The research study conducted on the Military Platforms Market involved extensive use of secondary sources, including directories, databases of articles, journals on aircrafts, marine vessels, land vehicles, company newsletters, and information portals such as Arms Control Association, Bloomberg, and Factiva to identify and collect information useful for this extensive, technical, market-oriented, and commercial study of the Military Platforms market. Primary sources are several industry experts from the core and related industries, alliances, organizations, Original Equipment Manufacturers (OEMs), vendors, suppliers, and technology developers. These sources relate to all segments of the value chain of the Military platforms industry. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among others, to obtain and verify critical qualitative and quantitative information and to assess future prospects of the market.

Secondary Research

Secondary research was conducted in order to gather relevant details for this market study on military platforms. Various sources were consulted to accumulate vital information and insights into this market. Annual reports, whitepapers, press releases, investor presentations by major companies, certified publications, and reputable articles were all sourced. Other information was extracted from articles, manufacturer associations, industry directories, and specialized databases. Mostly primary research was done for the crucial discovery of about the supply chain in the military platforms industry, the financial structure of the market, key players, and also the segmentation of the market based upon the industry trends. Further, the secondary research was undertaken in order to provide knowledge on regional markets, technological issues as well as important developments; hence gave an overall understanding of market-driven as well as technology-driven aspects.

Primary Research

Extensive primary research has been conducted after obtaining information regarding the Military platforms Marketscenario through secondary research. Several primary interviews have been conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, Middle East, Africa, and Latin America. Primary data has been collected through questionnaires, emails, and telephonic interviews. These interviews have been conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market size forecasting, and data triangulation. It has also helped analyze the platform, technology and end-user segments of the market for five key regions.

About the assumptions considered for the study, To know download the pdf brochure

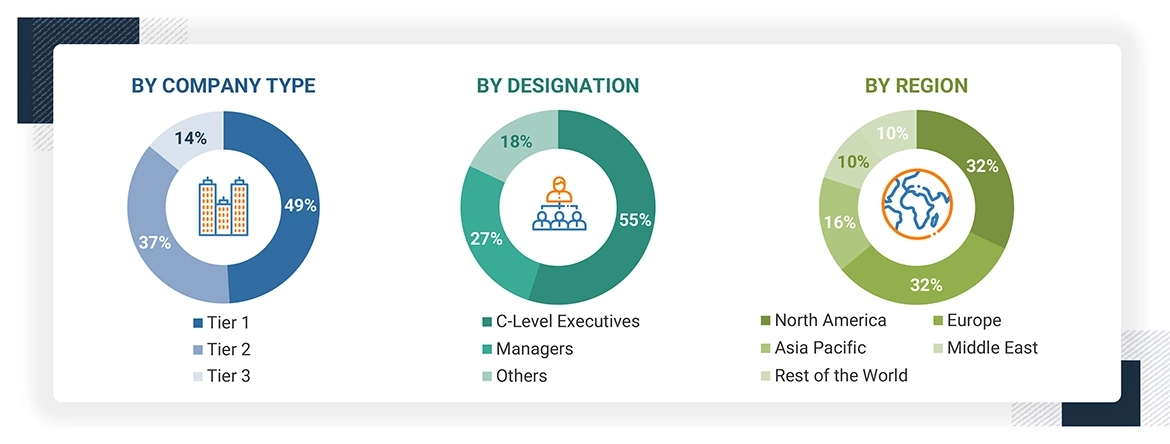

Note: Note: C-level executives include the CEO, COO, and CTO, among others.

Others include Sales Managers, Marketing Managers, and Product Managers. The tiers of the companies have been defined based on their total revenue as of 2022. Tier 1 = > USD 1 billion, Tier 2 = USD 100 million to USD 1 billion, and Tier 3 = < USD 100 million.

Growth opportunities and latent adjacency in Military Platforms Market