Personal Care Ingredients Market

Personal Care Ingredients Market by Ingredient Type (Emollients, Surfactants, Rheology Modifiers, Emulsifiers, Conditioning Polymers), Application (Skin Care, Hair Care, Oral Care, Makeup), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

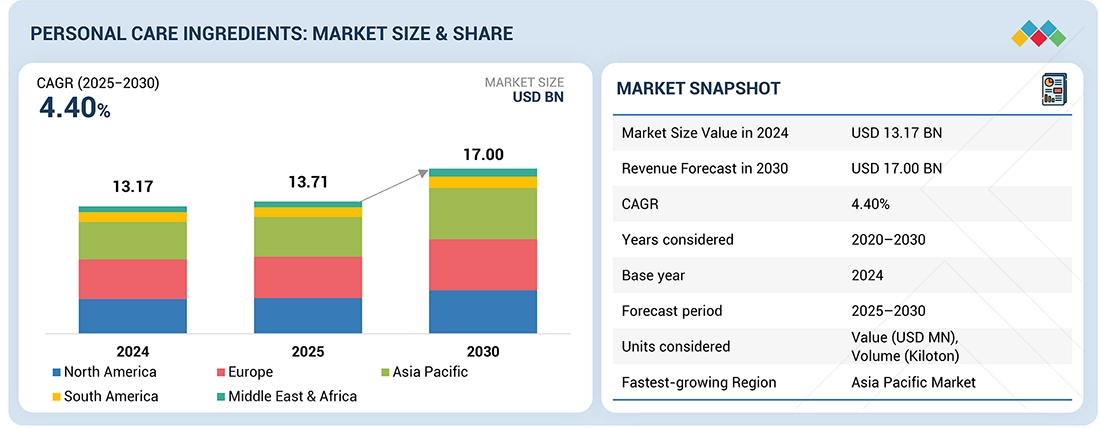

The personal care ingredients market is estimated to grow from USD 13.17 billion in 2024 to USD 17.00 billion by 2030, at a CAGR of 4.40%. .Personal care ingredients comprise emollients, surfactants, emulsifiers, rheology modifiers, conditioning polymers, UV filters, and active ingredients used in the formulation of skincare, hair care, oral care, and cosmetic products. These ingredients play a crucial role in enhancing texture, stability, efficacy, and sensory appeal of finished products. Market growth is driven by rising consumer awareness toward hygiene, self-care, and sustainable beauty, along with the growing demand for naturally derived and bio-based ingredients.

KEY TAKEAWAYS

-

BY INGREDIENT TYPEThe personal care ingredients market is segmented into conditioning polymers, surfactants, emollients, rheology modifiers, emulsifiers, and others. Emollients dominate due to their extensive use in moisturizers, lotions, and creams for providing hydration and smooth texture. Surfactants and conditioning polymers are gaining traction in hair care and cleansing products, while emulsifiers and rheology modifiers are increasingly used to improve formulation stability, consistency, and sensory feel.

-

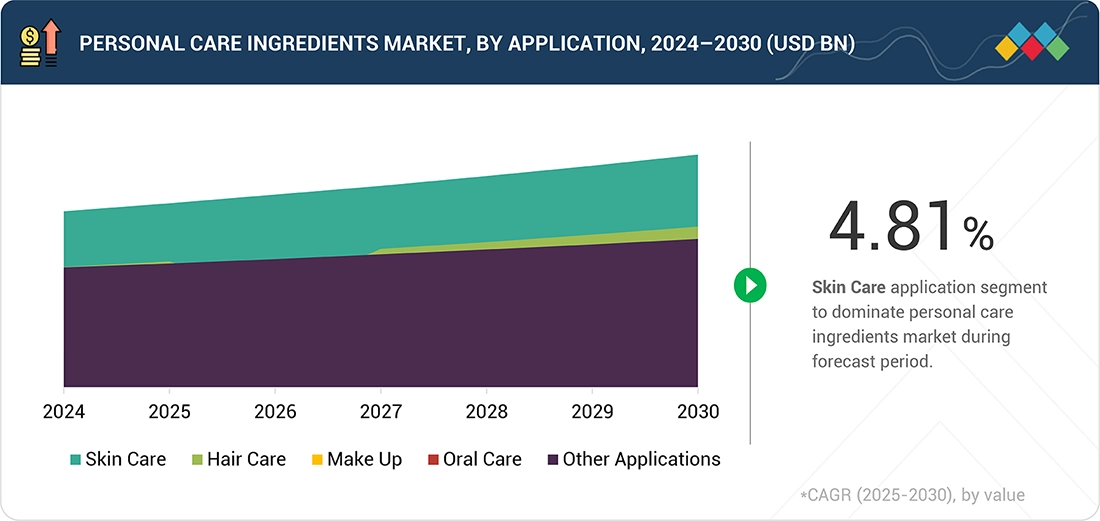

BY APPLICATIONKey applications include skin care, hair care, make-up, oral care, and others. Skincare leads the market, driven by strong demand for anti-aging, brightening, and moisturizing formulations. Hair care follows closely, supported by rising use of actives such as ceramides, peptides, and botanical extracts. The make-up segment is evolving toward hybrid cosmetic products infused with skincare actives, while oral care benefits from natural and bio-based ingredient innovations.

-

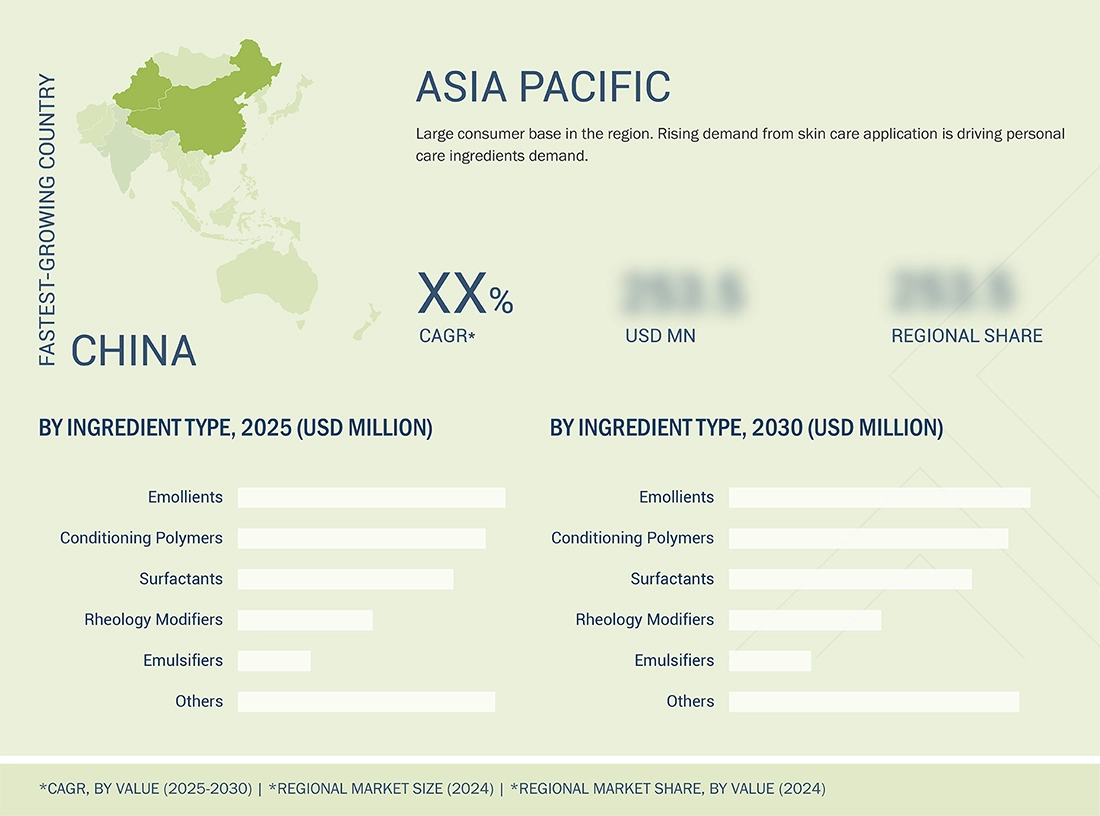

BY REGIONAsia Pacific is projected to be the fastest-growing region, registering a CAGR of 5.06%, driven by increasing disposable income, rapid urbanization, and strong consumer demand for affordable and premium personal care products in China, India, Japan, and South Korea.

-

COMPETITIVE LANDSCAPELeading market participants focus on both organic and inorganic growth strategies, including partnerships, acquisitions, and new product developments. Major players such as BASF SE, Croda International Plc, Dow Inc., Syensqo SA/NV, Ashland Global, and Clariant AG are expanding their sustainable and naturally derived ingredient portfolios to meet the growing demand for clean-label and high-performance formulations across personal care applications.

The Personal Care Ingredients Market is projected to witness steady growth over the coming years, driven by increasing consumer focus on hygiene, self-care, and clean beauty trends. With the growing shift toward sustainable, multifunctional, and bio-based ingredients, the market is expected to gain significant traction across skincare, hair care, oral care, and cosmetic applications. Advancements in green chemistry, active delivery systems, and natural substitutes are reinforcing the role of personal care ingredients as essential enablers of performance, efficacy, and sensory enhancement in finished formulations.

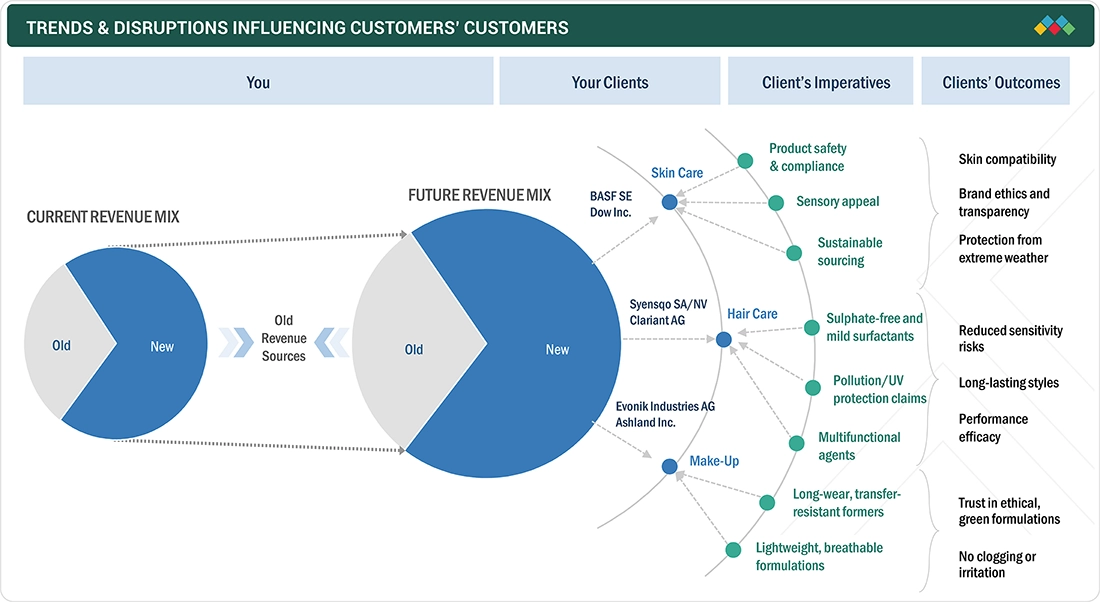

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ business emerges from customer trends or disruptions. Skincare, hair care, make-up, and oral care brands are key clients relying on ingredients like emollients, surfactants, and actives. Rising demand for clean beauty, sustainable, and multifunctional formulations is reshaping end-user product strategies, directly influencing ingredient demand and revenue patterns. As brands prioritize eco-friendly and high-performance solutions, ingredient suppliers are adapting portfolios to align with sustainability and innovation-driven growth.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Changing lifestyles and increasing purchasing power of consumers in developing countries

-

Rapid growth of multifunctional personal care ingredients industry

Level

-

Government-led regulations pertaining to cosmetics

Level

-

High market potential in emerging economies

-

Shifting demand toward sustainable and bio-based products

Level

-

Toxicity of some personal care ingredients

-

Volatility in raw material prices

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid growth of multifunctional personal care ingredients industry

The multifunctional personal care ingredients sector is experiencing significant growth, driven by evolving consumer preferences and an expanding range of applications. Key ingredients within this market include surfactants, rheology modifiers, emulsifiers, and emollients. Surfactants play a critical role in formulations for skin care, hair care, ointments, gels, creams, and a broad spectrum of cosmetic products. Historically, their primary applications were limited to soaps and shampoos. However, their utilization is now expanding into various cosmetic products, such as cold creams and lotions. This shift reflects the industry’s responsiveness to contemporary consumer demands.

Restraints: Governmental regulations against cosmetic products

Personal care products are subject to regulation by various government entities across the globe. While these regulatory frameworks differ by country, they share a common objective: ensuring personal care products’ safety and accurate labeling. The European Commission Cosmetics Directive (ECCD) and various state agencies have established rigorous standards governing the manufacturing and application of these products. In China, the regulations imposed by the China Food and Drug Administration (CFDA) prohibit using unregistered ingredients, limiting the introduction of innovative components globally. This constraint hampers the development of new personal care formulations, delays market entries, and elevates costs for newly launched products. Moreover, the potential for product recalls is a significant risk, indicating that modifications to existing regulations can have detrimental effects on market growth.

Opportunities: High market potential in emerging economies

China, India, Brazil, Mexico, Indonesia, and Saudi Arabia are recognized as the six leading developing nations among the top 20 global economies by nominal GDP. As developed countries approach market saturation, these emerging economies are increasingly becoming attractive markets for businesses. The Asia Pacific and the Middle East & Africa regions, in particular, are identified as high-growth areas for the personal care industry, owing to the abundant availability of essential ingredients.

Challenges: Toxicity of some personal care ingredients

The use of certain personal care ingredients such as parabens, sulfates, phthalates, formaldehyde releasers, and synthetic fragrances has raised increasing health and environmental concerns. These ingredients, though effective in preservation or performance, are associated with potential risks such as skin irritation, endocrine disruption, and long-term toxicity. Growing consumer awareness and stricter regulatory scrutiny in regions like the EU and North America are compelling manufacturers to reformulate or replace traditional ingredients with safer, bio-based, and non-toxic alternatives, which increases formulation complexity and R&D costs.

Personal Care Ingredients Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Sulfate-free shampoos and body washes using extra-mild, sugar-based surfactants for gentle yet effective cleansing | Extra mild to skin and hair with rich, creamy foam and enhanced sensorial profile |

|

Conditioning and deposition polymers for shampoos and conditioners to enhance detangling and active delivery | Better wet/dry combing, softness, foam sensorials, and efficient deposition of actives onto hair |

|

Emollient systems to elevate moisturization and sensorial feel in skin care and topical formats | Non-irritating emollients that support barrier repair and provide appealing skin sensory properties |

|

Mild secondary surfactants for shampoos, body washes, and liquid soaps that boost foam and viscosity | Improved mildness with cost-efficient thickening from concentrated CAPB grades and RSPO-certified feedstocks |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

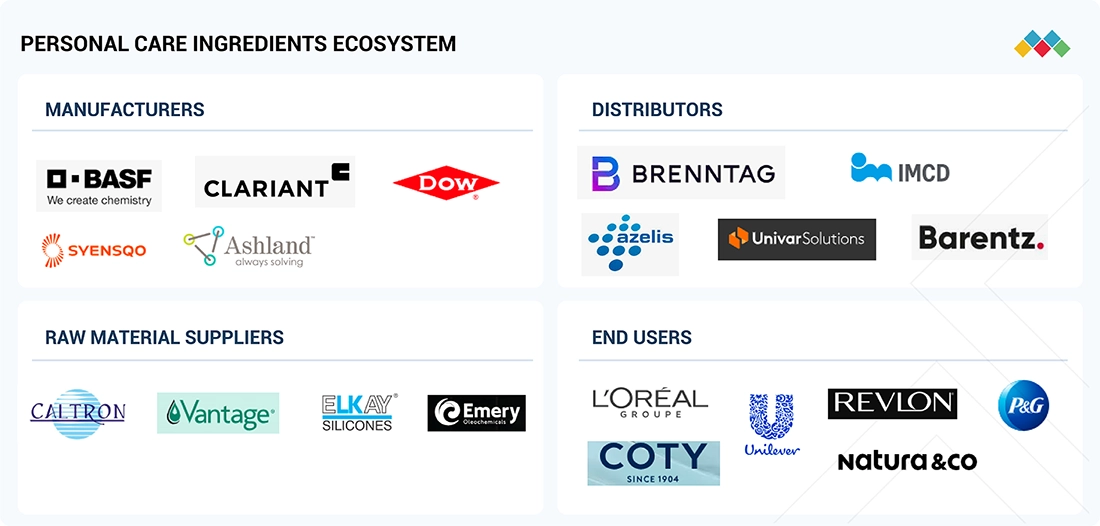

MARKET ECOSYSTEM

The personal care ingredients ecosystem comprises raw material suppliers, ingredient manufacturers, distributors, and end users. Suppliers provide natural oils, fatty acids, surfactants, and polymers to manufacturers, who process them into emollients, conditioning agents, emulsifiers, and active ingredients through formulation and synthesis technologies. Distributors link manufacturers with cosmetic, skincare, hair care, and oral care brands, ensuring smooth supply and compliance. End users, and cosmetic companies, utilize these ingredients to develop finished products, creating a connected value chain driven by innovation, sustainability, and evolving consumer preferences.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Personal Care Ingredients Market, By Ingredient Type

The rheology modifiers segment is expected to be the fastest-growing category in the global personal care ingredients market in terms of value during the forecast period. This growth is primarily driven by the increasing demand for superior texture, enhanced product stability, and improved user experience in personal care formulations. Rheology modifiers play a crucial role in controlling viscosity, flow behavior, and spreadability in products such as creams, lotions, gels, and serums. As consumers increasingly seek products with lightweight, non-greasy textures and luxurious sensory attributes, manufacturers are incorporating specialized rheology modifiers to achieve elevated formulation aesthetics and performance.

Personal Care Ingredients Market, By Application

The skincare application segment captured the largest share of the global personal care ingredients market by value. This growth is primarily driven by an increasing consumer emphasis on issues related to aging, skin health, and preventive care, resulting in heightened demand for high-performance skincare products. Consumers are seeking multifunctional solutions that deliver hydration, anti-aging benefits, UV protection, skin brightening, and acne control, all of which require a sophisticated blend of specialty ingredients such as emollients, active compounds, UV filters, antioxidants, and rheology modifiers.

REGION

Asia Pacific to be fastest-growing region in global personal care ingredients market during forecast period

Asia Pacific is emerging as the fastest-growing region, projected to grow at a CAGR of 5.06%, fueled by rising urbanization, increasing disposable incomes, rapid expansion of the beauty and personal care sector, and growing demand for skincare and haircare products across countries like China, India, and Southeast Asia. The region’s growth is also supported by the adoption of innovative ingredients, e-commerce penetration, and younger demographics seeking new personal care solutions.

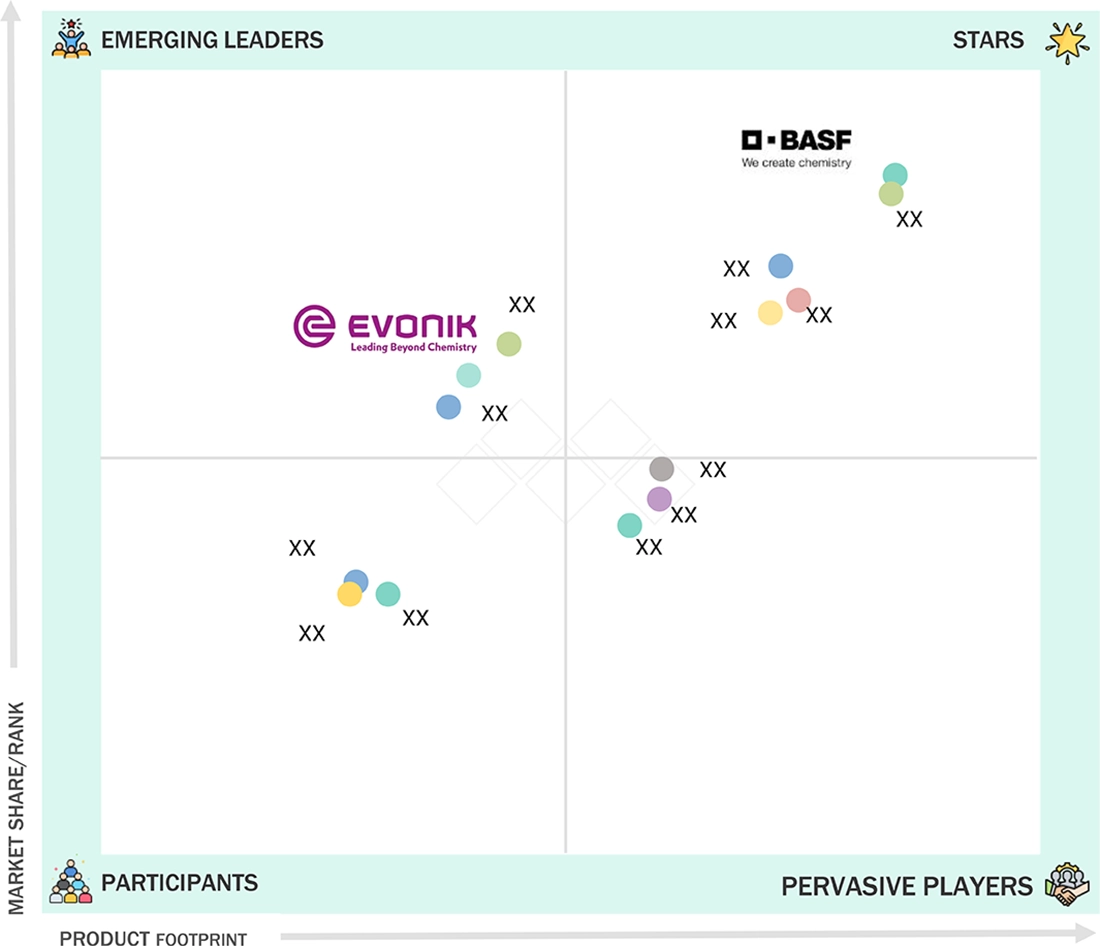

Personal Care Ingredients Market: COMPANY EVALUATION MATRIX

In the personal care ingredients market matrix, BASF SE leads with a strong global presence and a broad portfolio of innovative ingredients spanning skincare, haircare, and color cosmetics. Its focus on sustainable, bio-based solutions, cutting-edge formulations, and strategic collaborations with cosmetic brands drives widespread adoption across key applications. BASF’s scale, diversified offerings, and continuous investment in R&D firmly position it at the forefront of the industry, maintaining its leadership in the leaders' quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 13.17 Billion |

| Revenue Forecast in 2030 | USD 17.00 Billion |

| Growth Rate | CAGR of 4.40% from 2025-2030 |

| Actual data | 2020-2030 |

| Base year | 2024 |

| Forecast period | 2025-2030 |

| Units considered | Value (USD Million), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Ingredient Type: Conditioning Polymers, Surfactants, Emollients, Rheology Modifiers, Emulsifiers, and Other Types By Application: Skin Care, Hair Care, Make-Up, Oral Care and Other Applications |

| Regional Scope | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

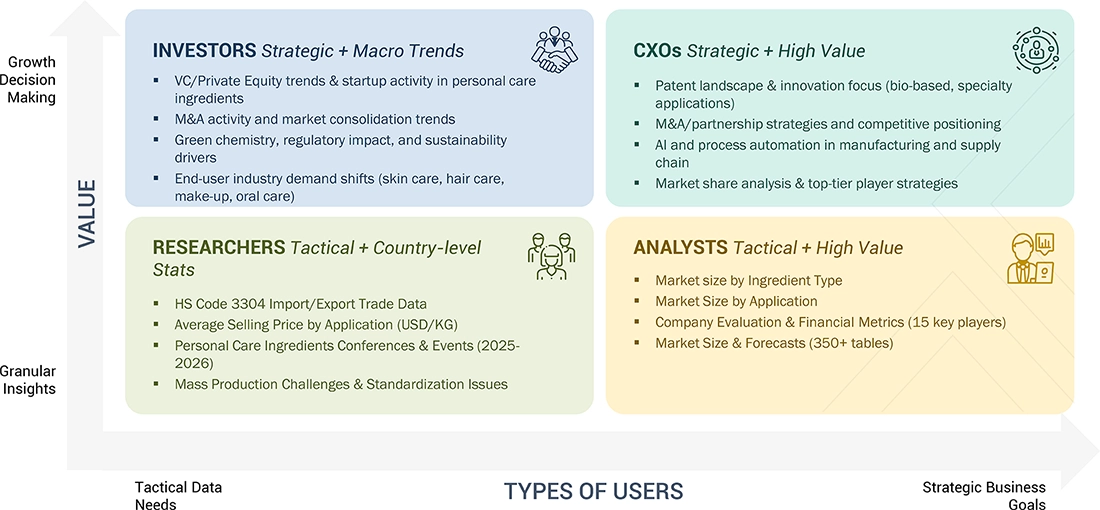

WHAT IS IN IT FOR YOU: Personal Care Ingredients Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Europe-based Personal Care Ingredient Manufacturer |

|

|

| Asia Pacific-based Personal Care Ingredient Manufacturer |

|

|

RECENT DEVELOPMENTS

- October 2024 : In BASF SE launched Emulgade?Verde, a new line of natural-based emulsifiers designed for personal care applications. This range includes two key ingredients: Emulgade?Verde?10?OL (Polyglyceryl-10 Oleate) and Emulgade Verde10 MS (Polyglyceryl-10 Stearate). Both are derived from 100% renewable feedstocks, are COSMOS- and NATRUE-approved.

- October 2023 : Clariant AG acquired Lucas Meyer Cosmetics for USD 810 million. This strategic move aligns with Clariant’s purpose-led growth agenda, aiming to bolster its presence in the high-value cosmetic ingredients market, especially across North America, and to enhance its customer-facing and sustainability-driven innovation capabilities.

- April 2022 : The Lubrizol Corporation and Suzano entered a global partnership to co-develop natural, sustainable ingredients for beauty, personal, and home care markets. Combining Lubrizol’s formulation expertise with Suzano’s eucalyptus-based bioproduct knowledge, the collaboration focuses on creating high-performing, biodegradable ingredients using renewable feedstocks.

- April 2021 : Ashland Inc. acquired Schülke & Mayr’s personal care division. This acquisition focuses on enhancing Ashland’s specialty additives portfolio, expanding its biotechnology and microbiology capabilities, and strengthening its consumer and household care market position.

Table of Contents

Methodology

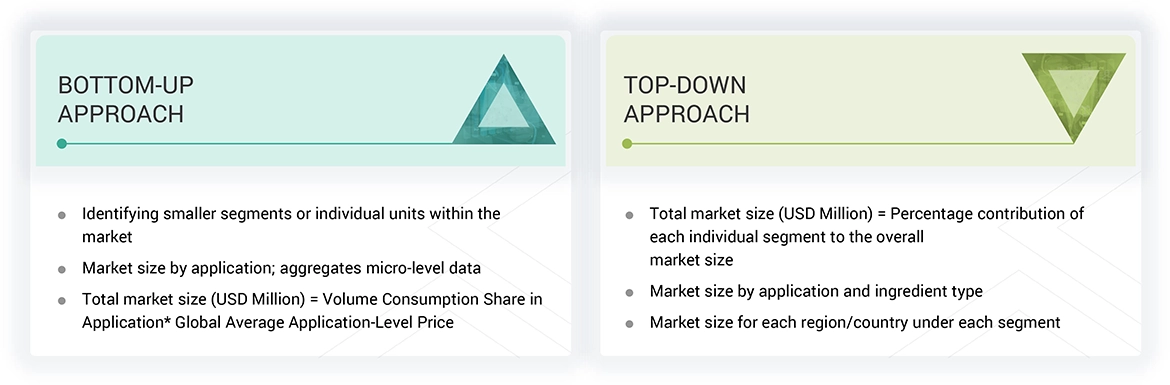

The study involved four major activities in estimating the personal care ingredients market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

Primary Research

The personal care ingredients market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. Key opinion leaders in various applications for the personal care ingredients market characterize the demand side of this market. Advancements in technology and diverse application industries characterize the supply side. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Breakdown of Primary Participants

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023/2024, available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME | DESIGNATION | |

|---|---|---|

| BASF SE | Senior Manager | |

| Dow Inc. | Innovation Manager | |

| Syensqo SA/NV | Vice-President | |

| Clariant AG | Production Supervisor | |

| Ashland Inc. | Sales Manager | |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the personal care ingredients market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

The market was split into several segments and subsegments after arriving at the overall market size—using the market size estimation processes as explained above. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides of the personal care ingredients industry.

Market Definition

The Personal Care Products Council (PCPC) and the Natural Products Association define personal care ingredients as ingredients that come from or are made from a renewable resource found in nature (flora, fauna, mineral) and petroleum compounds sources. For each ingredient, the substance must be listed as Generally Recognized as Safe (GRAS) by the FDA when used in accordance with Good Manufacturing Practices (GMP).

Personal care ingredients are constituents used for manufacturing consumer care products. These ingredients are used in various end-use applications such as skin care, hair care, oral care, and make-up. They provide cleansing, toning, moisturizing, hydrating, exfoliating, conditioning, anti-dandruff, antiperspirants, neutralizing, coloring, perfuming, and styling functionalities to personal care products.

Personal care ingredients include ingredients such as conditioning polymers, emollients, surfactants, rheology modifiers, emulsifiers, hair fixative polymers, antimicrobials, UV absorbers, skin-lightening agents, anti-aging agents, and opacifiers.

Stakeholders

- Personal care ingredient manufacturers

- Personal care ingredient distributors

- Raw material suppliers

- Service providers

- Government and research organizations

Report Objectives

- To analyze and forecast the market size of personal care ingredients in terms of volume and value

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To define, describe, and forecast the personal care ingredients market by ingredient type, application, and region

- To forecast the market size, in terms of value, based on regions, namely, Europe, North America, Asia Pacific, South America, and the Middle East & Africa

- To strategically analyze the market with respect to growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as expansions, new product launches/ innovations, agreements, mergers & acquisitions, partnerships, and joint ventures, in the personal care ingredients market

- To strategically profile key players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Who are the major players in the personal care ingredients market?

The key players include BASF SE (Germany), Dow Inc. (US), Syensqo SA/NV (Belgium), Clariant AG (Switzerland), Ashland Inc. (US), ADEKA Corporation (Japan), The Lubrizol Corporation (US), Evonik Industries AG (Germany), Nouryon (Netherlands), and Croda International Plc (US).

What are the drivers and opportunities for the personal care ingredients market?

Changing lifestyles and increasing purchasing power in developing countries, and rapid growth in multifunctional ingredients are key drivers. Opportunities lie in emerging economies and growing demand for sustainable, bio-based products.

Which strategies are the key players focusing upon in the personal care ingredients market?

Key players focus on product launches, partnerships, collaborations, mergers & acquisitions, agreements, and expansions to enhance global presence.

What is the expected growth rate of the personal care ingredients market between 2024 and 2030?

The market is projected to grow at a CAGR of 4.40% in terms of value during this period.

Which major factors are expected to restrain the growth of the personal care ingredients market during the forecast period?

Governmental regulations against cosmetic products are expected to hinder market growth.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Personal Care Ingredients Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Personal Care Ingredients Market

Ankit

Nov, 2017

Market information on Global Personal Care Ingredients with demand supply scenarion and pricing information.

Elsa

Jun, 2017

Sodium laureth sulfate (SLES) and Linear Alkyl Benzene Sulphonic Acid (LABSA) market size, value, growth and forecasts in Mexico..

Rosyid

Feb, 2019

List of companies mainly in Indonesia for Colouring product - Personal Care.

Jorge

Mar, 2019

Global biobased personal care ingredient market and natural sources.

Deborah

Nov, 2018

General information on Personal Care ingredient.

Jean

Aug, 2015

Information on Phosphates ingredients Market.

Minji

Jan, 2016

Personal Care Ingredients Market.