The study involved four major activities for estimating the industrial metaverse market size. Exhaustive secondary research has been conducted to collect information relevant to the market, its peer markets, and its child market. Primary research has been undertaken to validate key findings, assumptions, and sizing with industry experts across the value chain of the industrial metaverse market. Both top-down and bottom-up approaches have been employed to estimate the complete market size. It has been followed by the market breakdown and data triangulation methods to estimate the size of different segments and subsegments of the market.

Secondary Research

The research methodology used to estimate and forecast the size of the industrial metaverse market began with the acquisition of data related to the revenues of key vendors in the market through secondary research. Various secondary sources have been referred to in the secondary research process for identifying and collecting information for this study. Secondary sources include annual reports, press releases, and investor presentations of companies; white papers, journals, certified publications, and articles by recognized authors; websites; directories; and databases. Secondary research has mainly been used to obtain key information about the supply chain of the industrial metaverse market, the value chain of the market, key players, market classification, and segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both market and technology-oriented perspectives. Secondary data has been collected and analyzed to determine the overall market size, further validated through primary research. The secondary research referred to for this research study involves the The VR/AR Association (VRARA), Metaverse Association, Institute of Electrical and Electronics Engineers (IEEE), and Metaverse Standards Forum, Inc. Moreover, the study involved extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource, to identify and collect valuable information for a technical, market-oriented, and commercial study of the industrial metaverse market. Vendor offerings have been taken into consideration to determine market segmentation.

Primary Research

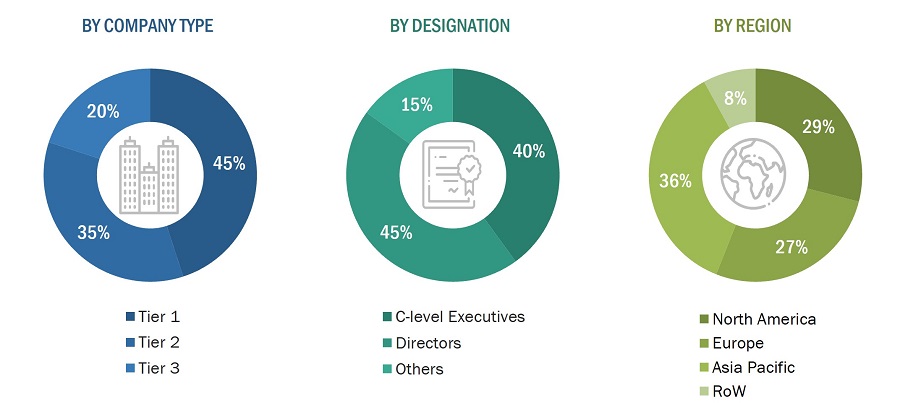

In the primary research, various primary sources from both the supply and demand sides have been interviewed to obtain the qualitative and quantitative information relevant to this report. Primary sources from the supply side include the key industry participants, subject-matter experts (SMEs), and C-level executives and consultants from various key companies and organizations in the industrial metaverse ecosystem. After the complete market engineering (including calculations for the market statistics, the market breakdown, the market size estimations, the market forecasting, and the data triangulation), extensive primary research has been conducted to verify and validate the critical market numbers obtained. Extensive qualitative and quantitative analyses have been performed during the market engineering process to list key information/insights throughout the report. Extensive primary research has been conducted after understanding the industrial metaverse market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand and supply-side players across key regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (Middle East, Africa and South America). Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents.

Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This and the in-house subject matter experts’ opinions have led us to the findings described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

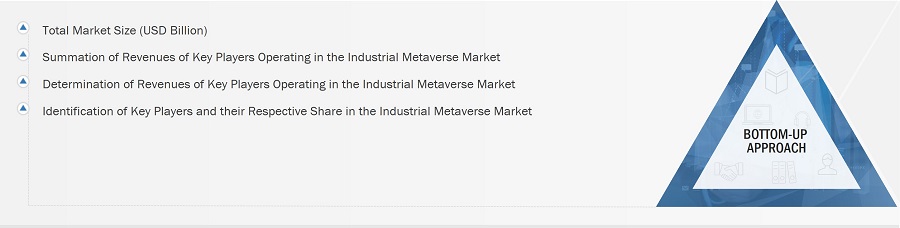

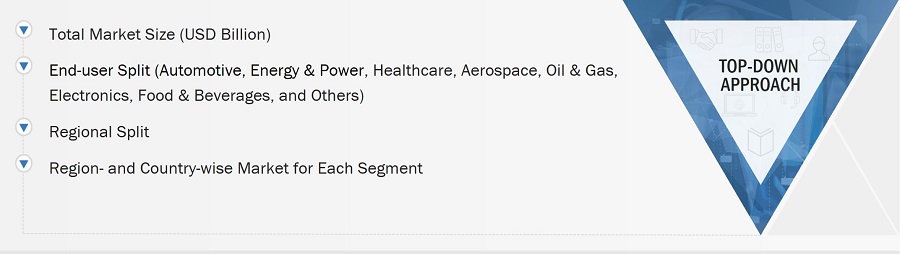

The total size of the industrial metaverse market has been estimated and validated using both top-down and bottom-up approaches. Furthermore, these methods have also been used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size is as follows:

-

Identifying different technologies influencing the value chain of the industrial metaverse market

-

Identifying major companies, system integrators, and service providers operating in the market

-

Estimating the size of the industrial metaverse market for each technology, further by end user and region based on demand for industrial metaverses

-

Tracking the ongoing and upcoming industrial metaverse projects to forecast the market size based on these developments and other critical parameters

-

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

-

Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

Global Industrial metaverse Market Size: Bottom-Up Approach

Global Industrial metaverse Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall size of the industrial metaverse market from the market size estimation process explained above, the total market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using both top-down and bottom-up approaches.

Market Definition

Industrial metaverse market refers to the usage of metaverse technologies for industrial applications, especially for manufacturing processes. The market covers a wide range of products and solutions to facilitate the integration of various technologies into the industrial applications. Industrial metaverse is a blend of digital and physical world formed using technologies such as digital twin, AI, AR &VR, and edge computing. Industrial Metaverse is used for enhancing connectivity, real time collaboration among production systems, processes, and teams working in a complex industrial environment.

Stakeholders:

-

Industrial Metaverse solution and service providers

-

Augmented reality (AR), virtual reality (VR), and mixed reality (MR) device manufacturers

-

Professional service providers and consulting companies

-

Raw material suppliers

-

Semiconductor foundries

-

Original Equipment Manufacturers (OEM)

-

Government organizations, forums, alliances, and associations

-

System Integrators (SIs) and Value-added Resellers (VARs)

-

Research organizations

-

Technology standard organizations, forums, alliances, and associations

-

Technology investors

-

End-use industries (Automotive, aerospace, electronics, healthcare, Oil & gas, energy & power, food & beverages, and others (chemicals and pulp and paper))

-

Research organizations

-

Technology standard organizations, forums, alliances, and associations

-

Venture capitalists, private equity firms, and startups

Report Objectives

-

To define, describe, segment, and forecast the size of the industrial metaverse market by technology, and end-user in terms of value

-

To describe and forecast the market for four main regions, namely, the North America, Asia Pacific, Europe, and Rest of the World, in terms of value

-

To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

-

To provide a detailed overview of the value chain of the industrial metaverse ecosystem

-

To strategically analyze micro-markets with respect to individual growth trends, prospects, and their contributions to the overall market

-

To strategically analyze the ecosystem, Porter’s five forces, regulations, region-wise regulations, upcoming technologies in the market, revenue shift model in the market, patent landscape, trade landscape, and case studies pertaining to the market under study

-

To analyze opportunities in the market for the stakeholders by identifying high-growth segments in the market

-

To strategically profile key players and provide details of the current competitive landscape

-

To analyze strategic approaches adopted by players in the industrial metaverse market, such as product launches and developments, acquisitions, collaborations, agreements, contracts, expansions, and partnerships

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

-

Detailed analysis and profiling of additional market players based on various blocks of the value chain.

Growth opportunities and latent adjacency in Industrial Metaverse Market