The study involved four major activities in estimating the current size of the overall equipment effectiveness software market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to identify and collect information important for the overall equipment effectiveness software market study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers and certified publications; articles from recognized authors; directories; and databases.

Secondary research was mainly conducted to obtain key information about the market value chain, the industry supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and key developments from both markets- and technology-oriented perspectives. Data from secondary research was collected and analyzed to arrive at the overall market size, which was further validated by primary research.

Primary Research

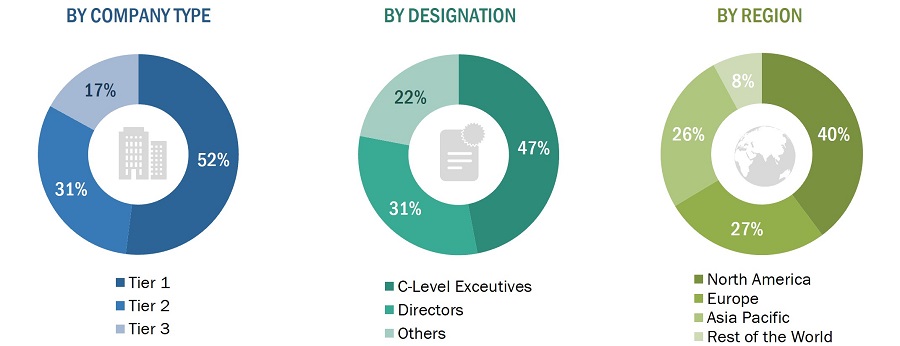

In the primary research process, various primary sources from both the supply and demand sides have been interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts, such as CEOs, VPs, marketing directors, technology and innovation directors, and related key executives from major companies and organizations operating in the overall equipment effectiveness software market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

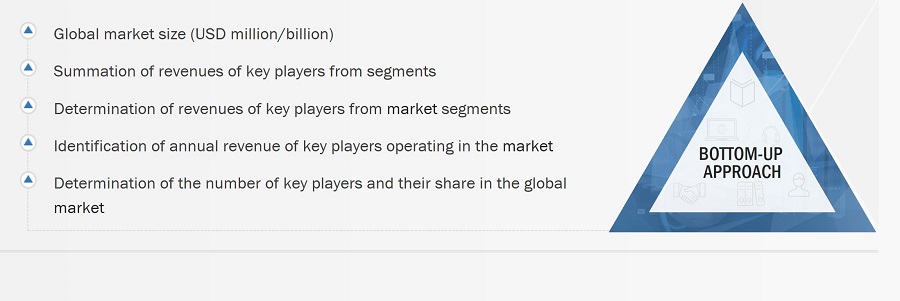

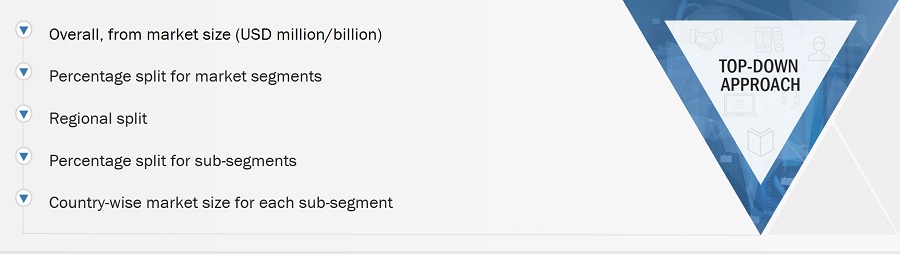

In this report, for the complete market engineering process, both top-down and bottom-up approaches were used, along with several data triangulation methods, to estimate, forecast, and validate the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were carried out to list the key information/insights pertaining to the overall equipment effectiveness software market.

Overall Equipment Effectiveness Software Market: Bottom-Up Approach

-

Key players operating in the overall equipment effectiveness software market have been identified through extensive secondary research.

-

The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

-

All percentage shares, splits, and breakdowns have been determined by using secondary sources and verified through primary sources.

Overall Equipment Effectiveness Software Market: Top-Down Approach

-

Focusing on the top-line expenditures and investments made throughout the overall equipment effectiveness software ecosystem for installing new overall equipment effectiveness software and retrofitting the existing ones.

-

Information related to revenues generated by the key developers and providers of overall equipment effectiveness software has been studied and analyzed.

-

Multiple on-field discussions have been carried out with the key opinion leaders of the leading companies involved in developing overall equipment effectiveness software.

-

The geographical split has been estimated using secondary sources based on various factors, such as the number of players in a specific country or region and the type of overall equipment effectiveness software offered by these players.

Data Triangulation

After arriving at the overall equipment effectiveness software market size—using the estimation processes explained above—the market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends in both the demand and supply sides of the overall equipment effectiveness software market.

Market Definition

Overall equipment effectiveness (OEE) software is a tool used to measure and improve the efficiency and productivity of manufacturing processes. It is a metric that quantifies the performance of equipment or a production line by considering three key factors: availability, performance, and quality. OEE software collects data from various sources, such as machines, sensors, and operators, and provides real-time monitoring and analysis of production performance. It calculates the OEE score by multiplying the abovementioned factors (availability, performance, and quality) to measure the equipment's effectiveness comprehensively.

Key Stakeholders

-

OEE software providers

-

Associations and regulatory authorities developing standards related to plant maintenance

-

Government bodies, venture capitalists, and private equity firms

-

Automation consultants

-

Automation system integrators

-

Software developers

-

Distributors and providers of SCADA, MES, ERP, predictive maintenance, and data historian

-

Providers of professional services/solutions

-

Process and discrete industries

-

Research organizations and consulting companies

-

Technology investors

-

Technology standards organizations, forums, alliances, and associations

Report Objectives:

-

To describe, segment, and forecast the overall equipment effectiveness software market based on offering, deployment mode, type, and industry.

-

To describe and forecast the market for various segments with respect to four main regions: North America, Europe, Asia Pacific, and the Rest of the World, in terms of value.

-

To provide qualitative information about the overall equipment effectiveness software methods.

-

To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the said market.

-

To provide a comprehensive overview of the overall equipment effectiveness software value chain

-

To analyze opportunities for stakeholders by identifying high-growth segments of the overall equipment effectiveness software market

-

To strategically analyze the ecosystem, Porter’s five forces, tariffs and regulations, patent landscape, trade landscape, and case studies/use cases pertaining to the market under study

-

To provide a detailed analysis of the impact of the recession on the overall equipment effectiveness software market, its segments, and market players

-

To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market size

-

To strategically profile the key players and comprehensively analyze their market positions in terms of their ranking and core competencies2, along with detailing the competitive landscape for market leaders.

-

To analyze competitive developments, such as product launches and development, acquisition, agreement, and partnership in the overall equipment effectiveness software market.

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Overall Equipment Effectiveness Software Market