Corrosion Inhibitors Market by Compound(Organic, Inorganic), Type(Water Based, Oil Based and VCI), Application, End-Use (Power Generation, Oil & Gas, Metal & Mining, Pulp & Paper, Utilities, Chemical), and Region - Global Forecast to 2026

Updated on : September 03, 2025

Corrosion Inhibitors Market

The global corrosion inhibitors market was valued at USD 7.9 billion in 2021 and is projected to reach USD 10.1 billion by 2026, growing at 4.9% cagr from 2021 to 2026. The growing demand for corrosion inhibitors from various end-use segments along with stringent regulatory and sustainability mandates concerning the environment is driving the market for corrosion inhibitors.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on global corrosion inhibitors market

Corrosion inhibitors are used in applications, such as water treatment, process & product additives, and oil & gas production in various end-use industries, including power generation, oil & gas and refinery, metal & mining, pharmaceutical and utilities, among others. Corrosion inhibitors are used for treating harmful water, preserving the life of metals & alloys in the above-mentioned end-use industries. They control the process of corrosion by slowing it in different parts of the industries and treating toxic water. Due to the Covid-19 pandemic, the chemical industry was severely impacted throughout the world. Disruption in the supply chain, reduction in workforce, restrictions in movement, and decline in demand due to global uncertainty hindered the growth of the chemical industry.

The oil & gas industry also saw a fall in demand due to the pandemic. Decreased output affecting revenue realization put a halt to the progress of many companies in these sectors. The pandemic caused widespread concern and economic hardship for consumers, businesses, and communities across the globe. The lockdown, owing to the pandemic in various countries, affected the transportation fuel demand. Travel bans, along with the grounding of international flights, had led to a heavy reduction in the consumption of Aviation Turbine Fuel (ATF) across the globe.

However, the corrosion inhibitor market hasn’t been affected much and their demand remains in industries like oil & gas, pharmaceutical, etc

Corrosion Inhibitors Market Dynamics

Driver: Increasing demand for treated water in various end-use segments

Freshwater resources account for only 2.5% of the total water resources globally, which makes the supply of water for industrial and domestic consumption a tough challenge. The widening gap between the demand and supply of water makes it necessary to efficiently recycle it, which can be undertaken by treating it. The corrosion inhibitor market is rapidly growing in water treatment sectors across the globe. Industrial manufacturers are the largest customers for corrosion inhibitors and seeking more effective inhibitors that will reduce downtime for equipment repair. An increase in the demand for corrosion inhibitors in various industries such as pulp & paper, chemical processing, oil & gas, petroleum, and metals to protect from corrosion has led to higher demand from emerging countries, in particular. Cooling water is the largest segment for corrosion inhibitors in the water treatment process to protect the metal machinery from the water flow.

Restraint: Use of corrosion-resistant materials

Industries in the developed market are showcasing a high degree of maturity. The replacement of steel with plastics, ceramics, composite materials, and corrosion-resistant alloys in these industries is an example of this. The metals and alloys which are capable of resisting corrosion to some degrees are known as Corrosion-Resistant Alloy (CRA). The corrosion inhibitors market is slowly moving toward more sustainable options due to the increasing environmental concerns and regulatory pressures. The use of Duplex Stainless Steel (DSS), Super Duplex Stainless Steel (SDSS), and other exotic materials is becoming popular in the oil & gas industry. These are used for handling highly corrosive fluids as the oil & gas industry has high stakes of shutdown due to material failure. These exotic metals also have excellent strength, durability, and ability to withstand extreme pressure & temperature, among other properties. Due to this property, these metals are being used in demanding sectors like automobile, aerospace, oil & gas industry, and power generation, among other industries.

Opportunity: Increasing industrialization in developing economies

Infrastructural development in economies such as China, India, Brazil, and South Korea, are expected to undergo infrastructural development and boost industrial activities for the growth of their economies. Infrastructural growth related to electricity demand, clean water demand, fuel demand, transportation demand, and construction demand are expected to boost the market for corrosion inhibitors in the next five years. The global spending on infrastructure is expected to reach USD 94 trillion by 2040, and an additional USD 3.4 trillion would be required to attain United Nations’ Sustainable Development Goals for electricity and water, according to Oxford Economics. Countries in Asia Pacific, China, India, Indonesia, Malaysia, the Philippines, Thailand, and Vietnam, will be among the fastest-growing infrastructure spending countries, according to an Oxford Economics study. This has led to the increasing consumption of industrial water in emerging economies. This creates an opportunity for manufacturers to offer a wide range of corrosion inhibitors to various specific applications in order to protect them from corrosion.

Challenge: Need for eco-friendly formulations

Stringent environmental legislation are the primary factors inhibiting the growth of the corrosion inhibitor market. The growing concern of chemicals having an impact on the environment and health has led to stringent regulatory constraints for corrosion inhibitors manufacturers. This influences the manufacturers to opt for non-toxic alternatives. The property of the non-toxic corrosion inhibitors formulations to perform under severe conditions makes it difficult for the manufacturers to provide a replacement for standard formulations. For instance, an alternative in the oil & gas industry has been zinc phosphate. Although effective, this inhibitor does not match the performance of chromate complexes like hexavalent chromium. This chemical is known for causing cancer in humans and animals, as per the United States Department of Labor.

Corrosion Inhibitors Market Ecosystem

|

COMPANY |

ROLE IN ECOSYSTEM |

|

BASF |

Raw Material and Product Manufacturing |

|

Dow Chemical Company |

Raw Material and Product Manufacturing |

|

Baker Hughes |

Raw Material and Product Manufacturing |

|

Lanxess |

Raw Material and Product Manufacturing |

|

Wego |

Raw Material and Distributor |

|

Brad-Chem |

Product Manufacturing |

|

Ecolab |

Product Manufacturing |

|

Nouryon |

Product Manufacturing |

|

Lubrizol |

Product Manufacturing |

|

Henkel |

Product Manufacturing |

|

SM-Service Ltd. |

Raw Material |

|

Bimaks Kimya VE Gida Tic Ltd. Sti. |

Raw Material |

|

B & V Chemicals |

Raw Material |

|

DESHI |

Raw Material |

|

TER Chemicals distribution group |

Distribution |

|

IMCD Canada Ltd |

Distribution |

|

Dormeco Ltd. |

Distribution |

|

Engichem Specialities Pvt. Ltd |

Distribution |

|

Bisterfeld Spezialchemie |

Distribution |

|

Integrated Chemicals Specialities |

Distribution |

|

|

|

In terms of value, the water-based segment is projected to account for the largest share of the corrosion inhibitor market, by type, during the forecast period.

Water-based corrosion inhibitors accounted for 69.8% of the share in 2020 and are the largest type of corrosion inhibitor available in the market. Water-based corrosion inhibitors modify the characteristics of the metal surfaces by decreasing their susceptibility to oxidation and corrosion formation. Water-based inhibitors are typically sold as a concentrate and diluted with water for use, to make their cost less than most oil/solvent-based products. Application methods for these inhibitors include spray, brush, or immersion. They are cleaner to use and eliminate concerns of solvent fumes. Water-based inhibitors can be effective in preventing corrosion for extended periods of time (weeks to months) under reasonable plant storage and protected shipping conditions.

Based on end-use, Oil & Gas and Refinery industry is projected to grow at a CAGR of 5.6%, in terms of value during the forecast period.

The oil & gas industry has a significant impact on a country’s GDP due to their economic improtance and size. The industry also utilizes corrosion inhibitors on a large scale. Equipments used in this industry, such as pipelines, vessels, and subsea equipment, for routine operations, require corrosion inhibitors for proper functioning. Corrosion inhibitors are used in various application areas, namely, exploration & production, transportation & storage, refining & petrochemical

Based on compound, the organic inhibitor market showcases largest CAGR during the forecast period.

Organic inhibitor is projected to be the fastest-growing compound in the corrosion inhibitor market. They are effective at a wide range of temperature, have good solubility with water, low cost and compatible with protected materials. Oxygen, nitrogen, or sulfur atoms as double bonds are present in these compound. The adsorption process is facilitated by the lone pair electrons of atoms. This process is neither physical nor purely chemical adsorption. The organic inhibitor’s chemical structure, nature & surface charge, distribution of charge in the molecule, and type of aggressive media influences the adsorption process.

The APAC region leads the water treatment chemicals market in terms of value.

APAC is the fastest-growing region for the corrosion inhibitor market. Factors such as high population, increasing industrial growth, and growing concern for the environment are driving the demand for water treatment chemicals in the region and are directly influencing the market of corrosion inhibitors. The rise in number of end-use industries in the region is also leading to innovations and developments in the field of corrosion inhibitor, thereby fuelling the growth of the Asia Pacific corrosion inhibitors market.

To know about the assumptions considered for the study, download the pdf brochure

Corrosion Inhibitors Market Players

Major players operating in the global corrosion inhibitor market include Solenis (US), Nouryon (The Netherlands), Baker Hughes Company (US), Ecolab (US), BASF SE (Germany), SUEZ Water Technologies & Solutions (France), DOW Chemical Company (US), Lubrizol Corporation (US), Lanxess (Germany), and Henkel Corporation (Germany).

Corrosion Inhibitors Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 7.9 billion |

|

Revenue Forecast in 2026 |

USD 10.1 billion |

|

CAGR |

4.9% |

|

Years considered for the study |

2019–2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Value (USD Million), Kilton(KT) |

|

Segments |

Type, End-use Industry, Compound, Application, Region |

|

Regions |

North America, Europe, APAC, the Middle East & Africa, and South America |

|

Companies |

Nouryon (Amsterdam), Henkel (Germany), The Lubrizol (US), BASF SE (Germany), Ecolab Inc. (US), Solenis LLC (US), Baker Hughes (US), Lonza (Switzerland), The Dow Chemical Company (US), and Suez S.A. (France) |

This research report categorizes the corrosion inhibitors market based on type, end-use industry, and region.

Corrosion Inhibitors Market based on compound:

- Organic corrosion inhibitors

- Inorganic corrosion inhibitors

Corrosion Inhibitors Market based on applications:

- Water Treatment

- Process and Product Additives

- Oil & Gas Production

Corrosion Inhibitors Market based on the type:

- Water-based Corrosion Inhibitors

- Oil-based Corrosion Inhibitors

- Volatile Corrosion Inhibitors

Corrosion Inhibitors Market based on the end-use industry:

- Oil & gas

- Power generation

- Chemicals

- Metals processing

- Pulp & paper

- Others (food & beverage, pharmaceuticals, hydrometallurgy, construction, automotive, aerospace)

Corrosion Inhibitors Market based on the region:

- APAC

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In February 2021, LANXESS signed a binding agreement to acquire 100 percent shares in Emerald Kalama Chemical on February 14, 2021. The US-based company is a globally leading manufacturer of specialty chemicals, especially for the consumer segment, and is majority-owned by affiliates of the US private equity firm, American Securities LLC.

- In August 2019, Nouryon planned to double capacity at its surfactants plant in Stenungsund, Sweden, to support the growth of several existing products as well as new sustainable technologies for markets, including oil and gas, lubricants, and fuels, and asphalt. The USD 14-million expansion and upgrade project include the installation of a new reactor and is expected to be completed by the first quarter of 2021. It will increase the production and innovation in corrosion inhibitors.

- In October 2018, SUEZ announced the signature of 19 contracts in Ecuador, Colombia, Brazil, Mexico, and Costa Rica. These contracts are part of the Group’s development drive in Latin America and the Caribbean, which account for 7% of its global turnover and represent over 7000 employees in 10 countries. With these new contracts, SUEZ strengthened its presence in water services management in large cities and developed in new markets of waste management and industrial services.

Frequently Asked Questions (FAQ):

What are the End users in corrosion inhibitors market?

Corrosion inhibitors are mostly used in power generation, refineries of oil and gas, metal & mining, pulp and paper, chemical, utilities & among others.

Who are the main key players in corrosion inhibitors market?

Corrosion inhibitors market includes Nouryon, Henkel, The Lubrizol, BASF SE, Ecolab Inc., Solenis LLC, Baker Hughes, Lonza, The Dow Chemical Company and Suez S.A. like main key players.

What are the factors influencing the growth of the corrosion inhibitor market?

The growth of this market can be attributed to rising demand due to industrialization in the developing countries.

Which are the key sectors driving the corrosion inhibitor market?

Power Generation, Oil & Gas and Refinery, Pulp & Paper, Metal & Mining, Chemical and Utilities are the key sectors driving the corrosion inhibitor market.

Who are the major manufacturers?

Major manufactures include Solenis (US), Nouryon (The Netherlands), Baker Hughes Company (US), Ecolab (US), BASF SE (Germany), SUEZ Water Technologies & Solutions (France), DOW Chemical Company (US), Lubrizol Corporation (US), Lanxess (Germany), and Henkel Corporation (Germany), among others.

What is the biggest restraint for corrosion inhibitors?

The availability of alternative of corrosion inhibitors are restraining the growth of the market.

How is COVID-19 affecting the overall corrosion inhibitor market?

Due to the pandemic, manpower shortage, logistical restrictions, material unavailability, and other restrictions slowed the growth of the industry in a considerable manner. However, the use of corrosion inhibitor in industries such as oil & gas and pharmaceutical has not been affected

What will be the growth prospects of the corrosion inhibitor market?

The market growth of corrosion inhibitors is influenced by rising population and rapid urbanization in emerging economies and an increase in demand for specific formulations. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 MARKET INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 CORROSION INHIBITORS MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 1 CORROSION INHIBITORS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Primary interviews – Demand and Supply Side

2.1.2.3 Key industry insights

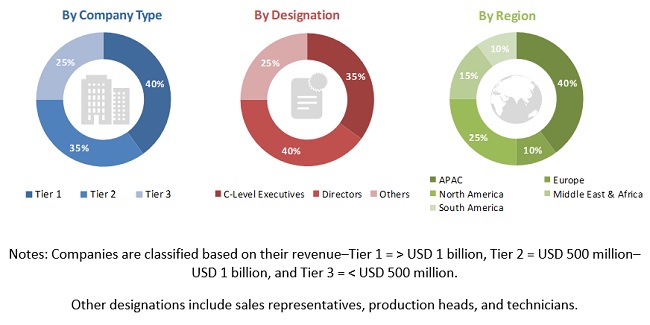

2.1.2.4 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 2 CORROSION INHIBITORS MARKET ESTIMATION, BY COUNTRY

FIGURE 3 MARKET SIZE ESTIMATION: MARKET, SUPPLY SIDE APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 4 CORROSION INHIBITORS MARKET: TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: MARKET, TOP-DOWN APPROACH

2.3 MARKET FORECAST APPROACH

2.3.1 SUPPLY-SIDE FORECAST PROJECTION:

2.3.2 DEMAND-SIDE FORECAST PROJECTION:

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

2.5 FACTOR ANALYSIS

2.6 ASSUMPTIONS AND LIMITATIONS

FIGURE 6 ASSUMPTIONS

2.6.1 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 48)

FIGURE 7 POWER GENERATION ACCOUNTED FOR THE LARGEST SHARE IN 2020

FIGURE 8 WATER BASED SEGMENT ACCOUNTED FOR THE LARGEST SHARE IN THE CORROSION INHIBITORS MARKET

FIGURE 9 ORGANIC INHIBITORS ACCOUNTED FOR THE LARGER SHARE IN THE CORROSION INHIBITORS MARKET IN 2020

FIGURE 10 WATER TREATMENT APPLICATION ACCOUNTED FOR THE LARGEST SHARE IN THE CORROSION INHIBITORS MARKET IN 2020

FIGURE 11 APAC WAS THE LARGEST CORROSION INHIBITORS MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 52)

4.1 ATTRACTIVE OPPORTUNITIES IN CORROSION INHIBITORS MARKET

FIGURE 12 EMERGING ECONOMIES TO OFFER LUCRATIVE GROWTH OPPORTUNITIES FOR MARKET PLAYERS

4.2 APAC: MARKET, BY END-USE INDUSTRY AND COUNTRY

FIGURE 13 CHINA WAS THE LARGEST MARKET FOR CORROSION INHIBITORS IN APAC IN 2021

4.3 CORROSION INHIBITORS MARKET, BY COMPOUND

FIGURE 14 ORGANIC COMPOUND TO GROW AT THE HIGHER CAGR

4.4 MARKET, BY TYPE

FIGURE 15 WATER-BASED CORROSION INHIBITORS TO GROW AT THE HIGHEST CAGR

4.5 CORROSION INHIBITORS MARKET, BY APPLICATION

FIGURE 16 WATER TREATMENT APPLICATION TO CAPTURE THE LARGEST SHARE OF THE CORROSION INHIBITORS MARKET DURING THE FORECAST PERIOD

4.6 CORROSION INHIBITORS MARKET, BY END-USE INDUSTRY

FIGURE 17 POWER GENERATION INDUSTRY WAS THE LARGEST SEGMENT DURING THE FORECAST PERIOD

4.7 CORROSION INHIBITORS MARKET: REGIONAL GROWTH RATES

FIGURE 18 APAC TO REGISTER THE HIGHEST CAGR, FOLLOWED BY MIDDLE EAST & AFRICA

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN CORROSION INHIBITORS MARKET

5.1.1 DRIVERS

5.1.1.1 Increasing corrosion cost leads to growing demand for corrosion inhibitors

5.1.1.2 Stringent government regulations regarding health and environmental safety

TABLE 1 GLOBAL ENERGY RELATED CO2 EMISSION (2015-2021)

5.1.1.3 Increasing demand for treated water in various end-use segments

5.1.2 RESTRAINTS

5.1.2.1 Use of corrosion-resistant materials

5.1.3 OPPORTUNITIES

5.1.3.1 Increasing industrialization in developing economies

TABLE 2 CHANGE IN ELECTRICITY DEMAND, BY REGION

5.1.4 CHALLENGES

5.1.4.1 Need for eco-friendly formulations

5.2 VALUE CHAIN ANALYSIS

FIGURE 20 VALUE CHAIN

5.2.1 RAW MATERIAL SUPPLIERS

5.2.2 MANUFACTURERS

5.2.3 DISTRIBUTORS

5.2.4 END-CONSUMERS

5.3 TARRIF & REGULATIONS

5.3.1 US

5.3.2 CANADA

5.3.3 EUROPE

5.4 TRADE ANALYSIS

5.4.1 IMPORT TRADE DATA FOR TOP COUNTRIES, 2016-2020 (USD)

5.4.2 EXPORT TRADE DATA FOR TOP COUNTRIES, 2016-2020 (USD)

5.4.3 IMPORT TRADE DATA FOR TOP COUNTRIES, 2016-2020 (USD)

5.4.4 EXPORT TRADE DATA FOR TOP COUNTRIES, 2016-2020 (USD)

5.5 ECOSYSTEM MAPPING

FIGURE 21 ECOSYSTEM

TABLE 3 CORROSION INHIBITORS ECOSYSTEM

5.6 TECHNOLOGY ANALYSIS

5.6.1 NON-TOXIC NANO-HYBRID COATINGS

5.6.2 GREEN CORROSION INHIBITORS

5.6.3 MIGRATING CORROSION INHIBITOR (MCI)

TABLE 4 NATURAL PRODUCTS AND THEIR ANTICORROSIVE PROPERTIES

5.7 CASE STUDY ANALYSIS

5.7.1 CORROSION INHIBITOR TO PROVIDE GREATER FLEXIBILITY, LOWER OVERALL COSTS, AND IMPROVE MARGINS OF A LARGE REFINERY IN INDIA

5.7.2 SOLVING LONG-TERM CORROSION PROBLEM OF THE REFINERY BY DEPLOYING TECHNOLOGY FOR CRUDE OVERHEAD SYSTEMS

5.7.3 CORROSION INHIBITOR HELPED THE REFINER IN GAINING HUGE RETURN ON INVESTMENT (ROI)

5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

5.9 COVID-19 IMPACT ANALYSIS

5.9.1 COVID-19 ECONOMIC ASSESSMENT

5.9.2 MAJOR ECONOMIC EFFECTS OF COVID-19

5.9.3 EFFECTS ON GDP OF COUNTRIES

FIGURE 22 GDP FORECASTS OF G20 COUNTRIES IN 2020

5.9.4 CONFIRMED CASES AND DEATHS, BY GEOGRAPHY

FIGURE 23 PACE OF GLOBAL PROPAGATION OF COVID-19 IS UNPRECEDENTED

5.9.5 IMPACT ON END-USE INDUSTRIES

5.9.5.1 Oil & Gas

5.9.5.2 Power

5.9.5.3 Chemical

5.9.5.4 Metal processing

5.1 MACROECONOMIC ANALYSIS

5.10.1 GLOBAL GDP TRENDS AND FORECASTS

TABLE 5 ANNUAL PERCENTAGE CHANGE OF REAL GDP GROWTH RATES FROM 2016 TO 2021

5.10.2 TRENDS IN POWER INDUSTRY

TABLE 6 ELECTRICITY GENERATION STATISTICS, BY COUNTRY, 2018–2019 (TERAWATT-HOURS)

5.10.3 OIL & GAS STATISTICS

TABLE 7 OIL PRODUCTION, BY COUNTRY, 2018-2019, THOUSAND BARRELS DAILY

5.11 RAW MATERIAL ANALYSIS

5.11.1 RAW MATERIALS FOR ORGANIC COMPOUNDS

5.11.2 RAW MATERIALS FOR INORGANIC COMPOUNDS

5.12 PORTER’S FIVE FORCES ANALYSIS

FIGURE 24 CORROSION INHIBITORS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.12.1 THREAT OF SUBSTITUTES

5.12.2 BARGAINING POWER OF SUPPLIERS

5.12.3 BARGAINING POWER OF BUYERS

5.12.4 THREAT OF NEW ENTRANTS

5.12.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 8 CORROSION INHIBITORS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.13 PATENT ANALYSIS

5.13.1 METHODOLOGY

5.13.2 DOCUMENT TYPE

FIGURE 25 GRANTED PATENTS VS. APPLIED PATENTS

FIGURE 26 PUBLICATION TRENDS – LAST 10 YEARS

5.13.3 INSIGHTS

5.13.4 JURISDICTION ANALYSIS

FIGURE 27 JURISDICTION ANALYSIS, BY COUNTRY

5.13.5 TOP COMPANIES/APPLICANTS

FIGURE 28 TOP COMPANIES/APPLICANTS WITH THE HIGHEST NUMBER OF PATENTS

5.13.5.1 List of patents by Ecolab USA Inc.

5.13.5.2 List of patents by China Petroleum and Chem. Corp.

5.13.5.3 List of patents by BASF S.E.

5.13.5.4 List of patents by PetroChina Co. Ltd.

5.13.5.5 List of patents by Halliburton Energy Services Inc.

5.13.6 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

5.14 AVERAGE PRICING ANALYSIS

FIGURE 29 IMPORT VALUE OF SODIUM SILICATE IN MAJOR COUNTRIES

FIGURE 30 IMPORT VALUE OF NITRITES & NITRATES IN MAJOR COUNTRIES

TABLE 9 GLOBAL AVERAGE PRICES OF CORROSION INHIBITORS (USD/KT)

5.15 ADJACENT/RELATED MARKET

5.15.1 INTRODUCTION

5.15.2 LIMITATIONS

5.15.3 WATER TREATMENT CHEMICALS MARKET

5.15.4 WATER TREATMENT CHEMICALS MARKET OVERVIEW

5.15.5 WATER TREATMENT CHEMICALS MARKET, BY TYPE

TABLE 10 WATER TREATMENT CHEMICALS MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

5.15.5.1 Coagulants & flocculants

5.15.5.2 Organic coagulants

5.15.5.3 Inorganic coagulants

5.15.5.4 Flocculants

5.15.5.5 Corrosion inhibitors

5.15.5.6 Scale inhibitors

5.15.5.7 Biocides & disinfectants

5.15.5.8 Chelating agents

5.15.5.9 Anti-foaming agents

5.15.5.10 PH adjusters & stabilizers

5.15.5.11 Others

5.15.6 WATER TREATMENT CHEMICALS MARKET, BY END USER

TABLE 11 WATER TREATMENT CHEMICALS MARKET SIZE, BY END USER, 2019-2026 (USD MILLION)

5.15.6.1 Residential

5.15.6.2 Commercial

5.15.6.3 Industrial

5.15.7 WATER TREATMENT CHEMICALS MARKET, BY SOURCE

5.15.7.1 Bio-based

5.15.7.2 Synthetic

5.15.8 WATER TREATMENT CHEMICALS MARKET, BY REGION

TABLE 12 WATER TREATMENT CHEMICALS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

5.15.8.1 North America

5.15.8.2 APAC

5.15.8.3 Europe

5.15.8.4 Middle East & Africa

5.15.8.5 South America

5.15.9 BOILER WATER TREATMENT CHEMICALS MARKET

5.15.10 BOILER WATER TREATMENT CHEMICALS MARKET, BY TYPE

TABLE 13 BWTC MARKET SIZE, BY TYPE, 2015–2022 (USD MILLION)

5.15.10.1 Corrosion inhibitors

5.15.10.2 Scale inhibitors

5.15.10.3 Oxygen scavengers

5.15.10.4 Others

5.15.11 BOILER WATER TREATMENT CHEMICALS MARKET, BY END-USE INDUSTRY

TABLE 14 BWTC MARKET SIZE, BY END-USE INDUSTRY, 2015–2022 (USD MILLION)

5.15.11.1 Power

5.15.11.2 Oil & Gas

5.15.11.3 Chemical & Petrochemical

5.15.11.4 Food & Beverage

5.15.11.5 Pulp & Paper

5.15.11.6 Others

5.15.12 BOILER WATER TREATMENT CHEMICALS MARKET, BY REGION

TABLE 15 BWTC MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

5.15.12.1 APAC

5.15.12.2 North America

5.15.12.3 Europe

5.15.12.4 Middle East & Africa (MEA)

5.15.12.5 South America

6 CORROSION INHIBITORS MARKET, BY COMPOUND (Page No. - 104)

6.1 INTRODUCTION

FIGURE 31 ORGANIC INHIBITORS TO BE THE LARGEST TYPE OF CORROSION INHIBITORS

TABLE 16 CORROSION INHIBITORS MARKET SIZE, BY COMPOUND, 2017–2020 (USD MILLION)

TABLE 17 MARKET SIZE, BY COMPOUND, 2021–2026 (USD MILLION)

TABLE 18 MARKET SIZE, BY COMPOUND, 2017–2020 (KILOTON)

TABLE 19 MARKET SIZE, BY COMPOUND, 2021–2026 (KILOTON)

6.2 ORGANIC INHIBITORS

6.2.1 LOW COST, GOOD SOLUBILITY WITH WATER, AND WIDE TEMPERATURE RANGE APPLICATION DRIVE THE MARKET

6.2.2 BENZOTRIAZOLE

6.2.3 AMINES

6.2.4 PHOSPHONATES

6.2.5 OTHERS

6.3 INORGANIC INHIBITORS

6.3.1 INCREASING ENVIRONMENTAL REGULATIONS AND CONCERNS ABOUT HEALTH INFLUENCING THE MARKET

6.3.2 NITRITES & NITRATES

6.3.3 CHROMATES, DI CHROMATES & BORATES

6.3.4 ZINC SULPHATE & OTHER SALTS

6.3.5 SILICATES

6.3.6 OTHERS

7 CORROSION INHIBITORS MARKET, BY TYPE (Page No. - 110)

7.1 INTRODUCTION

FIGURE 32 WATER BASED SEGMENT IS LEADING THE OVERALL MARKET

TABLE 20 CORROSION INHIBITORS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 21 MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 22 MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 23 MARKET SIZE, BY TYPE, 2021–2026 (KILOTON)

7.2 WATER-BASED CORROSION INHIBITORS

7.2.1 THE LEADING SEGMENT DUE TO ITS WIDE APPLICATIONS

TABLE 24 WATER-BASED CORROSION INHIBITORS

7.3 OIL/SOLVENT-BASED CORROSION INHIBITORS

7.3.1 WIDELY USED IN FUEL AND LUBRICANTS

TABLE 25 OIL/SOLVENT-BASED CORROSION INHIBITORS

7.4 VOLATILE CORROSION INHIBITORS

7.4.1 LOW MANUFACTURING AND OPERATING COST BOOSTING THE DEMAND

8 CORROSION INHIBITORS MARKET, BY APPLICATION (Page No. - 115)

8.1 INTRODUCTION

FIGURE 33 WATER TREATMENT TO BE THE LARGEST APPLICATION OF CORROSION INHIBITORS

TABLE 26 MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 27 CORROSION INHIBITORS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 28 MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 29 MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

8.2 WATER TREATMENT

8.2.1 WATER TREATMENT IS THE LEADING SEGMENT BECAUSE OF WIDE APPLICATIONS

8.3 PROCESS AND PRODUCT ADDITIVES

8.3.1 LARGE NUMBER OF APPLICATIONS IN PETROLEUM, PAINTS AND COATINGS, PROCESS INDUSTRIES

8.4 OIL & GAS PRODUCTION

8.4.1 INCREASING CONSUMPTION DUE TO THE GROWTH OF END USE INDUSTRY

9 CORROSION INHIBITORS MARKET, BY END-USE INDUSTRY (Page No. - 120)

9.1 INTRODUCTION

FIGURE 34 POWER GENERATION TO BE THE LARGEST END-USE INDUSTRY OF CORROSION INHIBITORS

TABLE 30 MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 31 CORROSION INHIBITORS MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 32 MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 33 MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

9.2 OIL & GAS AND REFINERY

9.2.1 CONTINUOUS EXPOSURE TO IMPURITIES AND SOURCES OF CORROSION DRIVES THE REQUIREMENT FOR CORROSION INHIBITORS

9.3 POWER GENERATION

9.3.1 RAPID INDUSTRIALIZATION IN THE APAC MARKET TO DRIVE THE POWER GENERATION INDUSTRY

9.4 METAL & MINING

9.4.1 CORROSION INHIBITORS INCREASE THE LIFESPAN OF VARIOUS EQUIPMENT USED IN METAL PROCESSING

9.5 PULP & PAPER

9.5.1 PRESENCE OF CORROSIVE CHEMICALS IN RECYCLING WATER DRIVE THE DEMAND FOR CORROSION INHIBITORS

9.6 UTILITIES

9.6.1 INITIATIVES TAKEN BY GOVERNMENTS DRIVE THE DEMAND FOR FRESHWATER

9.7 CHEMICAL

9.7.1 GOVERNMENT REGULATIONS ON THE DISCHARGE OF UNTREATED WATER DRIVE THE CORROSION INHIBITORS MARKET

9.8 OTHERS

9.8.1 FOOD & BEVERAGE

9.8.2 PHARMACEUTICALS

9.8.3 CONSTRUCTION

9.8.4 AUTOMOTIVE

9.8.5 AEROSPACE

10 CORROSION INHIBITORS MARKET, BY REGION (Page No. - 129)

10.1 INTRODUCTION

FIGURE 35 APAC TO BE THE LARGEST AND FASTEST-GROWING CORROSION INHIBITORS MARKET

TABLE 34 MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 35 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 36 MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 37 MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

10.2 APAC

FIGURE 36 APAC: CORROSION INHIBITORS MARKET SNAPSHOT

TABLE 38 APAC: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 39 APAC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 40 APAC: MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 41 APAC: MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 42 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 43 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 44 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 45 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

10.2.1 CHINA

10.2.1.1 Favorable urbanization and industrialization condition to boost the market

TABLE 46 CHINA: CORROSION INHIBITORS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 47 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 48 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 49 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

10.2.2 INDIA

10.2.2.1 Government initiatives to support the end-use industries

TABLE 50 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 51 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 52 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 53 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

10.2.3 SOUTH KOREA

10.2.3.1 Large and advanced industrial base to drive the corrosion inhibitors market

TABLE 54 SOUTH KOREA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 55 SOUTH KOREA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 56 SOUTH KOREA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 57 SOUTH KOREA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

10.2.4 JAPAN

10.2.4.1 Rising exports and technological advancement to drive the market for chemical & petrochemical based products

TABLE 58 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 59 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 60 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 61 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

10.2.5 INDONESIA

10.2.5.1 Growing population to drive industrialization and urbanization in the country

TABLE 62 INDONESIA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 63 INDONESIA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 64 INDONESIA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 65 INDONESIA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

10.2.6 REST OF APAC

TABLE 66 REST OF APAC: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 67 REST OF APAC: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 68 REST OF APAC: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 69 REST OF APAC: CORROSION INHIBITORS MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

10.3 EUROPE

FIGURE 37 EUROPE: CORROSION INHIBITORS MARKET SNAPSHOT

TABLE 70 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 71 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 72 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 73 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 74 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 75 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 76 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 77 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

10.3.1 GERMANY

10.3.1.1 Vast industrial base to support the corrosion inhibitors market

TABLE 78 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 79 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 80 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 81 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

10.3.2 FRANCE

10.3.2.1 Investments from international companies to drive the industrial growth

TABLE 82 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 83 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 84 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 85 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

10.3.3 UK

10.3.3.1 Newly established plants to influence the requirement for corrosion inhibitors

TABLE 86 UK: CORROSION INHIBITORS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 87 UK: CORROSION INHIBITORS MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 88 UK: CORROSION INHIBITORS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 89 UK: CORROSION INHIBITORS MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

10.3.4 ITALY

10.3.4.1 Waste water treatment regulations to influence the market for corrosion inhibitors

TABLE 90 ITALY: CORROSION INHIBITORS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 91 ITALY: CORROSION INHIBITORS MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 92 ITALY: CORROSION INHIBITORS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 93 ITALY: CORROSION INHIBITORS MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

10.3.5 RUSSIA

10.3.5.1 Government policies to support the infrastructural development

TABLE 94 RUSSIA: CORROSION INHIBITORS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 95 RUSSIA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 96 RUSSIA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 97 RUSSIA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

10.3.6 SPAIN

10.3.6.1 Growing power generation sector to drive the corrosion inhibitors market

TABLE 98 SPAIN: CORROSION INHIBITORS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 99 SPAIN: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 100 SPAIN: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 101 SPAIN: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

10.3.7 REST OF EUROPE

TABLE 102 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 103 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 104 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 105 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

10.4 NORTH AMERICA

FIGURE 38 NORTH AMERICA: CORROSION INHIBITORS MARKET SNAPSHOT

TABLE 106 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 107 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 108 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 109 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 110 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 111 NORTH AMERICA: CORROSION INHIBITORS MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 112 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 113 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

10.4.1 US

10.4.1.1 Availability of skilled workforce and high investment in R&D to drive various industries in the country

TABLE 114 US: CORROSION INHIBITORS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 115 US: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 116 US: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 117 US: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

10.4.2 CANADA

10.4.2.1 Abundance of natural resources influences the end use industries for corrosion inhibitors

TABLE 118 CANADA: CORROSION INHIBITORS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 119 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 120 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 121 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

10.4.3 MEXICO

10.4.3.1 Governments initiatives to drive the market

TABLE 122 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 123 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 124 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 125 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

10.5 MIDDLE EAST & AFRICA

TABLE 126 MIDDLE EAST & AFRICA: CORROSION INHIBITORS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 127 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 128 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 129 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 130 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 131 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 132 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 133 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

10.5.1 SAUDI ARABIA

10.5.1.1 Upcoming projects to influence the market for corrosion inhibitors

TABLE 134 SAUDI ARABIA: CORROSION INHIBITORS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 135 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 136 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 137 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

10.5.2 UAE

10.5.2.1 Natural gas production expansions to drive the market

TABLE 138 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 139 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 140 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 141 UAE: CORROSION INHIBITORS MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

10.5.3 SOUTH AFRICA

10.5.3.1 Governments initiatives to drive the market

TABLE 142 SOUTH AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 143 SOUTH AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 144 SOUTH AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 145 SOUTH AFRICA: CORROSION INHIBITORS MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

10.5.4 IRAN

10.5.4.1 Petrochemical industry to support the growth of non-oil revenue in the country

TABLE 146 IRAN: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 147 IRAN: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 148 IRAN: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 149 IRAN: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

10.5.5 REST OF MIDDLE EAST & AFRICA

TABLE 150 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 151 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 152 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 153 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

10.6 SOUTH AMERICA

TABLE 154 SOUTH AMERICA: CORROSION INHIBITORS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 155 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 156 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 157 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 158 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 159 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 160 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 161 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

10.6.1 BRAZIL

10.6.1.1 Growing power generation sector to drive the market for corrosion inhibitors

TABLE 162 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 163 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 164 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 165 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

10.6.2 ARGENTINA

10.6.2.1 Residential sector to drive the electricity demand in the country

TABLE 166 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 167 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 168 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 169 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

10.6.3 REST OF SOUTH AMERICA

TABLE 170 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 171 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 172 REST OF SOUTH AMERICA: CORROSION INHIBITORS MARKETMARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 173 REST OF SOUTH AMERICA: CORROSION INHIBITORS MARKETMARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

11 COMPETITIVE LANDSCAPE (Page No. - 202)

11.1 KEY PLAYERS’ STRATEGIES

TABLE 174 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, 2015–2020

11.2 MARKET RANKING OF KEY PLAYERS

FIGURE 39 CORROSION INHIBITOR MANUFACTURERS’ RANKING

11.3 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS

FIGURE 40 SHARE OF KEY PLAYERS OF CORROSION INHIBITORS MARKET, 2020

TABLE 175 CORROSION INHIBITORS: DEGREE OF COMPETITION

11.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 41 TOP PLAYERS DOMINATED THE MARKET IN LAST 5 YEARS

11.5 MARKET EVALUATION MATRIX

TABLE 176 MARKET EVALUATION MATRIX

11.6 COMPANY EVALUATION MATRIX 2020 TIER 1

11.6.1 STAR

11.6.2 EMERGING LEADERS

11.6.3 PERVASIVE

11.6.4 PARTICIPANT

FIGURE 42 CORROSION INHIBITORS MARKET: COMPANY EVALUATION TIER 1 MATRIX, 2020

11.6.5 STRENGTH OF PRODUCT PORTFOLIO

11.6.6 BUSINESS STRATEGY EXCELLENCE

TABLE 177 COMPANY PRODUCT FOOTPRINT

TABLE 178 COMPANY INDUSTRY FOOTPRINT

TABLE 179 COMPANY REGION FOOTPRINT

11.7 START-UPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX

11.7.1 PROGRESSIVE COMPANIES

11.7.2 STARTING BLOCKS

FIGURE 43 CORROSION INHIBITORS MARKET: START-UPS AND SMES MATRIX, 2020

11.8 COMPETITIVE TRENDS AND SCENARIO

11.8.1 DEALS

TABLE 180 CORROSION INHIBITORS MARKET: DEALS, JANUARY 2016-DECEMBER 2020

11.8.2 OTHERS

12 COMPANY PROFILES (Page No. - 220)

(Business Overview, Products/Solutions Offered, Recent Developments, SWOT Analysis, Winning Imperatives, Current Focus and Strategies, Threat From Competition, Right to Win)*

12.1 SOLENIS LLC

TABLE 181 SOLENIS LLC: BUSINESS OVERVIEW

12.2 NOURYON

TABLE 182 NOURYON: BUSINESS OVERVIEW

12.3 BAKER HUGHES INCORPORATED

TABLE 183 BAKER HUGHES INCORPORATED: BUSINESS OVERVIEW

FIGURE 44 BAKER HUGHES INCORPORATED: COMPANY SNAPSHOT

12.4 ECOLAB /NALCO WATER

TABLE 184 ECOLAB/NALCO WATER : BUSINESS OVERVIEW

FIGURE 45 ECOLAB/NALCO WATER: COMPANY SNAPSHOT

12.5 BASF SE

TABLE 185 BASF: BUSINESS OVERVIEW

FIGURE 46 BASF SE: COMPANY SNAPSHOT

12.6 SUEZ

TABLE 186 SUEZ: BUSINESS OVERVIEW

FIGURE 47 SUEZ: COMPANY SNAPSHOT

12.7 DOW CHEMICAL COMPANY

TABLE 187 DOW CHEMICAL COMPANY: BUSINESS OVERVIEW

FIGURE 48 DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

12.8 LUBRIZOL

TABLE 188 LUBRIZOL : BUSINESS OVERVIEW

12.9 LANXESS

TABLE 189 LANXESS: BUSINESS OVERVIEW

FIGURE 49 LANXESS: COMPANY SNAPSHOT

12.10 HENKEL

TABLE 190 HENKEL. : BUSINESS OVERVIEW

FIGURE 50 HENKEL: COMPANY SNAPSHOT

*Business Overview, Products/Solutions Offered, Recent Developments, SWOT Analysis, Winning Imperatives, Current Focus and Strategies, Threat From Competition, Right to Win might not be captured in case of unlisted companies.

12.11 OTHER PLAYERS

12.11.1 CHAMPIONX

12.11.2 ASHLAND

12.11.3 CLARIANT

12.11.4 EASTMAN CHEMICAL COMPANY

12.11.5 SOVLAY

12.11.6 KURITA WATER INDUSTRIES

12.11.7 ARKEMA

12.11.8 CORTEC CORPORATION

12.11.9 ICL GROUP

12.11.10 LONZA

12.11.11 W. R. GRACE

12.11.12 CHEMTREAT

12.11.13 KEMIRA OYJ

12.11.14 NOF METAL COATINGS

12.11.15 CROMWELL

13 APPENDIX (Page No. - 252)

13.1 INSIGHTS FROM INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the corrosion inhibitors market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and subsegments of the overall market.

Secondary Research

This research report involves extensive secondary sources, directories, and databases, such as Bloomberg, BusinessWeek, Factiva, ICIS, and OneSource, to identify and collect information useful for the technical, market-oriented, and commercial study of the corrosion inhibitors market. The secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles from recognized authors, authenticated directories, and databases.

Primary Research

The corrosion inhibitors market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, buyers, and regulatory organizations. The demand side of this market is characterized by developing the end-use industry, such as residential, commercial, and industrial. The supply side included industry experts, such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the corrosion inhibitors market. These methods were also used extensively to estimate the sizes of various subsegments in the market. The research methodology used to estimate the market size includes the following steps:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the estimation processes explained above—the corrosion inhibitors market was split into several segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the Corrosion Inhibitors market size, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To define, describe, and forecast the market based on compound, type, application and end-use industry

- To forecast the market size of different segments based on regions: Asia Pacific (APAC), Europe, North America, the Middle East & Africa, and South America, along with their key countries

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape of market leaders

- To analyze competitive developments: expansion, new product development, and acquisitions in the market

- To strategically profile the key players and comprehensively analyze their core competencies.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the corrosion inhibitors market report:

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company

Regional Analysis

- A further breakdown of the corrosion inhibitors market, by segments

Company Information

- Detailed analysis and profiling of additional market players (up to ten)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Corrosion Inhibitors Market