The study involved four major activities in estimating the current size of the Inflight Retail and advertising Market. Exhaustive secondary research was done to collect information on the Inflight Retail and Advertising Market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Demand-side analyses were carried out to estimate the overall size of the market. After that, market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the Inflight Retail and Advertising Market.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included government sources, such as SIPRI; corporate filings such as annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases.

Primary Research

Extensive primary research was conducted after acquiring information regarding the Inflight Retail and Advertising Market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East, and the Rest of the World, which includes Africa and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

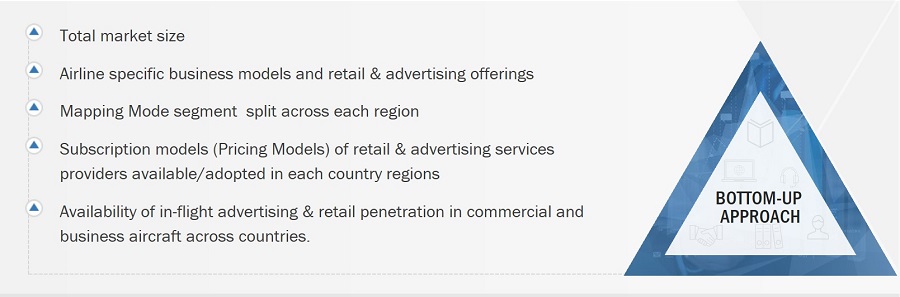

The top-down and bottom-up approaches were used to estimate and validate the size of the Inflight Retail and Advertising Market. The research methodology used to estimate the size of the market includes the following details.

Key players in the Inflight Retail and Advertising Market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews with leaders such as directors, engineers, marketing executives, and other stakeholders of leading companies operating in the Inflight Retail and Advertising Market.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the Inflight Retail and Advertising Market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Inflight Retail and Advertising Market Size: Bottom-up Approach

Inflight Retail and Advertising Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated market numbers for the market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Market Definition

The inflight retail and advertising market encompasses the commercial activities undertaken to generate revenue while passengers are aboard aircraft through in-flight e-commerce and advertising. In-Flight advertisement entails the display of commercials and promotional content to passengers through various channels within the airplane cabin, through various digital platforms like seatback screens, overhead screens and in-flight apps. In-flight retail involves facilitating the sale of goods and services to airline passengers during their flight. Facilitating the sale of branded products allows retail logistics providers of travel essentials, alcohol & beverages, travel essentials including electronics, etc, to enhance brand visibility and recognition among a diverse, international customer base.

Market Stakeholders

-

Airlines

-

Inflight Entertainment Providers

-

Retail Concessionaires

-

Advertising Agencies

-

Technology Providers

-

Passengers

Report Objectives

-

To define, describe, and forecast the inflight retail and advertising market size based on end-user, mode, seat class, operation and Region.

-

To forecast the size of different segments of the market with respect to five major regions: North America, Europe, Asia Pacific, the Middle East, and the Rest of the World, along with their respective key countries

-

To identify and analyze key drivers, restraints, opportunities, and challenges influencing the market’s growth

-

To identify industry trends and technology trends currently prevailing in the market

-

To analyze micromarkets1 with respect to their individual growth trends, prospects, and contribution to the overall market

-

To profile companies operating in the market based on their product portfolios, market share, and key growth strategies

-

To analyze the degree of competition among players in the market by identifying and analyzing their business revenues, products offered, and recent developments and ranking them based on these parameters

-

To analyze competitive developments such as deals, new product launches/developments, and partnerships/acquisitions undertaken by key market players

-

To strategically profile key players and comprehensively analyze their share and core competencies in the market

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

-

Additional country-level analysis of the Inflight Retail and Advertising Market

-

Profiling of other market players (up to 5)

Product Analysis

-

Product matrix, which provides a detailed comparison of the product portfolio of each company in the Inflight Retail and Advertising Market

Growth opportunities and latent adjacency in Inflight Retail and Advertising Market