Solid-State Battery Market Size, Share & Trends

Solid-State Battery Market by Battery Type (Primary, Secondary), Capacity (Below 20 mAh, 20-500 mAh, Above 500 mAh), Application (Consumer Electronics, Electric Vehicles, Medical Devices, Energy Harvesting, Wireless Sensors) - Global Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global solid-state battery market is expected to grow from USD 0.26 billion in 2025 to USD 1.77 billion by 2031, registering a CAGR of 37.5%. This growth is driven by the increasing adoption of electric vehicles, rising demand for safe and high-density energy storage solutions, and rapid progress in solid electrolytes such as sulfide, oxide, and polymer. Additionally, the market benefits from large R&D investments, pilot manufacturing efforts, and strong government-backed initiatives in Asia Pacific, North America, and Europe focused on bringing next-generation battery technologies to market.

KEY TAKEAWAYS

-

BY REGIONAsia Pacific is estimated to dominate the solid-state battery market.

-

BY APPLICATIONBy application, the Electric Vehicles segment held a share of 33.0% in 2024.

-

BY CAPACITYBy capacity, the Above 500 mAh segment is expected to grow at the highest CAGR of 43.3% during the forecast period.

-

BY BATTERY TYPEBy battery type, the secondary battery segment is projected to hold the largest share of 66.6% in 2025, supported by rising demand for durable, high-energy-density solutions in electric mobility and stationary storage systems.

-

COMPETITIVE LANDSCAPEProLogium Technology Co., Ltd. (Taiwan), Solid Power, Inc. (US), Blue Solutions (France), Factorial Inc. (US), Ilika (UK), QuantumScape Battery, Inc. (US), and LionVolt (Netherlands) were identified as Star players in the solid-state battery market, given their strong technological capabilities, pilot-scale production advancements, and strategic collaborations with automotive OEMs.

The global solid-state battery market is projected to grow from USD 0.26 billion in 2025 to USD 1.77 billion by 2031, registering a CAGR of 37.5%. Growth is being propelled by the accelerating adoption of electric vehicles, increasing demand for safe and high-density energy storage solutions, and rapid advancements in solid electrolytes such as sulfide, oxide, and polymer. The market is further supported by large-scale R&D investments, pilot-scale manufacturing initiatives, and strong government-backed programs in Asia Pacific, North America, and Europe aimed at commercializing next-generation battery technologies.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on customers’ businesses in the solid-state battery market is driven by the demand for safer, higher-performance energy storage solutions and the shift toward next-generation electrification. Automotive, renewable energy, consumer electronics, aerospace, and medical sectors are actively researching solid-state batteries, with electric mobility and grid-scale storage as key focus areas. Advances in solid electrolytes, increased energy density, and longer cycle life are changing expectations around performance, safety, and total cost of ownership for end users. These changes are speeding up demand for solid-state battery innovation and commercialization, positioning the technology as a transformative force in long-term energy and mobility development.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing R&D initiatives to launch advanced solid-state batteries.

-

Growing adoption of electric vehicles

Level

-

Intensive capital requirement for R&D and establishing manufacturing facilities

Level

-

Significant investments by established players to boost R&D activities

-

Rising demand for miniaturized devices in consumer electronics

Level

-

Complications associated with developing solid-state batteries

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing R&D initiatives to launch advanced solid-state batteries

Growing R&D efforts focused on developing advanced solid-state electrolytes and scalable manufacturing processes are driving innovation forward. Government funding and private investments are supporting companies in transitioning from lab-scale prototypes to commercial readiness.

Restraint: Intensive capital requirement for R&D and establishing manufacturing facilities

Commercializing solid-state batteries demands substantial capital for R&D, pilot production, and manufacturing facilities. These high expenses create barriers for new entrants and hinder widespread adoption.

Opportunity: Rising demand for miniaturized devices in consumer electronics

The growing use of medical implants, IoT devices, and wearable electronics is increasing demand for compact, durable, and safe energy storage solutions. Solid-state micro-batteries are well-suited these needs, creating niche growth opportunities.

Challenge: Complications associated with developing solid-state batteries

Scaling up solid-state batteries remains challenging because of issues like dendrite growth, electrolyte stability, and interface resistance. Solving these technical problems is essential for reliable, affordable mass production.

Solid-State Battery Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Developing solid-state lithium ceramic batteries for electric vehicles and consumer electronics; partnerships with global automakers for large-scale adoption | Higher safety with ceramic electrolytes, improved energy density, and enhanced fast-charging capabilities |

|

Producing sulfide-based solid-state battery cells for EVs and aerospace applications; collaboration with Ford and BMW for automotive integration | Greater range and performance, safer chemistry with no flammable liquid electrolyte, scalable cell designs for automotive platforms |

|

Commercializing GEN4 solid-state batteries across multiple sectors, including passenger cars, semi-trailers, public transport, light mobility, drones, eVTOLs, and consumer electronics | Actively pursuing Joint Development Agreements (JDAs) with OEMs such as BMW and others to accelerate adoption | Enhanced safety, extended lifespan, and high performance across diverse mobility and electronics applications; strong environmental impact through recycling initiatives and sustainable manufacturing in France |

|

Commercializing Factorial Electrolyte System Technology (FEST) for solid-state EV batteries; alliances with Hyundai, Stellantis, and Mercedes-Benz | High-voltage capability, enhanced driving range, automotive-grade safety, and compatibility with existing lithium-ion manufacturing lines |

|

Developing solid-state micro-batteries (Stereax) for medical devices, IoT sensors, and industrial monitoring; scaling towards automotive applications | Ultra-compact form factor, long cycle life, reliable operation in extreme conditions, and suitability for miniaturized electronics |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

Key players in the solid-state battery market include ProLogium Technology Co., Ltd. (Taiwan), Solid Power (US), Blue Solutions (France), Factorial Inc. (US), and Ilika (UK), along with other developing technology companies and established OEM partners. The ecosystem extends beyond just cell developers to include raw material suppliers, electrolyte innovators, component manufacturers, and research institutions that are speeding up commercialization. Automotive OEMs and energy storage system providers are central to this effort by integrating solid-state technologies into electric mobility and grid-scale applications. Meanwhile, government-supported R&D initiatives and pilot production facilities are strengthening the path toward wide adoption. Overall, this interconnected ecosystem is fueling technological innovation, increasing capacity, and laying the groundwork for a resilient and sustainable solid-state battery supply chain.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Solid-State Battery Market, By Battery Type

The secondary solid-state battery segment is expected to hold the largest share of the solid-state battery market, supported by its growing adoption in electric vehicles and large-scale energy storage systems. Secondary batteries offer higher energy density, enhanced safety, and longer cycle life compared to primary types, making them the preferred choice for automotive OEMs and renewable energy projects. With increasing investments from automakers and technology developers, secondary solid-state batteries are positioned to drive the commercialization and long-term growth of the market.

Solid-State Battery Market, By Capacity

The above 500 mAh segment is expected to hold the largest share of the solid-state battery market, driven by its suitability for electric vehicles and grid-scale energy storage applications. These batteries offer higher energy density, longer cycle life, and improved safety compared to lower-capacity segments, making them the preferred choice for high-power applications. With ongoing pilot-scale production and strong investments from automakers and energy companies, the above 500 mAh segment is poised to lead the scaling of solid-state battery commercialization.

Solid-State Battery Market, By Application

The electric vehicles segment is expected to hold the largest share of the solid-state battery market, driven by increasing global EV adoption and the demand for safer, higher-performance energy storage solutions. Solid-state batteries provide superior energy density, faster charging, and longer cycle life compared to traditional lithium-ion batteries, making them very appealing for next-generation mobility. With rising investments from automakers and strategic partnerships with solid-state battery developers, the electric vehicles sector is poised to lead the commercialization and large-scale deployment of solid-state technology.

REGION

Asia Pacific to be fastest-growing region in global Solid-State Battery Market during forecast period

Asia Pacific is expected to be the fastest-growing market for solid-state batteries, fueled by widespread electric vehicle adoption, rapid expansion of renewable energy storage projects, and substantial investments in next-generation battery manufacturing. The region hosts leading innovators and a broad supply chain ecosystem for materials, components, and advanced manufacturing, making it a key center for production and commercialization. Strong government-supported initiatives promoting clean mobility, renewable energy integration, and solid-state R&D, along with Industry 4.0 adoption across automotive and energy sectors, are further speeding up market growth. Countries such as China, Japan, and South Korea are leading in solid-state battery innovation, reinforcing Asia Pacific’s role as the primary growth driver of the global solid-state battery market.

Solid-State Battery Market: COMPANY EVALUATION MATRIX

In the solid-state battery market landscape, ProLogium Technology Co., Ltd. (Star) takes the lead with a strong global presence and a solid portfolio of next-generation solid-state battery solutions for electric vehicles and consumer products. Its strides in commercializing lithium ceramic battery technology, pilot-scale manufacturing capabilities, and strategic partnerships with leading automakers such as Mercedes-Benz and VinFast have solidified ProLogium as the dominant player in the industry. StoreDot (Emerging Leader), leveraging its expertise in fast-charging battery technologies, is accelerating its shift toward solid-state innovations through collaborations with major OEMs and investments in scaling production. While ProLogium maintains market leadership through proven solid-state advancements and strategic alliances, StoreDot shows strong growth momentum, positioning itself to move closer to the industry leaders within the evolving solid-state battery sector.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.18 Billion |

| Market Forecast in 2031 (Value) | USD 1.77 Billion |

| Growth Rate | CAGR of 37.5% from 2025-2031 |

| Years Considered | 2021-2031 |

| Base Year | 2024 |

| Forecast Period | 2025-2031 |

| Units Considered | Value (USD Billion), Volume (MWh) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, RoW |

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Automotive OEM |

|

|

| Energy & Utility Provider |

|

|

| Consumer Electronics Manufacturer |

|

|

| Investment Firm |

|

|

RECENT DEVELOPMENTS

- June 2025 : Factorial launched Gammatron, an AI-powered digital twin platform that dramatically accelerates battery development, forecasting long-term performance from just two weeks of lab data and optimizing fast-charging, cycle life, and electrolyte formulation to speed innovation from lab to road.

- May 2025 : ProLogium Technology partnered with Japan’s Kyushu Electric Power to co-develop a 24V lithium ceramic battery module for construction machinery, with a joint collaboration technology unveiling planned at CES 2026. This collaboration advances ProLogium’s global clean energy strategy and aims to expand sustainable solutions across industrial sectors.

- May 2025 : Solid Power and BMW Group reached a major milestone by integrating large-format all-solid-state battery (ASSB) cells into a BMW i7 test vehicle, marking the technology’s first real-world application. This deepened partnership reflects BMW’s commitment to next-gen battery innovation, aiming for higher energy density and longer EV range.

- April 2025 : Ilika validated that its Goliath solid-state batteries, produced at scale at the UK Battery Industrialisation Centre, show superior performance and higher manufacturing yield than pilot-line cells. This advancement boosts confidence in Goliath’s market readiness, offering improved EV range, faster charging, and reduced costs.

- December 2024 : Factorial unveiled its first A sample 40?Ah Solstice all solid state battery cells using a novel dry cathode coating process, achieving up to 80% higher energy density while eliminating hazardous solvents and an energy-intensive step, marking a scalable leap toward commercial EV application.

Table of Contents

Methodology

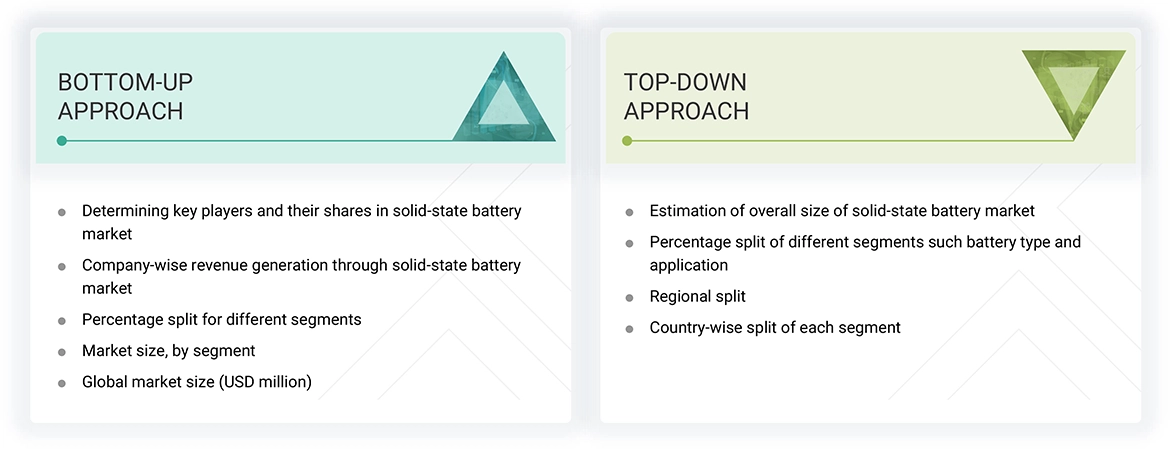

The study involved four major activities in estimating the current size of the solid-state battery market. Exhaustive secondary research has been conducted to gather information on the market, adjacent markets, and the overall solid-state battery landscape. These findings, assumptions, and projections were validated through primary research involving interviews with industry experts and key stakeholders across the value chain. Both top-down and bottom-up approaches were utilized to estimate the overall market size. Subsequently, market breakdown and data triangulation techniques were applied to determine the sizes of various segments and subsegments. Two key sources, secondary and primary, were leveraged to conduct a comprehensive technical and commercial assessment of the solid-state battery market.

Secondary Research

Various secondary sources have been referred to in the secondary research process to identify and collect important information for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain key information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the solid-state battery market through secondary research. Several primary interviews were conducted with experts from the demand and supply sides across four major regions: North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephone interviews.

Note: Three tiers of companies are defined based on their total revenue as of 2024: tier 3 = revenue less than USD 50 million; tier 2 = revenue between USD 50 million and USD 100 million; and tier 1 = revenue more than USD 100 million. Other designations include sales managers, marketing managers, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the solid-state battery market. These methods have also been used extensively to estimate the size of various subsegments on the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Solid-State Battery Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the solid-state battery market from the market size estimation process explained above, the total market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data has been triangulated by studying various factors and trends from the demand and supply sides. Additionally, the market size has been validated using top-down and bottom-up approaches.

Market Definition

The solid-state battery market involves developing and commercializing batteries that use solid electrolytes instead of liquid or gel-based ones. These batteries are designed to offer higher energy density, improved safety, and longer lifespan, making them ideal for electric vehicles and advanced energy storage. The companies are developing these batteries to cater to applications such as consumer electronics, electric vehicles, medical devices, energy harvesting, wireless sensors, and smart packaging. Other emerging uses span drones, aerospace, and smart textiles, where compact, lightweight, and safe power sources are crucial. The market also covers battery types, which include primary and secondary solid-state batteries. Market growth is primarily driven by rising demand for safer and more efficient batteries, rapid electrification of transport, increasing investment in battery R&D, and the push for miniaturization in electronic and medical devices.

Key Stakeholders

- Solid-state Battery Manufacturers

- Government Bodies and Policymakers

- Standards Organizations, Forums, Alliances, and Associations

- Market Research and Consulting Firms

- Raw Material Suppliers and Distributors

- Research Institutes and Organizations

- Material and Technology Providers

- Battery Cell and Battery Pack Manufacturers

- Consumer Electronics Manufacturers

- Testing, Inspection, and Certification Providers

- Distributors and Resellers

Report Objectives

- To define, describe, and forecast the solid-state battery market, by capacity, battery type, application, and region, in terms of value

- To describe and forecast the market with regard to four main regions: North America, Europe, Asia Pacific, and RoW, along with their respective countries, in terms of value

- To provide detailed information regarding major factors influencing the market growth, such as drivers, restraints, opportunities, and challenges

- To provide a detailed overview of the value chain of the solid-state battery market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the solid-state battery market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the solid-state battery market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze competitive strategies, such as product launches, expansions, and partnerships & collaborations, adopted by key market players in the solid-state battery market

Customization Options:

With the market data given, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

What is the CAGR expected to be recorded for the solid-state battery market during 2025-2031?

The global solid-state battery market is expected to record a CAGR of 37.5% from 2025 to 2031.

What are the driving factors for the solid-state battery market?

The solid-state battery market is driven by increasing research and development by solid-state battery manufacturers, rising demand for electric vehicles, and the benefits of solid-state batteries over traditional batteries.

Which application will grow at a high rate in the future?

The electric vehicle application is expected to grow at the highest CAGR during the forecast period. Solid-state batteries are designed primarily with solid electrolytes, which eliminates overheating in the EVs and is the major factor contributing to the segmental growth.

Which are the significant players operating in the solid-state battery market?

Blue Solutions (France), Solid Power, Inc. (US), ProLogium Technology Co, Ltd. (Taiwan), Ilika (UK), and Factorial Energy (US) are some major companies operating in the solid-state battery market.

Which region will offer lucrative opportunities for players in the solid-state battery market by 2031?

The Asia Pacific is expected to offer lucrative opportunities in the solid-state battery market during the projected period.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Solid-State Battery Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Solid-State Battery Market

Parag

Jul, 2022

All the solid-state batteries using advanced sulfur-based electrolytes are not complete commercial yet and are still in research phase. The all-solid state lithium-sulfur batteries include various sulfur composite cathodes such as sulfur/carbon composite and sulfur/metal composite, along with lithium metal anode and a solid electrolyte. However, in the recent past, many research institutes and firms have identified and developed high ionic conductivity compounds of lithium, phosphorus, germanium and sulfur to be combined as an efficient electrolyte materials called super-ionic conductors. NEI Corporation (US) one such company who is actively involved in producing different solid electrolyte materials of sulfide-based compositions..

Johan

Sep, 2021

Need details about listed companies in this domain, along with their market share. .