Electrophoresis Market by Product (Reagents (Protein & Nucleic Acid), (Gel Electrophoresis (1D & 2D), Capillary Electrophoresis (CZE, CGE), GDS, Software), Application (Research, Diagnostics), End User (Hospitals) & Region - Global Forecast to 2028

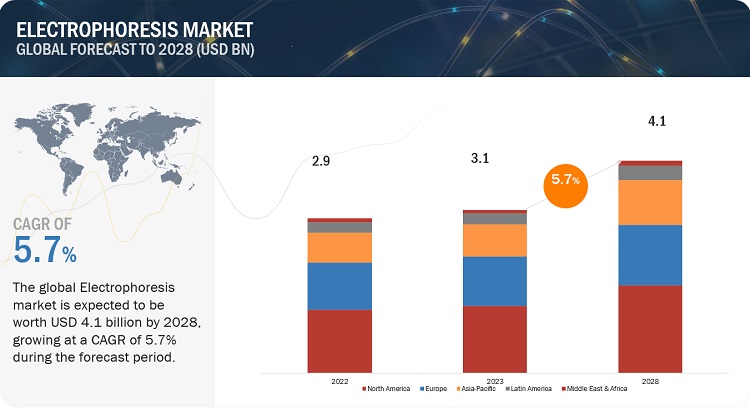

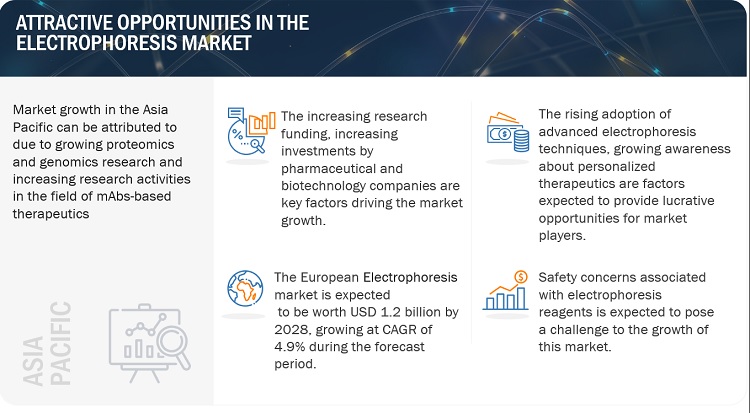

The global electrophoresis market, valued at US$2.9 billion in 2022, stood at US$3.1 billion in 2023 and is projected to advance at a resilient CAGR of 5.7% from 2023 to 2028, culminating in a forecasted valuation of US$4.1 billion by the end of the period. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The growth in this market is attributed to the the growing industry-academia research collaboations, and increasing number of clinical, forensic and research labs screening will drive the growth of the market. On the other hand, safety concerns associated with electrophoresis reagents may challenge the growth of market. Whereas, increasing demand for personalized medicines to provide growth opportunities for market.

Attractive Opportunities in the Electrophoresis Market

To know about the assumptions considered for the study, Request for Free Sample Report

Global Electrophoresis Dynamics

DRIVER: Growing industry-academia research collaborations

Electrophoresis is used in proteomic and genomic research in academic and research institutes. It is also used in the diagnosis of diseases and the quality control of drugs in pharmaceutical and biotechnology companies. Due to the widespread applications of electrophoresis, market players are collaborating with various academic institutions to increase awareness about new analytical technologies among students and researchers. For instance, In August 2022, SciGenom Labs, a genomics company in India and the US, announced a unique Ph.D. program to support research in genomics, proteomics, microbiome disciplines, and bio-nanotech in collaboration with CHARUSAT University. Numerous collaborative research projects and similar initiatives have already been launched, and several others are expected to be initiated during the forecast period. Several companies are also helping university researchers by providing technical and financial assistance to commercialize university research projects. Such developments are expected to positively impact the growth of the market during the forecast period.

OPPORTUNITY: Increasing demand for personalized medicines

Personalized medicine, which has become a core area of research in the healthcare industry, has entered mainstream clinical practice and is changing how many diseases are identified, classified, and treated. These advancements are particularly evident in the area of oncology. This growing demand for personalized medicine is expected to increase the uptake of electrophoretic systems in the drug development process. For instance:

- In October 2021, 4baseCare (India), a precision oncology company, collaborated with Cellworks Group, Inc. (US), a leading company in personalized medicine for oncology and immunology. The collaboration aimed to deliver greater insights to the oncology fraternity, predict patient therapy responses and enable therapy selection resulting in optimal treatment outcomes.

- In October 2021, 11 multidisciplinary projects in Israel, including research on cancers, Crohn’s, and rare diseases, received NIS 32 million (USD 9.9 million) in grants from Israel Precision Medicine Partnership to help accelerate the pace of discovery and the potential for implementing new therapeutic approaches and position Israel at the forefront of global precision medicine research

CHALLENGE: Need for high procedural efficiency to ensure accurate results

Electrophoresis requires a complex combination of analytical knowledge, extensive manual handling, dexterity, and strict protocol adherence to achieve reliable results. Furthermore, the gel concentration must be accurate to avoid errors; if too high or too low, the fragments will migrate too slowly or quickly, leading to errors in resolving the different bands. Care must be taken during the electrophoresis run to ensure the voltage is steady. Any fluctuations in the voltage will result in the unsteady migration of DNA fragments, leading to errors in reading the bands. The buffer solution must also be of the correct composition, as a buffer with the wrong pH or ionic concentration will change the DNA fragment shape and migration times.

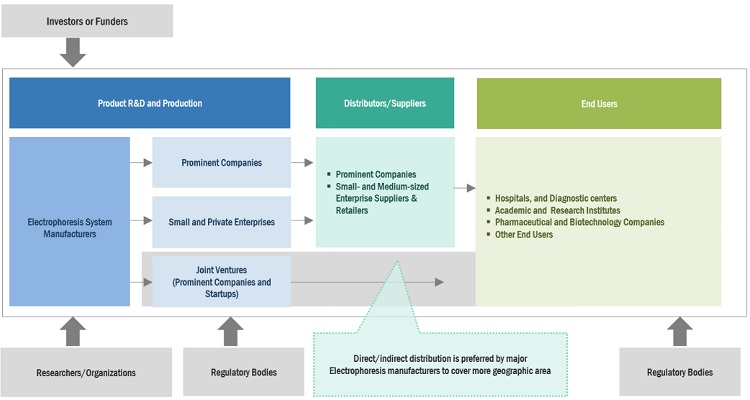

Electrophoresis Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of electrophoresis systems, reagent, gel documentation systems and software. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Thermo Fisher Scientific Inc. (US), Bio-Rad Laboratories (US), Merck Group (Germany), Agilent Technologies (US), and Danaher Corporation (US).

In 2022, software segment to observe highest growth rate of the electrophoresis industry, by product

Based on the products, the global electrophoresis market is broadly segmented into electrophoresis reagents, electrophoresis systems, gel documentation systems, and software. Software segment to observe highest growth rate during the forecast period. The high growth rate can be attributed to the simple and user-friendly workflow to guide users through each step of the analysis, allowing effortless identification of significantly changing proteins.

In 2022, academic & research institutes segment to dominate the electrophoresis industry, by end user

Based on end user, the electrophoresis market is segmented into academic & research institutes, hospitals & diagnostic centers, pharmaceutical & biotechnology companies, and other end users. Academic & research institutes to dominate the market due to increasing research being conducted in the fields of drug designing, proteomics, genomics, sequencing, biomarker discovery, and personalized medicine.

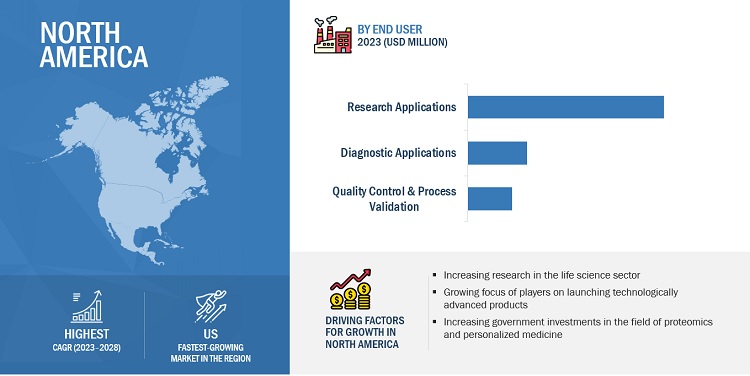

In 2022, North America to dominate in electrophoresis industry

The global electrophoresis market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa. North America is expected to dominate during the forecast period, primarily due to government initiatives to promote research, the increasing need to combat cancer, as well as growing public-private partnerships to promote research in areas of genomics and proteomics.

To know about the assumptions considered for the study, download the pdf brochure

The electrophoresis market is dominated by players such Thermo Fisher Scientific Inc. (US), Bio-Rad Laboratories (US), Merck Group (Germany), Agilent Technologies (US), and Danaher Corporation (US).

Scope of the Electrophoresis Industry:

|

Report Metric |

Details |

|

Market Size Available for Years |

2021–2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

Product, Application and End user |

|

Geographies Covered |

North America, Europe, Asia Pacific, Latin |

|

Companies Covered |

Bio-Rad Laboratories, Inc. (US), Thermo Fisher Scientific Inc. (US), Danaher Corporation (US), Merck KGaA (Germany), and Agilent Technologies, Inc. (US), PerkinElmer Inc. Inc. (US), QIAGEN N.V. (Netherlands), Lonza (Switzerland), Shimadzu Corporation (Japan), HOEFER INC.(US), Sebia Group (UK), Takara Bio Inc.(US), C.B.S. Scientific (US), 4Basebio PLC. (Germany), Helena Laboratories Corporation (US), Syngene (UK), VWR International (US), TBG Diagnostics Ltd. (Australia), Analytik Jena GMBH (Germany), Oprl Biosciences PVT.LTD. (India), Kaneka Eurogentec S.A. (Germany), Cleaver Scientific Ltd. (UK), Major Science Co., Ltd. (Taiwan), Bio World (India), National Analytical Corporation (India) and AES life sciences (Canada) |

This research report categorizes the Electrophoresis market to forecast revenue and analyze trends in each of the following submarkets:

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

By Product

- Electrophoresis Reagents

- Electrophoresis Systems

- Gel Documentation Systems

- Electrophoresis Software

By Application

- Research Applications

- Diagnostics Applications

- Quality Control & Process Validation

By End User

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Companies

- Hospitals & Diagnostic Centers

- Other End Users

Recent Developments of Electrophoresis Industry:

- In 2023, Advanced Electrophoresis Solutions Ltd (Canada) signed Medispec (India) as an exclusive distributor partner in India. This will allow AES’ critical solutions to reach many companies located in India.

- In 2022, Thermo Fisher Scientific (US) introduced a new Applied Biosystems SeqStudio Flex Series Genetic Analyzer to enable customers’ cutting-edge research in areas such as gene editing and infectious disease.

- In 2020, Danaher Corporation (US) acquired GE Healthcare Life Sciences (US) and rebranded it as Cytiva. This company will be a $3.3-billion global life sciences company with nearly 7000 employees in 40 countries.

Frequently Asked Questions (FAQ):

What is the projected market value of the global electrophoresis market?

The global market of electrophoresis is projected to reach USD 4.1 billion.

What is the estimated growth rate (CAGR) of the global electrophoresis market for the next five years?

The global electrophoresis market in terms of revenue was estimated to be worth $3.1 billion in 2023 and is poised to grow at a CAGR of 5.7%.

What are the major revenue pockets in the electrophoresis market currently?

The global market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa. North America is expected to dominate during the forecast period, primarily due to government initiatives to promote research, the increasing need to combat cancer, as well as growing public-private partnerships to promote research in areas of genomics and proteomics.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising funding for proteomics and genomics research- Growing industry-academia research collaborations- Growing use of NGS and declining cost of DNA sequencing- Increasing number of clinical, forensic, and research labs- Rising incidence of cancer, infectious diseases, and genetic disorders- Growing prominence of nanoproteomicsRESTRAINTS- Presence of alternative technologies offering better efficiency and results- Time-consuming operations and limited sample analysisOPPORTUNITIES- High growth opportunities in developing countries- Increasing demand for personalized medicines- Shift from plant-based to genome-based drug discoveryCHALLENGES- Safety concerns associated with electrophoresis reagents- Need for high procedural efficiency to ensure accurate results

- 6.1 INTRODUCTION

-

6.2 INDUSTRY TRENDSINTEGRATION OF MICROFLUIDIC/LAB-ON-CHIP TECHNOLOGIES IN CAPILLARY ELECTROPHORESISNANOMATERIAL-BASED CAPILLARY ELECTROPHORESISTRANSITION FROM MANUAL ELECTROPHORESIS SYSTEMS TO AUTOMATED ELECTROPHORESIS SYSTEMS

- 6.3 PRICING ANALYSIS

- 6.4 CE-MS SYSTEMS

- 6.5 VALUE CHAIN ANALYSIS

- 7.1 INTRODUCTION

-

7.2 ELECTROPHORESIS REAGENTSPROTEIN ELECTROPHORESIS REAGENTS- Increased use of electrophoresis techniques for protein-based research to propel marketNUCLEIC ACID ELECTROPHORESIS REAGENTS- Growing focus on DNA and RNA analyses to augment market

-

7.3 ELECTROPHORESIS SYSTEMSGEL ELECTROPHORESIS SYSTEMS- Gel electrophoresis systems, by instrument type- Horizontal gel electrophoresis systems- Vertical gel electrophoresis systems- Gel electrophoresis systems, by gel type- Polyacrylamide gel electrophoresis- Agarose gel electrophoresisCAPILLARY ELECTROPHORESIS SYSTEMS- Capillary zone electrophoresis systems- Capillary gel electrophoresis systems- Capillary isoelectric focusing systems- Micellar electrokinetic capillary chromatography systems- Capillary isotachophoresis systems- Capillary electrochromatography systems- Other capillary electrophoresis systems

-

7.4 GEL DOCUMENTATION SYSTEMSGROWING CLINICAL RESEARCH INDUSTRY AND INCREASING USE OF MOLECULAR BIOLOGY TECHNIQUES IN PATHOLOGY LABORATORY PRACTICES TO PROPEL MARKET

-

7.5 SOFTWAREINCREASING USE OF SOFTWARE SOLUTIONS TO ANALYZE DATA AND DRAW CONCLUSIONS FROM ELECTROPHORESIS APPLICATIONS TO FUEL MARKET

- 8.1 INTRODUCTION

-

8.2 RESEARCH APPLICATIONSTECHNOLOGICAL IMPROVEMENTS IN CAPILLARY ELECTROPHORESIS TO PROPEL MARKET

-

8.3 DIAGNOSTIC APPLICATIONSINCREASED USE OF CE MICROCHIP-BASED DIAGNOSTICS TO AID MARKET

-

8.4 QUALITY CONTROL & PROCESS VALIDATIONINCREASING FOCUS ON REGULATORY COMPLIANCE TO INCREASE ADOPTION OF ELECTROPHORETIC TECHNIQUES IN QUALITY CHECKS

- 9.1 INTRODUCTION

-

9.2 ACADEMIC & RESEARCH INSTITUTESINCREASED FUNDING FOR RESEARCH TO RESULT IN HIGH ADOPTION OF ELECTROPHORESIS TECHNOLOGY

-

9.3 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIESINCREASING FOCUS ON LAUNCHING QUALITY DRUGS TO SUPPORT MARKET

-

9.4 HOSPITALS & DIAGNOSTIC CENTERSSERUM PROTEIN ELECTROPHORESIS IN HOSPITALS AND DIAGNOSTIC CENTERS TO HELP IDENTIFY DIFFERENT DISEASES

- 9.5 OTHER END USERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: IMPACT OF RECESSIONUS- US to dominate North American electrophoresis market during forecast periodCANADA- Strong infrastructure and availability of funding for biomedical research to support market

-

10.3 EUROPEEUROPE: IMPACT OF RECESSIONGERMANY- Germany to hold largest share in European electrophoresis market during forecast periodFRANCE- Government of France to strongly support and invest in genomics and proteomics researchUK- Increasing awareness and research in personalized medicine to support marketITALY- Increasing life sciences R&D funding by government to drive marketSWITZERLAND- Well-established pharmaceutical & biotechnology industry to aid marketSPAIN- Well-established network of hospitals and research centers to increase initiatives for translational medicine researchREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: IMPACT OF RECESSIONJAPAN- Initiatives toward development of precision medicine to support marketCHINA- Rising biopharmaceutical research to drive marketINDIA- Increasing pharma R&D and government funding in biotechnology sector to propel marketAUSTRALIA- Increasing focus on precision medicine to fuel marketREST OF ASIA PACIFIC

-

10.5 LATIN AMERICALATIN AMERICA: IMPACT OF RECESSIONBRAZIL- Growing genomics research and increasing pharmaceutical & biologics QC to drive marketMEXICO- Strong pharmaceutical industry to provide growth opportunitiesREST OF LATIN AMERICA

-

10.6 MIDDLE EAST & AFRICAINCREASING R&D FUNDING BY PRIVATE SECTOR FOR BIOMARKER DISCOVERY TO SUPPORT MARKETMIDDLE EAST & AFRICA: IMPACT OF RECESSION

- 11.1 OVERVIEW

- 11.2 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

- 11.3 MARKET SHARE ANALYSIS

-

11.4 COMPETITIVE LEADERSHIP MAPPINGSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.5 COMPANY EVALUATION QUADRANT FOR SMES/START-UPSPROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

- 11.6 COMPANY FOOTPRINT ANALYSIS

-

11.7 COMPETITIVE SCENARIOKEY PRODUCT LAUNCHESKEY DEALSOTHER KEY DEVELOPMENTS

-

12.1 KEY PLAYERSBIO-RAD LABORATORIES, INC.- Business overview- Products/Services/Solutions offered- MnM viewTHERMO FISHER SCIENTIFIC INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewDANAHER CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewAGILENT TECHNOLOGIES, INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewMERCK KGAA- Business overview- Products/Services/Solutions offered- MnM viewPERKINELMER, INC.- Business overview- Products/Services/Solutions offeredQIAGEN N.V.- Products/Services/Solutions offered- Recent developmentsLONZA- Business overview- Products/Services/Solutions offeredSHIMADZU CORPORATION- Business overview- Products/Services/Solutions offeredHOEFER INC.- Business overview- Products/Services/Solutions offeredSEBIA- Business overview- Products/Services/Solutions offered- Recent developmentsTAKARA BIO INC.- Business overview- Products/Services/Solutions offered- Recent developmentsC.B.S. SCIENTIFIC- Business overview- Products/Services/Solutions offeredHELENA LABORATORIES CORPORATION- Business overview- Products/Services/Solutions offered

-

12.2 OTHER PLAYERSSYNGENE- Products/Services/Solutions offeredVWR INTERNATIONAL, LLC (AVANTOR)- Products/Services/Solutions offeredTBG DIAGNOSTICS LIMITED- Products/Services/Solutions offeredANALYTIK JENA GMBH- Products/Services/Solutions offeredOPRL BIOSCIENCES PVT., LTD.- Products/Services/Solutions offeredKANEKA EUROGENTEC S.A.- Products/Services/Solutions offeredCLEAVER SCIENTIFIC LTD.- Products/Services/Solutions offeredMAJOR SCIENCE CO., LTD.- Products/Services/Solutions offeredBIO WORLD- Products/Services/Solutions offeredNATIONAL ANALYTICAL CORPORATION- Products/Services/Solutions offeredAES LIFE SCIENCES- Products/Services/Solutions offered- Recent developments

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 RISK ASSESSMENT

- TABLE 2 INCREASING INCIDENCE OF CANCER, BY REGION, 2020 VS. 2030 VS. 2040 (IN MILLION)

- TABLE 3 PRICE RANGE FOR ELECTROPHORESIS MARKET

- TABLE 4 ELECTROPHORESIS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 5 ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 6 ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 7 PROTEIN ELECTROPHORESIS REAGENTS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 8 NUCLEIC ACID ELECTROPHORESIS REAGENTS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 9 ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 10 ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 11 GEL ELECTROPHORESIS SYSTEMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 12 GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021–2028 (USD MILLION)

- TABLE 13 HORIZONTAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 14 VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021–2028 (USD MILLION)

- TABLE 15 VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 16 1D GEL ELECTROPHORESIS SYSTEMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 17 2D GEL ELECTROPHORESIS SYSTEMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 18 GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021–2028 (USD MILLION)

- TABLE 19 GEL CONCENTRATIONS FOR SIZE SEPARATION

- TABLE 20 POLYACRYLAMIDE GEL ELECTROPHORESIS SYSTEMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 21 AGAROSE GEL ELECTROPHORESIS SYSTEMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 22 CAPILLARY ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 23 CAPILLARY ELECTROPHORESIS SYSTEMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 24 CAPILLARY ZONE ELECTROPHORESIS SYSTEMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 25 CAPILLARY GEL ELECTROPHORESIS SYSTEMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 26 CAPILLARY ISOELECTRIC FOCUSING SYSTEMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 27 MICELLAR ELECTROKINETIC CAPILLARY CHROMATOGRAPHY SYSTEMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 28 CAPILLARY ISOTACHOPHORESIS SYSTEMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 29 CAPILLARY ELECTROCHROMATOGRAPHY SYSTEMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 30 OTHER CAPILLARY ELECTROPHORESIS SYSTEMS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 31 ELECTROPHORESIS MARKET FOR GEL DOCUMENTATION SYSTEMS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 32 ELECTROPHORESIS MARKET FOR SOFTWARE, BY REGION, 2021–2028 (USD MILLION)

- TABLE 33 ELECTROPHORESIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 34 ELECTROPHORESIS MARKET FOR RESEARCH APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 35 ELECTROPHORESIS MARKET FOR DIAGNOSTIC APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 36 ELECTROPHORESIS MARKET FOR QUALITY CONTROL & PROCESS VALIDATION, BY REGION, 2021–2028 (USD MILLION)

- TABLE 37 ELECTROPHORESIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 38 ELECTROPHORESIS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 39 ELECTROPHORESIS MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 40 ELECTROPHORESIS MARKET FOR HOSPITALS & DIAGNOSTIC CENTERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 41 ELECTROPHORESIS MARKET FOR OTHER END USERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 42 ELECTROPHORESIS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 43 NORTH AMERICA: ELECTROPHORESIS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 44 NORTH AMERICA: ELECTROPHORESIS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 45 NORTH AMERICA: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 46 NORTH AMERICA: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 47 NORTH AMERICA: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021–2028 (USD MILLION)

- TABLE 48 NORTH AMERICA: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 49 NORTH AMERICA: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021–2028 (USD MILLION)

- TABLE 50 NORTH AMERICA: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 51 NORTH AMERICA: ELECTROPHORESIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 52 NORTH AMERICA: ELECTROPHORESIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 53 US: ELECTROPHORESIS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 54 US: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 55 US: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 56 US: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021–2028 (USD MILLION)

- TABLE 57 US: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 58 US: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021–2028 (USD MILLION)

- TABLE 59 US: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 60 US: ELECTROPHORESIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 61 US: ELECTROPHORESIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 62 CANADA: ELECTROPHORESIS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 63 CANADA: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 64 CANADA: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 65 CANADA: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021–2028 (USD MILLION)

- TABLE 66 CANADA: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 67 CANADA: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021–2028 (USD MILLION)

- TABLE 68 CANADA: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 69 CANADA: ELECTROPHORESIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 70 CANADA: ELECTROPHORESIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 71 EUROPE: ELECTROPHORESIS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 72 EUROPE: ELECTROPHORESIS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 73 EUROPE: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 74 EUROPE: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 75 EUROPE: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021–2028 (USD MILLION)

- TABLE 76 EUROPE: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 77 EUROPE: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021–2028 (USD MILLION)

- TABLE 78 EUROPE: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 79 EUROPE: ELECTROPHORESIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 80 EUROPE: ELECTROPHORESIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 81 GERMANY: ELECTROPHORESIS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 82 GERMANY: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 83 GERMANY: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 84 GERMANY: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021–2028 (USD MILLION)

- TABLE 85 GERMANY: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 86 GERMANY: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021–2028 (USD MILLION)

- TABLE 87 GERMANY: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 88 GERMANY: ELECTROPHORESIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 89 GERMANY: ELECTROPHORESIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 90 FRANCE: ELECTROPHORESIS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 91 FRANCE: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 92 FRANCE: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 93 FRANCE: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021–2028 (USD MILLION)

- TABLE 94 FRANCE: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 95 FRANCE: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021–2028 (USD MILLION)

- TABLE 96 FRANCE: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 97 FRANCE: ELECTROPHORESIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 98 FRANCE: ELECTROPHORESIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 99 UK: ELECTROPHORESIS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 100 UK: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 101 UK: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 102 UK: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021–2028 (USD MILLION)

- TABLE 103 UK: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 104 UK: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021–2028 (USD MILLION)

- TABLE 105 UK: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 106 UK: ELECTROPHORESIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 107 UK: ELECTROPHORESIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 108 ITALY: ELECTROPHORESIS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 109 ITALY: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 110 ITALY: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 111 ITALY: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021–2028 (USD MILLION)

- TABLE 112 ITALY: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 113 ITALY: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021–2028 (USD MILLION)

- TABLE 114 ITALY: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 115 ITALY: ELECTROPHORESIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 116 ITALY: ELECTROPHORESIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 117 SWITZERLAND: ELECTROPHORESIS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 118 SWITZERLAND: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 119 SWITZERLAND: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 120 SWITZERLAND: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021–2028 (USD MILLION)

- TABLE 121 SWITZERLAND: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 122 SWITZERLAND: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021–2028 (USD MILLION)

- TABLE 123 SWITZERLAND: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 124 SWITZERLAND: ELECTROPHORESIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 125 SWITZERLAND: ELECTROPHORESIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 126 SPAIN: ELECTROPHORESIS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 127 SPAIN: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 128 SPAIN: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 129 SPAIN: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021–2028 (USD MILLION)

- TABLE 130 SPAIN: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 131 SPAIN: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021–2028 (USD MILLION)

- TABLE 132 SPAIN: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 133 SPAIN: ELECTROPHORESIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 134 SPAIN: ELECTROPHORESIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 135 REST OF EUROPE: ELECTROPHORESIS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 136 REST OF EUROPE: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 137 REST OF EUROPE: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 138 REST OF EUROPE: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021–2028 (USD MILLION)

- TABLE 139 REST OF EUROPE: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 140 REST OF EUROPE: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021–2028 (USD MILLION)

- TABLE 141 REST OF EUROPE: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 142 REST OF EUROPE: ELECTROPHORESIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 143 REST OF EUROPE: ELECTROPHORESIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 144 ASIA PACIFIC: ELECTROPHORESIS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 145 ASIA PACIFIC: ELECTROPHORESIS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 146 ASIA PACIFIC: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 147 ASIA PACIFIC: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 148 ASIA PACIFIC: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021–2028 (USD MILLION)

- TABLE 149 ASIA PACIFIC: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 150 ASIA PACIFIC: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021–2028 (USD MILLION)

- TABLE 151 ASIA PACIFIC: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 152 ASIA PACIFIC: ELECTROPHORESIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 153 ASIA PACIFIC: ELECTROPHORESIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 154 JAPAN: ELECTROPHORESIS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 155 JAPAN: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 156 JAPAN: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 157 JAPAN: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021–2028 (USD MILLION)

- TABLE 158 JAPAN: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 159 JAPAN: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021–2028 (USD MILLION)

- TABLE 160 JAPAN: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 161 JAPAN: ELECTROPHORESIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 162 JAPAN: ELECTROPHORESIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 163 CHINA: ELECTROPHORESIS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 164 CHINA: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 165 CHINA: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 166 CHINA: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021–2028 (USD MILLION)

- TABLE 167 CHINA: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 168 CHINA: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021–2028 (USD MILLION)

- TABLE 169 CHINA: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 170 CHINA: ELECTROPHORESIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 171 CHINA: ELECTROPHORESIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 172 INDIA: ELECTROPHORESIS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 173 INDIA: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 174 INDIA: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 175 INDIA: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021–2028 (USD MILLION)

- TABLE 176 INDIA: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 177 INDIA: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021–2028 (USD MILLION)

- TABLE 178 INDIA: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 179 INDIA: ELECTROPHORESIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 180 INDIA: ELECTROPHORESIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 181 AUSTRALIA: ELECTROPHORESIS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 182 AUSTRALIA: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 183 AUSTRALIA: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 184 AUSTRALIA: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021–2028 (USD MILLION)

- TABLE 185 AUSTRALIA: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 186 AUSTRALIA: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021–2028 (USD MILLION)

- TABLE 187 AUSTRALIA: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 188 AUSTRALIA: ELECTROPHORESIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 189 AUSTRALIA: ELECTROPHORESIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 190 REST OF ASIA PACIFIC: ELECTROPHORESIS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 191 REST OF ASIA PACIFIC: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 192 REST OF ASIA PACIFIC: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 193 REST OF ASIA PACIFIC: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021–2028 (USD MILLION)

- TABLE 194 REST OF ASIA PACIFIC: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 195 REST OF ASIA PACIFIC: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021–2028 (USD MILLION)

- TABLE 196 REST OF ASIA PACIFIC: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 197 REST OF ASIA PACIFIC: ELECTROPHORESIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 198 REST OF ASIA PACIFIC: ELECTROPHORESIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 199 LATIN AMERICA: ELECTROPHORESIS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 200 LATIN AMERICA: ELECTROPHORESIS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 201 LATIN AMERICA: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 202 LATIN AMERICA: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 203 LATIN AMERICA: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021–2028 (USD MILLION)

- TABLE 204 LATIN AMERICA: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 205 LATIN AMERICA: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021–2028 (USD MILLION)

- TABLE 206 LATIN AMERICA: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 207 LATIN AMERICA: ELECTROPHORESIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 208 LATIN AMERICA: ELECTROPHORESIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 209 BRAZIL: ELECTROPHORESIS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 210 BRAZIL: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 211 BRAZIL: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 212 BRAZIL: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021–2028 (USD MILLION)

- TABLE 213 BRAZIL: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 214 BRAZIL: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021–2028 (USD MILLION)

- TABLE 215 BRAZIL: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 216 BRAZIL: ELECTROPHORESIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 217 BRAZIL: ELECTROPHORESIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 218 MEXICO: ELECTROPHORESIS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 219 MEXICO: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 220 MEXICO: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 221 MEXICO: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021–2028 (USD MILLION)

- TABLE 222 MEXICO: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 223 MEXICO: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021–2028 (USD MILLION)

- TABLE 224 MEXICO: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 225 MEXICO: ELECTROPHORESIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 226 MEXICO: ELECTROPHORESIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 227 REST OF LATIN AMERICA: ELECTROPHORESIS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 228 REST OF LATIN AMERICA: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 229 REST OF LATIN AMERICA: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 230 REST OF LATIN AMERICA: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021–2028 (USD MILLION)

- TABLE 231 REST OF LATIN AMERICA: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 232 REST OF LATIN AMERICA: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021–2028 (USD MILLION)

- TABLE 233 REST OF LATIN AMERICA: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 234 REST OF LATIN AMERICA: ELECTROPHORESIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 235 REST OF LATIN AMERICA: ELECTROPHORESIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 236 MIDDLE EAST & AFRICA: ELECTROPHORESIS MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 237 MIDDLE EAST & AFRICA: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS REAGENTS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 238 MIDDLE EAST & AFRICA: ELECTROPHORESIS MARKET FOR ELECTROPHORESIS SYSTEMS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 239 MIDDLE EAST & AFRICA: GEL ELECTROPHORESIS SYSTEMS MARKET, BY INSTRUMENT TYPE, 2021–2028 (USD MILLION)

- TABLE 240 MIDDLE EAST & AFRICA: VERTICAL GEL ELECTROPHORESIS SYSTEMS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 241 MIDDLE EAST & AFRICA: GEL ELECTROPHORESIS SYSTEMS MARKET, BY GEL TYPE, 2021–2028 (USD MILLION)

- TABLE 242 MIDDLE EAST & AFRICA: CAPILLARY ELECTROPHORESIS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 243 MIDDLE EAST & AFRICA: ELECTROPHORESIS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 244 MIDDLE EAST & AFRICA: ELECTROPHORESIS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 245 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN ELECTROPHORESIS MARKET

- TABLE 246 ELECTROPHORESIS MARKET: DEGREE OF COMPETITION

- TABLE 247 OVERALL COMPANY FOOTPRINT

- TABLE 248 COMPANY REGIONAL FOOTPRINT

- TABLE 249 COMPANY PRODUCT FOOTPRINT

- TABLE 250 KEY PRODUCT LAUNCHES

- TABLE 251 KEY DEALS

- TABLE 252 OTHER KEY DEVELOPMENTS

- TABLE 253 BIO-RAD LABORATORIES, INC.: COMPANY OVERVIEW

- TABLE 254 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 255 DANAHER CORPORATION: COMPANY OVERVIEW

- TABLE 256 AGILENT TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 257 MERCK KGAA: COMPANY OVERVIEW

- TABLE 258 PERKINELMER, INC.: COMPANY OVERVIEW

- TABLE 259 QIAGEN N.V.: COMPANY OVERVIEW

- TABLE 260 LONZA: COMPANY OVERVIEW

- TABLE 261 SHIMADZU CORPORATION: COMPANY OVERVIEW

- TABLE 262 HOEFER INC.: COMPANY OVERVIEW

- TABLE 263 SEBIA: COMPANY OVERVIEW

- TABLE 264 TAKARA BIO INC.: COMPANY OVERVIEW

- TABLE 265 4BASEBIO: COMPANY OVERVIEW

- TABLE 266 HELENA LABORATORIES CORPORATION: COMPANY OVERVIEW

- FIGURE 1 ELECTROPHORESIS MARKET

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 PRIMARY SOURCES

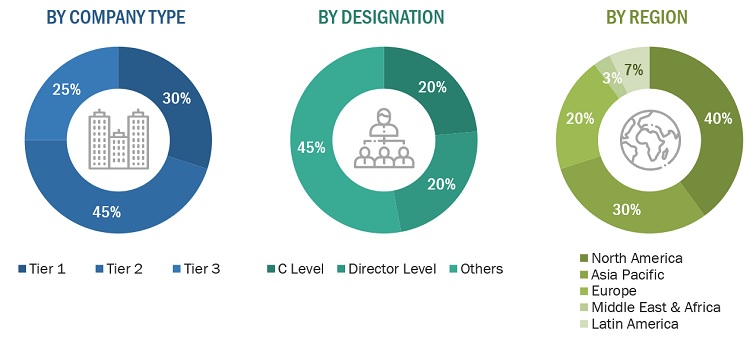

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 6 CAGR PROJECTIONS: SUPPLY SIDE ANALYSIS

- FIGURE 7 TOP-DOWN APPROACH

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

- FIGURE 9 ELECTROPHORESIS MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 ELECTROPHORESIS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 ELECTROPHORESIS MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 GEOGRAPHIC ANALYSIS OF ELECTROPHORESIS MARKET

- FIGURE 13 INCREASING RESEARCH IN LIFE SCIENCES INDUSTRY TO DRIVE MARKET

- FIGURE 14 CAPILLARY ZONE ELECTROPHORESIS SEGMENT TO ACCOUNT FOR LARGEST SHARE OF EUROPEAN CAPILLARY ELECTROPHORESIS MARKET IN 2023

- FIGURE 15 CHINA TO WITNESS HIGHEST REVENUE GROWTH DURING FORECAST PERIOD

- FIGURE 16 NORTH AMERICA TO DOMINATE ELECTROPHORESIS MARKET TILL 2028

- FIGURE 17 ELECTROPHORESIS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 REDUCTION IN COST OF DNA SEQUENCING PER RAW MEGABASE, 2016–2021 (USD)

- FIGURE 19 PERSONALIZED MEDICINES ACCOUNTED FOR MORE THAN 25% OF FDA APPROVALS FOR LAST SEVEN YEARS

- FIGURE 20 ELECTROPHORESIS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 21 FDA APPROVALS FOR PERSONALIZED MEDICINES (2015–2021)

- FIGURE 22 NORTH AMERICA: ELECTROPHORESIS MARKET SNAPSHOT

- FIGURE 23 ASIA PACIFIC: ELECTROPHORESIS MARKET SNAPSHOT

- FIGURE 24 REVENUE SHARE ANALYSIS OF TOP PLAYERS IN ELECTROPHORESIS MARKET

- FIGURE 25 COMPANY EVALUATION QUADRANT FOR KEY PLAYERS: ELECTROPHORESIS MARKET

- FIGURE 26 COMPANY EVALUATION MATRIX FOR SMES/START-UPS: ELECTROPHORESIS MARKET

- FIGURE 27 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 28 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2022)

- FIGURE 29 DANAHER CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 30 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 31 MERCK KGAA: COMPANY SNAPSHOT (2022)

- FIGURE 32 PERKINELMER, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 33 QIAGEN N.V.: COMPANY SNAPSHOT (2022)

- FIGURE 34 LONZA: COMPANY SNAPSHOT (2022)

- FIGURE 35 SHIMADZU CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 36 TAKARA BIO INC.: COMPANY SNAPSHOT (2022)

- FIGURE 37 4BASEBIO: COMPANY SNAPSHOT (2021)

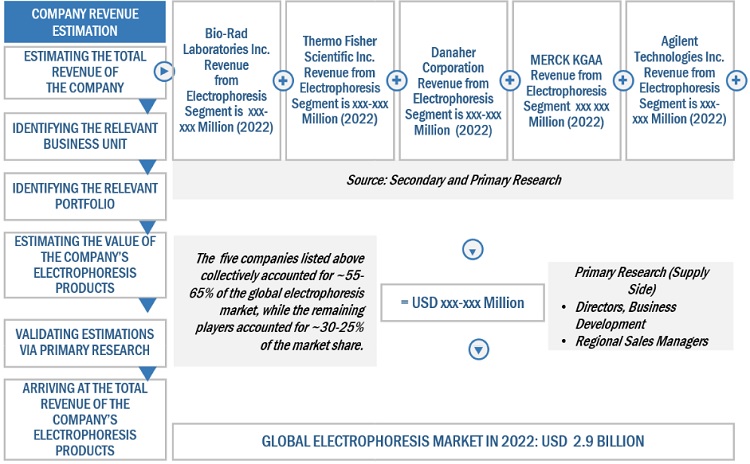

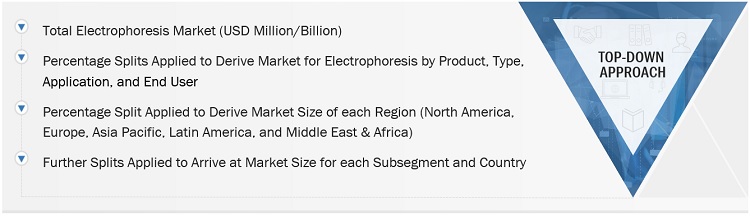

The objective of the study is analyze the key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies. To track companies developments such as acquisitions, product launches, expansions, collaborations, agreements and partnerships of the leading players, the competitive landscape of the electrophoresis market to analyzes market players on various parameters within the broad categories of business and product strategy. Top-down and bottom-up approaches were use to estimate the market size. To estimate the market size of segments and subsegments the market breakdown and data triangulation were used.

The four steps involved in estimating the market size are

Collecting Secondary Data

The secondary research data collection process involves the usage of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B), annual reports, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the electrophoresis market. A database of the key industry leaders was also prepared using secondary research.

Collecting Primary Data

The primary research data was conducted after acquiring knowledge about the electrophoresis market scenario through secondary research. A significant number of primary interviews were conducted with stakeholders from both the demand side (such clinical laboratories, hospitals, and academic & research institutes) and supply-side (such as included various industry experts, such as Directors, Chief X Officers (CXOs), Vice Presidents (VPs) from business development, marketing and product development teams, product manufacturers, wholesalers, channel partners, and distributors) across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Approximately 40% of the primary interviews were conducted with stakeholders from the demand side while those from the supply side accounted for the remaining 60%. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

A breakdown of the primary respondents is provided below:

Breakdown of Primary Participants:

Note 1: *Others include sales managers, marketing managers, and product managers.

Note 2: Tiers are defined based on a company’s total revenue as of 2022: Tier 1=> USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3=< USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Thermo Fisher Scientific Inc. |

General Manager |

|

Bio-Rad Laboratories Inc. |

Senior Product Manager |

|

Danaher Corporation |

Regional Manager |

|

Agilent Technologies Inc. |

General Manager of Sales |

Market Size Estimation

All major product manufacturers offering various electrophoresis were identified at the global/regional level. Revenue mapping was done for the major players and was extrapolated to arrive at the global market value of each type of segment. The market value electrophoresis market was also split into various segments and subsegments at the region and country level based on:

- Product mapping of various manufacturers for each type of electrophoresis market at the regional and country-level

- Relative adoption pattern of each electrophoresis market among key application segments at the regional and/or country-level

- Detailed primary research to gather qualitative and quantitative information related to segments and subsegments at the regional and/or country-level.

- Detailed secondary research to gauge the prevailing market trends at the regional and/or country-level

Global Electrophoresis Market Size: Botton Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Electrophoresis market Size: Top Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the Electrophoresis industry.

Market Definition

Electrophoresis is an analytical method used for the separation and characterization of proteins and nucleic acids for genomic and proteomic research. With the growing demand for next-generation sequencing, personalized medicine, and structure-based drug design, electrophoresis techniques have become an integral part of life sciences research. Electrophoresis systems are frequently used in diagnostics, antibody analysis, drug quality control, vaccine analysis, and DNA sequencing.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To provide detailed information about the factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To define, describe, segment, and forecast the electrophoresis market by product, application, end user, and region

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall electrophoresis market

- To forecast the size of the electrophoresis market in five main regions along with their respective key countries, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile key players in the electrophoresis market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments, such as acquisitions; product launches; expansions; collaborations, agreements, & partnerships; and R&D activities of the leading players in the electrophoresis market

- To benchmark players within the electrophoresis market using the Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

Additional country-level analysis of the Electrophoresis market

Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Electrophoresis Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Electrophoresis Market