Brazed Plate Heat Exchangers Market by Application (Evaporator, Condenser, And Economizer), End-use Industry (HVACR, chemical, food & beverage, power, heavy industries, and others), and Region - Global Forecast to 2024

Updated on : April 04, 2024

Brazed Plate Heat Exchangers Market

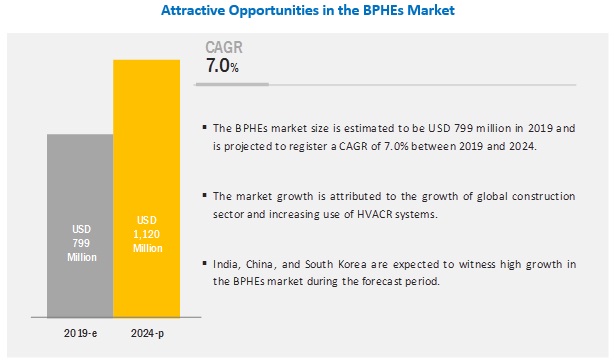

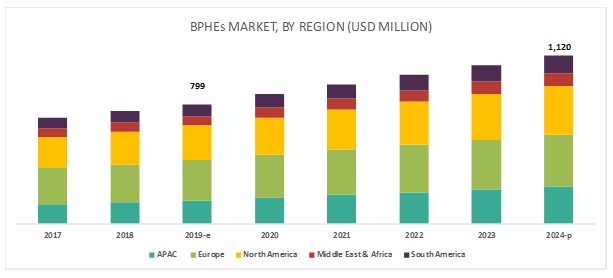

The global brazed plate heat exchangers market was valued at USD 799 million in 2019 and is projected to reach USD 1120 million by 2024, growing at 7.0% cagr from 2019 to 2024. The brazed plate heat exchangers (BPHEs) market is driven by the growth of the global construction sector and the increasing use of HVACR systems in this sector. However, BPHEs are not demountable, which is expected to restrict the market growth. Rapid industrialization in emerging economies is expected to create opportunities for the manufacturers of BPHEs.

HVACR is projected to be the fastest–growing end-use industry during the forecast period.

On the basis of end-use industry, the BPHEs market is segmented into HVACR, chemical, food & beverage, power, heavy industries, and others. The HVACR industry is expected to grow rapidly owing to increasing demand from the global construction sector. The global construction sector is growing, owing to globalization, urbanization, rising standard of living, increasing purchasing power parity (PPP), infrastructural development, and increasing need for construction of megacities in emerging countries.

Europe is expected to account for the largest share of the global market during the forecast period

Based on region, the BPHEs market has been segmented into APAC, Europe, North America, the Middle East & Africa, and South America. Europe was estimated to be the largest BPHEs market in 2019, owing to the large industrial base in the region. The region also has many key players in the BPHEs market, such as Alfa Laval (Sweden), SWEP (Sweden), Danfoss (Denmark), and Kelvion (Germany). However, the market in Europe is already mature, and hence these companies are now strategically tapping into opportunities in the emerging markets.

Brazed Plate Heat Exchangers Market Players

The major vendors in the BPHEs market are Alfa Laval (Sweden), Kelvion (Germany), SWEP (Sweden), Danfoss (Denmark), Xylem (US), API Heat Transfer (US), Chart Industries (US), Hisaka Works (Japan), Kaori (Taiwan), Paul Mueller Company (US), Baode Heat Exchanger (China), Barriquand Group (France), Boyd Corporation (US), Diversified Heat Transfer (US), Funke (Germany), HRS Heat Exchangers (UK), HYDAC (Germany), Onda (Italy), Secespol (Poland), and Weil-McLain (US).

Alfa Laval (Sweden) is among the leading BPHEs manufacturers, globally. The company has adopted various organic and inorganic strategies to be a leading player in the BPHEs market. The strategies adopted are new product launch, expansion, and acquisition. The company also has strong focus on R&D and has acquired certain technologies to drive sustainable energy solutions.

SWEP (Sweden) is one of the leading manufacturers of BPHEs. These BPHEs are generally used in air conditioning, refrigeration, heating, and industrial applications. They can be also be used as desuperheater and condenser, depending on the application area. New product launch was the key strategy adopted by the company to penetrate the global BPHEs market.

Brazed Plate Heat Exchangers Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 799 million |

|

Revenue Forecast in 2024 |

USD 1,120 million |

|

CAGR |

7.0% |

|

Years considered for the study |

2017-2024 |

|

Base year |

2018 |

|

Forecast period |

2019-2024 |

|

Units considered |

Value (USD Million and Thousand) |

|

Segments |

Application, End-use Industry, and Region |

|

Regions |

North America, APAC, Europe, South America, and the Middle East & Africa |

|

Companies |

Alfa Laval (Sweden), Kelvion (Germany), SWEP (Sweden), Danfoss (Denmark), Xylem (US), and others |

This research report categorizes the brazed plate heat exchangers (BPHEs) market based on application, end-use industry, and region.

On the basis of application, the BPHEs market has been segmented as follows:

- Evaporator

- Condenser

- Economizer

On the basis of end-use industry, the BPHEs market has been segmented as follows:

- HVACR

- Chemical

- Food & beverage

- Power

- Heavy industries

- Others (marine and district energy)

On the basis of region, the BPHEs market has been segmented as follows:

- APAC

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

In October 2019, Alfa Laval launched a new BPHE model, CB210. The company has now integrated several new technological features for BPHEs in this new model. This new model will provide increased capacity in the same footprint and will also boost the thermal efficiency of a heating or cooling system. This will help the company to meet the continuously rising demand for high-quality BPHEs.

In October 2019, SWEP introduced a new pressure class model, B427-Y, in its range of BPHEs. This new model is designed particularly for customers who do not need a product that can withstand high pressure like other BPHEs. This new development will help the company to meet the specific needs of customers.

In July 2016, Danfoss acquired Sondex Holding A/S (Denmark), a global manufacturer of heat transfer products. This acquisition helped the company to improve its product offering and strengthen its position in the BPHEs market.

Key questions addressed by the report

- What are the upcoming hot bets for the BPHEs market?

- How are the market dynamics changing for different types of BPHEs?

- How are the market dynamics changing for different end-use industries of BPHEs?

- Who are the major manufacturers of BPHEs?

- How are the market dynamics changing for different regions of BPHEs?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.3.1 BPHEs Market Analysis Through Primary Interviews

2.4 Limitations

2.5 Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 28)

4.1 Attractive Opportunities in the BPHEs Market

4.2 BPHEs Market, By End-Use Industry

4.3 BPHEs Market, By Region

4.4 APAC BPHEs Market, By End-Use Industry and Country

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growth of Global Construction Sector and Increasing Use of HVACr Systems in the Sector

5.2.1.2 Technological Developments

5.2.2 Restraints

5.2.2.1 BPHEs are Not Demountable

5.2.3 Opportunities

5.2.3.1 Rapid Industrialization in Emerging Economies

5.3 Porter’s Five Forces Analysis

5.3.1 Bargaining Power of Buyers

5.3.2 Bargaining Power of Suppliers

5.3.3 Threat of New Entrants

5.3.4 Threat of Substitutes

5.3.5 Intensity of Competitive Rivalry

6 BPHEs Market, By Application (Page No. - 34)

6.1 Introduction

6.2 Evaporator

6.3 Condenser

6.4 Economizer

7 BPHEs Market, By End-Use Industry (Page No. - 35)

7.1 Introduction

7.2 HVACr

7.2.1 Increase in Construction Activities Driving the Demand for BPHEs in HVACr Industry

7.3 Chemical

7.3.1 Increasing Demand for Chemicals Expected to Drive the Demand for BPHEs

7.4 Food & Beverage

7.4.1 Growing Population Expected to Drive the Food & Beverage Industry

7.5 Power

7.5.1 Need for Efficient Cooling During Power Generation Process to Fuel Demand for BPHEs

7.6 Heavy Industries

7.6.1 Increased Production Efficiency and Maximized Heat Recovery to Fuel the BPHEs Demand

7.7 Others

8 BPHEs Market, By Region (Page No. - 49)

8.1 Introduction

8.2 APAC

8.2.1 China

8.2.1.1 Presence of Large Construction, Chemical, and Food & Beverage Sectors Fueling Consumption of BPHEs

8.2.2 India

8.2.2.1 India is Fastest-Growing Market for BPHEs, Globally

8.2.3 Japan

8.2.3.1 Growth of Construction, Pharmaceutical, and Food & Beverage Industries is Driving the Market

8.2.4 South Korea

8.2.4.1 Economic Growth of the Country Driving the Market

8.2.5 Rest of APAC

8.3 North America

8.3.1 US

8.3.1.1 Rise in Infrastructure Development Activities Boosting the Market

8.3.2 Canada

8.3.2.1 Recovery of the Country’s Economy Favorable for Market Growth

8.3.3 Mexico

8.3.3.1 Growing Industrial Sector Turning Mexico Into A Lucrative Market for BPHEs

8.4 Europe

8.4.1 Germany

8.4.1.1 Presence of Strong Industrial Base Driving the BPHEs Market in Germany

8.4.2 France

8.4.2.1 Development in Chemical and Pharmaceutical Sectors Likely to Propel the Use of BPHEs

8.4.3 Italy

8.4.3.1 Construction Industry to Fuel the Italian BPHEs Market

8.4.4 Russia

8.4.4.1 Recovery of the Economy is Triggering Growth of Various Industries

8.4.5 UK

8.4.5.1 Chemical and Pharmaceutical Industries are the Major Contributors to the Country’s Economy

8.4.6 Turkey

8.4.6.1 Turkey to Register the Fastest Growth Rate During the Forecast Period

8.4.7 Spain

8.4.7.1 Government Investing to Facilitate Growth of Various Manufacturing Industries

8.4.8 Rest of Europe

8.5 Middle East & Africa

8.5.1 Saudi Arabia

8.5.1.1 Increasing Investments in Infrastructure Expected to Spur the Demand for BPHEs

8.5.2 South Africa

8.5.2.1 Increasing Foreign Investment in Various Industries Supporting the Market Growth

8.5.3 Rest of Middle East & Africa

8.6 South America

8.6.1 Brazil

8.6.1.1 Brazil Emerging as A Lucrative Market for BPHEs With Growing Industrial Sector

8.6.2 Argentina

8.6.2.1 Recovering Economy of the Country is Expected to Help the Market Growth

8.6.3 Rest of South America

9 Competitive Landscape (Page No. - 74)

9.1 Overview

9.2 Competitive Leadership Mapping, 2018

9.2.1 Visionary Leaders

9.2.2 Innovators

9.2.3 Dynamic Differentiators

9.2.4 Emerging Players

9.2.5 Strength of Product Portfolio

9.2.6 Business Strategy Excellence

9.3 Ranking of Key Players

9.4 Competitive Scenario

9.4.1 New Product Launch

9.4.2 Acquisition

9.4.3 Expansion

10 Company Profiles (Page No. - 82)

10.1 Alfa Laval

10.1.1 Business Overview

10.1.2 Products Offered

10.1.3 Recent Developments

10.1.4 SWOT Analysis

10.1.5 Current Focus and Strategies

10.1.6 Threat From Competition

10.2 Kelvion

10.2.1 Business Overview

10.2.2 Products Offered

10.2.3 Recent Developments

10.2.4 SWOT Analysis

10.2.5 Current Focus and Strategies

10.2.6 Threat From Competition

10.3 SWEP

10.3.1 Business Overview

10.3.2 Products Offered

10.3.3 Recent Developments

10.3.4 SWOT Analysis

10.3.5 Current Focus and Strategies

10.3.6 Threat From Competition

10.4 Danfoss

10.4.1 Business Overview

10.4.2 Products Offered

10.4.3 Recent Developments

10.4.4 SWOT Analysis

10.4.5 Current Focus and Strategies

10.4.6 Threat From Competition

10.5 Xylem

10.5.1 Business Overview

10.5.2 Products Offered

10.5.3 SWOT Analysis

10.5.4 Current Focus and Strategies

10.5.5 Threat From Competition

10.6 API Heat Transfer

10.6.1 Business Overview

10.6.2 Products Offered

10.6.3 MnM View

10.7 Chart Industries

10.7.1 Business Overview

10.7.2 Products Offered

10.7.3 MnM View

10.8 Hisaka Works

10.8.1 Business Overview

10.8.2 Products Offered

10.8.3 MnM View

10.9 Kaori

10.9.1 Business Overview

10.9.2 Products Offered

10.9.3 Recent Developments

10.9.4 MnM View

10.10 Paul Mueller Company

10.10.1 Business Overview

10.10.2 Products Offered

10.10.3 MnM View

10.11 Other Companies

10.11.1 Baode Heat Exchanger

10.11.2 Barriquand Group

10.11.3 Boyd Corporation

10.11.4 Diversified Heat Transfer

10.11.5 Funke

10.11.6 HRS Heat Exchangers

10.11.7 HYDAC

10.11.8 Onda

10.11.9 Secespol

10.11.10 Weil-Mclain

11 Appendix (Page No. - 100)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Available Customizations

11.4 Related Reports

11.5 Author Details

List of Tables (73 Tables)

Table 1 BPHEs Market Size, By End-Use Industry, 2017–2024 (USD Million)

Table 2 BPHEs Market Size in HVACr, By Region, 2017–2024 (USD Thousand)

Table 3 APAC: BPHEs Market Size in HVACr, 2017–2024 (USD Thousand)

Table 4 Europe: BPHEs Market Size in HVACr, 2017–2024 (USD Thousand)

Table 5 North America: BPHEs Market Size in HVACr, 2017–2024 (USD Thousand)

Table 6 Middle East & Africa: BPHEs Market Size in HVACr, 2017–2024 (USD Thousand)

Table 7 South America: BPHEs Market Size in HVACr, 2017–2024 (USD Thousand)

Table 8 BPHEs Market Size in Chemical, By Region, 2017–2024 (USD Thousand)

Table 9 APAC: BPHEs Market Size in Chemical, 2017–2024 (USD Thousand)

Table 10 Europe: BPHEs Market Size in Chemical, 2017–2024 (USD Thousand)

Table 11 North America: BPHEs Market Size in Chemical, 2017–2024 (USD Thousand)

Table 12 Middle East & Africa: BPHEs Market Size in Chemical, 2017–2024 (USD Thousand)

Table 13 South America: BPHEs Market Size in Chemical, 2017–2024 (USD Thousand)

Table 14 BPHEs Market Size in Food & Beverage, By Region, 2017–2024 (USD Thousand)

Table 15 APAC: BPHEs Market Size in Food & Beverage, 2017–2024 (USD Thousand)

Table 16 Europe: BPHEs Market Size in Food & Beverage, 2017–2024 (USD Thousand)

Table 17 North America: BPHEs Market Size in Food & Beverage, 2017–2024 (USD Thousand)

Table 18 Middle East & Africa: BPHEs Market Size in Food & Beverage, 2017–2024 (USD Thousand)

Table 19 South America: BPHEs Market Size in Food & Beverage, 2017–2024 (USD Thousand)

Table 20 BPHEs Market Size in Power, By Region, 2017–2024 (USD Thousand)

Table 21 APAC: BPHEs Market Size in Power, 2017–2024 (USD Thousand)

Table 22 Europe: BPHEs Market Size in Power, 2017–2024 (USD Thousand)

Table 23 North America: BPHEs Market Size in Power, 2017–2024 (USD Thousand)

Table 24 Middle East & Africa: BPHEs Market Size in Power, 2017–2024 (USD Thousand)

Table 25 South America: BPHEs Market Size in Power, 2017–2024 (USD Thousand)

Table 26 BPHEs Market Size in Heavy Industries, By Region, 2017–2024 (USD Thousand)

Table 27 APAC: BPHEs Market Size in Heavy Industries, 2017–2024 (USD Thousand)

Table 28 Europe: BPHEs Market Size in Heavy Industries, 2017–2024 (USD Thousand)

Table 29 North America: BPHEs Market Size in Heavy Industries, 2017–2024 (USD Thousand)

Table 30 Middle East & Africa: BPHEs Market Size in Heavy Industries, 2017–2024 (USD Thousand)

Table 31 South America: BPHEs Market Size in Heavy Industries, 2017–2024 (USD Thousand)

Table 32 BPHEs Market Size in Other Industries, By Region, 2017–2024 (USD Thousand)

Table 33 APAC: BPHEs Market Size in Other Industries, 2017–2024 (USD Thousand)

Table 34 Europe: BPHEs Market Size in Other Industries, 2017–2024 (USD Thousand)

Table 35 North America: BPHEs Market Size in Other Industries, 2017–2024 (USD Thousand)

Table 36 Middle East & Africa: BPHEs Market Size in Other Industries, 2017–2024 (USD Thousand)

Table 37 South America: BPHEs Market Size in Other Industries, 2017–2024 (USD Thousand)

Table 38 BPHEs Market Size, By Region, 2017–2024 (USD Million)

Table 39 APAC: BPHEs Market Size, By Country, 2017–2024 (USD Thousand)

Table 40 APAC: BPHEs Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 41 China: BPHEs Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 42 India: BPHEs Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 43 Japan: BPHEs Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 44 South Korea: BPHEs Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 45 Rest of APAC: BPHEs Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 46 North America: BPHEs Market Size, By Country, 2017–2024 (USD Thousand)

Table 47 North America: BPHEs Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 48 US: BPHEs Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 49 Canada: BPHEs Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 50 Mexico: BPHEs Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 51 Europe: BPHEs Market Size, By Country, 2017–2024 (USD Thousand)

Table 52 Europe: BPHEs Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 53 Germany: BPHEs Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 54 France: BPHEs Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 55 Italy: BPHEs Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 56 Russia: BPHEs Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 57 UK: BPHEs Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 58 Turkey: BPHEs Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 59 Spain: BPHEs Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 60 Rest of Europe: BPHEs Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 61 Middle East & Africa: BPHEs Market Size, By Country, 2017–2024 (USD Thousand)

Table 62 Middle East & Africa: BPHEs Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 63 Saudi Arabia: BPHEs Market Size, End-Use Industry, 2017–2024 (USD Thousand)

Table 64 South Africa: BPHEs Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 65 Rest of Middle East & Africa: BPHEs Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 66 South America: BPHEs Market Size, By Country, 2017–2024 (USD Thousand)

Table 67 South America: BPHEs Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 68 Brazil: BPHEs Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 69 Argentina: BPHEs Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 70 Rest of South America: BPHEs Market Size, By End-Use Industry, 2017–2024 (USD Thousand)

Table 71 New Product Launch, 2016–2020

Table 72 Acquisition, 2016–2020

Table 73 Expansion, 2016–2020

List of Figures (34 Figures)

Figure 1 BPHEs Market: Research Design

Figure 2 BPHEs Market: Bottom-Up Approach

Figure 3 BPHEs Market: Top-Down Approach

Figure 4 BPHEs Market: Data Triangulation

Figure 5 BPHEs Market Analysis Through Secondary Sources

Figure 6 Base Number Calculation

Figure 7 HVACr to Be Fastest-Growing End-Use Industry of BPHEs Market

Figure 8 APAC BPHEs Market to Witness the Highest Growth Rate

Figure 9 Emerging Countries Witnessing High Growth in Demand for BPHEs

Figure 10 HVACr is Projected to Be the Fastest-Growing End-Use Industry

Figure 11 India to Register the Highest CAGR During the Forecast Period

Figure 12 China Accounted for the Largest Market Share in 2018

Figure 13 Drivers, Restraints, and Opportunities in the BPHEs Market

Figure 14 BPHEs Market: Porter’s Five Forces Analysis

Figure 15 HVACr to Be the Leading End-Use Industry of BPHEs

Figure 16 APAC to Be the Fastest-Growing Market During Forecast Period

Figure 17 BPHEs Market in India to Witness the Highest CAGR

Figure 18 APAC: BPHEs Market Snapshot

Figure 19 North America: BPHEs Market Snapshot

Figure 20 Europe: BPHEs Market Snapshot

Figure 21 Companies Adopted New Product Launch as the Key Growth Strategy Between 2016 and 2020

Figure 22 BPHEs Market: Competitive Leadership Mapping, 2018

Figure 23 Alfa Laval Led the Market in 2018

Figure 24 Alfa Laval: Company Snapshot

Figure 25 Alfa Laval: SWOT Analysis

Figure 26 Kelvion: SWOT Analysis

Figure 27 SWEP: SWOT Analysis

Figure 28 Danfoss: Company Snapshot

Figure 29 Danfoss: SWOT Analysis

Figure 30 Xylem: Company Snapshot

Figure 31 Xylem: SWOT Analysis

Figure 32 Chart Industries: Company Snapshot

Figure 33 Hisaka Works: Company Snapshot

Figure 34 Mueller: Company Snapshot

The study involved four major activities to estimate the current market size of BPHEs. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg Businessweek, Factiva, World Bank, and Industry Journals, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; and databases.

Primary Research

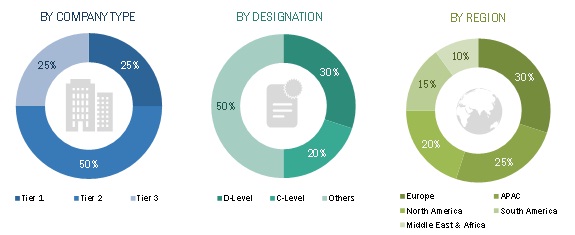

The BPHEs market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations, in the supply chain. The demand side of this market is characterized by the development of HVACR, chemical, food & beverage, power, heavy industries, and other end-use industries. The supply side is characterized by advancements in technology. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the BPHEs market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following steps:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the HVACR, chemical, food & beverage, power, and heavy industries.

Report Objectives:

- To analyze and forecast the brazed plate heat exchangers (BPHEs) market size in terms of value

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To define, describe, and forecast the market by end-use industry

- To forecast the size of the market with respect to five regions, namely, Asia Pacific (APAC), Europe, North America, South America, and the Middle East & Africa (MEA), along with their countries

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze competitive developments, such as new product launch, acquisition, and expansion in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific needs of the companies.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of APAC BPHEs market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Brazed Plate Heat Exchangers Market