Augmented Reality and Virtual Reality – M&A Private Equity Investment, and Patent Filing Analysis

Augmented reality (AR) is a technology that overlays a computer-generated image on a user’s view which connects the real world with the virtual world. This technology enhances the perception of reality, thereby increasing the user experience and also provides data about the consumer’s immediate environment. The virtual reality (VR) technology provides the user a virtual environment with the help of computer hardware and software and also offers a fully immersive environment where the user can interact with objects similar to those in the real world.

There has been tremendous growth in the M&A deals, investments, and patent filings in the AR & VR from 2014 to 2015. It is anticipated that the usage of AR and VR would provide the next major computing platform after smartphones.

Magic Leap, Inc. (U.S.) filed the maximum patents as of February, 2016 among the other companies in this market. Magic Leap has been experimenting with the use of AR and VR to come out with a breakthrough product in the AR-VR market. The other companies which have been active in the patent filings include the Qualcomm, Inc. (U.S.), Microsoft Technology Licensing LLC (U.S.), LG Electronics, Inc. (South Korea), Pantech Co. Ltd. (South Korea), Sony Corporation (Japan), Intel Corporation (U.S.) among others.

There have been significant investments in the augmented reality (AR) and virtual reality (VR) market during 2012–2016, with the total value of investments in 2016 being more than USD 1 Billion in the first quarter of 2016. It is observed that 2016 would witness an increase in PE investments and would motivate the start-ups and attract more investments in the AR-VR sector due to huge investments in the first quarter itself. The usage of augmented reality and virtual reality is gaining traction with the increasing support of both hardware manufacturers and software developers in applications such as gaming, entertainment, retail, medical, defense among others. The use of augmented reality and virtual reality in the fields such as brand marketing and advertising has provided a significant boost to the opportunities of the brand marketers.

The use of AR & VR in sectors such as the e-commerce and retail, and gaming and entertainment has been driving the market. The increased interest of the large tech companies has been one of the major driving factor for the augmented and virtual reality market. The growing demand of AR and VR in the tourism sector would help the market to boost. The virtual reality technology is in its growth stage whereas the augmented reality is in the introduction stage of its life-cycle but has helped raise a lot of interest of the investors and marketers.

The report categorizes the augmented reality and virtual reality industry during 2012–2016 by M&A deals, patent analysis, and private equity investment. AR/VR companies are focusing on their research and development activities to ensure they can provide their customers required products and services. As the augmented reality and virtual reality are emerging technologies, the cost of research and development activities is also increasing significantly. Thus, the investments associated with development of devices and applications will increase. These factors have led to an increase in the number of AR/VR investments and M&A deals. The investments in the AR-VR market have been huge and investors have been keen to invest in the companies which have proved the worth of their technologies and upcoming products in the last few years. The major investments were carried out mainly on to companies such as the Magic Leap Inc. (U.S.), Mindmaze SA (Switzerland) among others. The companies in the AR-VR market have come up with new technologies with the use of new and improved mixed reality. The investments have driven the innovations which in turn would enhance the patent filings in the AR-VR market.

The companies in the U.S. have been highly active in the augmented reality and virtual reality patent fillings. A majority of the patents are from the North American region in 2016. In the Asia-Pacific region, South Korea and China registered the maximum number of patent filings.

Companies such as Intel Corporation (U.S.), Google Inc. (U.S.), Qualcomm Inc. (U.S.), Apple, Inc. (U.S.), Microsoft Corporation (U.S.), Facebook, Inc. (U.S.), Samsung Electronics Co., Ltd (South Korea), Magic Leap Inc. (U.S.), Blippar, Inc. (U.S.), and others are operating in this market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Industry Definition

1.3 Study Scope

1.3.1 Years Considered for the Study

1.3.2 Currency

1.4 Limitations

1.5 Stakeholders

1.6 Research Methodology

1.6.1 Key Data From Secondary Sources

1.6.2 Key Data From Primary Sources

1.6.3 Key Industry Insights

2 Executive Summary (Page No. - 19)

3 Industry Overview (Page No. - 24)

3.1 Introduction

3.2 Value Chain Analysis

3.3 Porter’s Five Forces Analysis

3.3.1 Porter’s Five Forces Analysis of Augmented Reality Market

3.3.1.1 Bargaining Power of Suppliers

3.3.1.2 Bargaining Power of Buyers

3.3.1.3 Threat of New Entrants

3.3.1.4 Threat of Substitutes

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 Porter’s Five Forces Analysis of Virtual Reality Market

3.3.2.1 Bargaining Power of Suppliers

3.3.2.2 Bargaining Power of Buyers

3.3.2.3 Threat of New Entrants

3.3.2.4 Threat of Substitutes

3.3.2.5 Intensity of Competitive Rivalry

3.4 Key Industry Trends and Competitive Situation

3.4.1 Key Industry Trends in the Augmented Reality Market

3.4.2 Key Industry Trends in the Virtual Reality Market

4 Market Dynamics (Page No. - 41)

4.1 Introduction

4.2 Market Dynamics for Augmented Reality

4.2.1 Drivers

4.2.1.1 Growing Interest in Augmented Reality By Most of the Large Tech Companies

4.2.1.2 Growing Demand for Augmented Reality Across Various Verticals

4.2.2 Restraints

4.2.2.1 Lack of Awareness About Augmented Reality Technology

4.2.2.2 Development of AR Depends on the Advancements in Computer and Digital Network

4.2.2.3 Limited User Interface Affecting the Navigation Performance of Augmented Reality Applications

4.2.2.4 Limited Processing Power and Inadequate Storage

4.2.3 Opportunities

4.2.3.1 Rising Investments in the Augmented Reality Market

4.2.3.2 Increasing Demand for AR Devices and Apps in the Tourism Vertical

4.2.3.3 Opportunities in the E-Commerce Industry Would Help to Penetrate the AR Market

4.2.4 Challenges

4.2.4.1 Low Adoption Due to Privacy Issue and Complexity in the Design

4.2.4.2 Reconfiguration of AR Application for Different Platforms

4.3 Market Dynamics for Virtual Reality

4.3.1 Drivers

4.3.1.1 Penetration of Head Mounted Displays (HMD) in Gaming and Entertainment Verticals

4.3.1.2 Decline in Prices of Hardware Components

4.3.1.3 More Effective Training and Simulation Using VR Technology Integrated Devices

4.3.2 Restraints

4.3.2.1 Display Latency and Energy Consumption Affecting the Overall Performance of Virtual Reality Devices

4.3.2.2 Low Resolution Restrains the Immersion of Virtual Reality

4.3.3 Opportunities

4.3.3.1 Increasing Capital Investments

4.3.3.2 Opportunity in Healthcare Industry for Penetration of Head Mounted Display (HMD)

4.3.4 Challenges

4.3.4.1 Challenges to Identify the Level of Details Required in A VR Device for Complete Immersion

5 Patent Analysis (Page No. - 52)

5.1 Introduction

5.2 U.S. and South Korea are the Major Patent Filing Nations

5.3 The Increased Patent Filings Will Boost the AR-VR Market

5.4 North America is Leading in Patent Filing for AR-VR Market

6 Investor Analysis (Page No. - 57)

6.1 Introduction

6.2 Investors in the U.S. Dominate the AR-VR Investments

6.3 Increased Investments From APAC Will Boost the Overall Development of AR-VR

6.4 Enterprise Vertical is the Biggest Investor in the AR-VR Market

6.5 Investors in the AR-VR Market

7 Private Equity Investment Analysis (Page No. - 64)

7.1 Introduction

7.2 Regulations for Pe Firms and Investments

7.3 Pe Investment Flow

7.3.1 Investment Flow, Based on the Establishment Year of the Company

7.3.2 Investment Flow, Based on Total Investments in Market Value in A Particular Year

7.4 Virtual Reality: Private Equity Investments

7.5 Augmented Reality: Private Equity Investments

7.6 Company Profile

(Overview, Products and Services, Financials, Strategy & Development)*

7.6.1 Magic Leap, Inc.

7.6.2 Jaunt Inc.

7.6.3 Avegant Corporation

7.6.4 Matterport Inc.

7.6.5 Playful Corporation

7.6.6 Mindmaze SA

7.6.7 Nextvr Inc.

7.6.8 Skully Inc.

7.6.9 Meta Co.

7.6.10 WEVR Inc.

7.6.11 Legend3D Inc.

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies.

8 Mergers and Acquisitions: Augmented Reality and Virtual Reality (Page No. - 90)

8.1 Introduction

8.2 M&A Trends in Augmented Reality and Virtual Reality

8.3 Deals Based on Capital Investments

8.4 Deals Based on Target Company

8.5 Deals Based on Deal Volume

8.6 M&A Analysis, By Key Players

8.7 M&A Analysis, By Geographical Coverage

8.8 Company Profile

(Overview, Products and Services, Financials, Strategy & Development)*

8.8.1 Facebook Incorporation

8.8.2 Apple Inc.

8.8.3 Microsoft Corporation

8.8.4 Intel Corporation

8.8.5 Blippar Inc.

8.8.6 Qualcomm Inc.

8.8.7 Daqri LLC

8.8.8 Atheer Inc.

8.8.9 PTC

8.8.10 Cyberglove Systems Inc.

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies.

9 Future Industry Roadmap (Page No. - 124)

9.1 Introduction

9.2 Evolution Phase of Augmented Reality and Virtual Reality

9.3 AR & VR Evolving Space

9.3.1 Comprehensive Industry Strategy

9.3.2 Strategic Benchmarking of AR&VR

9.3.3 Patent Goals

9.4 Channels Affecting Industry Growth

9.4.1 Competition

9.4.2 Innovation & Productivity

9.4.3 Acceptance

9.5 Life Cycle Analysis of the Market, By Region

10 Appendix (Page No. - 136)

10.1 Insights of Industry Experts

10.2 Discussion Guide

10.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

10.4 Introducing RT: Real Time Market Intelligence

10.5 Available Customizations

10.6 Related Reports

List of Tables (33 Tables)

Table 1 Porter’s Five Forces Analysis: Threat of New Entrants Likely to Have Maximum Impact on the Overall Market

Table 2 Threat of New Entrants Likely to Have Major Impact on the Overall Market

Table 3 Key Industry Trends in the Augmented Reality Market

Table 4 Key Industry Trends in the Virtual Reality Market

Table 5 Growing Demand for Augmented Reality in Retail

Table 6 Limited User Interface Devices in Mobile-Driven Augmented Reality is A Major Problem for AR Market Growth

Table 7 Increasing Demand for AR Devices and Apps in the Tourism Vertical

Table 8 The Growing Demand of Virtual Reality in Gaming and Entertainment

Table 9 Display Latency is the Major Issue Restraining the Growth of Virtual Reality Market

Table 10 Opportunity in Healthcare Industry to Drive VR Market

Table 11 To Identify the Level of Details Necessary for A User to Accept the Illusion is A Major Challenge

Table 12 Country Wise Patent Filing, 2012- 2016

Table 13 Investment in the Companies Established in 2015

Table 14 Investment in the Companies Established in 2014

Table 15 Investment in the Companies Established in 2013

Table 16 Major Investments in the Augmented Reality Companies

Table 17 List of M&A in Augmented Reality

Table 18 List of M&A in Virtual Reality

Table 19 Facebook Incorporation: Financial Analysis, 2012-2015

Table 20 Key Financial Ratio (2015)

Table 21 Financial Strength (2015)

Table 22 Apple Inc.: Financial Analysis, 2012-2015

Table 23 Key Financial Ratio (2015)

Table 24 Financial Strength (2015)

Table 25 Microsoft Corporation: Financial Analysis, 2012-2015

Table 26 Key Financial Ratio (2015)

Table 27 Financial Strength (2015)

Table 28 Intel Corporation: Financial Analysis, 2012-2015

Table 29 Key Financial Ratio (2015)

Table 30 Financial Strength (2015)

Table 31 Qualcomm Inc.: Financial Analysis, 2012-2015

Table 32 Key Financial Ratio (2015)

Table 33 Financial Strength (2015)

List of Figures (92 Figures)

Figure 1 Industrial Landscape Classification

Figure 2 Research Design

Figure 3 Augmented Reality and Virtual Reality Market, 2013–2020 (USD Billion)

Figure 4 M&A Deals, Based on Target Company Between 2013 and 2016

Figure 5 Investment Analysis of AR-VR From 2011 to 2015

Figure 6 Venture Capital Firms are the Biggest Investors in the AR-VR Market

Figure 7 Patent Filings for AR-VR Market, 2012-2016

Figure 8 Value Chain Analysis of Augmented Reality (2015): Major Value is Added During Research & Product Development and Manufacturing Stages

Figure 9 Value Chain Analysis (2015) of Augmented Reality and Virtual Reality: Major Value is Added During Manufacturing and Assembly Stages

Figure 10 Porter’s Five Forces Analysis of Augmented Reality Market

Figure 11 Augmented Reality Market: Porter’s Five Forces Analysis

Figure 12 Bargaining Power of Suppliers is High Due to Maximum Number of Suppliers in the Market and Their Financial Power

Figure 13 Bargaining Power of Buyers Will Be Medium Because of Low Price Sensitive Market and High Product Differentiation

Figure 14 High Threat of New Entrants Due to Competitive Market Space With High Capital Requirements

Figure 15 Low Threats of Substitutes Due to Less Legislative Regulations and Low Quality and Performance in the Market

Figure 16 Increase in Number of Patent Filings Have A High Impact on Intensity of Competitive Rivalry

Figure 17 Porter’s Five Forces Analysis of Virtual Reality Market

Figure 18 Virtual Reality Market: Porter’s Five Forces Analysis

Figure 19 Increase in Number of Suppliers Would Affect the Bargaining Power of Suppliers

Figure 20 Bargaining Power of Buyers is High Because of Increase in Number of Suppliers in the Market

Figure 21 High Capital Requirement is Major Threat to New Entrants

Figure 22 Threat of Substitutes has Medium Impact in the Market Due to Low Competitive Pricing and Moderate Availability of Substitutes

Figure 23 Intensity of Competitive Rivalry is High Due to High Entry Barrier and Existing Number of Players

Figure 24 The Large Tech Companies Entry and Growing Start-Ups Will Drive the Growth of the AR Market

Figure 25 Affordable Hardware With Penetration of Head Mounted Display (HMD) for Various Applications is A Driving Force for VR Market

Figure 26 Major Patent Filing Companies in the AR-VR Market, 2012-2016

Figure 27 Patent Filings in the AR-VR Market, 2012–2016

Figure 28 North America Led the Patent Filing Between 2012-2016

Figure 29 Augmented Reality Gains More Patent Filings Than the Virtual Reality

Figure 30 Number of Major Investors in the AR-VR Vertical, By Country

Figure 31 Investments in AR & VR, By Region

Figure 32 Major Venture Capital Investors in the AR-VR Market

Figure 33 Major Investors in the AR-VR Market

Figure 34 Investment in the AR-VR Start-Ups Founded in 2015

Figure 35 Investment in the AR-VR Start-Ups Founded in 2014

Figure 36 Investment in the AR-VR Start-Ups Founded in 2013

Figure 37 Investment in the AR-VR Start-Ups Founded in 2012

Figure 38 Investment in the AR-VR Companies Founded Before 2012

Figure 39 Investment Analysis of AR-VR, By Foundation Year of the Company

Figure 40 Investment Analysis of AR-VR Companies for the Period 2011–2015

Figure 41 Overall Investment Share of Augmented Reality vs Virtual Reality

Figure 42 Major Investments in Global Virtual Reality Market

Figure 43 U.S. Virtual Reality Investments, By Company

Figure 44 Global Virtual Reality Investments, By Geography

Figure 45 Percentage Share of Investment in Virtual Reality

Figure 46 Global Augmented Reality Investments

Figure 47 U.S. Augmented Reality Investments

Figure 48 Global Augmented Reality Investments, By Geography

Figure 49 Magic Leap, Inc.: Company Snapshot

Figure 50 Jaunt Inc.: Company Snapshot

Figure 51 Avegant Corporation: Company Snapshot

Figure 52 Matterport Inc.: Company Snapshot

Figure 53 Playful Corporation: Company Snapshot

Figure 54 Mindmaze SA: Company Snapshot

Figure 55 Nextvr Inc.: Company Snapshot

Figure 56 Skully Inc.: Company Snapshot

Figure 57 Meta Co.: Company Snapshot

Figure 58 WEVR Inc.: Company Snapshot

Figure 59 Legend3D Inc.: Company Snapshot

Figure 60 Key Trends in M&A Undertaken By the Key Players in AR-VR Market

Figure 61 Mergers & Acquisitions, By Deal Value Between 2013 and 2016

Figure 62 Top Players in M&A Based on Maximum Investments (Deal Value)

Figure 63 M&A Deals, Based on Target Company Between 2013 and 2016

Figure 64 M&A Based on Deal Volume Between Year 2014-2016

Figure 65 Top Players With Highest M&A Transaction

Figure 66 Geographic Landscape: the Companies in the U.S. Have Undertaken the Maximum M&A

Figure 67 Facebook Incorporation: Company Snapshot

Figure 68 Facebook Incorporation: SWOT Analysis

Figure 69 Apple Inc.: Company Snapshot

Figure 70 Apple Inc.: SWOT Analysis

Figure 71 Microsoft Corporation: Company Snapshot

Figure 72 Microsoft Corporation: SWOT Analysis

Figure 73 Intel Corporation: Company Snapshot

Figure 74 Blippar Inc.: Company Snapshot

Figure 75 Qualcomm Inc.: Company Snapshot

Figure 76 Daqri LLC: Company Snapshot

Figure 77 Atheer Inc.: Company Snapshot

Figure 78 PTC: Company Snapshot

Figure 79 Cyberglove Systems Inc.: Company Snapshot

Figure 80 Evolution of Virtual Reality and Augmented Reality

Figure 81 Gaming and E-Commerce Application Expect to Grow at Highest Rate in the Near Future

Figure 82 AR and VR Technology is Set to Boom With the Increased Use in Diverse Applications

Figure 83 Consumer Vertical Expected to Witness the Highest Growth in the Virtual Reality Between 2015 and 2020

Figure 84 Commercial Vertical Expected to Witness the Highest Growth Rate Between 2015 and 2020

Figure 85 AR&VR Growth Strategy

Figure 86 Key Drivers and Risk Factors for Merger and Acquisitions Deals

Figure 87 Benchmarking of VR: Organic and Inorganic Growth Strategies for New Product and Technology Development

Figure 88 Benchmarking of AR: Key Players Largely Adopted the Strategy of New Product Launches

Figure 89 Patent Benefits to Industry Players

Figure 90 AR and VR Market Stage in Different Regions, 2015

Figure 91 Marketsandmarkets Knowledge Store Snapshot

Figure 92 Marketsandmarkets Knowledge Store: Semiconductor & Electronics Industry Snapshot

The research methodology used to estimate and forecast the global augmented reality and virtual reality market covers collecting of data on key vendor revenues through secondary research. The vendor offerings are also taken into consideration to determine the market segmentation. The patents, mergers & acquisitions, and PE investments have been verified through various sources. The sources were chosen through primary research by conducting extensive interviews with key industry people - CEOs, VPs, Directors, and executives. The analysis of the M&A deals in augmented reality and virtual reality market includes extensive primary research to gather information and verify and validate the critical conclusions arrived at after an extensive secondary research.

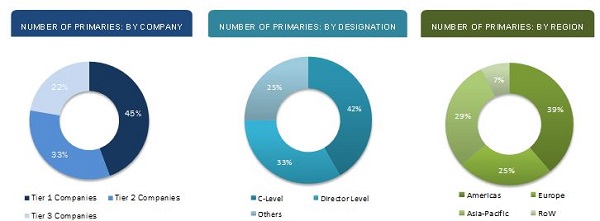

The breakdown of profiles of primary is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The top players in the augmented reality and virtual reality market covered in this report include Intel Corporation (U.S.), Microsoft Corporation (U.S.), Qualcomm Incorporated (U.S.), Apple Inc., Blippar Inc. (U.K.), Sony Corporation (Japan), Magic Leap, Inc. (U.S.), Jaunt Inc. (U.S.) Avegant Corporation (U.S.), and Atheer Inc. (U.S.) among others have been profiled in the study.

Key Target Audience

- Raw Material and Manufacturing Equipment Suppliers

- Semiconductor Foundries

- Original Equipment Manufacturers (OEMs) (end-user application or electronic product manufacturers)

- Product Manufacturers

- ODM and OEM Technologies Solution Providers

- Research Organizations

- Technology Standards Organizations, Forums, Alliances, and Associations

- Technology Investors

- Governments, Financial Institutions, and Investment Communities

- Analysts and Strategic Business Planners

- End Users

Scope of the Report

The research report segments merger and acquisition, PE investments, and patent analysis in augmented reality and virtual reality market during the period 2013-2016 into following categories:

Patent Analysis for Augmented Reality and Virtual Reality Market

- By Major Companies

- By Year

- By Geography

- By Technology

Investor Analysis for Augmented Reality and Virtual Reality Market

- By Region (& Country)

- By Investor Type

- By Major Investors

Private Equity Investment in Augmented Reality and Virtual Reality Market

- By Establishment Year of the Company

- By Total Investments in a Year

- By AR and VR

Merger and Acquisition in Augmented Reality and Virtual Reality Market

- By Deal Value

- By Target Company

- By Deal Volume

- By Geographical Coverage

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Patent Analysis

- Application analysis of the patents of the major companies

Private Equity Investment Analysis

- Detailed analysis and profiling of additional market players (Up to 5)

Growth opportunities and latent adjacency in Augmented Reality and Virtual Reality