Plate & Frame Heat Exchanger Market

Plate & Frame Heat Exchanger Market by Type (Gasketed, Welded, Brazed), Application (HVAC & Refrigeration, Chemical, Petrochemical, Oil & Gas, Food & Beverage, Power Generation, Pulp & Paper), Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

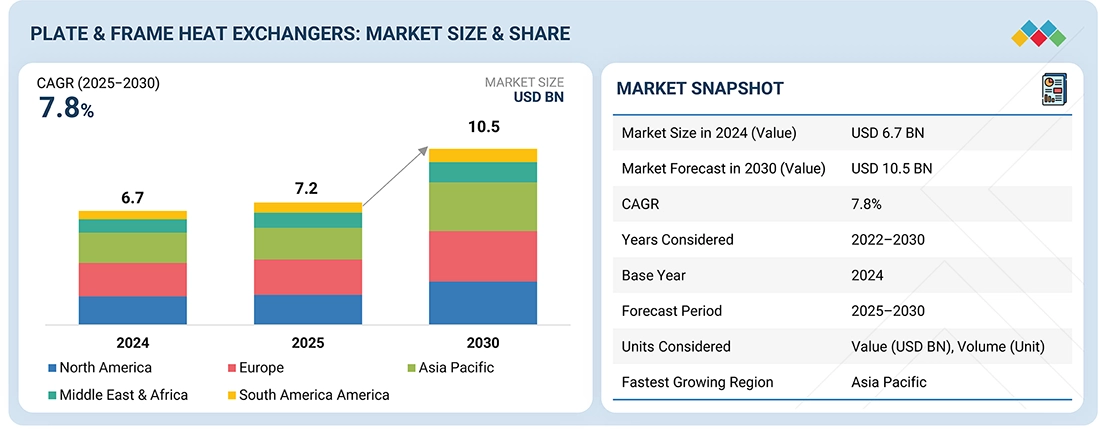

The global plate & frame heat exchanger market is projected to reach USD 10.50 billion by 2030 from USD 7.21 billion in 2025, at a CAGR of 7.8% during the forecast period. Some of the main factors influencing the plate & frame heat exchanger market include increasing demand for energy efficiency solutions across several industries, including HVAC, chemical processing, food & beverage, and their efficiency, compact size, and cost-effectiveness.

KEY TAKEAWAYS

-

BY TYPEGasketed plate & frame heat exchangers have the highest market share in the plate & frame heat exchanger market because of their unique combination of efficiency, versatility, and relative ease of maintenance. The modular design features multiple thin plates with gaskets that enable very efficient heat transfer and compact design, especially suited for industrial settings with space constraints and the need for high thermal performance.

-

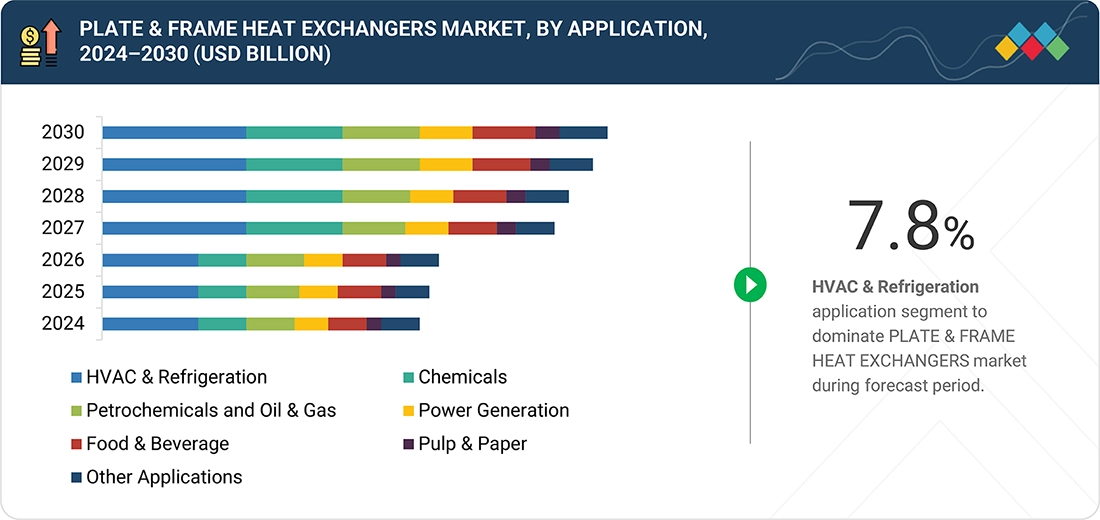

BY APPLICATIONThe HVAC & refrigeration segment requires reliable, efficient, compact solutions for thermal management. The global trend to urbanize and increased construction activity in the residential, commercial, and industrial sectors means there is increased demand for better climate control systems. Plate & frame heat exchangers are extensively utilized in HVAC and refrigeration applications due to their small sizes, highly effective heat removal capabilities, and ability to extract or add heat and optimize space utilization in buildings of varied scales

-

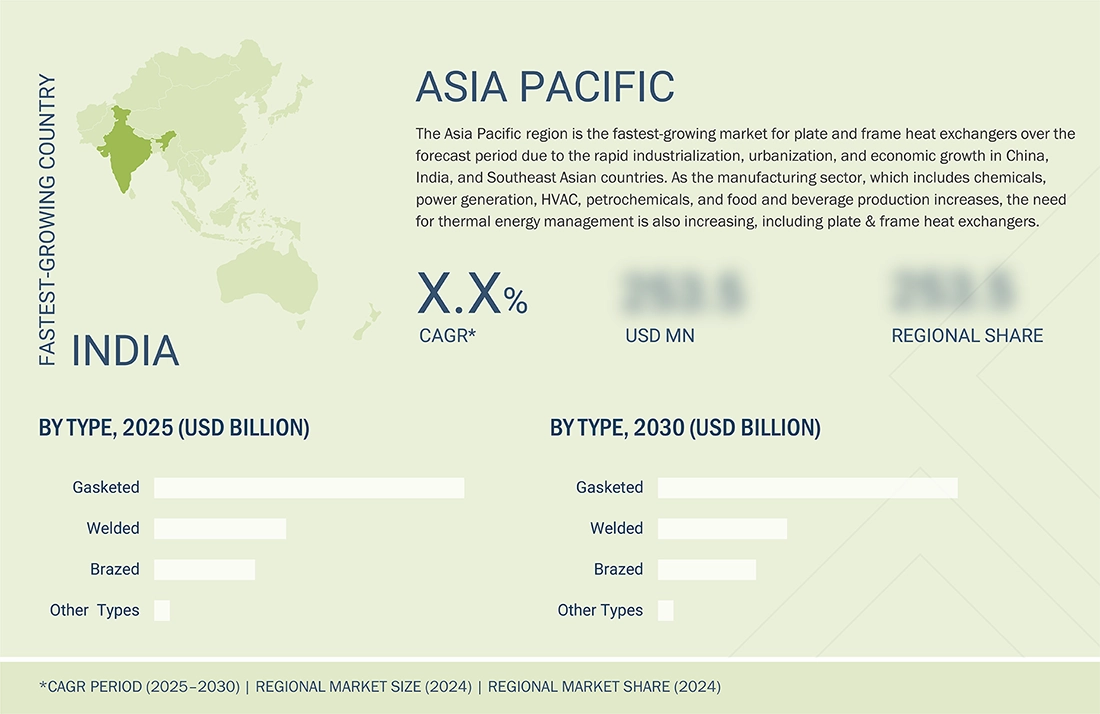

BY REGIONThe manufacturers' sector in Asia Pacific is backed by investments in infrastructure and other industrial developments, and growing power usage, with new power generation units. Furthermore, rising energy efficiency and environmental regulations are forcing industries to invest in advanced energy-efficient equipment. Moreover, from a market trend perspective, plate & frame heat exchangers offer the most compact, modular, and efficient product offering of all of the competing products.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including mergers & acquisition. For instance, Wabtec Corporation (US) acquired Bloom Engineering, enhancing its Heat Transfer and Energy Solutions portfolio.

The plate & frame heat exchanger market include increasing demand for energy efficiency solutions across several industries, including HVAC, chemical processing, food & beverage, and their efficiency, compact size, and cost-effectiveness. In addition, the type segment plays an important role in this expansion because the variety of product types accommodates the requirements of industries, which further drives the overall market expansion

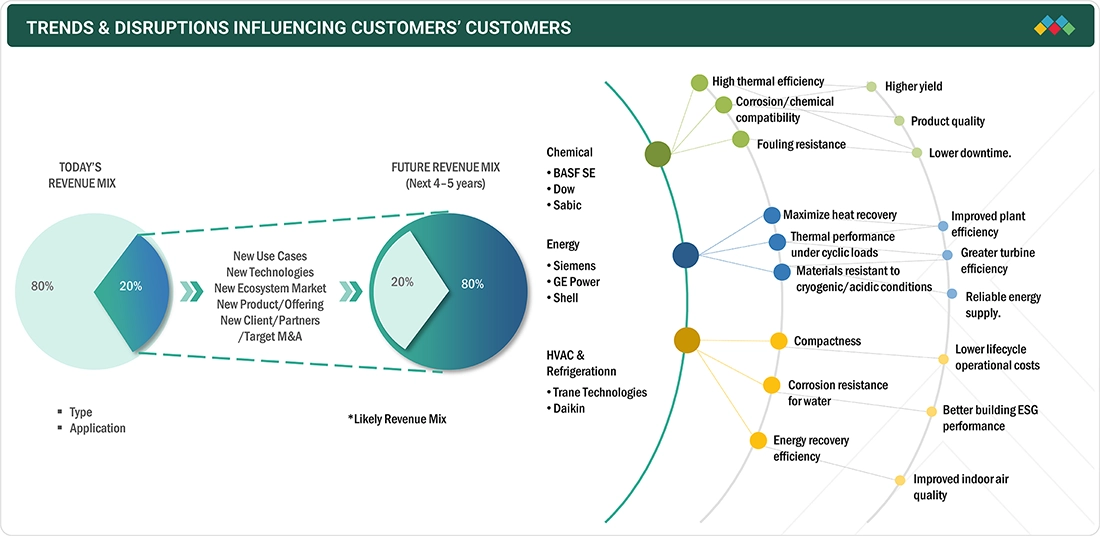

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The plate & frame heat exchanger market is witnessing significant trends & disruptions, reshaping customer businesses across various industries. Innovative manufacturing techniques drive the development of products with improved efficiency. The increasing focus on sustainability and environmental regulations is prompting companies to adopt initiative for reducing their carbon footprint.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand for HVACR equipment

-

Technological development in brazed plate heat exchangers

Level

-

Volatility in raw material prices

-

Increasing demand for battery electric vehicles

Level

-

Rapid industrialization in emerging regions

-

Growth of plate & frame heat exchanger aftermarket

Level

-

Clogging of heat exchnagers

-

Limited serviceability of brazed plate & frame heat exchanger

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for HVACR equipment

The increased demand for HVACR (heating, ventilation, air conditioning, and refrigeration) is one of the major drivers of growth in the plate and frame heat exchanger market. Urbanization is accelerating, and global population increase is leading to huge growth in residential, commercial, and industrial development requiring climate control solutions. HVACR systems provide the best method for buildings and manufacturing facilities to ensure energy efficiency. In addition, energy as a life cycle cost, thermal comfort, and indoor air quality are important as they are increasingly being installed in large buildings and manufacturing facilities. Plate and frame heat exchangers are an important component of air, marine, power generation, petrochemical processes, and HVACR systems as they efficiently transfer heat between two or more fluids for the purpose of heating or cooling, while relatively minimizing the energy consumption. The emergence of sustainable building practices and strict laws for energy usage have encouraged greater usage of newer modern heat exchangers to help systems optimize higher efficiencies and also design operational savings costs. Usability and easy operation of HVACR equipment have increased due to advances in technology, with the installation of smart controls being a factor, the development of more environmentally sensible refrigerant alternatives has further fostered acceptance for newer, higher operational efficient heating

Restraint: Volatility raw material prices

Fluctuating raw material prices relate to the operation of the plate and frame heat exchanger market and are a major constraint, in that heat exchangers will mostly consist of metals, i.e., copper, aluminum, and steel. Changes in the prices of metals are affected due to the aforementioned economic conditions, exchange rates, supply chain disruptions, mining policies, and geopolitical events. Thus, manufacturers can find themselves facing escalating production costs due to the fluctuations in raw material prices, resulting in difficulties in managing allowable estimates for project costs. Unpredictable increases in material costs frequently result in higher prices for projects, causing delays or stoppages of large capital projects altogether. This means that the plate and frame heat exchanger industry is adversely affected in terms of growth and profit for manufacturers. Sometimes premiums cannot be charged, or companies may have to take steps to minimize manufacturing costs by using cheaper materials to manage costs to offer lower costs. This could lead to lower performance and efficiency and, therefore, lower lifespans of heat exchangers, leading to higher maintenance costs for end users. Long-term contracts with suppliers can only magnify a manufacturer's exposure to upward price swings in raw materials prices; ultimately, this means difficulties in producing competitive products or lower profit margins at current levels. Tariffs and material shortages can relate to raw material supplies, with tariffs ultimately adding further limitations on supplies to manufacturers with increases in costs, which results in a larger impact on the plate and frame heat exchanger market; this ultimately restricts growth opportunities for the plate and frame heat exchanger market, though various industries are seeing growth in demand

Opportunity: Rapid industrialization in emerging regions

Strong opportunities are offered for the plate and frame heat exchanger market in emerging regions due to rapid industrialization. Emerging economies invest heavily in infrastructure, manufacturing, energy generation, and the process industries. Many countries in the Asia Pacific, Latin America, and pockets of Africa are realizing a significant increase in new manufacturing processes, such as factories, power generation, chemical processing, food processing, and beverages, all of which must effectively manage thermal energy so that production can be optimized and energy consumption reduced. The increasing need for energy efficiency, considering rising energy costs, government regulations limiting emissions, and the global desire to reach carbon neutrality will accentuate demand for the advanced heat exchanger technology. For example, in the mature and industrialized sectors such as chemicals, oil & gas, and HVAC, there is growth in the Asia Pacific region (China, India, and Southeast Asia), where plate and frame heat exchangers are generally used in heating and cooling and waste heat recovery applications. Additionally, because of foreign direct investments, new government programs are enticing multinational corporations to create new manufacturing bases, further expanding the market

Challenge: Clogging of heat exchangers

Clogging continues to be a persistent concern in the plate and frame heat exchanger sector that hinders operational performance while degrading the reliability of the overall system. With narrow gaps between plates (usually between 2.5mm and 5.5 mm), plate and frame heat exchangers are particularly susceptible to blockages caused by suspended solids, fibers and debris, and scale in process fluids. It can lead to significant drops in heat transfer efficiency and increased pressure across the unit. In the case of blockages, there are expected to be interruptions in processes, increased energy usage, or unplanned outages for cleaning or maintenance. In extreme cases, blockages may lead to a halt in production. Any of these situations can lead to costly downtime and reduced profits for end users due to reduced production. Clogging is more likely in systems without adequate filtration and that are potentially subject to poorly treated fluids before the water is fed into a plate and frame heat exchanger. While regular maintenance, chemical or mechanical cleaning, and placing filters upstream may help mitigate clogging, each of these options results in added operational costs and is one of those vices in terms of downtime of system maintenance

Plate and Frame Heat Exchanger Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Plate & Frame heat exchangers are used in reactors, distillation units, condensers, and reboilers for heat transfer, cooling, and energy recovery. | Improves process efficiency and product yield & enhances operational safety and compliance |

|

Used in boiler feedwater heating, steam condensers, waste-heat recovery units, and LNG processing. | Boosts power plant efficiency, Enables sustainable energy operations by lowering emissions |

|

Cooling and heating of fluids, condensing gases, heat recovery in refineries and gas processing units. | Enhances process efficiency, improves safety |

|

Applied in air conditioning systems. | Lowers operational costs. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

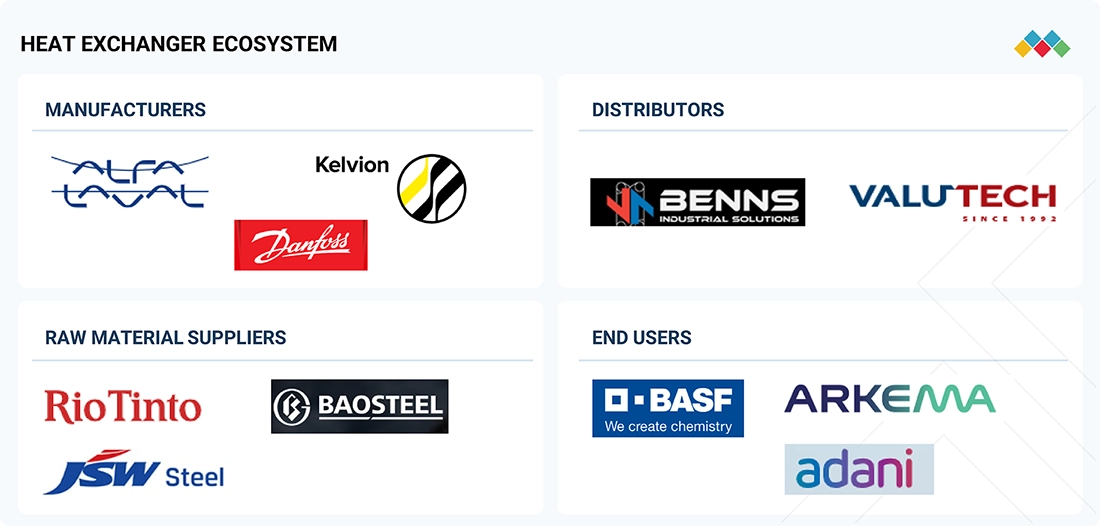

MARKET ECOSYSTEM

The plate & frame heat exchanger market ecosystem comprises raw material suppliers, manufacturers, distributors, and end users. The raw materials for manufacturing plate & frame heat exchangers include corrosion-resistant metals and specialized materials. Raw material suppliers supply the necessary materials for the manufacture of plate & frame heat exchangers. The raw materials are processed by manufacturers into different types of plate & frame heat exchangers. The distribution of the product is crucial for the delivery of products to consumers. End-use industries, including HVAC & refrigeration, chemicals, petrochemicals and oil & gas, power generation, food & beverages, and pulp & paper, use plate & frame heat exchangers for various applications.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Plate & Frame Heat Exchangers Market, By Type

Their design is specifically suited to achieve high thermal efficiency with close temperature approaches that assist with energy conservation and maintaining compliance with government regulations. Heat exchangers also cover a huge range of applications and retain the largest share of all plate & frame heat exchangers. They are used in multi-story buildings for heating and cooling, providing building comfort. They are also efficiently used in power generation and maritime propulsion heat exchangers, as well as industrial processes requiring relatively low-temperature heat transfer conditions. Recent developments in gasket and plate materials enhance stability and allow greater temperatures and pressures. This is an important distinction when each manufacturer strives to obtain the allegiance of segments of customer markets.

Plate & Frame Heat Exchangers Market, By Application

Plate & frame heat exchangers are highly modular and customizable, in that, they can be tailored for a very wide range of temperatures, pressures, and fluids; therefore, they can also be a very efficient means of heating and cooling for indoor air quality and comfort in buildings. Ever evolving policies and building codes that target increased building efficiency and sustainability, alongside improved building codes in recent years, have seen plate and frame heat exchangers being increasingly used in recent decades. Plate & frame heat exchangers have already seen wide acceptance from the HVAC and refrigeration sector as critical components in intelligent, sustainable, energy-efficient climate control system concepts that ultimately focus on low operational costs, low energy consumption, and low environmental impacts as more efficient means of heat transfer.

REGION

Asia Pacific to be fastest-growing region in global plate & frame heat exchangers market during forecast period

Rising energy efficiency and environmental regulations are forcing industries to invest in advanced energy-efficient equipment. Moreover, from a market trend perspective, plate & frame heat exchangers offer the most compact, modular, and efficient product offering of all of the competing products. Asia Pacific's position is also supported by developed economies (i.e., Japan and Australia) and rapidly developing economies; together, they comprise a majority (over 70 percent) of all global economic growth. Finally, with companies expanding into the Asia Pacific to take advantage of cheap labor, raw materials, and increasing demand from local markets, it is the trend in innovation (including emerging technologies such as AI and IoT for smarter heat exchanger systems) that continues to push this region's market into the forefront of growth

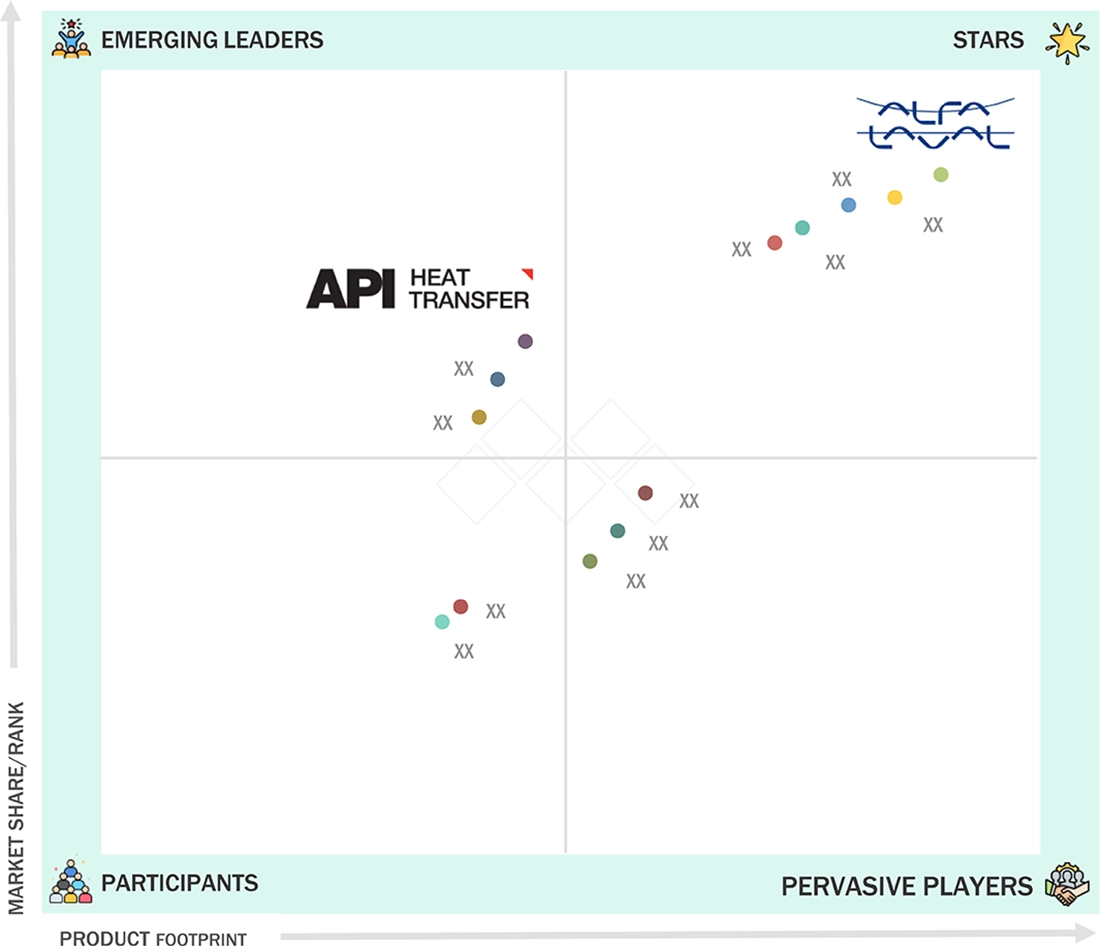

Plate and Frame Heat Exchanger Market: COMPANY EVALUATION MATRIX

In the plate & frame heat exchanger market matrix, alfa laval (Star), a Sweden company, leads the market through its high-quality heat exchanger, which find extensive applications in various end-use industries such as chemical, food, oil & gas and others. API Heat Transfer (US) is gaining traction with its technological advancements in plate & frame heat exchanger.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 6.7 Billion |

| Market Forecast in 2030 (value) | USD 10.5 Billion |

| Growth Rate | CAGR of 7.8% from 2025-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

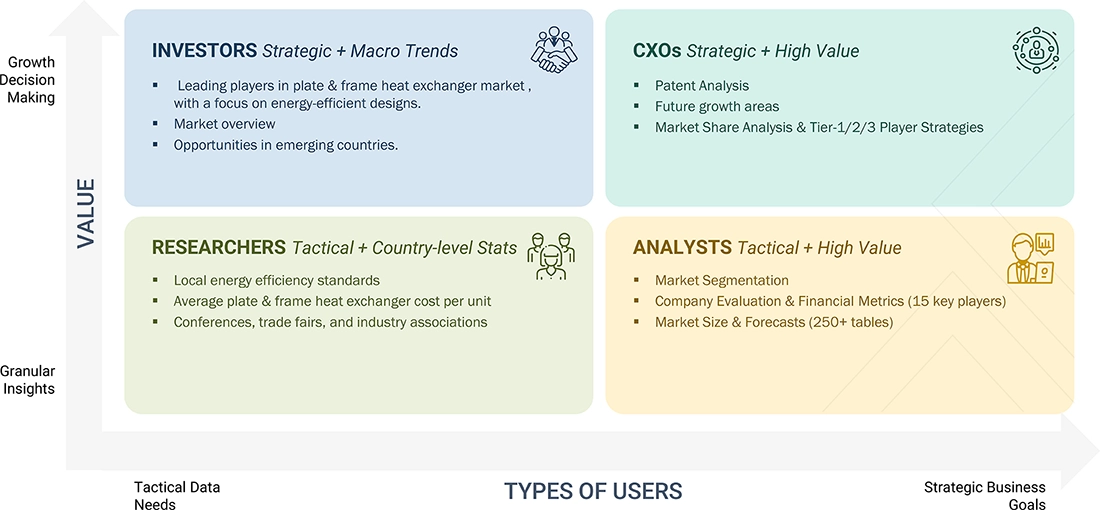

WHAT IS IN IT FOR YOU: Plate and Frame Heat Exchanger Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| HVAC & Refrigeration Organization |

|

|

| Distributor |

|

Insights on demand growth in high-potential segments, Support product targeting and faster adoption, Minimize substitution risks through innovation |

| Concern about raw material trends & pricing impact | Built a materials cost tracker covering stainless steel, copper, aluminum, and titanium price trends, supply risks, and recycling opportunities | Enabled procurement teams to hedge costs, secure suppliers, and explore material substitutions |

| Interest in competitive benchmarking | Provided a comparison of top plate & frame heat exchanger suppliers by product range, and market presence | Supported go-to-market strategy and positioning vs competitors |

RECENT DEVELOPMENTS

- April 2025 : ALFA LAVAL launched a TS25 semi-welded heat exchanger to boost energy efficiency in clean energy and process industries.

- July 2023 : SPX FLOW expanded its Innovation Center in the Asia Pacific region as part of its strategy to enhance localized customer support and strengthen its presence in high-growth markets.

- May 2023 : ALFA LAVAL expanded its production capacity of brazed plate heat exchangers to meet the growing demand in the global energy transition

Table of Contents

Methodology

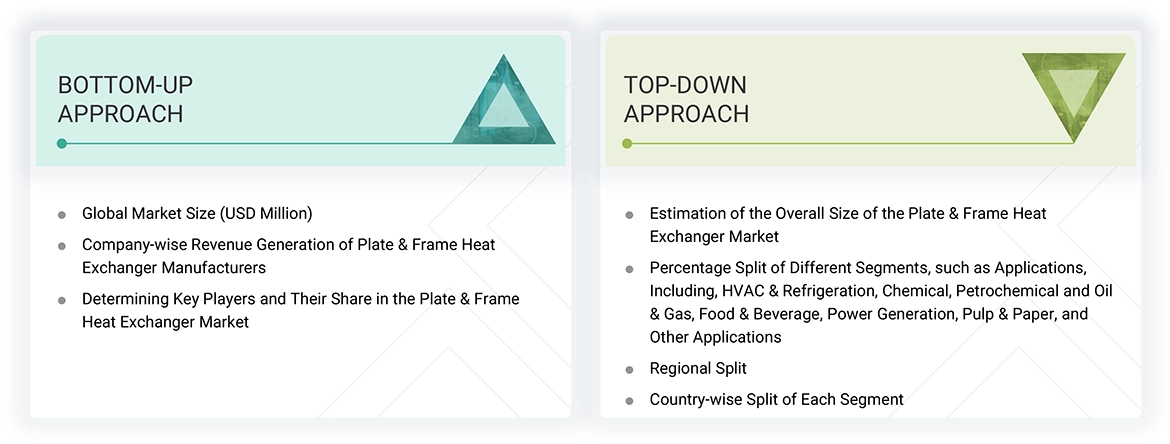

The study involves two major activities in estimating the current market size for the plate & frame heat exchanger. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both, top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering plate & frame heat exchangers and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. Secondary data was collected and analyzed to arrive at the overall size of the plate & frame heat exchanger market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the plate & frame heat exchanger market scenario through secondary research. Several interviews were conducted with market experts from both, the demand and supply sides across major countries of North America, Europe, Asia Pacific, Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from plate & frame heat exchanger industry vendors; material providers; distributors; and key opinion leaders. Interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are seeking plate & frame heat exchanger services, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of plate & frame heat exchangers and future outlook of their business which will affect the overall market.

The Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the plate & frame heat exchanger market includes the following. The sizing of the market was undertaken from the demand side. The market was upsized based on the demand for plate & frame heat exchangers for different applications at regional levels. Such procurements provide information on the demand aspects of the plate & frame heat exchanger industry for each application. For each application, all possible segments of the plate & frame heat exchanger market were integrated and mapped.

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both, the top-down and bottom-up approaches.

Market Definition

The plate & frame heat exchanger market comprises the global industry involved in the design, manufacturing, distribution, and maintenance of heat exchangers that utilize a series of corrugated metal plates clamped together within a frame to transfer heat between two fluids. These systems offer high thermal efficiency, compact size, and flexibility, making them ideal for applications across HVAC & refrigeration, chemical, petrochemical and oil & gas, food & beverage, power generation, pulp & paper, and other applications. Plate & frame heat exchangers are characterized by their modularity, ease of cleaning and maintenance, and superior performance in low-to-medium pressure and temperature operations. The market is driven by the increasing demand for energy-efficient heat transfer systems, tightening environmental regulations, and the expanding industrial infrastructure in emerging economies. Technological advancements, such as gasketed, brazed, and welded variants, further diversify their applications and adoption.

Stakeholders

- Plate & Frame Heat Exchanger Manufacturers

- Plate & Frame Heat Exchanger Distributors and Suppliers

- End-use Industries

- Universities, Governments, and Research Organizations

- Associations and Industrial Bodies

- R&D Institutes

- Environmental Support Agencies

- Investment Banks and Private Equity Firms

- Research and Consulting Firms

Report Objectives

- To define, describe, and forecast the plate & frame heat exchanger market size in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and project the global plate & frame heat exchanger market by type, application, and region

- To forecast the market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America, and analyze the significant region-specific trends

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, and product developments/new product launches, to draw the competitive landscape

- To strategically profile the key market players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

What is the current size of the global plate & frame heat exchanger market?

The plate & frame heat exchanger market is projected to reach USD 10.50 billion by 2030 from USD 7.21 billion in 2025, at a CAGR of 7.8% during the forecast period.

Who are the key players in the global plate & frame heat exchanger market?

ALFA LAVAL (Sweden), Danfoss (Denmark), Kelvion Holding GmbH (Germany), SPX Flow (US), XYLEM (US), API Heat Transfer (US), H. Guntner (UK) LTD. (UK), Boyd Corporation (US), Johnson Controls (Ireland), and Wabtec Corporation (US).

What are some of the drivers for market growth?

High chemical resistance requirements, compliance with stringent environmental and safety regulations, and a growing need for long-term durability and low maintenance requirements.

What are the different types of plate & frame heat exchangers?

Gasketed, welded, and brazed plate & frame heat exchangers.

What are the major applications of plate & frame heat exchangers?

HVAC & Refrigeration, Chemicals, Petrochemicals and Oil & Gas, Power Generation, Food & Beverages, and Pulp & Paper.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Plate & Frame Heat Exchanger Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Plate & Frame Heat Exchanger Market