and analyzing the System-on-Chip (SoC) market scenario through secondary research. Several primary interviews were conducted with key opinion leaders from both demand- and supply-side vendors across four major regions-North America, Europe, Asia Pacific, and RoW. The primary interviews were conducted with the demand side to the extent of 40% and with the supply side to the extent of 60%. Primary data collected through questionnaires, emails, telephonic interviews, through the contact of various departments in organizations, sales, operations, and administration are considered to provide a holistic viewpoint in the report.

Note: The three tiers of companies are based on their total revenue as of 2023: Tier 1 - equal to or more than USD 1,000 million; Tier 2 - between USD 500 million and USD 1,000 million; and Tier 3 - less than or equal to USD 500 million. Other designations include managers and academicians.

About the assumptions considered for the study, To know download the pdf brochure

Market Size Estimation

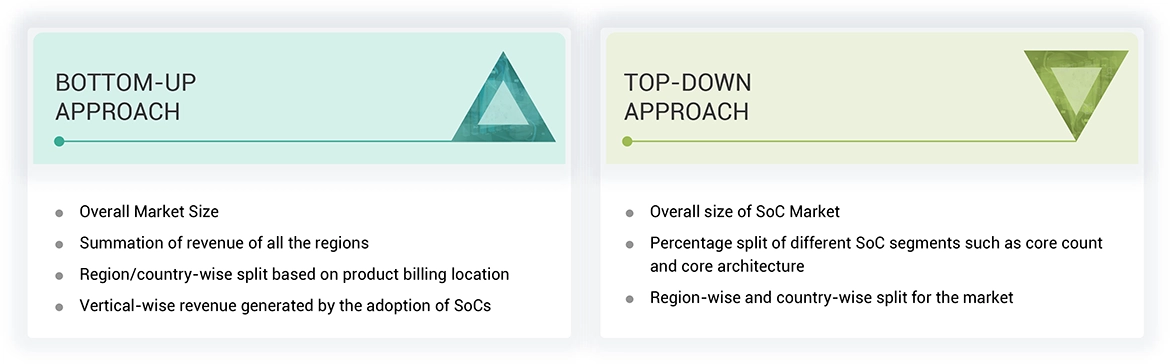

In the complete market engineering process, both top-down and bottom-up approaches were used, along with several data triangulation methods, to estimate and forecast the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were carried out on the complete market engineering process to list the key information/insights pertaining to System-on-Chip (SoC) market.

The key players in the market were identified through secondary research, and their rankings in the respective regions determined through primary and secondary research. This entire procedure involved the study of the annual and financial reports of top players, and interviews with industry experts such as chief executive officers, vice presidents, directors, and marketing executives for quantitative and qualitative key insights. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, supplemented with detailed inputs and analysis from MarketsandMarkets, and presented in this report.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both demand and supply sides. Along with this, the market size was validated using both top-down and bottom-up approaches.

Market Definition

A System-on-Chip is an integrated circuit or an IC that integrates an entire electronic or computer system on a single chip instead of its use with individual components. The typical components usually found within this IC include the central processing unit, memory interfaces, I/O ports, and other specialized functions, like graphics processing units, NPU, and wireless communication modules. Therefore, SoCs are designed for such miniature systems where the design can provide a complete system solution on one chip in a compact form and will result in reduced power consumption, smaller device sizes, and better performance. Thus, they prove to be very practical for major applications in mobile devices, embedded systems, Internet of Things (IoT), and industrial applications.

This market will encompass all types of cargo ships, passenger ships, as well as other commercial vessels that can be turned into a methanol-fueled vessel due to its combustion profile, storage properties, and scalability. Green methanol has the highest potential for long-haul routes because it offers energy density, potentially being significantly more efficient than battery- or hydrogen-based fuel.

Stakeholders

-

Government and financial institutions and investment communities

-

Analysts and strategic business planners

-

Semiconductor product designers and fabricators

-

Application providers

-

SoC providers

-

Business providers

-

Professional service/solution providers

-

Research organizations

-

Technology standard organizations, forums, alliances, and associations

-

Technology investors

Report Objectives

-

To define, describe, segment, and forecast the size of the System-on-Chip (SoC) market, in terms of value, based on core count, core architecture, vertical, and region

-

To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW)

-

To define, describe, segment, and forecast the size of the System-on-Chip (SoC) market, in terms of volume, based on vertical

-

To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

-

To provide an ecosystem analysis, case study analysis, patent analysis, technology analysis, pricing analysis, Porter's five forces analysis, investment and funding scenario, and regulations pertaining to the market

-

To provide a detailed overview of the value chain analysis of the system-on-chip ecosystem

-

To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the total market

-

To analyze opportunities for stakeholders by identifying high-growth segments of the market

-

To strategically profile the key players, comprehensively analyze their market positions in terms of ranking and core competencies2, and provide a competitive market landscape.

-

To analyze strategic approaches such as product launches, acquisitions, agreements, and partnerships in the System-on-Chip (SoC) market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

-

Detailed analysis and profiling of additional market players (up to 7)

Growth opportunities and latent adjacency in System-on-Chip (SoC) Market