Micro Battery Market Size, Share & Industry Trends Growth Analysis Report by Type (Thin Film, Printed, Solid-state Chip, Button), Capacity (Below 10 mAh, 10 to 100 mAh, Above 100 mAh), Battery Type (Primary, Secondary), Application (Smart cards, Wireless Sensors) and Region - Global Forecast to 2028

Updated on : Oct 22, 2024

Micro Battery Market Size & Share

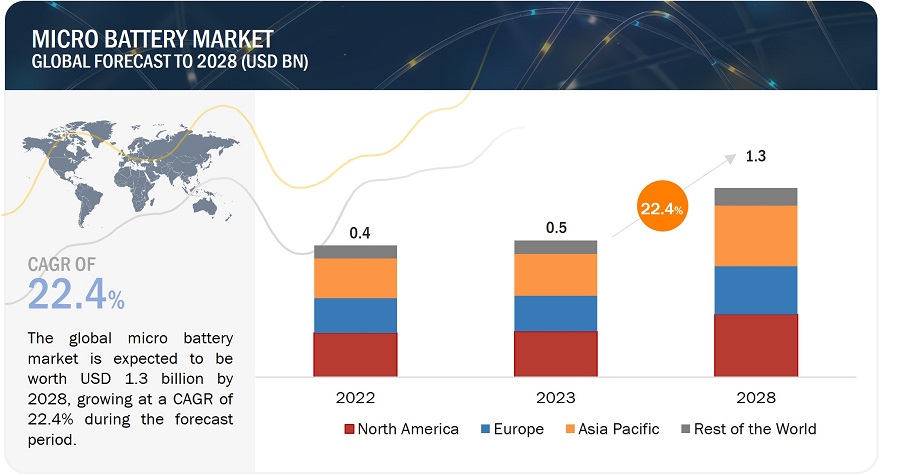

The global Micro Battery Market Size is expected to grow from USD 0.5 Billion in 2023 to USD 1.3 Billion by 2028, growing at a CAGR of 22.4% during the forecast period from 2023 to 2028.

Micro batteries, such as thin film and printed batteries, are designed to complement products requiring an onboard ultra-thin power supply. Printed batteries offer flexibility and are available in thin and ultra-thin sizes, allowing them to be integrated as a power source in various applications, such as smart packaging, smart cards, wearable devices, consumer electronics, and medical devices. Moreover, advancements in thin film and printed batteries have resulted in new emerging application areas, such as smart textiles, wireless sensors, and energy-harvesting devices.

Micro Battery Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Micro Battery Market Trends

DRIVERS: Rising demand for wearable devices

Wearable devices include eyewear, such as smart glasses and virtual reality wearable headsets; and wristwear, such as smartwatches and fitness wristbands. People wear wearable devices to compute their daily activities or track body movement and heart rate information.

Wearable devices come in many shapes and forms, and most wearable applications require ultra-thin durable batteries, creating a vast market potential for micro batteries. The application areas of wearable devices are growing from consumer electronics and medical devices to wireless communication devices.

There are growth opportunities for wearable medical devices and wireless healthcare monitoring systems, as the medical sector will likely witness a significant technological shift. The market for wearable technology is witnessing increasing product innovation with new product launches and developments. Hence, wearable devices require high flexibility and ultra-thin design, which can be achieved through the integration of thin film and printed batteries.

RESTRAINTS: Lack of standards in micro battery designs

The proprietary technology used to manufacture micro batteries differs from manufacturer to manufacturer and is based on the manufacturer’s specifications. These micro batteries are manufactured specifically for specific electronic devices, due to which compatibility issues may arise if used in other devices.

Moreover, no substantial regulatory standards exist in printed battery manufacturing regarding the various types of printed technologies and materials used. These factors, therefore, create the requirement for measures and standards to develop these batteries. Thus, due to the lack of standards for the design of micro batteries, it is challenging for product manufacturers to choose the appropriate micro battery for their products.

OPPORTUNITIES: Growing use of wireless sensors equipped with micro batteries

Wireless sensors are being adopted rapidly due to the advancements in IoT and wireless sensor technologies. Micro batteries are quickly emerging as a viable power supply option for embedded system designers, enabling wireless sensors to be used in applications that were previously not feasible.

Micro batteries allow combining energy harvesting through a thin battery with flexible form factors. These batteries are ideal for energy harvesting systems owing to their ultra-thin profile and low leakage characteristics. The increasing adoption of energy harvesting-based autonomous wireless sensors is expected to act as a growth opportunity for the micro battery industry.

CHALLENGES: Complexities in battery fabrication

Thin film batteries have a number of distinctive features, such as high flexibility, easy portability, lightweight, higher power-holding capacity, and excellent energy density. During the fabrication of thin film lithium-ion batteries, achieving an optimal match between core components such as nanostructured electrode materials, shape-conformable solid electrolytes, and soft current collectors is essential.

This enables batteries to maintain stable electrochemical performance even if they are deformed to fit powered devices. However, the fabrication process of such batteries is costly. It also requires a complex screening of solid-state electrolytes, soft current collectors, electrode materials, and whole lithium-ion battery cell assemblies.

However, the fabrication of such batteries is more challenging than conventional rechargeable lithium-ion batteries. Studies are being undertaken to focus on the fundamental understanding and simulation of fully thin film and printed flexible lithium-ion batteries. Research is also being carried out to test the reliability and performance of these batteries, which are not easily explored using the present state-of-the-art technologies. Thus, the complexity of fabricating thin film lithium-ion batteries is a key challenge for the market's growth.

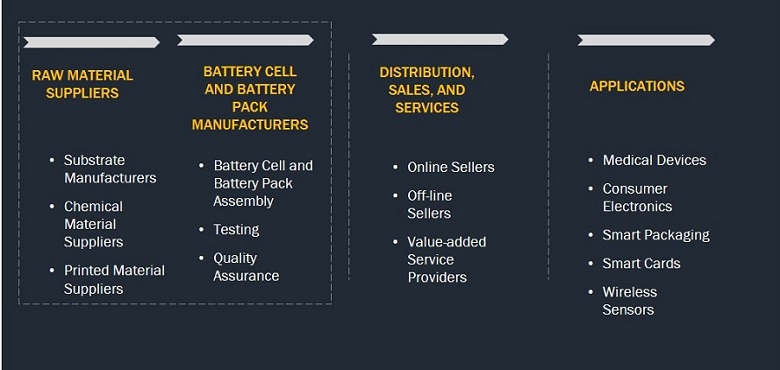

Micro Battery Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers such as Panasonic Holdings Corporation (Japan), Murata Manufacturing Co., Ltd. (Japan), TDK Corporation (Japan), Maxell, Ltd. (Japan), VARTA AG (Germany), and Duracell Inc. (US).

These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Along with the well-establiished companies, there are a large number of startups and small companies operating in this market such as Cymbet Corporation (US), Enfucell (Finland), and Ultralife Corporation (US), especially for products such as thin film and printed batteries.

Micro Battery Market Segment

Primary battery segment is expected to hold a substantial market share during the forecast period.

Primary or single-use batteries are non-rechargeable batteries that are discarded once used. These batteries are supplied fully charged and discarded after use. Most printed batteries built on zinc-based materials, in particular, are typically primary batteries.

Primary batteries are prominently used in applications wherein the recharging of the battery is impossible. These batteries are integrated into the products and do not require recharging. They play an essential role, especially when charging is impractical or impossible, for instance, in pacemakers of heart patients and smart meters. Also, these batteries are disposable and less hazardous as they do not contain cadmium, lead, and mercury, which are hazardous to the environment and human health.

The market for consumer electronics is projected to grow at an impressive CAGR during the forecast period

Micro batteries are increasingly used in consumer electronics applications such as low-drain devices, wearables, calculators, and remote controls. The application of thin film, printed, coin/button, and solid-state chip batteries in consumer electronic devices are driven by the miniaturization of electronic products and rising demand for flexible electronic devices.

Thin film batteries can power portable consumer electronic products. They can also conform to the flexible design of portable electronic devices. Micro batteries are being used in low-power consumer electronic devices, which require a flexible, ultra-thin power source. Integrating printed batteries in the place of conventional batteries could make the product flexible, eventually leading to the use of printed batteries in portable consumer electronic products. Button/coin batteries are used in various consumer electronics such as watches, wearables, remote controls, and more.

Micro Battery Market Statistics by Region

To know about the assumptions considered for the study, download the pdf brochure

Micro Battery Market Regional Analysis

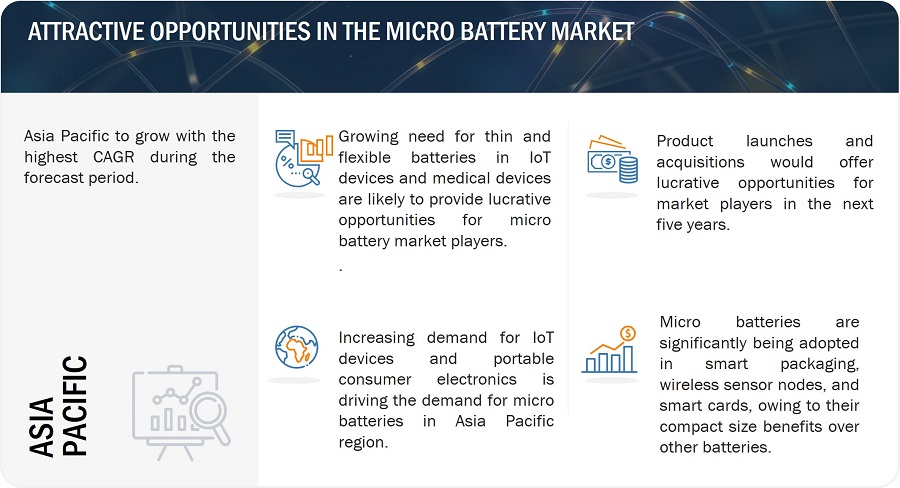

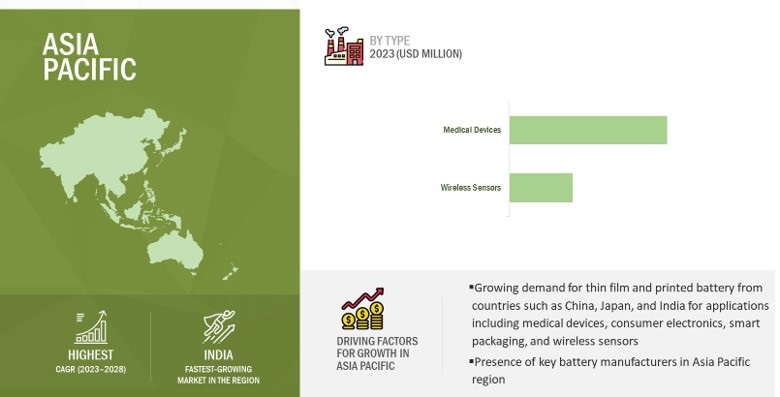

The market in Asia Pacific is projected to grow at the highest CAGR from 2023 to 2028.

The market in Asia Pacific mainly comprises developing economies, such as China and India, which have a huge potential for the micro battery industry growth. Increasing demand for IoT devices and portable consumer electronic devices in countries such as China, India, Japan, and South Korea drives the market for micro batteries in the region.

The popularity of next-generation smart cards is also rapidly increasing in this region. All these developments have, in turn, led to the increased demand for flexible batteries in smart cards. The market for micro batteries in Asia Pacific is expected to grow due to the need for smart packaging, wearable devices, and consumer electronics from the major countries in this region.

Top Micro Battery Companies - Key Market Players

- Cymbet Corporation (US),

- Enfucell (Finland),

- Ultralife Corporation (US),

- Molex, LLC (US),

- Panasonic Holdings Corporation (Japan),

- Murata Manufacturing Co., Ltd. (Japan),

- TDK Corporation (Japan),

- Maxell, Ltd. (Japan),

- VARTA AG (Germany),

- Renata SA (Switzerland), and

- Duracell Inc. (US) among others are among a few key players in the micro battery companies.

Micro Battery Market Report Scope:

|

Report Metric |

Details |

|

Estimated Market Size |

USD 0.5 Billion in 2023 |

|

Projected Market Size |

USD 1.3 Billion by 2028 |

|

Growth Rate |

CAGR of 22.4% |

|

Market Size Available for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Units |

Value (USD Million/Billion) |

|

Segments Covered |

Type, Capacity, Battery Type, and Application |

|

Geographic Regions Covered |

North America, Asia Pacific, Europe, and RoW |

|

Companies Covered |

Major Players: Panasonic Holdings Corporation (Japan), Murata Manufacturing Co., Ltd. (Japan) TDK Corporation (Japan), Maxell, Ltd. (Japan), VARTA AG (Germany), Cymbet Corporation (US), Enfucell (Finland), Ultralife Corporation (US), Molex, LLC (US), Shenzhen Grepow Battery Co., Ltd. (China), Renata SA (Switzerland), Duracell Inc. (US), and Seiko Instruments Inc. (Japan) and Others- (Total 25 players have been covered) |

Micro Battery Market Highlights

This research report categorizes the micro battery market by material, type, capacity, battery type, application, and region.

|

Segment |

Subsegment |

|

By Material: |

|

|

By Type: |

|

|

By Capacity: |

|

|

By Battery Type: |

|

|

By Application: |

|

|

By Region |

|

Recent Developments in Micro Battery Industry

- In November 2022, VARTA AG launched its latest version of CoinPower series at Electronica, the world's leading trade fair and conference for electronics. The cells of the A5 generation are suitable for TWS headphones and gaming TWS Earbuds, wearables, and IoT devices.

- In September 2022, Maxell, Ltd. developed the PSB401515H. This high-capacity ceramic packaged solid-state battery uses a solid sulfide electrolyte that helps to increase the side length.

- In October 2020, Murata Manufacturing Co., Ltd. introduced High Drain silver oxide batteries (SR) and alkaline manganese batteries (LR) to its product portfolio for medical devices.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the micro battery market from 2023 to 2028?

The global micro battery market is expected to record a CAGR of 22.4% from 2023 to 2028.

What are the driving factors for the micro battery market?

The growing miniaturization of consumer electronics globally is the key driving factor for the micro battery market.

Which application will grow at a fast rate in the future?

The consumer electronics industry is expected to grow significantly during the forecast period. The rising adoption of small form factor devices and wearables is one of the key reasons for this sector's growth.

Which are the significant players operating in the micro battery market?

Cymbet Corporation (US), Enfucell (Finland), Ultralife Corporation (US), Molex, LLC (US), Panasonic Holdings Corporation (Japan), and Murata Manufacturing Co., Ltd. (Japan) are among a few key players in the micro battery market.

Which region will grow at a fast rate in the future?

The micro battery market in Asia Pacific is expected to grow at the highest CAGR during the forecast period

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Advantages of micro batteries over traditional batteries- Growing adoption of micro batteries in medical devices- Increasing demand for wearables using thin and printed batteries- Growing adoption of specialized batteries in IoT applications- Rising focus on miniaturization of electronic devicesRESTRAINTS- Requirement for high initial investment in creating manufacturing setup for advanced batteries- Lack of designing and manufacturing standards for micro batteriesOPPORTUNITIES- Rising demand for flexible batteries in smart textiles- Increasing adoption of wireless sensorsCHALLENGES- Complex battery fabrication process

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM MAPPING

-

5.5 PRICING ANALYSISAVERAGE SELLING PRICE TRENDAVERAGE SELLING PRICE TREND, BY TYPEAVERAGE SELLING PRICE TREND, BY KEY PLAYERAVERAGE SELLING PRICE TREND, BY REGION

-

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.7 TECHNOLOGY ANALYSISSOLID-STATE BATTERIESMETAL-AIR BATTERIESLIQUID-METAL BATTERIESZINC-MANGANESE BATTERIESVANADIUM FLOW BATTERIESLITHIUM-SILICON BATTERIESLITHIUM-COBALT OXIDE BATTERIESNICKEL-MANGANESE-COBALT BATTERIESLITHIUM-NICKEL-COBALT-ALUMINUM OXIDE BATTERIESLITHIUM-SULFUR BATTERIES

-

5.8 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRIES

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.10 CASE STUDY ANALYSIS

- 5.11 TRADE ANALYSIS

-

5.12 PATENT ANALYSIS

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.14 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATORY STANDARDS

- 6.1 INTRODUCTION

-

6.2 ELECTRODESCATHODE- Cathode material helps determine key battery characteristicsANODE- Wide use of carbon-based materials in micro batteries

-

6.3 SUBSTRATESIMPLEMENTATION OF POLYMER SUBSTRATES IN MICRO BATTERIES FOR COST EFFICIENCY

-

6.4 ELECTROLYTESDEPLOYMENT OF SOLID ELECTROLYTES IN MICRO BATTERIES TO INCREASE BATTERY OUTPUT

- 6.5 OTHER COMPONENTS

- 7.1 INTRODUCTION

-

7.2 ALKALINEDURABILITY AND AFFORDABILITY OF ALKALINE BATTERY TO DRIVE MARKET

-

7.3 SILVER OXIDEHIGH ENERGY DENSITY AND STABILITY OF SILVER OXIDE BATTERIES TO BOOST DEMAND

-

7.4 LITHIUM-IONRISING DEMAND FOR MINIATURIZED CONSUMER ELECTRONICS AND MEDICAL DEVICES TO BOOST ADOPTION OF LITHIUM-ION BATTERIES

-

7.5 LITHIUM POLYMERHIGH DURABILITY OF LITHIUM POLYMER BATTERIES TO INCREASE ADOPTION IN CONSUMER DEVICES

-

7.6 ZINCNEXT-GENERATION WEARABLE ELECTRONICS TO ADOPT ZINC-BASED FLEXIBLE PRINTED BATTERIES

- 8.1 INTRODUCTION

-

8.2 THIN FILM BATTERIESINCREASED DEMAND FOR MINIATURE PRODUCTS TO BOOST ADOPTION OF THIN FILM BATTERIES

-

8.3 PRINTED BATTERIESFLEXIBLE AND ECO-FRIENDLY FEATURES TO DRIVE DEMAND FOR PRINTED BATTERIES

-

8.4 SOLID-STATE CHIP BATTERIESSAFETY CONCERNS IN DEVICES TO BOOST ADOPTION OF SOLID-STATE CHIP BATTERIES

-

8.5 BUTTON BATTERIESINEXPENSIVE AND SAFE NATURE OF BUTTON BATTERIES TO DRIVE DEMAND IN NUMEROUS APPLICATIONS

- 9.1 INTRODUCTION

-

9.2 PRIMARYUSE OF DISPOSABLE BATTERIES IN MEDICAL DEVICES TO DRIVE DEMAND FOR PRIMARY BATTERIES

-

9.3 SECONDARYUSE OF COMPACT AND FLEXIBLE RECHARGEABLE BATTERIES TO DRIVE SEGMENTAL GROWTH

- 10.1 INTRODUCTION

-

10.2 BELOW 10 MAHDEMAND FOR LIGHTWEIGHT AND COMPACT BATTERIES TO BOOST ADOPTION OF BATTERIES BELOW 10 MAH

-

10.3 10 TO 100 MAHINCREASED ADOPTION OF PORTABLE DEVICES TO DRIVE DEMAND FOR MODERATE CAPACITY BATTERIES

-

10.4 ABOVE 100 MAHHIGH POWER APPLICATIONS TO DRIVE DEMAND FOR BATTERIES ABOVE 100 MAH

- 11.1 INTRODUCTION

-

11.2 CONSUMER ELECTRONICSMINIATURIZATION OF ELECTRONIC PRODUCTS TO DRIVE DEMAND FOR MICRO BATTERIES

-

11.3 MEDICAL DEVICESTECHNOLOGICAL ADVANCEMENTS IN MEDICAL INDUSTRY TO BOOST ADOPTION OF MICRO BATTERIES

-

11.4 SMART PACKAGINGADOPTION OF RFID TAGS TO DRIVE DEMAND FOR MICRO BATTERIES IN SMART PACKAGING INDUSTRY

-

11.5 SMART CARDSRISING DEMAND FOR SELF-POWERED SMART CARDS TO BOOST ADOPTION OF THIN FILM BATTERIES

-

11.6 WIRELESS SENSORSLONG SHELF LIFE OF MICRO BATTERIES TO INCREASE SUITABILITY FOR WIRELESS SENSORS

- 11.7 OTHERS

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICAIMPACT OF RECESSION ON MARKET IN NORTH AMERICAUS- Rising adoption of smart packaging solutions to increase demand for micro batteriesCANADA- Adoption of IoT technology in medical sector to fuel demand for micro batteriesMEXICO- Growth of consumer electronics sector to support market growth

-

12.3 EUROPEIMPACT OF RECESSION ON MARKET IN EUROPEGERMANY- Increasing investments in R&D of advanced battery technologies to drive marketUK- Growing demand for wearable devices to drive adoption of micro batteriesFRANCE- Rising adoption of smart cards to drive demand for thin film and printed batteriesREST OF EUROPE

-

12.4 ASIA PACIFICIMPACT OF RECESSION ON MARKET IN ASIA PACIFICCHINA- Strong manufacturing capabilities to drive demand for micro batteriesJAPAN- Presence of major consumer electronics manufacturers to drive marketINDIA- Rising trend of digitalization and infrastructural development to drive demand for micro batteriesREST OF ASIA PACIFIC

-

12.5 ROWIMPACT OF RECESSION ON MARKET IN ROWMIDDLE EAST & AFRICA- Rising demand for consumer electronics to support market growthSOUTH AMERICA- Increasing foreign investments for infrastructure development to result in high adoption of micro batteries

- 13.1 INTRODUCTION

- 13.2 STRATEGIES ADOPTED BY MAJOR PLAYERS

- 13.3 REVENUE ANALYSIS FOR TOP 5 COMPANIES

- 13.4 MARKET SHARE ANALYSIS, 2022

-

13.5 COMPANY EVALUATION MATRIX, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

13.6 COMPANY EVALUATION MATRIX FOR SMES, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 13.7 MICRO BATTERY MARKET: COMPANY FOOTPRINT

- 13.8 COMPETITIVE BENCHMARKING

- 13.9 COMPETITIVE SITUATIONS AND TRENDS

-

14.1 KEY PLAYERSPANASONIC HOLDINGS CORPORATION- Business overview- Products offered- MnM viewENERGIZER HOLDINGS, INC.- Business overview- Products offered- MnM viewVARTA AG- Business overview- Products offered- Recent developments- MnM viewULTRALIFE CORPORATION- Business overview- Products offered- Recent developments- MnM viewMOLEX, LLC- Business overview- Products offered- MnM viewENFUCELL- Business overview- Products offered- Recent developments- MnM viewCYMBET CORPORATION- Business overview- Products offered- Recent developmentsDURACELL INC.- Business overview- Products offeredMAXELL, LTD.- Business overview- Products offered- Recent developmentsMURATA MANUFACTURING CO., LTD.- Business overview- Products offered- Recent developmentsRENATA SA- Business overview- Products offered- Recent developmentsSEIKO INSTRUMENTS INC.- Business overview- Products offered- Recent developmentsSHENZHEN GREPOW BATTERY CO., LTD.- Business overview- Products offered- Recent developmentsSTMICROELECTRONICS N.V.- Business overview- Products offeredTDK CORPORATION- Business overview- Products offered- Recent developments

-

14.2 OTHER COMPANIESBRIGHTVOLTENERGY DIAGNOSTICSEXCELLATRON SOLID STATE, LLCGMB CO., LTD.IMPRINT ENERGYITENJENAX INC.PROLOGIUM TECHNOLOGY CO., LTD.RIOT ENERGYYICHANG POWER GLORY TECHNOLOGY CO., LTD.

- 15.1 INTRODUCTION

-

15.2 FLOW BATTERY MARKET: BY APPLICATIONINTRODUCTIONUTILITIES- Growing adoption of flow batteries in utilities to support market growthCOMMERCIAL & INDUSTRIAL- Commercial & industrial segment to hold significant market share during forecast periodEV CHARGING STATION- Growing need for fast recharging of vehicles to fuel adoption of flow batteries in charging stationsOTHERS

- 16.1 INSIGHTS FROM INDUSTRY EXPERTS

- 16.2 DISCUSSION GUIDE

- 16.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.4 CUSTOMIZATION OPTIONS

- 16.5 RELATED REPORTS

- 16.6 AUTHOR DETAILS

- TABLE 1 RISK ASSESSMENT

- TABLE 2 ROLE OF PLAYERS IN MICRO BATTERY ECOSYSTEM

- TABLE 3 MICRO BATTERY MARKET: AVERAGE SELLING PRICE AND VOLUME

- TABLE 4 AVERAGE SELLING PRICE OF MICRO BATTERIES OFFERED BY MAJOR PLAYERS (USD)

- TABLE 5 AVERAGE SELLING PRICE FOR MICRO BATTERIES, BY REGION (USD)

- TABLE 6 IMPACT OF PORTER’S FIVE FORCES ON MARKET

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

- TABLE 8 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 9 USE OF THIN FILM BATTERIES IN SPORTS APPLICATIONS

- TABLE 10 UTILIZATION OF THIN FILM BATTERIES TO POWER SKIN PATCHES

- TABLE 11 DEVELOPMENT OF SAFE BED-EXIT SENSORS USING THIN FILM BATTERIES

- TABLE 12 INTEGRATION OF THIN FILM BATTERIES IN FLEXIBLE SENSOR TAGS TO TRACK SHIPMENTS

- TABLE 13 ADOPTION OF SMALL RECHARGEABLE BATTERIES BY BITKEY TO BUILD THIN SMART LOCK KEY

- TABLE 14 US: TOP 20 PATENT OWNERS IN LAST 10 YEARS

- TABLE 15 MICRO BATTERY MARKET: LIST OF PATENTS, 2019–2022

- TABLE 16 MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 17 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 STANDARDS FOR MARKET

- TABLE 22 MICRO BATTERY MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 23 MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 24 THIN FILM BATTERIES: MARKET, BY BATTERY TYPE, 2019–2022 (USD MILLION)

- TABLE 25 THIN FILM BATTERIES: MARKET, BY BATTERY TYPE, 2023–2028 (USD MILLION)

- TABLE 26 THIN FILM BATTERIES: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 27 THIN FILM BATTERIES: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 28 THIN FILM BATTERIES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 29 THIN FILM BATTERIES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 PRINTED BATTERIES: MARKET, BY BATTERY TYPE, 2019–2022 (USD MILLION)

- TABLE 31 PRINTED BATTERIES: MARKET, BY BATTERY TYPE, 2023–2028 (USD MILLION)

- TABLE 32 PRINTED BATTERIES: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 33 PRINTED BATTERIES: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 34 PRINTED BATTERIES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 35 PRINTED BATTERIES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 SOLID-STATE CHIP BATTERIES: MARKET, BY BATTERY TYPE, 2019–2022 (USD MILLION)

- TABLE 37 SOLID-STATE CHIP BATTERIES: MARKET, BY BATTERY TYPE, 2023–2028 (USD MILLION)

- TABLE 38 SOLID-STATE CHIP BATTERIES: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 39 SOLID-STATE CHIP BATTERIES: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 40 SOLID-STATE CHIP BATTERIES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 41 SOLID-STATE CHIP BATTERIES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 BUTTON BATTERIES: MARKET, BY BATTERY TYPE, 2019–2022 (USD MILLION)

- TABLE 43 BUTTON BATTERIES: MARKET, BY BATTERY TYPE, 2023–2028 (USD MILLION)

- TABLE 44 BUTTON BATTERIES: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 45 BUTTON BATTERIES: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 46 BUTTON BATTERIES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 47 BUTTON BATTERIES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 MARKET, BY BATTERY TYPE, 2019–2022 (USD MILLION)

- TABLE 49 MARKET, BY BATTERY TYPE, 2023–2028 (USD MILLION)

- TABLE 50 PRIMARY: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 51 PRIMARY: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 52 SECONDARY: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 53 SECONDARY: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 54 MICRO BATTERY MARKET, BY CAPACITY, 2019–2022 (USD MILLION)

- TABLE 55 MARKET, BY CAPACITY, 2023–2028 (USD MILLION)

- TABLE 56 MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 57 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 58 CONSUMER ELECTRONICS: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 59 CONSUMER ELECTRONICS: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 60 CONSUMER ELECTRONICS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 61 CONSUMER ELECTRONICS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 MEDICAL DEVICES: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 63 MEDICAL DEVICES: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 64 MEDICAL DEVICES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 65 MEDICAL DEVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 SMART PACKAGING: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 67 SMART PACKAGING: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 68 SMART PACKAGING: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 69 SMART PACKAGING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 SMART CARDS: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 71 SMART CARDS: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 72 SMART CARDS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 73 SMART CARDS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 74 WIRELESS SENSORS: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 75 WIRELESS SENSORS: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 76 WIRELESS SENSORS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 77 WIRELESS SENSORS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 78 OTHERS: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 79 OTHERS: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 80 OTHERS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 81 OTHERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 82 MICRO BATTERY MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 83 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 85 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 87 NORTH AMERICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 88 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 89 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 90 EUROPE: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 91 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 92 EUROPE: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 93 EUROPE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 94 EUROPE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 95 EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 96 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 97 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 98 ASIA PACIFIC: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 99 ASIA PACIFIC: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 100 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 101 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 102 ROW: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 103 ROW: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 104 ROW: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 105 ROW: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 106 ROW: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 107 ROW: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 108 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 109 MICRO BATTERY MARKET SHARE ANALYSIS (2022)

- TABLE 110 COMPANY FOOTPRINT

- TABLE 111 APPLICATION: COMPANY FOOTPRINT

- TABLE 112 REGION: COMPANY FOOTPRINT

- TABLE 113 MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 114 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 115 MARKET: PRODUCT LAUNCHES

- TABLE 116 MARKET: DEALS

- TABLE 117 PANASONIC HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 118 PANASONIC HOLDINGS CORPORATION: PRODUCTS OFFERED

- TABLE 119 ENERGIZER HOLDINGS, INC.: COMPANY OVERVIEW

- TABLE 120 ENERGIZER HOLDINGS, INC.: PRODUCTS OFFERED

- TABLE 121 VARTA AG: COMPANY OVERVIEW

- TABLE 122 VARTA AG: PRODUCTS OFFERED

- TABLE 123 VARTA AG: PRODUCT LAUNCHES

- TABLE 124 VARTA AG: DEALS

- TABLE 125 VARTA AG: OTHERS

- TABLE 126 ULTRALIFE CORPORATION: COMPANY OVERVIEW

- TABLE 127 ULTRALIFE CORPORATION: PRODUCTS OFFERED

- TABLE 128 ULTRALIFE CORPORATION: DEALS

- TABLE 129 MOLEX, LLC: COMPANY OVERVIEW

- TABLE 130 MOLEX, LLC: PRODUCTS OFFERED

- TABLE 131 ENFUCELL: COMPANY OVERVIEW

- TABLE 132 ENFUCELL: PRODUCTS OFFERED

- TABLE 133 ENFUCELL: PRODUCT LAUNCHES

- TABLE 134 CYMBET CORPORATION: COMPANY OVERVIEW

- TABLE 135 CYMBET CORPORATION: PRODUCTS OFFERED

- TABLE 136 CYMBET CORPORATION: PRODUCT LAUNCHES

- TABLE 137 CYMBET CORPORATION: DEALS

- TABLE 138 DURACELL INC.: COMPANY OVERVIEW

- TABLE 139 DURACELL INC.: PRODUCTS OFFERED

- TABLE 140 MAXELL, LTD.: COMPANY OVERVIEW

- TABLE 141 MAXELL, LTD.: PRODUCTS OFFERED

- TABLE 142 MAXELL, LTD.: PRODUCT LAUNCHES

- TABLE 143 MURATA MANUFACTURING CO., LTD.: COMPANY OVERVIEW

- TABLE 144 MURATA MANUFACTURING CO., LTD.: PRODUCTS OFFERED

- TABLE 145 MURATA MANUFACTURING CO., LTD.: PRODUCT LAUNCHES

- TABLE 146 RENATA SA: COMPANY OVERVIEW

- TABLE 147 RENATA SA: PRODUCTS OFFERED

- TABLE 148 RENATA SA: PRODUCT LAUNCHES

- TABLE 149 SEIKO INSTRUMENTS INC. COMPANY OVERVIEW

- TABLE 150 SEIKO INSTRUMENTS INC.: PRODUCTS OFFERED

- TABLE 151 SEIKO INSTRUMENTS INC.: PRODUCT LAUNCHES

- TABLE 152 SHENZHEN GREPOW BATTERY CO., LTD.: COMPANY OVERVIEW

- TABLE 153 SHENZHEN GREPOW BATTERY CO., LTD.: PRODUCTS OFFERED

- TABLE 154 SHENZHEN GREPOW BATTERY CO., LTD.: DEALS

- TABLE 155 SHENZHEN GREPOW BATTERY CO., LTD.: OTHERS

- TABLE 156 STMICROELECTRONICS NV: COMPANY OVERVIEW

- TABLE 157 STMICROELECTRONICS N.V.: PRODUCTS OFFERED

- TABLE 158 TDK CORPORATION: COMPANY OVERVIEW

- TABLE 159 TDK CORPORATION: PRODUCTS OFFERED

- TABLE 160 TDK CORPORATION: PRODUCT LAUNCHES

- TABLE 161 FLOW BATTERY MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 162 FLOW BATTERY MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

- FIGURE 1 MICRO BATTERY MARKET SEGMENTATION

- FIGURE 2 MARKET: REGIONAL SCOPE

- FIGURE 3 MARKET: RESEARCH DESIGN

- FIGURE 4 MARKET: RESEARCH APPROACH

- FIGURE 5 MARKET: BOTTOM-UP APPROACH

- FIGURE 6 MARKET: TOP-DOWN APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY FOR MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 ASSUMPTIONS

- FIGURE 10 MARKET, 2019–2028 (USD MILLION)

- FIGURE 11 THIN FILM BATTERIES TO WITNESS HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 12 PRIMARY BATTERIES TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 13 10 TO 100 MAH SEGMENT TO EXHIBIT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 14 CONSUMER ELECTRONICS APPLICATION TO CAPTURE LARGEST MARKET SHARE THROUGHOUT FORECAST PERIOD

- FIGURE 15 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 16 INTEGRATION OF THIN FILM AND FLEXIBLE BATTERIES INTO CONSUMER ELECTRONICS TO DRIVE MARKET

- FIGURE 17 THIN FILM BATTERIES TO CAPTURE LARGEST MARKET SHARE IN 2028

- FIGURE 18 CONSUMER ELECTRONICS APPLICATION TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 19 MEDICAL DEVICES AND US TO BE LARGEST SHAREHOLDERS OF NORTH AMERICAN MARKET IN 2028

- FIGURE 20 GERMANY TO BE FASTEST-GROWING MARKET FROM 2023 TO 2028

- FIGURE 21 MICRO BATTERY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 23 MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 24 MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 25 MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 26 MARKET: VALUE CHAIN ANALYSIS

- FIGURE 27 MARKET: ECOSYSTEM ANALYSIS

- FIGURE 28 AVERAGE SELLING PRICE TREND FOR MICRO BATTERIES, 2022–2028

- FIGURE 29 AVERAGE SELLING PRICE OF MICRO BATTERIES OFFERED BY KEY PLAYERS

- FIGURE 30 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN MARKET

- FIGURE 31 MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- FIGURE 33 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- FIGURE 34 IMPORT VALUE OF LITHIUM CELLS AND BATTERIES, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 35 EXPORT VALUE OF LITHIUM CELLS AND BATTERIES, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 36 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 37 NUMBER OF PATENTS GRANTED PER YEAR, 2013–2022

- FIGURE 38 MICRO BATTERY MARKET, BY COMPONENT

- FIGURE 39 MARKET: BY MATERIAL

- FIGURE 40 MARKET, BY TYPE

- FIGURE 41 THIN FILM BATTERIES TO EXHIBIT HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 42 MARKET, BY BATTERY TYPE

- FIGURE 43 SECONDARY BATTERY TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 44 MARKET: BY CAPACITY

- FIGURE 45 10 TO 100 MAH SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 46 MARKET, BY APPLICATION

- FIGURE 47 SMART PACKAGING SEGMENT TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 48 MARKET, BY REGION

- FIGURE 49 GERMANY TO BE FASTEST-GROWING COUNTRY IN GLOBAL MARKET FROM 2023 TO 2028

- FIGURE 50 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 51 US TO ACCOUNT FOR LARGEST SHARE OF MARKET IN NORTH AMERICA FROM 2023 TO 2028

- FIGURE 52 EUROPE: MARKET SNAPSHOT

- FIGURE 53 GERMANY TO DOMINATE EUROPEAN MARKET FOR MICRO BATTERIES DURING FORECAST PERIOD

- FIGURE 54 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 55 CHINA TO ACCOUNT FOR LARGEST SHARE OF ASIA PACIFIC MARKET FROM 2023 TO 2028

- FIGURE 56 MIDDLE EAST AND AFRICA TO REGISTER HIGHER CAGR IN MARKET IN ROW DURING FORECAST PERIOD

- FIGURE 57 MICRO BATTERY MARKET: REVENUE ANALYSIS FOR TOP 5 PLAYERS, 2018–2022

- FIGURE 58 SHARE OF KEY PLAYERS IN MARKET, 2022

- FIGURE 59 MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 60 MARKET: COMPANY EVALUATION MATRIX FOR SMES, 2022

- FIGURE 61 PANASONIC HOLDINGS CORPORATION: COMPANY SNAPSHOT

- FIGURE 62 ENERGIZER HOLDINGS, INC.: COMPANY SNAPSHOT

- FIGURE 63 VARTA AG: COMPANY SNAPSHOT

- FIGURE 64 ULTRALIFE CORPORATION: COMPANY SNAPSHOT

- FIGURE 65 MAXELL, LTD.: COMPANY SNAPSHOT

- FIGURE 66 MURATA MANUFACTURING CO., LTD.: COMPANY SNAPSHOT

- FIGURE 67 STMICROELECTRONICS N.V.: COMPANY SNAPSHOT

- FIGURE 68 TDK CORPORATION: COMPANY SNAPSHOT

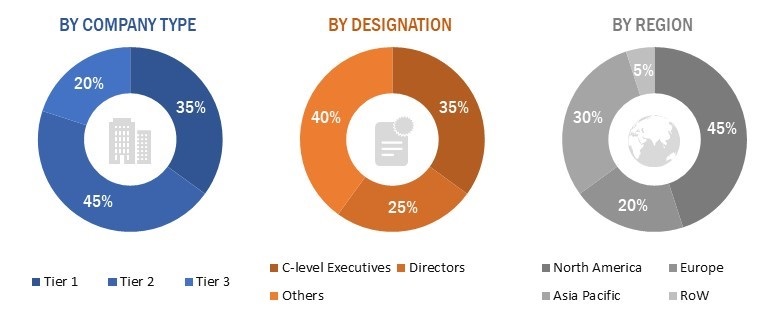

The study involved four major activities in estimating the current size of the micro battery market. Exhaustive secondary research has been done to collect information on the market, peer, and parent markets. The next step has been to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the total market size. After that, market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments. Secondary and primary sources have been used to identify and collect information for an extensive technical and commercial study of the micro battery market.

Secondary Research

Secondary sources include company websites, magazines, industry news, associations, and databases (Factiva and Bloomberg). These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

Primary sources mainly consist of several experts from the core and related industries, along with preferred micro battery providers, distributors, alliances, standards, and certification organizations related to various segments of this industry’s value chain.

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from various micro battery providers, such as Panasonic Holdings Corporation (Japan), Murata Manufacturing Co., Ltd. (Japan), Enfucell (Finland), Ultralife Corporation (US), Molex, LLC (US), TDK Corporation (Japan), Maxell, Ltd. (Japan), and VARTA AG (Germany); research organizations, distributors, industry associations, and key opinion leaders. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

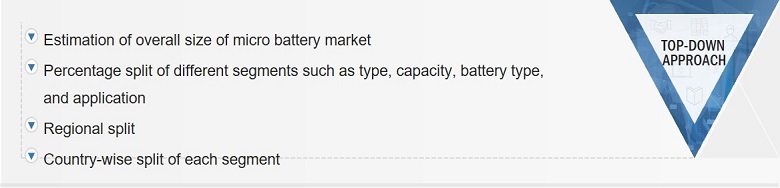

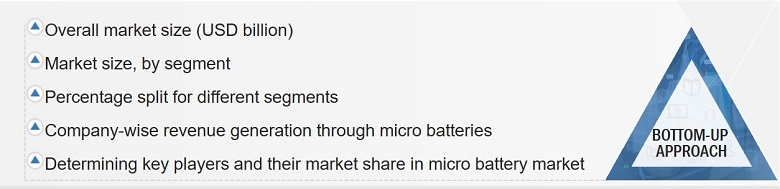

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the micro battery market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Micro Battery Market : Top-down Approach

In the top-down approach, the overall market size has been used to estimate the size of the individual market (mentioned in market segmentation) through percentage splits from secondary and primary research. For specific market segments, the size of the most appropriate immediate parent market has been used to implement the top-down approach. The bottom-up approach has also been implemented for data obtained from secondary research to validate the market size of various segments.

Micro Battery Market : Bottom-up Approach

The bottom-up approach has been used to arrive at the overall size of the micro battery market from the revenues of the key players and their market shares. Calculations based on revenues of key companies identified in the market led to the estimation of their overall market size.

Market Definition

Micro batteries are composed of thinner materials as compared to conventional batteries and are different from conventional batteries in terms of features, size, form factor, shape, and flexibility. These small-sized batteries are composed of substrate materials, electrodes (cathodes and anodes), electrolyte materials, separators, and other components. Micro batteries consume less space as compared to conventional batteries, and consequently, allow end products to weigh less. Micro batteries are categorized by type into thin-film batteries, printed batteries, solid-state chip batteries, and button batteries. These batteries find applications in consumer electronics, medical devices, wireless sensors, wearable devices, smart textiles, smart cards, and smart packaging.

Market Stakeholders

- Micro battery manufacturers

- Government Bodies and Policymakers

- Industry-standard Organizations, Forums, Alliances, and Associations

- Market Research and Consulting Firms

- Raw Material Suppliers and Distributors

- Research Institutes and Organizations

- Testing, Inspection, and Certification Providers

- Distributors and Resellers

- End Users

Report Objectives

- To define and forecast the micro battery market regarding the type, capacity, battery type, and application.

- To describe and forecast the micro battery market and its value segments for four regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW), along with their respective countries.

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micro-markets concerning individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain and allied industry segments of the micro battery market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the market

- To strategically profile key players and comprehensively analyze their market position regarding ranking and core competencies, along with a detailed market competitive landscape.

- To analyze strategic approaches such as agreements, collaborations, and partnerships in the micro battery market

- To provide an analysis of the recession impact on the growth of the market and its segments

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Micro Battery Market