Non-volatile Memory Express (NVMe) Market by Product (SSDs, Servers, All-flash Arrays, Adapters), Deployment Location (On-premise, Remote, Hybrid), Communication Standard (Ethernet, Fibre Channel, InfiniBand), Vertical, and Region - Global Forecast to 2025

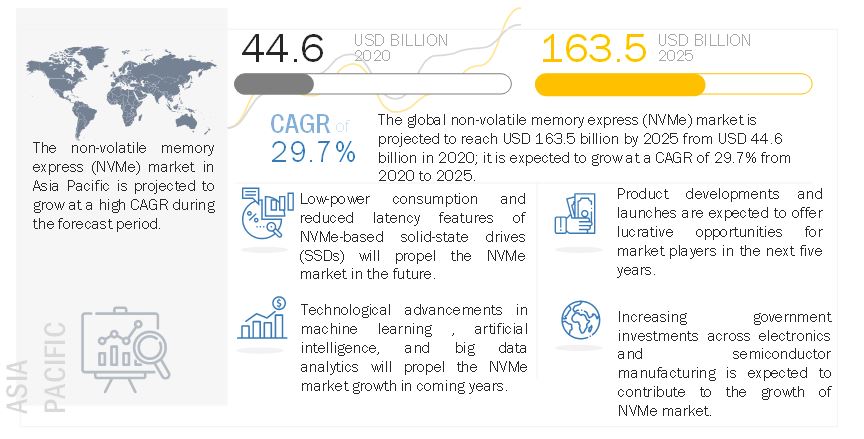

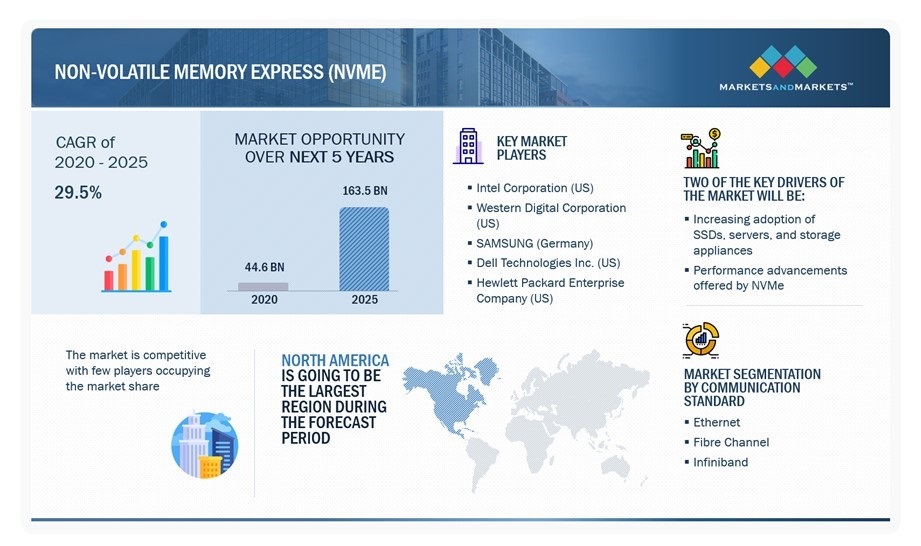

The non-volatile memory express (NVMe) market is projected to grow from USD 44.6 billion in 2020 to USD 163.5 Billion by 2025, at a CAGR of 29.7% from 2020 to 2025.

Non-volatile memory express (NVMe) is a host controller interface and storage protocol that is used to increase the speed of data transfer between a host system and a peripheral target storage device over a computer’s high-speed Peripheral Component Interconnect Express (PCIe) bus. NVMe is designed for storage and networking devices with NVMe interface and NVMe compatibility, including solid-state drives (SSDs), adapters, storage arrays, and servers.

Non-volatile Memory Express (NVMe) Market Forecast to 2025

To know about the assumptions considered for the study, Request for Free Sample Report

NVMe has been prevalent across the internet of things (IoT) and connected devices. With the increasing deployment of the internet of things (IoT) and connected devices, equipment with higher efficiency for ultra-low power applications is gaining momentum. Since NVMe is one of the crucial components for connected devices as it is low latency and high-performance storage technology, the non-volatile memory express (NVMe) market is projected to grow significantly in the next 10 years.

The NVMe storage solutions are witnessing high adoption from the retail and e-commerce sector. Companies in the retail industry realize the benefits of data storage and management to serve in this competitive market. Data analytics, which deals with tracking shipping orders, deliverables, and consumer preferences, is the growing e-commerce trend. Processing and storing vast amounts of data in the consumer goods and retail industry primarily requires maintaining quality, safety, performance standards, and scalability in product lines, operations, and supply chains. Adequate data storage and management in this industry helps companies to focus on their consumers by providing innovative, cost-efficient, and market-driven products and services. This is expected to fuel the growth of the non-volatile memory express (NVMe) market in the coming years.

Non-Volatile Memory Express (NVMe) Market Dynamics:

Driver: Growing Digitalization Across Various Industry Verticals Creating High Demand for High-end Data Storage and Processing Infrastructure

The enormous growth in the volume of digital data companies generated recently has made it difficult for many organizations to manage such large amounts of data. Increasing digitization across businesses has led to more content creation, with over 80% of data being in documents, images, and audio/video files, contributing to an abundance of unstructured data and content. This has made it essential for businesses to explore efficient database applications and implement scalable content management and storage solutions being deployed across enterprises.

However, IT infrastructure budgets are currently not growing at the same rate as that of data. IT companies are under tremendous pressure to maximize returns on infrastructure, which includes both computing and storage. This is especially important where applications with heavy workloads are involved. NVMe can handle rigorous application workloads with a smaller infrastructure footprint, thus reducing the overall cost or total operations cost (TOC). This is expected to amplify the adoption of NVMe storage solutions over the forecast timeframe.

Restraint: Issues Associated with the Storage Software to Restraint the NVMe Market Growth

Although NVMe flash offers reduced latency, specific performance gaps and overheads emerge due to the components associated with NVMe flash storage software. A typical NVMe array with 24 NVMe drives may have the raw potential to deliver almost 12 million IOPS, but once the overhead of the storage ecosystem is factored in, it offers less than 1 million IOPS. This performance gap is usually not because of the hardware used but the storage software. Storage software is not usually designed to achieve efficiency but to increase storage performance. Features such as deduplication, clones, compression, tiering, and error detection and correction are continuously added to the software. Due to the addition of these features, the CPU gets choked, and its resources are not available for the storage I/O to high-performance drives.

Opportunity: Proliferation of artificial intelligence, big data, and blockchain technologies to fuel the adoption of NVMe

The adoption of artificial intelligence (AI) is growing significantly in end-use industries such as healthcare, defense, and transportation. Machine learning (ML) and blockchain analytics have gained the same level of traction and have become an important technology in AI. Companies that have adopted AI and ML in their production are shifting to a multi-cloud environment to ensure enhanced data protection and drive seamless customer experience. As they make this essential transition to the multi-cloud environment, NVMe technology becomes important for both on-premises and cloud storage of enterprise data and networking.

Data storage is one of the critical supporting components for adopting technologies such as AI, ML, and deep learning (DL) as it helps manage vast amounts of unstructured data. The advent of advanced data storage from mechanical hard drives to NVMe SSDs has promoted the next level of high-performance computing (HPC) and its applications. Therefore, increasing adoption of advanced technologies such as artificial intelligence, big data, and blockchain technologies will boost the non-volatile memory express (NVMe) market growth over the forecast period.

Challenge: Data integrity and data protection concerns

Data protection and data integrity are vital to providing a comprehensive solution in the storage market. SSDs usually erase blocks before storing new information and use a newly erased block to store changed data, leaving the old data intact in the old block. This technique is known as wear leveling. SSDs usually change a cell within a block of cells, and typically have a limited number of writes that can occur before a cell ceases to function and the data is lost.

Therefore, address translation and data versioning techniques are crucial to prevent the drive controller from returning to the old data. These techniques should be incorporated to ensure that data integrity is maintained and the data is protected from being erased wrongly

Non-Volatile Memory Express (NVMe) Market Segment Insights:

Based on product, solid-state drives (SSDs) segment to hold high market share from 2020 to 2025

Based on product, the non-volatile memory express (NVMe) market has been segmented into solid-state drives (SSDs), adapters, all-flash arrays, servers, and others. The solid-state drives (SSDs) segment is expected to hold high market share over the forecast period. SSDs are next-generation solid-state storage devices that were introduced as an improvement and as an alternative to hard disk drives (HDDs). SSDs use internal circuit assembly to store data using flash memory. NVMe was specifically designed for SSDs; it communicates with the storage interface and the CPU via high-speed PCIe sockets. NVMe-based SSDs have various benefits, including reduced latency, higher input/output operations per second (IOPS), and low power consumption based on the form factor. NVMe SSDs are available in form factors 2.5”, M.2, U.2, and FHHL and HHHL. The high-performance and low-power consumption features of SSDs will boost the non-volatile memory express (NVMe) market growth over the forecast timeline.

Based on communication standards, the Ethernet segment registered the largest share during forecast timeframe

Based on communication standards, the non-volatile memory express (NVMe) market has been classified into Ethernet, fibre channel, and InfiniBand. Ethernet is projected to hold the largest size of the non-volatile memory express (NVMe) market from 2020 to 2025. Ethernet mainly depends on Remote Direct Memory Access (RDMA), which allows two computers on the same network to exchange data/memory contents without the involvement of a processor. RDMA can be enabled in storage networking with the RDMA over Converged Ethernet (RoCE) and Internet Wide Area RDMA Protocol (iWARP). Data centers and enterprises that use applications involving systems and storage in a network to communicate and exchange data prefer Ethernet for the benefits it provides. Therefore, this segment will register a high market share over the forecast timeframe.

Based on deployment location, the on-premises segment to account for largest size of the NVMe market during forecast period

Based on deployment location, the non-volatile memory express (NVMe) market is segmented into on-premises, remote, and hybrid. During the forecast period, the on-premises deployment will hold the largest share of the non-volatile memory express (NVMe) market. On-premise offerings are deployed within the physical perimeters or data centers of an organization. The NVMe-based storage and server solutions are primarily deployed in on-premise locations. The on-premises deployment offers several benefits, including complete control over physical hardware, offline operability, and security against external breaches. The high-end feature provided by the on-premises deployment will foster the non-volatile memory express (NVMe) market growth in coming years.

Based on vertical, telecommunications & ITeS segment to hold high market share

By vertical, the non-volatile memory express (NVMe) market has been segmented into Banking, Financial Services and Insurance (BFSI), consumer goods and retail, telecommunications & Information Technology Enabled Services (IteS), healthcare, energy, government, education & research, media & entertainment, manufacturing, business & consulting, and others. Changing market dynamics and intense competition are forcing the telecommunications & ITeS vertical to upgrade continuously. The service providers are experiencing challenges with respect to data storage due to the increasing number of users, adoption of data analytics, and data sharing over mobile devices. Data science and big data analytics are the significant emerging opportunities in the telecommunications industry. Social media and sentiment analysis is the new emerging trend in analytics to predict and tackle potential problems and maintain brand image. To address security and regulatory compliances, telecommunication & ITeS related services demand storage solutions with a variety of facilities, including data mobility, storage virtualization, backup, and recovery, among others. This will add new growth opportunities for the vendors operating in the non-volatile memory express (NVMe) market.

Regional Insights:

The Asia Pacific region is projected to Grow at highest CAGR during the forecast period

The growth of the non-volatile memory express (NVMe) market in Asia Pacific can be attributed to the due to the rising adoption of technologically advanced consumer electronics products. The growing number of small and medium-sized enterprises (SMEs), their need for secure data storage, and the ability to access the data over the enterprise network. This is one of the most significant factors driving the growth of the region's non-volatile memory express (NVMe) market.

Non-volatile Memory Express (NVMe) Market by Region

To know about the assumptions considered for the study, download the pdf brochure

The growth in the consumer electronics market and high IT infrastructure expenditures in countries such as China, South Korea, India, and Japan are propelling the growth of the non-volatile memory express (NVMe) market in Asia Pacific. The growth of the consumer electronics goods, such as notebooks/laptops, tablets, desktop PCs, etc. in China and India is contributing to the growth of the NVMe SSDs market. With the increasing use of SSDs in tablets and laptops in these countries, the market for NVMe SSDs in Asia Pacific is expected to grow in the coming years.

The North America region held the major share of the NVMe market in 2020

The North America region is enriched by the presence of a large number of prominent players such as Dell Technologies Inc. (US), NetApp, Inc. (US), and Hewlett Packard Enterprise Company (US). These players are in the server-attached networks and storage business, providing hard-disk drives (HDDs) and solid-state drives (SSDs)-based solutions. This factor drives the demand for NVMe SSDs in enterprise applications. The market for data centers has been evolving through organizational and federal mandates for data center optimization. The increasing adoption of the cloud is also driving the demand for data centers for hosting data. The US, Canada, and Mexico are the major contributors to the North American NVMe market.

Key Market Players:

Some of the Major players in the non-volatile memory express (NVMe) market are Intel Corporation (US), Western Digital Corporation (US), SAMSUNG (South Korea), Dell Technologies Inc. (US), and Hewlett Packard Enterprise Company (US). These players have adopted various growth strategies such as contracts, joint ventures, partnerships & agreements, acquisitions, and new product launches to further expand their presence in the non-volatile memory express (NVMe) market.

Intel Corporation (US) has adopted a virtuous cycle of growth, enabling the expansion of memory, cloud, data centers, and connected devices. The demand for data storage is increasing as a large number of components and devices are becoming increasingly connected to each other. This is being effectively addressed by the company’s advanced memory technologies and storage device solutions. To be technologically competitive, the company invests mainly in R&D. The R&D efforts help the company constantly upgrade and expand its portfolio of products and services, gain an edge over its competitors, and exploit new opportunities. In addition, Intel focuses on product launches as an effective strategy to expand its SSD business worldwide.

SAMSUNG (South Korea) has a multidimensional business approach with both backward and forward integration, where it provides foundry, testing, and packaging services along with the integration of memory such as DRAM, flash, and low-power memory; and end-user application products such as data center SSDs, enterprise SSDs, etc., in a one-stop approach. This approach has allowed the company to produce innovative NVMe SSDs and take the top position in the SSD market.

Non-Volatile Memory Express (NVMe) Market Report Scope:

|

Report Metric |

Details |

| Estimated Value | USD 44.6 billion in 2020 |

| Projected Value | USD 163.5 Billion by 2025 |

| Growth Rate | CAGR of 29.7% |

|

Market size availability years |

2017–2025 |

|

Base year |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD billion/million/thousand) |

|

Covered segments |

Product, communication standard, deployment location, vertical, and geography |

|

Covered regions |

North America, Europe, APAC, and RoW |

|

Covered companies |

Samsung Electronics Co., Ltd. (Samsung) (South Korea), Western Digital Corporation (Western Digital) (US), Intel Corporation (Intel) (US), Dell EMC (US), Hewlett Packard Enterprise (HPE) (US), Broadcom Inc. (Broadcom) (US), Micron Technology, Inc. (Micron Technology) (US), Cisco Systems, Inc. (Cisco) (US), Toshiba Corporation (Toshiba) (Japan), NetApp, Inc. (NetApp) (US), International Business Machines Corporation (IBM) (US), Microchip Technology Inc. (Microchip Technology) (US), Marvell Technology Group (Marvell) (US), Seagate Technology LLC (Seagate) (US), SK Hynix Inc. (SK Hynix) (South Korea), Renesas Electronics Corporation (Renesas Electronics) (Japan), Mellanox Technologies Ltd. (Mellanox) (Israel), Pure Storage, Inc. (Pure Storage) (US), Super Micro Computer, Inc. (Supermicro) (US), and Huawei Technologies Co., Ltd. (Huawei) (China) |

NVMe Market Segmentation:

In this report, the NVMe market has been segmented into the following categories:

Based on Product, the Non-Volatile Memory Express (NVMe) Market been Segmented as below:

- Solid-state Drives (SSDs)

- Adapters

- All-flash Arrays

- Servers

- Others

Based on Communication Standard, the Non-Volatile Memory Express (NVMe) Market been Segmented as below:

- Ethernet

- Fibre Channel

- InfiniBand

Based on Deployment Location, the Non-Volatile Memory Express (NVMe) Market been Segmented as below:

- On-premise

- Remote

- Hybrid

Based on Vertical, the Non-Volatile Memory Express (NVMe) Market been Segmented as below:

- Banking, Financial Services, and Insurance (BFSI)

- Consumer Goods & Retail

- Telecommunications & ITeS

- Healthcare

- Energy

- Government

- Education & Research

- Media & Entertainment

- Manufacturing

- Business & Consulting

- Others

Based on Region, the Non-Volatile Memory Express (NVMe) Market been Segmented as below:

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Non-Volatile Memory Express (NVMe) Market Highlights:

What is new?

- NVMe market players are expected to focus on the BFSI application segment of NVMe market in coming years.

The high adoption of NVMe-based data storage in banking, financial services, and insurance is due to the huge amounts of data being generated at a rapid rate in this industry. The financial sector is transforming into new business processes and growing organically in new sectors and geographies, subsequently generating large amounts of data. BFSI companies are adopting new business models such as smartphone integration, blockchain trading, virtual banking, and digital mobile wallets to offer customer-centric services. These business models can be implemented by leveraging technologies such as data analytics, predictive financial modeling, and automation of operations. These technologies need reliable storage products and solutions that offer rapid IOPS in real-time. Thus, NVMe-based products and solutions are being adopted in this vertical.

- Addition/refinement in segmentation–Increase in depth or width of segmentation of the market.

-

NVMe Market, by Product

-

Solid-State Drives (SSDs)

- 2.5”

- M.2

- U.2 (SFF 8639)

- FHHL and HHHL

- Adapters

- All-Flash Arrays

- Servers

- Others (I/O Accelerator Blocks, Switches, and Controllers)

- Coverage of new market players and change in the market share of existing players of the NVMe market.

Company profiles: Company profiles give a glimpse of the key players in the market with respect to their business overviews, financials, product offerings, recent developments undertaken by them, and MnM view. In the new edition of the report, we have total 20 players (10 major, 10 Other key companies).

- Updated financial information and product portfolios of players operating in the NVMe market.

Newer and improved representation of financial information: The new edition of the report provides updated financial information in the context of the NVMe market till 2017/2020 for each listed company in the graphical representation in a single diagram (instead of multiple tables). This would help to quickly analyze the present status of profiled companies in terms of their financial strength, profitability, key revenue-generating region/country, business segment focus in terms of the highest revenue-generating segment, and investment in research and development activities.

- Updated market developments of the profiled players.

Recent Developments: Updated market developments such as contracts, joint ventures, partnerships & agreements, acquisitions, new service launches, new product launches, investments, funding, and certification have been mapped for the years 2017 to 2020. For instance, In January 2020, SAMSUNG (South Korea) launched a portable SSD, the Samsung T7 Touch, incorporating the latest NVMe technology and a fingerprint reader for additional security.

Recent Developments

- In October 2022, Kingston Technology (US) launched new PCIe 4.0 SSD based on NVMe technology. The new SSD delivers read/write speeds up to 3,500/2,800MB/s. This new SSD is available in storage capacities from 250GB to 2TB.

- In August 2022, SAMSUNG (South Korea) launched 990 PRO, the company’s high-performance NVMe SSD based on PCIe 4.0. The new SSD is optimised for graphically demanding games and other intensive tasks including 3D rendering, 4K video editing and data analysis.

- In July 2022, Kioxia Corporation (Japan) launched its new KIOXIA CM7 series enterprise NVMe SSDs. The new SSDs are available in in Enterprise and Datacenter Standard Form Factor (EDSFF) E3.S and 2.5-inch form factors in the market.

- In May 2022, Western Digital Corporation (US) launched its new Ultrastar NVMe PCIe 4.0 SSD. The new SSDs include a 2.5-inch form-factor for traditional infrastructure and the slimmer, ruler E1.L form-factor, with capacities up to 15.36TB.

Frequently Asked Questions (FAQ):

What is the current size of the non-volatile memory express (NVMe) market?

The non-volatile memory express (NVMe) market is projected to grow from USD 44.6 billion in 2020 to USD 163.5 Billion by 2025, at a CAGR of 29.7% from 2020 to 2025.

Who are the winners in the non-volatile memory express (NVMe) market?

Intel Corporation (US), Western Digital Corporation (US), SAMSUNG (South Korea), Dell Technologies Inc. (US), and Hewlett Packard Enterprise Company (US).

What are the opportunities for new market entrants?

The increasing application of next-generation technology such as artificial intelligence, blockchain, machine learning, etc., need to process data at a very high rate. NVMe standard offers a lucrative market opportunity for new entrants in the NVMe market.

What are the drivers and opportunities for the non-volatile memory express (NVMe) market?

The major factors driving the market's growth include the increasing adoption of NVMe technologies in SSDs, servers, and storage appliances; exponential rise in data generation and evolving demand for data storage and processing infrastructure; and significant performance advancements offered by NVMe.

What are the different types of NVMe products available in the market?

The different types of products available in the market are Solid-State Drives (SSDs), Adapters, All-Flash Arrays, Servers, Switches, Controllers, and others.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

-

Solid-State Drives (SSDs)

Table of Contents

1 Introduction (Page No. - 20)

1.1 Study Objectives

1.2 Market Definition and Scope

1.2.1 Inclusions and Exclusions

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.1.3 Secondary and Primary Research

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing Market Size Using Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing Market Share Using Top-Down Analysis (Supply Side)

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 32)

4 Premium Insights (Page No. - 38)

4.1 Opportunities in NVMe Market

4.2 NVMe Market for SSDS, By Vertical, 2017–2025 (USD Million)

4.3 APAC NVMe Market, By Vertical and Country

4.4 NVMe Market for BFSI, By Region, 2017–2025 (USD Billion)

4.5 APAC NVMe Market, By Country

5 Market Overview (Page No. - 41)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Adoption of NVMe Technologies in SSDS, Servers, and Storage Appliances

5.2.1.2 Exponential Rise in Data Generation and Evolving Demand for Data Storage and Processing Infrastructure

5.2.1.3 Significant Performance Advancements Offered By NVMe

5.2.2 Restraints

5.2.2.1 Performance Problems Associated With Storage Software

5.2.3 Opportunities

5.2.3.1 Growing Adoption of NVMe for Big Data, IoT, Artificial Intelligence, and Blockchain

5.2.3.2 End-To-End NVMe Over Fabrics (NVMe-Of)

5.2.4 Challenges

5.2.4.1 Issues Related to Data Integrity and Data Protection

5.2.4.2 High Cost of NVMe

5.3 Value Chain Analysis

6 NVM Express Market, By Product (Page No. - 52)

6.1 Introduction

6.2 Solid-State Drives (SSDS)

6.2.1 NVMe SSDS Projected to Hold Largest Share in NVMe Market

6.2.1.1 2.5”

6.2.1.2 M.2

6.2.1.3 U.2 (SFF 8639)

6.2.1.4 FHHL and HHHL

6.3 Adapters

6.3.1 Growth of Hyper-Converged Infrastructure is Expected to Lead to Increase in Adoption of NVMe Adapters

6.4 All-Flash Arrays

6.4.1 All-Flash Arrays to Grow at Highest CAGR During Forecast Period

6.5 Servers

6.5.1 Increased Enterprise, Data Center, and Hci Applications of NVMe Servers to Drive Growth of Servers Segment

6.6 Others (I/O Accelerator Blocks, Switches, and Controllers)

6.6.1 Other Products Segment to Grow Steadily Due to Increased Adoption of NVMe-Based Servers and Storage Solutions

7 NVM Express Market, By Communication Standard (Page No. - 67)

7.1 Introduction

7.2 Ethernet

7.2.1 Ethernet to Hold Largest Market Size During Forecast Period

7.3 Fibre Channel

7.3.1 NVMe Over Fibre Channel Expected to Grow Steadily During Forecast Period

7.4 Infiniband

7.4.1 Infiniband Expected to Grow at Second-Highest CAGR

8 NVM Express Market, By Deployment Location (Page No. - 72)

8.1 Introduction

8.2 On-Premise

8.2.1 On-Premise Deployment to Hold Largest Share of NVMe Market During Forecast Period

8.3 Remote

8.3.1 Remote NVMe Deployments are Expected to Grow Steadily During Forecast Period

8.4 Hybrid

8.4.1 Hybrid Deployments are Expected to Grow at Highest CAGR During Forecast Period

9 NVM Express Market, By Vertical (Page No. - 77)

9.1 Introduction

9.2 Banking, Financial Services, and Insurance (BFSI)

9.2.1 BFSI Held Largest Share in NVMe Market in 2019

9.3 Consumer Goods & Retail

9.3.1 Emergence of E-Commerce and Online Retail is Leading to Increasing Adoption of NVMe Solutions

9.4 Telecommunications & Ites

9.4.1 Emerging Opportunities in Data Science and Analytics Leading to Growth of NVMe in the Telecommunications & Ites Vertical

9.5 Healthcare

9.5.1 Healthcare Vertical to Grow at Highest CAGR During Forecast Period

9.6 Energy

9.6.1 Increasing Adoption of Real-Time Analytics Leading to NVMe Market Growth in Energy Vertical

9.7 Government

9.7.1 Increasing Investments to Adopt Digitization and Analytics are Driving Adoption of NVMe

9.8 Education & Research

9.8.1 E-Learning is Driving NVMe Market Growth in Education & Research Vertical

9.9 Media & Entertainment

9.9.1 Increasing Adoption of NVMe Solutions By Media & Entertainment Firms Drives NVMe Market Growth in This Vertical

9.10 Manufacturing

9.10.1 Emergence of Iiot and Industry 4.O Driving NVMe Market Growth in Manufacturing Vertical

9.11 Business & Consulting

9.11.1 Need for Efficient Data Management and High-Performance Computing to Drive NVMe Market in Business & Consulting Vertical

9.12 Others

10 Geographic Analysis (Page No. - 104)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.1.1 US Projected to Account for Largest Size of NVMe Market in North America

10.2.2 Canada

10.2.2.1 NVMe Market in Canada Projected to Grow Due to Increasing Need for Efficient Data Management

10.2.3 Mexico

10.2.3.1 NVMe Market in Mexico Projected to Grow at Highest CAGR During Forecast Period

10.3 Europe

10.3.1 UK

10.3.1.1 UK Held Largest Share of European NVMe Market in 2019

10.3.2 Germany

10.3.2.1 Increasing Use of Connected Devices and Requirement of Managing Large Datasets to Drive NVMe Demand in Germany

10.3.3 France

10.3.3.1 France Expected to Be the Fastest-Growing NVMe Market in Europe

10.3.4 Rest of Europe

10.4 APAC

10.4.1 China

10.4.1.1 China LED NVMe Market in APAC in 2019

10.4.2 Australia

10.4.2.1 Australian NVMe Market Expected to Grow at Highest Rate Among APAC Countries During Forecast Period

10.4.3 Japan

10.4.3.1 Increased Adoption of Next-Generation Technologies Expected to Contribute to Growth of NVMe Market in Japan

10.4.4 South Korea

10.4.4.1 Flourishing Consumer Electronics Industry and Presence of Key Manufacturers of NVMe Fuel NVMe Market Growth in South Korea

10.4.5 India

10.4.5.1 Big Data, IoT, and Other Digital and Virtualized Platforms to Trigger Adoption of NVMe in India

10.4.6 Rest of APAC

10.5 RoW

10.5.1 Middle East &Africa

10.5.1.1 Established Market of Advanced Storage in UAE Drives NVMe Demand in Middle East & Africa

10.5.2 South America

11 Competitive Landscape (Page No. - 139)

11.1 Overview

11.2 Ranking Analysis

11.3 Competitive Scenario

11.3.1 Product Launches and Developments

11.3.2 Partnerships, Agreements, and Collaborations

11.3.3 Mergers and Acquisitions

11.4 Competitive Leadership Mapping

11.4.1 Visionary Leaders

11.4.2 Dynamic Differentiators

11.4.3 Innovators

11.4.4 Emerging Companies

12 Company Profiles (Page No. - 146)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

12.1 Key Companies

12.1.1 Intel

12.1.2 Western Digital

12.1.3 Samsung

12.1.4 Dell EMC

12.1.5 Hewlett Packard Enterprise (HPE)

12.1.6 Broadcom

12.1.7 Micron Technology

12.1.8 Cisco

12.1.9 Toshiba

12.1.10 Netapp

12.2 Right-To-Win

12.3 Other Key Companies

12.3.1 IBM

12.3.2 Microchip Technology

12.3.3 Marvell

12.3.4 Seagate Technology

12.3.5 SK Hynix

12.3.6 Renesas Electronics

12.3.7 Mellanox

12.3.8 Pure Storage

12.3.9 Supermicro

12.3.10 Huawei

*Details on Business Overview, Products & Services Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 180)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (119 Tables)

Table 1 Specifications for Sata-Based Ssd, Sas-Based Ssd, Pcie-Based Ssd, and NVMe-Based Ssd

Table 2 Comparison of Sata Based on Ahci With Pcie Based on NVMe Protocol

Table 3 Comparison of Price Per Gb of Various Protocols

Table 4 NVMe Market, By Product, 2017–2025 (USD Billion)

Table 5 NVMe SSDS Market, By Communication Standard, 2017–2025 (USD Million)

Table 6 NVMe SSDS Market, By Deployment Location, 2017–2025 (USD Million)

Table 7 NVMe SSDS Market, By Vertical, 2017–2025 (USD Million)

Table 8 NVMe SSDS Market, 2017–2025 (Units in Zettabytes)

Table 9 NVMe SSDS Market, By Form Factor, 2017–2025 (USD Million)

Table 10 NVMe Adapters Market, By Communication Standard, 2017–2025 (USD Million)

Table 11 NVMe Adapters Market, By Deployment Location, 2017–2025 (USD Million)

Table 12 NVMe Adapters Market, By Vertical, 2017–2025 (USD Million)

Table 13 NVMe All-Flash Arrays Market, By Communication Standard, 2017–2025 (USD Million)

Table 14 NVMe All-Flash Arrays Market, By Deployment Location, 2017–2025 (USD Million)

Table 15 NVMe All-Flash Arrays Market, By Vertical, 2017–2025 (USD Million)

Table 16 NVMe Servers Market, By Communication Standard, 2017–2025 (USD Million)

Table 17 NVMe Servers Market, By Deployment Location, 2017–2025 (USD Million)

Table 18 NVMe Servers Market, By Vertical, 2017–2025 (USD Million)

Table 19 Non-volatile Memory Express Market for Other Products, By Communication Standard, 2017–2025 (USD Million)

Table 20 Non-volatile Memory Express Market for Other Products, By Deployment Location, 2017–2025 (USD Million)

Table 21 Non-volatile Memory Express Market for Other Products, By Vertical, 2017–2025 (USD Million)

Table 22 Non-volatile Memory Express Market, By Communication Standard, 2017–2025 (USD Billion)

Table 23 NVMe Over Ethernet Market, By Product, 2017–2025 (USD Million)

Table 24 NVMe Over Fibre Channel Market, By Product, 2017–2025 (USD Million)

Table 25 NVMe Over Infiniband Market, By Product, 2017–2025 (USD Million)

Table 26 Non-volatile Memory Express Market, By Deployment Location, 2017–2025 (USD Billion)

Table 27 On-Premise NVMe Market, By Product, 2017–2025 (USD Million)

Table 28 Remote NVMe Market, By Product, 2017–2025 (USD Million)

Table 29 Hybrid NVMe Market, By Product, 2017–2025 (USD Million)

Table 30 Non-volatile Memory Express Market, By Vertical, 2017–2025 (USD Billion)

Table 31 Non-volatile Memory Express Market in BFSI Vertical, By Product, 2017–2025 (USD Million)

Table 32 Non-volatile Memory Express Market in BFSI Vertical, By Deployment Location, 2017–2025 (USD Million)

Table 33 Non-volatile Memory Express Market in BFSI Vertical, By Region, 2017–2025 (USD Million)

Table 34 Non-volatile Memory Express Market in Consumer Goods & Retail Vertical, By Product, 2017–2025 (USD Million)

Table 35 Non-volatile Memory Express Market in Consumer Goods & Retail Vertical, By Deployment Location, 2017–2025 (USD Million)

Table 36 Non-volatile Memory Express Market in Consumer Goods & Retail Vertical, By Region, 2017–2025 (USD Million)

Table 37 Non-volatile Memory Express Market in Telecommunications & Ites Vertical, By Product, 2017–2025 (USD Million)

Table 38 Non-volatile Memory Express Market in Telecommunications & Ites Vertical, By Deployment Location, 2017–2025 (USD Million)

Table 39 Non-volatile Memory Express Market in Telecommunications & Ites Vertical, By Region, 2017–2025 (USD Million)

Table 40 Non-volatile Memory Express Market in Healthcare Vertical, By Product, 2017–2025 (USD Million)

Table 41 Non-volatile Memory Express Market in Healthcare Vertical, By Deployment Location, 2017–2025 (USD Million)

Table 42 Non-volatile Memory Express Market in Healthcare Vertical, By Region, 2017–2025 (USD Million)

Table 43 NVMe Market in Energy Vertical, By Product, 2017–2025 (USD Million)

Table 44 Non-volatile Memory Express Market in Energy Vertical, By Deployment Location, 2017–2025 (USD Million)

Table 45 Non-volatile Memory Express Market in Energy Vertical, By Region, 2017–2025 (USD Million)

Table 46 Non-volatile Memory Express Market in Government Vertical, By Product, 2017–2025 (USD Million)

Table 47 Non-volatile Memory Express Market in Government Vertical, By Deployment Location, 2017–2025 (USD Million)

Table 48 Non-volatile Memory Express Market in Government Vertical, By Region, 2017–2025 (USD Million)

Table 49 Non-volatile Memory Express Market in Education & Research Vertical, By Product, 2017–2025 (USD Million)

Table 50 Market in Education & Research Vertical, By Deployment Location, 2017–2025 (USD Million)

Table 51 Market in Education & Research Vertical, By Region, 2017–2025 (USD Million)

Table 52 Market in Media & Entertainment Vertical, By Product, 2017–2025 (USD Million)

Table 53 Market in Media & Entertainment Vertical, By Deployment Location, 2017–2025 (USD Million)

Table 54 Market in Media & Entertainment Vertical, By Region, 2017–2025 (USD Million)

Table 55 Market in Manufacturing Vertical, By Product, 2017–2025 (USD Million)

Table 56 Market in Manufacturing Vertical, By Deployment Location, 2017–2025 (USD Million)

Table 57 Market in Manufacturing Vertical, By Region, 2017–2025 (USD Million)

Table 58 Market in Business & Consulting Vertical, By Product, 2017–2025 (USD Million)

Table 59 Market in Business & Consulting Vertical, By Deployment Location, 2017–2025 (USD Million)

Table 60 Market in Business & Consulting Vertical, By Region, 2017–2025 (USD Million)

Table 61 Market in Other Verticals, By Product, 2017–2025 (USD Million)

Table 62 Market in Other Verticals, By Deployment Location, 2017–2025 (USD Million)

Table 63 Market in Other Verticals, By Region, 2017–2025 (USD Million)

Table 64 Market, By Region, 2017–2025 (USD Billion)

Table 65 Market in North America, By Vertical, 2017–2025 (USD Million)

Table 66 Market North America, By Country, 2017–2025 (USD Million)

Table 67 North America Non-volatile Memory Express Market for BFSI Vertical, By Country, 2017–2025 (USD Million)

Table 68 North America Non-volatile Memory Express Market for Consumer Goods & Retail Vertical, By Country, 2017–2025 (USD Million)

Table 69 North America Non-volatile Memory Express Market for Telecommunications & Ites Vertical, By Country, 2017–2025 (USD Million)

Table 70 North America Market for Healthcare Vertical, By Country, 2017–2025 (USD Million)

Table 71 North America NVMe Market for Energy Vertical, By Country, 2017–2025 (USD Million)

Table 72 North America NVMe for Government Vertical, By Country, 2017–2025 (USD Million)

Table 73 North America NVMe for Education & Research Vertical, By Country, 2017–2025 (USD Million)

Table 74 North America NVMe for Media & Entertainment Vertical, By Country, 2017–2025 (USD Million)

Table 75 North America NVMe for Manufacturing Vertical, By Country, 2017–2025 (USD Million)

Table 76 North America NVMe for Business & Consulting Vertical, By Country, 2017–2025 (USD Million)

Table 77 North America NVMe for Other Verticals, By Country, 2017–2025 (USD Million)

Table 78 NVMe Market in Europe, By Vertical, 2017–2025 (USD Million)

Table 79 NVMe Market in Europe, By Country, 2017–2025 (USD Million)

Table 80 Europe NVMe Market for BFSI Vertical, By Country, 2017–2025 (USD Million)

Table 81 Europe Non-volatile Memory Express Market for Consumer Goods & Retail Vertical, By Country, 2017–2025 (USD Million)

Table 82 Europe Non-volatile Memory Express Market for Telecommunications & Ites Vertical, By Country, 2017–2025 (USD Million)

Table 83 Europe Non-volatile Memory Express Market for Healthcare Vertical, By Country, 2017–2025 (USD Million)

Table 84 Europe Non-volatile Memory Express Market for Energy Vertical, By Country, 2017–2025 (USD Million)

Table 85 Europe Non-volatile Memory Express Market for Government Vertical, By Country, 2017–2025 (USD Million)

Table 86 Europe Non-volatile Memory Express Market for Education & Research Vertical, By Country, 2017–2025 (USD Million)

Table 87 Europe NVMe Market for Media & Entertainment Vertical, By Country, 2017–2025 (USD Million)

Table 88 Europe NVMe Market for Manufacturing Vertical, By Country, 2017–2025 (USD Million)

Table 89 Europe NVMe Market for Business & Consulting Vertical, By Country, 2017–2025 (USD Million)

Table 90 Europe NVMe Market for Other Verticals, By Country, 2017–2025 (USD Million)

Table 91 NVMe Market in APAC, By Vertical, 2017–2025 (USD Million)

Table 92 NVMe Market in APAC, By Country, 2017–2025 (USD Million)

Table 93 APAC NVMe for BFSI Vertical, By Country, 2017–2025 (USD Million)

Table 94 APAC NVMe for Consumer Goods & Retail Vertical, By Country, 2017–2025 (USD Million)

Table 95 APAC NVMe for Telecommunications & Ites Vertical, By Country, 2017–2025 (USD Million)

Table 96 APAC NVMe for Healthcare Vertical, By Country, 2017–2025 (USD Million)

Table 97 APAC NVMe Market for Energy Vertical, By Country, 2017–2025 (USD Million)

Table 98 APAC NVMe Market for Government Vertical, By Country, 2017–2025 (USD Million)

Table 99 APAC NVMe Market for Education & Research Vertical, By Country, 2017–2025 (USD Million)

Table 100 APAC NVMe Market for Media & Entertainment, By Country, 2017–2025 (USD Million)

Table 101 APAC NVMe Market for Manufacturing Vertical, By Country, 2017–2025 (USD Million)

Table 102 APAC NVMe Market for Business & Consulting Vertical, By Country, 2017–2025 (USD Million)

Table 103 APAC NVMe Market for Other Verticals, By Country, 2017–2025 (USD Million)

Table 104 NVMe Market in RoW, By Vertical, 2017–2025 (USD Million)

Table 105 RoW NVMe, By Region, 2017–2025 (USD Million)

Table 106 RoW NVMe for BFSI Vertical, By Region, 2017–2025 (USD Million)

Table 107 RoW NVMe for Consumer Goods & Retail Vertical, By Region, 2017–2025 (USD Million)

Table 108 RoW NVMe for Telecommunications & Ites Vertical, By Region, 2017–2025 (USD Million)

Table 109 RoW NVMe for Healthcare Vertical, By Region, 2017–2025 (USD Million)

Table 110 RoW NVMe for Energy Vertical, By Region, 2017–2025 (USD Million)

Table 111 RoW NVMe for Government Vertical, By Region, 2017–2025 (USD Million)

Table 112 RoW NVMe for Education & Research Vertical, By Region, 2017–2025 (USD Million)

Table 113 RoW NVMe for Media & Entertainment Vertical, By Region, 2017–2025 (USD Million)

Table 114 RoW NVMe for Manufacturing Vertical, By Region, 2017–2025 (USD Million)

Table 115 RoW NVMe for Business & Consulting Vertical, By Region, 2017–2025 (USD Million)

Table 116 RoW NVMe for Other Verticals, By Region, 2017–2025 (USD Million)

Table 117 Product Launches and Developments, March 2018– January 2020

Table 118 Partnerships, Agreements, and Collaborations, August 2017–September 2019

Table 119 Mergers and Acquisitions, January 2017–September 2019

List of Figures (62 Figures)

Figure 1 NVMe Market Segmentation

Figure 2 Research Flow

Figure 3 NVMe Market: Research Design

Figure 4 Bottom-Up Approach

Figure 5 Top-Down Approach

Figure 6 Data Triangulation

Figure 7 SSDS to Hold Largest Size of NVMe Market From 2020 to 2025

Figure 8 Ethernet Communication Standard to Hold Largest Size of NVMe Market From 2020 to 2025

Figure 9 Hybrid Deployment to Grow at Highest CAGR From 2020 to 2025

Figure 10 BFSI Vertical to Hold Largest Size of NVMe Market From 2020 to 2025

Figure 11 North America Accounted for Largest Share of NVMe Market in 2019

Figure 12 Increased Global Adoption of High-Performance Computing Projected to Fuel Growth of NVMe Market From 2020 to 2025

Figure 13 NVMe-Based SSDS Market to Grow at Highest CAGR in Healthcare Vertical From 2020 to 2025

Figure 14 BFSI Segment and China Accounted for the Largest Share of APAC NVMe Market in 2019

Figure 15 North America Projected to Lead NVMe Market for BFSI From 2020 to 2025

Figure 16 Australia NVMe Market Projected to Grow at Highest CAGR From 2020 to 2025

Figure 17 Non-Volatile Memory Express (NVMe) Market: Drivers, Restraints, Opportunities, and Challenges

Figure 18 Adoption Rate of NVMe Compared With Sata and SAS in Server-Attached Storage

Figure 19 Adoption Rate of NVMe Compared With SAS in Storage Arrays

Figure 20 Comparison of Average Latency for Traditional Sata, Sas, and Hdd With NVMe Protocol

Figure 21 Comparison of Sequential Read and Write Speed of Hdd, Sata, and NVMe

Figure 22 Value Chain: Non-Volatile Memory Express Market, 2019

Figure 23 SSDS Segment Expected to Lead NVMe Market From 2020 to 2025

Figure 24 On-Premise Deployment Holds Largest Share of NVMe SSDS Market

Figure 25 On-Premise Deployment to Hold Largest Share of NVMe Adapters Market

Figure 26 Ethernet to Hold Largest Share of NVMe Servers Market During Forecast Period

Figure 27 On-Premise Deployment Holds Largest Share of NVMe Market for Other Products

Figure 28 Ethernet Communication Standard of NVMe Market Projected to Grow at Highest CAGR From 2020 to 2025

Figure 29 On-Premise Deployment Projected to Lead NVMe Market Between 2020 and 2025

Figure 30 NVMe Market for Healthcare Expected to Grow at Highest Rate During Forecast Period

Figure 31 On-Premise Deployment Expected to Hold Largest Share of NVMe Market in BFSI Vertical During Forecast Period

Figure 32 NVMe Market in Consumer Goods & Retail Vertical to Grow at Highest CAGR in Rest of the World

Figure 33 NVMe SSDS Account for Largest Share in Telecommunications & Ites Vertical of NVMe Market

Figure 34 Remote Deployment to Grow at Highest CAGR in Healthcare Vertical of NVMe Market During Forecast Period

Figure 35 North America Expected to Hold Largest Share of NVMe Market in Energy Vertical During Forecast Period

Figure 36 Hybrid Deployment Expected to Grow at Highest CAGR in Government Vertical of the NVMe Market During Forecast Period

Figure 37 North America to Hold Largest Share of NVMe Market in Education & Research Vertical

Figure 38 All-Flash Arrays Expected to Grow at Highest CAGR in Media & Entertainment Vertical of the NVMe Market During Forecast Period

Figure 39 On-Premise Deployment to Account for Largest Share of NVMe Market in Manufacturing Vertical During Forecast Period

Figure 40 NVMe Market in Business & Consulting Vertical to Grow at Highest CAGR in Rest of the World During Forecast Period

Figure 41 On-Premise Deployment to Hold Largest Share of NVMe Market in Other Verticals

Figure 42 Geographic Snapshot of NVMe Market

Figure 43 North America Projected to Lead NVMe Market From 2020 to 2025

Figure 44 North America NVMe Market Snapshot

Figure 45 US Projected to Lead North America NVMe Market for Media & Entertainment From 2020 to 2025

Figure 46 Europe NVMe Market Snapshot

Figure 47 UK Projected to Lead Europe NVMe Market for Healthcare From 2020 to 2025

Figure 48 APAC NVMe Market Snapshot

Figure 49 China Projected to Lead APAC NVMe Market for Consumer Goods & Retail From 2020 to 2025

Figure 50 Companies Adopted Product Launches and Developments as the Key Growth Strategy From January 2017 to January 2020

Figure 51 Ranking Analysis of Top 5 Players in NVMe Market

Figure 52 NVMe Market (Global) Competitive Leadership Mapping, 2019

Figure 53 Intel: Company Snapshot

Figure 54 Western Digital: Company Snapshot

Figure 55 Samsung: Company Snapshot

Figure 56 Dell EMC: Company Snapshot

Figure 57 Hewlett Packard Enterprise: Company Snapshot

Figure 58 Broadcom: Company Snapshot

Figure 59 Micron Technology: Company Snapshot

Figure 60 Cisco: Company Snapshot

Figure 61 Toshiba: Company Snapshot

Figure 62 NetApp: Company Snapshot

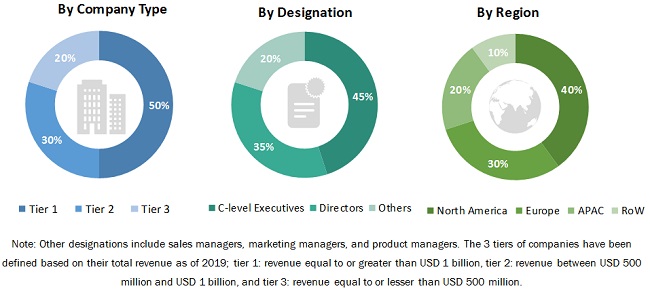

The study involved the estimation of the current size of the Non-volatile Memory Express (NVMe) market. Exhaustive secondary research was conducted to collect information on the market, its peer markets, and its parent market. This was followed by the validation of these findings, assumptions, and sizing with the industry experts identified across the value chain through primary research. Both, top-down and bottom-up approaches were employed to estimate the overall size of the NVMe market. It was followed by the market breakdown and data triangulation procedures, which were used to estimate the size of the market based on different segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to for the identification and collection of relevant information for this study on the NVMe market. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles by recognized authors, websites, directories, and databases. Secondary research was conducted to obtain the key information regarding the supply chain and value chain of the industry, total pool of key players, market segmentation according to industry trends (to the bottom-most level), geographic markets, and key developments from market- and technology-oriented perspectives. Secondary data was collected and analyzed to arrive at the overall size of the NVMe market, which was further validated by primary research.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information relevant to this report. Several primary interviews were conducted with the market experts from both demand (manufacturers of NVMe products and components used in different industries) and supply sides. The primary data was collected through questionnaires, emails, and telephonic interviews. Primary sources included industry experts such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related executives from various key companies and organizations operating in the NVMe market. Approximately 30% and 70% of the primary interviews were conducted from the demand and supply sides, respectively.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were implemented to estimate and validate the total size of the NVMe market. These methods were used extensively to estimate the size of the market based on various segments and subsegments. The research methodology used to estimate the market size included the following steps:

- Key players in the industry were identified through extensive secondary research.

- The industry’s supply chain was identified, and the market size, in terms of value, was determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall NVMe market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from the demand and supply sides across different applications.

Study Objectives

- To describe and forecast the NVMe market, in terms of value, based on product, communication standard, deployment location, and vertical

- To describe and forecast the market, in terms of value, for 4 major regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the NVMe market

- To strategically analyze micromarkets1 with respect to individual growth trends and contributions to the total market

- To profile key players and comprehensively analyze their position in terms of market ranking and core competencies2, along with a detailed competitive landscape of the market

- To analyze the competitive growth strategies—collaborations, agreements, partnerships, acquisitions, product launches and developments, research and development (R&D) activities—adopted by major players in the NVMe market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for this report:

- Product matrix that gives a detailed comparison of the product portfolio of each company

- Further breakdown of the RoW NVMe market at the country level

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Non-volatile Memory Express (NVMe) Market