Nutraceutical Packaging Market

Nutraceutical Packaging Market by Packaging Type (Blisters & Strips; Bottles), Product Type (Dietary Supplements; Functional Foods), Product Form (Tablets & Capsules; Powder & Granules), Material, Ingredient & Region - Global Forecast to 2030

Updated on : November 27, 2025

NUTRACEUTICAL PACKAGING MARKET OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global nutraceutical packaging market is projected to reach USD 4.66 billion by 2030 from USD 3.67 billion in 2025, at a CAGR of 4.9% during the forecast period. The market for nutraceutical packaging is substantially expanding due to several factors including rising consumer demand for healthy products and functional foods. Functional foods and dietary supplements are major segments that are contributing to the market in a positive way and need specialized packaging to maintain active ingredients, product integrity, and shelf life.

KEY TAKEAWAYS

-

BY PRODUCT FORMThe nutraceutical packaging market, by product, has been segmented into tablets & capsules, powder & granules, liquid and solid & soft gel. The tablet & capsules segment accounted for largest market share. Their compact design facilitates easy swallowing and ensures precise dosing due to consistent manufacturing processes.

-

BY PRODUCT TYPEBased on product type, the nutraceutical packaging market is segmented into dietary supplements, functional foods, functional beverages, and others. The dietary supplements accounted for largest share as they offer convenient way for consumer to obtain essential nutrients and support overall health and well being.

-

BY PACKAGING TYPEThe packaging type segment of the nutraceutical packaging market is broadly categorized into blisters & strips, bottles, jars & canisters, bags & pouches, stick packs, boxes & cartons, caps & closures and others. The bottles segment dominated the market owing to their durability, convenience and ability to protect product integirty.

-

BY MATERIALThe material segment of the nutraceutical packaging market is categorized into plastics, paper & paperboard, metals, glass and others. The plastics segment accounted for the largest share owing to their ease of molding, high durability, cost-effectiveness, excellent barrier properties, and design flexibility.

-

BY INGREDIENTThe ingredient segment of the nutraceutical packaging market is categorized into vitamins, minerals, probiotics & prebiotics, amino acids, omega-3 fatty acids, and others. The vitamins segment accounted for the largest share as they are essential micronutrients which play crucial role in metabolism, immune funtion, and maintaining overall health.

-

BY REGIONThe nutraceutical packaging market covers Europe, North America, Asia Pacific, South America, the Middle East, and Africa. Asia Pacific is expected to grow fastest, with a CAGR of 5.8%, driven by growing population, urbanization, and increase in chronic diseases in the region.

-

COMPETITIVE LANDSCAPEThe market is driven by strategic collaborations, capacity expansions, and technological innovations from leading players such as Berry Global, Amcor Plc, WestRock Company, Mondi, Sonoco Products Company, Huhtamaki among others. The market is highly fragmented comprising large number of large, medium-sized, and small companies.

The firms in the nutraceutical packaging sector are turning to environmentally-friendly options like biodegradable and recyclable packaging due to tighter sustainability regulations. Smart packaging, which includes QR codes and NFC labels, keeps track of products by engaging consumers and allows brands to stand out from competitors. Companies like Amcor Inc. are introducing recyclable high-barrier laminates, both providing safety of the product and meeting sustainability objectives.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Nutraceutical packaging is used in the packaging and securing of medicinal products or drugs. It plays a vital role in safeguarding and maintaining the efficacy of drugs. Various new and advanced technologies such as nanotechnology, nano barcodes, modified atmosphere packaging, biodegradable and sustainable materials, advanced polymers, and IoT in medicine, are expected to drive the market in the near future.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing demand for nutraceutical products

-

Increasing demand from personal care and food & beverage end-use industries

Level

-

Regulatory compliance and stringent standards

-

Higher cost consideration compared to conventional packaging

Level

-

Child-resistant packaging innovations

-

Increasing acceptance of eco-friendly packaging solutions in nutraceutical industry

Level

-

Shelf life and product stability

-

Supply chain disruptions

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing demand for nutraceutical products

One of the major drivers of the growth of the nutraceutical packaging industry is the increased use of nutraceuticals. Health and wellness awareness levels are rising that has fueled the consumption of nutraceuticals, including dietary supplements, functional foods, and drinks, which provide added medicinal benefits compared to normal nutrition. These have been helped by increases in disposable incomes, urbanization, and lifestyles shifting towards healthy living worldwide. Nutraceutical packaging is necessary to sustain the effectiveness and integrity of products, which are usually manufactured from vitamins, minerals, antioxidants, and probiotics, all of which are sensitive. IMPORTANT: Tamper evident seals, barrier properties for moisture, UV protectiveness, etc. assist in contributing to integrity while meeting stringent regulatory standards for labeling and safety. Greater understanding of exercise routines and nutrition has accelerated via social media and the health community on the internet, exponentially, particularly among millennials. Celebrities and influencers promote nutraceutical products which will also drive demand. The aging demographic increasingly turns towards nutraceuticals to impact age-related disorders, which augurs well for market growth additionally. E-commerce also alters buyer behavior, and hence packaging is being created in order to make online buying with protective measures to ensure safe carriage. Sustainability programs are also increasingly being accepted and gaining momentum amongst consumers with tendencies towards green offerings and recyclable and biodegradable packaging goods.

Restraint: Regulatory compliance and stringent standards

Regulatory responsibilities and exacting standards represent a tremendous barrier to the nutraceutical packaging sector — companies are required to meet regulatory guidelines established by United States Food and Drug Administration (USFDA), European Food Safety Agency (EFSA), and others internationally. The regulations ensure the safety of products, validity of the label, and suitability of materials for nutraceuticals, which inherently complicates the packaging process. Compliance usually requires substantial testing, reporting, and certification, this drives additional costs and time to market. For example, nutraceutical packaging has extremely specific requirements for moisture resistance, oxygen barrier, and UV protection, in order to maintain the integrity of the product. Moreover strict restrictions on single use plastics require high cost inputs in new materials and innovative packaging options, which adds up to the cost of the final products. Ongoing regulatory changes and variation from one region to another also make it difficult for packaging to become standardized with nutraceutical packaging companies that operate globally, which can lead to inefficiencies. Moreover, the need for transparent and compliant label claims such as: health claims, ingredient disclosure, and allergens warnings increases the need for continuous monitoring to avoid penalties and fines. Non-compliance can result in substantial fines and potential product recalls as well as harm to the company's reputation or goodwill, resulting in reluctance to embrace new packaging technologies. These factors represent some of the principal barriers to better packaged nutraceutical supplement.

Opportunity: Child resistant packaging innovations

The growing emphasis on child-friendly packaging has created an opportunity for the nutraceutical packaging industry. With parents becoming more concerned with of nutrition and the overall health well being of children, the demand for children-specific dietary supplements and functional drinks is rising at a high pace. This shifts packaging to require a unique focus on positional safety, user-friendly packaging features, attractive aesthetics, etc. Child-resistant packaging (CRP) is a mandatory requirement, meaning that supplements like gummies or chews should not be easily accessible to younger children (to reduce any accidental consumption). Child-safe closure also serves as an "open portal" for innovation of tamper-evident and child-resistant packaging modalities, like push-and-turn closures, blister packs, and reseal pouches. The packaging also has to resonate attractive possibilities for kids while keeping parents delighted that the package includes quality and authentic items. This means bright color schemes, interactive designs, and clear labeling that emphasizes safety and nutritional value often included in the packages. Time-strapped parents are also experienced (like single dose, easy dropper bottles, and spill-proof containers) which raises the consumer demand connected to time-efficient and easy to use . For parents who are more environmentally conscious, there are also sustainability factors influencing demand for packages that are compostable, recyclable, and BPA-free.

Challenges: Shelf life and product stability

Shelf life and product stability are among the most significant challenges faced by the nutraceuticals packaging industry. Because nutraceuticals typically contain sensitive ingredients such as vitamins, probiotics, or botanical extracts, efficacy can be lost if the packaging fails to limit moisture, oxygen, heat, or light. Packaging must ensure product efficacy throughout the intended shelf life of the nutraceutical, which means it is assumed that the packaging has some overall superior barrier property; and, that it is sufficiently sophisticated. This realization inhibits the development of the superior packaging while maintaining cost-effectiveness and environmental friendliness. For example, packaging materials must display excellent barrier properties against moisture and oxygen intrusion, which usually means multilayer films, aluminum foil or proprietary coatings are required. Adding difficulty to superior packaging development, these barriers elevate production costs and are not suited towards the new area of sustainable packaging. Also, many temperature-sensitive nutraceuticals, such as probiotics or omega-3 supplements, do require packaging that offers thermal insulation or cold-chain shipments, which adds a distance logistical challenge. Lastly, light-sensitive nutraceutical products require opaque or UV-resistant packaging which gives little flexibility in material design selection.

nutraceutical-packaging-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Customized packaging labels with specialty effects including cold foil, holographic elements, and UV coatings | Enhanced visual appeal and improved brand differentiation while ensuring regulatory compliance |

|

High gloss spot labels with foil stamping and embossing for multivitamin packaging | Increased brand recall by 30% through standout visual packaging and maintaining product integrity against moisture and light exposure |

|

Custom plastic bottles made from 90% post-consumer recycled material with a modified child-resistant closure | Enhanced sustainability appeal, meeting consumers demand for eco-friendly packaging |

|

Beehive-shaped custom structure for vitamin supplements using paperboard material | Reinforcing natural positioning in a competitive organic products segment |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The nutraceutical packaging market ecosystem comprises raw material suppliers, manufacturers, distributors, and end users. The raw materials for manufacturing nutraceutical packaging include certain metals, glass, papers, paperboard, and plastic. Raw material suppliers supply necessary materials for the manufacturing of nutraceutical packaging. These materials should comply with strict regulatory standards for safety and biocompatibility. The raw materials are then processed by manufacturers into different types of packaging used for nutraceuticals. The distribution of the product is crucial for the delivery of products to the consumers. End users include dietary supplements, functional foods, functional beverages, herbal products, and consumer goods industries for which use these packaging types various applications.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Nutraceutical Packaging Market, By Packagin Type

Bottles are the fastest-growing packaging form in nutraceutical packaging due to their convenience, strength, and ease of use for customers. Bottles are an amazing storage option for powders, granules, and liquids in a way that retains the product effectiveness and adds to shelf life. Bottles are convenient to use, they can be resealed, and they can be designed as child-resistant packaging for functional foods and dietary supplements. Bottles can also be produced using environment-friendly materials like recyclable plastic, which is going to gain greater significance from consumers. And the growth in e-commerce also added to the demand for bottles since they possess the capability of offering strong packaging during shipping. All these make bottles grow incredibly fast in nutraceuticals packaging.

Nutraceutical Packaging Market, By Product Type

Dietary supplements is the fastest growing product type in nutraceutical packaging market. An increase in health-conscious customers is driving demand for supplements related to overall health, immunity, weight control and sports nutrition. Growth is further supplemented by an aging world population which tends to rely on supplements to help address aging-related health issues. The post-pandemic has seen an increase in the use of immunity-related supplements, and this has led to an increase in demand for new and protective packaging. Dietary supplements typically need differentiated packaging to maintain product integrity, safety and efficacy. This has generated new lines of environmentally friendly and sustainable packaging including biodegradable materials and recyclable packaging design.

Nutraceutical Packaging Market, By Product Form

During the forecast period, tablets and capsules are projected to be the highest growing product form in the nutraceutical packaging market. They are easy to use having increased shelf life, and accurate dosages benefits. Due to their ease of consumption and the growing need for dietary supplements consumers prefer using tablets and capsules. Additionally tablets and capsules is fueling growth for pharmaceutical-grade packaging, such as blister packs, pouches, and bottles, that promote sustain product stability, protect against contamination, and bolster product presentation. The direct-to-consumer and e-commerce delivery marketplace is creating a need for heavy-duty, tamper-proof, durable packaging design condition. Tablets and capsules will occupy the highest value share in nutraceutical packaging market as health awareness elevation and new innovative packaging materials to protect and promote sustainability.

REGION

Asia Pacific to be fastest-growing region in global nutraceutical packaging market during forecast period

Asia-Pacific is projected to be the fastest growing region of the nutraceutical packaging market during the forecast period due to the increased health awareness, higher disposable incomes, and the growing aging population. Countries such as China, India, Japan and South Korea are experiencing growth in demand for nutraceuticals including dietary supplements, functional foods and beverages, due to changes in consumer preferences towards preventive healthcare. Such strong growth is also resulting in an increasing need for innovative and protective packaging that stabilizes, prolongs shelf life and enhances convenience. Furthermore, the rapid urbanization of the region and the rise of e-commerce, has also increased the adoption of sophisticated packaging technologies (e.g. tamper proof, moisture resistant and sustainable packaging). Even governments in countries like India and China, are implementing stricter compliance standards for packaging materials and labeling, leading companies to invest in compliance-driven and eco-friendly packaging.

nutraceutical-packaging-market: COMPANY EVALUATION MATRIX

In the nutraceutical packaging market matrix, Amcor, is one of the leading global suppliers of nutraceutical packaging, through a combination of strategic strengths, innovation, and alignment with industry trends. Birchwood Contract Manufacturing is one of the emerging player in the nutraceutical packaging market owing to its specialized contract services, adaptibility to market demands, and strategic positioning in a rapidly expanding sector.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 66.67 Billion |

| Market Forecast in 2030 (value) | USD 97.27 Billion |

| Growth Rate | CAGR of 6.6% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (KiloTon) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: nutraceutical-packaging-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| US-based Nutraceutical Packaging Manufacturer |

|

|

| Nutraceutical Manufacturers |

|

|

| Nutraceutical Packaging Distributor |

|

|

| Raw Material Supplier |

|

|

RECENT DEVELOPMENTS

- December 2024 : Sonoco Products company completed its acquisition of Eviosys, Europe's top food can and closure manufacturer from KPS Capital Partners.

- October 2024 : Berry Global launched ClariPPil fully recyclable polypropylene(PP) pill bottles for healthcare applications

- July 2024 : Smurfit Kappa has completed its acquisition of WestRock, forming Smurfit Westrock, one of the world's largest packaging companies.

- May 2023 : Apar CSP Technologies launched Avanti an innovative probiotic mixology solution using Activ-Polymer technology

- February 2022 : Comar Packaging Solutions acquired Automatic Plastics Ltd., a contract manufacturer of injection molded products primarily for the medical device, pharmaceutical, and nutraceutical sectors

Table of Contents

Methodology

The study involved four major activities in estimating the market size of the nutraceutical packaging market. Exhaustive secondary research was done to collect information on the market, the peer market, and the grandparent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, gold standard and silver standard websites, and databases. Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The nutraceutical packaging market comprises several stakeholders in the value chain, which include manufacturers, and end users. Various primary sources from the supply and demand sides of the nutraceutical packaging market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in industrial sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the nutraceutical packaging industry. Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to packaging type, product type, product form, material, ingredient and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage of nutraceutical packaging and outlook of their business, which will affect the overall market.

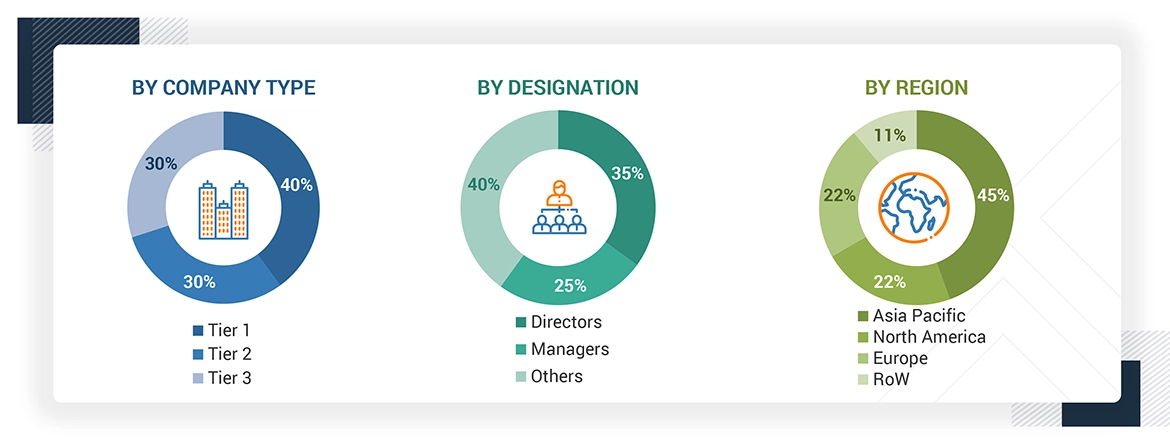

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the nutraceutical packaging market.

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Data Triangulation

After arriving at the total market size from the estimation process, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Nutraceutical packaging involves the special packaging solutions that are specifically tailored to accommodate nutraceutical products, including dietary supplements, functional foods, herbal-based products, and healthy beverages beyond ordinary nutrition. All these forms of packaging address various purposes, including product integrity, shelf life extension, contamination avoidance, and protection against external conditions such as moisture, light, and oxidation.

Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

- Manufacturers

- Raw Material Suppliers

Report Objectives

- To define, describe, and forecast the size of the nutraceutical packagingmarket, in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on type, technology, application, end-use industry, and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Nutraceutical Packaging Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Nutraceutical Packaging Market