The study involved major activities in estimating the current size of the relay market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles by recognized authors; and databases of various companies and associations. Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both, market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, and related key executives from various companies and organizations operating in the relay market.

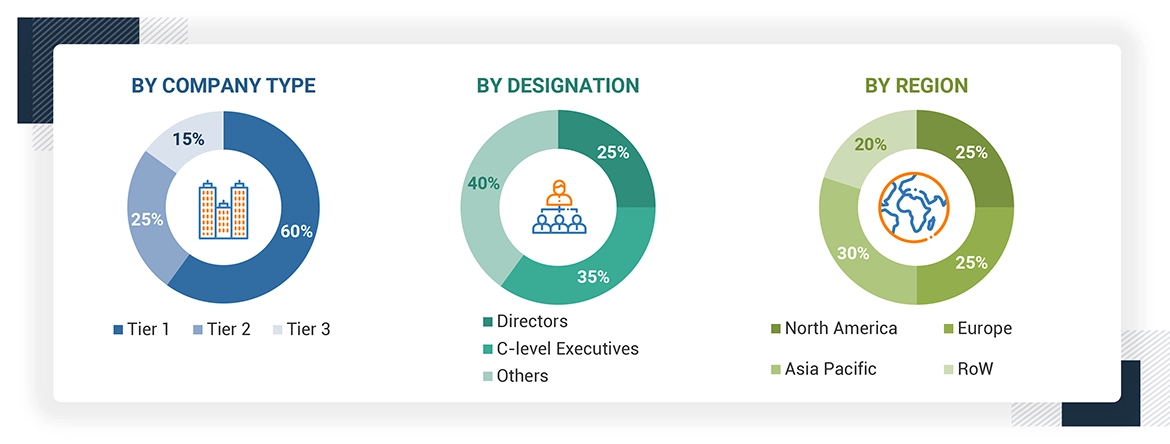

In the complete market engineering process, the top-down and bottom-up approaches, along with several data triangulation methods, were extensively used to perform the market size estimations and forecasts for all segments and subsegments listed in this report. Extensive qualitative and quantitative analyses were conducted to complete the market engineering process and list key information/insights throughout the report. Following is the breakdown of primary respondents:

Note: Other designations include sales managers, engineers, and regional managers.

The tier of the companies is defined based on their total revenue; as of 2023: Tier 1 = > USD 1 billion,

Tier 2 = From USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the relay market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Relay Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market size was validated using the top-down and bottom-up approaches.

Market Definition

A relay is an electrically operated switch that regulates the flow of electricity in a circuit by utilizing a low-power signal to control higher-power currents. It functions by opening or closing electrical contacts and is widely used in sectors such as automation, telecommunications, and electrical protection. These devices play a vital role in enhancing automation and safety within electrical systems, enabling remote control of circuits without human intervention. Their swift and precise response to electrical fluctuations makes them essential in fields like power distribution, manufacturing, and transportation. In industrial environments, relays boost efficiency by automating processes, while in protective applications, they help safeguard equipment by responding to faults. With ongoing technological advancements, modern relays are increasingly integrating digital capabilities for improved control and seamless incorporation into complex electrical systems.

Stakeholders

-

Energy utilities

-

Automotive relay manufacturers

-

State and national regulatory authorities

-

Organizations, forums, alliances, and associations

-

Investors/Shareholders

-

Manufacturers’ associations

-

Relay raw material and component manufacturers

-

Relay manufacturers, dealers, and suppliers

-

Electrical equipment manufacturers’ associations and groups

-

Power utilities and other end-user companies

-

Consulting companies in the energy and power domain

-

EV relay manufacturers

Report Objectives

-

To define, describe, analyze, and forecast the relay market based on mounting type, application, voltage range, type, verticals, and region

-

To identify, explain, and divide the market for relay according to application

-

To project the market sizes for each of the four major regions—North America, Europe, Asia Pacific, and Rest Of world ,—at the individual nation levels

-

To give comprehensive details regarding the main factors, obstacles, chances, and sector-specific difficulties impacting the expansion of the relay market

-

To systematically examine the market for relay in terms of each segment's contributions to the market, growth trends, and prospects

-

To provide the impact, supply chain analysis, trends/disruptions impacting customer business, market map, pricing analysis, and regulatory analysis of the relay market

-

To conduct a strategic analysis of micromarkets1 concerning their respective growth trends, planned expansions, and market share contributions.

-

To sketch a competitive environment for market participants and assess the potential for stakeholders in the relay business

-

To benchmark players within the market using the company evaluation matrix, which analyzes market players on various parameters within the broad categories of business and product strategies

-

To compare key market players for the market share, product specifications, and applications

-

To strategically profile key players and comprehensively analyze their market ranking and core competencies

-

To track and analyze competitive developments in the relay market, such as sales contracts, agreements, investments, expansions, product launches, alliances, mergers, partnerships, joint ventures, collaborations, and acquisitions

-

To study the impact of AI/Gen AI on the market under study, along with the global macroeconomic outlook

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

-

Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

-

Detailed analyses and profiling of additional market players

Growth opportunities and latent adjacency in Relay Market