Sprinkler Irrigation Systems Market by Type (Center Pivot, Lateral Move, Solid Set), Crop Type (Cereals, Oilseeds & Pulses, Fruits & Vegetables), Field Size (Small, Medium, Large), Mobility (Stationary, Towable), and Region - Global Forecast to 2025

[181 Pages Report] Sprinkler irrigation, also known as mechanized irrigation, is a crop irrigation system that uses machinery; it is engineered to propel a specific amount of water and has the ability to control and monitor the water resource. The mechanized systems are mainly developed to abate the growing concern of water stress across the globe. These systems may be stationary or mobile and are available in various types, such as center pivot systems, lateral move systems, and solid set irrigation systems.

Agricultural market cycles around the world have made growers and governments realize the importance of irrigation in increasing agricultural production and yields. Sprinkler irrigation, also known as mechanized irrigation, is a system for crop irrigation that involves the aid of machinery, engineered to pump a specific amount of water, with the ability to control and monitor the water resource, resulting in water and energy savings. The flexibility of advanced sprinkle equipment, and its efficient control of water application, make the method useful in most topographic conditions.

Moreover, with the rapidly growing population, the demand for agricultural products is increasing. This, in turn, has increased the demand for irrigation systems which can efficiently irrigate the crops and reduce wastage of water. The area under sprinkler and other microirrigation methods has increased at least 6.4-fold, from 1.6 million hectares to more than 10.3 million, over the last 20 years. Due to increased government efforts to conserve water sources, governments in various countries are encouraging the use of irrigation systems such as sprinkler and drip irrigation by offering subsidies and other beneficial schemes. In November 2017, the World Bank approved USD 130 million to support farmers in the Punjab province of Pakistan to use water more efficiently and adopt irrigations systems such as sprinkler and drip systems.

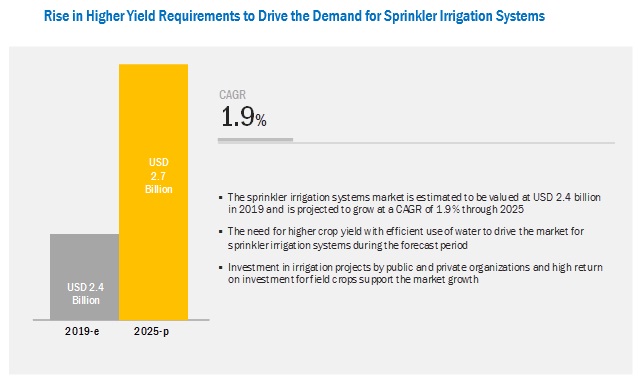

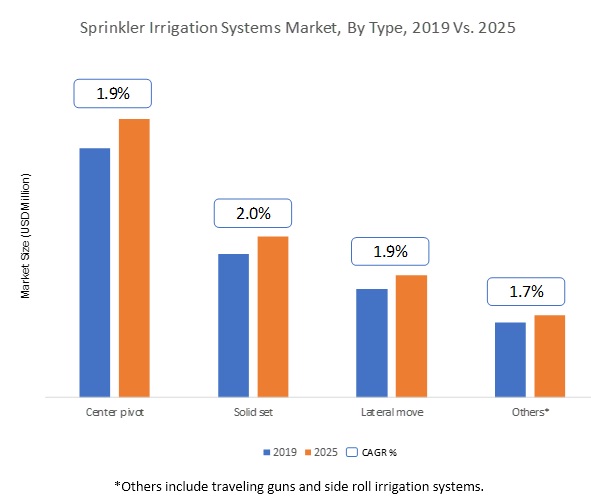

The sprinkler irrigation systems market is projected to grow at a CAGR of 1.9% during the forecast period (2019–2025), to reach a value of USD 2.7 billion by 2025. Amongst various types, the lateral move segment is expected to grow at the highest rate during the forecast period. The capital costs for lateral systems are lower than that of pivots since these are preferable for large areas. Moreover, unlike pivots, these systems have a uniform pressure along the length and are also more labor-intensive. One of the main disadvantages of lateral move systems is that it irrigates over recently irrigated land when changing direction, which poses operational problems such as non-uniform irrigation.

Lateral move irrigation systems projected to be the fastest-growing market for sprinkler irrigation systems from 2019 to 2025

The lateral move irrigation systems segment is projected to grow at the highest CAGR during the forecast period. A linear move sprinkler system is a continuous, self-moving, and straight lateral that irrigates a rectangular field. It is similar to the center pivot system, except that the lateral is supported by trusses, cables, and towers mounted on wheels. Most linear move systems are driven by electric motors located in each tower or are hydraulic-driven. A self-aligning system is used to maintain uniform travel in a straight line. One tower is the master control tower for the lateral where the speed is set, and all other towers operate in start-stop mode to maintain alignment.

The oilseeds & pulses segment is projected to be the fastest-growing crop type for sprinkler irrigation systems from 2019 to 2025.

The sprinkler irrigation systems market, by crop type, is estimated to be dominated by the cereals segment in 2018. However, the oilseeds & pulses segment is projected to be the fastest growing through 2025. Oilseed crops provide management options for irrigators seeking to reduce irrigation requirements, diversification, and/or to reduce input costs. Many parameters collectively influence the profitability and financial feasibility of oilseeds & pulses. To achieve maximum profitability, the annual cost of crop production is required to be maintained. Irrigation is one of the important factors affecting the profitability and quality of oilseed & pulse crops.

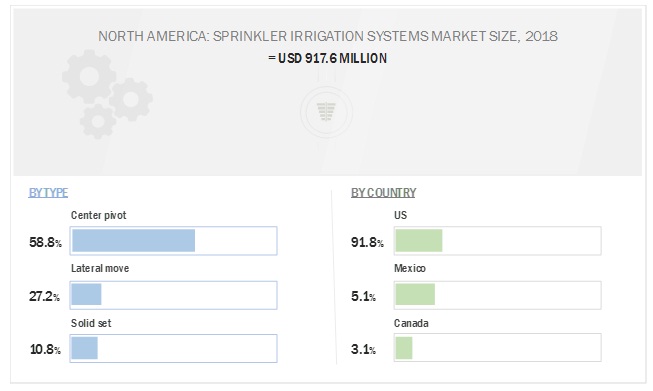

North America is set to lead the sprinkler irrigation systems market with the largest share in 2018.

The North American market is estimated to be the largest in 2018. The penetration of sprinkler irrigation systems is the highest in North America. The key players such as Valmont Industries, Lindsay Corporation, T-L Irrigation, and Reinke Manufacturing, Inc. are located in this region, which gives the region a competitive advantage. These key players have introduced growers to precise irrigation techniques that have contributed significantly to the development of irrigation infrastructure in the region. Moreover, the market penetration of sprinkler irrigation systems in the US has increased from 35% to 46% over the past decade.

Both ground and surface water are used for irrigation practices in North America; however, according to the International Groundwater Resource Assessment Centre, around 60% of the irrigated area is watered using groundwater in the US, which is a major market. A large number of cropping cycles in a year is possible in large parts of America due to the climatic conditions, owing to which a larger cropping intensity is possible in this region.

Market Dynamics

Shift from traditional irrigation methods to technologically advanced irrigation systems

The growing awareness about the advantages of sprinkler irrigation among farmers is causing a rapid shift from flood irrigation toward sprinkler systems. The major factor encouraging this trend is the concern regarding water wastage in flood irrigation as well as the leaching associated with it. Though the initial capital for the installation of the systems is high, the return on investment associated with the cost after 2-3 years, as well as the availability of a wide range of sprinkler system components, encourage producers to adopt sprinkler irrigation systems. The downward trend of flood irrigation is due to its disadvantages such as poor water-use efficiency, inability to irrigate uneven terrains, and uneven water distribution.

High capital investment for equipment and installation

Any advanced irrigation system requires significantly higher capital for installation as compared to the traditional methods of flood irrigation and rain-fed agriculture. The capital investment is a cumulative cost of the equipment and setup costs, which include the cost of pipes, sprinklers, pumps, electrical lines, well connectors, power units, and installation charges. The equipment cost is half of the capital investment, whereas the other half of the capital is incurred as installation charges. Moreover, sprinkler irrigation systems are mainly adopted for cost-intensive agricultural practices, such as orchards and agricultural fields. This high investment for low-value crops would yield a low return on investments.

Development of innovative irrigation products

Advancements in the existing irrigation systems for better monitoring and control of water resources and higher efficiency are driven by the growing demand for sprinkler irrigation systems. Technological advancements are largely adopted by key players in incorporating additional features or enhancing the already existing features in their products. The development of remotely controllable systems and user-friendly control panels enables farmers to handle center pivots and irrigation stream flow effectively. Sensor-based irrigation systems are developed by Valmont Industries and Reinke Manufacturing Company, which monitor the soil moisture for irrigation purposes. Additionally, these companies have developed new systems, which not only support irrigation but also support fertigation and chemigation. Apart from the development of new systems, technological advancements are witnessed in the irrigation system’ components as well. For instance, leading players such as Lindsay Corporation and Valmont Industries focus on the development of airless wheels for easier flexibility and mobility, user-friendly remote control panels, wireless pumps, anti-theft mechanism, GPS-enabled irrigation systems, and components of different durable materials.

Falling trend in commodity prices and farm income

According to the FAO, the annual average prices of all basic foodstuffs, except dairy products, have witnessed a significant decline. According to the USDA Grains Supply and Demand Report, the prices of crops, especially corn and soybean in the US, decreased to the lowest level, which had a severe impact on farmers’ income. After witnessing peak pricing across the agricultural sector in 2013, this drastic decline across not one, but all agricultural commodities, is taking a heavy toll on the farmers’ income, making them unable to further invest on agricultural equipment and input. According to the USDA, in 2019, the farmers’ net income would be 49.0% less than the net income in 2013.

Subsequently, the irrigation market is also negatively affected since sprinkler irrigation systems require high initial investments. Though farmers invest in irrigation systems, the low commodity prices result in lower profits as compared to the cost incurred for the installation of the system. These factors were responsible for the decreased demand for irrigation systems during 2017-18, which negatively impacted the revenues of the key players. As stated by key players, such as Lindsay Corporation and Valmont Industries, in 2015, the net farm income decreased by 38% from 2014, which showed its effect in developing a lower demand for sprinkler irrigation systems in the domestic market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2025 |

|

Base year considered |

2018 |

|

Forecast period |

2017–2025 |

|

Forecast units |

Million (USD) |

|

Segments covered |

Type (Centre Pivot, Lateral Move, Solid Set), Crop Type (Cereals, Oilseeds & pulses, Fruits & vegetables), Field Size (Small fields, Medium-sized, Large fields) By Mobility (Stationary, Towable), and Region |

|

Geographies covered |

North America, Europe, APAC, RoW, and South America |

|

Companies covered |

Valmont Industries (US), Lindsay Corporation (US), Jain Irrigation Systems Ltd. (India), The Toro Company (US), Rivulis Irrigation Ltd. (Israel), Netafim Limited (Israel), Rain Bird Corporation (US), T-L Irrigation (US), Reinke Manufacturing Co., Inc. (US), Nelson Irrigation Corporation (US), Hunter Industries (US), Mahindra EPC Ltd. (India), Alkhorayef Group (Saudi Arabia), Elgo Irrigation Ltd. (Israel), and Antelco Pty Ltd. (Australia), and Irritec S.p.A (Italy). |

The research report categorizes the sprinkler irrigation systems market to forecast the revenues and analyze the trends in each of the following sub-segments:

Based on type, the market has been segmented as follows:

- Center pivot irrigation systems

- Lateral move irrigation systems

- Solid set sprinkler systems

- Others

Based on crop type, the market has been segmented as follows:

- Cereals

- Oilseeds & pulses

- Fruits & vegetables

- Others

Based on field size, the market has been segmented as follows:

- Small fields

- Medium-sized

- Large fields

Based on mobility, the market has been segmented as follows:

- Stationary

- Towable

Based on region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- RoW (the Middle East, and Africa)

Key Market Players

Valmont Industries (US), Lindsay Corporation (US), Jain Irrigation Systems Ltd. (India), The Toro Company (US), Rivulis Irrigation Ltd. (Israel), Netafim Limited (Israel), Rain Bird Corporation (US), T-L Irrigation (US), Reinke Manufacturing Co., Inc. (US), Nelson Irrigation Corporation (US), Hunter Industries (US), Mahindra EPC Ltd. (India), Alkhorayef Group (Saudi Arabia), Elgo Irrigation Ltd. (Israel), and Antelco Pty Ltd. (Australia), and Irritec S.p.A (Italy).

Recent Developments

- In August 2018, Valley Irrigation, a subsidiary of Valmont Industries announced a new hybrid configuration for its machine X-Tec center drive motor. The new configuration makes the machine more efficient in terms of speed, power, and value.

- In April 2017, T-L Irrigation introduced linear irrigation systems with GPS navigation capabilities. The integration with linear irrigation systems reduced the need for buried wires, aboveground cables, or furrows for guidance.

- In September 2016, Lindsay introduced 9500DS Drop Span Option to its pivot system product line. With this new product, growers can irrigate more acres while avoiding permanent obstacles such as buildings, fences, and equipment.

- In February 2019, Reinke Manufacturing set up a new distribution center in Tifton, Georgia, US. This expansion would help the company to serve both the southeast and northeast regions of the US.

- In February 2018, The Toro Company invested in GreenSight Agronomics (US) to form a technology partnership. Through this partnership, GreenSight’s technologies and analytics, related to autonomous drone hardware and sensors for remote sensing and mapping, would be aligned with Toro’s water management expertise.

- In February 2018, Valmont Industries acquired a majority stake of Torrent Engineering & Equipment (US). The acquisition would help Valmont to gain access on the high-pressure water pumping and compressed air process systems.

Critical questions the report answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming trends for the sprinkler irrigation systems market?

- Which segment provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Periodization Considered

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Key Industry Insights

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 33)

4.1 Opportunities in the Global Market

4.2 Sprinkler Irrigation Market, By Type

4.3 North America: Sprinkler Irrigation Systems Market

4.4 Sprinkler Irrigation Systems Market, By Crop Type and Region

4.5 Sprinkler Irrigation Market, By Key Country

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Macroeconomic Indicators

5.2.1 Distribution & Availability of Water for Irrigation

5.2.1.1 Rates of Water Withdrawal

5.2.1.2 Area Under Irrigation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Shift From Traditional Irrigation Methods to Technologically Advanced Irrigation Systems

5.3.1.2 High Return on Investments With Time

5.3.1.3 Good Water-Use Efficiency During Extreme Climatic Conditions

5.3.1.4 Public and Private Support for Irrigation Projects in Developing Economies

5.3.2 Restraints

5.3.2.1 High Capital Investment for Equipment and Installation

5.3.2.2 High Maintenance Cost for Crop Growers

5.3.3 Opportunities

5.3.3.1 Development of Innovative Irrigation Products

5.3.4 Challenges

5.3.4.1 Falling Trend in Commodity Prices and Farm Income

5.3.4.2 Lower Demand From Labor-Intensive Geographies

5.4 Patent Analysis

6 Market for Sprinkler Irrigation Systems, By Type (Page No. - 49)

6.1 Introduction

6.2 Center Pivot Irrigation Systems

6.2.1 High Crop Yield With Efficient Use of Water Drives the Market for Center Pivot Irrigation Systems

6.3 Lateral Move Irrigation Systems

6.3.1 Adoption of Lateral Move Systems is Increasing in High-Value Crops

6.4 Solid Set Sprinkler Systems

6.4.1 Cheaper Price and Ease of Operation Drives the Market for Solid Set Sprinkler Systems

6.5 Other Types

7 Market for Sprinkler Irrigation Systems, By Crop Type (Page No. - 56)

7.1 Introduction

7.2 Cereals

7.2.1 Corn

7.2.2 Wheat

7.2.3 Sorghum

7.2.4 Other Cereals

7.3 Oilseeds & Pulses

7.3.1 Soybean

7.3.2 Cotton

7.3.3 Canola

7.3.4 Other Oilseeds & Pulses

7.4 Fruits & Vegetables

7.5 Other Crop Types

8 Market for Sprinkler Irrigation Systems, By Field Size (Page No. - 65)

8.1 Introduction

8.2 Small Fields

8.2.1 Asia Pacific is the Leading Market Under This Segment Due to the Larger Presence of Small-Scale Growers

8.3 Medium-Sized

8.3.1 Single Span and Multi-Span Pivots are Largely Preferred in Medium-Sized Fields

8.4 Large Fields

8.4.1 North America and Europe are Key Markets to Tap the Demand Under the Large-Scale Farm Category

9 Market for Sprinkler Irrigation Systems, By Mobility (Page No. - 70)

9.1 Introduction

9.2 Stationary

9.2.1 The Adoption of Stationary Systems is High in Technologically Advanced Countries

9.3 Towable

9.3.1 High Growth Prospects in the Asia Pacific Region

10 Market for Sprinkler Irrigation Systems, By Region (Page No. - 74)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.1.1 The Presence of Leading Sprinkler Irrigation System Manufacturers Provide A Competitive Advantage to the Country

10.2.2 Canada

10.2.2.1 Oilseeds & Pulses Occupied the Largest Share Among All the Crops Grown in Canada

10.2.3 Mexico

10.2.3.1 Higher Production of Export-Oriented Crops to Boost the Demand for Sprinkler Irrigation Systems in the Country

10.3 Asia Pacific

10.3.1 China

10.3.1.1 China Accounted for High Market Share Due to the Availability of Large Area Equipped for Irrigation

10.3.2 India

10.3.2.1 Government Support Through Subsidies Boost the Growth of the Indian Sprinkler Irrigation Systems Market

10.3.3 Australia

10.3.3.1 High Water Prices Arising Through Flood Irrigation Increases the Popularity of Automated Irrigation Systems

10.3.4 Japan

10.3.4.1 Severe Droughts Have Increased the Adoption of Sprinkler Systems in Japan

10.3.5 Rest of Asia Pacific

10.4 Europe

10.4.1 Germany

10.4.1.1 Increase in the Area Harvested for Oilseeds and Pulses Will Increase the Demand for Sprinkler Irrigation in the Country

10.4.2 France

10.4.2.1 Rise in Population Will Increase the Demand for Agriculture Products, Thus Indirectly Increasing the Demand for Irrigation

Systems

10.4.3 Uk

10.4.3.1 Increase in Farm Income Will Lead to Greater Demand for Advanced Irrigation Systems

10.4.4 Spain

10.4.4.1 Stronger Demand From Cereals and Fruits & Vegetables is Expected to Strengthen the Market Demand

10.4.5 Italy

10.4.5.1 Increase in Farm Size Will Lead to Greater Demand for Sprinkler Irrigation Systems in the Country

10.4.6 Russia

10.4.6.1 Increased Government Spending in Agriculture Will Lead to Higher Demand for Sprinkler Irrigation Systems in Russia

10.4.7 Ukraine

10.4.7.1 Increase in the Area Harvested for Pulses Will Increase the Demand for the Sprinkler Irrigation Market

10.4.8 Rest of Europe

10.5 South America

10.5.1 Brazil

10.5.1.1 Strong Sprinkler Irrigation Market Expected Among Oilseed Growers in the Coming Years

10.5.2 Chile

10.5.2.1 Introduction of Low-Pressure Emitters and Sprinkler Lines Aid Farmers in Chile

10.5.3 Rest of South America

10.6 Rest of the World (RoW)

10.6.1 Africa

10.6.1.1 Strong Boost for Sprinkler Irrigation Systems is Projected for Cereal and Oilseed Crops

10.6.2 Middle East

10.6.2.1 Strong Boost for Sprinkler Irrigation Systems is Projected for Fruit & Vegetable Crops

11 Competitive Landscape (Page No. - 123)

11.1 Overview

11.2 Competitive Leadership Mapping

11.2.1 Dynamic Capitalizers

11.2.2 Innovators

11.2.3 Visionary Leaders

11.2.4 Emerging Companies

11.3 Competitive Benchmarking

11.3.1 Strength of Product Portfolio

11.3.1.1 Business Strategy Excellence

11.4 Competitive Leadership Mapping (For Tier Iii Players)

11.4.1 Emerging Leaders

11.4.2 Starting Blocks

11.4.3 Progressive Companies

11.4.4 Dynamic Capitalizers

11.5 Competitive Benchmarking

11.5.1 Strength of Product Portfolio

11.5.2 Business Strategy Excellence

11.6 Market Share Analysis, 2018

11.7 Competitive Scenario

11.7.1 New Product Launches

11.7.2 Expansions and Investments

11.7.3 Mergers and Acquisitions

11.7.4 Partnerships, Joint Ventures, and Agreements

12 Company Profiles (Page No. - 137)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View)*

12.1 Lindsay Corporation

12.2 Valmont Industries Inc.

12.3 Jain Irrigation Systems Ltd.

12.4 Rivulis

12.5 The Toro Company

12.6 Netafim Limited

12.7 T-L Irrigation Company

12.8 Rinke Manufacturing Co., Inc.

12.9 Nelson Irrigation Corporation

12.10 Rain Bird Corporation

12.11 Hunter Industries

12.12 Mahindra EPC Ltd.

12.13 Alkhorayef Group

12.14 Elgo Irrigation Ltd.

12.15 Antelco Pty Ltd.

12.16 Irritec S.P.A

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 174)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (100 Tables)

Table 1 USD Exchange Rate, 2014–2018

Table 2 Countries With the Largest Agricultural Water Withdrawals

Table 3 Total Irrigated Area and Sprinkler Irrigation Area, By Key Country, 2018

Table 4 Comparison Between Flood Irrigation and Center Pivot Systems

Table 5 Comparison of Pivot and Subsurface Drip Irrigation (For 125 Acres)

Table 6 Comparison Between Crop Yield Under Sprinkler and Conventional Methods of Irrigation

Table 7 Comparison Between Capital Investment for Center Pivot and Flood Irrigation

Table 8 Comparison of Operating Costs of Different Sprinkler Systems

Table 9 List of Important Patents for Sprinkler Irrigation Systems, 2014–2019

Table 10 Sprinkler Irrigation Market Size, By Type, 2017–2025 (USD Million)

Table 11 Center Pivot Irrigation Systems Market Size, By Region, 2017–2025 (USD Million)

Table 12 Lateral Move Irrigation Systems Market Size, By Region, 2017–2025 (USD Million)

Table 13 Solid Set Irrigation Systems Market Size, By Region, 2017–2025 (USD Million)

Table 14 Other Sprinkler Irrigation Systems Market Size, By Region, 2017–2025 (USD Million)

Table 15 Market Size, By Crop Type, 2017–2025 (USD Million)

Table 16 Sprinkler Irrigation Market Size in Cereal Crop Cultivation, By Crop, 2017–2025 (USD Million)

Table 17 Sprinkler Irrigation Market Size in Cereal Crop Cultivation, By Region, 2017–2025 (USD Million)

Table 18 Sprinkler Irrigation Systems Market Size in Oilseed & Pulse Crop Cultivation, By Crop, 2017–2025 (USD Million)

Table 19 Market Size in Oilseed & Pulse Crop Cultivation, By Region, 2017–2025 (USD Million)

Table 20 Sprinkler Irrigation Market Size in Fruit & Vegetable Crop Cultivation, By Region, 2017–2025 (USD Million)

Table 21 Sprinkler Irrigation Systems Market Size in Other Crop Type Cultivation, By Region, 2017–2025 (USD Million)

Table 22 Market Size, By Field Size, 2017–2025 (USD Million)

Table 23 Small Fields: Sprinkler Irrigation System Market Size, By Region, 2017–2025 (USD Million)

Table 24 Medium-Sized: Sprinkler Irrigation System Market Size, By Region, 2017–2025 (USD Million)

Table 25 Large Fields: Sprinkler Irrigation System Market Size, By Region, 2017–2025 (USD Million)

Table 26 Market Size for Sprinkler Irrigation Systems, By Mobility, 2017–2025 (USD Million)

Table 27 Stationary Irrigation Systems Market Size, By Region, 2017–2025 (USD Million)

Table 28 Towable Irrigation Systems Market Size, By Region, 2017–2025 (USD Million)

Table 29 Market Size for Sprinkler Irrigation Systems, By Region, 2017–2025 (USD Million)

Table 30 North America: Sprinkler Irrigation Systems Market Size, By Country, 2017–2025 (USD Million)

Table 31 North America: Sprinkler Irrigation Market Size, By Type, 2017–2025 (USD Million)

Table 32 North America: Sprinkler Irrigation Market Size, By Mobility, 2017–2025 (USD Million)

Table 33 North America: Sprinkler Irrigation Market Size, By Crop Type, 2017–2025 (USD Million)

Table 34 North America: Market Size for Sprinkler Irrigation Systems, By Field Size, 2017–2025 (USD Million)

Table 35 US: Sprinkler Irrigation Systems Market Size, By Type, 2017–2025 (USD Million)

Table 36 US: Market Size, By Crop Type, 2017–2025 (USD Million)

Table 37 Canada: Sprinkler Irrigation Systems Market Size, By Type, 2017–2025 (USD Million)

Table 38 Canada: Sprinkler Irrigation Market Size, By Crop Type, 2017–2025 (USD Million)

Table 39 Mexico: Market Size for Sprinkler Irrigation Systems, By Type, 2017–2025 (USD Million)

Table 40 Mexico: Market Size, By Crop Type, 2017–2025 (USD Million)

Table 41 Asia Pacific: Sprinkler Irrigation Systems Market Size, By Country, 2017-2025 (USD Million)

Table 42 Asia Pacific: Sprinkler Irrigation Market Size, By Type, 2017-2025 (USD Million)

Table 43 Asia Pacific: Sprinkler Irrigation Market Size, By Mobility, 2017-2025 (USD Million)

Table 44 Asia Pacific: Market Size for Sprinkler Irrigation Systems, By Crop Type, 2017-2025 (USD Million)

Table 45 Asia Pacific: Market Size, By Field Size, 2017-2025 (USD Million)

Table 46 China: Sprinkler Irrigation Systems Market Size, By Type, 2017-2025 (USD Million)

Table 47 China: Sprinkler Irrigation Market Size, By Crop Type, 2017-2025 (USD Million)

Table 48 India: Sprinkler Irrigation Systems Market Size, By Type, 2017-2025 (USD Million)

Table 49 India: Market Size, By Crop Type, 2017-2025 (USD Million)

Table 50 Australia: Market Size for Sprinkler Irrigation Systems, By Type, 2017-2025 (USD Million)

Table 51 Australia: Market Size, By Crop Type, 2017-2025 (USD Million)

Table 52 Japan: Sprinkler Irrigation Systems Market Size, By Type, 2017-2025 (USD Million)

Table 53 Japan: Sprinkler Irrigation Market Size, By Crop Type, 2017-2025 (USD Million)

Table 54 Rest of Asia Pacific: Sprinkler Irrigation Systems Market Size, By Type, 2017-2025 (USD Million)

Table 55 Rest of Asia Pacific: Market Size, By Crop Type, 2017-2025 (USD Million)

Table 56 Europe: Sprinkler Irrigation Systems Market Size, By Country, 2017–2025 (USD Million)

Table 57 Europe: Sprinkler Irrigation Market Size, By Type, 2017–2025 (USD Million)

Table 58 Europe: Sprinkler Irrigation Market Size, By Mobility, 2017–2025 (USD Million)

Table 59 Europe: Market Size, By Crop Type, 2017–2025 (USD Million)

Table 60 Europe: Market Size, By Field Size, 2017–2025 (USD Million)

Table 61 Germany: Market Size for Sprinkler Irrigation Systems, By Type, 2017–2025 (USD Million)

Table 62 Germany: Sprinkler Irrigation Market Size, By Crop Type, 2017–2025 (USD Million)

Table 63 France: Sprinkler Irrigation Systems Market Size, By Type, 2017–2025 (USD Million)

Table 64 France: Sprinkler Irrigation Market Size, By Crop Type, 2017–2025 (USD Million)

Table 65 UK: Sprinkler Irrigation Systems Market Size, By Type, 2017–2025 (USD Million)

Table 66 UK: Market Size, By Crop Type, 2017–2025 (USD Million)

Table 67 Spain: Sprinkler Irrigation Systems Market Size, By Type, 2017–2025 (USD Million)

Table 68 Spain: Sprinkler Irrigation Market Size, By Crop Type, 2017–2025 (USD Million)

Table 69 Italy: Sprinkler Irrigation Systems Market Size, By Type, 2017–2025 (USD Million)

Table 70 Italy: Sprinkler Irrigation Market Size, By Crop Type, 2017–2025 (USD Million)

Table 71 Russia: Sprinkler Irrigation Systems Market Size, By Type, 2017–2025 (USD Million)

Table 72 Russia: Sprinkler Irrigation Market Size, By Crop Type, 2017–2025 (USD Million)

Table 73 Ukraine: Sprinkler Irrigation Systems Market Size, By Type, 2017–2025 (USD Million)

Table 74 Ukraine: Market Size, By Crop Type, 2017–2025 (USD Million)

Table 75 Rest of Europe: Sprinkler Irrigation Systems Market Size, By Type, 2017–2025 (USD Million)

Table 76 Rest of Europe: Market Size, By Crop Type, 2017–2025 (USD Million)

Table 77 South America: Market Size for Sprinkler Irrigation Systems, By Country, 2017-2025 (USD Million)

Table 78 South America: Sprinkler Irrigation Market Size, By Type, 2017-2025 (USD Million)

Table 79 South America: Market Size, By Mobility, 2017-2025 (USD Million)

Table 80 South America: Market Size, By Crop Type, 2017-2025 (USD Million)

Table 81 South America: Market Size, By Field Size, 2017-2025 (USD Million)

Table 82 Brazil: Sprinkler Irrigation Systems Market Size, By Type, 2017-2025 (USD Million)

Table 83 Brazil: Market Size, By Crop Type, 2017-2025 (USD Million)

Table 84 Chile: Sprinkler Irrigation Systems Market Size, By Type, 2017–2025 (USD Million)

Table 85 Chile: Market Size, By Crop Type, 2017–2025 (USD Million)

Table 86 Rest of South America: Sprinkler Irrigation Systems Market Size, By Type, 2017–2025 (USD Million)

Table 87 Rest of South America: Sprinkler Irrigation Market Size, By Crop Type, 2017–2025 (USD Million)

Table 88 RoW: Sprinkler Irrigation Systems Irrigation Market, By Region, 2017–2025 (USD Million)

Table 89 RoW: Sprinkler Irrigation Systems Market Size, By Type, 2017-2025 (USD Million)

Table 90 RoW: Market Size, By Mobility, 2017-2025 (USD Million)

Table 91 RoW: Market Size, By Crop Type, 2017-2025 (USD Million)

Table 92 RoW: Market Size, By Field Size, 2017-2025 (USD Million)

Table 93 Africa: Sprinkler Irrigation Systems Market Size, By Type, 2017-2025 (USD Million)

Table 94 Africa: Market Size, By Crop Type, 2017-2025 (USD Million)

Table 95 Middle East: Sprinkler Irrigation Systems Market Size, By Type, 2017-2025 (USD Million)

Table 96 Middle East: Market Size, By Crop Type, 2017-2025 (USD Million)

Table 97 New Product Launches, 2014 –2019

Table 98 Expansions and Investments, 2014 - 2019

Table 99 Mergers and Acquisitions, 2014 –2019

Table 100 Partnerships, Joint Ventures, and Agreements, 2014–2019

List of Figures (42 Figures)

Figure 1 Sprinkler Irrigation Systems: Market Segmentation

Figure 2 Regional Segmentation

Figure 3 Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation Methodology

Figure 8 Sprinkler Irrigation System Market Size, By Type, 2018

Figure 9 Market, By Crop Type, 2018

Figure 10 Sprinkler Irrigation System Market, By Field Size, 2018

Figure 11 Regional Snapshot

Figure 12 Increasing Number of Government Investments Through Public-Private Partnership for Water Conservation Supports the Market Growth

Figure 13 Stationary Sprinkler Systems Witnessed A High Adoption Rate Across the Globe in 2018

Figure 14 North America: Center Pivot Systems Witnessed Higher Demand in the Us Market in 2018

Figure 15 North America Recorded the Largest Market Share in 2018 for Irrigating Fruits and Vegetables Using Sprinkler Systems

Figure 16 Us Was the Largest Market for Sprinkler Irrigation Systems in 2018

Figure 17 Sector-Wise Water Withdrawal, By Region, 2017

Figure 18 Sprinkler Irrigation Systems Market: Drivers, Restraints, Opportunities, and Challenges

Figure 19 US Commodity Price for Crop Production and Net Farm Income, 2011-2018 (USD Billion)

Figure 20 Number of Patents Approved for Sprinkler Irrigation Systems, By Key Company, 2016–2019

Figure 21 Regional Analysis: Patent Approval for Sprinkler Irrigation Systems, 2014–2019

Figure 22 Sprinkler Irrigation Systems Market Size, By Type, 2019 vs. 2025 (USD Million)

Figure 23 Sprinkler Irrigation Market Size, By Crop Type, 2018 vs. 2023 (USD Million)

Figure 24 Sprinkler Irrigation Market Size, By Field Size, 2019 vs. 2025 (USD Million)

Figure 25 Sprinkler Irrigation Systems Market Size, By Mobility, 2019 vs. 2025 (USD Million)

Figure 26 Asian Countries to Witness High Market Growth During the Forecast Period

Figure 27 North America: Market Snapshot

Figure 28 Asia Pacific: Regional Snapshot

Figure 29 Sprinkler Irrigation Systems Market: Competitive Leadership Mapping for Tier I & Ii Players, 2018

Figure 30 Sprinkler Irrigation Systems Market: Competitive Leadership Mapping for Tier Iii Players, 2018

Figure 31 Key Developments of the Leading Players in the Sprinkler Irrigation Systems Market, 2014 –2019

Figure 32 Sprinkler Irrigation Market: Company Market Share, 2018

Figure 33 Lindsay Corporation: Company Snapshot

Figure 34 Lindsay Corporation: SWOT Analysis

Figure 35 Valmont Industries: Company Snapshot

Figure 36 Valmont Industries: SWOT Analysis

Figure 37 Jain Irrigation Systems Ltd.: Company Snapshot

Figure 38 Jain Irrigation Systems Ltd.: SWOT Analysis

Figure 39 Rivulis Irrigation: SWOT Analysis

Figure 40 The Toro Company: Company Snapshot

Figure 41 The Toro Company: SWOT Analysis

Figure 42 Mahindra EPC Ltd.: Company Snapshot

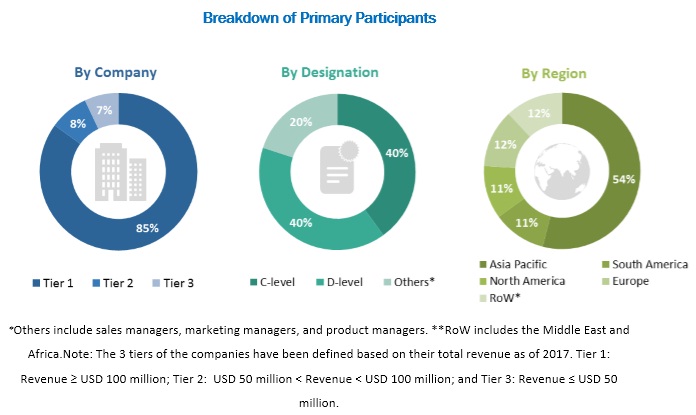

The study involved four major activities in estimating the market size for sprinkler irrigation system. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, so as to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

The market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand-side of this market is characterized by the development of cost-efficient sprinkler systems, particularly from the developing countries. The supply side is characterized by the advancements in technology and diverse applications across industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Given below is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the sprinkler irrigation system market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the food, feed, pharmaceutical, nutraceutical, and personal care industries.

Report Objectives

- To describe and forecast the sprinkler irrigation system market, in terms of type, crop type, mobility, field size, and region

- To describe and forecast the sprinkler irrigation system market, in terms of value, by region—Asia Pacific, Europe, North America, South America, and Rest of the World (RoW)—along with their respective countries

- To provide detailed information regarding the major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets, with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of sprinkler irrigation system

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the sprinkler irrigation system ecosystem

- To strategically profile key players and comprehensively analyze their market positions in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze strategic approaches such as acquisitions and divestments, expansions and investments, product launches and approvals, agreements, and collaborations and partnerships in the sprinkler irrigation system market

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to client-specific requirements. The available customization options are as follows:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further country-wise breakdown of the market in North America and Europe, based on site of operation

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Growth opportunities and latent adjacency in Sprinkler Irrigation Systems Market