Central Fill Pharmacy Automation Market by Product (Equipment (Medication Dispensing System, Automated Medication Compounding Systems, Workflow Management), Service (Process Optimization, Facility Design), Software), Vendor - Global Forecast to 2024

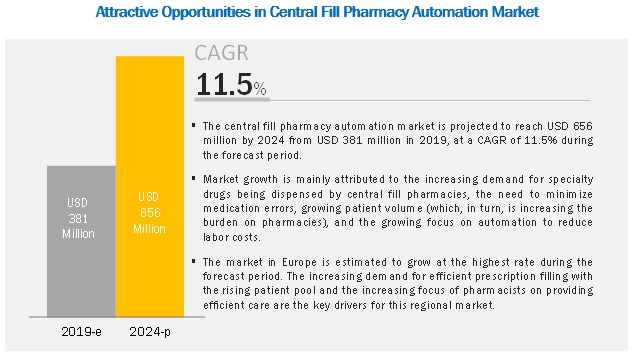

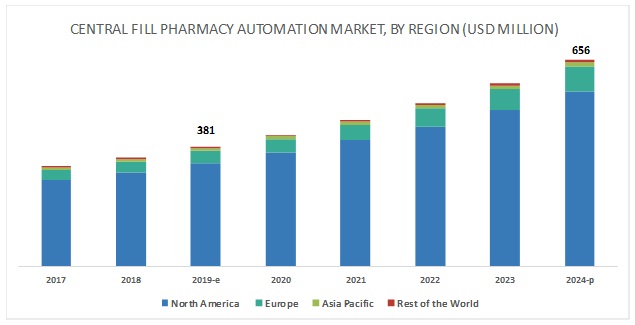

[129 Pages Report] The central fill pharmacy automation market is projected to reach USD 656 million by 2024 from USD 381 million in 2019, at a CAGR of 11.5%. The increasing demand for specialty drugs being dispensed by central fill pharmacies is one of the primary drivers propelling the growth of this market.

The equipment segment is expected to account for the largest share of the central fill pharmacy automation market, by product & service, in 2018

By product and service, the market is segmented by equipment, services, and software. The equipment segment is expected to account for the largest share of the market in 2018. The equipment segment is further segmented into integrated workflow Process Automation systems, automated medication dispensing systems, automated packaging and labeling systems, automated tabletop counters, automated medication compounding systems, automated storage and retrieval systems, and other automated systems for tracking, tablet splitting, and filling. In 2018, the automated medication dispensing systems segment accounted for the largest share of the central fill pharmacy automation equipment market.

Equipment vendors segment to dominate the central fill pharmacy automation market

Based on the vendor, the market is segmented into equipment vendors and consulting vendors. The equipment vendors segment is estimated to account for the largest market share in 2018. The large share of the equipment vendors segment can be attributed to the wide range of products offered by them, vast geographic presence, strong technical expertise, and access to spare parts (resulting in reduced downtime). Also, these vendors offer the equipment, services, and software under one roof, making them the preferred choice among customers.

The Europe market is expected to grow at the highest CAGR during the forecast period

The global central fill pharmacy automation industry in Europe is expected to grow at the highest CAGR during the forecast period. The Europe region is currently under-penetrated with respect to the number of central fill facilities. Countries such as the UK are adopting the central fill pharmacy model which will aid market growth in the coming years. Furthermore, the increasing demand for efficient prescription filling with the rising patient pool and the increasing focus of pharmacists on providing efficient patient care are key factors supporting the growth of the market.

Key Market Players

Prominent players in the central fill pharmacy automation market are ARxIUM, Inc. (US), RxSafe, LLC (US), TCGRX Pharmacy Workflow Solutions (US), Omnicell, Inc. (US), McKesson Corporation (US), ScriptPro (US), Kuka AG (Germany), Innovation (US), R/X Automation Solutions (US), Tension Packaging & Automation (US), Cornerstone Automation Systems, LLC (CASI, US), and QMSI (US).

Please visit 360Quadrants to see the vendor listing of Best Pharmacy Management Systems Quadrant

McKesson Corporation is a leading player in the central fill pharmacy automation market. The company offers products such as drug dispensing systems along with pharmacy management software solutions in this market. McKesson’s high volume solutions offer better operational efficiency to healthcare facilities and also allow the company to customize solutions as per the requirement of different healthcare facilities. The company offers a wide range of services for centralized facilities such as consulting, setting-up, and integrating services, among others.

The company reaches its customers through its wide network of distributors and sales offices located across the globe. This vast geographical presence of the company helps it maintain its position at the global level. McKesson focuses on partnering with payers, hospitals, pharmacies, pharmaceutical companies, and other organizations across the spectrum of care to deliver better care to patients in every setting. The company also focuses on innovation in existing products and solutions as a key strategy to enhance its market standing. While McKesson is a well-established company in the US and Canadian markets, it will benefit by increasing its presence in the European region.

Scope of the Report:

|

Report Metric |

Details |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Product and Service, Vendor, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Rest of the World |

|

Companies covered |

ARxIUM, Inc. (US), RxSafe, LLC (US), TCGRX Pharmacy Workflow Solutions (US), Omnicell, Inc. (US), ScriptPro (US), Kuka AG (Germany), Innovation (US), R/X Automation Solutions (US), Tension Packaging & Automation (US), McKesson Corporation (US), Cornerstone Automation Systems, LLC (CASI, US), and QMSI (US) |

The research report categorizes the market into the following segments and subsegments:

Central Fill Pharmacy Automation Market, by Product and Service

-

Equipment

- Automated Medication Dispensing System

- Integrated Workflow Automation Systems

- Automated Packaging and Labeling Systems

- Automated Table Top Counters

- Automated Medication Compounding Systems

- Automated Storage and retrieval Systems

- Other Automated Systems

- Software

-

Services

- Consulting

- Workflow and process optimization

- Facility Designing

- Custom Software Development

- Other Services (Licensing, Inventory Management, Turnkey System Manufacturing, Staffing)

Central Fill Pharmacy Automation Market, by Vendor

- Equipment Vendors

- Consulting Vendors

Central Fill Pharmacy Automation Market, by Region

- North America

- US

- Canada

- Europe

- Asia Pacific

- Rest of the World

Recent Developments

- In 2018, TCGRx acquired Parata Systems, to expand the company’s existing growth initiatives with central fill, inventory control, and automated blister card packaging technologies.

- In 2018, ARxIUM, Inc., launched cGMP RIVA IV Compounding system for 503B facilities.

- In 2018, Swisslog Healthcare acquired Talyst Systems, LLC. With the aim of expanding Swisslog’s inpatient and outpatient pharmacy solutions along with the company’s field service network.

Critical questions answered in the report:

- How will the current technological trends affect the central fill pharmacy automation market in the long term?

- How is the service market for central fill pharmacy automation market moving?

- Which regions are likely to grow at the highest CAGR?

- What are the growth strategies being implemented by major market players?

- Which are the vendors that offer their product and services for the central fill pharmacy automation market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

1.6 Limitations

2 Research Methodology (Page No. - 16)

2.1 Research Approach

2.1.1 Secondary Research

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Research

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Break Down of Primaries

2.1.2.3 Key Industry Insights

2.2 Market Size Estimation

2.3 Data Triangulation Approach

2.4 Market Share Estimation

2.5 Assumptions for the Study

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Central Fill Pharmacy Automation: Market Overview

4.2 Central Fill Pharmacy Automation Market: Geographic Growth Opportunities

4.3 Regional Mix: Central Fill Pharmacy Automation Market (2019–2024)

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Market Drivers

5.2.1.1 Increasing Specialty Drug Dispensing

5.2.1.2 Growing Need to Minimize Medication Errors

5.2.1.3 Rising Patient Pool

5.2.1.4 Growing Focus on Automation to Reduce Labor Costs

5.2.2 Market Restraints

5.2.2.1 High Initial Capital Investments

5.2.3 Market Opportunities

5.2.3.1 Untapped Emerging Markets

5.2.4 Market Challenges

5.2.4.1 Logistical Challenges

5.3 Market Trend

5.3.1 Multichannel Communication

5.4 Regulatory Landscape

6 Central Fill Pharmacy Automation Market, By Product & Service (Page No. - 37)

6.1 Introduction

6.2 Equipment

6.2.1 Automated Medication Dispensing Systems

6.2.1.1 Automated Medication Dispensing Systems Dispense Thousands of Prescriptions Per Hour, Utilizing Point-Of-Dispense Barcode Scanning

6.2.2 Integrated Workflow Automation Systems

6.2.2.1 Integrated Workflow Automation Systems are Used in the Designing, Automation, and Execution of Specific Tasks Which Require A Set Pattern That is Automated By Software

6.2.3 Automated Packaging and Labeling Systems

6.2.3.1 Automated Packaging and Labeling Systems are Used to Improve the Dispensing Process

6.2.4 Automated Tabletop Counters

6.2.4.1 Automated Tabletop Counters Have Pre-Programmed Protocols That Reduce the Chances of Error

6.2.5 Automated Medication Compounding Systems

6.2.5.1 Automated Medication Compounding Systems Reduce the Cost-Per-Dose of Medication and the Need for Medication Outsourcing

6.2.6 Automated Storage and Retrieval Systems

6.2.6.1 Rising Focus on Reducing the Time and Cost Involved in Functions Related to the Storage and Retrieval of Medications in Pharmacies to Drive Market Growth

6.2.7 Other Automated Systems

6.3 Software

6.3.1 Software Solutions Automate the Inventory Ordering, Receiving, Stocking, Picking, and Verification Processes By Integrating All the Systems in A Particular Central Fill Facility

6.4 Services

6.4.1 Consulting

6.4.1.1 Consulting Services Segment Accounted for the Largest Share of the Central Fill Pharmacy Automation Services Market in 2018

6.4.2 Workflow & Process Optimization

6.4.2.1 Companies Provide This Service on the Fee for Service Model and Also Offer Multi-Level Training to the Pharmacy Staff in Order to Ensure Maximum Efficiency of the Workflow

6.4.3 Facility Designing

6.4.3.1 A Good Facility Design Helps Optimize the Workflow By Eliminating Unnecessary Steps

6.4.4 Custom Software Development

6.4.4.1 High Cost of Developing and Integrating These Software Solutions May Hinder Market Growth to A Certain Extent

6.4.5 Other Services (Licensing, Inventory Management, Turnkey System Manufacturing, Staffing)

7 Central Fill Pharmacy Automation Market, By Vendor (Page No. - 58)

7.1 Introduction

7.2 Equipment Vendors

7.2.1 Equipment Vendors Dominated the Market in 2018

7.3 Consulting Vendors

7.3.1 Need for Dedicated Consulting to Start A Central Fill Facility to Aid Market Growth

8 Central Fill Pharmacy Automation Market, By Region (Page No. - 62)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.1.1 Increasing Specialty Drug Dispensing is A Major Growth Factor for the Market

8.2.2 Canada

8.2.2.1 The Country is Adopting Centralized Medication Dispensing to Minimize Medication Errors

8.3 Europe

8.3.1 European Market to Grow at the Highest Rate During the Forecast Period

8.4 Asia Pacific

8.4.1 Currently Under-Penetrated, the APAC Market to Provide Potential Growth Opportunities in the Coming Years

8.5 Rest of the World

8.5.1 Government Efforts Towards Increasing the Accessibility and Affordability of Healthcare Services to Aid Market Growth

9 Competitive Landscape (Page No. - 82)

9.1 Overview

9.2 Market Share Analysis

9.3 Competitive Situation and Trends

9.3.1 Product & Services Launches

9.3.2 Expansions

9.3.3 Acquisitions

9.3.4 Agreements and Partnerships

10 Company Profiles (Page No. - 90)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

10.1 Mckesson Corporation

10.2 Omnicell, Inc.

10.3 Arxium, Inc.

10.4 Innovation

10.5 Scriptpro LLC

10.6 Tcgrx Pharmacy Workflow Solutions

10.7 Rxsafe, LLC.

10.8 Kuka AG

10.9 Tension Packaging & Automation

10.10 R/X Automation Solutions

10.11 Cornerstone Automation Systems, LLC. (CASI)

10.12 Quality Manufacturing Systems, Inc. (QMSI)

*Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 121)

11.1 Insights of Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (60 Tables)

Table 1 Market Dynamics: Impact Analysis

Table 2 Central Fill Pharmacy Automation Market, By Product & Service, 2017–2024 (USD Million)

Table 3 Central Fill Pharmacy Automation Market, By Region, 2017–2024 (USD Million)

Table 4 Central Fill Pharmacy Automation Equipment Market, By Type, 2017–2024 (USD Million)

Table 5 Central Fill Pharmacy Automation Equipment Market, By Region, 2017–2024 (USD Million)

Table 6 Popular Automated Medication Dispensing Systems Available in the Market

Table 7 Automated Medication Dispensing Systems Market, By Region, 2017–2024 (USD Million)

Table 8 Popular Integrated Workflow Automated Systems Available in the Market

Table 9 Integrated Workflow Automation Systems Market, By Region, 2017–2024 (USD Million)

Table 10 Popular Automated Packaging & Labeling Systems Available in the Market

Table 11 Automated Packaging & Labeling Systems Market, By Region, 2017–2024 (USD Million)

Table 12 Popular Automated Tabletop Counters Available in the Market

Table 13 Automated Tabletop Counters Market, By Region, 2017–2024 (USD Million)

Table 14 Popular Automated Medication Compounding Systems Available in the Market

Table 15 Automated Medication Compounding Systems Market, By Region, 2017–2024 (USD Million)

Table 16 Popular Automated Storage & Retrieval Systems Available in the Market

Table 17 Automated Storage & Retrieval Systems Market, By Region, 2017–2024 (USD Million)

Table 18 Other Automated Systems Market, By Region, 2017–2024 (USD Million)

Table 19 Central Fill Pharmacy Automation Software Market, By Region, 2017–2024 (USD Million)

Table 20 Central Fill Pharmacy Automation Services Market, By Type, 2017–2024 (USD Million)

Table 21 Central Fill Pharmacy Automation Services Market, By Region, 2017–2024 (USD Million)

Table 22 Consulting Services Market, By Region, 2017–2024 (USD Million)

Table 23 Workflow & Process Optimization Services Market, By Region, 2017–2024 (USD Million)

Table 24 Facility Designing Services Market, By Region, 2017–2024 (USD Million)

Table 25 Custom Software Development Services Market, By Region, 2017–2024 (USD Million)

Table 26 Other Central Fill Pharmacy Automation Services Market, By Region, 2017–2024 (USD Million)

Table 27 Central Fill Pharmacy Automation Market, By Vendor, 2017–2024 (USD Million)

Table 28 Central Fill Pharmacy Automation Market for Equipment Vendors, By Region, 2017–2024 (USD Million)

Table 29 Central Fill Pharmacy Automation Market for Consulting Vendors, By Region, 2017–2024 (USD Million)

Table 30 Central Fill Pharmacy Automation Market, By Region, 2017–2024 (USD Million)

Table 31 North America: Central Fill Pharmacy Automation Market, By Country, 2017–2024 (USD Million)

Table 32 North America: Central Fill Pharmacy Automation Market, By Product & Service, 2017–2024 (USD Million)

Table 33 North America: Central Fill Pharmacy Automation Equipment Market, By Type, 2017–2024 (USD Million)

Table 34 North America: Central Fill Pharmacy Automation Services Market, By Type, 2017–2024 (USD Million)

Table 35 North America: Central Fill Pharmacy Automation Market, By Vendor, 2017–2024 (USD Million)

Table 36 US: Central Fill Pharmacy Automation Market, By Product & Service, 2017–2024 (USD Million)

Table 37 US: Central Fill Pharmacy Automation Equipment Market, By Type, 2017–2024 (USD Million)

Table 38 US: Central Fill Pharmacy Automation Services Market, By Type, 2017–2024 (USD Million)

Table 39 US: Central Fill Pharmacy Automation Market, By Vendor, 2017–2024 (USD Million)

Table 40 Canada: Central Fill Pharmacy Automation Market, By Product & Service, 2017–2024 (USD Million)

Table 41 Canada: Central Fill Pharmacy Automation Equipment Market, By Type, 2017–2024 (USD Million)

Table 42 Canada: Central Fill Pharmacy Automation Services Market, By Type, 2017–2024 (USD Million)

Table 43 Canada: Central Fill Pharmacy Automation Market, By Vendor, 2017–2024 (USD Million)

Table 44 Europe: Central Fill Pharmacy Automation Market, By Product & Service, 2017–2024 (USD Million)

Table 45 Europe: Central Fill Pharmacy Automation Equipment Market, By Type, 2017–2024 (USD Million)

Table 46 Europe: Central Fill Pharmacy Automation Services Market, By Type, 2017–2024 (USD Million)

Table 47 Europe: Central Fill Pharmacy Automation Market, By Vendor, 2017–2024 (USD Million)

Table 48 Asia Pacific: Central Fill Pharmacy Automation Market, By Product & Service, 2017–2024 (USD Million)

Table 49 Asia Pacific: Central Fill Pharmacy Automation Equipment Market, By Type, 2017–2024 (USD Million)

Table 50 Asia Pacific: Central Fill Pharmacy Automation Services Market, By Type, 2017–2024 (USD Million)

Table 51 Asia Pacific: Central Fill Pharmacy Automation Market, By Vendor, 2017–2024 (USD Million)

Table 52 RoW: Central Fill Pharmacy Automation Market, By Product & Service, 2017–2024 (USD Million)

Table 53 RoW: Central Fill Pharmacy Automation Equipment Market, By Type, 2017–2024 (USD Million)

Table 54 RoW: Central Fill Pharmacy Automation Services Market, By Type, 2017–2024 (USD Million)

Table 55 RoW: Central Fill Pharmacy Automation Market, By Vendor, 2017–2024 (USD Million)

Table 56 Central Fill Pharmacy Automation Market Share, By Key Player, 2018

Table 57 Product and Service Launches, 2016–2018

Table 58 Expansions, 2016–2018

Table 59 Acquisitions, 2016–2018

Table 60 Agreements and Partnerships, 2016–2018

List of Figures (24 Figures)

Figure 1 Central Fill Pharmacy Automation Market

Figure 2 Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designations, and Region

Figure 4 Bottom-Up Approach

Figure 5 Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 Central Fill Pharmacy Automation Market, By Product & Service, 2019 vs 2024 (USD Million)

Figure 8 Central Fill Pharmacy Automation Equipment Market, By Type, 2019 vs 2024 (USD Million)

Figure 9 Central Fill Pharmacy Automation Services Market, By Type, 2019 vs 2024 (USD Million)

Figure 10 Central Fill Pharmacy Automation Market, By Vendor, 2019 vs 2024 (USD Million)

Figure 11 Geographical Snapshot of the Central Fill Pharmacy Automation Market

Figure 12 Increasing Specialty Drug Dispensing Through Centralized Facilities to Drive Market Growth

Figure 13 US Dominated the Central Fill Pharmacy Automation Market in 2018

Figure 14 Europe to Register the Highest Growth Rate During the Forecast Period (2019–2024)

Figure 15 Projected Growth in the Geriatric Population, 2010 vs 2015 vs 2030

Figure 16 Equipment Segment to Dominate the Central Fill Pharmacy Automation Products & Services Market During the Forecast Period

Figure 17 Integrated Workflow Automation Systems Segment to Witness the Highest Growth During the Forecast Period

Figure 18 Equipment Vendors Segment Will Continue to Dominate the Central Fill Pharmacy Automation Market During the Forecast Period

Figure 19 North America: Central Fill Pharmacy Automation Market Snapshot

Figure 20 Declining Pharmacy Funding in England (2006–2015)

Figure 21 Product Launches—Key Growth Strategy Adopted By Market Players From 2016 to March 2019

Figure 22 Mckesson Corporation: Company Snapshot (2018)

Figure 23 Omnicell, Inc.: Company Snapshot (2018)

Figure 24 Kuka AG: Company Snapshot (2018)

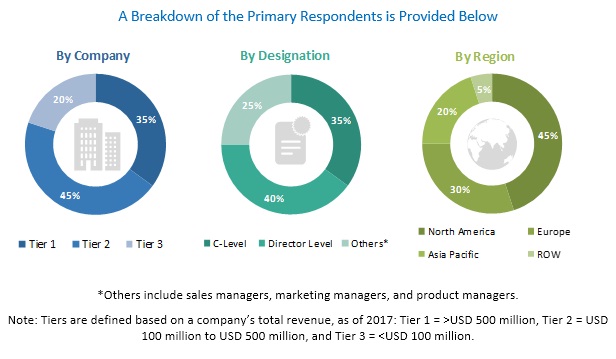

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the central fill pharmacy automation market. It was also used to obtain important information about the key players and market classification, and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as pharmacy automation instrument manufacturers, service providers, software developers, distributors, and related key executives from various key companies and organizations operating in the central fill pharmacy automation market. The primary sources from the demand side included industry experts from central fill pharmacy facilities. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (segmental analysis of major segments) and top-down approach (assessment of utilization/adoption/penetration trends, by product & service, by vendor, and by region).

Data Triangulation

After arriving at the market size, the central fill pharmacy automation was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable.

Objectives of the Study

- To define, describe, segment, and forecast the central fill pharmacy automation market by product and service, vendor, and region

- To provide detailed information about the factors influencing market growth (such as drivers, restraints, opportunities, and industry-specific challenges)

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the central fill pharmacy automation market in four main regions—North America, Europe, Asia Pacific, and the Rest of the World

- To profile key players in the central fill pharmacy automation market and comprehensively analyze their core competencies2 and market shares

- To track and analyze competitive developments such as acquisitions, product launches, expansions, collaborations, and partnerships of the leading players in the central fill pharmacy automation market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Central Fill Pharmacy Automation Market