Augmented and Virtual Reality Market Size, Share and Growth 2032

Augmented and Virtual Reality Market by Enterprise, Technology (Augmented Reality, Virtual Reality), Offering (Hardware, Software), Device Type (HMDs, HUDs, Gesture Tracking Devices), Application, and Region -Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

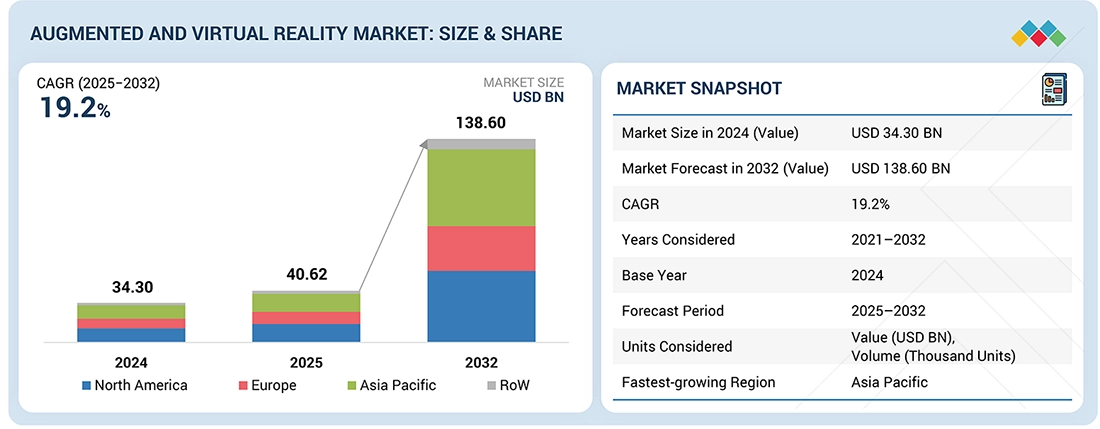

The augmented and virtual reality market is projected to reach USD 138.60 billion by 2032 from USD 40.62 billion in 2025, at a CAGR of 19.2% from 2025 to 2032. AR and VR technologies are currently pivotal in the development of emerging technologies, including AR smart glasses, VR-based microdisplays, mobile AR, near-eye displays, and AR-powered displays. AR smart glasses, such as Microsoft HoloLens and Vuzix Blade, project digital content into the user's view, allowing hands-free interaction and being utilized for industrial training, remote assistance, and gaming. VR-based microdisplays, utilizing OLED and LCD technologies, enhance VR headsets with high-resolution visuals and wide fields of view, developed by companies such as eMagin and Kopin. Mobile AR leverages smartphone capabilities for apps, such as Pokémon Go and Snapchat, driven by advancements in computer vision and 3D rendering.

KEY TAKEAWAYS

-

By RegionNorth America accounted for the largest market share of 35.6% in 2024.

-

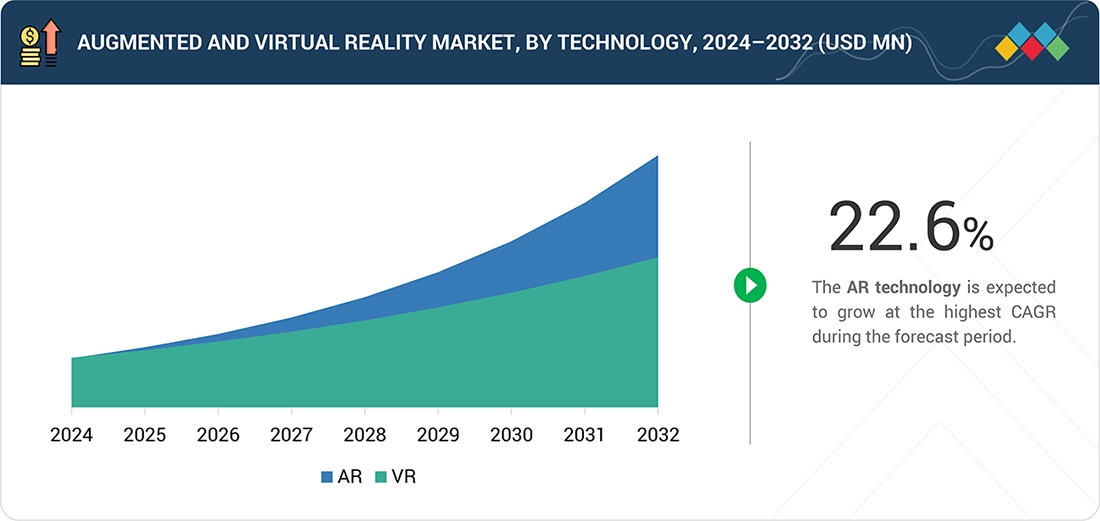

By TechnologyBy technology, augmented reality accounted for a market share of 49.8% in 2024.

-

By OfferingBy offering, the augmented reality software segment accounted for a market share of 87.5% in 2024.

-

By Device TypeAR head-mounted displays (HMDs) and VR gesture tracking devices are expected to witness the highest CAGR in the AR and VR market during the forecast period.

-

By ApplicationBy application, enterprise and consumer applications are expected to account for the largest market share in 2024.

-

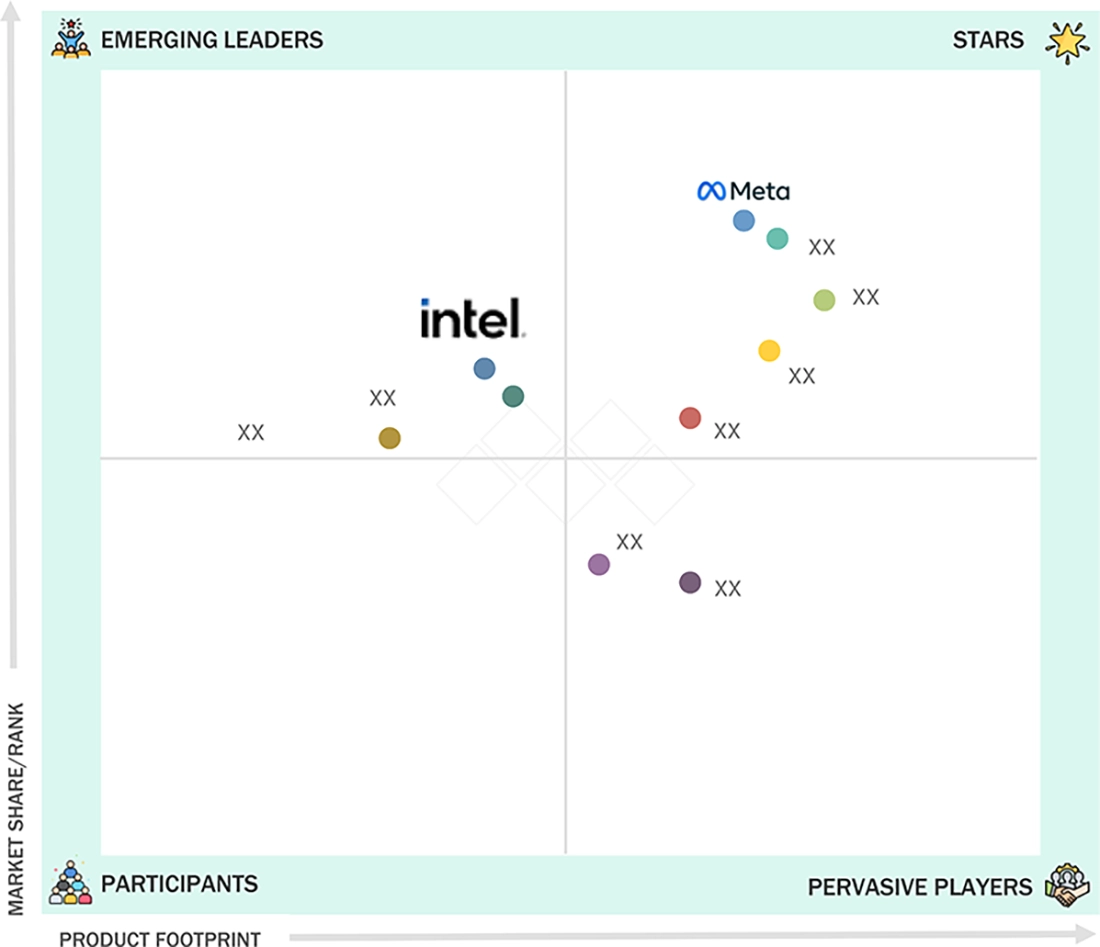

Competitive LandscapeMeta (US) and Apple, Inc. (US) are identified as the star players in the North America augmented an d virtual reality market, given their strong market share and product footprint.

-

Competitive LandscapeVRchat (US) and Praxis Labs (US), among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

Governments worldwide are fostering the growth of the AR market through various forms of support, such as funding, research and development assistance, startup grants, and partnerships with academic institutions. For example, in September 2023, Envisics, a UK-based holographic company that produces in-car technology projecting navigation and safety alerts onto windshields, raised USD 100 million in its Series C funding round. The company is expected to commercialize AR head-up displays during the forecast period.

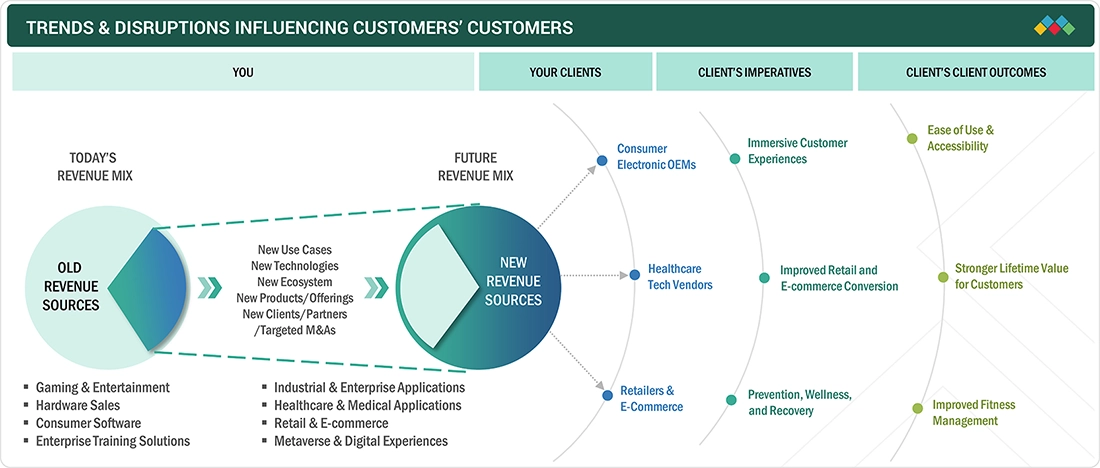

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The AR and VR market is primarily driven by hardware components, including sensors, displays, semiconductor devices, cameras, and head-mounted systems, as well as a rapidly expanding software ecosystem. While VR initially gained momentum through the adoption of hardware in gaming and entertainment, it has increasingly penetrated enterprise applications across various industries. AR, on the other hand, has seen strong consumer and business interest, particularly in applications such as smart glasses, mobile AR, and near-eye displays for training, industrial operations, and remote assistance. Ongoing advancements in AR-powered displays, microdisplays, and immersive visualization technologies are anticipated to create significant growth opportunities for AR and VR vendors worldwide over the next five years.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Strong adoption of AR/VR in gaming and enterprise applications

Level

-

High cost of AR/VR hardware and content development

Level

-

Expansion of AR smart glasses and spatial computing

Level

-

User comfort, privacy, and data security concerns

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Strong adoption of AR/VR in gaming and enterprise applications

A mature gaming ecosystem and a high level of enterprise digitalization drive strong demand for AR and VR technologies. Advanced headsets such as Apple Vision Pro and Meta Quest are accelerating user adoption by offering improved performance and immersive experiences. In parallel, enterprises are deploying AR/VR for training, simulation, design, and remote collaboration, supporting sustained market growth.

Restraint: High cost of AR/VR hardware and content development

The high upfront cost of advanced AR/VR devices, along with expenses related to custom software and content creation, limits widespread adoption. Small and medium-sized enterprises and price-sensitive consumers often delay investment due to unclear return on investment. This cost barrier slows penetration beyond early adopters.

Opportunity: Expansion of AR smart glasses and spatial computing

Growing interest in hands-free, spatial computing solutions presents a major opportunity for AR smart glasses. Industries such as healthcare, manufacturing, logistics, and defense are increasingly adopting AR for real-time guidance and productivity enhancement. Continuous investment and innovation by major technology players are expected to accelerate the commercialization and widespread adoption of these technologies.

Challenge: User comfort, privacy, and data security concerns

Prolonged use of AR/VR devices still raises concerns around user comfort, eye strain, and motion sickness. Additionally, the use of cameras and sensors in AR/VR systems creates privacy and data security challenges, particularly in enterprise and public environments. Addressing these technical and regulatory concerns is critical for long-term adoption in the market.

AUGMENTED AND VIRTUAL REALITY MARKET SIZE, SHARE AND GROWTH 2032: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Apple Vision Pro used for spatial computing applications in enterprise collaboration, medical visualization, immersive media consumption, and advanced design workflows. | Enhanced productivity, realistic 3D visualization, improved user experience, and acceleration of spatial computing adoption across industries. |

|

Meta Quest headsets deployed for gaming, social VR, enterprise training, and virtual collaboration through Horizon Workrooms. | Cost-effective immersive experiences, scalable enterprise training, reduced training time, and strong ecosystem support for developers and content creators. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

This illustrates the ecosystem of the AR and VR market, spanning the entire value chain from research and development to end users. Academic and research institutions drive core innovation, while component providers enable software platforms and processing capabilities. Device manufacturers translate these technologies into commercial AR/VR hardware, supported by distributors that ensure large-scale market reach. End users across industries such as aerospace, automotive, tourism, and healthcare ultimately drive demand and real-world adoption of AR and VR solutions.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

By Region

North America is expected to hold the largest share of the AR and VR market due to the presence of major technology players, strong R&D capabilities, and early adoption of immersive technologies. High consumer spending power, combined with a well-established gaming and entertainment industry, further drives demand for AR and VR devices and applications. In addition, significant investments across defense, healthcare, and enterprise training accelerate large-scale deployment in the US market.

By Application

The enterprise application segment is expected to dominate the AR market during the forecast period. This growth is driven by the increasing need to enhance workforce training, reduce human error, and improve operational efficiency, particularly across manufacturing, healthcare, and logistics. The integration of AR into training and workflow optimization aligns strongly with Industry 4.0 initiatives, offering greater visibility and real-time guidance to employees.

By Technology

Augmented reality is expected to grow at the highest rate among immersive technologies due to its wide applicability across enterprise and consumer use cases. Strong adoption of mobile AR, smart glasses, and spatial computing solutions is accelerating deployment in industries such as healthcare, manufacturing, retail, and logistics. Continuous advancements in computer vision, AI, and 5G connectivity are enhancing AR performance and real-time capabilities.

By Offering

Software holds the largest share of the AR and VR market due to the growing demand for content platforms, development tools, and enterprise application software. The increasing use of AR/VR in gaming, training, simulation, and remote collaboration is driving recurring revenue from software licenses and subscriptions. The strong adoption of engines and platforms, such as Unity and Unreal Engine, as well as enterprise AR solutions, further supports software dominance. Additionally, continuous updates, customization needs, and integration with AI and cloud services reinforce software’s leading market position.

REGION

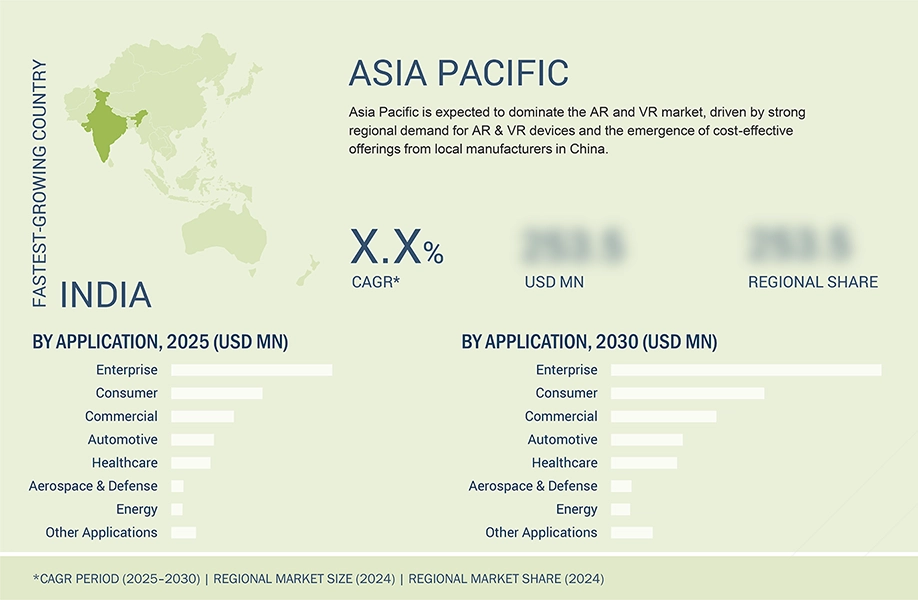

Asia Pacific to be fastest-growing region in AR and VR market during forecast period

Key drivers for the AR and VR market in the Asia Pacific include sectors such as consumer electronics, retail, banking, financial services, and insurance (BFSI), healthcare, transportation, and sports & entertainment. These industries are poised for substantial growth in AR and VR technologies due to increasing consumer awareness and the rapid integration of new technologies, particularly in countries such as China, India, and South Korea.

The Europe augmented and virtual reality market is projected to grow from USD 9.70 billion in 2025 to USD 30.42 billion by 2032, registering a CAGR of 17.7% during the forecast period. The rapid adoption of AR and VR across gaming, entertainment, and immersive media is a key growth driver in the European region. This expansion is supported by AR’s ability to enhance user interaction with digital content and by ongoing advancements in VR that improve performance, ergonomics, and user comfort.

North America augmented and virtual reality market is projected to reach USD 39.96 billion by 2030 from USD 10.25 billion in 2025, at a CAGR of 31.3% from 2025 to 2030. The rapid adoption of AR and VR applications across the gaming and entertainment industry is a key driver for the North America augmented and virtual reality market. Furthermore, the regional market is driven by AR’s ability to transform how users interact with digital content, along with advancements in VR that improve performance, form factor, and user comfort through devices such as Apple Vision Pro and Meta Quest 3, which have seen strong traction in the region.

AUGMENTED AND VIRTUAL REALITY MARKET SIZE, SHARE AND GROWTH 2032: COMPANY EVALUATION MATRIX

Stars are the leading market players in terms of new developments, including product launches, innovative technologies, and growth strategies. These companies boast a diverse portfolio, offer innovative products, and maintain a global presence. They have well-established channels throughout the value chain. Meta (US) is an example of a star company in this category. Emerging Leaders are known for their significant product innovations compared to their competitors. Many companies are increasing their investments in research and development (R&D) to introduce a range of new products to the market. Some companies have a unique portfolio, while others have made substantial investments in R&D or have recently launched multiple innovative products. Intel Corporation (US) falls into this category.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Google (US)

- Meta (US)

- Microsoft (US)

- Apple Inc. (US)

- PTC (US)

- Eon Reality (US)

- Magic Leap, Inc. (US)

- Atheer, Inc. (US)

- Vuzix (US)

- Ultraleap (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 34.30 Billion |

| Market Forecast in 2032 (Value) | USD 138.60 Billion |

| Growth Rate | CAGR of 19.2% from 2025-2032 |

| Years Considered | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, and RoW |

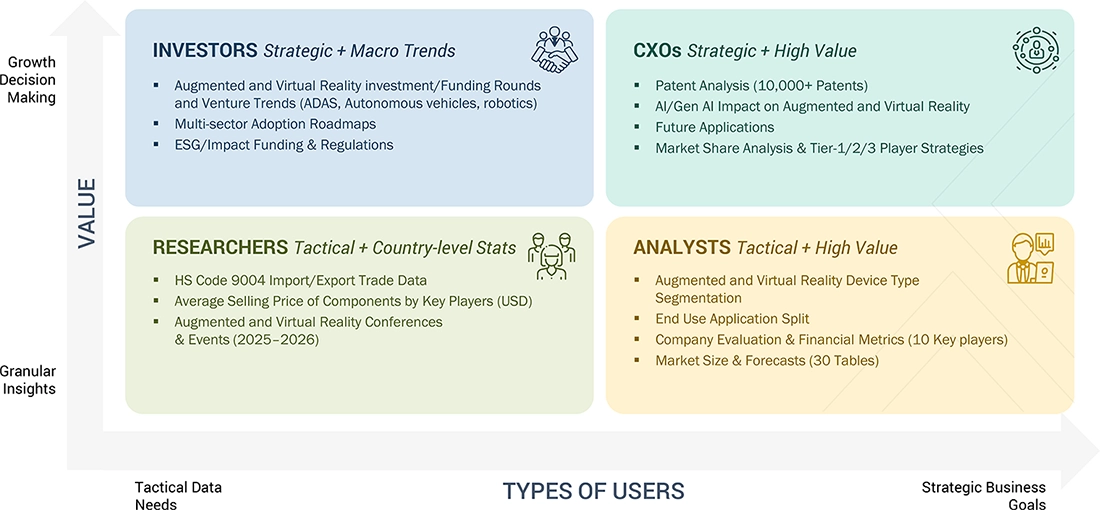

WHAT IS IN IT FOR YOU: AUGMENTED AND VIRTUAL REALITY MARKET SIZE, SHARE AND GROWTH 2032 REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Enterprise & Industrial Clients | Competitive benchmarking of AR/VR hardware and software providers (headsets, smart glasses, platforms), assessment of use-case feasibility for training, remote assistance, digital twins, and Industry 4.0 adoption. | Enables enterprises to select cost-effective and scalable AR/VR solutions, reduce training errors, improve operational efficiency, and accelerate digital transformation initiatives. |

| Gaming & Media Companies | Evaluation of VR platforms, content engines, and immersive media solutions for gaming, live events, and sports broadcasting, including user experience and monetization analysis. | Supports development of immersive consumer experiences, improves engagement and retention, and identifies high-growth revenue opportunities in the entertainment market. |

RECENT DEVELOPMENTS

- June 2024 : Apple Inc. launched VisionOS 2, which provided Vision Pro with new spatial computing experiences. Through this, the user can turn their photos into spatial photos, gestures for navigating visionOS, and many more ways to take advantage of spatial computing.

- May 2024 : Alo Moves and Meta entered a partnership deal that will feature 3D classes for a new level of immersion. Under this partnership, Alo Moves will utilize Meta Quest 3 in the same rooms as the instructors for yoga, Pilates, and meditation classes.

- April 2024 : Meta and EssilorLuxottica partnered to produce second-generation smart glasses, which expanded the Ray-Ban Meta smart glasses collection. It includes additional features, such as updates to Meta Al, that will make the glasses more useful.

- June 2023 : Apple Inc. launched Vision Pro, a revolutionary spatial computer that allows users to stay present and connected to Other Hardware Components. It creates an infinite canvas for apps that scales beyond the boundaries of a traditional display and introduces a fully three-dimensional user interface controlled by the user's eyes, hands, and voice.

Table of Contents

Methodology

The research study involved 4 major activities in estimating the size of the augmented and virtual reality market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the supply chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information required for this study. The secondary sources include annual reports, press releases, and investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, regional outlook and developments from both market and technology perspectives.

Primary Research

In primary research, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative insights required for this report. Primary sources from supply side include experts such as CEOs, vice presidents, marketing directors, manufacturers, technology and innovation directors, end users and related executives from multiple key companies and organizations operating in the augmented and virtual reality market ecosystem.

Market Size Estimation

Top-down and bottom-up approaches have been used to estimate and validate the size of the augmented and virtual reality market. The key players in the market have been identified through secondary research, and their market shares in respective regions have been determined through primary and secondary research. This entire research methodology includes the study of key insights by top players, as well as interviews with experts (such as CXOs, vice presidents, directors, and marketing executives) for quantitative and qualitative key insights. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All parameters that affect markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been competitive and supplemented with detailed inputs and analysis from the MarketsandMarkets data repository and presented in this report.

In the market engineering process, both top-down and bottom-up approaches have been used along with data triangulation methods to estimate and validate the size of the augmented and virtual reality market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Analyzing the size of the global augmented and virtual reality market by identifying segment and subsegment revenue related to the market

- Identifying the total number of augmented and virtual reality HMDs shipped globally

- Estimating the ASP of augmented and virtual reality HMDs

- Estimating the size of the augmented and virtual reality HMDs market (augmented and virtual reality HMDs shipment * ASP of augmented and virtual reality HMDs)

- Estimating the market size of other augmented and virtual reality display types

- Estimating the market size of augmented and virtual reality hardware market size (summation of augmented and virtual reality HMDs market and market of other augmented and virtual reality display types)

- Estimating the market size of augmented and virtual reality’s new software by determining its percentage increase with respect to augmented and virtual reality hardware market size

- Estimating the market size of augmented and virtual reality’s retrofitted software by determining its percentage increase with respect to augmented and virtual reality new software market size

- Estimating the augmented and virtual reality software market size (summation of augmented and virtual reality’s new software market and market of augmented and virtual reality’s retrofitted software)

- Estimating the global augmented and virtual reality market size (summation of augmented and virtual reality software market size and augmented and virtual reality hardware market size)

- Identifying the upcoming projects related to augmented and virtual reality by various companies in different regions and forecasting the market size based on these developments and other important parameters.

Data Triangulation

After arriving at the overall market size by the market size estimation process explained in the earlier section, the overall augmented and virtual reality market has been divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been used, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply side perspectives. Along with data triangulation and market breakdown, the market has been validated by top-down and bottom-up approaches.

Market Definition

AR improves the natural environment by overlaying potential digital information which includes images, text, or 3D objects. This augmentation can be actualized in many devices such as AR head-mounted displays (HMDs), smartphones, tablets, AR smart glasses, and heads-up displays (HUDs). On top of a user's view of the actual world, the technology lays computer-generated elements—thus making it interactive and enriched. One of the common examples of AR is the Pokémon GO game, whereby digital creatures seem to exist within an actual world when viewed through the camera of a smartphone.

On the other hand, VR blacks out users into a completely computer-created environment and replace the real world with a simulated one physically. Users usually put on and wear VR head-mounted displays, which, covering the field of vision, often incorporate motion tracking sensors. This sort of head mounted displays, that give users a feeling of existing in a virtual world, is called a feeling of presence in frontier interact in and navigate this digital space as if it were real. Common uses of VR include gaming, training simulations, virtual tours, and immersive storytelling experiences.

Stakeholders

- Raw material and manufacturing equipment suppliers

- Semiconductor foundries

- Original Equipment Manufacturers (OEMs)

- Augmented and virtual reality device manufacturers

- Original design manufacturers (ODMs) and OEM technology solution providers

- Software, and Technology Providers

- Standardization and Testing Firms

- Government Bodies such as Regulatory Authorities and Policymakers

- Research Institutes and Organizations

- Market Research and Consulting Firms

- Technology investors

The main objectives of this study are as follows:

- To define, analyze and forecast the augmented and virtual reality market size, by virtual reality technology, offering, device type, and application in terms of value

- To define, analyze and forecast the augmented and virtual reality market size, by device type, in terms of volume.

- To forecast the market size for various segments with respect to four main regions, namely, North America, Europe, Asia Pacific and Rest of the World (RoW)

- To provide detailed information regarding the major drivers, restraints, opportunities, and challenges influencing the growth of the augmented and virtual reality market

- To study the complete supply chain and related industry segments for the augmented and virtual reality market

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the supply chain, market ecosystem; trends/disruptions impacting customer’s business; technology analysis; pricing analysis; Porter’s five forces model; key stakeholders & buying criteria; case study analysis; trade analysis; patent analysis; key conferences & events, 2024–2025; regulations related to the augmented and virtual reality market; and investment and funding scenario.

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the market.

- To strategically profile the key players and comprehensively analyze their market position in terms of ranking, core competencies2, company valuation and financial metrics and product/brand comparison; along with detailing the competitive landscape for the market leaders.

- To analyze competitive developments such as product launches, product developments, partnerships, collaborations, acquisitions, joint investments, strategic supplier relations, contracts, acquisitions, expansions and research and development (R&D) activities carried out by players in the augmented and virtual reality market.

Customizations Options:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Information

- Detailed analysis of additional countries (up to 5)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Augmented and Virtual Reality Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Augmented and Virtual Reality Market

User

Sep, 2019

We have developed a system to aid doctors with the patients analysis prior to surgery with the Oculus Rift VR-Device and now want to explore the potentials of the VR software for studying. To continue our research in the area of our interest, your report would be of great interest for us in order to gain more financing. I would therefore like to know if the report covers comprehensively the aspect of VR software and its use-cases mapped against the applications. .

User

Sep, 2019

I am interested in your market forecast for Augmented/Virtual Reality. However, being an IT services company (particularly a system integration), I am more interested in finding out the market forecast for IT Services related to Augmented/Virtual Reality. Do you have this information in your report? Also, i would like to know if the report covers AR usage on mobile - market size, market potential/growth both in terms of current apps and consumer usage..

User

Sep, 2019

I am interested to understand the global trends and projects in the AR/VR market over the next 5-10 years and the major players in this space. I would also like to know the product offerings of the major industry players, their growth areas in all industries, their expertise of the technology, and reception from consumers. Does your report cover the aspect of competitive landscape in detail?.

User

Jun, 2021

Hello, I would like to cite this report, but I cannot find the names of the authors. Who are they ?.