To estimate the size of the mid and high-level precision GPS receiver market, the study utilized four major activities. Exhaustive secondary research was conducted to gather information on the market, as well as its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Finally, market breakdown and data triangulation methods were utilized to estimate the market size for different segments and subsegments.

Secondary Research

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the mid and high-level precision GPS receiver market. Secondary sources for this research study include corporate filings (such as annual reports, investor presentations, and financial statements), trade, business, and professional associations, white papers, certified publications, articles by recognized authors, directories, and databases. The secondary data was collected and analyzed to determine the overall market size, further validated through primary research.

List of key secondary sources

Primary Research

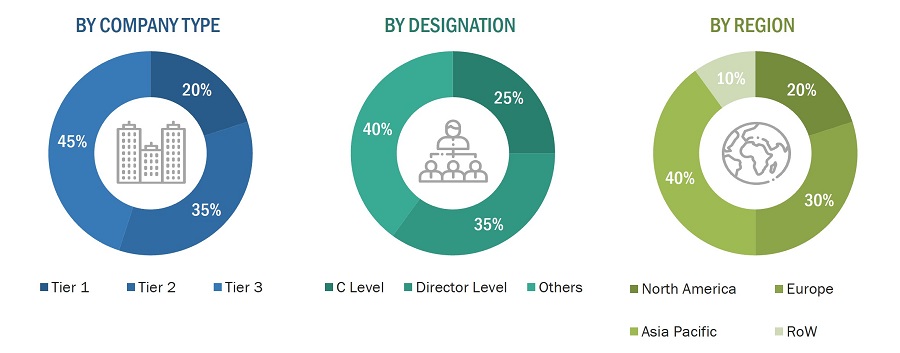

To gather insights on market statistics, revenue data, market breakdowns, size estimations, and forecasting, primary interviews were conducted. Additionally, primary research was used to comprehend the various technology, application, vertical, and regional trends. Interviews with stakeholders from the demand side, including CIOs, CTOs, CSOs, and customer/end-user installation teams using mid and high-level precision GPS receivers, were also conducted to understand their perspective on suppliers, products, component providers, and their current and future use of mid and high-level precision GPS receiver, which will impact the overall market. Several primary interviews were conducted across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To estimate and validate the size of the mid and high-level precision GPS receiver market and its submarkets, both top-down and bottom-up approaches were utilized. Secondary research was conducted to identify the key players in the market, and primary and secondary research was used to determine their market share in specific regions. The entire process involved studying the annual and financial reports of top players and conducting extensive interviews with industry leaders such as CEOs, VPs, directors, and marketing executives. Secondary sources were used to determine all percentage shares and breakdowns, which were then verified through primary sources. All parameters that could impact the markets covered in this research study were accounted for, analyzed in detail, verified through primary research, and consolidated to obtain the final quantitative and qualitative data.

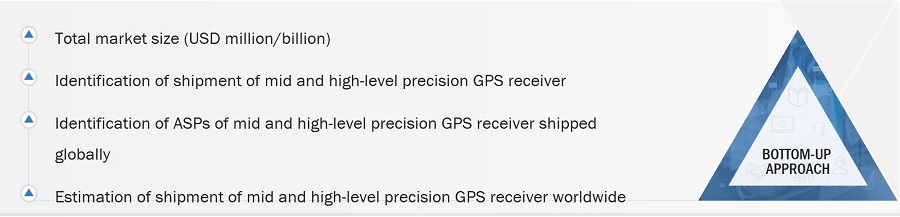

Global Mid and high-level Precision GPS Receiver Market Size: Botton Up Approach

-

Companies offering mid and high-level precision GPS receiver products have been identified, and their product mapping with respect to different parameters, such as functional deployment, type, and end-user industry has been carried out.

-

The market size has been estimated based on the demand for different mid and high-level precision GPS receivers for different applications. The anticipated change in demand for mid and high-level precision GPS receivers offered by these companies in the recession and company revenues have been analyzed and estimated.

-

Primary research has been conducted with a few major players operating in the mid and high-level precision GPS receiver market to validate the global market size. Discussions included the impact of the recession on the mid and high-level precision GPS receiver ecosystem.

-

The size of the mid and high-level precision GPS receiver market has been validated through secondary sources, which include the International Trade Centre (ITC), the World Trade Organization, and the World Economic Forum.

-

The CAGR of the mid and high-level precision GPS receiver market has been calculated considering the historical and future market trends and the impact of the recession by understanding the adoption rate of mid and high-level precision GPS receiver for different applications.

-

The estimates at every level have been verified and cross-checked through discussions with key opinion leaders, such as corporate executives (CXOs), directors, and sales heads, and with the domain experts in MarketsandMarkets.

-

Various paid and unpaid information sources, such as company websites, annual reports, press releases, research journals, magazines, white papers, and databases, have also been studied.

Global Mid and high-level Precision GPS Receiver Market Size: Top Down Approach

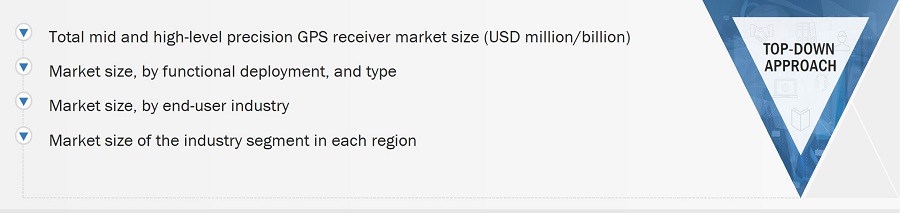

The top-down approach has been used to estimate and validate the total size of the mid and high-level precision GPS receiver market.

-

Focusing initially on R&D investments and expenditures being made in the ecosystem of the mid and high-level precision GPS receiver market, further splitting the market on the basis of type, functional deployment, and region and listing key developments.

-

Identifying leading players in the mid and high-level precision GPS receiver market through secondary research and verifying them through brief discussions with industry experts

-

Analyzing revenue, product mix, geographic presence, and key applications for which all identified players serve products to estimate and arrive at percentage splits for all key segments

-

Discussing splits with industry experts to validate the information and identify key growth pockets across all key segments

-

Breaking down the total market based on verified splits and key growth pockets across all segments.

Data Triangulation

Once the overall size of the mid and high-level precision GPS receiver market was determined using the methods described above, it was divided into multiple segments and subsegments. Market engineering was performed for each segment and subsegment using market breakdown and data triangulation methods, as applicable, to obtain accurate statistics. To triangulate the data, various factors and trends from the demand and supply sides were studied. The market was validated using both top-down and bottom-up approaches.

Market Definition

Mid and high-level precision GPS receivers are specialized devices designed to provide accurate and reliable positioning information for various applications. These receivers operate within the broader category of Global Positioning System (GPS) technology but differ in terms of their precision and intended uses. High-level precision GPS receivers are engineered to deliver extremely accurate and reliable positioning information. These receivers are often employed in professional fields that demand precise location data, such as surveying, geodetic mapping, scientific research, and certain aspects of agriculture and construction.

Key Stakeholders

-

GPS product designers and fabricators

-

GPS receiver providers

-

Application providers

-

Business providers

-

GPS product distributors and providers

-

Research institutes and organizations

-

Governments and other regulatory bodies

-

Technology standard organizations, forums, alliances, and associations

-

Technology investors

Report Objectives

-

To describe and forecast the mid and high-level precision GPS receiver market, by functional deployment, type, end-user industry, and region, in terms of value.

-

To describe and forecast the market for various segments across four main regions, namely, North America, Europe, Asia Pacific, and Rest of the World (RoW), in terms of value

-

To forecast the mid and high-level precision GPS receiver market by type, in terms of volume

-

To strategically analyze the micro-markets with regard to the individual growth trends, prospects, and contribution to the mid and high-level precision GPS receiver market

-

To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the mid and high-level precision GPS receiver market

-

To analyze opportunities in the market for stakeholders by identifying high-growth segments in the market

-

To provide a detailed overview of the mid and high-level precision GPS receiver value chain

-

To strategically analyze the ecosystem, regulatory landscape, patent landscape, Porter’s five forces, import and export scenarios trade landscape, and case studies pertaining to the market under study

-

To strategically profile key players in the mid and high-level precision GPS receiver market and comprehensively analyze their market shares and core competencies

-

To strategically profile the key players and provide a detailed competitive landscape of the mid and high-level precision GPS receiver market.

-

To analyze competitive developments such as partnerships, acquisitions, expansions, collaborations, and product launches, along with research and development (R&D) in the mid and high-level precision GPS receiver market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

-

Detailed analysis and profiling of additional market players (up to 5)

-

Additional country-level analysis of the mid and high-level precision GPS receiver market

Product Analysis

-

Product matrix, which provides a detailed comparison of the product portfolio of each company in the mid and high-level precision GPS receiver market.

Growth opportunities and latent adjacency in Mid and High-Level Precision GPS Receiver Market