Smart Irrigation Market Size, Share, Trends and Growth

Smart Irrigation Market by System Type (Weather-based, Sensor-based), Controllers, Sensors (Soil Moisture Sensors, Temperature Sensors, Rain/Freeze Sensors, Fertigation Sensors), Water Flow Meters, Greenhouses, Open Fields - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

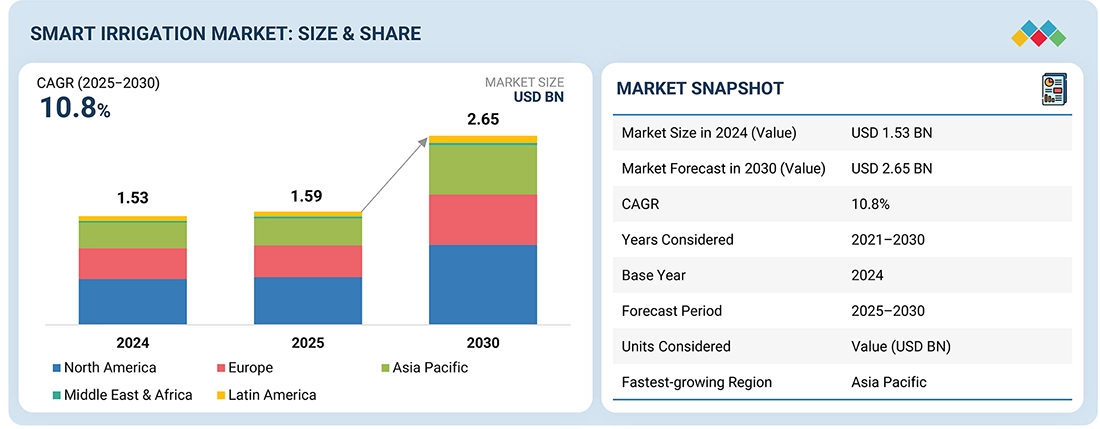

The smart irrigation market is projected to grow from USD 1.59 billion in 2025 to USD 2.65 billion by 2030, expanding at a CAGR of 10.8% during the forecast period. This growth is fueled by the rising need for water conservation, increasing adoption of precision agriculture practices, and government initiatives promoting sustainable agriculture practices. Advancements in sensor technologies, cloud-based irrigation management, and AI-driven analytics are further enhancing the efficiency and effectiveness of smart irrigation systems. Agriculture and non-agricultural applications such greenhouse, openfields, and residential farming are widely adopting smart irrigation systems to optimize water usage, reduce operational costs, and improve overall resource management.

KEY TAKEAWAYS

-

BY COMPONENTBy component, the controllers segment accounted for a share of 63.3% in terms of value in 2024.

-

BY SYSTEM TYPEBy system type, the sensor-based segment is projected to grow at a CAGR of 12.5% during the forecast period.

-

BY APPLICATIONBy application, the agricultural segment is expected to account for a market share of 47.5% in 2025.

-

BY REGIONNorth America is estimated to dominate the smart irrigation market with a share of 41.8% in 2025.

-

COMPETITIVE LANDSCAPEThe Toro Company, Rain Bird Corporation, Hunter Industries, NETAFIM, HydroPoint were identified as Star players in the smart irrigation market, given their broad industry coverage and strong operational & financial strength.

The smart irrigation market is projected to experience significant growth over the next decade, driven by the increasing need for water conservation, the rising adoption of precision agriculture, and advancements in IoT and sensor technologies. Smart irrigation systems utilize data from soil moisture sensors, weather forecasts, and crop requirements to optimize watering schedules. This approach minimizes water waste and enhances crop yields. Additionally, the integration of cloud-based analytics and remote monitoring capabilities improves operational efficiency and scalability. These systems are gaining popularity across agricultural, residential, and commercial sectors, making them essential for sustainable water management in farms, golf courses, parks, and urban green spaces.

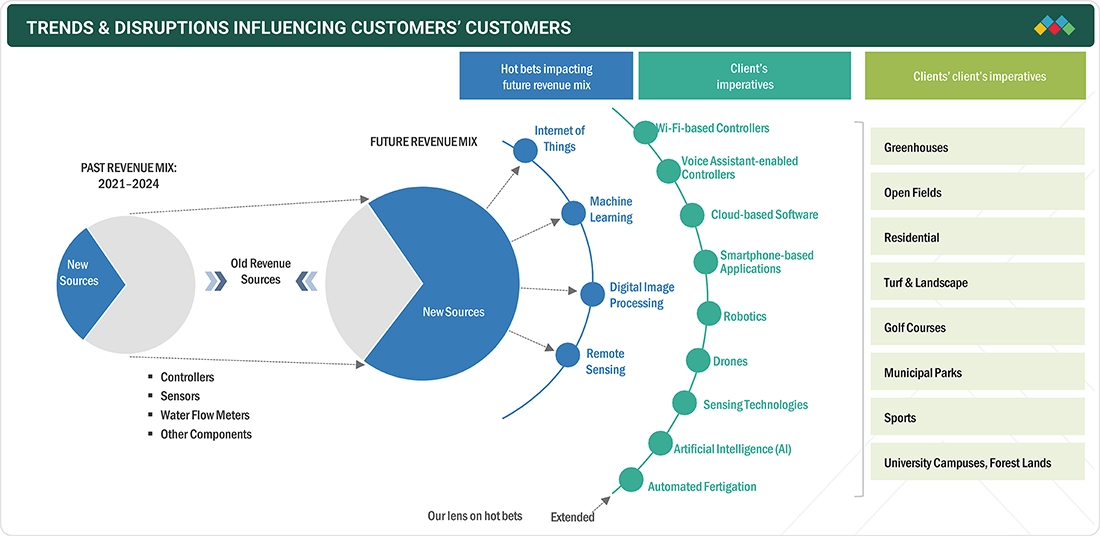

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The smart irrigation market is undergoing a significant transformation driven by emerging technologies and sustainability trends that will reshape the market landscape over the next 4–5 years. Key developments include the integration of IoT-based sensors, AI-driven water management platforms, cloud analytics, and satellite imaging for precision irrigation. Smart irrigation systems are increasingly used in agriculture for real-time soil moisture monitoring and automated irrigation control, in residential lawns and gardens for optimized watering, and in commercial landscapes and golf courses for resource-efficient management. These advancements address key challenges, including water scarcity, labor shortages, and climate variability, enabling higher productivity, reduced operational costs, and sustainable water usage across the agricultural, residential, and commercial sectors.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Deployment of automated monitoring systems in farming sector

-

Advancements in sensor technology & connectivity

Level

-

Lack of training and education among farmers

Level

-

Declining costs of smart irrigation components

-

Ongoing developments in irrigation technologies and farming practices

Level

-

Connectivity issues in rural areas

-

Data security and privacy concerns

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Deployment of automated monitoring systems in farming sector

The deployment of automated monitoring systems is a key driver of the smart irrigation market. Technologies like IoT, AI, and cloud computing enable real-time soil and weather monitoring to optimize water use. Supported by government incentives and affordability, these systems enhance efficiency, reduce costs, and promote sustainable modern farming globally.

Restraint: Lack of training and education among farmers

A major restraint in the smart irrigation market is the lack of training and education among farmers, especially in rural areas. Limited technical knowledge and awareness hinder adoption and effective use of advanced systems. Despite initiatives by organizations like NABARD and IWMI, inadequate skills and outreach continue to slow market growth.

Opportunity: Declining costs of smart irrigation components

The declining cost of smart irrigation components such as sensors, controllers, and valves is a major growth driver. Advances in technology, economies of scale, and competition have made systems more affordable. Combined with government incentives and modular, open-source designs, this trend promotes wider adoption and enhances global water-use efficiency and productivity.

Challenge: Connectivity issues in rural areas

One of the major challenges in the smart irrigation market is limited connectivity in rural areas, where most agricultural activities occur. Poor internet or cellular infrastructure restricts data transmission between field sensors and control systems, hindering scalability. Despite initiatives like BharatNet and Starlink, inconsistent connectivity continues to limit adoption and system efficiency.

Smart Irrigation Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Toro developed automated irrigation controllers integrated with weather-based data and IoT connectivity to optimize watering schedules for commercial landscapes and golf courses | Reduced water consumption by up to 30%, improved irrigation accuracy, and minimized manual intervention, enhancing sustainability and cost savings |

|

Netafim launched precision irrigation systems combining soil moisture sensors and AI-driven analytics to deliver water and nutrients efficiently to crops in real time | Increased crop yield and quality, reduced fertilizer use, and improved resource efficiency in large-scale agricultural operations |

|

Rain Bird deployed smart sprinkler systems using Wi-Fi-enabled controllers and mobile app connectivity for residential and commercial landscapes | Improved user convenience, decreased water wastage, and optimized irrigation schedules based on real-time environmental data |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The smart irrigation market ecosystem comprises an interconnected network of stakeholders, including equipment manufacturers, system integrators, distributors, and end users (applications). These players collaborate to deliver efficient, technology-driven irrigation solutions that optimize water use and enhance agricultural productivity. Manufacturers such as The Toro Company, Rain Bird Corporation, Netafim Ltd., and Hunter Industries design and produce essential components, including smart controllers, soil moisture sensors, weather-based irrigation systems, and automated valves. System Integrators like CropX Technologies and Valmont Industries bridge the gap between hardware and data intelligence by integrating IoT, AI, and cloud-based platforms. Distributors, including Sprinkler Warehouse and Parkland, play a crucial role in connecting manufacturers with end users. Applications span across agriculture, landscaping, golf courses, and greenhouse management, with organizations like Sentosa Golf Club, Corteva Agriscience, and Syngenta representing major end users.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Smart Irrigation Market, by Component

Sensors are expected to witness the highest CAGR in the smart irrigation market due to their crucial role in the real-time monitoring of soil moisture, temperature, and humidity. The increasing adoption of IoT-based precision farming, demand for data-driven irrigation control, and declining sensor costs are driving the widespread integration of IoT across agricultural and landscaping applications.

Smart Irrigation Market, by System Type

The sensor-based segment is expected to witness the highest CAGR due to the growing adoption of IoT and soil moisture sensors that enable real-time monitoring and precise irrigation control. These systems optimize water usage, reduce wastage, and enhance crop productivity, aligning with global sustainability goals and increasing demand for smart farming solutions.

Smart Irrigation Market, by Application

The agricultural segment is expected to witness the highest CAGR in the smart irrigation market due to increasing global demand for efficient water management, rising adoption of precision farming, and government initiatives promoting sustainable agriculture. Integration of IoT and sensor-based technologies enhances crop yield, reduces water wastage, and optimizes resource utilization in large-scale farming.

REGION

Asia Pacific to be the fastest-growing region in the global smart irrigation market during the forecast period

The Asia Pacific region is projected to experience the highest CAGR in the smart irrigation industry. This growth is driven by rapid digitalization in agriculture, government initiatives that promote water conservation, and the increasing adoption of precision farming technologies in countries such as India, China, and Australia. Additionally, the expansion of agricultural lands and a growing awareness of sustainable practices are further fueling market growth.

Smart Irrigation Market: COMPANY EVALUATION MATRIX

In the smart irrigation companies matrix, The Toro Company (Star) leads with a strong market presence, diverse product portfolio, and advanced smart irrigation technologies. Its solutions integrate weather-based automation, IoT-enabled controllers, and cloud-based management platforms, driving adoption across residential, commercial, and agricultural applications. Galcon (Emerging Leader) is rapidly gaining traction with innovative wireless irrigation controllers and precision water management systems designed for both farming and landscaping applications. While Toro dominates through scale, technological innovation, and a robust global distribution network, Galcon demonstrates strong growth potential supported by R&D advancements, affordable IoT-based solutions, and increasing international expansion, positioning it to move toward the leaders’ quadrant in the smart irrigation market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.53 Billion |

| Market Forecast in 2030 (Value) | USD 2.65 Billion |

| Growth Rate | CAGR of 10.8% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

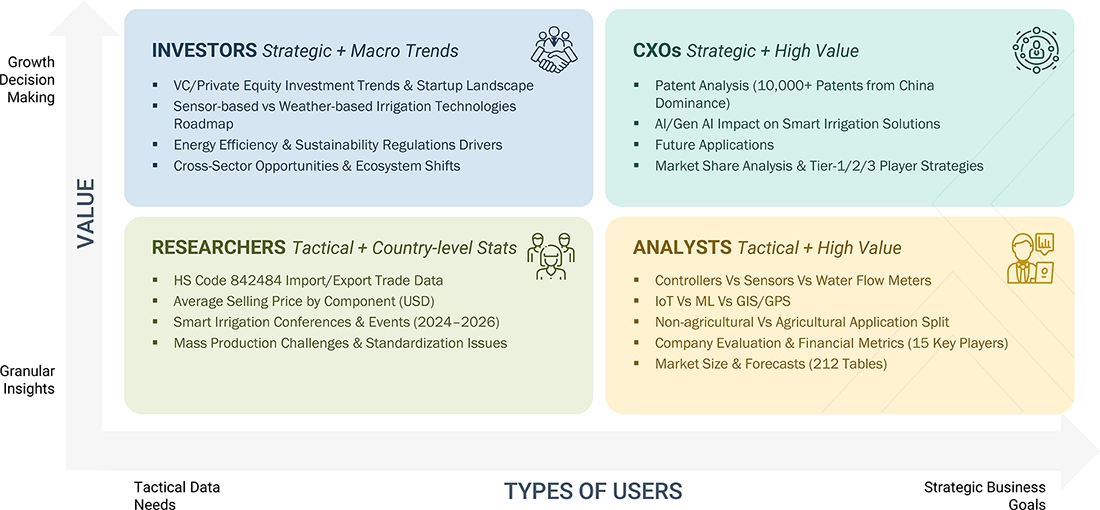

WHAT IS IN IT FOR YOU: Smart Irrigation Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Agri-Tech Equipment Manufacturer |

|

|

| Irrigation System Integrator / Solution Provider |

|

|

| Government / Water Management Agency |

|

|

| Agri-Input Company / Fertigation Technology Provider |

|

|

RECENT DEVELOPMENTS

- October 2024 : NETAFIM, a global leader in precision agriculture and part of Orbia, introduced two innovative products: GrowSphere and Orion PC. GrowSphere is an advanced digital irrigation and fertigation operating system that integrates IoT, cloud computing, and data analytics to automate irrigation based on real-time data and agronomic intelligence.

- February 2024 : HydroPoint launched its enterprise water solution, HydroPoint 360, which includes data insights, waste forecasting, and localized industry-specific best practices.

- November 2023 : HUNTER INDUSTRIES INC. launched the HYDRAWISE APP, which is an irrigation management software that offers enhanced control and clarity to promote a healthy landscape with minimal effort.

- November 2023 : HydroPoint launched its new Baseline devices, SubStation RV and SubStation CP, that allows wireless scalability for valve control and flow sensing.

- February 2022 : The Toro Company introduced the Tempus Automation System for agricultural irrigation, providing a smart, user-friendly, and highly connected solution to automate and remotely manage irrigation systems.

Table of Contents

Methodology

The research study involved four major activities in estimating the size of the smart irrigation market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information required for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, regional outlook, and developments from both market and technology perspectives.

Primary Research

In primary research, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative insights required for this report. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, manufacturers, technology and innovation directors, end users, and related executives from multiple key companies and organizations operating in the smart irrigation market ecosystem. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary research. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

Note: “Others” includes sales, marketing, and product managers

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches, along with data triangulation methods, have been used to estimate and validate the size of the smart irrigation market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

The bottom-up procedure has been employed to arrive at the overall size of the smart irrigation market.

- Major companies that provide smart irrigation systems were identified. This included analyzing company portfolios, product offerings, and presence across various regions.

- The segment-specific revenues of the companies, particularly those related to smart irrigation, were determined.

- These individual revenue figures were compiled to determine the total revenue generated across the identified companies within the sector.

- Using this consolidated data, the global market size for smart irrigation was obtained.

The top-down approach has been used to estimate and validate the total size of the smart irrigation market.

- Identified top-line investments and spending in the ecosystem and major market developments to consider segment-level splits

- Estimated the overall smart irrigation market size, then segmented the global market by allocating shares based on the segments considered

- Distributed the segment-level markets into regions and countries by aligning regional smart irrigation activity with economic indicators, smart irrigation manufacturing presence, and national development initiatives

Smart Irrigation Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides of the smart irrigation market

Market Definition

The smart irrigation sector involves the development, integration, and implementation of advanced irrigation technologies designed to optimize water usage in agricultural, commercial, and residential applications. This market focuses on improving irrigation efficiency, conserving water resources, and enhancing crop yields by automating and precisely controlling irrigation processes. Smart irrigation systems utilize a network of technologies, including soil moisture sensors, weather-based controllers, flow meters, and automated valves, supported by IoT platforms, cloud computing, and data analytics, to deliver targeted water applications based on real-time environmental data. The smart irrigation industry provides a comprehensive range of solutions and services, such as sensor-based irrigation systems to monitor soil moisture and crop needs, climate-based irrigation controllers that adjust watering schedules based on weather data, and advanced control systems that enable remote management and automation of irrigation operations. These systems are capable of detecting leaks, measuring water flow, and preventing overwatering or underwatering, ultimately ensuring water efficiency and crop health.

Key Stakeholders

- Agricultural equipment component suppliers

- Original equipment manufacturers (OEMs)

- Irrigation system component and device suppliers and distributors

- Software, service, and technology providers

- Standardization and testing firms

- Government bodies such as regulatory authorities and policymakers

- Research institutes and organizations

- Farmer organizations

Report Objectives

- To define, describe, segment, and forecast the smart irrigation market by system type, component, and application in terms of value

- To describe and forecast the market for various segments, with respect to four main regions: North America, Europe, Asia Pacific, and RoW, in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the smart irrigation market

- To offer a detailed overview of the smart irrigation market’s value chain, along with the ecosystem, technology trends, use cases, regulatory environment, and Porter’s five forces analysis

- To analyze industry trends, patents and innovations, and trade data (export and import data) related to smart irrigation

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To identify the key players and comprehensively analyze their market share and core competencies

- To analyze opportunities for stakeholders and provide a detailed competitive landscape of the market

- To investigate competitive developments, such as product launches/developments, collaborations, agreements, partnerships, acquisitions, and research & development (R&D), carried out by players in the smart irrigation market

- To profile key players in the smart irrigation market and comprehensively analyze their market ranking based on their revenue, market share, and core competencies

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Country-wise breakdown for North America, Europe, Asia Pacific, and Rest of the World

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is the current size of the global smart irrigation market?

The smart irrigation market is projected to reach USD 2.65 billion by 2030 from USD 1.59 billion in 2025, growing at a CAGR of 10.8% during the forecast period.

Who are the significant players in the global smart irrigation market?

The Toro Company (US), Rain Bird Corporation (US), HUNTER INDUSTRIES INC. (US), NETAFIM (Israel), and HydroPoint (US) are the major players in the smart irrigation market.

Which region is expected to hold the largest market size?

North America is expected to hold the largest share of the smart irrigation market during the forecast period.

What are the major smart irrigation market drivers?

Growing deployment of automated monitoring systems in the farming sector, advancement in sensor technology & connectivity, and government initiatives to promote water conservation are the major drivers for the smart irrigation market.

What are the major strategies adopted by market players?

The key players have adopted product launches, partnerships, collaborations, acquisitions, agreements, and expansions to strengthen their smart irrigation market position.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Smart Irrigation Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Smart Irrigation Market

User

Sep, 2019

Traditionaly weather-based controller adoption has good amount of penetration. But in recent years sensor-based controllers has gained strong momentum mainly in agriculture area. What level of adoption has been provided for these contollers in 2018 and during forecast period?.

User

Sep, 2019

Automated irrigation systems has good penetration level in North America but level of penetration for these systems is very low in developing countries. Can you provide penetration level for smart irrigation in developing countries..

User

Sep, 2019

I was wondering if the data is just divided in commercial and residential or if it is further broken down in to more applications. .

User

Nov, 2019

Can you please share the research methodology and assumptions you followed to come up with the numbers provided in the report ?.

User

Mar, 2019

Does this report provide data regarding competitor analysis and major companies strategies..