Pharmacy Automation Market: Growth, Size, Share, and Trends

Pharmacy Automation Market by Product (Automated Medication Dispensing & Storage Systems, Table-Top Counter, Retrieval Systems, Medication Compounding), End User (Inpatient, Outpatient, Retail, ASC), Facility (Large, Mid) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

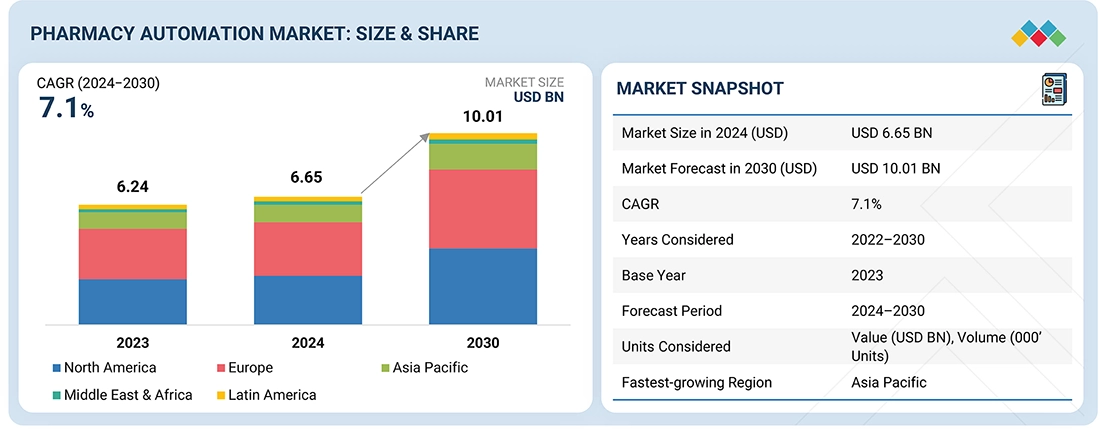

The pharmacy automation market is expected to reach USD 10.01 billion by 2030 from USD 6.65 billion in 2024, at a CAGR of 7.1% during forecast period from 2024 to 2030. The growing number of hospital admissions and the need for advanced healthcare solutions are the main factors propelling the demand for pharmacy automation market.

KEY TAKEAWAYS

-

By RegionThe North America pharmacy automation market accounted for a 47.8% revenue share in 2024.

-

By ProductBy product, the Automated Packaging and Labeling Systems segment is expected to register the highest CAGR of 7.6%.

-

By ComponentBy component, the Software segment is projected to grow at the fastest rate from 2024 to 2030.

-

By ApplicationBy application, the Centralized Operations segment is expected to dominate the market.

-

By Facility TypeBy facility type, the Small & mid-sized Pharmacies segment will grow the fastest during the forecast period.

-

By End UserBy end user, the Retail Pharmacies segment is expected grow at the highest CAGR of 8.2%.

The pharmacy automation market is witnessing steady growth, driven by the increasing incidence of chronic diseases, enhancing the need for effective and precise management of drugs. The requirement of efficient pharmacy operations to boost the efficiency of the workflow and cut down medication mistakes is further accelerating the usage of automation. Moreover, government initiatives and policies promoting digital health and automation are propelling market growth.

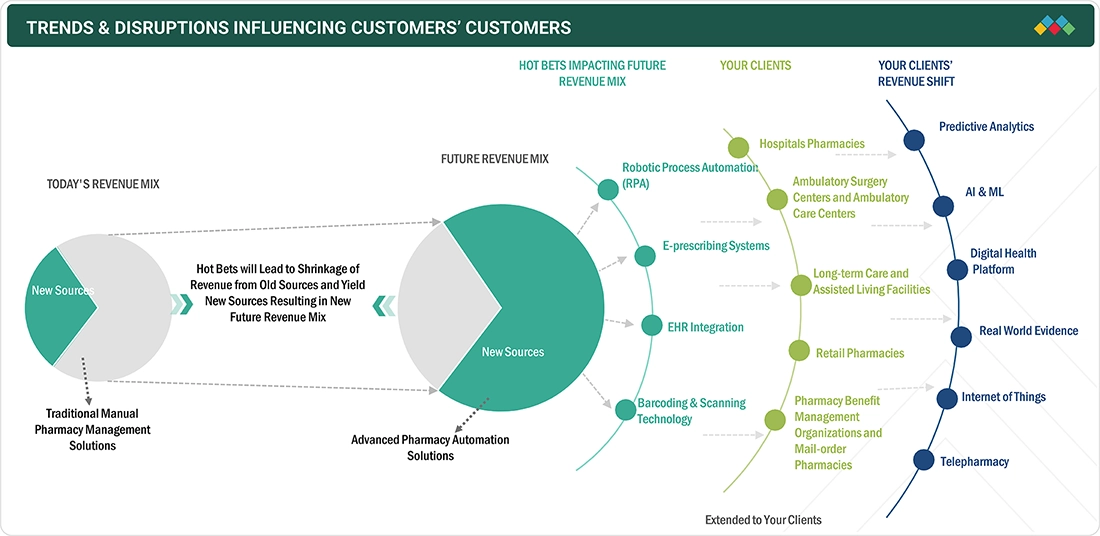

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Patients now expect faster, error-free, and personalized pharmacy services, fueling the need for automation in prescription fulfillment, remote medication management, and enhanced patient engagement. As consumer expectations evolve, pharmacies must adopt automated solutions to improve efficiency & service quality. Additionally, the shortage of qualified pharmacists and technicians further drive the demand for automation, as these systems handle repetitive tasks, allowing pharmacy staff to focus on patient care & clinical services. Emerging technologies, such as artificial intelligence, robotic dispensing, and IoT-enabled inventory tracking, are revolutionizing pharmacy operations by enabling real-time monitoring, predictive analytics, and seamless integration with healthcare systems, optimizing efficiency and regulatory compliance. Furthermore, strict regulatory requirements, including medication traceability and patient safety protocols, are pushing pharmacies to adopt automated systems that ensure compliance, operational transparency, and improved medication management.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing need to minimize medication errors

-

Decentralization of pharmacies

Level

-

High initial capital investments

-

Reluctance to adopt pharmacy automation systems

Level

-

Gradual shift to online pharmacy systems

-

Expansion of telepharmacy & remote patient management services

Level

-

Stringent regulatory process for automated pharmacy systems

-

Risk of cross-contamination

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing need to minimize medication errors

According to the National Coordinating Council for Medication Error Reporting and Prevention (NCC MERP), a medication error can be defined as any preventable event that may cause or lead to inappropriate medication use or patient harm while the medication is in the control of a healthcare professional, patient, or consumer. Medication errors and dispensing errors are recognized as leading causes of hospital readmission worldwide. Poor order communication between physicians and pharmacists, dangerous storage practices in pharmacies, and the confusion arising from similar labels and drug prescriptions during the preparation or dispensing of drugs or during drug administration are some key factors contributing to medication errors. In September 2022, the World Health Organization (WHO) highlighted the significant impact of medication errors within the European Region. In Europe, the rate of medication errors in hospitals varies, ranging from 0.3% to 9.1% in prescriptions and from 1.6% to 2.1% at the dispensing stage. Common contributing factors include environmental issues, staffing challenges, and workflow problems. Implementing electronic prescriptions, medication error surveillance, and barcode medication administration systems are identified as crucial strategies to reduce these errors. Additionally, the WHO highlighted that globally medication harm accounts for over half of the overall preventable harm in medical care, with an estimated annual cost of USD 4.63-22.4 billion (€4.5–21.8 billion) in Europe. Automated systems are considered as one of the most efficient solutions to minimize these errors. In the past, the successful implementation of automated dispensing cabinets (ADCs) and automated dispensing machines (ADMs) in hospitals has 0led to significant reductions in the number of dispensing and medication errors in hospitals. In April 2023, according to a study published in NCBI, following the adoption of ADCs, the rate of prescription errors dropped from 3.03 to 1.75 per 100,000 prescriptions, while dispensing errors decreased from 3.87 to 0 per 100,000 dispensations. These findings highlight the effectiveness of ADCs in enhancing medication safety, reducing human errors, and improving overall patient outcomes in critical care settings. Such advancements in medication management technology align with broader efforts to enhance patient safety and streamline healthcare workflows. Thus, to minimize medication and dispensing errors, governments in several countries are promoting the use of automated dispensing and medication tools in pharmacies and hospitals, thus leading to the higher adoption of pharmacy automation systems

Restraint: High initial capital investments

One of the biggest barriers to adopting pharmacy automation systems is the substantial upfront costs required for hardware, software, and facility modifications. Implementing automation technologies such as robotic dispensing systems, automated storage solutions, and AI-driven medication management requires significant capital investment, making it financially unfeasible for small & medium-sized pharmacies or healthcare facilities. Additionally, these systems require regular maintenance, software updates, and periodic upgrades, further increasing operational expenses. According to an article published in NCBI, the installation of automated dispensing cabinets in hospitals was priced at USD 34,000–39,000 (EUR 32,500 ± EUR 4,200), including equipment acquisition costs, installation costs, and initial savings (stock-value reductions and non-investment in traditional ward pharmacies). The approximate annual balance of USD 5,400–13,200 (EUR 8,622±3,564) included amortization and maintenance costs, human resources, medication, logistics, and safety savings. This was an estimated 3.8-year (min 2.7–max 6.4) time to recovery and an ROI of approximately USD 39,300 [EUR 36,476 (min EUR 7,964–max EUR 64,988)] after 8 years. Thus, the initial investments for installing automated dispensing systems is high, which is a significant factor restraining the market adoption on a global scale. Limitations of automation in handling specialized medications Automated dispensing systems find it challenging to manage certain medications, such as blood derivatives, cytotoxic drugs, and flammable medications. Many pharmacy robots and automated systems lack the flexibility to handle complex prescriptions that require special handling, refrigeration, or patient-specific customization. For instance, oncology drugs and biologic medications often have strict storage requirements, making for a challenging utilization through automated dispensing systems. Additionally, several compounded medications require manual preparation, making automation less effective in these cases. This limits the applicability of automation in specialty pharmacies, oncology centers, and compounding pharmacies, making full-scale automation difficult in certain healthcare settings. Moreover, pharmacies must comply with strict regulations for handling & storing certain drugs, which may not align with the capabilities of current automation systems. This limitation forces healthcare providers to rely on manual methods, reducing the overall efficiency gains offered by automation

Opportunity: Gradual shift to online pharmacy systems

The increasing shift toward online pharmacy services has created a significant demand for automated systems that enhance prescription fulfillment, verification, and delivery. E-pharmacy platforms have gained prominence due to their convenience, allowing patients to order medications remotely. This trend was further accelerated by the COVID-19 pandemic, leading to a surge in online medication orders and home deliveries. Automated systems play a critical role in streamlining online pharmacy operations by ensuring accurate prescription verification, reducing manual errors, and improving efficiency in dispensing. Additionally, automation solutions assist with secure packaging and labeling, minimizing the risk of medication mix-ups during transportation. For instance, in October 2024, Amazon Pharmacy aimed to launch pharmacies in 20 new US cities, doubling its Same-Day Delivery capabilities. Amazon aims to reduce medication delivery times and improve healthcare accessibility by leveraging advanced automation. By the end of 2025, nearly 45% of US customers will be eligible for Same-Day Delivery of their medications, enhancing patient adherence and engagement. Similarly, in January 2025, Walgreens opened its ninth automated micro-fulfillment center to enhance prescription filling efficiency and reduce pharmacist workloads, aiming to establish 22 such centers. Hence, such advancements in pharmacy automation are expected to improve medication accessibility, accuracy, and efficiency to enhance patient care and streamlined pharmacy operations

Challenge: Stringent regulatory process for automated pharmacy systems

The stringency of regulatory approvals depends on the class to which a particular device belongs; it may vary from one region to another. Several state boards of pharmacies (agencies of a state responsible for the control and regulation of the practice of a pharmacy and the licensing of pharmacists in the state) have different requirements for using automated dispensing devices (ADDs) in healthcare practices. Thus, manufacturers of automated systems for pharmacies must adhere to various regulations; ensuring such compliance is a tedious task and can delay product launches. Moreover, regulations differ across regions. For example, the US requires products to be FDA-approved, while European countries seek for a CE Mark; both approvals have different regulations that must be adhered to. Moreover, countries have intellectual property (IP) protection laws to protect domestic companies and are sometimes reluctant to allow foreign companies to launch their products in respective domestic markets. Thus, the varied stringency of regulations & procedures for product approval may hamper the growth of this market to a certain extent

Pharmacy Automation Systems Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Develops automated dispensing systems (e.g., BD Pyxis) for hospitals and retail pharmacies to manage medication storage, tracking, and dispensing. | Enhances medication safety, reduces dispensing errors, improves inventory control, and supports regulatory compliance. |

|

Provides end-to-end automated medication management solutions, including dispensing cabinets, robotic pharmacy systems, and cloud analytics platforms. | Increases pharmacy efficiency, reduces medication waste, improves patient safety, and enables data-driven medication management. |

|

Offers robotic and logistics automation systems for hospital pharmacies (e.g., PillPick, BoxPicker) to handle medication storage, packaging, and distribution. | Optimizes pharmacy workflows, lowers operational costs, minimizes manual handling, and ensures traceable medication delivery. |

|

Focuses on IV automation systems and compounding technologies (e.g., EXACTAMIX) for preparing sterile and customized IV solutions. | Improves accuracy and sterility in IV preparation, reduces compounding errors, and enhances patient safety and throughput. |

|

Provides medication management carts, automated dispensing systems, and workflow solutions for point-of-care environments. | Streamlines medication administration, supports mobile care delivery, enhances nurse efficiency, and reduces risk of medication errors. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The pharmacy automation ecosystem is a dynamic network of stakeholders, technologies, and regulatory bodies working together to enhance medication management, patient safety, and operational efficiency. At the core of this ecosystem are healthcare providers, including hospitals, retail pharmacies, long-term care facilities, and mail-order pharmacies, all of which rely on automation to streamline prescription fulfillment, improve inventory control, and ensure compliance with strict medication safety protocols. Technology vendors and solution providers play a crucial role by developing automated dispensing cabinets (ADCs), robotic prescription filling systems, RFID-enabled tracking solutions, and pharmacy management software (PMS) that integrate seamlessly with healthcare systems. Regulatory bodies, such as the Food and Drug Administration, Drug Enforcement Administration, and , European Medicines Agency, and other regional authorities, enforce guidelines on medication dispensing, controlled substance tracking, and data security, ensuring that automation technologies comply with legal and safety standards. Patients are also becoming active participants in this ecosystem, with mobile health applications, telepharmacy services, and digital prescription management platforms improving medication adherence and accessibility. A key driver of the ecosystem is interoperability, enabling pharmacy automation solutions to connect with electronic health records (EHRs), telehealth platforms, and predictive analytics tools, ensuring real-time monitoring and optimizing pharmacy operations. Additionally, big data analytics, AI-driven predictive models, and cloud-based automation systems are reshaping the industry by allowing pharmacies to forecast demand, reduce operational costs, and deliver personalized care. As pharmacy automation continues to evolve, the synergy between technology, healthcare providers, regulatory frameworks, and consumer engagement will play a critical role in advancing the future of medication management and patient-centered healthcare delivery

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Pharmacy Automation Market, By Product

In 2024, automated medication dispensing and storage systems accounted for the largest share of the pharmacy automation market. This dominance is attributed to the widespread adoption of automated dispensing cabinets (ADCs) and robotic dispensing systems across hospital and retail pharmacies. These solutions help minimize medication errors, streamline inventory management, and enhance workflow efficiency by ensuring accurate, real-time tracking of medication usage and stock levels. Growing emphasis on patient safety and regulatory compliance further supported the segment’s growth.

Pharmacy Automation Market, By Component

Based on components, the hardware segment dominated the market in 2024 due to the extensive deployment of physical dispensing units, robotic systems, automated storage modules, and packaging machines. The high cost and critical operational role of these systems in improving accuracy, reducing labor dependency, and optimizing inventory handling contributed significantly to their market share. Continuous upgrades in robotics, sensor integration, and barcode verification systems also reinforced hardware leadership in this segment.

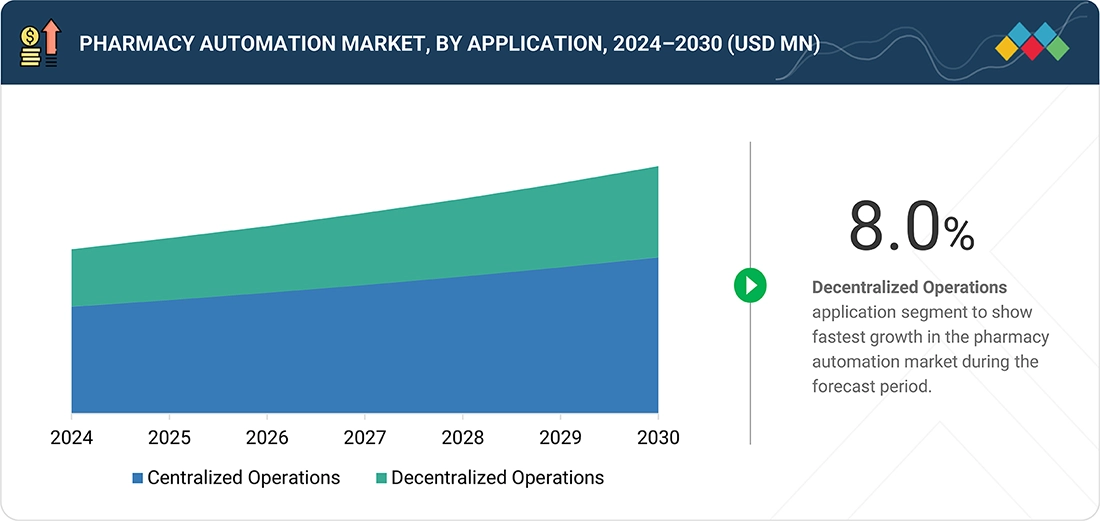

Pharmacy Automation Market, By Application

The centralized operations segment is expected to dominate the market owing to the increasing consolidation of pharmacy operations within healthcare networks and hospital systems. Centralized models enable bulk dispensing, centralized inventory management, and standardized medication preparation, leading to cost savings and improved operational control. The growing trend toward centralized compounding and refill centers further accelerates this shift.

Pharmacy Automation Market, By Facility Type

In 2024, large-scale facilities accounted for the largest market share by facility type due to their higher medication volumes, larger budgets for automation infrastructure, and greater focus on integrating end-to-end medication management solutions. These facilities often deploy multiple automated systems from dispensing robots to packaging and inventory platforms to improve throughput and ensure medication traceability.

Pharmacy Automation Market, By End User

In 2024, hospital pharmacies held the largest share of the pharmacy automation market, driven by rising patient volumes, increasing complexity of medication regimens, and the need for stringent safety and compliance standards. The growing adoption of ADCs, robotic compounding systems, and integrated medication management platforms in inpatient and outpatient hospital settings has significantly boosted automation uptake within this segment.

REGION

Asia Pacific to be fastest-growing region in global pharmacy automation market during forecast period

The Asia Pacific pharmacy automation market is expected to register the highest CAGR during the forecast period. The market is witnessing rapid growth due to following factors including the increasing healthcare spending, growing number of hospitalizations, and the rising need to minimize dispensing errors in pharmacies. Additionally, the presence of well-equipped hospitals and other healthcare facilities further drives the demand for and adoption of advanced solutions such as pharmacy automation systems in region. Medication errors are a leading cause of hospitalizations in Asia Pacific. According to a study published in the National Journal of Physiology, Pharmacy, and Pharmacology (NJPPP), in July 2023, highlighted a medication error rate of 36.11% in a tertiary care hospital in South India, emphasizing the pressing need for improved medication management. The study found that prescription errors accounted for 92.2% of all reported mistakes, followed by documentation errors (17.8%), dispensing errors (4.1%), and administration errors (3.3%). These findings underscore the importance of stricter medication protocols, enhanced pharmacy automation, and digital prescription systems to mitigate risks and improve patient safety in India and across the Asia Pacific region

Pharmacy Automation Systems Market: COMPANY EVALUATION MATRIX

In the pharmacy automtion market matrix, Omnicell (Star) leads with a strong and established product & service portfolio and a strong geographic and market presence. Oracle (Emerging Leader) has strong business strategies but weaker product & service offerings than other market players. While Omnicell dominates through scale and a diverse portfolio, Oracle shows significant potential to move toward the leaders’ quadrant as demand for automation continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 6.65 Billion |

| Market Forecast in 2030 (Value) | USD 10.01 Billion |

| Growth Rate | CAGR of 7.1% from 2024-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Billion), Volume (000' Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

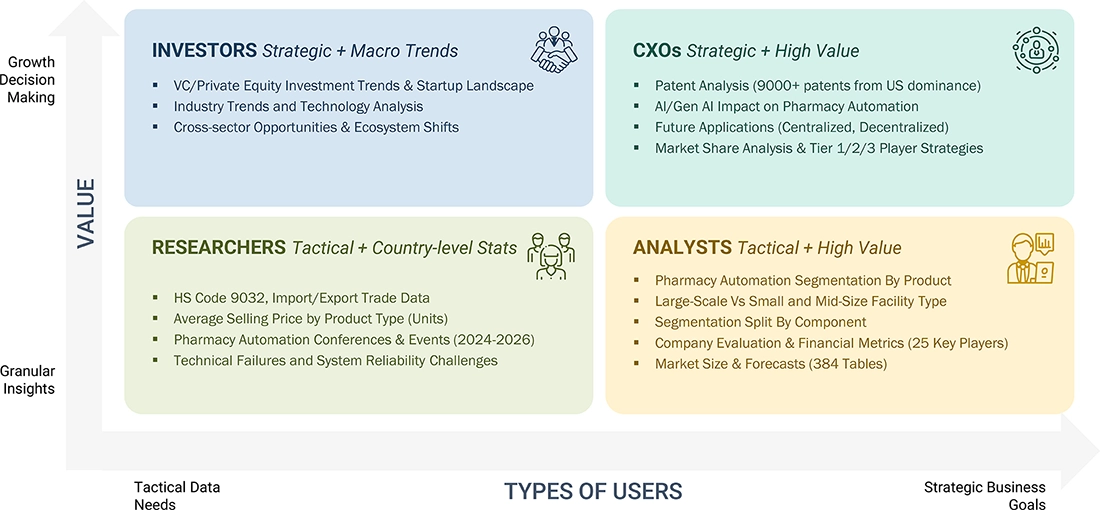

WHAT IS IN IT FOR YOU: Pharmacy Automation Systems Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Low-cost automation for high-volume retail pharmacies | Lightweight, modular dispensing units and retrofit kits for existing counters | Faster ROI for small retailers; lowers entry barrier to automation |

| Multilingual UI and local regulatory compliance | Localized software (multi language), configurable regulatory workflows and reporting templates for country-level audits | Faster deployment, fewer compliance gaps, better staff adoption |

| Cold-chain & specialty medication handling (vaccines, biologics) | Integrated temperature-monitoring, alarmed cold-storage modules and temperature-logged dispensing workflows | Ensures cold-chain integrity, reduces spoilage, supports specialty drug requirements |

| Multi-site centralised management across hospitals & community pharmacies | Cloud-enabled central dashboard with role-based access, remote monitoring, and centralized inventory optimization | Consolidated visibility, lower stock levels, faster replenishment across network |

| Limited IT resources and intermittent connectivity in tier-2/3 locations | Hybrid on-premise + offline-first software with scheduled sync and lightweight edge controllers | Continuous operations during outages; simplified IT footprint and lower maintenance needs |

RECENT DEVELOPMENTS

- December 2024 : BD and Swisslog Healthcare partnered to improve hospital pharmacy operations by integrating Swisslog's robotic medication management systems with BD Pyxis Logistics software. This partnership aimed to streamline inventory tracking and automate workflows, enhancing efficiency across hospital systems with multiple storage and dispensing points. The solution targets centralized service centers handling large medication volumes, offering improved visibility, reduced blind spots, and optimized performance

- December 2024 : Omnicell collaborated with Gollmann Kommissioniersysteme GmbH (Gollmann) to integrate Gollmann's advanced robotic storage and dispensing solutions into Omnicell’s retail and central pharmacy offerings. The collaboration aimed to streamline medication management workflows, enhance efficiency, and improve patient outcomes.

- May 2024 : Swisslog Healthcare introduced the ezCUT Automated Tablet Cutter to the North American market. Developed in collaboration with JVM Manufacturing, ezCUT automates the cutting of oral solid medications for half-strength prescriptions, aiming to enhance dosing accuracy and reduce manual workload in pharmacies.

- COLUMN 'A' SHOULD BE IN TEXT FORMAT AND NOT DATE FORMAT :

Table of Contents

Methodology

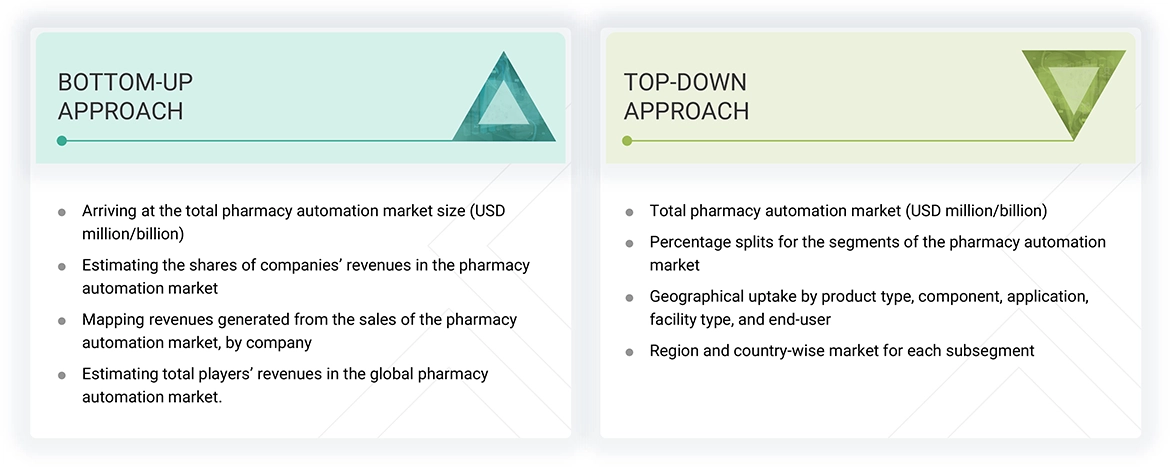

The study involved major activities in estimating the current market size for the pharmacy automation market. Exhaustive secondary research was done to collect information on the pharmacy automation industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the pharmacy automation market.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to in order to identify and collect information for the study of pharmacy automation market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

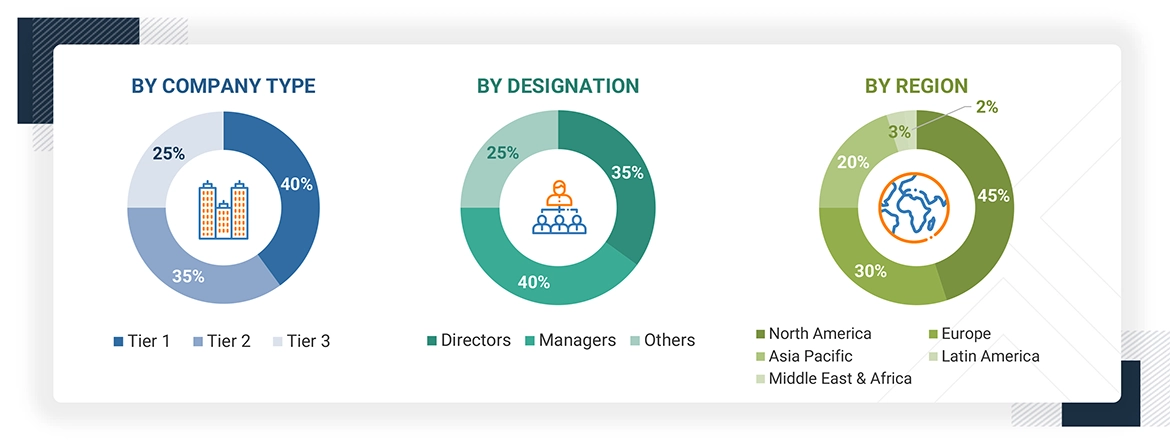

Extensive primary research was conducted after acquiring basic knowledge about the global pharmacy automation market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand side (Hospital directors, Hospital Vice Presidents, Department heads, and Critical care specialists ) and supply side (such as C-level and D-level executives, technology experts, product managers, marketing and sales managers, among others) across five major regions—North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews

The following is a breakdown of the primary respondents:

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tiers of companies are defined on the basis of their total revenues in 2023. Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the pharmacy automation market. These methods were also used extensively to estimate the size of various subsegments in the market.

The research methodology used to estimate the market size includes the following:

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the pharmacy automation market.

Market Definition

Pharmacy automation is the usage of technology and automated systems to manage several pharmacy operations, including medication packaging, dispensing, prescription processing, labeling, storage, and inventory management, among others. These technologies aim to boost efficiency, minimize human errors, enhance medication safety, and improve workflow in hospitals, pharmacies, and healthcare facilities.

Stakeholders

- Pharmacy Automation Devices Manufacturers

- Suppliers and Distributors of Pharmacy Automation Devices

- AI Providers

- Pharmacy Automation Software Provider

- Healthcare IT Service Providers

- Hospital Pharmacies, Ambulatory Surgery Center (ASC), Ambulatory Care Center (ACC), and Other Outpatient Settings, Long-Term Care Facilities & Assisted Living Facilities, Retail Pharmacies, and Pharmacy Benefit Management Organization and Mail-Order Pharmacies

- Venture Capitalists

- Government Bodies/Regulatory Bodies

- Corporate Entities

- Accountable Care Organizations

- Pharmacy Automation Resource Centers

- Research and Consulting Firms

- Medical Research Institutes

- Clinical Departments

Report Objectives

- To define, describe, and forecast the global pharmacy automation market based on product type, component, application, facility type, end-user, and region.

- To provide detailed information regarding the major factors (such as drivers, restraints, opportunities, and challenges) influencing the market growth.

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall pharmacy automation market.

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To strategically analyze the market structure profile of the key players of the pharmacy automation market and comprehensively analyze their core competencies.

- To forecast the size of the market segments with respect to five regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

- To track and analyze competitive developments such as product launches and enhancements and investments, partnerships, collaborations, acquisitions, expansions, funding, grant, agreements, sales contracts, product testing, FDA approval, product approval, and alliances in the pharmacy automation market during the forecast period.

Key Questions Addressed by the Report

- Robots/robotic automated dispensing system

- Carousels

- Automated dispensing cabinets

- The report contains the following end user segments.

-

Hospital Pharmacies

- Inpatient

- Outpatient

- Ambulatory Surgery Center (ASC), Ambulatory Care Center (ACC), and Other Outpatient Settings

- Long-Term Care Facilities & Assisted Living Facilities

- Retail Pharmacies

- Pharmacy Benefit Management Organization and Mail-Order Pharmacies

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Pharmacy Automation Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Pharmacy Automation Market