Rubber Process Oil Market

Rubber Process Oil Market by Type (Naphthenic, Paraffinic, TDAE, DAE, MES, RAE, and TRAE), Application (Tires, Industrial Rubber Products, Oil-extended Polymers, and Thermoplastic Elastomers), Viscosity, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global rubber process oil market is projected to grow from USD 2.19 billion in 2025 to USD 2.49 billion by 2030, at a CAGR of 2.6% during the forecast period. Rubber process oils are specialty oils used to improve the processing, mixing, and performance characteristics of natural and synthetic rubber compounds by reducing viscosity, enhancing filler dispersion, and supporting smoother extrusion and molding. The market is defined by several product types, including Treated Distillate Aromatic Extract (TDAE), Distillate Aromatic Extract (DAE), Mild Extracted Solvate (MES), Residual Aromatic Extract (RAE), and Treated RAE (TRAE), along with paraffinic and naphthenic oils, each selected based on compatibility and desired end-product properties. These oils are further segmented by viscosity—low, medium, and high viscosity grades—which allows manufacturers to tailor processing behavior for soft, flexible elastomers or dense, high-strength rubber products. On the application side, rubber process oils are used extensively in tires, oil-extended polymers, industrial rubber products, thermoplastic elastomers (TPE), and several other downstream rubber goods where consistent processability and mechanical performance are essential. Collectively, these segments form the core structure of the RPO market. Demand continues to grow due to rising global tire production, expanding synthetic rubber manufacturing, and the industry’s increasing shift toward low-PAH and specialty RPO grades that meet stricter environmental and performance requirements.

KEY TAKEAWAYS

-

BY REGIONThe Asia Pacific region is expected to register the highest CAGR of 3.7% during forecast period.

-

BY TYPEBy type, TDAE segment is projected to grow at the highest CAGR of 3.4% during the forecast period.

-

BY APPLICATIONBy application, the thermoplastic elastomer (TPE) segment is projected to register the highest CAGR of 4.0% during the forecast period.

-

BY VISCOSITYBy viscosity, the medium viscosity segment is expected to dominate the overall market.

-

Competitive Landscape - Key PlayersSinopec, Exxon Mobil Corporation, PetroChina Company Limited, and Chevron Corporation were identified as some of the leading players in the rubber process oil market, given their strong market share and product footprint.

-

Competitive Landscape - StartupsLODHA Petro, RLS Petrochem Lubricants LLC, and Panol Industries RMC FZE, among others, have become leading startups or SMEs because they identify niche gaps early and deliver solutions that precisely match unmet customer needs. Their agility, faster decision-making, and ability to innovate continuously allow them to outperform larger, less flexible competitors.

The rubber process oil market continues to evolve as rubber manufacturers focus on improving compound consistency and processing efficiency across diverse applications. RPOs such as TDAE, DAE, MES, RAE/ TRAE, paraffinic, and naphthenic oils remain central to rubber formulation, helping reduce viscosity, enhance filler dispersion, and fine-tune mechanical properties in both natural and synthetic rubber. Market growth is shaped by the varied viscosity needs of the industry, with low-, medium-, and high-viscosity grades enabling optimized processing for everything from soft elastomeric goods to robust industrial components. These oils support a wide range of applications, including tires, oil-extended polymers, industrial rubber goods, thermoplastic elastomers, and several other downstream segments that rely on precise compound behavior. As rubber manufacturers shift toward advanced, high-performance formulations and tighter quality specifications, RPO suppliers are increasingly tailoring product lines to meet application-specific processing demands. The market is being pushed forward by the rising production of synthetic rubber, ongoing expansion of tyre manufacturing capacity, and the growing need for specialty, low-PAH oils that comply with stricter global environmental standards.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' businesses arises from evolving customer trends or market disruptions. Megatrends such as sustainability, and digital transformation—alongside disruptions like AI, supply chain localization, and energy transition—are significantly reshaping customer priorities and business models. Traditionally, revenue mixes were dominated by legacy products and processes focused on volume and cost. Today, customers are shifting toward high-margin, innovation-driven, and sustainable solutions to remain competitive and future-proof. This transition is prompting businesses to adapt quickly, invest in cleaner technologies, and enhance agility, with suppliers expected to deliver compliant, efficient, and tech-enabled offerings that align with evolving market demands.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising global vehicle production, including passenger cars, MHCVs, and off-highway vehicles, along with increasing aftermarket tire replacements

-

Growth in synthetic rubber production

Level

-

Stringent global regulations on aromatic RPO (EU, US, China)

-

Substitution by bio-based/sustainable plasticizers

Level

-

Rising demand for green/biodegradable rubber oils

-

New tire plant investments across Asia, Middle East & Africa, and Eastern Europe

Level

-

Fluctuating prices of key RPO feedstocks such as crude-derived distillates and aromatic extracts

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising global vehicle production, including passenger cars, MHCVs, and off-highway vehicles, along with increasing aftermarket tire replacements

Rising global vehicle production across passenger cars, medium- and heavy-commercial vehicles, and off-highway equipment is directly strengthening demand for rubber process oils (RPO) by expanding the overall volume of tyres required for OEM fitments. As automotive manufacturers scale up output to meet growing mobility needs, each new vehicle rolling off the assembly line generates the need for multiple tyre variants—tread, carcass, sidewall, inner liner—each of which uses RPO to ensure proper rubber flow, filler dispersion, and compound stability. Alongside OEM demand, the steady rise in aftermarket tyre replacements further amplifies consumption, as expanding vehicle parc sizes, longer travel distances, and faster tyre wear cycles continue to boost replacement frequency. This dual demand from OEM and aftermarket channels increases tyre production rates globally, which in turn elevates the requirement for RPO grades such as TDAE, MES, RAE/ TRAE, paraffinic, and naphthenic oils used in both natural and synthetic rubber formulations. As tyre manufacturers ramp up output to meet these needs, the demand for RPO grows proportionally, making rising vehicle production and replacement tyre consumption one of the strongest and most consistent drivers of the rubber process oil market.

Restraint: Stringent global regulations on aromatic RPO (EU, US, China

Stringent global regulations targeting high-aromatic rubber process oils (RPO), particularly in the EU, the US, and China, are acting as a significant restraint on market expansion by limiting the use of traditional distillate aromatic extracts (DAE). These regions have imposed strict limits on polycyclic aromatic hydrocarbons (PAHs) due to their environmental and health impacts, compelling manufacturers to transition toward compliant alternatives such as TDAE, MES, naphthenic, and paraffinic oils. While this regulatory push improves product safety, it creates supply bottlenecks because compliant oils require more refined feedstocks, higher processing costs, and tighter quality control, all of which constrain production flexibility. Producers relying heavily on conventional aromatic extracts face operational challenges, including reformulation efforts, investments in new processing technologies, and disruptions in long-term supply contracts. For tire and rubber product manufacturers, the shift away from high-aromatic oils increases input costs and complicates compound design, especially in applications that traditionally rely on strong solvency and compatibility characteristics of aromatic RPO. Collectively, these regulatory pressures limit the availability of conventional RPO grades, increase compliance costs, and slow market growth in regions with the strictest environmental and chemical-safety frameworks.

Opportunity: New tire plant investments across Asia, Middle East & Africa, and Eastern Europe

The establishment of new tire manufacturing plants across Asia, the Middle East & Africa, and Eastern Europe is creating significant growth opportunities for the rubber process oil (RPO) market by expanding the regional consumption base for both natural and synthetic rubber compounds. These greenfield and expansion projects are designed to meet rising domestic and export demand for passenger, commercial, and off-highway tires, directly increasing the volume of rubber required and, consequently, the consumption of RPO grades such as TDAE, MES, RAE/ TRAE, paraffinic, and naphthenic oils. New plants often incorporate advanced production technologies and higher-quality tire formulations, which require specialized RPOs with tailored viscosity, low PAH content, and optimized dispersion characteristics to achieve performance targets such as enhanced durability, rolling resistance, and heat resistance. Additionally, the concentration of these investments in emerging and high-growth regions provides a consistent and long-term demand pipeline for suppliers, encouraging them to expand production capacities and diversify product portfolios. Overall, these tire plant investments not only drive immediate demand for rubber process oils but also support the development of specialized and high-performance RPO grades, offering suppliers new avenues for revenue growth and technological innovation.

Challenge: Fluctuating prices of key RPO feedstocks such as crude-derived distillates and aromatic extracts

Fluctuating prices of key rubber process oil (RPO) feedstocks, including crude-derived distillates and aromatic extracts, pose a significant challenge to the growth and stability of the market by creating cost pressures for both manufacturers and end users. As RPO production relies heavily on petroleum-based feedstocks, any volatility in crude oil prices directly affects the cost of producing grades such as TDAE, DAE, MES, RAE/ TRAE, paraffinic, and naphthenic oils. Sharp increases in feedstock costs can lead to higher RPO prices, which in turn impact the profitability of downstream rubber product manufacturers, including tire producers, industrial rubber goods manufacturers, and thermoplastic elastomer processors. Conversely, sudden price drops can disrupt production planning and inventory management, making it difficult for suppliers to maintain consistent supply and profit margins. Additionally, dependence on specific base oils and aromatic extracts means that supply shortages or geopolitical disruptions can further exacerbate cost pressures, forcing manufacturers to explore alternative grades or adjust formulations. Collectively, this volatility increases operational risks, limits the ability to plan long-term investments, and acts as a restraint on market expansion, as both producers and buyers face uncertainty in raw material availability and pricing.

Rubber Process Oil Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Manufactures RPO for tire production, helping rubber compounds achieve improved flexibility, uniform mixing, and better processing during manufacturing | Enhances tire performance, increases durability, ensures smoother manufacturing, and extends tire lifespan while improving safety and road handling |

|

Manufactures RPO for automotive tires and high-performance rubber products, ensuring consistent material properties under various conditions | Improves grip, enhances safety, supports high-performance applications, and maintains consistent quality across batches |

|

Manufactures RPO for oil-extended polymers used in industrial rubber products, including conveyor belts, gaskets, and seals | Reduces production costs, improves processing efficiency, enhances elasticity, and extends product lifespan under harsh conditions |

|

Manufactures RPO for consumer rubber products such as footwear soles, flexible toys, and household rubber items | Increases flexibility and comfort, improves product durability, maintains integrity under repeated use, and enhances overall consumer satisfaction |

|

Manufactures RPO for specialty tires and high-performance rubber compounds used in sports and off-road vehicles | Provides superior heat resistance, enhances wear performance, improves handling, and supports the development of high-performance and niche rubber products |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The rubber process oil ecosystem consists of raw material suppliers (e.g., Exxon Mobil Corporation, Petro Naft), producers (e.g. Exxon Mobil Corporation, H&R Group), distributors (e.g. MEHTA PETRO REFINERIES LTD., Reliable Enterprises), and end users (e.g., CEAT, Bridgestone). Rubber process oil is used in various end-use applications, such as tires, industrial rubber products, and thermoplastic elastomers.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Rubber Process Oil Market, By Application

The tires segment represents the largest application area for the rubber process oil (RPO) market, driven by the extensive use of RPO in both passenger and commercial vehicle tire manufacturing. Rubber process oils are critical in improving the flexibility, processability, and uniformity of rubber compounds, which are essential for producing tires with enhanced performance characteristics. As the automotive industry continues to expand globally, the demand for tires has surged, directly boosting the consumption of RPO. Several factors contribute to the dominance of this segment. The rising adoption of high-performance and specialty tires for luxury vehicles, sports cars, and electric vehicles has created a need for superior rubber compounds that require high-quality process oils. RPO improves tire elasticity, heat resistance, and durability, making it indispensable in achieving these performance standards. Additionally, the growth of replacement tire markets and increasing new car registrations in emerging economies further drive demand. Environmental and regulatory pressures are also encouraging manufacturers to optimize tire formulations, often incorporating RPO to balance performance with sustainability. Overall, the tire industry’s scale, evolving consumer preferences, and the technological demands of modern vehicles make it the most significant application segment for rubber process oils, underpinning steady market growth across regions.

Rubber Process Oil Market, By Type

Treated distillate aromatic extract (TDAE) is emerging as the fastest-growing type in the overall rubber process oil market, largely due to its positioning as a safer and more environmentally aligned alternative to traditional aromatic oils. With increasing global regulations restricting the use of high-PAH (polycyclic aromatic hydrocarbon) oils in tire manufacturing, tire producers are steadily shifting toward TDAE. This type offers a cleaner formulation with significantly lower PAH content, allowing manufacturers to comply with stringent environmental and health standards without compromising material performance. Growth in high-performance and premium tire production is further accelerating the uptake of TDAE. Tire manufacturers prefer TDAE as it enhances rubber elasticity, improves traction, and supports better rolling resistance—key attributes needed for modern passenger, commercial, and electric vehicle tires. As EVs demand high-efficiency tires with lower heat build-up, the role of TDAE becomes even more critical. Additionally, global automotive industry growth, rising replacement tire demand, and expanding production capacities across Asia are collectively pushing tire makers to adopt higher-quality, regulation-compliant oils. TDAE fits these needs exceptionally well, balancing performance with sustainability. As a result, it continues to gain rapid traction, making it the fastest-growing segment within the rubber process oil market.

REGION

Asia Pacific to be fastest-growing region in global rubber process oil market during forecast period

Asia Pacific is the fastest-growing region in the rubber process oil market, driven by rapid expansion in automotive production, tire manufacturing, and a broad range of industrial rubber applications. The region has become a major hub for tire and rubber goods manufacturing, with extensive capacity additions and continuous modernization of production facilities. This strong manufacturing footprint creates high and sustained demand for rubber process oils used in tire compounds, molded rubber components, belts, hoses, and oil-extended polymers. Rising vehicle ownership, growing mobility needs, and a thriving replacement tire ecosystem are further boosting the consumption of RPO across the region. Manufacturers are also increasingly adopting higher-quality and environmentally aligned RPO grades to meet evolving performance and regulatory expectations, reinforcing demand for specialty oils such as TDAE and low-PAH formulations. Another key driver is the region’s robust petrochemical and refining base, which ensures stable feedstock availability and competitive pricing for RPO producers. In addition, expanding construction activity, growth in consumer rubber products, and the increasing scale of export-oriented rubber goods manufacturing continue to create new opportunities. Together, these factors position Asia Pacific as the fastest-growing regional market, supported by its strong industrial growth trajectory and rising demand for high-quality rubber materials.

Rubber Process Oil Market: COMPANY EVALUATION MATRIX

In the rubber process oil market matrix, Sinopec (Star) is regarded as one of the leading players in the rubber process oil market due to its strong refining base, large production capacities, and ability to deliver consistent, high-quality RPO across a wide range of applications. Its deep integration within the petrochemical value chain ensures steady feedstock availability, competitive pricing, and dependable supply—factors that make it a preferred partner for major tire and industrial rubber manufacturers. Repsol (Emerging Leader) is emerging as a notable competitor as it expands its footprint in specialty oils and focuses on producing cleaner, more advanced RPO grades. The company’s increasing emphasis on product quality, and active engagement with new customer segments are helping it gain traction and recognition in the global market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Sinopec (China)

- Exxon Mobil Corporation (US)

- PetroChina Company Limited (China)

- Chevron Corporation (US)

- Shell plc (UK)

- H&R Group (Germany)

- Indian Oil Corporation Ltd (India)

- Repsol (Spain)

- ORGKHIM Biochemical Holding (Russia)

- Nynas AB (Sweden)

- Hindustan Petroleum Corporation Limited (India)

- Idemitsu Kosan Co., Ltd. (Japan)

- IRANOL (LLP) (Iran)

- PT. Enerco RPO Internasional (Indonesia)

- Calumet, Inc. (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 2.14 BN |

| Market Forecast in 2030 (Value) | USD 2.49 BN |

| CAGR (2025–2030) | 2.6% |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2021–2030 |

| Units Considered | Value (USD Billion), and Volume (Kiloton) |

| Report Coverage | Revenue forecast, competitive landscape, growth factors, and trends |

| Segments Covered | By Type: Treated Distillate Aromatic Extract (TDAE), Distillate Aromatic Extract (DAE), Mild Extracted Solvate (MES), Residual Aromatic Extract (RAE), Treated Residual Aromatic Extract (TRAE), Paraffinic, and Naphthenic |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, and South America |

WHAT IS IN IT FOR YOU: Rubber Process Oil Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Tire manufacturer seeking clarity on optimal RPO grades for high-performance and EV tires | RPO grade performance comparison; TDAE vs. aromatic oils analysis; tire-compound suitability matrix | Improved formulation choices; stronger product performance alignment; reduced trial-and-error costs |

| Industrial rubber goods producer looking for new RPO suppliers | Supplier benchmarking toolkit; quality and consistency scoring; cost–reliability evaluation | Better sourcing decisions; lower procurement risk; improved pricing leverage |

| Petrochemical company exploring entry into specialty and low-PAH RPO | Specialty RPO opportunity mapping; regulatory and compliance analysis; competitive landscape overview | Clear product development direction; identification of high-potential segments; stronger market entry planning |

| Investment firm evaluating RPO market attractiveness | Market growth opportunity matrix; value chain profitability modeling; risk and sensitivity assessment | Stronger investment validation; improved long-term forecasting; better understanding of market resilience |

| Chemical distributor trying to understand end user buying patterns | Buyer behavior dashboard; demand cycle mapping; procurement criteria analysis | Optimized sales strategy; better customer targeting; higher customer retention |

RECENT DEVELOPMENTS

- Mar 2023 : Nynas AB introduced Nytex Bio 6200, a bio-based tire and rubber process oil designed as a sustainable drop-in alternative to conventional mineral oils. Developed using renewable ISCC PLUS-certified feedstocks, the product offers equivalent performance with a significantly reduced carbon footprint. This launch aligns with Nynas’ post-reorganization growth strategy to expand its specialty oil portfolio, focusing on sustainable solutions and emerging opportunities in the e-mobility and tire industries.

- May 2020 : Nynas introduced Nytex 8022, a new hydrotreated naphthenic process oil designed for high versatility across multiple applications. With solvent power, low volatility, and low-temperature properties, Nytex 8022 ensures compatibility with a wide range of polymers and resins, making it ideal for tire and rubber compounding, printing inks, and industrial chemical formulations. Its medium viscosity and non-CLP classification offer both performance and safety advantages.

- October 2020 : Sulzer partnered and delivered a customized mass transfer solution to PT Enerco RPO Internasional’s grassroots plant for the production of treated distillate aromatic extract (TDAE) in Batam, Indonesia. The facility features the world’s largest agitated extraction column type KuhniTM (ECR), which has been designed and built by Sulzer. This piece of equipment plays a crucial role in the manufacture of eco-friendly rubber process oils (RPOs) for the tire and rubber sectors.

Table of Contents

Methodology

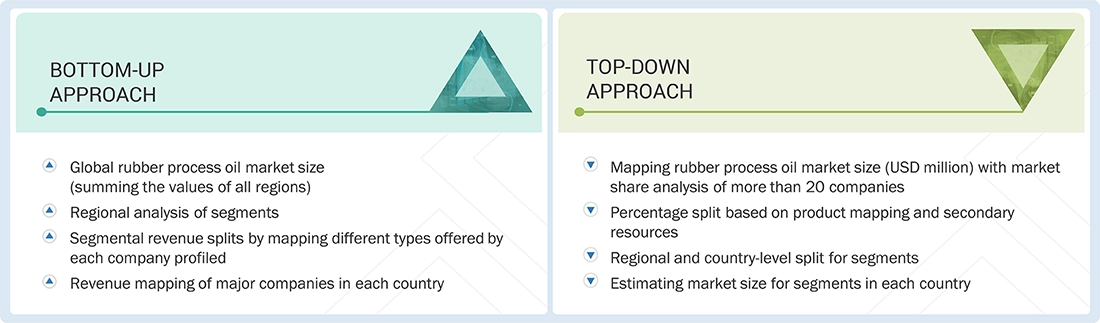

This research encompassed four primary actions in assessing the present market size of rubber process oil. Comprehensive secondary research was conducted to gather information on the market, the peer market, and the parent market. The subsequent stage involved corroborating these findings, assumptions, and dimensions with industry specialists throughout the rubber process oil value chain via primary research. The total market size is ascertained with both top-down and bottom-up methodologies. Subsequently, market segmentation analysis and data triangulation were employed to ascertain the dimensions of the market segments and sub-segments.

Secondary Research

The research approach employed to assess and project the rubber process oil market begins with the collection of revenue data from prominent suppliers using secondary research. In the course of the secondary research, many secondary sources, such as Hoovers, Bloomberg BusinessWeek, Factiva, the World Bank, and industry magazines, were utilized to identify and compile information for this study. The secondary sources comprised annual reports, press releases, and investor presentations from corporations; white papers; accredited periodicals; writings by esteemed authors; announcements from regulatory agencies; trade directories; and databases. Vendor offerings have been considered to ascertain market segmentation.

Primary Research

The rubber process oil market comprises several stakeholders, such as manufacturers, suppliers, traders, associations, and regulatory organizations, in the supply chain. The demand side of this market consists of tire manufacturers, synthetic rubber producers, industrial rubber product makers, oil-extended polymer producers, and TPE manufacturers. These sectors use RPOs for improving processability, flexibility, and filler dispersion in rubber compounds. The supply side is made up of refiners and specialty oil producers that supply aromatic, paraffinic, naphthenic, and treated RPO grades derived from base oils and extract streams. Supply availability depends on refinery output, feedstock availability, and the capacity of manufacturers to produce specific RPO types and viscosities. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the rubber process oil market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the rubber process oil market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Global Rubber Process Oil Market Size: Bottom-Up and Top-Down Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The market size was calculated globally by summing up the country-level and regional-level data.

Market Definition

Rubber process oil is a petroleum-derived processing aid used in the compounding of natural and synthetic rubber to improve mixing, soften the rubber matrix, enhance filler dispersion, and support smoother extrusion or molding. It functions as a plasticizer that helps achieve uniform viscosity, better elasticity, and consistent mechanical properties in finished rubber products. RPOs are produced in several grades—such as Treated Distillate Aromatic Extract (TDAE), Distillate Aromatic Extract (DAE), Mild Extracted Solvate (MES), Residual Aromatic Extract (RAE), and Treated RAE (TRAE), along with paraffinic and naphthenic oils—each selected based on compatibility, desired softness, regulatory requirements, and end-use performance needs. These oils are integral to manufacturing tires, oil-extended polymers, industrial rubber goods, and various elastomer-based applications.

Stakeholders

- Rubber Process Oil Manufacturers

- Rubber Process Oil Suppliers

- Rubber Process Oil Traders, Distributors, and Suppliers

- Investment Banks and Private Equity Firms

- Raw Material Suppliers

- Government and Research Organizations

- Consulting Companies/Consultants in the Chemicals and Materials Sectors

- Industry Associations

- Contract Manufacturing Organizations (CMOs)

- NGOs, Governments, Investment Banks, Venture Capitalists, and Private Equity Firms

Report Objectives

- To define, describe, and forecast the size of the global rubber process oil market in terms of value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the global rubber process oil market

- To analyze and forecast the size of various segments (application, viscosity, and type) of the rubber process oil market based on five major regions—North America, Asia Pacific, Europe, the Middle East & Africa, and South America, along with key countries in each of these regions

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Rubber Process Oil Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Rubber Process Oil Market