Oxygen Scavenger Market

Oxygen Scavenger Market by Type (Inorganic, Organic), Form (Films & Laminates, Sachets, Canisters, Liquid, Resin), End Use Industry (Food & Beverage, Pharmaceutical, Power, Oil & Gas, Chemical, Pulp & Paper), & Region - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global oxygen scavenger market is projected to grow from USD 3.03 billion in 2024 to USD 4.32 billion by 2029, at a CAGR of 7.3%. The increasing use of organic and inorganic oxygen scavengers, in the food & beverage, pharmaceutical, power, oil & gas industries in emerging economies is expected to drive the market during the forecast period.

KEY TAKEAWAYS

-

By TypeThe oxygen scavenger market, by type, is segmented into inorganic oxygen scavenger and organic oxygen scavenger. Inorganic oxygen scavenger to be the fastest growing segment for forecasted period in terms of value. Inorganic oxygen scavenger segment is further segmented to sulfite and iron based oxygen scavengers. Iron-based oxygen scavengers are activated in the presence of moisture in the environment and automatically start absorbing the residual oxygen present inside the headspace of the packaging. Iron-based oxygen scavengers are hydrated with atmospheric moisture to oxidize to a ferric state.

-

By FormOn the basis of form, the oxygen scavenger market has been segmented as Sachets, Canisters, Liquid, Films & Laminates, Resin and Others. Resin by form, is projected to be the fastest growing in terms of value. Resin oxygen scavengers are special materials introduced in packaging films to consume oxygen actively, thereby providing enhanced preservation of food as well as other sensitive products. These are different from traditional oxygen scavengers, which are often used in sachets or packets, and thus the resin-based scavenger is embedded directly into the polymer matrix of the packaging material.

-

By End-Use IndustryOn the basis of end use industry, the oxygen scavenger market has been segmented as Food & Beverage, Pharmaceutical, Power, Oil & Gas, Chemicals, Pulp & Paper and Others. Power by end-use industry to be the third larget for the forecasted period in terms of value. Oxygen scavengers are now recognized as a vital component in the power generation industry, especially for corrosion control in thermal power plants. As the demand for reliable and efficient energy production increases, using oxygen scavengers maintains the integrity of critical equipment, such as boilers and piping systems, by removing dissolved oxygen from feedwater.

-

BY REGIONEurope is estimated to be the third largest in terms of value for the forecasted period. In several industries, oxygen scavengers are widely utilized in Europe, thus reflecting the high importance of it towards enhancing the quality and safety levels of products. In food and beverages, oxygen scavengers ensure an active packaging system that gives them a shelf life extension period over the perishable commodities. Once scavenged inside the sealed packets, they prevent oxidation that causes spoilage, preserving the flavors and colors for those products.

-

COMPETITIVE LANDSCAPEMajor market players are pursuing both organic and inorganic growth strategies, including partnerships, collaborations, and investments, to strengthen their market presence. For instance, The oxygen scavenger market comprises major players such as Mitsubishi Gas Chemical Company, Inc. (Japan), Clariant (Switzerland), Ecolab (US), BASF (Germany) and Avient Corporation (US) have engaged in multiple agreements and strategic initiatives to address the rising demand for oxygen scavenger across food & beverage, pharmaceutical and power applications.

They are used to provide safety and extend the shelf life of a product. They also minimize corrosion in water-handling equipment such as boiler systems and feedwater systems. The choice of scavenger depends on various factors, including the specific application, the amount of oxygen to be removed, and the environmental conditions such as temperature and humidity.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The oxygen scavenger market is undergoing a major transformation driven by sustainability pressures, advanced packaging innovations, and diversification beyond traditional food and beverage use. While the current market is still dominated by iron-based and moisture-activated systems, future growth is being fueled by enzyme-based, polymer-integrated, and bio-derived scavengers that align with global circular economy goals. Rapid adoption across sectors such as pharmaceuticals, cosmetics, industrial preservation, and smart packaging is reshaping the value chain, prompting collaborations between scavenger manufacturers, film converters, and end-use industries. This evolution reflects a clear shift toward high-performance, recyclable, and intelligent oxygen control solutions designed to enhance product longevity, safety, and environmental compliance across diverse applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising beverage consumption in North America and Asia Pacific

-

Growing consumer concerns over reduction of food wastage and demand for advanced packaging

Level

-

Environmental and disposal concerns

-

Limited awareness and understanding of oxygen scavengers

Level

-

Rising demand for pharmaceuticals and medical devices

-

Changing consumer preference for convenience, premium quality, and wellness-focused RTD beverages

Level

-

Incorporation of oxygen scavenging systems into polymer matrices

-

Challenges in processing oxygen-scavenging films

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising beverage consumption in North America and Asia Pacific

The global beverage industry has been experiencing remarkable growth, driven by evolving consumer preferences and significant innovations in product development. Beverages, from simple bottled water to complex alcoholic drinks, are integral to consumer lifestyles and are consumed both, at home and in restaurants. Advances in technology and product formulations have led to diverse offerings, including low-calorie, sugar-free, and functional beverages, catering to the growing demand for healthier alternatives. In North America, the beverage market is set to see continued growth, with user penetration in the American beverage market expected to rise from 29.6% in 2024 to 34.1% by 2029. The average revenue per user in the American beverage market was USD 462.20 in 2024, contributing to the sector’s projected USD 121.00 billion in revenue in 2024. This rise in beverage consumption reflects shifting dietary habits, with Gen X (54%) and millennials (41%) increasingly purchasing lower-alcohol and no-alcohol products, aligning with their wellness-oriented lifestyles.

Restraint: Environmental and disposal concerns

Environmental and disposal concerns related to oxygen scavengers primarily stem from the by-products they produce, and the materials used in their construction. For instance, iron-based oxygen scavengers often generate rust (iron oxide) as a by-product during their chemical reaction with oxygen. While rust itself is generally harmless, it can cause environmental issues if it accumulates in large quantities, particularly in aquatic environments, where it may harm aquatic life. Additionally, some oxygen scavengers release acidic by-products, such as hydrochloric acid, which can be harmful to the environment if not properly managed during disposal. Another concern is that many oxygen scavengers are made from non-biodegradable materials, such as certain plastics or composite materials, which contribute to long-term environmental pollution if not properly disposed of or recycled.

Opportunity: Changing consumer preference for convenience, premium quality, and wellness-focused RTD beverages

The ready-to-drink (RTD) market is witnessing remarkable growth, driven by changing consumer preferences for convenience, premium quality, and wellness-focused beverages. As consumers increasingly seek sophisticated, health-conscious options, the global RTD market is projected to grow at an impressive rate. This growth is fueled by the rising popularity of premium cocktails and long drinks, as well as the shift toward healthier RTD beverages that feature lower-calorie, natural ingredients. Today's consumers are moving away from sugary and artificial drinks, demanding more sophisticated, flavorful, and nutritious alternatives that align with their wellness goals. As a result, RTD brands have responded by offering products that prioritize health and quality, such as those with organic, plant-based, and low-sugar ingredients, appealing to the growing health-conscious demographic. Within the broader RTD market, the protein beverage segment is emerging as a particularly strong growth area.

Challenge: Challenges in processing oxygen-scavenging films

Processing oxygen scavenging films poses significant challenges, particularly with the incorporation of organic-based scavenging agents. These agents have gained popularity in recent years due to their eco-friendly nature and high efficacy. However, their inherent instability at elevated temperatures required for extrusion processes creates hurdles in integrating them into polymer matrices. High processing temperatures can degrade organic scavengers, reducing their effectiveness and complicating their compatibility with common film production methods. To overcome this, researchers and manufacturers must develop innovative solutions, such as using stabilizers, optimizing processing conditions, or exploring alternative manufacturing techniques. These efforts are critical to ensure the seamless incorporation of organic-based oxygen scavengers while maintaining the desired properties and functionality of the polymer films.

Oxygen Scavengers Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Incorporation of oxygen scavengers in beverage and dairy packaging to extend shelf life and maintain freshness. | Reduced spoilage, extended product shelf life, consistent taste and quality, lower wastage |

|

Designs and installs advanced cleaning systems for food and beverage processing equipment to ensure consistent hygiene, efficient changeovers, and minimal waste generation. | Enhanced barrier performance, improved product safety, longer shelf life, better consumer trust |

|

Application of oxygen scavengers in fuel storage, lubricants, and industrial oil preservation | Preserved potency and stability, reduced oxidation risk, compliance with stringent regulations |

|

Use of oxygen scavengers in pharmaceutical packaging for sensitive drugs and nutraceuticals | Prevention of oxidation and corrosion, extended storage life, improved operational efficiency |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The oxygen scavenger ecosystem comprises raw material suppliers providing chemicals to manufacturers, manufacturers conducting research & development of the final products for use in various industries, and intermediaries & distributors providing a link between manufacturers and end users by supplying final products. They work together to supply the final products to end users in different industries. It involves a series of processes, from raw material procurement to manufacturing the end products and distributing them to end users for further use in various end-use industries.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Oxygen Scavenger Market, By Type

Inorganic oxygen scavenger segment to be largest type during the forecast period. Inorganic oxygen scavengers have a metallic base, including iron powder and sulfites. They are used mainly in food applications and require moisture or humidity to work properly. Inorganic oxygen scavengers are not ideal for dry applications as they require moisture to activate. Iron-based oxygen scavengers are very common in food & beverage and pharmaceuticals due to their easy handling, and faster reaction as compared with organic oxygen scavengers. They are hydrated by atmospheric moisture for oxidation to the ferric state. It reduces the quantity of oxygen present in the atmosphere and thus keeps safety along with increasing shelf life. Sulfite-based oxygen scavengers are used in water treatment applications as they are cheaper than organic oxygen scavengers. These oxygen scavengers are cost-effective, have increased reaction rates when catalyzed, and are ideal for low alkalinity water systems.

Oxygen Scavenger Market, By Form

Liquid oxygen scavenger to be the largest form segment during forecast period. Liquid oxygen scavengers are used to effectively remove dissolved oxygen from various industrial applications, such as in water treatment, oil & gas production units, and steam generation. Liquid oxygen scavenger has higher solubility and quicker action because it does not have a solid or powdered form, making it useful where rapid oxygen removal is needed. Common examples of such agents include sodium bisulfite and ammonium bisulfite, which decompose dissolved oxygen into relatively harmless byproducts, which include sulfur dioxide, therefore preventing corrosion and degradation.

Oxygen Scavenger Market, By End Use Industry

Food & beverage to be the largest end-use industry during the forecast period. Food & beverage is one of the major end-use industries in the oxygen scavenger market. Oxygen scavengers protect food products from oxygen degradation, thus increasing their shelf life, customer acceptability, and food safety while preserving the natural properties of the food product. Oxygen scavengers help inhibit food spoilage microbes, which, if present, can affect the integrity of the food products. During the last decade, food preservation techniques have improved significantly due to the proper sealing of food products in oxygen-impregnable packaging and the frequent use of oxygen scavengers in the food industry. As consumers become more health-conscious and seek convenience, manufacturers are turning to these solutions to ensure their products remain appealing and safe for consumption over extended periods.

REGION

Asia Pacific to be fastest-growing region in global oxygen scavenger market during forecast period

Asia Pacific to hold largest market share during the forecast period. Asia Pacific is a significant region for the oxygen scavenger market, with huge growth opportunities, mainly because of technological advancements, consumer demand growth, and regulatory landscape changes. In this mature market, product line innovation along with digital transformation are expected to form the crux of the future growth trajectory. This trend is expected to be stimulated by the growing demand for environment-friendly and sustainable solutions in chemicals, oil & gas, power, food & beverages, and pharmaceutical industries. Urbanization is also gaining momentum in countries such as India and China. Convenience foods and packaged products are shifting toward this direction as busy consumers prefer them as quick meal solutions. Oxygen scavengers have minimized the risks of oxidation, which eventually causes spoilage and leads to loss of nutritional values. This has resulted in their increased application in food & beverages and pharmaceuticals also, as the stability of the product is highly important.

Oxygen Scavengers Market: COMPANY EVALUATION MATRIX

In the oxygen scavenger market matrix, Ecolab (Star) leads with a strong market share and a comprehensive portfolio of oxygen control solutions—including sachets, polymer-integrated systems, and enzyme-based scavengers—widely adopted across food & beverage, beverage cartons, industrial preservation, and pharmaceutical packaging applications. Multisorb (Emerging Leader) is gaining visibility with its specialized oxygen scavenger formulations and tailored solutions for high-value and sensitive products, strengthening its position through innovation and niche applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 3.03 Billion |

| Market Forecast in 2029 (value) | USD 4.32 Billion |

| Growth Rate | CAGR of 7.3% from 2024-2029 |

| Years Considered | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024–2029 |

| Units Considered | Value (USD Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Oxygen Scavengers Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| U.S.-based Food & Beverage Processor |

|

|

| Flexible Packaging & Film Manufacturers |

|

|

| Pharmaceutical & Nutraceutical Packaging OEM |

|

|

| European Oxygen Scavenger Supplier |

|

|

| Industrial & Consumer Packaging OEMs |

|

|

RECENT DEVELOPMENTS

- November 2023 : Nalco Water, an Ecolab Company acquired Flottec, LLC, a US-based provider of flotation products and services for the mineral processing industry. This acquisition enhances Nalco Water’s flotation offerings and expands its capabilities in serving the industry from mine to metal. The acquisition is now part of the Global Industrial reporting segment.

- October 2022 : Indorama Ventures Public Limited, in partnership with Coca-Cola Beverages Philippines, launched PETValue, the country's first food-grade bottle-to-bottle recycling facility. Located in General Trias, Cavite, the plant is expected to recycle 2 billion PET bottles annually and create 200 local jobs. This initiative aligns with Coca-Cola's ‘World Without Waste’ program and Indorama Ventures Public Limited commitment to sustainability.

- July 2021 : BASF significantly enhanced its production capabilities by expanding its mobile emissions catalysts plant located in Chennai, India. This aims to nearly double the company's production capacity for heavy-duty on- and off-road catalysts.

- February 2021 : Clariant launched DESVOCANT adsorbents, made from natural, non-toxic bentonite, effectively reducing exposure to volatile organic compounds (VOCs) in packaged goods and shipping containers. Available in sachets, bags, and hanger strips, they enhance safety for handlers, merchants, and consumers.

Table of Contents

Methodology

The study involved four major activities in estimating the market size of the oxygen scavenger market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, corporate documents, white papers, certified publications, trade directories, certified publications, articles from recognized authors, associations, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

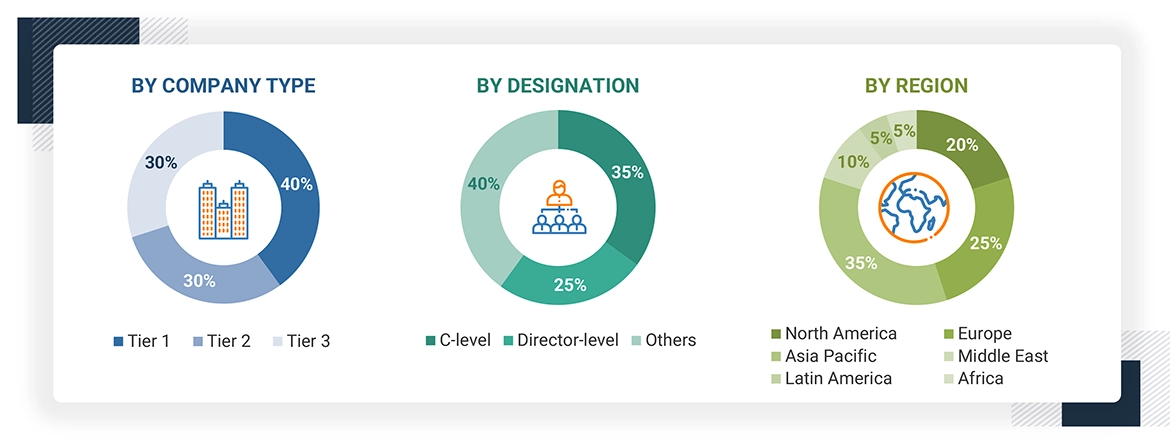

The oxygen scavenger market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, distributors and end user. Various primary sources from the supply and demand sides of the oxygen scavenger market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the oxygen scavenger industry.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, form, end-use industry and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of oxygen scavenger and future outlook of their business which will affect the overall market.

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023 available in the public domain, product portfolios, and geographical presence.

Other designations include sales representatives, production heads, and technicians.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the size of various submarkets for oxygen scavenger for each region. The research methodology used to estimate the market size included the following steps:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- The global market was then segmented into five major regions and validated by industry experts.

- All percentage shares, splits, and breakdowns based on type, form, end-use industry and region were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed inputs and analysis and presented in this report.

The market size include the following:

Data Triangulation

After arriving at the total market size from the estimation process of oxygen scavenger above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Oxygen scavengers can be defined as chemicals that are used to reduce the level of oxygen in enclosed packages. They are used to provide safety and extend the shelf life of a product. They also reduce corrosion in water-handling equipment such as boiler systems and feedwater systems. The major end-use industries for these chemicals include food & beverage, pharmaceutical, power, oil & gas, chemical, pulp & paper, and others. In addition, oxygen scavengers are now increasingly applied not only in traditional packaging but also in advanced packaging systems employing new materials with barrier-enhancing capabilities. This has the benefit of faster oxygen removal and overall product protection.

Stakeholders

- Oxygen scavenger manufacturers

- Raw material suppliers

- End-use companies, oxygen scavenger companies

- Oxygen scavenger traders, distributors, and suppliers

- Research organizations

- Industry associations

- Governments and research organizations

Report Objectives

- To define, describe, and forecast the size of the oxygen scavenger market, in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market.

- To estimate and forecast the market size based on type, form, end-use industry, and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries.

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships, mergers and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Oxygen Scavenger Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Oxygen Scavenger Market