Neuromodulation Market Size, Growth, Share & Trends Analysis

Neuromodulation Market by Technology (Internal, External), Stimulation Type (Spinal Cord, Deep Brain, Vagus Nerve Stimulation), Application (Ischemia, Depression, Epilepsy, Obesity), End User (Hospitals, ASCs, Clinics) & Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

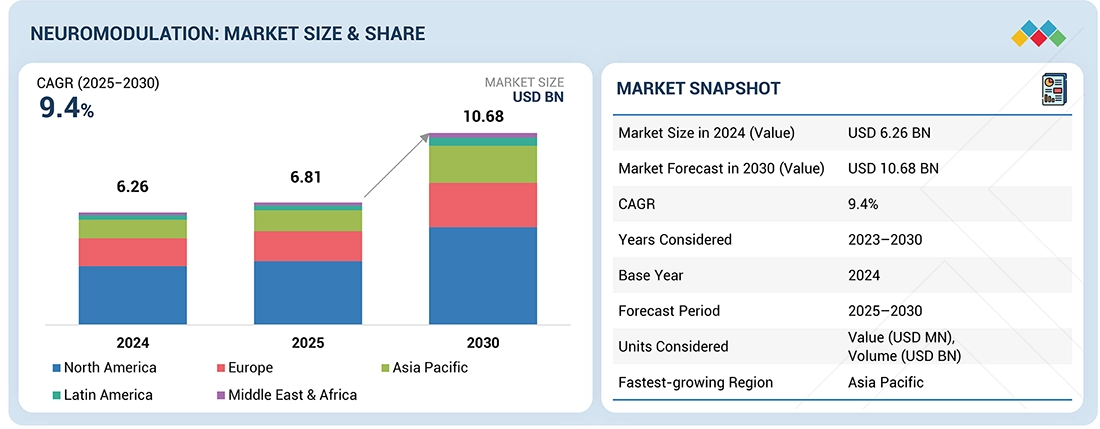

The global neuromodulation market is projected to reach USD 10.68 billion by 2030 from USD 6.81 billion in 2025, at a CAGR of 9.4% during the forecast period. Neuromodulation is increasingly recognized as an effective method for managing chronic conditions and improving patients’ quality of life. It is gaining momentum as a cost-efficient, long-term treatment for neurological and nerve-related disorders. Neurostimulation devices work by interrupting pain signals between the spinal cord and the brain, and they can be either implantable or non-implantable. Market growth is driven by the rising prevalence of neurological disorders and nerve injuries, an aging population, and increasing government support and funding for neurological research. The development of advanced neuromodulation technologies, along with collaborations among device manufacturers, healthcare providers, and research institutions, further promotes industry growth. However, high procedural costs and potential adverse effects associated with neuromodulation devices remain significant barriers to widespread adoption. Conversely, emerging economies present substantial opportunities, fueled by large populations, rising healthcare expenditures, and the expanding application of neuromodulation across various therapeutic areas.

KEY TAKEAWAYS

-

BY TECHNOLOGYThe neuromodulation market is defined by two major technology categories—internal and external neuromodulation. Implantable systems are increasingly being adopted due to their ability to deliver targeted, long-term relief for complex neurological conditions, supported by continuous innovations such as rechargeable batteries, adaptive stimulation, and miniaturized implants. Meanwhile, external neuromodulation continues to play an important role in addressing less severe disorders, highlighting a technology landscape that balances advanced, invasive solutions with non-invasive options for broader patient needs.

-

BY STIMULATION TYPEThe neuromodulation market spans multiple stimulation types, including spinal cord stimulation, deep brain stimulation, sacral nerve stimulation, vagus nerve stimulation, gastric electrical stimulation, transcutaneous electrical nerve stimulation (TENS), transcranial magnetic stimulation (TMS), respiratory electrical stimulation (RES), and other stimulation. Advancements in device technologies, supportive reimbursement, growing clinical evidence, and expanding approvals across these stimulation types are enabling wider adoption and more personalized treatment approaches for diverse neurological and pain conditions.

-

BY APPLICATIONThe neuromodulation market by application is categorised into the application for each stimulation type, such as spinal cord stimulation is further divided into failed back syndrome, chronic pain, and ischemia, alongside other condition-specific uses. Growing prevalence of chronic pain, combined with the limitations of conventional treatments like invasive surgeries, is driving the need for more effective and sustainable alternatives. Expanding clinical evidence, rising healthcare burden from pain-related disorders, and the ability of stimulation therapies to provide targeted and minimally invasive relief are strengthening adoption across these application areas.

-

BY END USERThe neuromodulation market is segmented into hospitals, ambulatory surgery clinics, physiotherapy centers, and other end users. Hospitals and ambulatory surgery clinics remain central to adoption due to their advanced infrastructure, availability of multidisciplinary expertise, and ability to support complex procedures and long-term patient management. At the same time, the increasing role of physiotherapy and other care settings reflects the market’s gradual shift toward broader access, minimally invasive options, and supportive rehabilitation pathways that complement neuromodulation therapies.

-

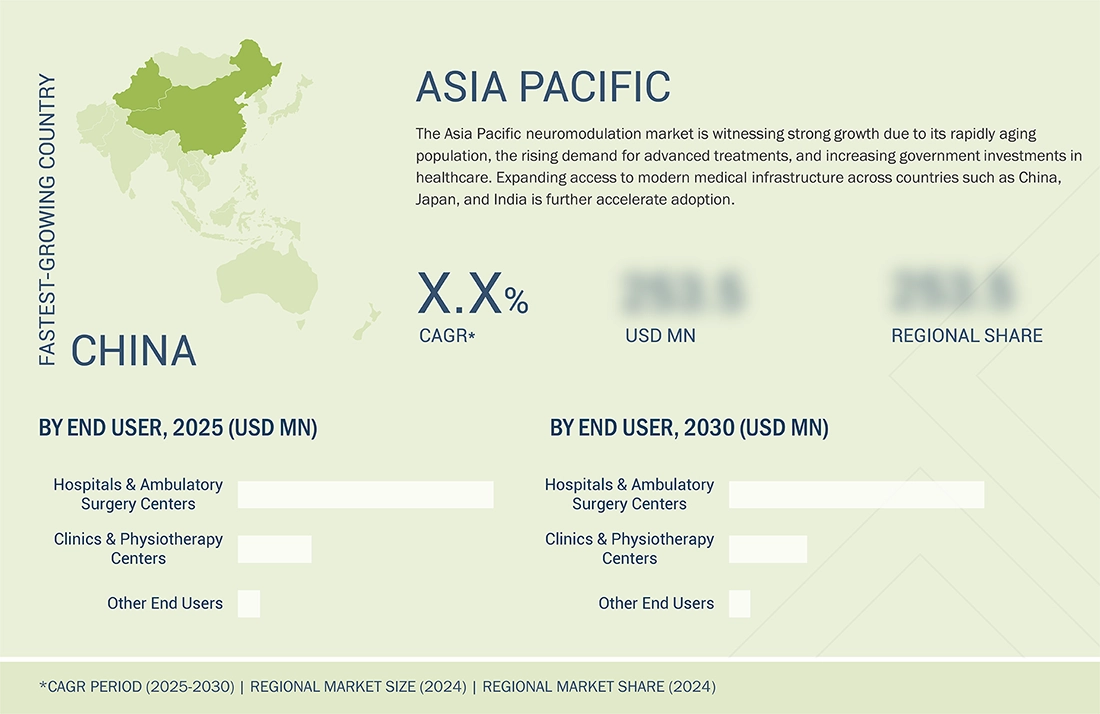

BY REGIONThe global neuromodulation market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific is witnessing strong growth due to its aging population, inceasing healthcare costs, and a rising incedence of neurological disorders.

-

COMPETITIVE LANDSCAPEThe global neuromodulation market is steadily growing, driven by strategic partnerships and strong R&D investments. Key players like Medtronic (Ireland), Boston Scientific Corporation (US), Abbott (US), LivaNova PLC (UK), Nevro Corp (US) and others leverage diverse product portfolios and innovation to expand globally through collaborations, acquisitions, and new product launches.

Neuromodulation is increasingly recognized as an effective approach for managing chronic conditions and enhancing patients’ quality of life. It is emerging as a cost-efficient, long-term solution for neurological and nerve-related disorders, with devices—both internal and external—designed to interrupt pain signals between the spinal cord and the brain. Market growth is fueled by the rising prevalence of neurological disorders and nerve injuries, an aging population, and growing government support for neurological research. Advancements in technology, coupled with collaborations among device manufacturers, healthcare providers, and research institutions, are further accelerating industry progress. Nonetheless, high procedural costs and potential side effects remain notable challenges to broader adoption. On the other hand, emerging economies offer significant growth opportunities, supported by large patient pools, rising healthcare investments, and the expanding use of neuromodulation across multiple therapeutic applications.

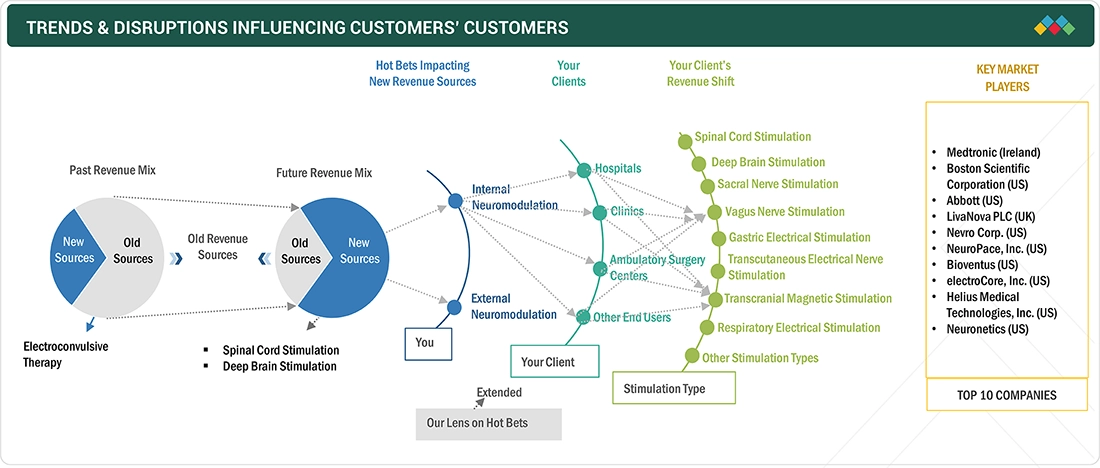

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on the neuromodulation market stems from evolving healthcare needs and advancements in neurological solutions. Hospitals, ambulatory surgery centers (ASCs), clinics, and other end users form the core customer base, addressing stimulation type applications such as chronic pain, migrain, depression. Additionally, the focus on reducing complications through innovative treatments is fueling the demand for more neuromodulation products. These trends shape customer decisions and attract investments in innovative neuromodulation solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising prevalence of neurological disorders and nerve injuries

-

Growing collaborations among device manufacturers, healthcare providers, and research institutions

Level

-

High cost of neuromodulation procedures

-

Preference for drug therapies over neuromodulation products

Level

-

Large population and high healthcare expenditure in emerging economies

-

Widening application scope of neuromodulation

Level

-

Stringent regulatory framework and time-consuming approval processes for neuromodulation and neurostimulation devices

-

Shortage of trained professionals

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver:Rising prevalence of neurological disorders and nerve injuries

The increasing prevalence of neurological disorders and nerve injuries significantly drives the global adoption of neuromodulation. Conditions like Parkinson’s disease, epilepsy, and chronic pain syndromes are rapidly rising due to aging populations, lifestyle shifts, and greater disease awareness. According to the World Health Organization, neurological disorders now rank among the top causes of disability and death, placing a heavy burden on healthcare systems. Nerve injuries caused by trauma, surgery, or chronic illnesses often lead to persistent neuropathic pain that is hard to treat with traditional medicines. In such cases, neuromodulation methods like spinal cord stimulation, deep brain stimulation, and vagus nerve stimulation provide effective alternatives, offering long-term relief and a better quality of life. As the number of patients increases, the need for innovative, minimally invasive neuromodulation devices is growing rapidly. This trend is further supported by mounting clinical evidence of their effectiveness and increasing healthcare investments to meet unmet needs in neurological care.

Restraint: High cost of neuromodulation procedures

The high cost of neuromodulation procedures remains a major barrier to market growth, especially in low- and middle-income regions. Implantable devices like spinal cord stimulators, deep brain stimulators, and vagus nerve stimulators involve not only the price of the device itself but also expenses related to surgery, hospital stays, post-operative care, and long-term device maintenance. For instance, the total cost of a spinal cord stimulation procedure can reach tens of thousands of dollars, making it unaffordable for many patients without comprehensive insurance coverage. In countries with limited or inconsistent reimbursement policies, the financial burden falls directly on patients, limiting access to advanced neuromodulation solutions. Even within developed healthcare systems, reimbursement is often restricted to specific conditions or patient groups, leaving others without coverage. Additionally, the need for battery replacements or system upgrades over time increases the overall treatment cost. As a result, the high procedural expense not only deters patient adoption but also discourages healthcare providers in cost-sensitive regions from adopting neuromodulation therapies into routine practice, thereby slowing market growth penetration.

Opportunity: Widening the application scope of neuromodulation

The expanding scope of neuromodulation offers a significant chance for market growth. Originally used mainly for chronic pain and movement disorders, neuromodulation therapies are now being explored for a wide range of neurological, psychiatric, and systemic conditions. Advances in technology and clinical research have broadened their application to treatment-resistant depression, obsessive-compulsive disorder, tinnitus, and epilepsy. Emerging studies are also examining neuromodulation for conditions such as migraine, stroke rehabilitation, traumatic brain injury, and even gastrointestinal or bladder dysfunction, emphasizing its potential beyond traditional neurological disorders. Non-invasive and minimally invasive methods, like transcranial magnetic stimulation (TMS) and transcutaneous vagus nerve stimulation (tVNS), are further increasing accessibility, enabling treatment in outpatient or home-care settings. These innovations not only expand the patient pool but also attract patients seeking alternatives to drugs with fewer side effects. As evidence supporting these new uses grows, healthcare providers and payers are more likely to incorporate neuromodulation into standard care, creating strong opportunities for device manufacturers to expand into new applications and reach a broader patient base.

Challenge: Shortage of trained professionals

The shortage of trained professionals is a major obstacle to the adoption and growth of neuromodulation therapies. These procedures, whether involving spinal cord stimulation, deep brain stimulation, or vagus nerve stimulation, require highly skilled specialists in neurosurgery, neurology, psychiatry, and pain management. Besides surgical skills, clinicians need to be adept at device programming, patient selection, and long-term care, making training both demanding and resource-intensive. In many areas, especially emerging markets, the limited availability of such expertise greatly restricts patient access to advanced neuromodulation treatments. Even in developed countries, the number of specialists qualified to perform complex procedures such as deep-brain stimulation does not meet the increasing patient demand. The situation is worsened by steep learning curves and the ongoing development of neuromodulation technologies, which require continuous training updates and hands-on practice. This shortage not only causes delays in timely treatment but also discourages hospitals and clinics from establishing neuromodulation programs due to a lack of staff. Bridging this gap through structured training, cross-disciplinary collaboration, and industry-supported education will be essential for wider adoption and long-term market growth.

Neuromodulation Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Offers a wide portfolio of neuromodulation devices including spinal cord stimulators, deep brain stimulation systems, sacral neuromodulation, and targeted drug delivery systems for managing chronic pain, movement disorders, and urological conditions. | Provides proven pain relief, improves motor function in movement disorder patients, restores bladder/bowel control, and supports personalized therapy through advanced programming features. |

|

Provides advanced neuromodulation solutions such as spinal cord stimulation and deep brain stimulation devices, integrating adaptive stimulation and wireless technologies for chronic pain and neurological disorders. | Enhances patient comfort with customizable stimulation, reduces chronic pain intensity, improves neurological function, and offers minimally invasive options that support quicker recovery. |

|

Supplies a broad range of neuromodulation therapies including spinal cord stimulation, dorsal root ganglion stimulation, and deep brain stimulation systems for pain and movement disorders. | Ensures targeted pain relief, improves patient mobility and daily functioning, enables remote monitoring and adjustments, and delivers long-term therapy cost efficiency. |

|

Focuses on neuromodulation solutions such as vagus nerve stimulation (VNS) therapy for epilepsy and treatment-resistant depression. | Provides clinically validated therapy for hard-to-treat epilepsy and depression, reduces seizure frequency, improves mood stability, and enhances patient quality of life through continuous stimulation. |

|

Specializes in high-frequency spinal cord stimulation systems (HF10 therapy) designed for chronic pain management without paresthesia. | Delivers superior pain relief without tingling sensations, supports treatment of back and leg pain, improves long-term patient outcomes, and enhances overall quality of life with reduced side effects. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

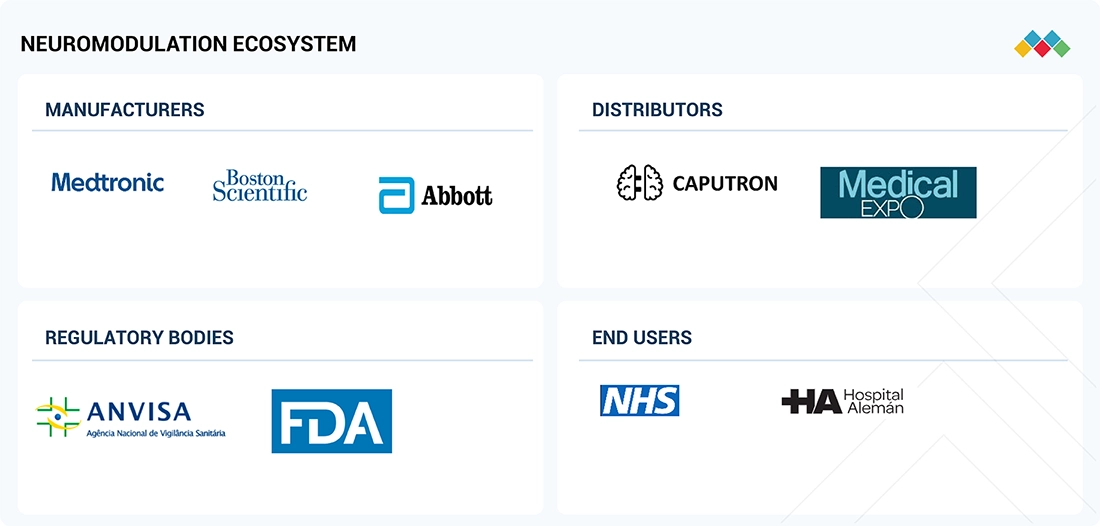

MARKET ECOSYSTEM

The ecosystem market map of the neuromodulation industry includes its key elements, which are defined by the organizations involved. Product manufacturers of neuromodulation devices are companies engaged in research, product development, optimization, and launching. These products are distributed to end users such as hospitals, ambulatory surgical centers, clinics, and other healthcare facilities, where they are used for various applications. Regulatory agencies monitor the safety, quality, and compliance of these products with industry standards products.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

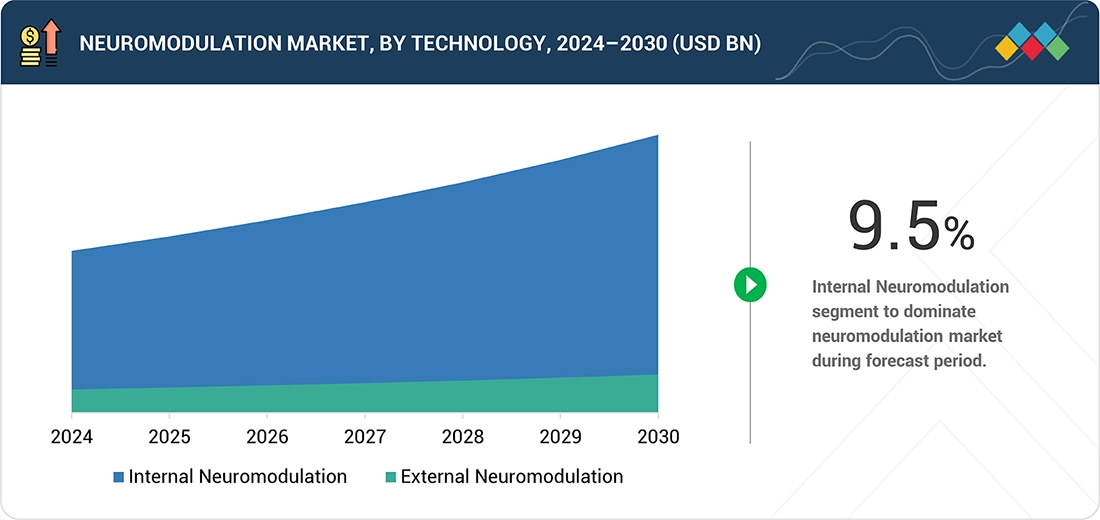

Neuromodulation Market, By Technology

The neuromodulation market is categorized by technology: internal neuromodulation and external neuromodulation. Internal neuromodulation held the largest market share in 2024. It commands a bigger portion of the market because implantable systems like spinal cord stimulators, deep brain stimulators, and vagus nerve stimulators provide targeted, long-term benefits for patients with chronic pain, movement disorders, and refractory epilepsy. These devices are supported by strong clinical results, established physician confidence, and increasing inclusion in treatment guidelines, making them a preferred choice for complex neurological conditions. Innovations such as rechargeable batteries, adaptive stimulation technologies, and miniaturized implants have improved safety and patient convenience, further boosting adoption. Conversely, external neuromodulation solutions are more commonly used for less severe conditions, leaving implantable devices as the main segment in treating high-burden neurological disorders.

Neuromodulation Market, By Stimulation Type

The neuromodulation market is categorized by stimulation types, including spinal cord stimulation, deep brain stimulation, sacral nerve stimulation, vagus nerve stimulation, gastric electrical stimulation, transcutaneous electrical nerve stimulation (TENS), transcranial magnetic stimulation (TMS), respiratory electrical stimulation (RES), and other stimulation methods. In 2024, spinal cord stimulation occupied the largest market share. It leads the stimulation type segment in neuromodulation due to its extensive use in managing chronic pain conditions that do not respond to conventional treatments. The therapy has gained widespread acceptance in clinical practice because it can significantly reduce pain, improve mobility, and enhance quality of life for patients with failed back surgery syndrome, complex regional pain syndrome, and neuropathic pain. The availability of various device options, including rechargeable, non-rechargeable, and high-frequency systems, allows physicians to customize treatment based on individual patient needs, further increasing adoption. Growing awareness among patients and healthcare providers, along with favorable reimbursement policies in many regions, supports its market dominance. Additionally, increasing clinical trials demonstrating its effectiveness, ongoing research and development to optimize stimulation settings, and expanding approvals for new indications continue to reinforce SCS's position as the leading neuromodulation therapy worldwide.

Neuromodulation Market, By Application

The neuromodulation market is categorized based on application, reflecting the different stimulation types. In 2024, spinal cord stimulation by application held the largest market share. This segment is further divided into failed back syndrome, chronic pain, and ischemia, with chronic pain being the leading category. Chronic pain has become the primary application within the spinal cord stimulation (SCS) segment for neuromodulation due to its high global prevalence and the significant unmet need for effective long-term treatment options. Traditional approaches like analgesics, opioids, and invasive surgeries often provide limited relief or cause adverse effects, prompting patients and clinicians to pursue more sustainable solutions. SCS offers a targeted, minimally invasive method that directly interrupts pain signals, leading to better outcomes compared to conventional treatments. The segment’s dominance is reinforced by expanding clinical evidence supporting SCS’s effectiveness for various chronic pain conditions, including neuropathic pain, complex regional pain syndrome, and post-surgical pain. Additionally, the rising economic burden of chronic pain on healthcare systems has driven the adoption of SCS in pain management strategies, establishing it as the preferred neuromodulation technique for this patient group and solidifying its leading role in the market.

Neuromodulation Market, By End User

The neuromodulation market is divided into hospitals & ambulatory surgery centers, clinics & physiotherapy centers, and other end users. In 2024, hospitals & ambulatory surgery centers represented the largest segment of the neuromodulation market. These healthcare facilities hold the leading share in the end-user segment because of their extensive infrastructure, specialized expertise, and capacity to perform complex procedures. Neuromodulation therapies, especially implantable systems like spinal cord stimulators, deep brain stimulators, and vagus nerve stimulators, require advanced surgical environments, imaging support, and highly trained multidisciplinary teams that are predominantly found in these settings. Hospitals and ASCs also provide integrated post-operative care, device programming, and long-term patient monitoring—key components for successful outcomes. The growing trend toward minimally invasive procedures has further boosted the role of ambulatory surgery centers, as they enable shorter recovery times, lower costs, and higher patient throughput while maintaining high standards of care. Additionally, hospitals act as referral centers for patients with complex neurological and chronic pain conditions, ensuring a constant flow of suitable cases for neuromodulation therapies. Overall, these factors position hospitals and ASCs as the main end users driving the adoption and growth of neuromodulation technologies worldwide.

REGION

Asia Pacific is the fastest growing region in the neuromodulation market

Asia Pacific is emerging as the fastest-growing region in the neuromodulation market, driven by a combination of demographic, economic, and healthcare system advancements. The region is witnessing a sharp rise in the prevalence of neurological disorders and chronic pain conditions, fueled by aging populations and changing lifestyles. Expanding healthcare infrastructure, growing availability of specialized neurological care, and increasing adoption of advanced medical technologies are further accelerating market growth. Governments across several Asia Pacific countries are boosting investments in healthcare and supporting regulatory reforms that encourage the introduction of innovative therapies. Additionally, rising disposable incomes, improving insurance coverage, and growing awareness among patients and clinicians are contributing to higher treatment uptake. Global manufacturers are also expanding their presence through partnerships, training programs, and localized manufacturing to tap into the region’s vast, underserved patient base, positioning Asia Pacific as a key growth engine for the neuromodulation industry.

Neuromodulation Market: COMPANY EVALUATION MATRIX

Medtronic maintains a strong position in the neuromodulation market through its diverse and integrated product portfolio, combining organic innovation with strategic mergers and acquisitions to foster growth. Its consistent R&D investments—USD 2.74 billion in 2022, USD 2.69 billion in 2023, and USD 2.73 billion in 2024—demonstrate a continuous commitment to advancing technology and sustaining market leadership. Regulatory successes, such as the 2022 FDA approval of Intellis rechargeable neurostimulators for chronic pain related to diabetic peripheral neuropathy, along with strategic acquisitions, have further solidified its position. Medtronic’s global manufacturing footprint and strong clinician partnerships enable the delivery of tailored, cost-effective solutions with rapid adoption.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 6.26 Billion |

| Revenue Forecast in 2030 | USD 10.68 Billion |

| Growth Rate | CAGR of 9.4% from 2025-2030 |

| Actual data | 2023-2030 |

| Base year | 2024 |

| Forecast period | 2025-2030 |

| Units considered | Value (USD Million), Volume (USD Billion) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Technology (Internal Neuromodulation, External Neuromodulation), Stimulation Type (spinal cord stimulation, deep brain stimulation, sacral nerve stimulation, vagus nerve stimulation, gastric electrical stimulation, transcutaneous electrical nerve stimulation (TENS), transcranial magnetic stimulation (TMS), respiratory electrical stimulation (RES), and other stimulation types), Application (spinal cord stimulation-by application, deep brain stimulation-by application, sacral nerve stimulation-by application, vagus nerve stimulation-by application, gastric electrical stimulation-by application, transcutaneous electrical nerve stimulation (TENS)-by application, transcranial magnetic stimulation (TMS)-by application, respiratory electrical stimulation (RES)-by application, and other applications), and End User (Hospitals & Ambulatory Surgery Centers, Clinics & Physiotherapy Centers, Other end Users) |

| Regional Scope | North America, Europe, Asia Pacific, Latin America and the Middle East & Africa |

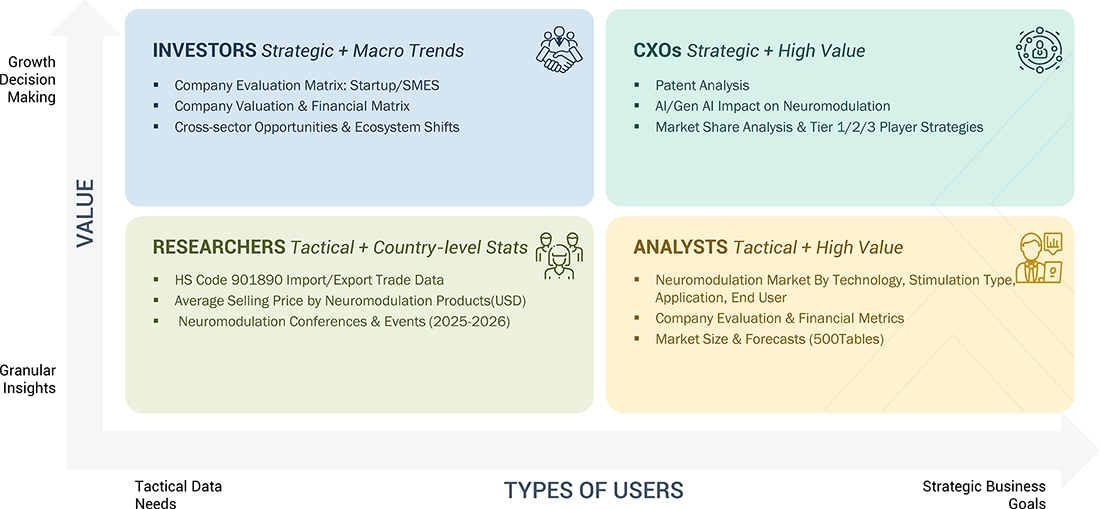

WHAT IS IN IT FOR YOU: Neuromodulation Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | Product Matrix, which provide a detailed comparison of the product portfolio of each company in the market. | • Enables identification of treatment adoption shifts across speciality clinics, hospitals, ASCs and other end users; highlights efficiency, and compliance trends influencing purchasing decisions. |

| Company Information | • Detailed analysis and profiling of additional market players (Up to five) | • Provides insights into competitive strategies, innovation focus , and partnerships shaping the pelvic organ prolapse devices and supplies landscape. |

| Geographic Analysis | • Further breakdown of the pelvic organ prolapse market into specific countries for the Rest of Europe, the Rest of Asia Pacific, the Rest of Latin America, and the Middle East & Africa | • Country level demand mapping for new product launches and localization strategy planning. |

RECENT DEVELOPMENTS

- February 2025 : Medtronic (Ireland) received FDA approval for innovative adaptive deep brain stimulation, which enhances personalized therapy and improves the quality of life for Parkinson’s patients.

- November 2024 : Boston Scientific Corporation (US) completed the acquisition of Axonics, Inc. (US), strengthening its portfolio in treating urinary and bowel dysfunction with advanced medical technologies.

- May 2025 : electroCore, Inc. (US) completes the acquisition of NeuroMetrix (US), expanding non-invasive bioelectronic therapies and strengthening market presence in chronic pain and wellness solutions.

- March 2023 : Helius Medical Technologies, Inc. (US) and partnered with HealthTech Connex (Canada)in an exclusive distribution deal for the PoNS device across Vancouver and Fraser Valley, Canada

Table of Contents

Methodology

The study involved key activities in estimating the current market size for the neuromodulation industry. Exhaustive secondary research was conducted to gather information on the neuromodulation sector. The next step was to validate these findings, assumptions, and estimates with industry experts across the value chain through primary research. Different methods, such as top-down and bottom-up approaches, were used to determine the total market size. Subsequently, market segmentation and data triangulation procedures were applied to estimate the market size of segments and subsegments within the neuromodulation market.

The four steps involved in estimating the market size are:

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, investor presentations, SEC filings of companies and publications from government sources [such as National Institutes of Health (NIH), US FDA, US Census Bureau, World Health Organization (WHO), , Global Burden of Disease Study, and Centers for Medicare and Medicaid Services (CMS) were referred to identify and collect information for the global neuromodulation market study. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to gather qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and other key executives from various companies and organizations in the neuromodulation market. The primary sources from the demand side include biotechnology companies, CROs, pharmacies, medical device companies, and research academics and universities. Primary research was conducted to validate the market segmentation, identify key players, and gather insights on important industry trends and key market dynamics.

The following is a breakdown of the primary respondents:

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Companies are classified into tiers based on their total revenues. As of 2024, Tier 1 = >USD 100 million, Tier 2 = USD 10 million to USD 100 million, and Tier 3 = < USD 10 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For the global market value, annual revenues were calculated based on revenue mapping of major product manufacturers and OEMs active in the worldwide neuromodulation market. All key service providers were identified at the global and/or country/regional level. Revenue mapping for the relevant business segments/sub-segments was performed for the major players. The global neuromodulation market was split into various segments and sub-segments based on:

- List of major players operating in the products market at the regional and/or country level

- Product mapping of neuromodulation providers at the regional and/or country level

- Mapping of annual revenue generated by listed major players from neuromodulation (or the nearest reported business unit/product category)

- Extrapolation of the revenue mapping of the listed major players to derive the global market value of the respective segments/subsegments

- Summation of the market value of all segments/subsegments to arrive at the global neuromodulation market

The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

The research methodology used to estimate the market size includes the following:

Data Triangulation

After determining the overall market size using the process described above, the total market was divided into several segments. To finalize the market engineering process and obtain precise statistics for all segments and subsegments, data triangulation and market breakdown methods were employed where applicable. The data was triangulated by analyzing various factors and trends from both the demand and supply sides.

Market Definition

Neuromodulation is a medical technology that modifies nerve activity by delivering targeted stimulation to specific areas of the body. It covers a broad range of therapies, from managing chronic pain—which is the most common use—to treating neurological and urological disorders, as well as movement disorders like Parkinson’s disease. By directly affecting neural pathways, neuromodulation can restore function, alleviate symptoms, and enhance quality of life, with ongoing innovations making it a rapidly growing field in modern medicine healthcare.

Stakeholders

- Neuromodulation and related device manufacturing companies

- Equipment manufacturers

- Suppliers and distributors of neuromodulation devices

- Healthcare service providers

- Teaching hospitals and academic medical centers (AMCs)

- Health insurance players

- Research and consulting firms

- Medical research institutes

- Healthcare institutions/providers (hospitals, medical groups, physicians’ practices, diagnostic centers, and outpatient clinics)

- Venture capitalists

- Community centers

Report Objectives

- To define, describe, segment, and forecast the global neuromodulation market by technology, stimulation type, application, end user, and region

- To provide detailed information regarding the major factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall neuromodulation market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to five regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To benchmark players within the market using the proprietary Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of business and product excellence

- To study the impact of AI/Gen AI on the market, along with the macroeconomic outlook for each region

Key Questions Addressed by the Report

Which are the top industry players in the neuromodulation market?

Key players include Medtronic (Ireland), Boston Scientific Corporation (US), Abbott (US), LivaNova PLC (UK), Nevro Corp (US), NeuroPace, Inc. (US), Bioventus (US), electroCore, Inc. (US), Helius Medical Technologies, Inc. (US), and Neuronetics (US).

What are some of the major drivers for this market?

Major drivers are the increasing prevalence of neurological disorders, nerve injuries, a growing elderly population, government support and funding for neurological research, technological advances, and rising collaborations among manufacturers, healthcare providers, and research institutions.

Which technologies have been included in the global neuromodulation market?

The market is segmented into internal and external neuromodulation technologies. Internal neuromodulation held the largest market share in 2024 and is widely used in hospital settings.

Which end users have been included in the global neuromodulation market?

End users include Hospitals & Ambulatory Surgery Centers, Clinics & Physiotherapy Centers, and Other End Users.

Which region is lucrative for the global neuromodulation market?

Asia Pacific is projected to have the highest CAGR during the forecast period, driven by an aging population, rising healthcare costs, and increasing neurological disorders.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Neuromodulation Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Neuromodulation Market