Precipitated Silica Market

Precipitated Silica Market by Application (Rubber, Food, Plastics, Battery Seperator, Others), End-Use Industry (Automobile, Cosmetics, ELectronics, Agriculture), Grade (Rubber, Food, Industrial, Cosmetic), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

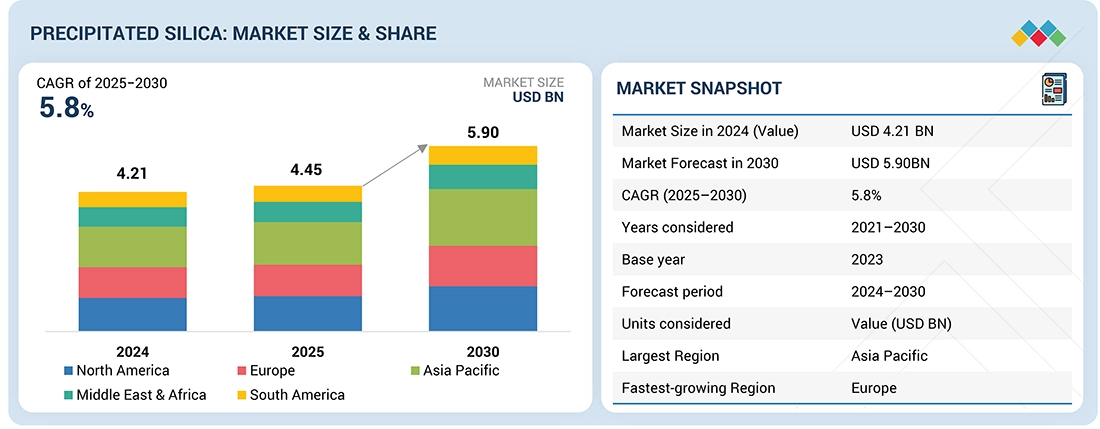

The global precipitated silica market is projected to grow from USD 4.20 billion in 2024 to USD 5.90 billion by 2030, at a CAGR of 5.8% from 2024 to 2030, in terms of value. Global precipitated silica market is driven by growing demand from the tire and rubber industries, where it is being used primarily as a reinforcing filler to impart durability, fuel efficiency, and performance. Low rolling resistance tires driven by stringent environmental regulations also drive growing use of precipitated silica in green tires. Similarly, growing demand from the cosmetics and personal care industry also drives demand for precipitated silica in toothpaste, skin care, and cosmetics products, where it acts as a thickener, anti-caker, and abrasive. Furthermore, growing demand for green and high-performance products also drives manufacturers to use precipitated silica in products. Urbanization and growing disposable incomes, particularly in emerging economies, are also driving the market. Innovation in production technology and application of silica in coating, adhesives, and food products are also driving market growth. Overall, all these drivers collectively drive global demand for precipitated silica in all industries

KEY TAKEAWAYS

-

BY ApplicationBy Applications the Global Precipitated Silica market is bifurcated into Rubber, Personal Care, Food, Battery Separator, Coating & Inks, Adhesives & Sealants, Other Applications. Rubber applications dominate as precipitated silica offers superior reinforcement, wear resistance, and longevity compared to carbon black, making it essential for high-performance tyre and industrial rubber products.

-

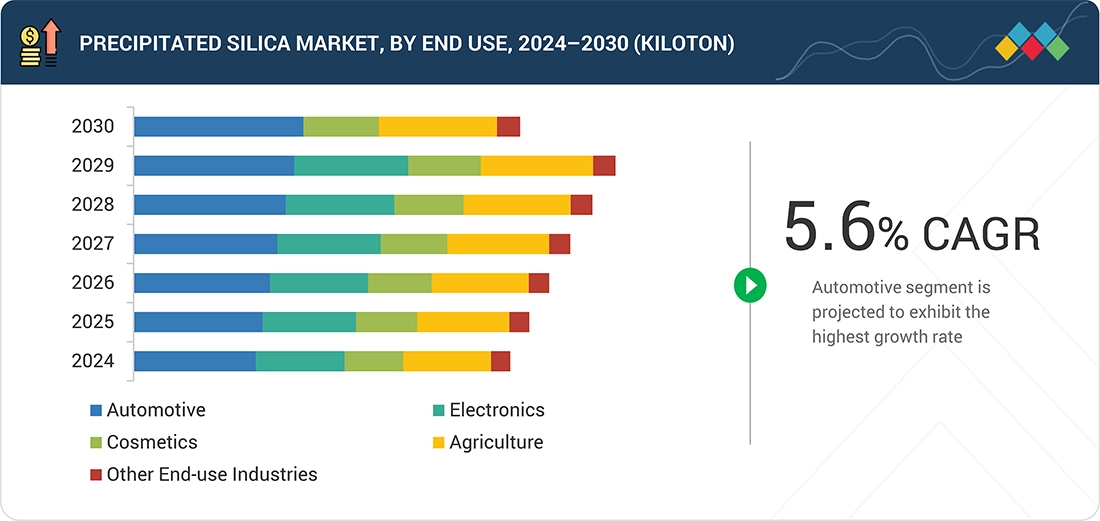

BY End Use IndustryBy End-Use Industry the Global Precipitated Silica market is clasiffied into Automotive, Electronics, Cosmetics, Agriculture, Other End-use Industries. . The automotive industry holds the largest share as precipitated silica is extensively used in tyres to enhance fuel efficiency, traction, and durability, driven by rising vehicle production and strict emission regulations.

-

By GradeRubber grade precipitated silica dominates the market as it enhances tyre performance by improving wet traction, reducing rolling resistance, and increasing wear resistance.

-

BY RegionGlobal Precipitated Silica market covers Europe, North America, Asia Pacific, South America and Middle East and Africa. Asia Pacific holds the largest share due to the region's rapid automotive production and growing tyre demand, especially in China, India, and Japan. High industrial growth and expanding rubber and chemical manufacturing sectors further drive precipitated silica consumption.

The automotive industry dominates the global precipitated silica market as it is a key material in tyre manufacturing, where it enhances grip, reduces rolling resistance, and improves fuel efficiency. Growing vehicle production, including electric vehicles, has increased the demand for high-performance tyres using silica-reinforced rubber compounds. Stringent fuel economy and emission regulations further drive tyre manufacturers to adopt silica for better efficiency and durability. Rubber applications hold the largest share as precipitated silica provides superior reinforcement, wear resistance, and longevity compared to carbon black. Continuous advancements in silica technology and coupling agents also support its widespread use in automotive rubber products, securing its market dominance.

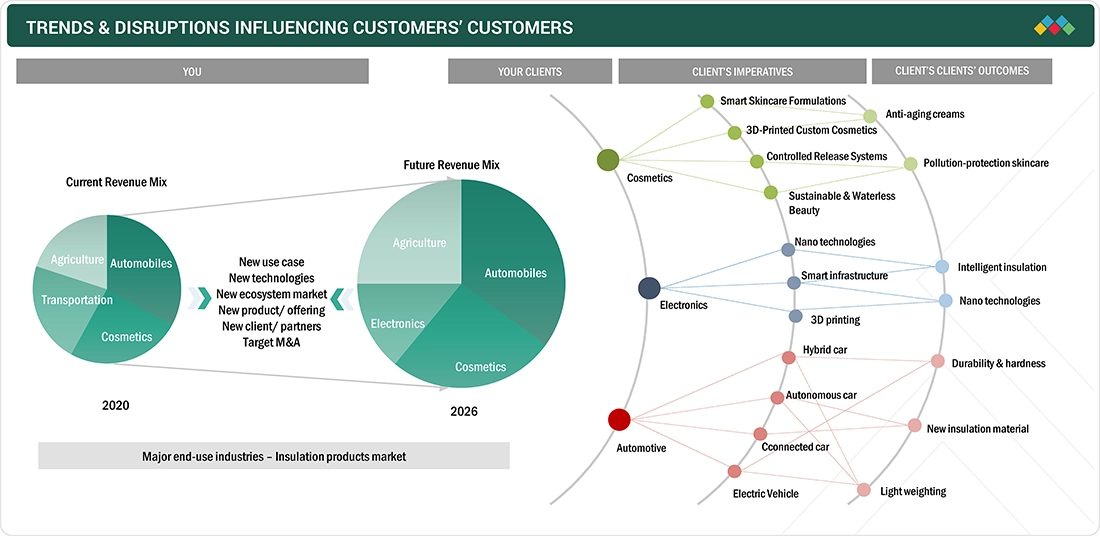

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

In 2024, the market is primarily driven by building & construction, with notable contributions from industrial and transportation sectors. By 2030, the revenue mix is forecast to shift significantly, fueled by the adoption of new technologies, expanded application areas, innovative product offerings, and increased mergers & acquisitions activity. Key trends impacting customer businesses include a surge in smart construction technologies, green infrastructure, nano technologies, and advanced 3D printing—each paving the way for highly energy-efficient insulation solutions and intelligent materials. The automotive segment is set to experience transformation due to autonomous vehicles, connected cars, electric vehicles, and durability enhancements, reinforcing the importance of light-weighting and new insulation material innovations. Ultimately, these disruptions indicate accelerated growth for precipitated silica, as its versatile application aligns with emerging market needs for sustainability, efficiency, and performance.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing demand from rubber and tire industries

-

Increased agricultural applications

Level

-

Environmental and regulatory challenges

-

Health and Safety Concerns

Level

-

Increasing demand for processed and packaged foods

-

Expansion in electric vehicle (EV) industry

Level

-

Volatility in raw material supply

-

Competition from substitutes

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing demand from rubber and tire industries

The global market for precipitated silica is expected to experience enormous growth largely on account of growing demand from the rubber and tire industries. The growth of the automotive industry, particularly, with growing demand for electric vehicles and more emphasis on fuel efficiency, has contributed to higher consumption by the tire manufacturers of higher quantities of precipitated silica to make tires with improved performance, improved fuel efficiency, and improved longevity. Its use in lowering rolling resistance and improving grip on wet roads is converting it into an essential part of green and high-performance tires. Furthermore, the use of green tires due to the imposition of stringent environmental regulations is also driving demand. According to International Organiztion of Motor Vehicle Manufacturers Association, in 2023, global sales totaled more than 93 million units, 10% more than 2022, led by Asia-Oceania's 55 million units, and grow around 2% to 5% till 2030 globally. Apart from tires, precipitated silica has extensive applications in industrial rubber products, such as conveyor belts, hoses, and footwear, driving overall market growth. The increasing trend towards lightweight materials in vehicle production is also driving its application in polymer-based rubber compounds. With ongoing innovation in tire technology and sustainability programs, precipitated silica demand is anticipated to grow steadily across the world.

Restraint: Environmental and regulatory challenges

World precipitated silica market is hampered by regulation- and environment-related issues that impose production cost and limit growth. Strict environmental regulations on silica dust release and waste disposal force the manufacturers to go through costly compliance procedures, which adversely impact profitability. Moreover, sustainability concerns and strict workplace protection regulations necessitate sophisticated filtration and handling systems, further increasing operational costs. Government regulations on the use of chemicals, particularly in applications such as food, pharmaceuticals, and cosmetics, result in slow approval processes and regulatory barriers. Strict REACH and EPA regulations in high-end markets such as Europe and North America restrict means of production, deterring market entry. Moreover, growing demands for green solutions are compelling businesses towards sustainable alternatives, which can decrease demand. All these issues combined restrict business expansion, deterring innovation and market expansion.

Opportunity: Expansion in electric vehicle (EV) industry

The rapid growth of the electric vehicle (EV) industry offers a significant opportunity for the global precipitated silica market. As the production of EVs increases, there is a heightened demand for high-performance tires, which use precipitated silica to improve fuel efficiency, durability, and grip. In addition, precipitated silica has a critical application in EV battery separators, providing thermal stability and safety and thus making significant contributions to battery performance. Growing interest in the application of lightweight materials in EV production also fuels demand, as precipitated silica is applied widely in adhesives, coatings, and plastics to reduce vehicle weight and enhance efficiency. As governments worldwide are concentrating on clean energy policy, investment in electric vehicle infrastructure will also generate consumption of silica. Additionally, technological innovation in battery and energy storage will drive the use of new applications. This shift to clean transport also further establishes the role of precipitated silica in the changing automotive sector

Challenge: Volatility in raw material supply

Market-volatility raw material concern impediments to development of global precipitated silica market. Major feedstocks including sodium silicate and sulfuric acid suffer supply chain disruptions. It is due to mining prohibitory effects, environmental regulations, and silica sand uncertainty resulting in spasmodic production with higher costs-across all goods. Geopolitics, trade-distorted logistics further exacerbate the problem making procurement very inefficient for producers. Further, increased spend from energy costs to the production process adds a cost burden that negatively affects profitability. Supply chain uncertainty results in price volatilities that have made stable production difficult for end-use industries such as rubber, batteries and pharmaceuticals. To mitigate the risks, producers have resorted to alternative sourcing practices and recycling processes. Except for chain resilience improvement initiatives, the growth opportunity for the market would continue to be challenged

Precipitated Silica Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Develops high-performance precipitated silica used in tire manufacturing, industrial rubber, and coatings. Their ULTRASIL® grades are optimized for low rolling resistance and improved wet grip in green tire technology. | Enhances fuel efficiency, reduces CO2 emissions, and improves tire durability and safety performance. |

|

Produces advanced precipitated silica solutions for rubber reinforcement, food additives, and oral care applications under the HI-SIL® brand. Tailored formulations support multi-sector integration. | Increases product performance consistency, supports formulation flexibility, and meets regulatory safety standards. |

|

Manufactures specialty silicas for energy-efficient tires, toothpaste abrasives, and food-grade applications. Its Efficium® silica range balances high dispersion and processing efficiency.. | Enables superior processing, improves compound rheology, and delivers cost-effective sustainability in production.. |

|

Provides precipitated silicas engineered for paints, coatings, personal care, and defoamer formulations. Focuses on surface treatment customization to optimize performance. | Improves product stability, enhances rheology control, and extends shelf life in formulated products. |

|

Offers functional precipitated silica for catalysis, pharmaceuticals, and coatings. Incorporates controlled particle morphology for superior adsorption and dispersibility. | Ensures enhanced catalyst performance, consistent product texture, and optimized energy usage in downstream processing. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

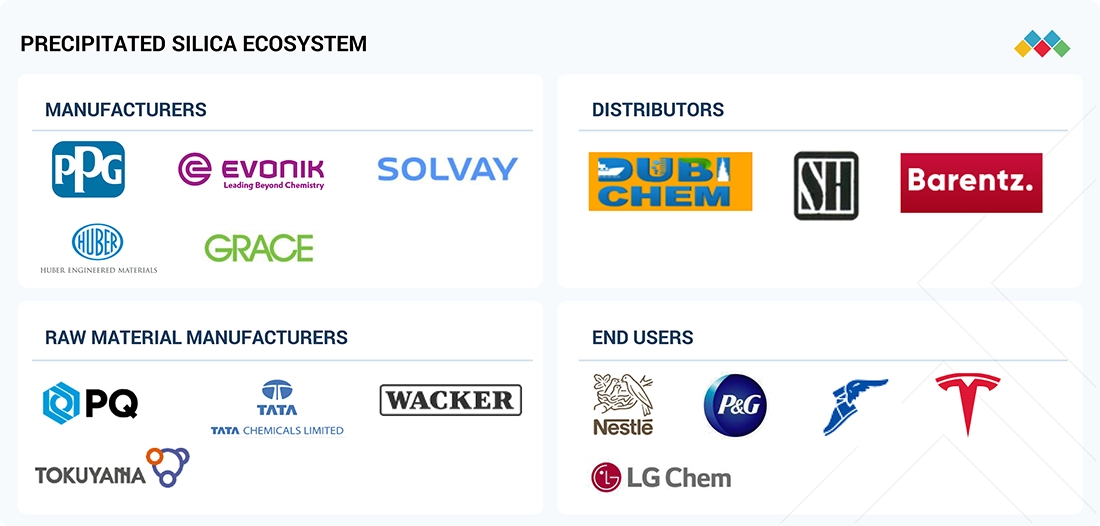

MARKET ECOSYSTEM

The precipitated silica ecosystem consists of major raw material supplying companies like TATA Chemicals Limiter, Tokuyama Corporation, PQ Corp., Wacker Chemie AG, and many more . The manufacturers of precipitated silica like Evonik Industries AG, Qemetica, Solvay AG, W.R. Grace, etc., collaborate with end-use industries, including Nestle, Tesla, Good Year, LG Chem, etc., to help the supply chain meet the growing demands of the automotive, F & B, and cosmetics sectors

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

By end-use industry automobile segment to record highest CAGR during forecast period in terms of volume

The automobile sector exhibited the highest growth rate in the forecast period in the global market for precipitated silica, due to increasing demand for fuel-efficient and eco-friendly vehicles is fueling the application of precipitated silica in tire production. Precipitated silica enhances tire performance through increased fuel efficiency, traction, and rolling resistance reduction, hence resulting in tires that last longer. The increasing automotive industry, particularly in developing economies, is also boosting demand for precipitated silica. Besides, sustainability practices and green programs are promoting the application of green products, such as precipitated silica, in the automotive industry. The expanding middle-class population and increased disposable incomes in these economies further support the growth of the automobile sector. Finally, manufacturing process developments and product improvements are improving both the efficiency and cost-effectiveness of precipitated silica, thus making it an even more preferred choice for the automotive sector

By application rubber segment to record fastest growth during forecast period in terms of value

The rubber segment experienced the highest growth during the forecast period in the global precipitated silica market, primarily due to its widespread application as a reinforcement filler in the rubber industry. Tire producers are placing increasing emphasis on the production of green tire production to achieve the increasing fuel-economy standards and minimize vehicular emissions. The transition towards greener tires is propelling the demand for precipitated silica, which improves the performance characteristics of rubber products by enhancing their tear strength, abrasion resistance, and other characteristics. Moreover, the expansion of the automotive sector, particularly in the Asia-Pacific region, is fueling the demand for precipitated silica in rubber applications. Rising production of high-quality tires to fulfill tire labeling standards also contributes to the high growth of the rubber segment

By grade, rubber grade segment to hold largest share during the forecast period in terms of volume

The rubber grade precipitated silica segment witnessed the highest growth during the forecast period in the global precipitated silica market due to a series of key drivers. Foremost among them is the growing demand for green tires with improved fuel efficiency and reduced emissions, which is the driving force behind demand for rubber grade precipitated silica. The rubber grade precipitated silica is the most important factor in enhancing the mechanical properties of tires, including reducing rolling resistance and enhancing durability. In addition, the growing automotive industry, particularly in the emerging world, is bolstering demand for rubber grade precipitated silica. The tire industry is more and more interested in the manufacture of green tires to meet growing fuel-economy standards and reduce vehicle emissions. It is estimated that this trend will continue, driving the growth of the rubber grade segment in the precipitated silica market even higher

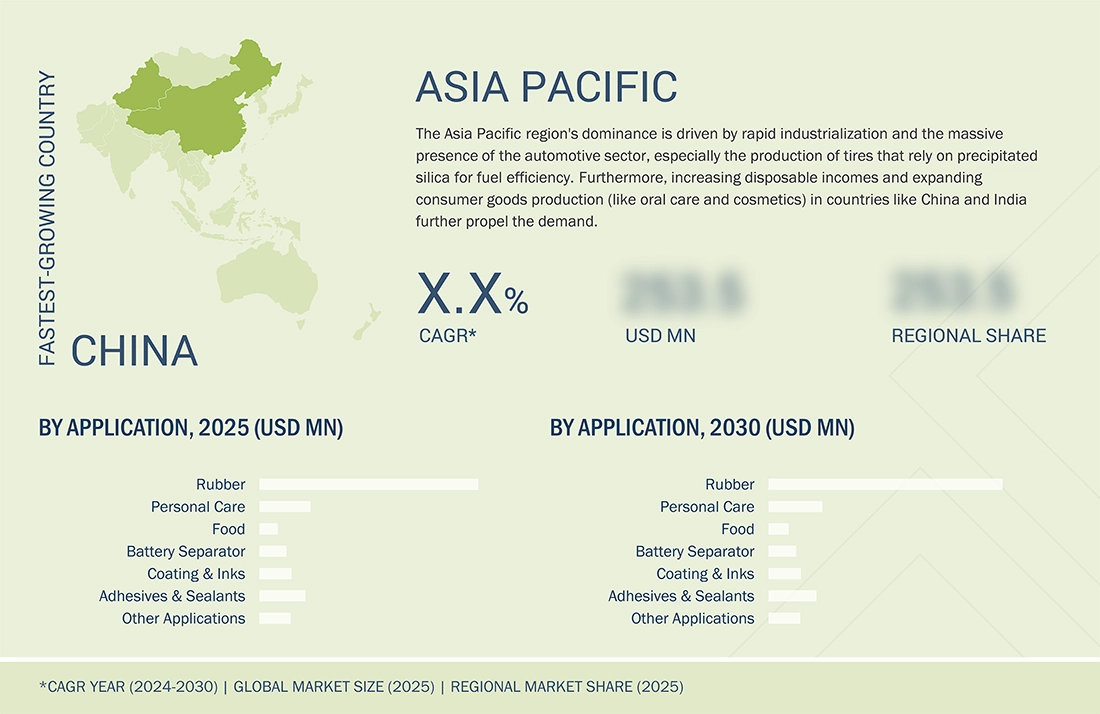

REGION

Asia Pacific to dominate precipitated silica market during forecast period in terms of volume

The Asia Pacific region exhibited the most dynamic growth across the forecast period in the global precipitated silica market, courtesy of a variety of key reasons. Foremost among these was the rapid urbanization and industrialization taking place in countries like China, India, and Japan, which is driving the market for precipitated silica in myriad applications. Rapid growth in the automotive industry, especially the intensified production of automotive tires, further fuels this. In addition to this, population growth in the middle class as well as improved disposable incomes is further boosting consumption patterns for good-quality products and thus further enhancing the market. Sustainability initiatives in addition to the focus on the use of products that are friendlier to the environment are further driving the increase in the utilization of precipitated silica in several industries. Moreover, high R&D investments combined with advancements in production technologies have enhanced the functionality and cost-effectiveness of precipitated silica and made it further attractive for usage in a series of applications

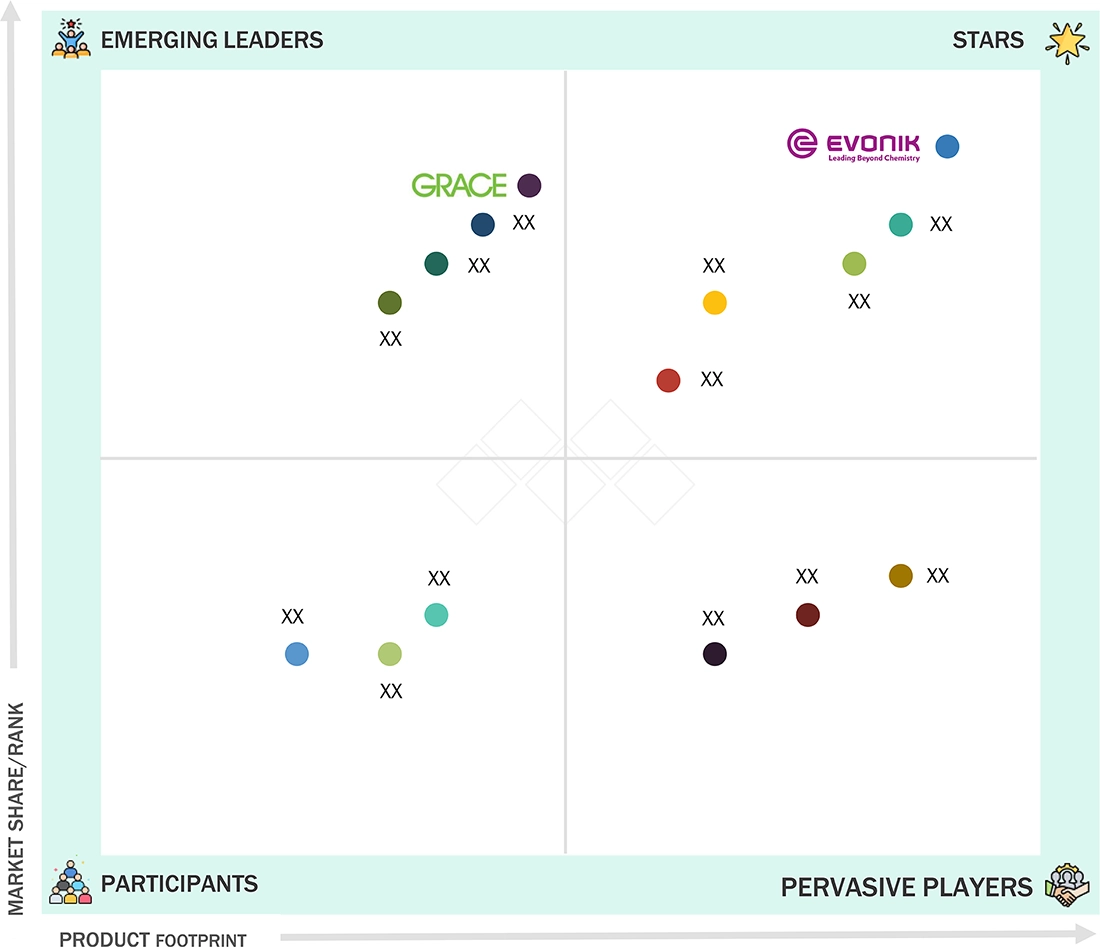

Precipitated Silica Market: COMPANY EVALUATION MATRIX

IIn the global precipitated silica market, the image positions Evonik as a "Star" player, highlighting its strong market share and broad product footprint compared to competitors. Evonik's placement in the top-right quadrant indicates its dominance and leadership, driven by innovation, robust distribution, and strong customer relationships. WR Grace is shown in the "Emerging Leaders" quadrant, reflecting its rising influence and increasing market share, though it trails Evonik in terms of product breadth and market reach. Grace’s trajectory suggests its ongoing investments in technology and business development are elevating its competitive position and enabling growth in high-potential segments. Other notable players are actively expanding their offerings to meet rising demand for energy-efficient, scalable, and regulation-compliant precipitated silica production systems, positioning themselves to capture future growth opportunities in this evolving market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 4.21 BN |

| Market Forecast in 2030 | USD 5.90 BN |

| CAGR (2024–2030) | 5.80% |

| Years considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2024–2030 |

| Units Considered | Value (USD Billion and USD Million) and Volume (Kiloton) |

| Report Coverage | The report defines, segments, and projects the precipitated silica market based on Grade, Application, End Use Industry, Process, and Region. It provides detailed information regarding the major factors influencing the market's growth, such as drivers, restraints, opportunities, and challenges. It strategically profiles precipitated silica manufacturers, comprehensively analyses their market shares and core competencies, and tracks and analyzes competitive developments they undertake in the market, such as expansions, partnerships, and new product launches. |

| Segments Covered | |

| Regional Scope | North America, Europe, Asia Pacific, South America, and Middle East & Africa |

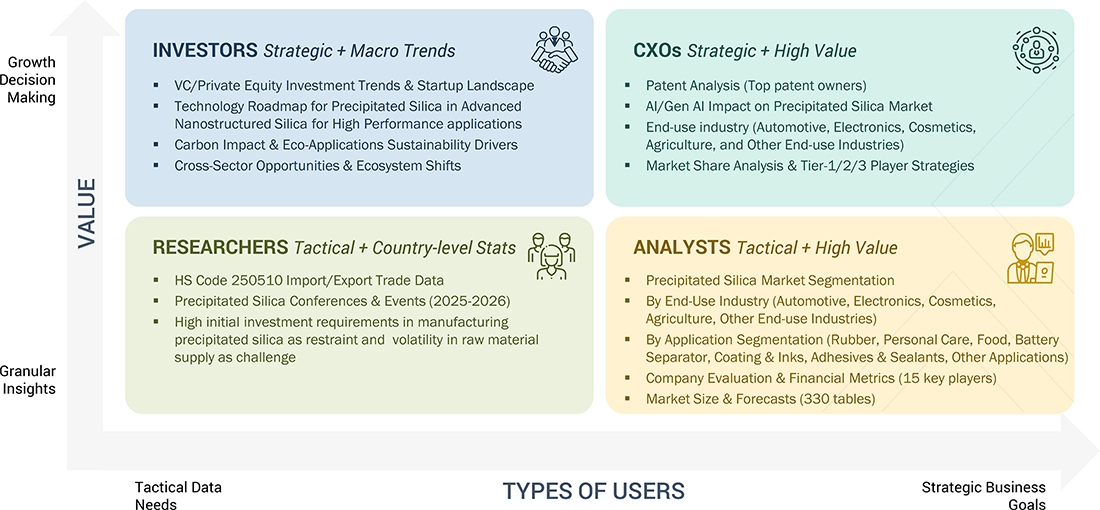

WHAT IS IN IT FOR YOU: Precipitated Silica Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Automobile Manufacturers | Assessment and benchmarking of precipitated silica formulations in tire, battery separator, and automotive rubber applications. Integration analysis for lightweighting and rolling resistance reduction. | Enhanced tire performance, increased fuel efficiency, reduced carbon footprint, improved safety. |

| Cosmetics Manufacturers | Evaluation of precipitated silica in formulations for skin-care, oral-care, and color cosmetics. Custom performance testing for texture and safety compliance. | Superior sensory feel, improved absorption, product differentiation, regulatory compliance. |

| Electronics Manufacturers | Performance and integration analysis for silica as a matting agent, thermal insulator, and moisture absorber in electronic components. Lifecycle modeling for reliability. | Improved product stability, enhanced thermal management, prolonged device life, consistent performance. |

| Agriculture Manufacturers | Application development for silica-based carriers and flow conditioning agents in crop protection products. Validation for soil fertility improvement solutions. | Higher crop yield, improved product handling, sustainable farming input solutions, better distribution. |

| Paper & Textiles Manufacturers | Benchmarking of silica in pigment, coating, and filler applications for enhanced print quality and fabric finish. Lifecycle and cost optimization studies. | Enhanced print clarity, smoother surface finish, reduced material usage, increased product durability. |

| Paints & Coatings Manufacturers | Customization of silica types for anti-caking, matting, and rheology modification in paints and coatings. Comparative cost-performance analysis for innovative recipes. | Improved coating durability, superior surface appearance, minimized settling, extended shelf life. |

RECENT DEVELOPMENTS

- January 2025 : Evonik has formed a new entity called Smart Effects, created through the merger of its Silica and Silanes business lines. With 3,500 employees globally, Smart Effects will operate under the "Advanced Technologies" division in Evonik's new organizational structure. This merger combines the expertise of both business lines to offer innovative solutions aimed at benefiting both customers and the environment.

- January 2025, : PQ completed the acquisition of the specialty silicate business from the Sibelco Group, which operates at the Lödöse plant in Sweden. This acquisition expands PQ's presence in the Nordic region, allowing the company to offer its silicate products and services to new customers.

- October 2024, : Evonik Industries announced the expansion at its Charleston site in South Carolina’s Berkeley County. This new development will boost the production capacity of precipitated silica by 50%, catering to the increasing demand from the tire industry, particularly for green tires in the US.

- August 2024, : In August 2024, Qemetica, a Polish chemical group, agreed to acquire PPG's silica products business for approximately PLN 1.2 billion (USD 310 million) from. The deal includes acquiring two factories in the US and the Netherlands, as well as gaining rights to conduct manufacturing and R&D activities at two additional US locations. PPG’s silica products are used as performance-enhancing additives in industries like tire production, batteries, and fillers. This acquisition is expected to boost Qemetica's revenue, EBITDA, and diversify its product offerings and geographical presence. It is one of the largest transactions of its kind by a Polish company in the US.

- November 2023 : Evonik constructed a new plant in Weston, Michigan, to produce ultra-high purity colloidal silica, with an investment of USD 7.9 million planned for 2023 and 2024. Colloidal silica is a key raw material for the electronics and semiconductor industries, which are experiencing growth due to the increasing global demand for microchips and digital products.

Table of Contents

Methodology

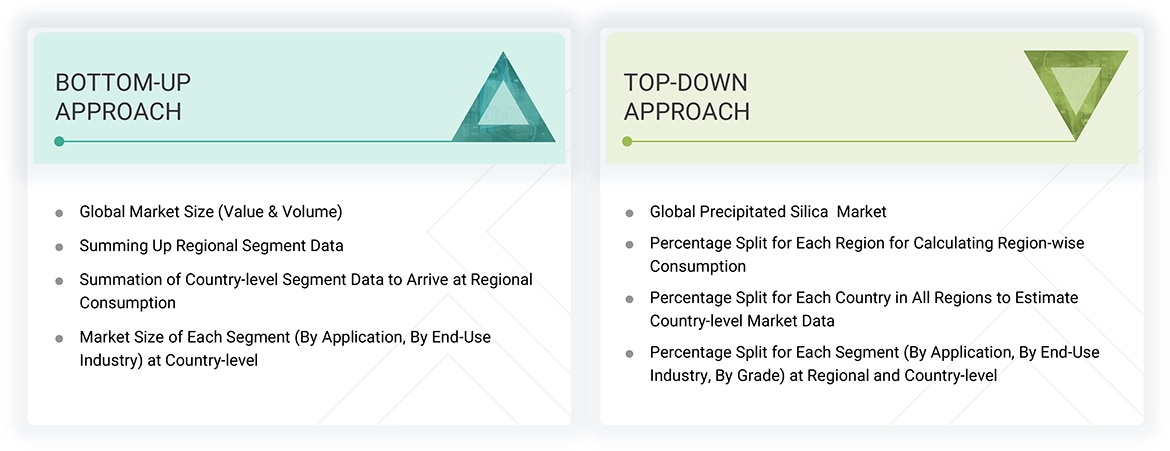

The estimation of the current size of the precipitated silica market involved a four-step methodology. Initially, secondary research included all pertinent information about the market itself, as well as related and parent markets. These results, along with assumptions and metrics, were validated with primary research that involved experts from both the supply and demand sides of the precipitated silica value chain. Total market size was determined through a top-down and bottom-up approach. Finally, the market sizes for various segments and subsegments were found using comprehensive market segmentation and data triangulation techniques.

Secondary Research

The research methodology followed in estimating the current precipitated silica market size consisted of four significant activities. Extensive secondary research was conducted to provide information on the market, peer markets, and parent markets. These findings, assumptions, and metrics were validated through primary research undertaken with experts from the demand side of the precipitated silica value chain. Both top-down as well as bottom-up approaches were followed for the estimation of the total market size. The complete market segmentation and data triangulation techniques had been applied for the final estimation of various segments and subsegments.

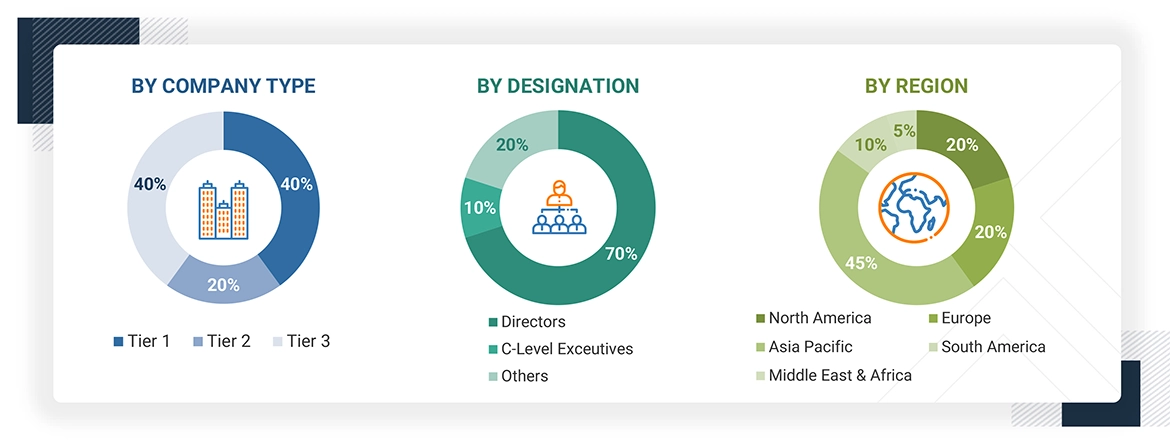

Primary Research

The precipitated silica market comprises several stakeholders in the supply chain, such as precipitated silica producers, precipitated silica processing and refining companies, manufacturers, distributors and traders, government and regulatory bodies, and end users. The development of battery seperator, rubber, electronics, textile and food defines the demand side of this market. Interviews were conducted with various primary sources on both the supply and demand sides of the market to gather qualitative and quantitative data.

Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the precipitated silica market. These methods were used to determine the market size of various segments. The research methodology used for the market size estimation is as follows:

- Extensive primary and secondary research was done to identify the key players.

- The value chain and market size of the precipitated silica market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were collected through secondary sources and verified through primary sources.

- All possible parameters that affect the market were covered in this research study and are viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- This research includes the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Research Methodology

The research methodology used to estimate and forecast the global market size began by first aggregating data and information from the country and different levels. To estimate and validate the size of the precipitated silica market, the top-down and bottom-up approaches have been used. Secondary research has been applied to identify the players involved in the market and, thereby, determine revenues generated by these players in the various regions. This procedure involves the study of annual and financial reports of key market players such as Evonik Industries AG (Germany), QEMETICA (Poland), Solvay (Belgium), Madhu Silica Pvt Ltd (India), Oriental Silicas Corporation (Taiwan), W.R. Grace & Co (Peru), Tosoh Silica Corporation (Japan), TATA Chemical Ltd. (India), Anten Chemicals Co. Ltd (China), PQ Corporation (US), IQE Group (Spain), Glassven CA (Venezuela), Supersil Chemical (I) Pvt. Ltd. (India), MLA Group (India), and Fuji Silysia Chemical Limited (Japan). Interviews were also conducted with industry leaders, such as CEOs, directors, and marketing executives of leading companies, to gain insight into the precipitated silica market

Precipitated Silica Market Size: Bottom-Up & Top-Down Approach

Data Triangulation

After estimating the overall market size using the above estimation, the market was split into various segments and subsegments. Data triangulation, market breakup techniques, and the market engineering process were used to reach the exact market analysis data for each segment and subsegment. data triangulation and market breakdown procedures were used, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using the top-down and bottom-up approaches.

Market Definition

The precipitated silica market encompasses the trade and supply of manufactured silica that is in a bulk form. The production is done by the reaction of sodium silicate with sulfuric acid which forms the product in the form of a fine white powder and has a high absorption index. The silica is mainly utilized in the rubber industry for tires, medicines, food products, personal care products, coatings and even batteries. The fuel-efficient tires, expansion of the electric vehicle market, and increasing use of silica in food and healthcare products have boosted the market. Also, environmental policies encouraging green substitutes are driving the use of silica solutions. With technological improvements and greater industrial uses, the precipitated silica market is likely to grow steadily across the globe.

Stakeholders

- Transfection products manufacturing companies

- Pharmaceutical & Biopharmaceutical Companies

- Chemical Companies

- Biopharmaceutical Companies

- Contract Research Organizations (CROs)

- Contract Development and Manufacturing Organizations (CDMOs)

- Research Institutes and Universities

- Venture Capitalists & Investors

- Government Associations

Report Objectives

- To define, describe, and forecast the size of the global precipitated silica market in terms of value and volume.

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the precipitated silica market

- To analyze and forecast the size of various segments (grade, application and end use industry) of the precipitated silica market based on five major regions—North America, Europe, Asia Pacific, Middle East & Africa and South America—along with key countries in each region.

- To analyze recent developments and competitive strategies, such as expansions, new product developments, partnerships, and acquisitions, to draw the market's competitive landscape.

- To strategically profile the key players in the market and comprehensively analyze their core competencies.

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Precipitated Silica Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Precipitated Silica Market