Military Navigation Market by Platform (Ammunition, Aviation, Ground, Marine, Unmanned Vehicle, Space), Application (ISR, C2, Combat & Security, Targeting & Guidance, SAR), Component (Hardware, Software, Service), Grade & Region (2017-2023)

Updated date -

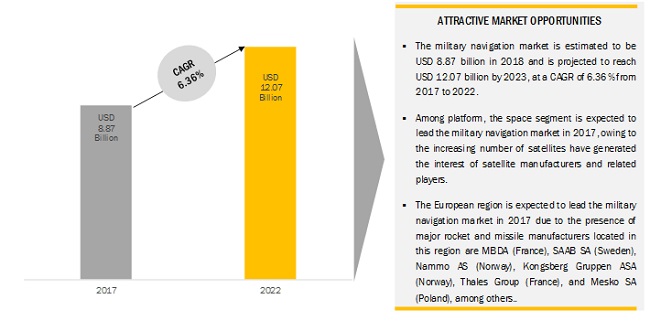

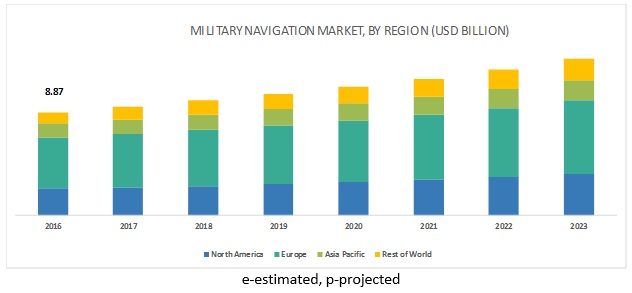

The military navigation market is estimated to be USD 8.40 million in 2017 and is projected to reach USD 12.07 million by 2023, at a CAGR of 6.36% during the forecast period.

Military forces worldwide are focused on the integration of navigation equipment with aircraft, ships, unmanned systems, missiles, and rockets, which is expected to drive the military navigation market. The decline in the procurement of defense equipment due to limited defense funding is acting as a key restraint to the growth of the military navigation market.

Market overview:

Based on platform, the ammunition segment dominated the military navigation market in 2017

Based on platform, the ammunition segment dominated the military navigation market in 2017 due to the increase in demand for military navigation systems for missiles and rockets from militaries. For instance, Hydra-70 rockets can be fired from a variety of rotary and fixed-wing platforms, including the US Army’s Apache, the US Marine Corps’ Cobra attack helicopters, and F-16s. The rapid growth in government defense budgets in various key countries, such as China and Saudi Arabia, is leading to the increasing implementation of navigation systems in the ammunition platform.

Based on component, the hardware segment dominated the military navigation market in 2017

Based on component, the hardware segment dominated the military navigation market in 2017. This is attributed to the increasing number of military operations, increasing investments in defense equipment, and increasing government defense budgets across the globe. The rise in procurement of defense aircraft, ships, and other defense products and increase in budget allocations are key factors driving the growth of the hardware segment in military navigation market.

Based on application, the intelligence, surveillance & reconnaissance segment lead the military navigation market in 2017

Based on application, the intelligence, surveillance & reconnaissance segment dominated the military navigation market in 2017. Military navigation guides various platforms of military forces by providing the exact locations of personnel in real-time or near real-time. Effective command & control on the battlefield requires real-time information that can be used at critical times for effective decision making. Intelligence, surveillance & reconnaissance helps in situational awareness by providing military commanders with the precise location of warfare operations. Intelligence is considered a crucial military competency as it acts as a force-multiplier by providing advanced situational awareness to armed forces. For instance, the Distributed Common Ground System (DCGS), a globally networked intelligence system of the US Department of Defense, integrates multiple sensors to gather intelligence data from various sources. This data fusion provides defense forces a 360- degree picture of the war scenario, enabling them to monitor enemy movement.

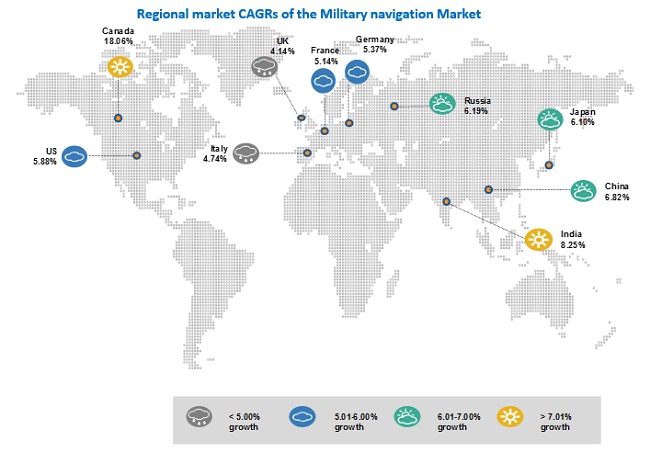

Based on region, Europe is accounted for the largest share of the military navigation market in 2017

Among regions, Europe is accounted for the largest share in the military navigation market in 2017. Countries in this region include the UK, Russia, Germany, France, and Italy, among others. The presence of some of the major market players, such as Safran (France), Cobham (UK), Garmin (Switzerland), and Thales (France), and the large number of military missiles deliveries in this region have contributed to the growth of the military navigation market in Europe.

Driver: Rising demand for missiles and artillery systems due to geopolitical instabilities and changing nature of warframe

Geopolitical instabilities in various countries across the globe have led to a rise in defense budgets. For instance, during the cold war era from the 1950s to 1990s, countries such as the US and Russia invested significantly for the procurement of submarine-launched ballistic missiles, nuclear warheads, long-range rockets, artillery systems, and other weapon systems. During the last 5 years, the number of active conflicts has also increased globally. Some of the ongoing conflicts include the South China Sea issue, the Afghanistan war, the India-Pakistan dispute, the North Korea issue, the Iran nuclear program, and the Syrian conflict. The rise in the number of conflicts is expected to drive the demand for rockets and missiles in the near future. Advanced missile defense capabilities help countries defend themselves from rocket and missile attacks. For instance, Israel’s Iron Dome air defense system has prevented more than 1,000 missiles and mortar attacks to date, at a 90% success rate Incidences of urban warfare in different parts of the world have led to the development of rocket and missile systems with precision striking capabilities that minimize collateral damage. Thus, the changing nature of conflicts between some countries has resulted in the increasing demand for enhanced rockets and missiles from militaries across the globe, which is expected to directly drive the military navigation market.

Opportunity: Demand for new generation air and missile defense system

Developments in new generation missiles with high-end technologies are a major threat to strategic installations and platforms, such as military airbases and ships. These developments include nuclear-capable ballistic missiles and high-speed cruise missiles. Nuclear ballistic missiles have the ability to destroy various cities and lives during war. Various nations are developing such advanced weapons capable of defeating high-end air defense systems, such as the Medium Extended Air Defense System (MEADS), Patriot Advanced Capability (PAC-3), and S-400. Countries such as India, China, and Russia have developed hypersonic missiles with integrated navigation systems that make it difficult for them to be intercepted by missile shields. For instance, India and Russia have jointly developed the BrahMos missile which is difficult to engage by missile defense shields. These developments have led to the high requirement for military navigation systems, which is directly driving the military navigation market.

Challenge: Measurement errors from inertial navigation system

Stable platform Inertial Navigation Systems (INS) depend on the interconnection of various mechanical parts with different joints for their functioning. These joints need to be frictionless to avoid any kind of measurement errors. With continued usage and wear and tear of these systems, the error due to friction increases, which, in turn, hampers the performance of these systems. Apart from friction, there are a few computational errors that are induced as a result of noise and drifts. For instance, MEMS inertial sensors encompass very tiny mechanical components weighing in micrograms. These components are so light that they occasionally fail to react to small changes with respect to orientation. Thus, friction and drifts induce a measurement error, which increases in the long run.

Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

2016–2023 |

|

Base Year Considered |

2017 |

|

Forecast Period |

2018–2023 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

Grade, Platform, Component, Application, and Region |

|

Geographies Covered |

North America, Asia Pacific, Europe, and Rest of the World |

|

Companies Covered |

Cobham (UK), Esterline Technologies (US), Garmin Ltd. (Switzerland), GE Aviation (US), Honeywell International (US), Israel Aerospace Industries (Israel), KVH Industries (US), LORD MicroStrain (US), L3 Technologies (US), Moog (US), Northrop Grumman (US), Raytheon (US), Rockwell Collins (US), Safran Electronics & Defense (France), Thales (France), Trimble Navigation (US)and Intelsat (US) |

Military navigation Market, By Platform

-

Aviation

- Combat Aircraft

- Military Helicopter

- Military Transport Aircraft

-

Ammunition

- Missile

- Rockets

-

Marine

- Shipboard

- Submarine

-

Ground

- Armored Vehicle

- Man-Portable device

-

Space

- Space Launch Vehicles

- Satellites

-

Unmanned Vehicle

- UAVs

- UMVs

- UGVs

Military Navigation Market, By Application

- Command & Control

- Intelligence, Surveillance & Reconnaissance (ISR)

- Combat & Security

- Targeting & Guidance

- Search & Rescue (SAR)

Military Navigation Market, By Component

-

Hardware

- GPS Receiver

- Inertial Navigation System

- Anti-jamming Device

- SONAR

- Personal Navigation System

- Sense and Avoid System (SAS)

- Thrust Vector Control

- Radar Altimeter

- Radar

- AIS Receiver

- Software

- Service

Military Navigation Market, By Grade

- Navigation Grade

- Tactical Grade

- Space Grade

- Marine Grade

Military Navigation Market, By Region

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW)

Key market players in the military naviation market market in aviation include Cobham (UK), Esterline Technologies (US), Garmin Ltd. (Switzerland), GE Aviation (US), Honeywell International (US), Israel Aerospace Industries (Israel), KVH Industries (US), LORD MicroStrain (US), L3 Technologies (US), Moog (US), Northrop Grumman (US), and Raytheon (US) among others.

Recent Developments:

- In July 2017, Cobham plc launched a new next-generation Anti-Jam GPS System that provides better immunity to jamming as compared to conventional GPS antennas, allowing a platform to operate more than 100 times closer to the jammers while maintaining GPS reception.

- In November 2019, Esterline CMC Electronics (Canada), a wholly-owned subsidiary of Esterline Technologies Corporation, received a contract from the French Direction Générale de l’armement (DGA) and Airbus Helicopters (France) to supply GPS Landing Systems and Flight Management Systems. Under this contract, the company is expected to supply CMA-5024 GPS and CMA- 9000 (FMS) for Sécurité Civile fleet of EC145 helicopters.

- In July 2015, GE Aviation received a contract from ViaSat to provide inertial navigation systems for ViaSat airborne satellite communication applications. The contract is expected to include various military and aircraft programs.

Critical Questions Addressed by the Report:

- What is the growth perspective of the military navigation market?

- What are the key dynamics and trends governing the market?

- What are the key sustainability strategies adopted by the leading players in the military navigation market?

- What are the new and emerging technologies and use cases disrupting military navigation?

- What are the key applications where navigation play a significant role in the military industry?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in the Military Navigation Market

4.2 Europe Military Navigation Market, By Platform and Country

4.3 Military Navigation Market, By Application

4.4 Military Navigation Market, By Component

4.5 Military Navigation Market, By Country

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Demand for Missiles and Artillery Systems Due to Geopolitical Instabilities and Changing Nature of Warfare

5.2.1.2 Availability of Miniaturized Components at Affordable Prices

5.2.1.3 Increasing Preference for the use of UAVs in Modern Warfare

5.2.1.4 Increasing use of UAVs By Defense Forces as Loitering Munition

5.2.2 Restraints

5.2.2.1 Decline in Defense Budgets of Developed Countries

5.2.2.2 Operational Reliability Associated With High-End Inertial Navigation Sensors

5.2.3 Opportunities

5.2.3.1 Demand for New Generation Air and Missile Defense Systems

5.2.3.2 Integration of Anti-Jamming Capabilities With Navigation Systems

5.2.4 Challenges

5.2.4.1 Measurement Errors From Inertial Navigation Systems

5.2.4.2 High Cost in the Development of Military Navigation Equipment

6 Industry Trends (Page No. - 43)

6.1 Introduction

6.2 Technology Trends

6.2.1 Error-Free Digital Output Through Air Data Computers

6.2.2 Weapons Integrated Battlefield Management Systems (WIBBMS)

6.2.3 Micro-Electro-Mechanical Systems Ins

6.2.4 High-End Ins

6.2.4.1 Ring Laser Gyro Inertial Navigation Sensor

6.2.4.2 Fiber Optics Gyro Inertial Navigation Sensor

6.2.5 Gps-Aided Ins

6.2.6 Air Data Inertial Reference Unit (ADIRU)

6.2.7 Multi-Sensor Data Fusion for UAV Navigation

6.2.7.1 Use of Sense & Avoid Technology

6.2.8 Advanced Inertial Navigation Systems for UUV

6.3 Innovations & Patent Registrations

6.4 Analysis of Key Trends in the Military Navigation Market

7 Military Navigation Market, By Platform (Page No. - 49)

7.1 Introduction

7.2 Aviation

7.2.1 Combat Aircraft

7.2.1.1 Modernization of Airborne Defense Units By Procuring Fighter Aircraft to Drive the Demand for Combat Aircraft Across the World

7.2.2 Military Helicopter

7.2.2.1 Rapidly Evolving Geopolitical Dynamics, Increasing Threats of Terrorism, and Compunding Nature of Threat Perception to Drive the Market for Military Helicopters

7.2.3 Military Transport Aircraft

7.2.3.1 Military Transport Aircraft to Witness Steady Growth With Investment By Governing Bodies for Difense

7.3 Ammunition

7.3.1 Missile

7.3.1.1 Growing Covergae Capabilities to Drive the Demand for Missiles for Air, Land, and Marine Defense

7.3.2 Rockets

7.3.2.1 Growing use of Rockets By Artillery and Infantry Divisions of the Military to Drive the Segment Growth

7.4 Marine

7.4.1 Shipboard

7.4.1.1 Increasing Penetration of Navigation System on Shipboard for Smooth Flow of Navigation Information or Data is Driving the Market Growth for Segment

7.4.2 Submarine

7.4.2.1 Growing Need for Situational Awareness and Near Stealth Capacity to Drive the Demand for Submarines

7.5 Ground

7.5.1 Armored Vehicle

7.5.1.1 Use of Armored Vehicle to Transport Personnal or to Carry Out Combat Operaion is Driving the Demand for Segment

7.5.2 Man-Portable Device

7.5.2.1 Increasing Application in Enemy Territories and Capability to Operate in the Absence of Light During Night Mission is Driving the Demand for Man-Portable Devices

7.6 Space

7.6.1 Space Launch Vehicles

7.6.1.1 Used to Transport Spacecraft, Satellites and Payload From the Surface of Earth Into Outer Space

7.6.2 Satellites

7.6.2.1 Growing use of Satellites for Mapping, Positioning, and Navigation in Various Application Area Such as Aviation, Intelligent Transportation, Surveying and Geodesy to Drive the Segment Growth

7.7 Unmanned Vehicle

7.7.1 Unmanned Aerial Vehicles (UAVs)

7.7.1.1 Increasing Investments in R&D Activities in the Global Defense Industry Have Led to the Development of Unmanned Aerial Vehicles (UAVs)

7.7.2 Unmanned Marine Vehicles (UMVs)

7.7.2.1 Increasing use of Unmanned Marine Vehicles to Inspect Underwater Cables and Search for Crashed Aircraft, Sunken Ships and Valuable Minerals

7.7.3 Unmanned Ground Vehicles (UGVs)

7.7.3.1 Used for Protection or Rescue Duties in Hazardous Environments or to Carry Out Respective Tasks

8 Military Navigation Market, By Application (Page No. - 60)

8.1 Introduction

8.2 Command & Control (C2)

8.2.1 Emphasis on Centrally Managing Operational Planning and Governing Batte Areas to Isseu Early Warning Againts Enemy Aircrafts and Ships to Drive the Market for Command & Control System

8.3 Intelligence, Surveillance & Reconnaissance (ISR)

8.3.1 Growing Focus on Providing Advanced Situational Awareness to Armed Forces is Expected to Drive the Growth for Intelligence, Surveillance & Reconnaissance (ISR) Systems

8.4 Combat & Security

8.4.1 Growing Efforts to Increase Capabilities of Situational Awareness, Intelligence Gathering, Planning & Decision Making and Command & Control Operatrions of Weapon System to Drive the Growth of Combat & Security Application Segment

8.5 Targeting & Guidance

8.5.1 Use of Targeting & Guidance System for Positive Target Identification, Autonomous Tracking, Gps Coordinate Generation and Precise Weapons Guidance to Drive the Market

8.6 Search & Rescue (SAR)

8.6.1 Use of Sonar and Other Navigation Equipment for Search & Rescue Operations to Locate Objects on Ocean Floors is Driving the Growth for Search & Rescue (SAR) Application

9 Military Navigation Market, By Component (Page No. - 65)

9.1 Introduction

9.2 Hardware

9.2.1 Gps Receiver

9.2.1.1 Vital Component to Calibrate the Location of Position and Create Visual Pointer on the Display

9.2.2 Inertial Navigation System

9.2.2.1 The Ability of Inertial Navigation Systems to Provide Exact Location Details Have Led to Increased Applicability of Inertial Navigation System in the Defense Sector

9.2.3 Anti-Jamming Device

9.2.3.1 Anti-Jamming Devices to Witness High Demand From Military Sector for Secure Weapons Guided Systems Due to Increasing Vulnerability of GPS Signals

9.2.4 Sonar

9.2.4.1 Extensive use of Sonar Systems for Navigation and Obstacle Avoidance to Drive the Market

9.2.5 Personal Navigation System

9.2.5.1 Growing Emphasis on Enhancing Global Positioning System to Provide Higher Location Accuracy is Driving the Market Growth

9.2.6 Sense and Avoid System (SAS)

9.2.6.1 Growing Adoption of Sense & Avoid System in UAVs to Avoid Collisions With Aircraft and Terrain Objects Driving the Market Growth

9.2.7 Thrust Vector Control

9.2.7.1 Increasing Penetration of Thrust Vector Control (TVC) in Propulsion System to Provide Directional Control is Expected to Drive the Market Growth

9.2.8 Radar Altimeter

9.2.8.1 Need for Determinig Exact Altitude and Spped of Aircraft is Expected to Drive the Market for Radar Altimeter

9.2.9 Radar

9.2.9.1 Growing Need to Restrain the Illegeal Activities Such as Smuggling, Piracy, Illicit Fishing and Terrorism is Drving the Demand for Radars

9.2.10 Ais Receiver

9.2.10.1 Emphasis on Collision Avoidance System is Driving the Demand for Ais Receiver

9.3 Software

9.3.1 Growing Penetration of Digitalization in Military Sector is Stimulating the Demand for Software

9.4 Service

9.4.1 Growing Focus of Market Players Towards Providing Maintainence & Repaire Services is Fueling the Growth of Service Segment

10 Military Navigation Market, By Grade (Page No. - 71)

10.1 Introduction

10.2 Navigation Grade

10.2.1 Presence of Leading Players Such As, Vectornav Technology (US), Northrop Grumman (US) and Safran Electronics & Defense (France) is Driving the Growth for Navigation Grade Demand

10.3 Tactical Grade

10.3.1 Growing Demand for Tactical Grade is Credited to Its Cost-Effective Performance

10.4 Space Grade

10.4.1 Emphasis on Space Navigation Along With High Accuacy Demand is Stimulating the Demand for Space Grade

10.5 Marine Grade

10.5.1 Marine Grade Military Navigation is Among the Highest-Grade Navigation System Commercially Available Across the Globe

11 Military Navigation Market, By Region (Page No. - 74)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.1.1 Presence of Leading Manufacturers of Military Navigation in the US is Paving the Way for US Military Navigation Market Growth

11.2.2 Canada

11.2.2.1 Investment in Development and Upgradation of Its Weapon and Missiles to Fuel the Growth of Canada Military Navigation Market

11.3 Europe

11.3.1 Russia

11.3.1.1 Country’s Significant Defense Expenditure and Its Military Intervention in Syria is Major Factor Driving the Growth of Military Navigation Market

11.3.2 UK

11.3.2.1 Upgradation of Special Surveillance and Missile Defense Programs Expected to Drive the Growth of UK Military Navigation Market During Forecast Period

11.3.3 France

11.3.3.1 Presence of Leading Market Players in the Country is Stimulating the Market Growth in France

11.3.4 Italy

11.3.4.1 Increasing Demand for Military Navigation Products By Leading Aircraft Manufacturers Such as Piaggio Aerospace and Leonardo Anticipated to Drive the Growth of Military Navigation Market in Italy

11.3.5 Germany

11.3.5.1 High Investment in Modernization of Its Existing Patriot Missile Systems Expected to Drive the Growth of Military Navigation Market in Germany

11.3.6 Rest of Europe

11.3.6.1 High Investment in Modernization Programs By Countries Such as Switzerland and Austria Driving the Growth for Military Navigation Market

11.4 Asia Pacific

11.4.1 China

11.4.1.1 Increased Instances of Conflicts With Other Countries Leading to the Growth of Military Navigtion Market in China

11.4.2 Japan

11.4.2.1 Increasing Need for New and Advanced Defense Systems, Resulting in the Growth of Military Navigation Market in Japan

11.4.3 India

11.4.3.1 Rising Military Expenditure and Ongoing Modernization Programs for Special Rescue and Armed Forces Driving the Growth of Military Navigation Market in India

11.4.4 Rest of Asia Pacific

11.4.4.1 Emphasis on Developing Modern Defense Equipment By Countries Such as South Korea, Australia is Driving the Market Growth

11.5 Rest of the World

11.5.1 Middle East

11.5.1.1 Increasing Expenditure in Commercial as Well as Defense Sector is Driving the Growth for Middle East Military Navigation Market

11.5.2 Latin America & Africa

11.5.1.1 Increasing Spending for the Development and Deployment of New and Advanced Sensors, Remote Sensing Defense Equipment and Components, Command & Control Systems is Driving the Market Growth

12 Competitive Landscape (Page No. - 103)

12.1 Introduction

12.2 Competitive Analysis

12.3 Market Ranking Analysis

12.4 Competitive Scenario

12.4.1 Contracts

12.4.2 New Product Launches

12.4.3 Partnerships

12.4.4 Joint Ventures

12.4.5 Certifications

13 Company Profiles (Page No. - 110)

13.1 Introduction

13.2 Cobham

13.2.1 Business Overview

13.2.2 Products Offered

13.2.3 Recent Developments

13.2.4 SWOT Analysis

13.2.5 MnM View

13.3 Esterline Technologies

13.3.1 Business Overview

13.3.2 Products Offered

13.3.3 Recent Developments

13.4 Garmin

13.4.1 Business Overview

13.4.2 Products Offered

13.4.3 Recent Developments

13.5 GE Aviation

13.5.1 Business Overview

13.5.2 Products Offered

13.5.3 Recent Developments

13.6 Honeywell International

13.6.1 Business Overview

13.6.2 Products Offered

13.6.3 Recent Developments

13.6.4 SWOT Analysis

13.6.5 MnM View

13.7 Israel Aerospace Industries

13.7.1 Business Overview

13.7.2 Products Offered

13.7.3 Recent Developments

13.8 KVH Industries

13.8.1 Business Overview

13.8.2 Products Offered

13.8.3 Recent Developments

13.8.4 MnM View

13.9 Lord Microstrain

13.9.1 Business Overview

13.9.2 Products Offered

13.9.3 Recent Developments

13.10 L3 Technologies

13.10.1 Business Overview

13.10.2 Products Offered

13.10.3 Recent Developments

13.10.4 SWOT Analysis

13.10.5 MnM View

13.11 Moog

13.11.1 Business Overview

13.11.2 Products Offered

13.11.3 Recent Developments

13.12 Northrop Grumman

13.12.1 Business Overview

13.12.2 Products Offered

13.12.3 Recent Developments

13.12.4 SWOT Analysis

13.12.5 MnM View

13.13 Raytheon

13.13.1 Business Overview

13.13.2 Products Offered

13.13.3 Recent Developments

13.13.4 SWOT Analysis

13.13.5 MnM View

13.14 Rockwell Collins

13.14.1 Business Overview

13.14.2 Products Offered

13.14.3 Recent Developments

13.14.4 SWOT Analysis

13.14.5 MnM View

13.15 Safran Electronics & Defense

13.15.1 Business Overview

13.15.2 Products Offered

13.15.3 Recent Developments

13.16 Thales

13.16.1 Business Overview

13.16.2 Products Offered

13.16.3 Recent Developments

13.16.4 SWOT Analysis

13.16.5 MnM View

13.17 Trimble Navigation

13.17.1 Business Overview

13.17.2 Products Offered

13.17.3 Recent Developments

14 Appendix (Page No. - 147)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Introducing Rt: Real-Time Market Intelligence

14.4 Available Customization

14.5 Related Reports

14.6 Author Details

List of Tables (76 Tables)

Table 1 Ongoing Geopolitical Issues and Conflicts Since 2013

Table 2 Artillery System Procurements, By Country, 2013-2020

Table 3 Countries Using Loitering Munition

Table 4 Military Expenditure of Developed Countries, 2012-2016 (USD Billion)

Table 5 Innovations & Patent Registrations

Table 6 Military Navigation Size, By Platform, 2016-2023 (USD Million)

Table 7 Military Navigation for Aviation Platform, By Region, 2016-2023 (USD Million)

Table 8 Military Navigation for Aviation Platform, By Aircraft Type, 2016-2023 (USD Million)

Table 9 Military Navigation for Ammunition Platform, By Region, 2016-2023 (USD Million)

Table 10 Military Navigation for Ammunition Platform, By Type, 2016-2023 (USD Million)

Table 11 Military Navigation for Marine Platform, By Region, 2016-2023 (USD Million)

Table 12 Military Navigation for Marine Platform, By Type, 2016-2023 (USD Million)

Table 13 Military Aviation Market for Ground Platform, By Region, 2016-2023 (USD Million)

Table 14 Military Navigation for Ground Platform, By Type 2016-2023 (USD Million)

Table 15 Military Navigation for Space Platform, By Region, 2016-2023 (USD Million)

Table 16 Military Navigation for Space Platform, By Type, 2016-2023 (USD Million)

Table 17 Military Navigation for Unmanned Vehicle Platform, By Region, 2016-2023 (USD Million)

Table 18 Military Navigation Size, for Unmanned Vehicle Platform, By Type 2016-2023 (USD Million)

Table 19 Military Navigation Size, By Application, 2016-2023 (USD Million)

Table 20 Command & Control (C2) Segment, By Region, 2016-2023 (USD Million)

Table 21 Intelligence, Surveillance & Reconnaissance (ISR) Segment, By Region, 2016-2023 (USD Million)

Table 22 Combat & Security Segment, By Region, 2016-2023 (USD Million)

Table 23 Targeting & Guidance Segment, By Region, 2016-2023 (USD Million)

Table 24 Search & Rescue (SAR) Segment, By Region, 2016-2023 (USD Million)

Table 25 Military Navigations Market Size, By Component, 2016-2023 (USD Million)

Table 26 Hardware Segment, By Region, 2016-2023 (USD Million)

Table 27 Military Navigation Size, By Hardware, 2016-2023 (USD Million)

Table 28 Software Segment, By Region, 2016-2023 (USD Million)

Table 29 Service Segment, By Region, 2016-2023 (USD Million)

Table 30 Military Navigation Size, By Grade, 2016-2023 (USD Million)

Table 31 Military Navigation Size, By Region, 2016-2023 (USD Million)

Table 32 North America Military Navigation Size, By Platform, 2016-2023 (USD Million)

Table 33 North America Military Navigation Size, By Application, 2016-2023 (USD Million)

Table 34 North America Military Navigation Size, By Component, 2016-2023 (USD Million)

Table 35 North America Military Navigation Size, By Country, 2016-2023 (USD Million)

Table 36 US Military Navigation Size, By Platform, 2016-2023 (USD Million)

Table 37 US Military Navigation Size, By Application, 2016-2023 (USD Million)

Table 38 Canada Military Navigation Size, By Platform, 2016-2023 (USD Million)

Table 39 Canada Military Navigation Size, By Application, 2016-2023 (USD Million)

Table 40 Europe Military Navigation Size, By Platform, 2016-2023 (USD Million)

Table 41 Europe Military Navigation Size, By Application, 2016-2023 (USD Million)

Table 42 Europe Military Navigation Size, By Component, 2016-2023 (USD Million)

Table 43 Europe Military Navigation Size, By Country, 2016-2023 (USD Million)

Table 44 Russia Military Navigation Size, By Platform, 2016-2023 (USD Million)

Table 45 Russia Military Navigation Size, By Application, 2016-2023 (USD Million)

Table 46 UK Military Navigation Size, By Platform, 2016-2023 (USD Million)

Table 47 UK Military Navigation Size, By Application, 2016-2023 (USD Million)

Table 48 France Military Navigation Size, By Platform, 2016-2023 (USD Million)

Table 49 France Military Navigation Size, By Application, 2016-2023 (USD Million)

Table 50 Italy Military Navigation Size, By Platform, 2016-2023 (USD Million)

Table 51 Italy Military Navigation Size, By Application, 2016-2023 (USD Million)

Table 52 Germany Military Navigation Size, By Platform, 2016-2023 (USD Million)

Table 53 Germany Military Navigation Size, By Application, 2016-2023 (USD Million)

Table 54 Rest of Europe Military Navigation Size, By Platform, 2016-2023 (USD Million)

Table 55 Rest of Europe Military Navigation Size, By Application, 2016-2023 (USD Million)

Table 56 Asia Pacific Military Navigation Size, By Platform, 2016-2023 (USD Million)

Table 57 Asia Pacific Military Navigation Size, By Application, 2016-2023 (USD Million)

Table 58 Asia Pacific Military Navigation Size, By Component, 2016-2023 (USD Million)

Table 59 Asia Pacific Military Navigation Size, By Country, 2016-2023 (USD Million)

Table 60 China Military Navigation Size, By Platform, 2016-2023 (USD Million)

Table 61 China Military Navigation Size, By Application, 2016-2023 (USD Million)

Table 62 Japan Military Navigation Size, By Platform, 2016-2023 (USD Million)

Table 63 Japan Military Navigation Size, By Application, 2016-2023 (USD Million)

Table 64 India Military Navigation Size, By Platform, 2016-2023 (USD Million)

Table 65 India Military Navigation Size, By Application, 2016-2023 (USD Million)

Table 66 Rest of Asia Pacific Military Navigation Size, By Platform, 2016-2023 (USD Million)

Table 67 Rest of Asia Pacific Military Navigation Size, By Application, 2016-2023 (USD Million)

Table 68 RoW Military Navigation Size, By Platform, 2016-2023 (USD Million)

Table 69 RoW Military Navigation Size, By Application, 2016-2023 (USD Million)

Table 70 RoW Military Navigation Size, By Component, 2016-2023 (USD Million)

Table 71 RoW Military Navigation Size, By Region, 2016-2023 (USD Million)

Table 72 Middle East Military Navigation Size, By Platform, 2016-2023 (USD Million)

Table 73 Middle East Military Navigation Size, By Application, 2016-2023 (USD Million)

Table 74 Latin America & Africa Military Navigation Size, By Platform, 2016-2023 (USD Million)

Table 75 Latin America & Africa Military Navigation Size, By Application, 2016-2023 (USD Million)

Table 76 Ranking of Key Players in the Military Navigation, 2016

List of Figures (46 Figures)

Figure 1 Research Process Flow

Figure 2 Military Navigation: Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 The Ammunition Segment is Projected to Lead the Military Navigation During the Forecast Period

Figure 8 The Intelligence, Surveillance & Reconnaissance (ISR) Segment is Projected to Lead the Military Navigation During the Forecast Period

Figure 9 The Hardware Segment is Projected to Lead the Military Navigation During the Forecast Period

Figure 10 The Space Grade Segment of the Military Navigation is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 11 Europe is Estimated to Lead Global Military Navigation in 2018

Figure 12 Rising Demand for Missiles and Artillery Systems Due to Geopolitical Instabilities and Changing Nature of Warfare Expected to Drive the Growth of the Military Navigation From 2018 to 2023

Figure 13 The Ammunition Segment is Estimated to Lead the Europe Military Navigation in 2018

Figure 14 The Intelligence, Surveillance & Reconnaissance (ISR) Segment is Projected to Lead the Military Navigation From 2018 to 2023

Figure 15 The Hardware Segment is Projected to Lead the Military Navigation From 2018 to 2023

Figure 16 The Canada Military Navigation is Projected to Grow at the Highest CAGR From 2018 to 2023

Figure 17 Military Navigation: Drivers, Restraints, Opportunities, and Challenges

Figure 18 Military Navigation, By Platform, 2018 & 2023 (USD Million)

Figure 19 Military Navigation, By Application, 2018 & 2023

Figure 20 Military Navigation, By Component, 2018 & 2023 (USD Million)

Figure 21 Military Navigation, By Grade, 2018 & 2023

Figure 22 Military Navigation: Regional Snapshot

Figure 23 North America Military Navigation Snapshot

Figure 24 Europe Military Navigation Snapshot

Figure 25 Asia Pacific Military Navigation Snapshot

Figure 26 Companies Adopted Contracts as the Key Growth Strategy Between 2015 and 2017

Figure 27 Leading Companies in the Military Navigation, By Region

Figure 28 Cobham: Company Snapshot

Figure 29 Cobham: SWOT Analysis

Figure 30 Esterline Technologies: Company Snapshot

Figure 31 Garmin: Company Snapshot

Figure 32 Honeywell International: Company Snapshot

Figure 33 Honeywell International: SWOT Analysis

Figure 34 KVH Industries: Company Snapshot

Figure 35 L3 Technologies: Company Snapshot

Figure 36 L3 Technologies: SWOT Analysis

Figure 37 Moog: Company Snapshot

Figure 38 Northrop Grumman: Company Snapshot

Figure 39 Northrop Grumman Corporation: SWOT Analysis

Figure 40 Raytheon: Company Snapshot

Figure 41 Raytheon: SWOT Analysis

Figure 42 Rockwell Collins: Company Snapshot

Figure 43 Rockwell Collins: SWOT Analysis

Figure 44 Safran Electronic & Defense: Company Snapshot

Figure 45 Thales: Company Snapshot

Figure 46 Trimble: Company Snapshot

Growth opportunities and latent adjacency in Military Navigation Market

Hi team, kindly provide data on the Vietnam navigation market. Also, please provide intelligence on other markets such as the inertial navigation system market and the autonomous navigation market. Thanks.