Vacuum Insulation Panels Market by Core Material Type (Silica, Fiberglass, others), Type (Flat, Special Shape), Raw material (Silica, Fiberglass, Plastic, Metal, others), Application (Construction, Cooling & freezing devices, Logistics, Others) - Forecast to 2021

[176 Pages Report] The market for vacuum insulation panels is projected to grow from USD 6.38 Billion in 2016 to reach USD 8.14 Billion by 2021, at a CAGR of 4.99%. The report aims at estimating the market size and future growth potential of the vacuum insulation panels market across different segments such as core material, type, raw material, application, and region. Globally, competition in the vacuum insulation panels market is growing considerably owing to the growing construction and consumer durables industries. With the emergence of new technologies, manufacturers are looking for advanced techniques to make vacuum insulation panels more effective. The base year considered for the study is 2015 and the market size is projected from 2016 to 2021.

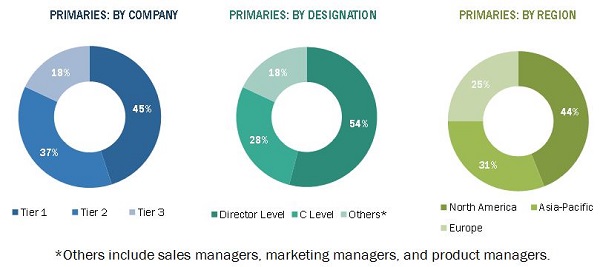

The research methodology used to estimate and forecast the market size included the top-down approach. The total market size of the vacuum insulation panels was calculated, and accordingly, the percentage was allotted to different sectors in each of the segments. This allotment and calculation were done on the basis of extensive primary interviews and secondary research. Primary research involved in this report includes extensive interviews with key people such as CEOs, VPs, directors, and executives. After arriving at the overall market size, the total market was split into several segments and subsegments. These data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primary respondents is depicted in the figure below.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of vacuum insulation panels comprises vacuum insulation panel distributors/suppliers such as Evonik Industries AG (Germany), LG Hausys Ltd. (Korea), Panasonic Corporation (Japan), Dow Corning Corporation (U.S.), and OCI Company Ltd. (Korea). Other players in this market include Kevothermal, LLC (Mexico), Porextherm Dämmstoffe GmbH (Germany), ThermoCor (U.S.), Va-Q-Tec AG (Germany), and Microtherm (Belgium) and government and environmental protection bodies which help the manufacturers in the development and growth of vacuum insulation panels, technologies, and markets.

Target audience

- Raw material suppliers and producers

- Regulatory bodies

- Vacuum insulation panels distributors/suppliers

- End users (builders, consumer durables manufacturers)

Scope of the Report

The research report segments vacuum insulation panels into the following submarkets:

By core Material:

- Silica

- Fiberglass

- Others (aerogel, polyurethane board, and micro-fleece board)

By Type:

- Flat

- Special shape

By Application

- Construction

- Cooling & freezing devices

- Logistics

- Others (storage, packaging, and industrial & automotive applications)

By Raw Material

- Silica

- Fiberglass

- Plastic

- Metal

- Others (glass and microfleece)

By Region:

- North America

- Europe

- Asia-Pacific

- RoW

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the client-specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of the market for different recycled product types

Geographic Analysis

- Further analysis of vacuum insulation panels market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to 5).

MarketsandMarkets projects that the market for vacuum insulation panels will grow from USD 6.38 Billion in 2016 to USD 8.14 Billion by 2021, at a CAGR of 4.99%. The market for vacuum insulation panels is growing due to innovative developments in the industrial sectors and growth in the construction and consumer durables industries. Rising per capita income of the middle class has increased its purchasing power, which has resulted in an increase in the number of buildings and cooling & freezing devices.

The vacuum insulation panels market is segmented on the basis of core material, type, application, raw material, and region. On the basis of core material, panels with silica held the largest market share. Their long life, spanning over 60 years, is the reason they are used in building constructions.

Based on type, flat vacuum insulation panels held the largest share. They are characterized by a compact size and high R values, which result in high thermal insulation. These panels can be used in building constructions, cooling & freezing devices, and also in the logistics industry.

The market is segmented into construction, cooling & freezing devices, logistics, and others, based on application. The construction segment accounted for the largest market share in 2015. This growth is attributed to the increasing infrastructure sector throughout the world.

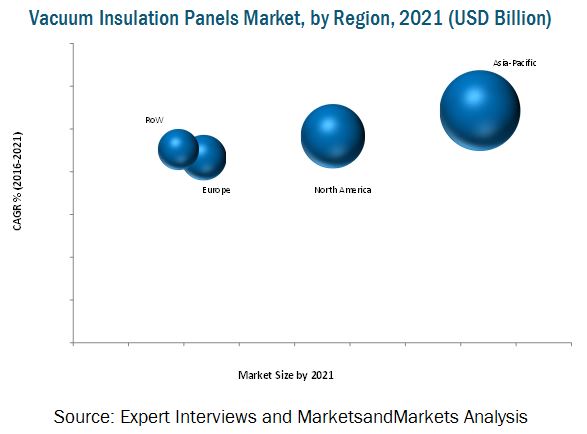

On the basis of key regions, the market for vacuum insulation panels is segmented into North America, Europe, Asia-Pacific, and the Rest of the World (RoW). Asia-Pacific is projected to grow at the highest rate from 2016 to 2021, because the countries in this region are expected to achieve high growth in the construction sector, thus triggering a huge demand for vacuum insulation panels.

There are certain factors prevailing in the market that hinder the growth of this industry. Some of these are high costs of vacuum insulation panels, as compared to other alternatives such as glass wool and polystyrene. Also, the shelf life of fiberglass based vacuum insulation panels is short, which can restrict their use in certain applications such as building construction.

Investment and expansion was the major strategy adopted by most players in the market. Companies such as Evonik Industries AG (Germany), LG Hausys Ltd. (Korea), Panasonic Corporation (Japan), Dow Corning Corporation (U.S.), and OCI Company Ltd. (Korea) were the key players who adopted this strategy to increase their geographic reach and product offerings, to increase the customer base, and to stay ahead of competitors. Companies aim to serve the market efficiently by investing in research & development activities and introducing new products to keep up with changing consumer needs.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 22)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Years Considered

1.4 Currency Considered

1.5 Unit Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 25)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.2.1 Breakdown of Primaries, By Company Type, Designation, and Region

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions Made for This Study

2.4.2 Limitations of the Research Study

3 Executive Summary (Page No. - 34)

3.1 Introduction

3.2 Vacuum Insulation Panels Market

3.3 Construction is Projected to Occupy the Largest Share Among All Applications By 2021

3.4 Asia-Pacific is Projected to Dominate the Market for Vacuum Insulation Panels

3.5 Market in India is Projected to Grow at the Highest CAGR From 2016 to 2021

3.6 Key Strategies, 2012-2016

4 Premium Insights (Page No. - 39)

4.1 Attractive Market Opportunities in the Market for Vacuum Insulation Panels

4.2 Vacuum Insulation Panels, By Core Material, 2014-2021 (USD Billion)

4.3 Asia-Pacific: Vacuum Insulation Panels Market, 2015

4.4 Projected Country-Wise Growth Rates, 2016-2021

4.5 Region-Wise Market Share in 2015

4.6 Emerging Markets vs Developed Markets

5 Market Overview (Page No. - 45)

5.1 Introduction

5.2 Evolution

5.3 Vacuum Insulation Panels Market Segmentation

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Demand-Side Drivers

5.4.1.1.1 Growing Construction Activities, Globally

5.4.1.1.2 Growing Packaging Industry and Demand for Consumer Appliances

5.4.1.2 Supply-Side Drivers

5.4.1.2.1 High Thermal Resistance Offered By Vacuum Insulation Panels

5.4.2 Restraints

5.4.2.1 Demand-Side Restraints

5.4.2.1.1 High Cost of Vacuum Insulation Panels

5.4.3 Opportunities

5.4.3.1 Energy Codes & Regulations for New Buildings

5.4.4 Challenges

5.4.4.1 Short Shelf-Life of Vacuum Insulation Panels

6 Industry Trends (Page No. - 54)

6.1 Introduction

6.2 Supply Chain Analysis

6.2.1 Prominent Companies

6.2.2 Small & Medium Enterprises

6.3 Porter’s Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.1 Threat of Substitutes

6.3.2 Bargaining Power of Suppliers

6.3.3 Bargaining Power of Buyers

6.3.4 Intensity of Competitive Rivalry

7 Vacuum Insulation Panels Market, By Core Material (Page No. - 60)

7.1 Introduction

7.2 Vacuum Insulation Panels Market, By Core Material

7.2.1 Silica-Based Vacuum Insulation Panels Dominated the Market in 2015

7.3 Silica

7.3.1 Fumed Silica

7.3.2 Precipitated Silica

7.4 Fiberglass

7.5 Others

8 Vacuum Insulation Panels Market, By Type (Page No. - 66)

8.1 Introduction

8.2 Vacuum Insulation Panels Market, By Type

8.2.1 Flat Panels Accounted for the Largest Share in 2015

8.3 Flat

8.3.1 Flat Vacuum Insulation Panels Market, By Core Material

8.3.1.1 Silica-Based Panels Segment Projected to Grow at the Highest Rate By 2021

8.4 Special Shape

8.4.1 Special Shape Vacuum Insulation Panels Market, By Core Material

8.4.1.1 Silica-Based Panels Segment Projected to Grow at the Highest Rate By 2021

9 Vacuum Insulation Panels Market, By Application (Page No. - 73)

9.1 Introduction

9.1.1 Vacuum Insulation Panels Market Size, By Application

9.1.1.1 Construction Segment Held the Largest Share in 2015

9.2 Construction

9.2.1 Construction Market, By Subsegment

9.2.1.1 Facades Projected to Form the Fastest-Growing Subsegment By 2021

9.2.1.2 Floor Insulation

9.2.1.3 Facades

9.2.1.4 Roof & Terrace Insulation

9.2.1.5 Others

9.2.2 Construction Market, By Panel Type

9.2.2.1 Flat Panels Segment Dominated the Market in 2015

9.2.3 Construction Market, By Core Material

9.2.3.1 Silica Panels Segment Projected to Grow at the Highest Rate By 2021

9.3 Cooling & Freezing Devices

9.3.1 Cooling & Freezing Devices Market, By Panel Type

9.3.1.1 Flat Panels Segment Accounted for the Largest Share in 2015

9.3.2 Cooling & Freezing Devices Market, By Core Material

9.3.2.1 Silica Panels Segment Dominated the Market in 2015

9.4 Logistics

9.4.1 Logistics Market, By Panel Type

9.4.1.1 Flat Panels Segment Projected to Grow at the Highest CAGR Through 2021

9.4.2 Logistics Market, By Core Material

9.4.2.1 Aerogel, Polyurethane Board, and Micro-Fleece Board Projected to Grow at the Highest Rate By 2021

9.5 Others

9.5.1 Other Applications Market, By Panel Type

9.5.1.1 Flat Panels Projected to Be the Fastest-Growing Segment Between 2016 and 2021

9.5.2 Other Applications Market, By Core Material

9.5.2.1 Fiberglass Segment Held the Second-Largest Share in 2015

10 Vacuum Insulation Panels Market, By Raw Material (Page No. - 88)

10.1 Introduction

10.1.1 Plastics Market, By Subsegment

10.1.1.1 Polyurethane Accounted for A Larger Market Share in 2015

10.1.2 Metal Market, By Subsegment

10.1.2.1 Aluminum is Projected to Be the Fastest-Growing Segment During the Forecast Period

10.2 Raw Material Market, By Region

10.2.1 North America

10.2.1.1 Silica is A High-Potential Raw Material in the Vacuum Insulation Panels Market

10.2.2 Europe

10.2.2.1 Fiberglass Segment to Grow at the Second-Highest Rate in the European Market

10.2.3 Asia-Pacific

10.2.3.1 Silica Segment Accounted for the Largest Market Share in 2015

10.2.4 RoW

10.2.4.1 Fiberglass Segment to Grow at the Second-Highest Rate By 2021

11 Vacuum Insulation Panels Market, By Region (Page No. - 95)

11.1 Introduction

11.1.1 Vacuum Insulation Panels Market Size, By Region

11.1.1.1 Asia-Pacific Dominated the Market for Vacuum Insulation Panels in 2015

11.2 Asia-Pacific

11.2.1 Asia-Pacific: Vacuum Insulation Panels Market, By Country

11.2.1.1 China Dominated the Asia-Pacific Vacuum Insulation Panels Market in 2015

11.2.1.2 Asia-Pacific: Vacuum Insulation Panels Market, By Core Material

11.2.1.2.1 Silica Segment Held the Largest Share in 2015

11.2.1.3 Asia-Pacific: Vacuum Insulation Panels Market, By Type

11.2.1.3.1 Flat Vacuum Insulation Panels Dominated the Asia-Pacific Region in 2015

11.2.1.4 Asia-Pacific: Vacuum Insulation Panels Market, By Application

11.2.1.4.1 Construction Segment Projected to Be the Fastest-Growing By 2021

11.2.2 China

11.2.2.1 China: Vacuum Insulation Panels Market, By Core Material

11.2.2.1.1 Silica Segment Projected to Grow at the Highest Rate By 2021

11.2.2.2 China: Vacuum Insulation Panels Market, By Type

11.2.2.2.1 Flat Segment Projected to Be the Fastest By 2021

11.2.2.3 China: Vacuum Insulation Panels Market, By Application

11.2.2.3.1 Cooling & Freezing Devices Segment Shows Growth Potential in China

11.2.3 Japan

11.2.3.1 Japan: Vacuum Insulation Panels Market, By Core Material

11.2.3.1.1 Fiberglass Segment Shows Growth Potential in Japan

11.2.3.2 Japan: Vacuum Insulation Panels Market, By Type

11.2.3.2.1 Flat Segment Dominated the Market in 2015

11.2.3.3 Japan: Vacuum Insulation Panels Market, By Application

11.2.3.3.1 Construction Segment Held the Largest Share in 2015

11.2.4 India

11.2.4.1 India: Vacuum Insulation Panels Market, By Core Material

11.2.4.1.1 Silica Segment Projected to Grow at the Highest Rate By 2021

11.2.4.2 India: Vacuum Insulation Panels Market, By Type

11.2.4.2.1 Flat Segment Dominated the Market in 2015

11.2.4.3 India: Vacuum Insulation Panels Market, By Application

11.2.4.3.1 Construction Segment Held the Largest Share in 2015

11.2.5 Australia

11.2.5.1 Australia: Vacuum Insulation Panels Market, By Core Material

11.2.5.1.1 Fiberglass Segment Showing Signs of Growth in Australia

11.2.5.2 Australia: Vacuum Insulation Panels Market, By Type

11.2.5.2.1 Flat Segment Dominated the Market in 2015

11.2.5.3 Australia: Vacuum Insulation Panels Market, By Application

11.2.5.3.1 Construction Segment Held the Largest Share in 2015

11.2.6 Rest of Asia-Pacific

11.2.6.1 Rest of Asia-Pacific: Market, By Core Material

11.2.6.1.1 Fiberglass Segment Projected to Grow at the Second-Highest Rate By 2021

11.2.6.2 Rest of Asia-Pacific: Vacuum Insulation Panels Market Size, By Type

11.2.6.2.1 Flat Segment Projected to Be the Fastest-Growing By 2021

11.2.6.3 Rest of Asia-Pacific: Market, By Application

11.2.6.3.1 Cooling & Freezing Devices Segment Held the Second-Largest Share in 2015

11.3 North America

11.3.1 North America: Vacuum Insulation Panels Market, By Country

11.3.1.1 The U.S. is Projected to Be the Fastest-Growing Market By 2021

11.3.1.2 North America: Market, By Core Material

11.3.1.2.1 Silica Segment Dominated the North American Market in 2015

11.3.1.3 North America: Market, By Type

11.3.1.3.1 Flat Segment Dominated the North American Region in 2015

11.3.1.4 North America: Market, By Application

11.3.1.4.1 Construction Segment Dominated in the North American Region in 2015

11.3.2 U.S.

11.3.2.1 U.S.: Vacuum Insulation Panels Market, By Core Material

11.3.2.1.1 Silica Segment Held the Largest Share in 2015

11.3.2.2 U.S.: Market, By Type

11.3.2.2.1 Flat Segment Projected to Be the Fastest-Growing By 2021

11.3.2.3 U.S.: Market, By Application

11.3.2.3.1 Construction Segment to Grow at the Highest CAGR By 2021

11.3.3 Canada

11.3.3.1 Canada: Market, By Core Material

11.3.3.1.1 Silica Segment Dominated the Canadian Market in 2015

11.3.3.2 Canada: Market, By Type

11.3.3.2.1 Special Shape Segment Projected to Be the Second-Fastest By 2021

11.3.3.3 Canada: Market, By Application

11.3.3.3.1 Construction Segment Held the Largest Share in 2015

11.3.4 Mexico

11.3.4.1 Mexico: Vacuum Insulation Panels Market, By Core Material

11.3.4.1.1 Fiberglass Segment Projected to Grow at the Second-Highest Rate By 2021

11.3.4.2 Mexico: Vacuum Insulation Panels Market, By Type

11.3.4.2.1 Flat Segment Projected to Be the Fastest-Growing By 2021

11.3.4.3 Mexico: Market, By Application

11.3.4.3.1 Cooling & Freezing Devices Segment Held the Second-Largest Share in 2015

11.4 Europe

11.4.1 Europe: Vacuum Insulation Panels Market Size, By Country

11.4.1.1 Germany is Projected to Be the Fastest-Growing Market By 2021

11.4.1.2 Europe: Vacuum Insulation Panels Market, By Core Material

11.4.1.2.1 Silica Segment to Grow at the Highest Rate By 2021

11.4.1.3 Europe: Vacuum Insulation Panels Market Size, By Type

11.4.1.3.1 Flat Segment Dominated the European Region in 2015

11.4.1.4 Europe: Vacuum Insulation Panels Market, By Application

11.4.1.4.1 Construction Segment Accounted for the Largest Share in 2015

11.4.2 Germany

11.4.2.1 Germany: Vacuum Insulation Panels Market, By Core Material

11.4.2.1.1 Silica Projected to Be the Fastest-Growing Segment By 2021

11.4.2.2 Germany: Market, By Type

11.4.2.2.1 The Flat Segment Dominated the Market in 2015

11.4.2.3 Germany: Vacuum Insulation Panels Market, By Application

11.4.2.3.1 The Construction Segment to Grow at the Highest Rate By 2021

11.4.3 U.K.

11.4.3.1 U.K.: Vacuum Insulation Panels Market, By Core Material

11.4.3.1.1 Fiberglass Segment Held the Second-Largest Share in 2015

11.4.3.2 U.K.: Vacuum Insulation Panels Market, By Type

11.4.3.2.1 The Flat Segment is Projected to Grow at A Higher Rate

11.4.3.3 U.K.: Vacuum Insulation Panels Market, By Application

11.4.3.3.1 The Construction Segment Dominated the Vacuum Insulation Panels Market, By Application, in 2015

11.4.4 Russia

11.4.4.1 Russia: Vacuum Insulation Panels Market, By Core Material

11.4.4.1.1 The Silica Segment Dominated the Market in 2015

11.4.4.2 Russia: Vacuum Insulation Panels Market, By Type

11.4.4.2.1 The Flat Segment is Projected to Grow at A Higher Rate By 2021

11.4.4.3 Russia: Vacuum Insulation Panels Market, By Application

11.4.4.3.1 The Construction Segment is Projected to Grow at the Highest Rate By 2021

11.4.5 France

11.4.5.1 France: Vacuum Insulation Panels Market, By Core Material

11.4.5.1.1 The Silica Segment Dominated the Market in 2015

11.4.5.2 France: Market, By Type

11.4.5.2.1 The Flat Segment Dominated the Market in 2015

11.4.5.3 France: Vacuum Insulation Panels Market, By Application

11.4.5.3.1 The Construction Segment is Projected to Be the Fastest-Growing By 2021

11.4.6 Rest of Europe

11.4.6.1 Rest of Europe: Vacuum Insulation Panels Market, By Core Material

11.4.6.1.1 The Fiberglass Segment is Projected to Grow at the Second-Highest Rate By 2021

11.4.6.2 Rest of Europe: Market, By Type

11.4.6.3 The Flat Segment Projected to Be the Fastest Growing Market By 2021

11.4.6.4 Rest of Europe: Market, By Application

11.4.6.4.1 Cooling & Freezing Devices Segment Held the Second-Largest Share in 2015

11.5 Rest of the World (RoW)

11.5.1 RoW: Vacuum Insulation Panels Market, By Country

11.5.1.1 South Africa is Projected to Be the Fastest-Growing Market By 2021

11.5.1.2 RoW: Vacuum Insulation Panels Market, By Core Material

11.5.1.2.1 Silica Segment to Grow at the Highest Rate By 2021

11.5.1.3 RoW: Vacuum Insulation Panels Market, By Type

11.5.1.3.1 Flat Segment Dominated the RoW Region in 2015

11.5.1.4 RoW: Vacuum Insulation Panels Market, By Application

11.5.1.4.1 The Construction Segment Accounted for the Largest Share in 2015

11.5.2 Brazil

11.5.2.1 Brazil: Vacuum Insulation Panels Market, By Core Material

11.5.2.1.1 Silica Segment Projected to Grow at the Highest Rate By 2021

11.5.2.2 Brazil: Vacuum Insulation Panels Market, By Type

11.5.2.2.1 The Flat Segment is Projected to Grow at A Higher Rate By 2021

11.5.2.3 Brazil: Vacuum Insulation Panels Market, By Application

11.5.2.3.1 The Construction Segment Held the Largest Share in 2015

11.5.3 South Africa

11.5.3.1 South Africa: Vacuum Insulation Panels Market, By Core Material

11.5.3.1.1 Silica Segment Dominated the Market in 2015

11.5.3.2 South Africa: Vacuum Insulation Panels Market, By Type

11.5.3.2.1 The Flat Segment Held the Largest Share in 2015

11.5.3.3 South Africa: Vacuum Insulation Panels Market, By Application

11.5.3.3.1 The Construction Segment is Projected to Grow at the Highest Rate By 2021

11.5.4 Other Countries in RoW

11.5.4.1 Other Countries in RoW: Vacuum Insulation Panels Market, By Core Material

11.5.4.1.1 Silica Segment Held the Largest Share in 2015

11.5.4.2 Other Countries in RoW: Vacuum Insulation Panels Market, By Type

11.5.4.2.1 The Flat Segment Dominated the Market in 2015

11.5.4.3 Other Countries in RoW: Vacuum Insulation Panels Market, By Application

11.5.4.3.1 Cooling & Freezing Devices Segment Showing Growth Potential in This Region

12 Competitive Landscape (Page No. - 178)

12.1 Overview

12.2 Competitive Situations & Trends

12.3 Key Growth Strategies, 2012–2016

12.3.1 Expansions

12.3.2 Collaborations, Agreements, and Joint Ventures

12.3.3 New Product Development

12.3.4 Mergers & Acquisitions

13 Company Profiles (Page No. - 185)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

13.1 Introduction

13.2 Evonik Industries AG

13.3 LG Hausys Ltd.

13.4 Panasonic Corporation

13.5 DOW Corning Corporation

13.6 OCI Company Ltd.

13.7 Kevothermal, LLC

13.8 Porextherm Dämmstoffe GmbH

13.9 Thermocor

13.10 Va-Q-Tec AG

13.11 Microtherm

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 207)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

List of Tables (176 Tables)

Table 1 Core Material Used in Vacuum Insulation Panels

Table 2 Vacuum Insulation Panels Market Size, By Core Material, 2014–2021 (USD Million)

Table 3 Market Size, By Core Material, 2014–2021 (Million Square Meters)

Table 4 Silica-Based Vacuum Insulation Panels Market Size, By Subsegment, 2014–2021 (USD Million)

Table 5 Silica-Based Vacuum Insulation Panels Market Size, By Subsegment, 2014–2021 (Million Square Meters)

Table 6 Vacuum Insulation Panels Market Size, By Type, 2014–2021 (USD Million)

Table 7 Market Size, By Type, 2014–2021 (Million Square Meters)

Table 8 Market Size, By Flat Type, 2014–2021 (USD Million)

Table 9 Market Size, By Flat Type, 2014–2021 (Million Square Meters)

Table 10 Flat Vacuum Insulation Panels Market Size, By Core Material, 2014–2021 (USD Million)

Table 11 Flat Vacuum Insulation Panels Market Size, By Core Material Type, 2014–2021 (Million Square Meters)

Table 12 Vacuum Insulation Panels Market Size, By Special Shape, 2014–2021 (USD Million)

Table 13 Market Size, By Special Shape, 2014–2021 (Million Square Meters)

Table 14 Special Shape Vacuum Insulation Panels Market Size, By Core Material, 2014–2021 (USD Million)

Table 15 Special Shape Vacuum Insulation Panels Market Size, By Core Material, 2014–2021 (Million Square Meters)

Table 16 Vacuum Insulation Panels Market Size, By Application, 2014–2021 (USD Million)

Table 17 Market Size, By Application, 2014–2021 (Million Square Meters)

Table 18 Construction Vacuum Insulation Panels Market Size, By Subsegment, 2014–2021 (USD Million)

Table 19 Construction Vacuum Insulation Panels Market Size, By Subsegment, 2014–2021 (Million Square Meters)

Table 20 Construction Vacuum Insulation Panels Market Size, By Panel Type, 2014–2021 (USD Million)

Table 21 Construction Vacuum Insulation Panels Market Size, By Panel Type, 2014–2021 (Million Square Meters)

Table 22 Construction Vacuum Insulation Panels Market Size, By Core Material, 2014–2021 (USD Million)

Table 23 Construction Vacuum Insulation Panels Market Size, By Core Material, 2014–2021 (Million Square Meters)

Table 24 Cooling & Freezing Devices Vacuum Insulation Panels Market Size, By Panel Type, 2014–2021 (USD Million)

Table 25 Cooling & Freezing Devices Vacuum Insulation Panels Market Size, By Panel Type, 2014–2021 (Million Square Meters)

Table 26 Cooling & Freezing Devices Vacuum Insulation Panels Market Size, By Core Material, 2014–2021 (USD Million)

Table 27 Cooling & Freezing Devices Vacuum Insulation Panels Market Size, By Core Material, 2014–2021 (Million Square Meters)

Table 28 Logistics Vacuum Insulation Panels Market Size, By Panel Type, 2014–2021 (USD Million)

Table 29 Logistics Vacuum Insulation Panels Market Size, By Panel Type, 2014–2021 (Million Square Meters)

Table 30 Logistics Vacuum Insulation Panels Market Size, By Core Material, 2014–2021 (USD Million)

Table 31 Logistics Vacuum Insulation Panels Market Size, By Core Material, 2014–2021 (Million Square Meters)

Table 32 Other Applications Vacuum Insulation Panels Market Size, By Type, 2014–2021 (USD Million)

Table 33 Other Applications Vacuum Insulation Panels Market Size, By Panel Type, 2014–2021 (Million Square Meters)

Table 34 Other Applications Vacuum Insulation Panels Market Size, By Core Material, 2014–2021 (USD Million)

Table 35 Other Applications Vacuum Insulation Panels Market Size, By Core Material, 2014–2021 (Million Square Meters)

Table 36 Vacuum Insulation Panels Market Size, By Raw Material, 2014–2021 (USD Million)

Table 37 Plastics Market Size, By Subsegment, 2014–2021 (USD Million)

Table 38 Metal Raw Material Market Size, By Subsegment, 2014–2021 (USD Million)

Table 39 North America: Vacuum Insulation Panels Market Size, By Raw Material, 2014–2021 (USD Million)

Table 40 Europe: Vacuum Insulation Panels Market Size, By Raw Material, 2014–2021 (USD Million)

Table 41 Asia-Pacific: Vacuum Insulation Panels Market Size, By Raw Material, 2014–2021 (USD Million)

Table 42 RoW: Vacuum Insulation Panels Market Size, By Raw Material, 2014–2021 (USD Million)

Table 43 Vacuum Insulation Panels Market Size, By Region, 2014–2021 (USD Million)

Table 44 Market Size, By Region, 2014–2021 (Million Square Meters)

Table 45 Asia-Pacific: Vacuum Insulation Panels Market Size, By Country, 2014–2021 (USD Million)

Table 46 Asia-Pacific: By Market Size, By Country, 2014–2021 (Million Square Meters)

Table 47 Asia-Pacific: By Market Size, By Core Material, 2014–2021 (USD Million)

Table 48 Asia-Pacific: By Market Size, By Core Material, 2014–2021 (Million Square Meters)

Table 49 Asia-Pacific: By Market Size, By Type, 2014–2021 (USD Million)

Table 50 Asia-Pacific: By Market Size, By Type, 2014–2021 (Million Square Meters)

Table 51 North America: Vacuum Insulation Panels Market Size, By Application, 2014–2021 (USD Million)

Table 52 Asia-Pacific: Vacuum Insulation Panels Market Size, By Application, 2014–2021 (Million Square Meters)

Table 53 China: Vacuum Insulation Panels Market Size, By Core Material, 2014–2021 (USD Million)

Table 54 China: By Market Size, By Core Material, 2014–2021 (Million Square Meters)

Table 55 China: By Market Size, By Type, 2014–2021 (USD Million)

Table 56 China: By Market Size, By Type, 2014–2021 (Million Square Meters)

Table 57 China: By Market Size, By Application, 2014–2021 (USD Million)

Table 58 China: By Market Size, By Application, 2014–2021 (Million Square Meters)

Table 59 Japan: Vacuum Insulation Panels Market Size, By Core Material, 2014–2021 (USD Million)

Table 60 Japan: By Market Size, By Core Material, 2014–2021 (Million Square Meters)

Table 61 Japan: By Market Size, By Type, 2014–2021 (USD Million)

Table 62 Japan: By Market Size, By Type, 2014–2021 (Million Square Meters)

Table 63 Japan: By Market Size, By Application, 2014–2021 (USD Million)

Table 64 Japan: By Market Size, By Application, 2014–2021 (Million Square Meters)

Table 65 India: Vacuum Insulation Panels Market Size, By Core Material, 2014–2021 (USD Million)

Table 66 India: By Market Size, By Core Material, 2014–2021 (Million Square Meters)

Table 67 India: By Market Size, By Type, 2014–2021 (USD Million)

Table 68 India: By Market Size, By Type, 2014–2021 (Million Square Meters)

Table 69 India: By Market Size, By Application, 2014–2021 (USD Million)

Table 70 India: By Market Size, By Application, 2014–2021 (Million Square Meters)

Table 71 Australia: Vacuum Insulation Panels Market Size, By Core Material, 2014–2021 (USD Million)

Table 72 Australia: Market Size, By Core Material, 2014–2021 (Million Square Meters)

Table 73 Australia: Market Size, By Type, 2014–2021 (USD Million)

Table 74 Australia: Market Size, By Type, 2014–2021 (Million Square Meters)

Table 75 Australia: Market Size, By Application, 2014–2021 (USD Million)

Table 76 Australia: Market Size, By Application, 2014–2021 (Million Square Meters)

Table 77 Rest of Asia-Pacific: Vacuum Insulation Panel Market Size, By Core Material, 2014–2021 (USD Million)

Table 78 Rest of Asia-Pacific: Vacuum Insulation Panel Market Size, By Core Material, 2014–2021 (Million Square Meters)

Table 79 Rest of Asia-Pacific: Vacuum Insulation Panel Market Size, By Type, 2014–2021 (USD Million)

Table 80 Rest of Asia-Pacific: Vacuum Insulation Panel Market Size, By Type, 2014–2021 (Million Square Meters)

Table 81 Rest of Asia-Pacific: Vacuum Insulation Panel Market Size, By Application, 2014–2021 (USD Million)

Table 82 Rest of Asia-Pacific: Vacuum Insulation Panel Market Size, By Application, 2014–2021 (Million Square Meters)

Table 83 North America: Vacuum Insulation Panels Market Size, By Country, 2014–2021 (USD Million)

Table 84 North America: By Market Size, By Country, 2014–2021 (Million Square Meters)

Table 85 North America: By Market Size, By Core Material, 2014–2021 (USD Million)

Table 86 North America: By Market Size, By Core Material, 2014–2021 (Million Square Meters)

Table 87 North America: By Market Size, By Type, 2014–2021 (USD Million)

Table 88 North America: By Market Size, By Type, 2014–2021 (Million Square Meters)

Table 89 North America: By Market Size, By Application, 2014–2021 (USD Million)

Table 90 North America: By Market Size, By Application, 2014–2021 (Million Square Meters)

Table 91 U.S.: Vacuum Insulation Panel Market Size, By Core Material, 2014–2021 (USD Million)

Table 92 U.S.: By Market Size, By Core Material, 2014–2021 (Million Square Meters)

Table 93 U.S.: By Market Size, By Type, 2014–2021 (USD Million)

Table 94 U.S.: By Market Size, By Type, 2014–2021 (Million Square Meters)

Table 95 U.S.: By Market Size, By Application, 2014–2021 (USD Million)

Table 96 U.S.: By Market Size, By Application, 2014–2021 (Million Square Meters)

Table 97 Canada: Vacuum Insulation Panels Market Size, By Core Material, 2014–2021 (USD Million)

Table 98 Canada: By Market Size, By Core Material, 2014–2021 (Million Square Meters)

Table 99 Canada: By Market Size, By Type, 2014–2021 (USD Million)

Table 100 Canada: By Market Size, By Type, 2014–2021 (Million Square Meters)

Table 101 Canada: By Market Size, By Application, 2014–2021 (USD Million)

Table 102 Canada: By Market Size, By Application, 2014–2021 (Million Square Meters)

Table 103 Mexico: Vacuum Insulation Panels Market Size, By Core Material, 2014–2021 (USD Million)

Table 104 Mexico: By Market Size, By Core Material, 2014–2021 (Million Square Meters)

Table 105 Mexico: By Market Size, By Type, 2014–2021 (USD Million)

Table 106 Mexico: By Market Size, By Type, 2014–2021 (Million Square Meters)

Table 107 Mexico: By Market Size, By Application, 2014–2021 (USD Million)

Table 108 Mexico: By Market Size, By Application, 2014–2021 (Million Square Meters)

Table 109 Europe: Vacuum Insulation Panels Market Size, By Country, 2014–2021 (USD Million)

Table 110 Europe: By Market Size, By Country, 2014–2021 (Million Square Meters)

Table 111 Europe: By Market Size, By Core Material, 2014–2021 (USD Million)

Table 112 Europe: By Market Size, By Core Material, 2014–2021 (Million Square Meters)

Table 113 Europe: By Market Size, By Type, 2014–2021 (USD Million)

Table 114 Europe: By Market Size, By Type, 2014–2021 (Million Square Meters)

Table 115 Europe: By Market Size, By Application, 2014–2021 (USD Million)

Table 116 Europe: By Market Size, By Application, 2014–2021 (Million Square Meters)

Table 117 Germany: Vacuum Insulation Panels Market Size, By Core Material, 2014–2021 (USD Million)

Table 118 Germany: By Market Size, By Core Material, 2014–2021 (Million Square Meters)

Table 119 Germany: By Market Size, By Type, 2014–2021 (USD Million)

Table 120 Germany: By Market Size, By Type, 2014–2021 (Million Square Meters)

Table 121 Germany: By Market Size, By Application, 2014–2021 (USD Million)

Table 122 Germany: By Market Size, By Application, 2014–2021 (Million Square Meters)

Table 123 U.K.: Vacuum Insulation Panels Market Size, By Core Material, 2014–2021 (USD Million)

Table 124 U.K.: By Market Size, By Core Material, 2014–2021 (Million Square Meters)

Table 125 U.K.: By Market Size, By Type, 2014–2021 (USD Million)

Table 126 U.K.: By Market Size, By Type, 2014–2021 (Million Square Meters)

Table 127 U.K.: By Market Size, By Application, 2014–2021 (USD Million)

Table 128 U.K.: By Market Size, By Application, 2014–2021 (Million Square Meters)

Table 129 Russia: Vacuum Insulation Panels Market Size, By Core Material, 2014–2021 (USD Million)

Table 130 Russia: By Market Size, By Core Material, 2014–2021 (Million Square Meters)

Table 131 Russia: By Market Size, By Type, 2014–2021 (USD Million)

Table 132 Russia: By Market Size, By Type, 2014–2021 (Million Square Meters)

Table 133 Russia: By Market Size, By Application, 2014–2021 (USD Million)

Table 134 Russia: By Market Size, By Application, 2014–2021 (Million Square Meters)

Table 135 France: By Market Size, By Core Material, 2014–2021 (USD Million)

Table 136 France: By Market Size, By Core Material, 2014–2021 (Million Square Meters)

Table 137 France: By Market Size, By Type, 2014–2021 (USD Million)

Table 138 France: By Market Size, By Type, 2014–2021 (Million Square Meters)

Table 139 France: By Market Size, By Application, 2014–2021 (USD Million)

Table 140 France: By Market Size, By Application, 2014–2021 (Million Square Meters)

Table 141 Rest of Europe: Vacuum Insulation Panels Market Size, By Core Material, 2014–2021 (USD Million)

Table 142 Rest of Europe: By Market Size, By Core Material, 2014–2021 (Million Square Meters)

Table 143 Rest of Europe: By Market Size, By Type, 2014–2021 (USD Million)

Table 144 Rest of Europe: By Market Size, By Type, 2014–2021 (Million Square Meters)

Table 145 Rest of Europe: By Market Size, By Application, 2014–2021 (USD Million)

Table 146 Rest of Europe: By Market Size, By Application, 2014–2021 (Million Square Meters)

Table 147 RoW: Vacuum Insulation Panels Market Size, By Country, 2014–2021 (USD Million)

Table 148 RoW: By Market Size, By Country, 2014–2021 (Million Square Meters)

Table 149 RoW: By Market Size, By Core Material, 2014–2021 (USD Million)

Table 150 RoW: By Market Size, By Core Material, 2014–2021 (Million Square Meters)

Table 151 RoW: By Market Size, By Type, 2014–2021 (USD Million)

Table 152 RoW: By Market Size, By Type, 2014–2021 (Million Square Meters)

Table 153 RoW: By Market Size, By Application, 2014–2021 (USD Million)

Table 154 RoW: By Market Size, By Application, 2014–2021 (Million Square Meters)

Table 155 Brazil: Vacuum Insulation Panels Market Size, By Core Material, 2014–2021 (USD Million)

Table 156 Brazil: By Market Size, By Core Material, 2014–2021 (Million Square Meters)

Table 157 Brazil: By Market Size, By Type, 2014–2021 (USD Million)

Table 158 Brazil: By Market Size, By Type, 2014–2021 (Million Square Meters)

Table 159 Brazil: By Market Size, By Application, 2014–2021 (USD Million)

Table 160 Brazil: By Market Size, By Application, 2014–2021 (Million Square Meters)

Table 161 South Africa: Vacuum Insulation Panels Market Size, By Core Material, 2014–2021 (USD Million)

Table 162 South Africa: By Market Size, By Core Material, 2014–2021 (Million Square Meters)

Table 163 South Africa: By Market Size, By Type, 2014–2021 (USD Million)

Table 164 South Africa: By Market Size, By Type, 2014–2021 (Million Square Meters)

Table 165 South Africa: By Market Size, By Application, 2014–2021 (USD Million)

Table 166 South Africa: By Market Size, By Application, 2014–2021 (Million Square Meters)

Table 167 Other Countries in RoW: Vacuum Insulation Panel Market Size, By Core Material, 2014–2021 (USD Million)

Table 168 Other Countries in RoW: Vacuum Insulation Panel Market Size, By Core Material, 2014–2021 (Million Square Meters)

Table 169 Other Countries in RoW: By Market Size, By Type, 2014–2021 (USD Million)

Table 170 Other Countries in RoW: By Market Size, By Type, 2014–2021 (Million Square Meters)

Table 171 Other Countries in RoW: By Market Size, By Application, 2014–2021 (USD Million)

Table 172 Other Countries in RoW: By Market Size, By Application, 2014–2021 (Million Square Meters)

Table 173 Expansions, 2011–2015

Table 174 Collaborations, Agreements, and Joint Ventures, 2011–2015

Table 175 New Product Development, 2011–2015

Table 176 Mergers & Acquisitions, 2011–2015

List of Figures (53 Figures)

Figure 1 Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Vacuum Insulation Panels, By Application, 2016 vs 2021 (USD Billion)

Figure 5 Vacuum Insulation Panels Market Size, By Region, 2016 vs 2021 (USD Billion)

Figure 6 India is Projected to Be the Fastest-Growing Market for Vacuum Insulation Panels From 2016 to 2021

Figure 7 Leading Market Players Adopted Expansions as the Key Strategy From 2012 to 2016

Figure 8 Emerging Economies Offer Attractive Opportunities in the Vacuum Insulation Panels Market

Figure 9 Silica Segment is Projected to Grow at the Highest Rate From 2016 to 2021

Figure 10 Construction Segment Accounted for the Largest Share in the Emerging Asia-Pacific Market in 2015

Figure 11 India is Projected to Be the Fastest-Growing Country-Level Market for Vacuum Insulation Panels, 2016-2021

Figure 12 Asia-Pacific Accounted for the Largest Market Share in Terms of Value Among All Regions in 2015

Figure 13 Emerging Markets Projected to Grow Faster Than Developed Markets From 2016 to 2021

Figure 14 Evolution of the Vacuum Insulation Panels Market

Figure 15 Vacuum Insulation Panels Market Segmentation

Figure 16 Growing Construction Activities Drive the Vacuum Insulation Panels Market

Figure 17 Construction Spending of Major Asia-Pacific Countries, 2013

Figure 18 Packaging Market Projected to Grow at A Rapid Rate Till 2018

Figure 19 Low Thermal Conductivity of Vacuum Insulation Panels as Compared to Other Alternatives

Figure 20 High ‘R’ Value of Vacuum Insulation Panels as Compared to Other Alternatives

Figure 21 Vacuum Insulation Panels Supply Chain

Figure 22 Porter’s Five Forces Analysis

Figure 23 Silica Dominated the Vacuum Insulation Panels Market in Terms of Core Material From 2014 to 2021 (USD Million)

Figure 24 Flat Vacuum Insulation Panels Projected to Dominate the Market By 2021

Figure 25 Construction Segment Projected to Dominate the Market By 2021 (USD Million)

Figure 26 Construction Market Share (Value), By Country, 2010

Figure 27 HVAC Equipment Market Size, By Category, 2011–2020 (USD Billion)

Figure 28 Construction of Vacuum Insulated Panels

Figure 29 Vacuum Insulation Panels Market Size, By Raw Material, 2016–2021 (USD Million)

Figure 30 Geographical Snapshot: Vacuum Insulation Panels Market Growth Rate (2016-2021)

Figure 31 China & India Poised to Grow at Competitive Rates, By Application, 2021

Figure 32 Asia-Pacific: Market Snapshot

Figure 33 Investment in the Construction Industry in China

Figure 34 Growing Construction Industry in India

Figure 35 North America: Market Snapshot

Figure 36 Europe: Market Snapshot

Figure 37 German Construction Industry Turnover & Investments, 2010 vs 2013 (USD Billion)

Figure 38 Russia Construction Output, 2009–2013 (USD Billion)

Figure 39 RoW: Market Snapshot

Figure 40 Companies Adopted Acquisitions as Their Key Growth Strategy Between 2011 and March 2016

Figure 41 LG Hausys Ltd. Grew at the Highest Rate Between 2011 and 2014

Figure 42 2014, the Most Active Year for Companies in Terms of Developments

Figure 43 Geographic Revenue Mix of Top Four Players

Figure 44 Evonik Industries AG: Company Snapshot

Figure 45 Evonik Industries AG: SWOT Analysis

Figure 46 LG Hausys Ltd.: Company Snapshot

Figure 47 LG Hausys Ltd.: SWOT Analysis

Figure 48 Panasonic Corporation: Company Snapshot

Figure 49 Panasonic Corporation: SWOT Analysis

Figure 50 DOW Corning Corporation: Company Snapshot

Figure 51 DOW Corning Corporation: SWOT Analysis

Figure 52 OCI Company Ltd.: Company Snapshot

Figure 53 OCI Company Ltd.: SWOT Analysis

Growth opportunities and latent adjacency in Vacuum Insulation Panels Market