Agricultural Variable Rate Technology Market by Offering (Hardware, Software, Service), Type (Fertilizer Vrt, Crop Protection Vrt), Crop Type, Application Method, Farm Size, Application Fit and Region - Global Forecast to 2027

Agricultural Variable Rate Technology Market Growth Analysis, 2027

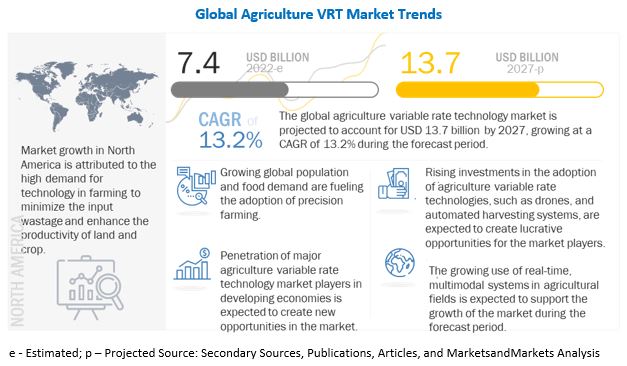

The agricultural variable rate technology market on financial terms was estimated to be worth $7.4 billion in 2022 and is poised to reach $13.7 billion by 2027, growing at a CAGR of 13.2% from 2022 to 2027.

Agriculture VRT is a technology-driven component of precision farming, which is used to provide varied crop materials to a given landscape. These materials include fertilizers, crop protection chemicals, and seeds, which help to optimize crop production. VRT-based crop management helps reduce production costs, increase the profitability of crop production, and have a positive environmental impact, which gives it leverage over conventional uniform crop management. VRT in agriculture is committed to providing intelligent and innovative technological solutions through variable-rate capable machinery, Artificial Intelligence (AI), and drone technology, facilitating other agriculture innovations to increase crop yields and profitability.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Drivers: Rapid adoption of advanced technologies in agriculture variable rate to reduce labor cost

Conventional agriculture industry is highly dependent on laborers for different activities. With technological advancements, automation is replacing the task of laborers and enabling the industry players to achieve high output in less time. Various government organizations, economists and policy makers are working in the favour for agriculture technological advancements. The major technologies used for agriculture variable rates are smart sensors, GPS, GNSS, auto-steering and guidance technology, and VRT, among others. They not only help to reduce the labor cost but also utilize resources in the best possible way and minimize wastage, which is higher in traditional farming techniques.

Restraints: High costs of agriculture VRT equipment

The agriculture VRT cane be adopted by small, mid-size and large farms, however the technology is being adopted by mainly large farms. The high costs associated with agriculture variable rate equipment. The technologies and equipment used in agriculture variable rate, including smart sensors, drones, VRT, GPS, GNSS, guidance tools, and receivers, are highly efficient but expensive. Besides, skilled personnel is required to set up and operate agriculture variable rate equipment. Hence, in developing countries such as India, China, and Brazil, with limited resources for agriculture practices, growers opt for traditional farming rather than new technology-based farming due to the requirement of high investments.

Opportunities: VRT services provided by leading market players in developing economies

VRT services mainly includes farm operation services and integration and services. These activities incluces farm mapping, soil and moisture management, agronomist serives and others which are being provided by various global companies. The entry of leading agriculture VRT players such as Deere & Company (US), AGCO Corporation (US), and Lindsay Corporation (US) in developing economies have played a major role in driving the agriculture variable rate technology market. Lindsay Corporation provides farm mapping and variable rate irrigation services in various developing countries, which assists in promoting the use of agriculture variable rate technologies in these countries where farmers cannot afford to set up agriculture technologies for their farmlands. These market players provide VRT services on a contractual basis, with periodic monthly or quarterly charges. The presence of such services in developing economies assists in improving the awareness regarding the advantages of agriculture variable rate technologies over traditional agriculture services.

Challenges: Lack of standardization in the agriculture variable rate technology

Agriculture VRT technologies are still under development and requires high level of expertise before implementation. Agriculture variable rate devices use various interfaces, technologies, and protocols. The lack of standardization of these communication interfaces and protocols may result in data misrepresentation. Further, the lack of technological standardization complicates the integration of systems and hinders the optimum data representation. Most equipment manufacturers use their interface communication protocols, which leads to compatibility issues with other manufacturing brands.

Fertilizer Vrt Is The Most Popular Agriculture Vrt Used Globally

Agriculture VRT is used for the distribution of various crop inputs such as fertilizers, crop protection chemicals, weed, lime and seed. There are significant variations with respect to soil properties and water & nutrient availability across most fields. Thus, it is important to apply nutrients and water according to site-specific conditions to account for spatial and temporal variations; this thereby improves yields with increased efficiency of application and reduced environmental impacts. In addition to this, increasing price of crop inputs is one of the major driver for the precision application of various farm inputs among which fertilizers are one of the major farm input for the health crop. Variable rate fertilizer technology applies different solid and liquid nutrients and fertilizers. Applicators using VRA for dry chemical nutrients, such as nitrogen, phosphorus, and potassium.

Increasing Demand Of Crop Gloabally Will Boost The Market For Agriculture VRT

As per the Statistics presented by United Nations’ median projection, the world’s population will grow to around 8.5 billion by 2030, which can increase the demand for food and water globally. However, there is significant growth in the agriculture sector, but the existing landmass will be a concern parameter. Hence various governments are supporting the technological advancements in the agriculture which will be helping for improved crop yields with existing landmass. Cereals & grains, oilseeds & pulses and fruits & vegetables crop type has adopted agriculture VRT. Cereals & grains dominated the agriculture VRT crop type globally owing to the large cultivation of cereals & grains globally.

To know about the assumptions considered for the study, download the pdf brochure

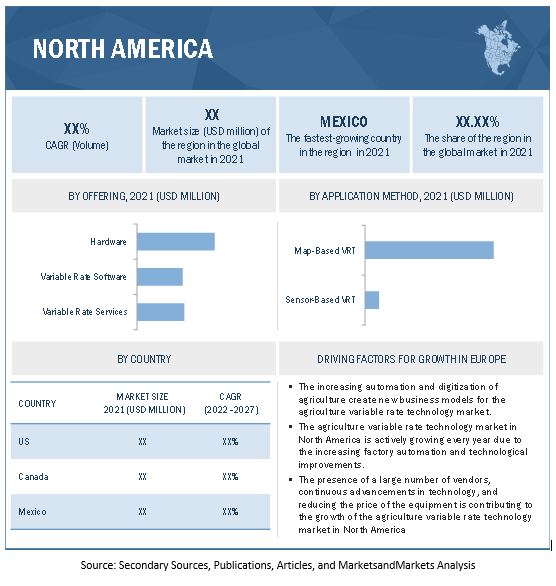

North America dominated the agriculture VRT market, with a value of USD 3.2 billion in 2021; it is projected to reach USD 6.2 billion by 2027, at a CAGR of 11.94% during the forecast period.

Today North America is the world’s leading producer of agriculture VRT. North America accounted for a market share of 48.5% in the global agriculture variable rate technology(VRT) market, in 2021. North America is the key exporter of various agriculture products; the region is dominated by large scale farm operations, which primary focus on exports is the major driver for the large market size for VRT.

In terms of the crop type, fruits & vegetables is projected to witness the fastest growth in terms of adoption in crop type segment. As the fruits and vegetable are high cash crop of farmers and require major attention due to their uncertain growth patterns, these two factors is driving the adoption of agriculture VRT in the particular crop type.

Key Market Players

The key players in this market include Deere & Company (US), Trimble, Inc. (US), AGCO Corporation (US), AgJunction Inc. (US), AG Leader Technology (US), Kubota Corporation (Japan), Yara International (Norway), Valmont Industries, Inc. (US), Lindsay Corporation (US), and SZ DJI Technology Co., Ltd. (China).

Scope of the report

|

Report Metric |

Details |

|

Market Valuation in 2022 |

USD 7.4 Billion |

|

Revenue Forecast in 2027 |

USD 13.7 Billion |

|

Growth Rate |

CAGR of 13.2% |

|

Forecast period considered |

2022–2027 |

|

Units considered |

Value (USD) |

|

Segments covered |

By Offering, By Type, By Crop Type, By Application Method, By Farm Size, By Application Fit, and By Region |

|

Regions covered |

North America, Asia Pacific, Europe, South America and RoW |

|

Companies studied |

|

This research report categorizes the agriculture variable rate technology market, based on Offering, Type, Crop Type, Application Method, Farm Size, Application Fit, and Region.

Target Audience:

- Growers or Farmers.

- Agriculture variable rate technology manufacturers

- OEMs, Component Suppliers, dealers, services providers etc.

- Government and research organizations

-

Associations, regulatory bodies, and other industry-related bodies:

- European GNSS Agency (GSA)

- International Society For Precision Agriculture (ISPA)

- Precision Agriculture Research Association (PARA)

- Precision Ag Institute

By Offering

-

Hardware

- Guidance and Steering systems

- Flow and Application Control Devices

- GPS/ DGPS Receivers

- Handheld Mobile Devices/Computers

- Yield Monitors

- Sensors

- Displays

- Variable Rate Software

-

Variable Rate Services

- Farm Operation Services

- Integration & Consultation Services

By Type:

-

Fertilizer VRT

- Urea VRT

- UAN VRT

- NH3 VRT

- Other VRT

- Crop Protection Chemical VRT

- Soil Sensing

- Seeding VRT

- Yield Monitoring

- Irrigation VRT

By Crop Type

-

Cereals and Grains

- Corn

- Wheat

- Others cereals and grains

-

Oilseeds & Pulses

- Soybeans

- Cotton

- Other oilseeds & pulses

- Fruits & Vegetables

By Application Method:

- Map-based VRT

-

Sensor-based VRT

- Active Optical Sensor VRT

- Drone-based VRT

- Satellite-based VRT

By Application Fit

-

Fertilizers

- Specialty Fertilizers

- Liquid Fertilizers

- Organic Fertilizers

- Other Fertilizers

-

Crop Protection Chemicals

- Herbicides

- Fungicides & Bactericides

- Insecticides

- Nematicides and others

- Other application fit

By Farm Size

- Large

- Medium

- Small

By Region

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World

Recent Developments

- In December 2021, Kubota Corporation signed a partnership agreement with Bloomfield Robotics, which is a company that delivers plant growth monitoring services to tree crops. The company uses image analysis technology and Artificial Intelligence (AI) to assess plant growth and detect pests on grape, blueberry, and other tree crops. This will promote the transition to smart agriculture on tree crop farms by building an alliance with Bloomfield through investments.

- In November 2021, CNH Industrial N.V. acquired Raven Industries, Inc., a US-based leader in precision agriculture technology. The acquisition builds on a long partnership and is an important milestone in CNH Industrial’s digital transformation.

- In August 2021, Deere & Company acquired Bear Flag Robotics. The deal accelerates the development and delivery of automation and autonomy on the farm and supports John Deere’s long-term strategy to create smarter machines with advanced technology to support individual customer needs.

- In August 2021, Topcon Positioning Group announced the expansion of the Topnet Live Global Navigation Satellite Systems (GNSS) network of correction solutions to support the work environment. The newly expanded global network now has more types of correction services and subscription options.

Frequently Asked Questions (FAQ):

What is the future growth potential of Agricultural Variable Rate Technology Market?

The global agricultural variable rate technology market size is projected to reach USD 13.7 billion by 2027.

What is the estimated growth rate (CAGR) of the global Agricultural Variable Rate Technology Market for the next five years?

The global agricultural variable rate technology market is expected to grow at a compound annual growth rate (CAGR) of 13.2% from 2022 to 2027.

What are the major revenue pockets in the Agricultural Variable Rate Technology Market currently?

North America accounted for the largest share of the agricultural variable rate technology (VRT) market. The increasing automation and digitization of agriculture are creating new business models for the agricultural VRT market. The agricultural variable rate technology (VRT) market in North America is actively growing every year owing to increasing adoption in various crops.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

TABLE 1 INCLUSIONS AND EXCLUSIONS

1.4 REGIONS COVERED

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 2 USD EXCHANGE RATES CONSIDERED, 2015–2021

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 2 AGRICULTURE VARIABLE RATE TECHNOLOGY MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Key industry insights

2.1.2.2 Breakdown of primaries

2.1.2.3 Key data from primary sources

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for capturing the market size using the bottom-up analysis (Demand side)

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing the market size using the top-down analysis (Demand side)

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RESEARCH LIMITATIONS

2.6 COVID-19 HEALTH ASSESSMENT

FIGURE 6 COVID-19: THE GLOBAL PROPAGATION

FIGURE 7 COVID-19 PROPAGATION: SELECT COUNTRIES

2.7 COVID-19 ECONOMIC ASSESSMENT

FIGURE 8 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.7.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 9 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 10 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 52)

FIGURE 11 FRUITS & VEGETABLES SEGMENT TO BE THE FASTEST-GROWING CROP TYPE DURING THE FORECAST PERIOD

FIGURE 12 HARDWARE SEGMENT TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 13 LARGE FARMS SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

FIGURE 14 MAP-BASED VRT TO BE MORE WIDELY USED FROM 2022 TO 2027

FIGURE 15 REST OF THE WORLD TO REGISTER THE HIGHEST GROWTH RATE, 2022–2027

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 ATTRACTIVE OPPORTUNITIES IN THE AGRICULTURE VRT MARKET

FIGURE 16 RISING DEMAND FOR TECHNOLOGY IN FARMING TO DRIVE THE MARKET DURING THE FORECAST PERIOD

4.2 AGRICULTURE VRT MARKET, BY TYPE

FIGURE 17 FERTILIZER VRT SEGMENT TO DOMINATE THE AGRICULTURE VRT MARKET BY TYPE

4.3 NORTH AMERICAN AGRICULTURE VARIABLE RATE TECHNOLOGY MARKET, BY REGION & OFFERING

FIGURE 18 NORTH AMERICA TO HOLD THE LARGEST SHARE IN THE GLOBAL AGRICULTURE VRT MARKET IN 2021

4.4 AGRICULTURE VRT MARKET, BY APPLICATION METHOD

FIGURE 19 NORTH AMERICA TO DOMINATE THE AGRICULTURE VRT MARKET IN 2021

4.5 COUNTRY-WISE ANALYSIS OF THE AGRICULTURE VRT MARKET

FIGURE 20 NORTH AMERICA TO HOLD THE LARGEST SHARE OF THE AGRICULTURE VRT MARKET IN 2021

5 MARKET OVERVIEW (Page No. - 59)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 AGRICULTURE VRT MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Rapid adoption of advanced technologies in agriculture variable rate to reduce labor cost

5.2.1.2 Improved efficiency and productivity through improved crop yields and field quality

5.2.1.3 Increase in the average age of farmers in developed countries

5.2.2 RESTRAINTS

5.2.2.1 High costs of agriculture VRT equipment

5.2.2.2 Small size of landholdings and limited availability of skilled labor

5.2.3 OPPORTUNITIES

5.2.3.1 Growing adoption of technologically advanced equipment and tools in the agriculture industry

5.2.3.2 VRT services provided by leading market players in developing economies

5.2.4 CHALLENGES

5.2.4.1 Difficulty in collecting and analyzing multiple farm data

5.2.4.2 Lack of standardization in the agriculture variable rate industry

5.3 IMPACT OF COVID-19 ON MARKET DYNAMICS

6 INDUSTRY TRENDS (Page No. - 63)

6.1 INTRODUCTION

6.2 COVID-19 IMPACT ON THE AGRICULTURE VRT MARKET

6.3 VALUE CHAIN

FIGURE 22 AGRICULTURE VARIABLE RATE TECHNOLOGY MARKET: VALUE CHAIN

6.3.1 RESEARCH AND DEVELOPMENT

6.3.2 HARDWARE COMPONENT PROVIDERS

6.3.3 SOFTWARE PROVIDERS

6.3.4 SERVICE PROVIDERS

6.3.5 APPLICATIONS

6.4 SUPPLY CHAIN

FIGURE 23 PRODUCT DEVELOPMENT AND MANUFACTURING TO PLAY A VITAL ROLE IN THE SUPPLY CHAIN FOR THE AGRICULTURE VRT MARKET

6.5 TECHNOLOGY ANALYSIS

6.5.1 REMOTE SENSING

6.5.1.1 Active remote sensing

6.5.1.2 Passive remote sensing

6.5.2 AGRICULTURE DRONES/UNMANNED AERIAL VEHICLES (UAVS)

6.5.3 INTERNET OF THINGS (IOT)

6.6 ECOSYSTEM

TABLE 3 AGRICULTURE VRT MARKET: ECOSYSTEM

6.7 TRENDS/DISRUPTIONS IMPACTING THE CUSTOMER’S BUSINESS

FIGURE 24 YC-YCC: REVENUE SHIFT FOR THE AGRICULTURE VRT MARKET

6.8 PATENT ANALYSIS

TABLE 4 KEY PATENTS PERTAINING TO AGRICULTURE VRT, 2020–2021

6.9 TRADE ANALYSIS

TABLE 5 IMPORT DATA FOR HS CODE 8433, BY COUNTRY, 2016–2020 (USD BILLION)

TABLE 6 EXPORT DATA FOR HS CODE 8433, BY COUNTRY, 2016–2020 (USD BILLION)

6.10 PORTER’S FIVE FORCES ANALYSIS

TABLE 7 AGRICULTURE VRT MARKET: PORTER’S FIVE FORCES ANALYSIS

6.10.1 INTENSITY OF COMPETITIVE RIVALRY

6.10.2 THREAT OF SUBSTITUTES

6.10.3 BARGAINING POWER OF BUYERS

6.10.4 BARGAINING POWER OF SUPPLIERS

6.10.5 THREAT OF NEW ENTRANTS

6.11 CASE STUDIES ANALYSIS

6.11.1 USE CASE 1: VARIABLE RATE AGRICULTURE BY AGCO USING INTERNET OF THINGS TECHNOLOGY

6.11.2 AGJUNCTION HELPED EFARMERS TO DEVELOP AFFORDABLE AUTOSTEER FOR FARMERS

6.11.3 USE OF IOT IN AGRICULTURE VRT

6.12 REGULATORY POLICIES

6.13 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 8 AGRICULTURE VRT MARKET: DETAILED LIST OF CONFERENCES & EVENTS

7 AGRICULTURE VARIABLE RATE TECHNOLOGY MARKET, BY OFFERING (Page No. - 77)

7.1 INTRODUCTION

FIGURE 25 HARDWARE SEGMENT TO DOMINATE THE MARKET BY 2027 IN TERMS OF VALUE

TABLE 9 AGRICULTURE VRT MARKET SIZE, BY OFFERING, 2019–2021 (USD MILLION)

TABLE 10 AGRICULTURE VRT MARKET SIZE, BY OFFERING, 2022–2027 (USD MILLION)

7.2 HARDWARE

TABLE 11 AGRICULTURE VRT MARKET SIZE, BY HARDWARE, 2019–2021 (USD MILLION)

TABLE 12 AGRICULTURE VRT MARKET SIZE, BY HARDWARE, 2022–2027 (USD MILLION)

TABLE 13 GLOBAL: AGRICULTURE VRT HARDWARE MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 14 GLOBAL: AGRICULTURE VRT HARDWARE MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.2.1 GUIDANCE AND STEERING SYSTEMS

TABLE 15 GLOBAL: GUIDANCE AND STEERING SYSTEMS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 16 GLOBAL: GUIDANCE AND STEERING SYSTEMS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.2.2 FLOW AND APPLICATION CONTROL DEVICES

TABLE 17 GLOBAL: FLOW AND APPLICATION CONTROL DEVICES MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 18 GLOBAL: FLOW AND APPLICATION CONTROL DEVICES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.2.3 GPS/DGPS RECEIVERS

TABLE 19 GLOBAL: GPS/DGPS RECEIVERS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 20 GLOBAL: GPS/DGPS RECEIVERS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.2.4 HANDHELD COMPUTERS

TABLE 21 GLOBAL: HANDHELD COMPUTERS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 22 GLOBAL: HANDHELD COMPUTERS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.2.5 YIELD MONITORS

TABLE 23 GLOBAL: YIELD MONITORS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 24 GLOBAL: YIELD MONITORS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.2.6 SENSORS

TABLE 25 GLOBAL: SENSORS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 26 GLOBAL: SENSORS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.2.6.1 Soil sensors

7.2.6.2 Nutrient sensors

7.2.6.3 Moisture sensors

7.2.7 DISPLAYS

TABLE 27 GLOBAL: DISPLAYS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 28 GLOBAL: DISPLAYS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.2.8 OTHERS

TABLE 29 GLOBAL: OTHERS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 30 GLOBAL: OTHERS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.3 VRT SOFTWARE

TABLE 31 GLOBAL: AGRICULTURE VRT SOFTWARE MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 32 GLOBAL: AGRICULTURE VRT SOFTWARE MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.4 VRT SERVICE

TABLE 33 AGRICULTURE VRT SERVICES MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 34 AGRICULTURE VRT SERVICES MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

7.4.1 FARM OPERATION SERVICES

TABLE 35 GLOBAL: FARM OPERATION SERVICES MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 36 GLOBAL: FARM OPERATION SERVICES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.4.2 INTEGRATION AND CONSULTING SERVICES

TABLE 37 GLOBAL: INTEGRATION AND CONSULTING SERVICES MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 38 GLOBAL: INTEGRATION AND CONSULTING SERVICES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8 AGRICULTURE VARIABLE RATE TECHNOLOGY MARKET, BY TYPE (Page No. - 95)

8.1 INTRODUCTION

TABLE 39 AGRICULTURE VRT MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 40 AGRICULTURE VRT MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

8.2 FERTILIZER VRT

TABLE 41 GLOBAL: FERTILIZER VRT MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 42 GLOBAL: FERTILIZER VRT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

TABLE 43 GLOBAL: FERTILIZER VRT MARKET SIZE, BY FERTILIZER VRT, 2019–2021 (USD MILLION)

TABLE 44 GLOBAL: FERTILIZER VRT MARKET SIZE, BY FERTILIZER VRT, 2022–2027 (USD MILLION)

8.2.1 UREA VRT

TABLE 45 GLOBAL: UREA VRT MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 46 GLOBAL: UREA VRT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.2.2 UAN VRT

TABLE 47 GLOBAL: UAN VRT MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 48 GLOBAL: UAN VRT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.2.3 NH3 VRT

TABLE 49 GLOBAL: NH3 VRT MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 50 GLOBAL: NH3 VRT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.2.4 OTHER VRT

TABLE 51 GLOBAL: OTHER VRT MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 52 GLOBAL: OTHER VRT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.3 CROP PROTECTION CHEMICAL VRT

TABLE 53 GLOBAL: CROP PROTECTION CHEMICAL VRT MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 54 GLOBAL: CROP PROTECTION CHEMICAL VRT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.4 SOIL SENSING

TABLE 55 GLOBAL: SOIL SENSING MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 56 GLOBAL: SOIL SENSING MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.5 SEEDING VRT

TABLE 57 GLOBAL: SEEDING VRT MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 58 GLOBAL: SEEDING VRT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.6 YIELD MONITORING

TABLE 59 GLOBAL: YIELD MONITORING MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 60 GLOBAL: YIELD MONITORING MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.7 IRRIGATION VRT

TABLE 61 GLOBAL: IRRIGATION VRT MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 62 GLOBAL: IRRIGATION VRT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.8 OTHER VRT TYPES

TABLE 63 GLOBAL: OTHER VRT TYPES MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 64 GLOBAL: OTHER VRT TYPES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9 AGRICULTURE VARIABLE RATE TECHNOLOGY MARKET, BY CROP TYPE (Page No. - 111)

9.1 INTRODUCTION

FIGURE 26 CEREALS & GRAINS SEGMENT TO DOMINATE THE MARKET BY 2027

TABLE 65 GLOBAL: AGRICULTURE VRT MARKET SIZE, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 66 GLOBAL: AGRICULTURE VRT MARKET SIZE, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 67 GLOBAL: AGRICULTURE VRT MARKET SIZE, BY CEREALS & GRAINS, 2019–2021 (USD MILLION)

TABLE 68 GLOBAL: AGRICULTURE VRT MARKET SIZE, BY CEREALS & GRAINS, 2022–2027 (USD MILLION)

TABLE 69 GLOBAL: AGRICULTURE VRT MARKET SIZE, BY OILSEEDS & PULSES, 2019–2021 (USD MILLION)

TABLE 70 GLOBAL: OIL SEEDS & PULSES MARKET SIZE, BY OILSEEDS & PULSES, 2022–2027 (USD MILLION)

9.2 CEREALS & GRAINS

FIGURE 27 CEREALS & GRAINS IN AGRICULTURE VRT MARKET SIZE, BY REGION, 2022 VS. 2027 (USD MILLION)

TABLE 71 GLOBAL: CEREALS AND GRAINS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 72 GLOBAL: CEREALS AND GRAINS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.2.1 CORN

TABLE 73 GLOBAL: CORN MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 74 GLOBAL: CORN MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.2.2 WHEAT

TABLE 75 GLOBAL: WHEAT MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 76 GLOBAL: WHEAT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.2.3 OTHER CEREALS AND GRAINS

TABLE 77 GLOBAL: OTHER CEREALS AND GRAINS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 78 GLOBAL: OTHER CEREALS AND GRAINS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.3 OILSEEDS & PULSES

TABLE 79 GLOBAL: OILSEEDS & PULSES MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 80 GLOBAL: OILSEEDS & PULSES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.3.1 SOYBEAN

TABLE 81 GLOBAL: SOYBEAN MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 82 GLOBAL: SOYBEAN MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.3.2 COTTON

TABLE 83 GLOBAL: COTTON MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 84 GLOBAL: COTTON MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.3.3 OTHER OIL SEEDS AND PULSES

TABLE 85 GLOBAL: OTHER OIL SEEDS AND PULSES MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 86 GLOBAL: OTHER OIL SEEDS AND PULSES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.4 FRUITS & VEGETABLES

TABLE 87 GLOBAL: FRUITS & VEGETABLES MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 88 GLOBAL: FRUITS & VEGETABLES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9.5 OTHERS

TABLE 89 GLOBAL: OTHERS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 90 GLOBAL: OTHERS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10 AGRICULTURAL VARIABLE RATE TECHNOLOGY MARKET, BY APPLICATION METHOD (Page No. - 126)

10.1 INTRODUCTION

FIGURE 28 MAP-BASED VRT SEGMENT TO DOMINATE THE MARKET BY 2027 IN TERMS OF VALUE

TABLE 91 GLOBAL: AGRICULTURAL VARIABLE RATE TECHNOLOGY MARKET SIZE, BY APPLICATION METHOD, 2019–2021 (USD MILLION)

TABLE 92 GLOBAL: AGRICULTURAL VARIABLE RATE TECHNOLOGY MARKET SIZE, BY APPLICATION METHOD, 2022–2027 (USD MILLION)

TABLE 93 AGRICULTURE VRT MARKET SIZE, BY SENSOR-BASED VRT, 2019–2021 (USD MILLION)

TABLE 94 AGRICULTURE VRT MARKET SIZE, BY SENSOR-BASED VRT, 2022–2027 (USD MILLION)

10.2 MAP-BASED VRT

TABLE 95 GLOBAL: MAP-BASED VRT MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 96 GLOBAL: MAP-BASED VRT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.3 SENSOR-BASED VRT

TABLE 97 GLOBAL: SENSOR-BASED VRT MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 98 GLOBAL: SENSOR-BASED VRT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.3.1 OPTICAL SENSORS

TABLE 99 GLOBAL: OPTICAL SENSORS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 100 GLOBAL: OPTICAL SENSORS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.3.2 DRONE-BASED VRT

TABLE 101 GLOBAL: DRONE-BASED MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 102 GLOBAL: DRONE-BASED MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.3.3 SATELLITE-BASED VRT

TABLE 103 GLOBAL: SATELLITE-BASED VRT MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 104 GLOBAL: SATELLITE-BASED VRT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

11 AGRICULTURE VARIABLE RATE TECHNOLOGY MARKET, BY FARM SIZE (Page No. - 135)

11.1 INTRODUCTION

FIGURE 29 REGION-WISE ARABLE LAND (HECTARES PER PERSON)

TABLE 105 AGRICULTURE VRT MARKET SIZE, BY FARM SIZE, 2019–2021 (USD MILLION)

TABLE 106 AGRICULTURE VRT MARKET SIZE, BY FARM SIZE, 2022–2027 (USD MILLION)

11.2 LARGE FARMS

TABLE 107 LARGE FARM MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 108 LARGE FARM MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

11.3 MID-SIZED FARMS

TABLE 109 MID-SIZED FARMS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 110 MID-SIZED FARMS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

11.4 SMALL FARMS

TABLE 111 SMALL FARM MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 112 SMALL FARM MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

12 AGRICULTURE VARIABLE RATE TECHNOLOGY MARKET, BY APPLICATION FIT (Page No. - 141)

12.1 INTRODUCTION

TABLE 113 AGRICULTURE VRT MARKET SIZE, BY APPLICATION FIT, 2019–2021 (USD MILLION)

TABLE 114 AGRICULTURE VRT MARKET SIZE, BY APPLICATION FIT, 2022–2027 (USD MILLION)

12.2 FERTILIZER

FIGURE 30 REGION-WISE FERTILIZER CONSUMPTION – 2019

TABLE 115 AGRICULTURE VRT MARKET SIZE, BY FERTILIZER, 2019–2021 (USD MILLION)

TABLE 116 AGRICULTURE VRT MARKET SIZE, BY FERTILIZER, 2022–2027 (USD MILLION)

TABLE 117 GLOBAL: FERTILIZERS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 118 GLOBAL: FERTILIZERS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

12.2.1 SPECIALTY FERTILIZERS

TABLE 119 AGRICULTURE VRT MARKET SIZE, BY SPECIALTY FERTILIZER, 2019–2021 (USD MILLION)

TABLE 120 AGRICULTURE VRT MARKET SIZE, BY SPECIALTY FERTILIZER, 2022–2027 (USD MILLION)

TABLE 121 GLOBAL: SPECIALTY FERTILIZERS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 122 GLOBAL: SPECIALTY FERTILIZERS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

12.2.1.1 Specialty compounds

TABLE 123 W2AGRICULTURE VRT MARKET SIZE, BY SPECIALTY COMPOUND, 2019–2021 (USD MILLION)

TABLE 124 AGRICULTURE VRT MARKET SIZE, BY SPECIALTY COMPOUND, 2022–2027 (USD MILLION)

TABLE 125 GLOBAL: SPECIALTY COMPOUNDS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 126 GLOBAL: SPECIALTY COMPOUNDS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

12.2.1.1.1 Nitrogen compounds

TABLE 127 GLOBAL: NITROGEN COMPOUNDS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 128 GLOBAL: NITROGEN COMPOUNDS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

12.2.1.1.2 Phosphate compounds

TABLE 129 GLOBAL: PHOSPHATE COMPOUNDS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 130 GLOBAL: PHOSPHATE COMPOUNDS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

12.2.1.1.3 Potash compounds

TABLE 131 GLOBAL: POTASH COMPOUNDS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 132 GLOBAL: POTASH COMPOUNDS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

12.2.1.2 Water soluble fertilizers

TABLE 133 GLOBAL: WATER SOLUBLE FERTILIZERS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 134 GLOBAL: WATER SOLUBLE FERTILIZERS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

12.2.1.3 Enhanced efficiency fertilizers

TABLE 135 AGRICULTURE VRT MARKET SIZE, BY ENHANCED EFFICIENCY FERTILIZER, 2019–2021 (USD MILLION)

TABLE 136 AGRICULTURE VRT MARKET SIZE, BY ENHANCED EFFICIENCY FERTILIZER, 2022–2027 (USD MILLION)

TABLE 137 GLOBAL: ENHANCED EFFICIENCY FERTILIZERS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 138 GLOBAL: ENHANCED EFFICIENCY FERTILIZERS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

12.2.1.3.1 Slow and controlled release

TABLE 139 GLOBAL: SLOW AND CONTROLLED RELEASE MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 140 GLOBAL: SLOW AND CONTROLLED RELEASE MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

12.2.1.3.2 Nitrogen stabilizers

TABLE 141 AGRICULTURE VRT MARKET SIZE, BY NITROGEN STABILIZER, 2019–2021 (USD MILLION)

TABLE 142 AGRICULTURE VRT MARKET SIZE, BY NITROGEN STABILIZER, 2022–2027 (USD MILLION)

TABLE 143 GLOBAL: NITROGEN STABILIZERS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 144 GLOBAL: NITROGEN STABILIZERS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

12.2.1.3.2.1 Nitrification inhibitors

TABLE 145 GLOBAL: NITRIFICATION INHIBITORS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 146 GLOBAL: NITRIFICATION INHIBITORS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

12.2.1.3.2.2 Urease inhibitors

TABLE 147 GLOBAL: UREASE INHIBITORS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 148 GLOBAL: UREASE INHIBITORS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

12.2.1.4 Micronutrients

TABLE 149 AGRICULTURE VRT MARKET SIZE, BY MICRONUTRIENT, 2019–2021 (USD MILLION)

TABLE 150 AGRICULTURE VRT MARKET SIZE, BY MICRONUTRIENT, 2022–2027 (USD MILLION)

TABLE 151 GLOBAL: MICRONUTRIENTS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 152 GLOBAL: MICRONUTRIENTS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

12.2.1.4.1 Non-chelated micronutrients

TABLE 153 GLOBAL: NON-CHELATED MICRONUTRIENTS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 154 GLOBAL: NON-CHELATED MICRONUTRIENTS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

12.2.1.4.2 Chelated micronutrients

TABLE 155 GLOBAL: CHELATED MICRONUTRIENTS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 156 GLOBAL: CHELATED MICRONUTRIENTS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

12.2.2 LIQUID FERTILIZERS

TABLE 157 GLOBAL: LIQUID FERTILIZERS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 158 GLOBAL: LIQUID FERTILIZERS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

12.2.3 ORGANIC FERTILIZERS

TABLE 159 AGRICULTURE VRT MARKET SIZE, BY ORGANIC FERTILIZER, 2019–2021 (USD MILLION)

TABLE 160 AGRICULTURE VRT MARKET SIZE, BY ORGANIC FERTILIZER, 2022–2027 (USD MILLION)

TABLE 161 GLOBAL: ORGANIC FERTILIZERS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 162 GLOBAL: ORGANIC FERTILIZERS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

12.2.3.1 Biofertilizers (Biologicals)

TABLE 163 GLOBAL: BIOFERTILIZERS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 164 GL OBAL: BIOFERTILIZERS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

12.2.3.2 Manures

TABLE 165 GLOBAL: MANURES MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 166 GLOBAL: MANURES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

12.2.4 OTHER FERTILIZERS

TABLE 167 GLOBAL: OTHER FERTILIZERS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 168 GLOBAL: OTHER FERTILIZERS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

12.3 CROP PROTECTION CHEMICALS

TABLE 169 AGRICULTURE VRT MARKET SIZE, BY CROP PROTECTION CHEMICAL, 2019–2021 (USD MILLION)

TABLE 170 AGRICULTURE VRT MARKET SIZE, BY CROP PROTECTION CHEMICAL, 2022–2027 (USD MILLION)

TABLE 171 GLOBAL: CROP PROTECTION CHEMICALS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 172 GLOBAL: CROP PROTECTION CHEMICALS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

12.3.1 HERBICIDES

TABLE 173 GLOBAL: HERBICIDES MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 174 GLOBAL: HERBICIDES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

12.3.2 FUNGICIDES & BACTERICIDES

TABLE 175 GLOBAL: FUNGICIDES & BACTERICIDES MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 176 GLOBAL: FUNGICIDES & BACTERICIDES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

12.3.3 INSECTICIDES

TABLE 177 GLOBAL: INSECTICIDES MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 178 GLOBAL: INSECTICIDES MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

12.3.4 NEMATICIDE & OTHERS

TABLE 179 GLOBAL: NEMATICIDES & OTHERS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 180 GLOBAL: NEMATICIDES & OTHERS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

12.4 OTHER APPLICATION FIT

TABLE 181 GLOBAL: OTHER APPLICATION FIT MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 182 GLOBAL: OTHER APPLICATION FIT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

13 AGRICULTURE VARIABLE RATE TECHNOLOGY MARKET, BY REGION (Page No. - 176)

13.1 INTRODUCTION

FIGURE 31 GEOGRAPHIC SNAPSHOT (2022–2027): RAPIDLY GROWING MARKETS ARE EMERGING AS NEW HOTSPOTS

TABLE 183 GLOBAL: AGRICULTURE VRT MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 184 GLOBAL: AGRICULTURE VRT MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

13.2 NORTH AMERICA

FIGURE 32 NORTH AMERICA: AGRICULTURE VRT: MARKET SNAPSHOT

TABLE 185 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 186 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 187 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY OFFERING, 2019–2021 (USD MILLION)

TABLE 188 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 189 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY HARDWARE, 2019–2021 (USD MILLION)

TABLE 190 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY HARDWARE, 2022–2027 (USD MILLION)

TABLE 191 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY VARIABLE RATE SERVICE, 2019–2021 (USD MILLION)

TABLE 192 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY VARIABLE RATE SERVICE, 2022–2027 (USD MILLION)

TABLE 193 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 194 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 195 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY FERTILIZER VRT, 2019–2021 (USD MILLION)

TABLE 196 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY FERTILIZER VRT, 2022–2027 (USD MILLION)

TABLE 197 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 198 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 199 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY CEREALS & GRAINS, 2019–2021 (USD MILLION)

TABLE 200 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY CEREALS & GRAINS, 2022–2027 (USD MILLION)

TABLE 201 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY OILSEEDS & PULSES, 2019–2021 (USD MILLION)

TABLE 202 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY OIL SEEDS & PULSES, 2022–2027 (USD MILLION)

TABLE 203 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY APPLICATION METHOD, 2019–2021 (USD MILLION)

TABLE 204 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY APPLICATION METHOD, 2022–2027 (USD MILLION)

TABLE 205 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY SENSOR-BASED VRT, 2019–2021 (USD MILLION)

TABLE 206 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY SENSOR-BASED VRT, 2022–2027 (USD MILLION)

TABLE 207 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY APPLICATION FIT, 2019–2021 (USD MILLION)

TABLE 208 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY APPLICATION FIT, 2022–2027 (USD MILLION)

TABLE 209 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY FERTILIZER, 2019–2021 (USD MILLION)

TABLE 210 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY FERTILIZER, 2022–2027 (USD MILLION)

TABLE 211 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY SPECIALTY FERTILIZER, 2019–2021 (USD MILLION)

TABLE 212 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY SPECIALTY FERTILIZER, 2022–2027 (USD MILLION)

TABLE 213 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY SPECIALTY COMPOUND, 2019–2021 (USD MILLION)

TABLE 214 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY SPECIALTY COMPOUND, 2022–2027 (USD MILLION)

TABLE 215 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY ENHANCED EFFICIENCY FERTILIZER, 2019–2021 (USD MILLION)

TABLE 216 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY ENHANCED EFFICIENCY FERTILIZER, 2022–2027 (USD MILLION)

TABLE 217 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY N STABILIZER, 2019–2021 (USD MILLION)

TABLE 218 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY N STABILIZER, 2022–2027 (USD MILLION)

TABLE 219 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY MICRONUTRIENT, 2019–2021 (USD MILLION)

TABLE 220 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY MICRONUTRIENT, 2022–2027 (USD MILLION)

TABLE 221 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY ORGANIC FERTILIZER, 2019–2021 (USD MILLION)

TABLE 222 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY ORGANIC FERTILIZER, 2022–2027 (USD MILLION)

TABLE 223 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY CROP PROTECTION CHEMICAL, 2019–2021 (USD MILLION)

TABLE 224 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY CROP PROTECTION CHEMICAL, 2022–2027 (USD MILLION)

TABLE 225 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY FARM TYPE, 2019–2021 (USD MILLION)

TABLE 226 NORTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY FARM TYPE, 2022–2027 (USD MILLION)

13.2.1 UNITED STATES

13.2.1.1 Presence of key players in the United States boosts the VRT market growth

13.2.2 CANADA

13.2.2.1 Farmers and growers in Canada are receptive to new technological advancements in agriculture variable rate technology to improve crop yield

13.2.3 MEXICO

13.2.3.1 Mexican government supports the growth of the agriculture variable rate technology market by undertaking different programs

13.3 EUROPE

TABLE 227 EUROPE: AGRICULTURE VRT MARKET SIZE, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 228 EUROPE: AGRICULTURE VRT MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 229 EUROPE: AGRICULTURE VRT MARKET SIZE, BY OFFERING, 2019–2021 (USD MILLION)

TABLE 230 EUROPE: AGRICULTURE VRT MARKET SIZE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 231 EUROPE: AGRICULTURE VRT MARKET SIZE, BY HARDWARE, 2019–2021 (USD MILLION)

TABLE 232 EUROPE: AGRICULTURE VRT MARKET SIZE, BY HARDWARE, 2022–2027 (USD MILLION)

TABLE 233 EUROPE: AGRICULTURE VRT MARKET SIZE, BY VARIABLE RATE SERVICE, 2019–2021 (USD MILLION)

TABLE 234 EUROPE: AGRICULTURE VRT MARKET SIZE, BY VARIABLE RATE SERVICE, 2022–2027 (USD MILLION)

TABLE 235 EUROPE: AGRICULTURE VRT MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 236 EUROPE: AGRICULTURE VRT MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 237 EUROPE: AGRICULTURE VRT MARKET SIZE, BY FERTILIZER VRT, 2019–2021 (USD MILLION)

TABLE 238 EUROPE: AGRICULTURE VRT MARKET SIZE, BY FERTILIZER VRT, 2022–2027 (USD MILLION)

TABLE 239 EUROPE: AGRICULTURE VRT MARKET SIZE, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 240 EUROPE: AGRICULTURE VRT MARKET SIZE, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 241 EUROPE: AGRICULTURE VRT MARKET SIZE, BY CEREALS & GRAINS, 2019–2021 (USD MILLION)

TABLE 242 EUROPE: AGRICULTURE VRT MARKET SIZE, BY CEREALS & GRAINS, 2022–2027 (USD MILLION)

TABLE 243 EUROPE: AGRICULTURE VRT MARKET SIZE, BY OIL SEED & PULSE, 2019–2021 (USD MILLION)

TABLE 244 EUROPE: AGRICULTURE VRT MARKET SIZE, BY OIL SEED & PULSE, 2022–2027 (USD MILLION)

TABLE 245 EUROPE: AGRICULTURE VRT MARKET SIZE, BY APPLICATION METHOD, 2019–2021 (USD MILLION)

TABLE 246 EUROPE: AGRICULTURE VRT MARKET SIZE, BY APPLICATION METHOD, 2022–2027 (USD MILLION)

TABLE 247 EUROPE: AGRICULTURE VRT MARKET SIZE, BY SENSOR-BASED VRT, 2019–2021 (USD MILLION)

TABLE 248 EUROPE: AGRICULTURE VRT MARKET SIZE, BY SENSOR-BASED VRT, 2022–2027 (USD MILLION)

TABLE 249 EUROPE: AGRICULTURE VRT MARKET SIZE, BY APPLICATION FIT, 2019–2021 (USD MILLION)

TABLE 250 EUROPE: AGRICULTURE VRT MARKET SIZE, BY APPLICATION FIT, 2022–2027 (USD MILLION)

TABLE 251 EUROPE: AGRICULTURE VRT MARKET SIZE, BY FERTILIZER, 2019–2021 (USD MILLION)

TABLE 252 EUROPE: AGRICULTURE VRT MARKET SIZE, BY FERTILIZER, 2022–2027 (USD MILLION)

TABLE 253 EUROPE: AGRICULTURE VRT MARKET SIZE, BY SPECIALTY FERTILIZER, 2019–2021 (USD MILLION)

TABLE 254 EUROPE: AGRICULTURE VRT MARKET SIZE, BY SPECIALTY FERTILIZER, 2022–2027 (USD MILLION)

TABLE 255 EUROPE: AGRICULTURE VRT MARKET SIZE, BY SPECIALTY COMPOUND, 2019–2021 (USD MILLION)

TABLE 256 EUROPE: AGRICULTURE VRT MARKET SIZE, BY SPECIALTY COMPOUND, 2022–2027 (USD MILLION)

TABLE 257 EUROPE: AGRICULTURE VRT MARKET SIZE, BY ENHANCED EFFICIENCY FERTILIZER, 2019–2021 (USD MILLION)

TABLE 258 EUROPE: AGRICULTURE VRT MARKET SIZE, BY ENHANCED EFFICIENCY FERTILIZER, 2022–2027 (USD MILLION)

TABLE 259 EUROPE: AGRICULTURE VRT MARKET SIZE, BY N STABILIZER, 2019–2021 (USD MILLION)

TABLE 260 EUROPE: AGRICULTURE VRT MARKET SIZE, BY N STABILIZER, 2022–2027 (USD MILLION)

TABLE 261 EUROPE: AGRICULTURE VRT MARKET SIZE, BY MICRONUTRIENT, 2019–2021 (USD MILLION)

TABLE 262 EUROPE: AGRICULTURE VRT MARKET SIZE, BY MICRONUTRIENT, 2022–2027 (USD MILLION)

TABLE 263 EUROPE: AGRICULTURE VRT MARKET SIZE, BY ORGANIC FERTILIZER, 2019–2021 (USD MILLION)

TABLE 264 EUROPE: AGRICULTURE VRT MARKET SIZE, BY ORGANIC FERTILIZER, 2022–2027 (USD MILLION)

TABLE 265 EUROPE: AGRICULTURE VRT MARKET SIZE, BY CROP PROTECTION CHEMICAL, 2019–2021 (USD MILLION)

TABLE 266 EUROPE: AGRICULTURE VRT MARKET SIZE, BY CROP PROTECTION CHEMICAL, 2022–2027 (USD MILLION)

TABLE 267 EUROPE: AGRICULTURE VRT MARKET SIZE, BY FARM TYPE, 2019–2021 (USD MILLION)

TABLE 268 EUROPE: AGRICULTURE VRT MARKET SIZE, BY FARM TYPE, 2022–2027 (USD MILLION)

13.3.1 GERMANY

13.3.1.1 Germany is in the introductory stage in adopting agriculture variable rate technology-related services

13.3.2 FRANCE

13.3.2.1 Driven by the high value of the crop and the importance of quality, several agriculture variable rate technology research projects already exist in the wine production areas of France

13.3.3 DENMARK

13.3.3.1 Rise in usage of technologies, such as drones and GPS systems, is driving the market for VRT

13.3.4 UNITED KINGDOM

13.3.4.1 The United Kingdom is increasingly adopting farming technologies due to their user-friendliness, as well as the reduced cost of GPS devices and fertilizers

13.3.5 REST OF EUROPE

13.4 ASIA PACIFIC

TABLE 269 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 270 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 271 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY OFFERING, 2019–2021 (USD MILLION)

TABLE 272 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 273 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY HARDWARE, 2019–2021 (USD MILLION)

TABLE 274 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY HARDWARE, 2022–2027 (USD MILLION)

TABLE 275 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY VARIABLE RATE SERVICE, 2019–2021 (USD MILLION)

TABLE 276 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY VARIABLE RATE SERVICE, 2022–2027 (USD MILLION)

TABLE 277 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 278 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 279 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY FERTILIZER VRT, 2019–2021 (USD MILLION)

TABLE 280 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY FERTILIZER VRT, 2022–2027 (USD MILLION)

TABLE 281 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 282 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 283 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY CEREALS & GRAINS, 2019–2021 (USD MILLION)

TABLE 284 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY CEREALS & GRAINS, 2022–2027 (USD MILLION)

TABLE 285 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY OIL SEEDS & PULSES, 2019–2021 (USD MILLION)

TABLE 286 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY OIL SEEDS & PULSES, 2022–2027 (USD MILLION)

TABLE 287 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY APPLICATION METHOD, 2019–2021 (USD MILLION)

TABLE 288 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY APPLICATION METHOD, 2022–2027 (USD MILLION)

TABLE 289 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY SENSOR-BASED VRT, 2019–2021 (USD MILLION)

TABLE 290 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY SENSOR-BASED VRT, 2022–2027 (USD MILLION)

TABLE 291 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY APPLICATION FIT, 2019–2021 (USD MILLION)

TABLE 292 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY APPLICATION FIT, 2022–2027 (USD MILLION)

TABLE 293 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY FERTILIZER, 2019–2021 (USD MILLION)

TABLE 294 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY FERTILIZER, 2022–2027 (USD MILLION)

TABLE 295 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY SPECIALTY FERTILIZER, 2019–2021 (USD MILLION)

TABLE 296 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY SPECIALTY FERTILIZER, 2022–2027 (USD MILLION)

TABLE 297 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY SPECIALTY COMPOUND, 2019–2021 (USD MILLION)

TABLE 298 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY SPECIALTY COMPOUND, 2022–2027 (USD MILLION)

TABLE 299 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY ENHANCED EFFICIENCY FERTILIZER, 2019–2021 (USD MILLION)

TABLE 300 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY ENHANCED EFFICIENCY FERTILIZER, 2022–2027 (USD MILLION)

TABLE 301 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY N STABILIZER, 2019–2021 (USD MILLION)

TABLE 302 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY N STABILIZER, 2022–2027 (USD MILLION)

TABLE 303 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY MICRONUTRIENT, 2019–2021 (USD MILLION)

TABLE 304 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY MICRONUTRIENT, 2022–2027 (USD MILLION)

TABLE 305 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY ORGANIC FERTILIZER, 2019–2021 (USD MILLION)

TABLE 306 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY ORGANIC FERTILIZER, 2022–2027 (USD MILLION)

TABLE 307 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY CROP PROTECTION CHEMICAL, 2019–2021 (USD MILLION)

TABLE 308 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY CROP PROTECTION CHEMICAL, 2022–2027 (USD MILLION)

TABLE 309 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY FARM TYPE, 2019–2021 (USD MILLION)

TABLE 310 ASIA PACIFIC: AGRICULTURE VRT MARKET SIZE, BY FARM TYPE, 2022–2027 (USD MILLION)

13.4.1 CHINA

13.4.1.1 Increasing demand for modern agriculture and the growing adoption of new technologies are the major reasons behind the high growth of the agriculture VRT market in China

13.4.2 AUSTRALIA

13.4.2.1 Agriculture variable rate technology in Australia is dominated by the grains industry

13.4.3 JAPAN

13.4.3.1 Shortage of labor is driving the VRT market in Japan

13.4.4 SOUTH KOREA

13.4.4.1 Agriculture variable rate technology has witnessed a better adoption rate in South Korea

13.4.5 REST OF ASIA-PACIFIC

13.5 SOUTH AMERICA

TABLE 311 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 312 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 313 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY OFFERING, 2019–2021 (USD MILLION)

TABLE 314 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 315 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY HARDWARE, 2019–2021 (USD MILLION)

TABLE 316 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY HARDWARE, 2022–2027 (USD MILLION)

TABLE 317 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY VARIABLE RATE SERVICE, 2019–2021 (USD MILLION)

TABLE 318 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY VARIABLE RATE SERVICE, 2022–2027 (USD MILLION)

TABLE 319 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 320 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 321 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY FERTILIZER VRT, 2019–2021 (USD MILLION)

TABLE 322 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY FERTILIZER VRT, 2022–2027 (USD MILLION)

TABLE 323 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 324 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 325 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY CEREALS & GRAINS, 2019–2021 (USD MILLION)

TABLE 326 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY CEREALS & GRAINS, 2022–2027 (USD MILLION)

TABLE 327 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY OIL SEEDS & PULSES, 2019–2021 (USD MILLION)

TABLE 328 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY OIL SEEDS & PULSES, 2022–2027 (USD MILLION)

TABLE 329 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY APPLICATION METHOD, 2019–2021 (USD MILLION)

TABLE 330 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY APPLICATION METHOD, 2022–2027 (USD MILLION)

TABLE 331 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY SENSOR-BASED VRT, 2019–2021 (USD MILLION)

TABLE 332 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY SENSOR-BASED VRT, 2022–2027 (USD MILLION)

TABLE 333 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY APPLICATION FIT, 2019–2021 (USD MILLION)

TABLE 334 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY APPLICATION FIT, 2022–2027 (USD MILLION)

TABLE 335 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY FERTILIZER, 2019–2021 (USD MILLION)

TABLE 336 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY FERTILIZER, 2022–2027 (USD MILLION)

TABLE 337 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY SPECIALTY FERTILIZER, 2019–2021 (USD MILLION)

TABLE 338 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY SPECIALTY FERTILIZER, 2022–2027 (USD MILLION)

TABLE 339 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY SPECIALTY COMPOUND, 2019–2021 (USD MILLION)

TABLE 340 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY SPECIALTY COMPOUND, 2022–2027 (USD MILLION)

TABLE 341 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY ENHANCED EFFICIENCY FERTILIZER, 2019–2021 (USD MILLION)

TABLE 342 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY ENHANCED EFFICIENCY FERTILIZERS, 2022–2027 (USD MILLION)

TABLE 343 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY N STABILIZER, 2019–2021 (USD MILLION)

TABLE 344 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY N STABILIZER, 2022–2027 (USD MILLION)

TABLE 345 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY MICRONUTRIENT, 2019–2021 (USD MILLION)

TABLE 346 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY MICRONUTRIENT, 2022–2027 (USD MILLION)

TABLE 347 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY ORGANIC FERTILIZER, 2019–2021 (USD MILLION)

TABLE 348 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY ORGANIC FERTILIZER, 2022–2027 (USD MILLION)

TABLE 349 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY CROP PROTECTION CHEMICAL, 2019–2021 (USD MILLION)

TABLE 350 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY CROP PROTECTION CHEMICAL, 2022–2027 (USD MILLION)

TABLE 351 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY FARM TYPE, 2019–2021 (USD MILLION)

TABLE 352 SOUTH AMERICA: AGRICULTURE VRT MARKET SIZE, BY FARM TYPE, 2022–2027 (USD MILLION)

13.5.1 BRAZIL

13.5.1.1 Support from the Brazilian government to adopt new agriculture technologies is driving the market for VRT

13.5.2 ARGENTINA

13.5.2.1 Largest crop growing areas in Argentina is boosting the market for the adoption of VRT

13.5.3 REST OF SOUTH AMERICA

13.6 REST OF THE WORLD (ROW)

TABLE 353 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 354 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 355 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY OFFERING, 2019–2021 (USD MILLION)

TABLE 356 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 357 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY HARDWARE, 2019–2021 (USD MILLION)

TABLE 358 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY HARDWARE, 2022–2027 (USD MILLION)

TABLE 359 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY VARIABLE RATE SERVICE, 2019–2021 (USD MILLION)

TABLE 360 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY VARIABLE RATE SERVICE, 2022–2027 (USD MILLION)

TABLE 361 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 362 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 363 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY FERTILIZER VRT, 2019–2021 (USD MILLION)

TABLE 364 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY FERTILIZER VRT, 2022–2027 (USD MILLION)

TABLE 365 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY CROP TYPE, 2019–2021 (USD MILLION)

TABLE 366 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY CROP TYPE, 2022–2027 (USD MILLION)

TABLE 367 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY CEREALS & GRAINS, 2019–2021 (USD MILLION)

TABLE 368 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY CEREALS & GRAINS, 2022–2027 (USD MILLION)

TABLE 369 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY OIL SEEDS & PULSES, 2019–2021 (USD MILLION)

TABLE 370 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY OIL SEEDS & PULSES, 2022–2027 (USD MILLION)

TABLE 371 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY APPLICATION METHOD, 2019–2021 (USD MILLION)

TABLE 372 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY APPLICATION METHOD, 2022–2027 (USD MILLION)

TABLE 373 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY SENSOR-BASED VRT, 2019–2021 (USD MILLION)

TABLE 374 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY SENSOR-BASED VRT, 2022–2027 (USD MILLION)

TABLE 375 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY APPLICATION FIT, 2019–2021 (USD MILLION)

TABLE 376 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY APPLICATION FIT, 2022–2027 (USD MILLION)

TABLE 377 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY FERTILIZER, 2019–2021 (USD MILLION)

TABLE 378 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY FERTILIZER, 2022–2027 (USD MILLION)

TABLE 379 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY SPECIALTY FERTILIZER, 2019–2021 (USD MILLION)

TABLE 380 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY SPECIALTY FERTILIZER, 2022–2027 (USD MILLION)

TABLE 381 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY SPECIALTY COMPOUND, 2019–2021 (USD MILLION)

TABLE 382 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY SPECIALTY COMPOUND, 2022–2027 (USD MILLION)

TABLE 383 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY ENHANCED EFFICIENCY FERTILIZER, 2019–2021 (USD MILLION)

TABLE 384 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY ENHANCED EFFICIENCY FERTILIZER, 2022–2027 (USD MILLION)

TABLE 385 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY N STABILIZER, 2019–2021 (USD MILLION)

TABLE 386 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY N STABILIZER, 2022–2027 (USD MILLION)

TABLE 387 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY MICRONUTRIENT, 2019–2021 (USD MILLION)

TABLE 388 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY MICRONUTRIENT, 2022–2027 (USD MILLION)

TABLE 389 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY ORGANIC FERTILIZER, 2019–2021 (USD MILLION)

TABLE 390 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY ORGANIC FERTILIZER, 2022–2027 (USD MILLION)

TABLE 391 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY CROP PROTECTION CHEMICAL, 2019–2021 (USD MILLION)

TABLE 392 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY CROP PROTECTION CHEMICAL, 2022–2027 (USD MILLION)

TABLE 393 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY FARM TYPE, 2019–2021 (USD MILLION)

TABLE 394 REST OF THE WORLD: AGRICULTURE VRT MARKET SIZE, BY FARM TYPE, 2022–2027 (USD MILLION)

13.6.1 SOUTH AFRICA

13.6.1.1 Growing awareness regarding the benefits associated with VRT among growers in South Africa boosts the market growth

13.6.2 MIDDLE EAST AND OTHERS

13.6.2.1 Rapid technological developments in VRT are driving the market in the Middle East

14 COMPETITIVE LANDSCAPE (Page No. - 263)

14.1 OVERVIEW

14.2 MARKET SHARE ANALYSIS, 2020

TABLE 395 GLOBAL AGRICULTURE VARIABLE RATE TECHNOLOGY MARKET: DEGREE OF COMPETITION

14.3 KEY PLAYER STRATEGIES

14.4 REVENUE ANALYSIS OF KEY PLAYERS, 2018–2020

FIGURE 33 REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 2018–2020 (USD BILLION)

14.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

14.5.1 STAR

14.5.2 PERVASIVE

14.5.3 EMERGING LEADERS

14.5.4 PARTICIPANTS

FIGURE 34 AGRICULTURE VARIABLE RATE TECHNOLOGY MARKET, COMPANY EVALUATION QUADRANT, 2020 (OVERALL MARKET)

14.5.5 PRODUCT FOOTPRINT

TABLE 396 AGRICULTURE VARIABLE RATE TECHNOLOGY MARKET: COMPANY PRODUCT APPLICATION FOOTPRINT

TABLE 397 AGRICULTURE VARIABLE RATE TECHNOLOGY MARKET: COMPANY REGION FOOTPRINT

14.6 AGRICULTURE VARIABLE RATE TECHNOLOGY MARKET, STARTUP/SMALL & MEDIUM SCALE ENTERPRISE EVALUATION QUADRANT, 2020

14.6.1 PROGRESSIVE COMPANIES

14.6.2 STARTING BLOCKS

14.6.3 RESPONSIVE COMPANIES

14.6.4 DYNAMIC COMPANIES

FIGURE 35 AGRICULTURE VARIABLE RATE TECHNOLOGY MARKET: COMPANY EVALUATION QUADRANT, 2020 (OTHERS)

14.7 NEW PRODUCT LAUNCHES AND DEALS

14.7.1 NEW PRODUCT LAUNCHES

TABLE 398 AGRICULTURE VARIABLE RATE TECHNOLOGY MARKET: PRODUCT LAUNCHES, JUNE 2018–JANUARY 2022

14.7.2 DEALS

TABLE 399 AGRICULTURE VARIABLE RATE TECHNOLOGY MARKET: DEALS, JUNE 2017- FEBRUARY 2021

14.8 MARKET RANKING ANALYSIS

FIGURE 36 AGRICULTURE VRT: KEY PLAYERS' RANKING

15 COMPANY PROFILES (Page No. - 276)

15.1 KEY PLAYERS

(Business overview, Products offered, Recent developments & MnM View)*

15.1.1 DEERE & COMPANY

TABLE 400 DEERE & COMPANY: BUSINESS OVERVIEW

FIGURE 37 DEERE & COMPANY: COMPANY SNAPSHOT

TABLE 401 DEERE & COMPANY: PRODUCTS OFFERED

TABLE 402 DEERE & COMPANY: DEALS, 2018–2022

TABLE 403 DEERE & COMPANY: OTHERS

15.1.2 TRIMBLE, INC.

TABLE 404 TRIMBLE, INC.: BUSINESS OVERVIEW

FIGURE 38 TRIMBLE, INC.: COMPANY SNAPSHOT

TABLE 405 TRIMBLE, INC.: PRODUCTS OFFERED

TABLE 406 TRIMBLE, INC: OTHERS

15.1.3 AGCO CORPORATION

TABLE 407 AGCO CORPORATION: BUSINESS OVERVIEW

FIGURE 39 AGCO CORPORATION: COMPANY SNAPSHOT

TABLE 408 AGCO CORPORATION: PRODUCTS OFFERED

TABLE 409 AGCO CORPORATION: DEALS, 2018–2022

15.1.4 TOPCON CORPORATION

TABLE 410 TOPCON CORPORATION: BUSINESS OVERVIEW

FIGURE 40 TOPCON CORPORATION.: COMPANY SNAPSHOT

TABLE 411 TOPCON CORPORATION: PRODUCTS OFFERED

TABLE 412 TOPCON CORPORATION: DEALS, 2018–2022

TABLE 413 TOPCON CORPORATION: PRODUCT LAUNCHES, 2018–2022

TABLE 414 TOPCON CORPORATION: OTHERS

15.1.5 CNH INDUSTRIAL N.V.

TABLE 415 CNH INDUSTRIAL N.V.: BUSINESS OVERVIEW

FIGURE 41 CNH INDUSTRIAL N.V.: COMPANY SNAPSHOT

TABLE 416 CNH INDUSTRIAL N.V.: PRODUCTS OFFERED

TABLE 417 CNH INDUSTRIAL N.V.: DEALS, 2018–2022

TABLE 418 CNH INDUSTRIAL N.V.: PRODUCT LAUNCHES, 2018–2022

15.1.6 KUBOTA CORPORATION

TABLE 419 KUBOTA CORPORATION: BUSINESS OVERVIEW

FIGURE 42 KUBOTA CORPORATION: COMPANY SNAPSHOT

TABLE 420 KUBOTA CORPORATION: PRODUCTS OFFERED

TABLE 421 KUBOTA CORPORATION: OTHERS, 2018–2022

TABLE 422 KUBOTA CORPORATION: DEALS, 2018–2022

15.1.7 HEXAGON

TABLE 423 HEXAGON: BUSINESS OVERVIEW

FIGURE 43 HEXAGON: COMPANY SNAPSHOT

TABLE 424 HEXAGON: PRODUCTS OFFERED

TABLE 425 HEXAGON: PRODUCT LAUNCHES, 2018–2022

15.1.8 YARA INTERNATIONAL ASA

TABLE 426 YARA INTERNATIONAL ASA: BUSINESS OVERVIEW

FIGURE 44 YARA INTERNATIONAL ASA.: COMPANY SNAPSHOT

TABLE 427 YARA INTERNATIONAL ASA: PRODUCTS OFFERED

15.1.9 SZ DJI TECHNOLOGY CO. CHANGES LTD.

TABLE 428 SZ DJI TECHNOLOGY CO., LTD.: BUSINESS OVERVIEW

TABLE 429 SZ DJI TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

TABLE 430 SZ DJI TECHNOLOGY CO., LTD.: PRODUCT LAUNCHES, 2018-2021

15.1.10 VALMONT INDUSTRIES INC.

TABLE 431 VALMONT INDUSTRIES INC.: BUSINESS OVERVIEW

FIGURE 45 VALMONT INDUSTRIES INC.: COMPANY SNAPSHOT

TABLE 432 VALMONT INDUSTRIES INC: PRODUCTS OFFERED

TABLE 433 VALMONT INDUSTRIES INC.: DEALS, 2018–2022

15.1.11 LINDSAY CORPORATION

TABLE 434 LINDSAY CORPORATION: BUSINESS OVERVIEW

FIGURE 46 LINDSAY CORPORATION: COMPANY SNAPSHOT

TABLE 435 LINDSAY CORPORATION: PRODUCTS OFFERED

TABLE 436 LINDSAY CORPORATION: DEALS, 2019-2021

TABLE 437 LINDSAY CORPORATION: PRODUCT LAUNCHES, 2018–2021

15.1.12 THE CLIMATE CORPORATION

TABLE 438 THE CLIMATE CORPORATION: BUSINESS OVERVIEW

TABLE 439 THE CLIMATE CORPORATION: PRODUCTS OFFERED

TABLE 440 THE CLIMATE CORPORATION: DEALS, 2018–2021

15.1.13 AG LEADER TECHNOLOGY

TABLE 441 AG LEADER TECHNOLOGY: BUSINESS OVERVIEW

TABLE 442 AG LEADER TECHNOLOGY: PRODUCTS OFFERED

TABLE 443 AG LEADER TECHNOLOGY: PRODUCT LAUNCHES, 2018–2021

15.1.14 AGJUNCTION

TABLE 444 AGJUNCTION: BUSINESS OVERVIEW

FIGURE 47 AGJUNCTION: COMPANY SNAPSHOT

TABLE 445 AGJUNCTION: PRODUCTS OFFERED

TABLE 446 AGJUNCTION: PRODUCT LAUNCHES, 2018–2022

TABLE 447 AGJUNCTION: DEALS, 2018–2022

15.1.15 EEJET TECHNOLOGIES

TABLE 448 TEEJET TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 449 TEEJET TECHNOLOGIES: PRODUCTS OFFERED

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

16 ADJACENT AND RELATED MARKETS (Page No. - 323)

16.1 INTRODUCTION

TABLE 450 ADJACENT MARKETS TO THE AGRICULTURE VARIABLE RATE TECHNOLOGY MARKET

16.2 LIMITATIONS

16.3 PRECISION FARMING MARKET

16.3.1 MARKET DEFINITION

16.3.2 MARKET OVERVIEW

TABLE 451 PRECISION FARMING MARKET, BY OFFERING, 2022–2030 (USD MILLION)

16.4 SMART AGRICULTURE MARKET

16.4.1 MARKET DEFINITION

16.4.2 MARKET OVERVIEW

TABLE 452 SMART AGRICULTURE MARKET, BY AGRICULTURE TYPE, 2021–2026 (USD MILLION)

17 APPENDIX (Page No. - 326)

17.1 DISCUSSION GUIDE

17.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.3 AVAILABLE CUSTOMIZATIONS

17.4 RELATED REPORTS

17.5 AUTHOR DETAILS

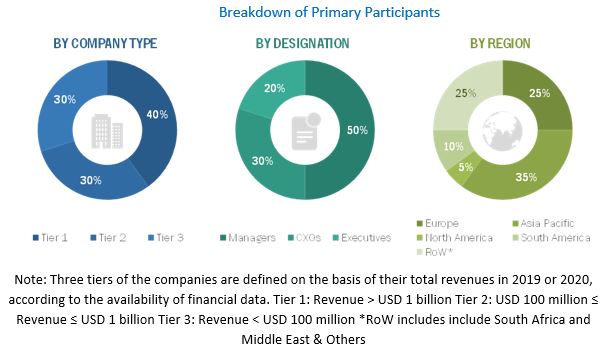

This research study involved the extensive use of secondary sources-directories and databases such as Bloomberg Businessweek and Factiva-to identify and collect information useful for a technical, market-oriented, and commercial study of the agricultural variable rate technology market. In-depth interviews were conducted with various primary respondents-such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants-to obtain and verify critical qualitative and quantitative information as well as to assess prospects. The following figure depicts the research design applied in drafting this report on the agricultural variable rate technology market.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology oriented perspectives

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the agricultural variable rate technology market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the agriculture variable rate technology market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research.

- The revenues of major agriculture variable rate technology manufacturers were determined through primary and secondary research, such as paid databases, which were used as the basis for market estimation.

- All macroeconomic and microeconomic factors affecting the growth of the agriculture variable rate technology market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Report Objectives

- To define, segment, and project the global market for agriculture variable rate technology on the basis of Offering, Type Crop Type, Application Method, Farm Size, Application Fit, and Region.

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value and with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze the competitive developments such as mergers & acquisitions, new product developments, and research & developments in the agriculture variable rate technology market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of APAC market for agriculture variable rate technology into the Thailand, Vietnam, Indonesia, India, and the Philippines

- Further breakdown of the Rest of Europe market for agriculture variable rate technology into Sweden, Hungary, and Spain

- Further breakdown of the Rest of South America market for agriculture variable rate technology into Chile, Venezuela, Peru, Bolivia, Paraguay, Uruguay, Ecuador, and Colombia

- Further breakdown of other countries in the RoW market for agriculture variable rate technology into South Africa and Middle East & Others

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Agricultural Variable Rate Technology Market