Insulin Delivery Devices Market: Growth, Size, Share, and Trends

Insulin Delivery Device Market by Type (Insulin Pens (Reusable, Disposable), Insulin Pumps (Tethered, Tubeless), Insulin Pen Needle (Standard, Safety), Insulin Syringes, Others), Disease Type (Type 1 Diabetes, Type 2 Diabetes) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

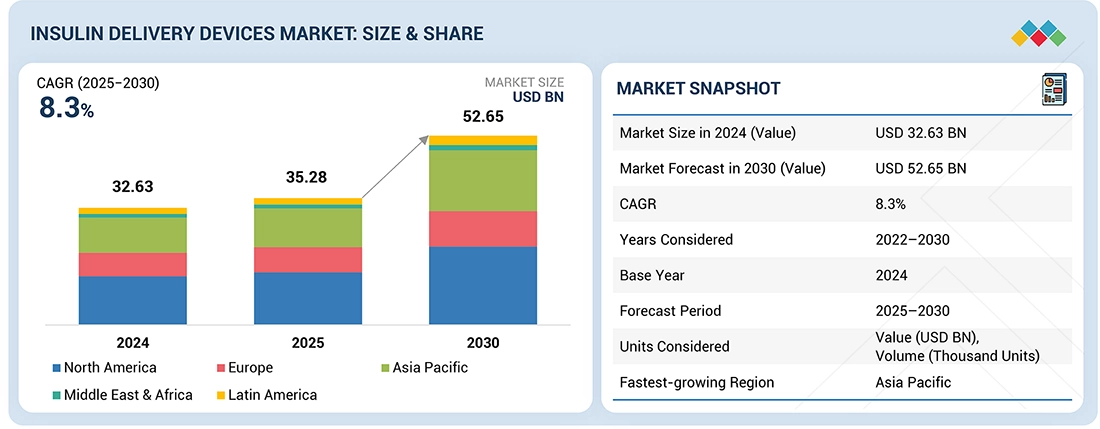

The global insulin delivery devices market is projected to reach USD 52.65 billion by 2030 from USD 35.27 billion in 2025, at a CAGR of 8.3% during the forecast period. Insulin delivery devices are medical devices designed to administer insulin, a hormone used in the management of diabetes, into the body. These devices are primarily used by individuals with diabetes who require insulin therapy to regulate their blood sugar levels. Insulin pens, pumps, pen needles, and syringes are the most widely used delivery devices. The insulin delivery devices market is experiencing steady growth, primarily due to the increasing number of individuals diagnosed with diabetes. The rising prevalence of type 1 diabetes, in particular, is driving the demand for insulin delivery devices, as patients with this condition rely on insulin to manage their blood glucose levels.

KEY TAKEAWAYS

-

BY TYPEThe insulin delivery devices market can be categorized into several types: insulin pens, insulin pumps, insulin syringes, insulin pen needles, and other insulin delivery devices. Within the category of insulin pens, there are two main types: reusable insulin pens and disposable insulin pens. As of 2024, reusable insulin pens held the largest market share. Reusable insulin pens feature a delivery chamber designed to hold prefilled insulin cartridges. These devices are more cost-effective than disposable insulin pens, leading to their increasing popularity for insulin delivery. They provide significant advantages in terms of affordability, sustainability, and user-friendliness. Additionally, reusable pens offer environmental benefits.

-

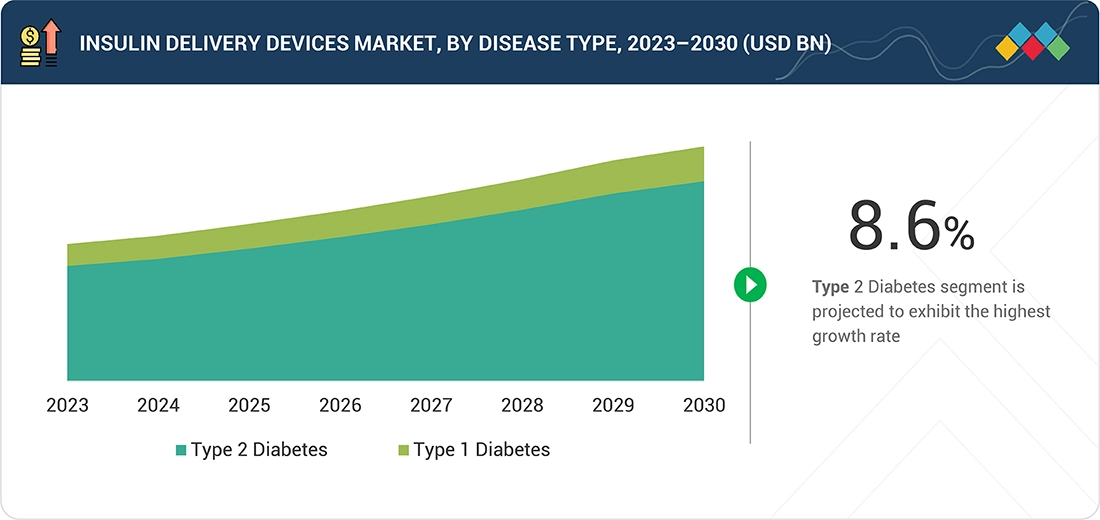

BY DISEASE TYPEThe insulin delivery devices market is categorized into two segments based on disease type: type 1 diabetes and type 2 diabetes. In 2024, the type 2 diabetes segment held the largest market share. This growth is attributed to the increasing prevalence and incidence of type 2 diabetes worldwide. For instance, as per International Diabetes Federation, By 2050, their projection show that 1 in 8 adults, approximately 853 million, will be living with diabetes, an increase of 46%.

-

BY END USERThe wearable healthcare devices market is segmented into general health & fitness, remote patient monitoring, and home healthcare. General health & fitness wearables lead in demand due to their widespread use for preventive health, wellness tracking, and lifestyle management, followed by remote patient monitoring and home healthcare, which are increasingly adopted for chronic disease management and telehealth applications.

-

BY REGIONThe insulin delivery devices market is segmented by region into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Among these regions, Asia Pacific is anticipated to be the fastest-growing market with the CAGR of 8.5% for insulin delivery devices during the forecast period. This growth is primarily attributed to the rapidly increasing prevalence of diabetes, particularly in densely populated countries like India and China.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies, including product launches, partnerships, and acquisitions. Leading companies such as Embecta Corp. (US), Novo Nordisk A/S (Denmark), Sanofi (France), Medtronic (Ireland), Eli Lily and Company (US) have strengthened their product portfolios and expanded their global presence to meet the rising demand for insulin delivery devices. Continuous innovation in insulin delivery devices, and advancement in syringe and needle technology has helped these players maintain competitive advantage in a rapidly evolving market

The insulin delivery devices market is experiencing consistent growth due to several factors. As the global population ages, the prevalence of conditions like diabetes is rising, leading to an increased demand for advanced insulin delivery devices. Additionally, government support and favorable reimbursement schemes are further promoting market growth.

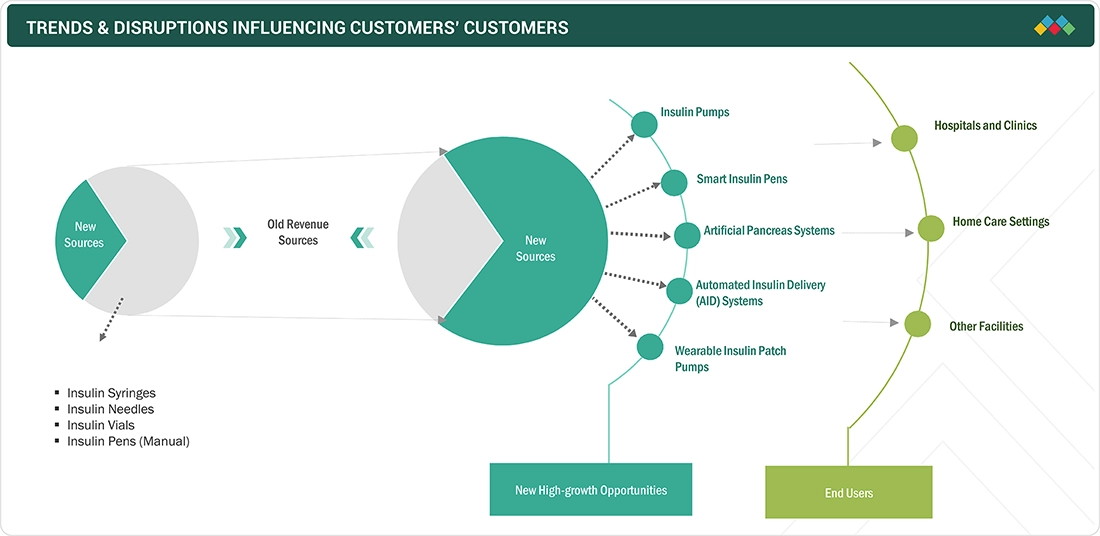

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The insulin delivery devices market is undergoing transformation as rising diabetes prevalence and technological innovation reshape customer strategies. Advanced insulin pens, pumps, and connected devices are improving dosing accuracy, ease of use, and patient adherence, creating strong demand among both hospitals and homecare settings. Favorable government initiatives and reimbursement policies in developed markets are accelerating adoption, while growing healthcare expenditure in emerging economies opens new opportunities. However, high device costs, limited reimbursement in certain regions, and needle-related anxiety continue to challenge uptake. These dynamics are pushing manufacturers and providers to balance innovation with affordability, patient comfort, and accessibility to sustain competitive advantage.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing prevalence of diabetic population

-

Technological advancements in insulin delivery devices

Level

-

High cost and lack of reimbursement in developing countries

-

Needle anxiety in patients to affect the growth of the pen needles and syringes market

Level

-

Increasing research and development activities and strategic partnerships

-

Increasing healthcare expenditure on diabetes care

Level

-

Needlestick injuries and misuse of injection pens

-

Lack of interoperability among insulin delivery devices

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing prevalence of diabetic population

The increasing prevalence of diabetes worldwide is significantly driving the growth of the insulin delivery devices market. According to the International Diabetes Federation (IDF) Atlas 2025, approximately 588.7 million people globally were affected by diabetes in 2024, and this number is projected to rise to 852.5 million by 2050, reflecting a 45% increase. The highest growth rate is expected in Africa at 142%, followed by the Middle East and North Africa at 92%, Southeast Asia at 73%, and South and Central America at 45%. As the incidence of diabetes continues to rise, governments and healthcare professionals are adopting advanced insulin delivery devices to enhance disease management and improve patient outcomes, thereby propelling the market on a global scale.

Restraint: Needle anxiety in patients

Needle anxiety is a significant barrier to the use of injectable insulin delivery devices. This issue affects not only new users and children but also adult patients. According to Harvard Health, an estimated 25% of adults have a fear of needles. Studies indicate that between one-fifth to one-third of people with diabetes are hesitant or unwilling to administer insulin injections for various reasons, including needle anxiety. Moreover, needlestick injuries present a safety concern for healthcare professionals and anyone else administering injections. The US National Institute for Occupational Safety and Health estimates that around 600,000 to 800,000 needlestick injuries occur in the US each year, which can lead to serious infections such as HIV and Hepatitis. The National Library of Medicine reports that the prevalence of fear of injections among individuals treated with insulin ranges from 6% to 43%. Those with needle phobia may experience severe anxiety, leading to panic attacks and avoidance of pen needles altogether.

Opportunity: Increasing healthcare expenditure on diabetes care

The global healthcare expenditure related to diabetes has significantly increased in recent decades. According to the IDF Diabetes Atlas 2025, total global health spending associated with diabetes reached USD 1.015 trillion in 2024, reflecting a remarkable 338% increase over the past 17 years. On average, USD 1,760 is spent per person on diabetes care.

Challenge: Needlestick injuries and misuse of injection pens

The global healthcare expenditure related to diabetes has significantly increased in recent decades. According to the IDF Diabetes Atlas 2025, total global health spending associated with diabetes reached USD 1.015 trillion in 2024, reflecting a remarkable 338% increase over the past 17 years. On average, USD 1,760 is spent per person on diabetes care. There are stark regional disparities in this expenditure. North America and the Caribbean have the highest diabetes-related health expenditure per adult, amounting to USD 7,812, followed by Europe at USD 2,951, South and Central America at USD 2,417, and the Western Pacific at USD 1,174. Furthermore, the differences at the country level are even more pronounced. In 2024, Switzerland reported the highest annual per-person expenditure on diabetes care at USD 12,234, followed by the US at USD 10,497 and Norway at USD 10,226.

Insulin Delivery Devices Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Focuses on manufacturing insulin delivery systems such as insulin syringes, pen needles, and injection devices designed for safe and reliable insulin administration. | Ensures consistent and accurate insulin dosing, enhances patient safety, and simplifies self-administration for diabetic patients. |

|

Offers a wide range of advanced insulin pens, smart insulin pens, and prefilled delivery systems integrating connectivity features for diabetes management. | Promotes convenient and precise dosing, improves treatment adherence, and enables digital tracking for personalized diabetes care. |

|

Develops insulin pumps, continuous glucose monitoring (CGM) systems, and hybrid closed-loop insulin delivery solutions integrating automated insulin adjustment. | Enhances glycemic control, reduces hypoglycemia risk, and minimizes manual intervention through automated insulin delivery. |

|

Provides prefilled insulin pens, smart delivery platforms, and digital monitoring tools integrated with insulin formulations like Lantus® and Toujeo®. | Improves user comfort, ensures accurate dose delivery, and supports comprehensive diabetes management through connected solutions. |

|

Offers reusable and disposable insulin pens and collaborates on digital insulin delivery platforms and smart pen technologies. | Simplifies daily insulin administration, improves dose precision, and supports patient adherence through intuitive and connected devices. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem market map of the Insulin delivery devices market includes products used in hospitals, senior care facilities, rehabilitation facilities, home, and end users. Manufacturers of various Insulin delivery devices include organizations that heavily invest in research and development. Distributors include third parties and e-commerce sites linked with the organization to market Insulin delivery devices products. Research and product development include in-house research facilities, contract research organizations, and contract development and manufacturing organizations that play a key role in outsourcing services for product development to manufacturers. End users adopt Insulin delivery devices products during various stages of application. These end customers are the key stakeholders in the supply chain of the Insulin delivery devices market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Insulin Deliver Devices Market, By Type

Based on type, the Insulin delivery devices market is divided into insulin pens, insulin pumps, insulin pen needles, insulin syringes, and other insulin delivery devices. Among these the insulin pen segment holds the largest markets share in 2024 across insulin delivery device market. The insulin pen segment holds the major share in the insulin delivery device market by type primarily due to its ease of use, convenience, and accuracy in dosing, which significantly enhances patient compliance

Insulin Deliver Devices Market, By Disease Type

Based on disease type, the insulin deliery devie market is divied int type 1 diabets & type 2 diabetes. Among these, in 2024 the type diabtes accounted for th mjor share owing toincrasing prevalence of type 2 diabetes. The increasing prevalence of Type 2 diabetes is being driven by multiple global trends, including population ageing, urbanization, economic transition, sedentary lifestyles, and poor dietary habits—such as rising consumption of processed foods, sugar-sweetened beverages, and red meats.

Insulin Deliver Devices Market, By End User

Based on end users, the Insulin delivery devices market is bifurcated into home care settings, hospitals & Clinics, and Other End Users. Among these in 2024, Home care settings segment accounted for the major share in the market and is also expected to grow at the fastest CAGR during the forecast period. This is due to the increasing emphasis on patient-centered care and the growing prevalence of diabetes worldwide. With advancements in technology, insulin delivery devices have become more user-friendly, portable, and easy to operate, enabling patients to manage their condition effectively outside of hospital settings.

REGION

Asia Pacific to be fastest-growing region in global insulin delivery devices market during forecast period

Based on region, the Insulin delivery devices market is bifurcated into North America, Europe, Asia Pacific, Latin America and Middle east & Africa. Among these, during forecast period, Asia Pacific is the fastest-growing regional market for insulin delivery devices. This is due to the rapidly increasing prevalence This sharp demographic shift is creating a substantial demand for effective diabetes management solutions, including insulin delivery devices. of diabetes, particularly in densely populated countries like India and China. This sharp demographic shift is creating a substantial demand for effective diabetes management solutions, including insulin delivery devices.

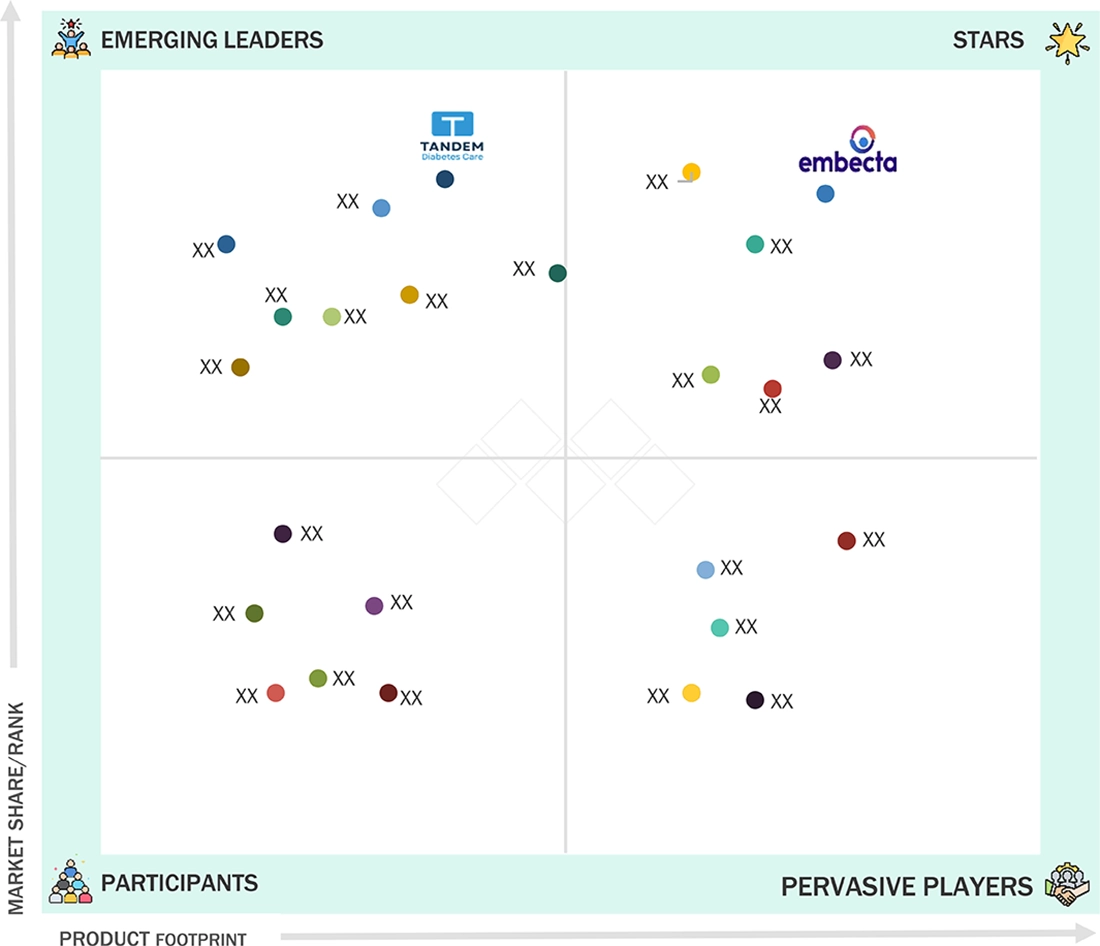

Insulin Delivery Devices Market: COMPANY EVALUATION MATRIX

The insulin delivery device market is characterized by strong competition among leading global players such as Embecta Corp., Novo Nordisk A/S, Medtronic Plc, Sanofi, and Eli Lilly and Company. Embecta Corp. excels through its broad portfolio of advanced insulin delivery solutions. Novo Nordisk maintains a robust global footprint with innovative insulin pens and needles. Medtronic leverages its diversified product range and strategic growth initiatives, while Sanofi and Eli Lilly continue to strengthen their market positions through innovation-driven insulin pen technologies.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 32.63 Billion |

| Revenue Forecast in 2030 | USD 52.65 Billion |

| Growth Rate | CAGR of 8.3% from 2025-2030 |

| Actual data | 2023-2030 |

| Base year | 2024 |

| Forecast period | 2025-2030 |

| Units considered | Value (USD Million), Volume (Million Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

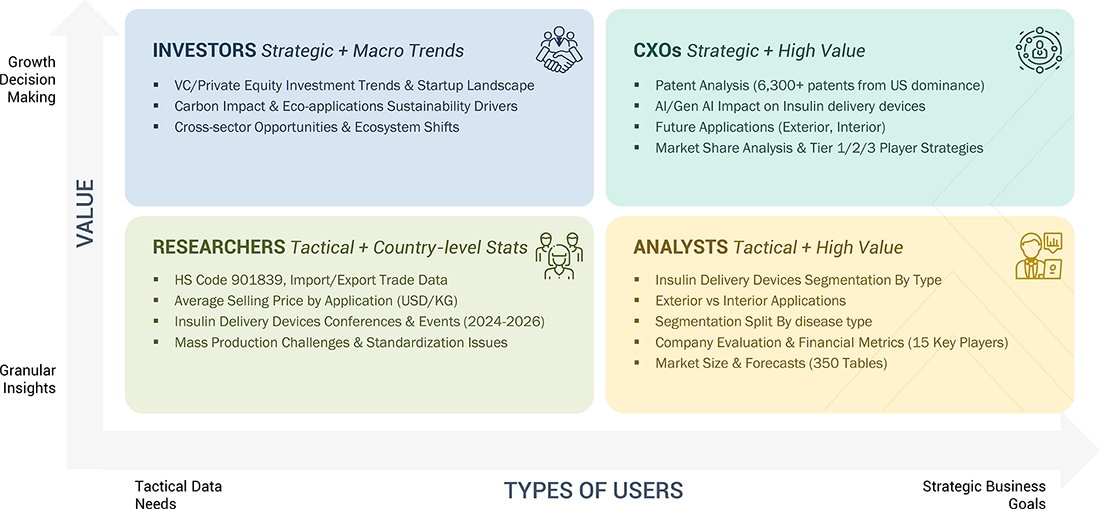

WHAT IS IN IT FOR YOU: Insulin Delivery Devices Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Company Information | Market Share Analysis, By Region (North America and Europe) & Competitive Leadership Mapping for Established Players in the US | Insights on market share analysis by region |

| Geographic Analysis |

|

Country level demand mapping for new product launches and localization strategy planning. |

RECENT DEVELOPMENTS

- January 2025 : Novo Nordisk A/S launched Awiqli (insulin icodec Injection) in Japan in a prefilled FlexTouch pen.

- December 2024 : Novo Nordisk successfully completed the acquisition of three manufacturing facilities from Novo Holdings A/S. This transaction follows Novo Holdings’ finalization of its acquisition of Catalent, Inc. (Catalent), a leading global contract development and manufacturing organization (CDMO). The integration of these manufacturing sites aligns with Novo Nordisk’s strategic objective of expanding access to its current and future treatments for individuals living with diabetes and obesity.

- November 2024 : Medtronic received USFDA approval for the InPen System, which is a home-use reusable pen for single-patient used by people with diabetes under the supervision of an adult caregiver, or by a patient aged 7 and older for the self-injection of a desired dose of insulin.

- August 2024 : Embecta Corp. announced that it has received 510(k) clearance from the USFDA for its proprietary disposable insulin delivery system. This system features a tubeless patch pump design equipped with a 300-unit insulin reservoir.

Table of Contents

Methodology

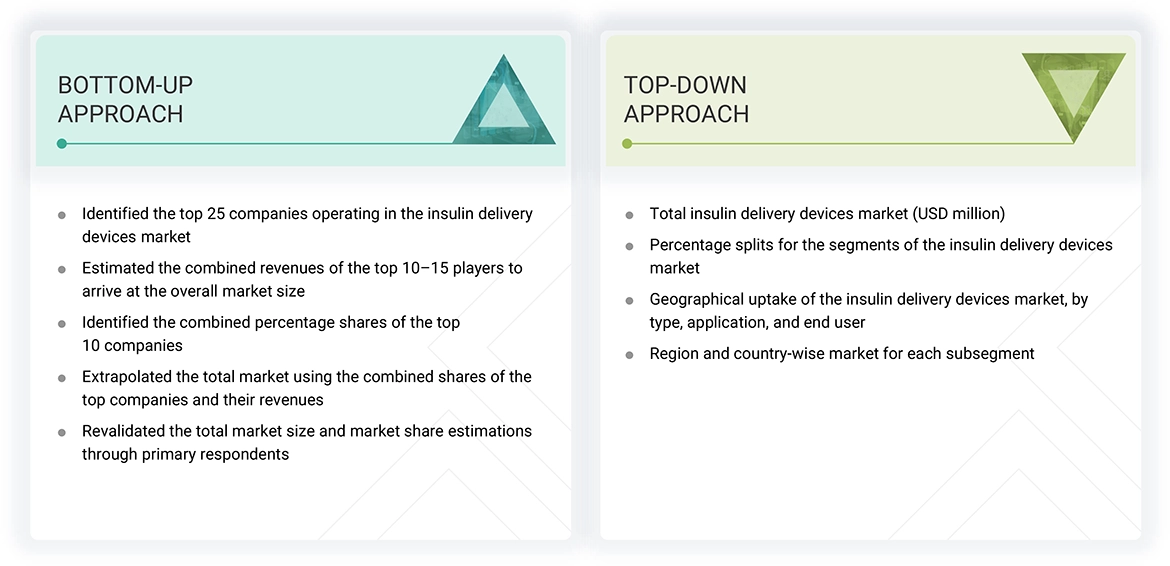

The study focused on estimating the current market size of the insulin delivery devices sector. Comprehensive secondary research was conducted to gather information about the industry. The next step involved validating these findings, assumptions, and estimates by consulting industry experts throughout the value chain through primary research. Various methods were used to calculate the total market size, including top-down and bottom-up approaches. Subsequently, market segmentation and data triangulation procedures were employed to determine the size of the segments and subsegments within the insulin delivery devices market.

Secondary Research

The secondary research process involves utilizing a range of secondary sources, including directories and databases such as Bloomberg Business, Factiva, and D&B Hoovers. It also encompasses white papers, annual reports, investor presentations, SEC filings from companies, and publications from various government sources. Notable organizations referenced include the National Institutes of Health (NIH), the US Food and Drug Administration (FDA), the US Census Bureau, the World Health Organization (WHO), the International Trade Administration (ITA), the Global Burden of Disease Study, and the Centers for Medicare and Medicaid Services (CMS).

These resources were used to gather information for the global insulin delivery devices market study. They provided crucial insights into key players within the market, as well as market classification and segmentation based on industry trends. Additionally, important developments related to market and technology perspectives were identified. A database of key industry leaders was also compiled using the information obtained through secondary research.

Primary Research

In the primary research process, interviews were conducted with various sources from both the supply and demand sides to gather qualitative and quantitative information for this report. The supply-side primary sources included industry experts, such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and other key executives from important companies and organizations in the insulin delivery devices market. On the demand side, the primary sources included personnel from home care settings, hospitals, clinics, and other end users. This primary research was carried out to validate market segmentation, identify key players in the market, and gather insights on essential industry trends and dynamics.

A breakdown of the primary respondents is provided below:

Note 1: C-level executives include CEOs, CFOs, COOs, and VPs.

Note 2: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 10 billion, Tier 2 = USD 1 billion to USD 10 billion, and Tier 3 = < USD 1 billion.

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Annual revenues were calculated based on the revenue mapping of major product manufacturers and OEMs (original equipment manufacturers) operating in the global insulin delivery devices market to determine the global market value. All significant product manufacturers were identified at both the global and country/regional levels. Revenue mapping for these key players was conducted for the relevant business segments and subsegments. Additionally, the global insulin delivery devices market was divided into various segments and subsegments based on specific criteria:

- List of major players operating in the products market at the regional and/or country level

- Product mapping of various insulin delivery device manufacturers at the regional and/or country level

- Mapping of annual revenues generated by listed major players from insulin delivery devices (or the nearest reported business unit/product category)

- Extrapolation of the revenue mapping of the listed major players to derive the global market value of the respective segments/subsegments

- Summation of the market value of all segments/subsegments to arrive at the global insulin delivery devices market

The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Market Size Estimation (Bottom-up Approach & Top-down Approach)

Data Triangulation

After arriving at the overall size of the global insulin delivery devices market through the above-mentioned methodology, this market was split into several segments and subsegments. Where applicable, the data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macroindicators and regional trends from both demand- and supply-side participants.

Market Definition

Insulin delivery devices are medical devices designed to administer insulin, a hormone used in the management of diabetes, into the body. These devices are primarily used by individuals with diabetes who require insulin therapy to regulate their blood sugar levels. Insulin pens, pumps, pen needles, and syringes are the most widely used delivery devices.

Stakeholders

- Manufacturing companies of insulin pen needles, insulin pens, insulin pumps, insulin syringes, injectable insulin delivery devices, and diabetes supplies

- Suppliers and distributors of insulin pen needles, insulin pens, insulin pumps, insulin syringes, injectable insulin delivery devices, and diabetes supplies

- Pharmaceutical and biopharmaceutical companies

- Healthcare service providers

- Teaching hospitals and academic medical centers

- Health insurance players

- Government bodies/municipal corporations

- Regulatory bodies

- Medical research institutes

- Business research and consulting service providers

- Venture capitalists

- Market research and consulting firms

Report Objectives

- To describe, analyze, and forecast the global insulin delivery devices market on the basis of type, end user, and region

- To describe and forecast the insulin delivery devices market for key regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the insulin delivery devices market

- To strategically analyze the ecosystem, regulations, patenting trend, value chain, Porter’s five forces, and prices pertaining to the market under study

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market players

- To profile the key players and comprehensively analyze their market shares and core competencies in the insulin delivery devices market

- To analyze competitive developments such as partnerships, collaborations, acquisitions, product launches, expansions, and R&D activities in the insulin delivery devices market

- To benchmark players within the market using the proprietary Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Frequently Asked Questions (FAQ)

Which are the top industry players in the global insulin delivery devices market?

Embecta Corp. (US), Novo Nordisk A/S (Denmark), Ypsomed (Switzerland), Medtronic, Plc (Ireland), Tandem Diabetes Care, Inc. (US), Sanofi (France), Eli Lilly and Company (US), and Insulet Corporation (US).

What are some of the major drivers for this market?

Growing prevalence of diabetes, technological advancements in insulin delivery devices, and government support and favorable reimbursement schemes.

Which end users have been included in the global insulin delivery devices market?

Hospitals & Clinics, Home Care Settings, and Other End Users.

Which product segments hold the largest market share in the insulin delivery devices market?

The insulin pens segment holds the largest market share.

Which region is the most lucrative in the insulin delivery devices market?

The Asia Pacific market is expected to witness the highest CAGR.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Insulin Delivery Device Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Insulin Delivery Device Market