Loitering Munition (Kamikaze and Suicide drones) Market Size, Share and Growth

Loitering Munition Market by Type (Recoverable and Expendable), Launch Mode (Air Launched Effect, Vertical Take-Off, Catapult Launched, Canister Launched, Hand Launched), End User, Range and Region - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The loitering munition market is projected to grow from USD 5.36 billion in 2025 to USD 13.26 billion by 2030 at a CAGR of 19.9% from 2025 to 2030. Spending on loitering weapons is rising as armed forces look for faster strike options. Suicide drones and kamikaze UAVs are seeing wider use in active missions. Recent growth reflects a clear move toward precise combat tools with lower operating costs. Geopolitical pressure is pushing countries to speed up defence upgrade plans. New progress in artificial intelligence and autonomous control is helping a wider field of use. Modular designs are also making these systems easier to deploy across different military roles.

KEY TAKEAWAYS

-

By RegionThe North America region dominated loitering munition market, with a share of 30.6% in 2025.

-

By TypeBy Connectivity , Expandable segment is expected to register the highest CAGR of 20.3%.

-

By ClassBy class, the long range (>100 KM) segment is projected to grow at the fastest rate from 2025 to 2030.

-

By Air TimeBy platform , the airborne segment will grow the fastest during the forecast period.

-

Competitive Landscape: Key PlayersAeroVironment Inc., Elbit Systems Ltd., and Rheinmetall are recognized as key players in the global loitering munition market. These companies hold strong positions due to their established product portfolios and wide operational presence. Their solutions are deployed across multiple regions and mission profiles. Consistent investment in product development supports their market standing.

-

Competitive Landscape: Start-upsArquimea, Roketsan, and the Overwatch group are considered progressive companies among others and have distinguished themselves in the loitering munition market due to strong product innovation in loitering weapons.

The loitering munition market is growing as defense forces move toward precise, lower-cost combat systems. Demand is rising for kamikaze drones and suicide UAVs that support accurate strike missions. Many countries are adding autonomous features to improve field use. Defense upgrade programs are also pushing the adoption of modular loitering weapons. Future demand will come from systems that support real-time monitoring and secure strike control. Major defense firms continue to invest in this space to improve mission readiness and battlefield performance.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The loitering munition market is changing as defense forces adopt new operating methods. More systems now rely on automated control instead of manual handling. This shift is affecting how missions are planned and executed on the ground. New concepts, such as coordinated use of multiple units, are altering force deployment choices. Older short-range platforms are slowly losing relevance. Buyers are adjusting procurement plans to match these changes.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Integration of Artificial Intelligence (AI) and Autonomous Targeting

-

Rising Geopolitical Tensions and Modernization of Defense Forces

Level

-

Limited Endurance and Payload Constraints

-

Export Control Restrictions and Technology Transfer Limitations

Level

-

Integration of Swarm and Collaborative Mission Systems

-

Advancements in AI-Driven Autonomy and Target Recognition

Level

-

Interoperability and Integration within Existing Defense Architectures

-

Countermeasure Proliferation and Evolving Threat Environments

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Integration of Artificial Intelligence (AI) and Autonomous Targeting

Artificial Intelligence is helping loitering munitions find and strike targets faster. This reduces the need for manual control during combat missions. Forces use this capability to improve reaction time on the field.

Restraint: Limited Endurance and Payload Constraints

Short flight time limits how long these systems can stay active in the field. Small payload size also restricts the type of missions they can support. This can reduce effectiveness in long operations.

Opportunity: Integration of Swarm and Collaborative Mission Systems

Swarm systems allow multiple loitering units to operate together in one mission. This improves strike reach and mission success in complex areas. Armies see this as a future combat option.

Challenge: Interoperability and Integration within Existing Defense Architectures

Many loitering systems do not connect easily with current defense networks. This slows down mission coordination during joint operations. Better system compatibility is needed for wider use.

LOITERING MUNITION (KAMIKAZE AND SUICIDE DRONES) MARKET SIZE, SHARE AND GROWTH: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

AI-enabled Target Recognition & Loitering Path Optimization for SkyStriker Loitering Munitions | Enhances target accuracy | Reduces strike time | Optimizes mission endurance | Improves lethality effectiveness |

|

Autonomous Navigation & GNSS-Denied Strike Capability in HAROP and Mini-Harpy Loitering Munitions | Enables precision strikes in electronic warfare environments | Improves survivability | Expands operational flexibility |

|

Digital Twin-Based Simulation for HERO-series Loitering Munitions to Test Aerodynamics, Payload Efficiency, and AI Strike Algorithms | Reduces testing costs| Improves payload performance | Accelerates product validation | Enhances mission reliability |

|

Swarm-Based Loitering Munition Coordination for Collaborative Surveillance and Multi-target Engagement | Enables synchronized attacks | Enhances battlefield intelligence | Reduces reaction time | Improves mission success rates |

|

Real-Time Damage Assessment & Sensor-Fused Battle Monitoring in Switchblade Loitering Drones | Provides live situational awareness | Enables surgical strike decisions | Minimizes collateral damage | Enhances operational precision |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The loitering munition market includes companies that make strike drones for military use. Firms such as AeroVironment, UVision, and Israel Aerospace Industries build loitering weapons and surveillance platforms. Other defense groups support guidance and control systems used during missions. These systems help improve strike control in the field. Defense forces in the US, Europe, Australia, and Israel are key users. They deploy loitering munitions for precision attacks and quick response operations.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Loitering Munition Market, By Type

The expandable segment dominated the market because forces prefer systems that offer a stronger impact during strike missions. These platforms support higher payload needs in field operations. Demand is steady due to their proven use in active combat zones.

Loitering Munition Market, By Class

The mid-range (25–100 KM) segment accounted for the largest market share as it fits common mission distances. This range supports strikes beyond direct line of sight. Forces use it for border and tactical operations. It offers balanced reach for field use.

Loitering Munition Market, By Air Time

The medium endurance (45–120 Min) segment dominated the market as it provides enough time to track targets. Operators can wait before making strike decisions. This endurance suits mixed surveillance roles. Many missions rely on this flight duration.

Loitering Munition Market, By Warhead type

The high-explosive warhead segment dominated the market as armies require strong strike output. These warheads are effective against a wide range of targets. Forces prefer them for frontline use. Orders remain high due to combat needs.

Loitering Munition Market, By Navsensor

The electro-optic segment dominated the market as it supports clear visual tracking in daylight. These sensors help confirm targets before strike. Field units rely on this method. Usage remains common across operations.

Loitering Munition Market, By Launch Mode

The canister-launched segment dominated the market because it allows fast use in the field. These systems need limited setup. Ground units deploy them during rapid missions. This launch mode suits mobile forces.

Loitering Munition Market, By End User

The army segment dominated the market as ground forces are the main users of loitering systems. These weapons support frontline strike roles. Armies deploy them during border operations. Demand stays high due to direct field use.

REGION

North America to be the fastest-growing region in the global loitering munition market during the forecast period.

The North American loitering munition market is expanding as defense forces are inclining towards unmanned strike systems. The US is using these platforms for active field roles. Canada is increasing its focus on loitering weapons for defense upgrades. Border watch tasks are adding to demand in the region. Spending plans are supporting wider use across ground units.

LOITERING MUNITION (KAMIKAZE AND SUICIDE DRONES) MARKET SIZE, SHARE AND GROWTH: COMPANY EVALUATION MATRIX

AeroVironment, Inc. (Star Player) leads the loitering munition market with AI-enabled kamikaze drones, long-endurance explosive UAVs, and precision-targeting loitering weapons. UVision (Leader) strengthens its market position with modular, combat-proven loitering missiles offering autonomous surveillance and high-impact strike capabilities. Northrop Grumman Corporation (Emerging Player) expands with sensor-integrated guidance systems and data-linked targeting solutions, driving mobility and autonomous strike efficiency.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- AEROVIRONMENT INC

- ELBIT SYSTEMS LTD

- RHEINMETALL AG

- ISRAEL AEROSPACE INDUSTRIES

- UVISION

- THALES

- NORTHROP GRUMMAN

- WB GROUP

- EDGE PJSC GROUP

- ANDURIL INDUSTRIES

- RTX

- AEVEX AEROSPACE

- STM

- KNDS

- PARAMOUNT GROUP

- MBDA

- TELEDYNE FLIR LLC

- SOLAR GROUP

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 5.36 Billion |

| Market Size in 2030 (Value) | USD 13.26 Billion |

| Growth Rate | 19.90% |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion), Volume (Unit) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East , Rest of the World |

WHAT IS IN IT FOR YOU: LOITERING MUNITION (KAMIKAZE AND SUICIDE DRONES) MARKET SIZE, SHARE AND GROWTH REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Manufacturer | Additional segment breakdown for countries | Additional country-level market sizing tables for segments/sub-segments covered at the regional/global level to gain an understanding of market potential by each country |

| Emerging Leader | Additional company profiles | Competitive information on targeted players to gain granular insights on direct competition |

| Regional Market Leader | Additional country market estimates | Additional country-level deep dive for a more targeted understanding of the total addressable market |

RECENT DEVELOPMENTS

- November 2025 : Rheinmetall AG received a contract valued at approximately USD 950 million from the German Ministry of Defence for a national drone program that includes the integration of loitering munition capabilities. The award supports the procurement and deployment of new tactical systems to enhance Germany’s reconnaissance and strike capabilities as part of its broader defense modernization initiative.

- August 2025 : Elbit Systems Ltd delivered a comprehensive range of defense systems, including loitering munitions, artillery, C4I, and precision munitions. The long-term program will be executed over several years, strengthening Elbit’s presence in European defense modernization programs.

- August 2025 : Elbit Systems Ltd will supply its canister-launched SkyStriker loitering munition systems. The systems are designed for precision-strike missions, featuring extended range, modular payloads, and autonomous target engagement. Deliveries are scheduled over a two-year period.

- August 2025 : Elbit Systems integrated its subsidiary Israel Airborne Munitions to expand its loitering munition and precision-guided weapon production capabilities. The reorganization supports the growth of domestic production and export programs aligned with the company’s SkyStriker and future aerial loitering platforms.

- January 2025 : AeroVironment Inc. was awarded its second delivery order under the U.S. Army’s USD 990 million IDIQ contract for Switchblade loitering munition systems. The USD 55.3 million order supports continued production and sustainment of the Switchblade family, reinforcing the system’s role in providing rapid-response, precision strike capabilities for tactical units.

Table of Contents

Methodology

This research study involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect information relevant to the Loitering Munition market. Primary sources included industry experts from the core and related industries, as well as preferred suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all the segments of this industry’s value chain. All primary sources were interviewed to obtain and verify critical qualitative and quantitative information and assess prospects for market growth during the forecast period.

Secondary Research

The ranking analysis of companies in the loitering munition market was determined using secondary data from paid and unpaid sources and by analyzing major companies’ product portfolios and service offerings. These companies were rated based on the performance and quality of their products. These data points were further validated by primary sources.

Secondary sources referred for this research study on the loitering munition market included financial statements of companies offering loitering munition, along with various trade, business, and professional associations, among others. The secondary data was collected and analyzed to arrive at the overall size of the loitering munition market, which was validated by primary respondents.

In addition, the secondary research was used to obtain key information about the industry’s value chain and supply chain to identify key players operating in the market, market classifications and segmentation according to offerings of major players; and industry trends related to type, end user, launch mode, range and regions as well as key developments in the market.

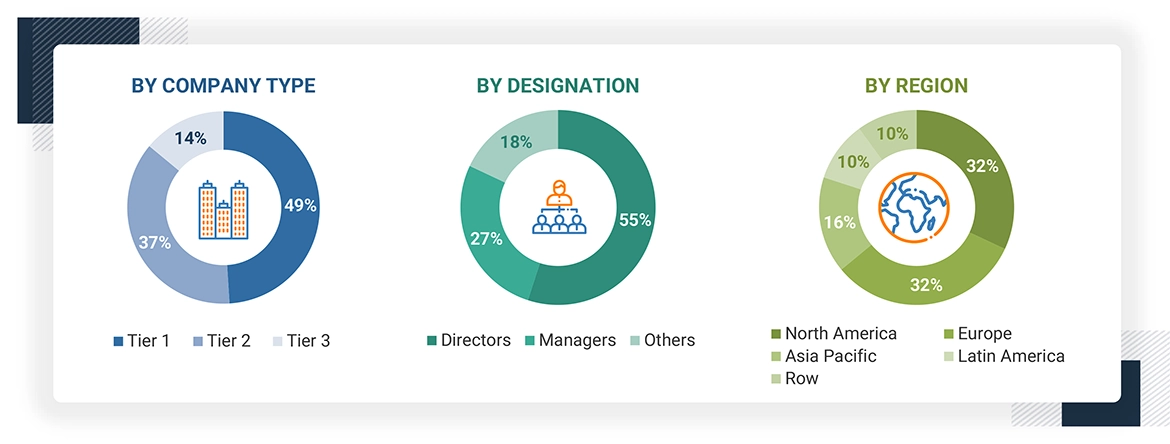

Primary Research

Extensive primary research was conducted after obtaining information about the current scenario of the loitering munition market through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across five regions: North America, Europe, Asia Pacific, Latin America, and Africa. This primary data was collected through questionnaires, emails, and telephonic interviews.

These interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market size forecasting, and data triangulation. It also helped analyze the type, end user, launch mode, and range segments of the market for five key regions.

Note: C-level Executives include the CEO, COO, and CTO, among others.

Others include Sales Managers, Marketing Managers, and Product Managers. The tiers of the companies have been defined based on their total revenue as of 2022. Tier 1 = > USD 1 billion, Tier 2 = USD 100 million to USD 1 billion, and Tier 3 = < USD 100 million

To know about the assumptions considered for the study, download the pdf brochure

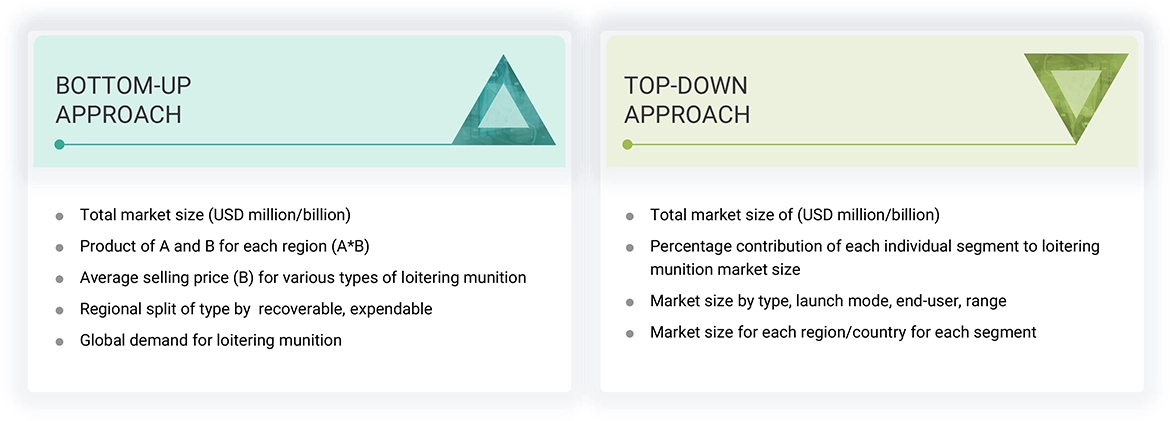

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the Loitering Munition market. The research methodology used to estimate the market size includes the following details:

- Key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of annual and financial reports of the top market players and extensive interviews of leaders, including CEOs, directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Loitering Munition Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the loitering munition market from the market size estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments, data triangulation and market breakdown procedures explained below were implemented, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both top-down and bottom-up approaches.

Market Definition

Loitering Munition Market refers to advanced aerial weapons, also known as suicide drones, kamikaze drones, or exploding drones. The purpose of these munitions is intended for precise and responsive engagement. Munitions, built with warheads, can spend a long time in a target area until they identify an enemy presence, and then directly impacting it. The loitering munition market encompasses a variety of application, end user, launch mode and range tailored for specific operational needs. Range includes short-range, medium- range, long- range, which can determine mission requirements. Type as recoverable and expendable for mission flexibility. The market is segmented by end user, including army, navy, and air force, and by launching mode, such as air-launched, vertical take-off, catapult, canister and hand-launched mechanisms.

Kamikaze drones, also referred to as suicide drones or loitering munitions, are designed to circle over a chosen area until a target is identified, after which they dive into it carrying an explosive payload. Unlike conventional missiles, they can linger in the air, providing surveillance and target information before being directed to strike. In some cases, operators can call off an attack and redirect the drone if circumstances change. These systems have become an important part of warfare today, with countries such as Russia, Ukraine, India, and Pakistan actively using or developing models like the Shahed-136, the Switchblade 300 and 600, and homegrown Indian variants.

Key Stakeholders

Various stakeholders of the market are listed below:

- Loitering Munition System Component Suppliers

- Loitering Munition System Manufacturers

- Loitering Munition System Pilot Training Institutes

- Technology Support Providers for Loitering Munition Systems

- Loitering Munition Software/Hardware/Service and Solution Providers

- Government and Defense Regulatory Bodies

- Loitering Munition System Consultants

- Defense Forces (Army, Navy, Airforce)

- Research and Development Institutions, Testing and Certification Agencies

- Integrated Defense Systems Providers for Loitering Munition Systems

Report Objectives

- To define, describe, segment, and forecast the size of the Loitering munition market based on type, launch mode, end-user, range, and region

- To forecast the size of market segments based on five regions: North America, Europe, Asia Pacific, Middle East, and Rest of the World, along with key countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify industry trends, market trends, and technology trends prevailing in the market

- To analyze micromarkets1 with respect to individual technological trends, prospects, and their contribution to the overall market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies2

- To provide a detailed competitive landscape of the market and analyze competitive growth strategies, such as product developments, contracts, partnerships, MOU’s, agreements, and collaborations adopted by key players in the market

- To identify the detailed financial position, key products, unique selling points, and key developments of leading companies in the market

1 Micromarkets are referred to as the segments and subsegments of the Loitering munition market included in the report.

2 Core competencies of companies were captured in terms of their key developments and key strategies adopted to sustain their positions in the market.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Regional Analysis

- Further breakdown of the market segments at the country level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Loitering Munition Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Loitering Munition Market