Industrial Gases Market

Industrial Gases Market by Type (Oxygen, Nitrogen, Hydrogen, Carbon Dioxide, Acetylene, Inert Gases), End-use Industry (Chemical, Electronics, Food & Beverage, Healthcare, Manufacturing, Metallurgy, Refining), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The industrial gases market is projected to reach USD 126.53 billion by 2030 from USD 98.79 billion in 2025, at a CAGR of 5.1% from 2025 to 2030. Demand for industrial gases is increasing due to expanding healthcare needs, growing chemical and manufacturing activities, rising metal fabrication and electronics production, and the shift toward clean energy and decarbonization. Enhanced industrial processes, stricter environmental standards, and technological advancements further drive the consumption of high-purity gases across diverse sectors

KEY TAKEAWAYS

-

BY TYPEThe industrial gases market is segmented by type into oxygen, nitrogen, carbon dioxide, hydrogen, acetylene, inert gases, and other gases, each serving critical roles across chemicals, metallurgy, healthcare, and manufacturing industries. Among these, oxygen represents the largest segment, driven by its extensive use in steelmaking, healthcare, and chemical processing. Nitrogen follows as the second largest, owing to its applications in food preservation, electronics, and industrial processing. Carbon dioxide, hydrogen, acetylene, and inert gases occupy smaller but significant shares, supporting specialized applications and emerging sustainable technologies

-

BY END-USE INDUSTRYThe industrial gases market is segmented by end-use industry into chemicals, electronics, food and beverages, healthcare, manufacturing, metallurgy, refining, and other industries. The chemical sector represents the largest share, as gases are essential for synthesis, reaction control, and large-scale production of petrochemicals, polymers, and specialty chemicals. Metallurgy follows as the second-largest segment, driven by its reliance on gases for steelmaking, refining, and process optimization. Other industries including healthcare, food and beverages, electronics, refining, and manufacturing contribute significantly, supporting both traditional applications and advanced technological processes

-

BY REGIONThe industrial gases market is segmented by region into North America, Europe, Asia Pacific, South America, and the Middle East & Africa. North America currently holds the largest share, supported by strong demand from the chemical, healthcare, and manufacturing sectors, along with well-established gas distribution networks. Asia Pacific, however, is the fastest-growing region, fueled by rapid industrialization, expanding steel and electronics production, and increasing healthcare needs in major economies like China and India. Europe, South America, and the Middle East & Africa also play vital roles with diverse industrial demand

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies including partnerships and investments. For instance, Air Liquide (France)Linde PLC (UK), Air Products and Chemicals, Inc. (US), Messer SE & Co. KGaA (Germany), NIPPON SANSO HOLDINGS CORPORATION (Japan), BASF SE (Germany) are entered into number of agreements and partnerships to cater the growing demand for industrial gases across various end-use industries

The industrial gases market is projected to grow steadily worldwide, supported by their indispensable role across diverse high-growth industries such as chemicals, metallurgy, healthcare, food and beverages, and advanced manufacturing. The market is expected to gain popularity because of increasing demand in steelmaking and refining, as well as increased usage in electronics and healthcare. The increased attention to cleaner production and sustainable industrial practices only contributes to the increased adoption of gases in low-carbon technologies and optimization of processes. As the supply chain in the industrial gases sector continues to be influenced by Asia Pacific, and other growth trajectories, the unpredictability of supply, industrial growth, and infrastructure advancement, and sustainable sourcing has continued to be one of the main factors that will determine the future of this industry

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ business emerges from customer trends or disruptions. Hot belts are the clients of industrial gases producers, and target applications are the clients of industrial gases producers. Shifts, which are changing trends or disruptions, will impact the revenues of end users. The revenue impact on end users will affect the revenue of hotbeds, which will further affect the revenues of industrial gases producers

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing demand from electronics industry

-

Green hydrogen scale-up

Level

-

Strict regulatory compliance

-

CapEx-heavy nature of gas production and storage facilities

Level

-

•Advanced semiconductor manufacturing expansion

-

•Medical gas expansion in emerging healthcare markets

Level

-

•Hazardous material handling and safety regulations

-

•Geopolitical disruptions in critical supply regions

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing demand from electronics industry

The electronics business sector is increasingly driving demand for industrial gases because it needs ultra-high-purity gases to manufacture semiconductors, display panels, and complex packaging. Chemical vapor deposition, plasma etching, photolithography and others, demand gases like nitrogen, argon, and helium, and specialty fluorinated compounds with very low impurity content. The recent rapid increase in semiconductor manufacturing, driven by the use of AI, IoT, and 5G, has increased the demand of these gases in semiconductor wafer manufacturing and chip assembly. Also, the development of flat-screen displays, LEDs and solar photovoltaics has produced sustained demand of electronic-grade gases. As mentioned by the Semiconductor Industry Association (SIA), global semiconductor sales reached USD 627.6 billion in 2024, which is an increase of 19.1% over the 2023, and is directly associated with the need to meet more industrial gas demand in high-tech manufacturing

Restraint: Strict regulatory compliance .

Strict regulatory compliance is a major restraint of the industrial gases market since many of the gases, such as oxygen, acetylene, hydrogen, and special fluorinated compounds are highly hazardous. Environmental, safety, and transport regulations (e.g. storage pressure limits, leakage monitoring, emission controls and so on) complicate operations and raise costs to manufacturers and end-users. As an example, the OSHA, EPA, and ADR regulations would need constant monitoring, safety audits, and certified equipment, especially in chemical, healthcare, and semiconductor industry. Non-compliance may attract hefty fines, closure of production, and negative publicity. In 2024, the International Labour Organization noted an increase in the production of industrial accidents associated with gas management, which supports the high adherence levels, limiting the market development, particularly in developing markets with dynamic regulatory systems

Opportunity: Advanced semiconductor manufacturing expansion

The industrial gases market has a huge growth prospect with the rapid growth of the advanced semiconductor manufacture. Next-generation nodes and high performance chips require ultra-high-purity gases like nitrogen, hydrogen, argon and specialty fluorinated compounds in important processes like atomic layer deposition, chemical vapor deposition, etching and wafer cleaning. The global trend in AI, quantum computing, and 5G applications has led to the rapid development of state-of-the-art fabs in such regions as the US, Taiwan, South Korea, and the EU. This trend will allow gas suppliers to build custom solutions, to expand the local supply chain, and to sign a long-term contract with the major chip producers

Challenge: Hazardous material handling and safety regulations

Hazardous material handling and stringent safety regulations pose a critical challenge to the industrial gases market. Most of the industrial gases are highly flammable, toxic, or cryogenic such as hydrogen, acetylene, and specialty fluorinated compounds necessitating special storage, transportation, and handling procedures. The standards training, safety equipment, and monitoring systems required as a result of the need to comply with standards like ISO 21014, OSHAs Process Safety Management, and local environmental and transport regulations are costly in terms of investment. The International Labour Organization (2024) reported that the number of accidents with improper gas handling is increasing and points to operational risks. This would mean increased operating expenses, greater liability and delayed market penetration of products to the market especially in the developing markets where enforcement is not uniform hence limiting the swift market penetration in spite of the increased demand in high tech and manufacturing industries

Industrial Gases Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Linde provided precise nitrogen and CO2 gas control during plastics compounding to minimize oxidation, moisture interference, and inconsistencies in polymer production | Improved product uniformity, reduced scrap, higher throughput, lower operating costs, and enhanced end-product performance |

|

Air Liquide implemented a CO2 recycling system in lithium carbonate purification, enabling closed-loop recovery and reuse of CO2 in battery material production | Reduced fresh CO2 consumption by up to 80%, lower emissions, cost savings, sustainable operations, and minimal process disruption |

|

Messer supplied high-purity CO2 for injection into mature oilfields to enhance oil recovery while sequestering CO2 underground | Increased oil recovery by 10–15%, extended field life, safe CO2 storage, and dual benefits of production and carbon mitigation |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The industrial gases market ecosystem has an organized value chain beginning with the purchase of raw materials up to use of the products in various industries. The major raw materials are natural gas, atmospheric air, electrolysis hydrogen, CO 2 recovered in the industrial processes and specialty chemicals. The suppliers of these inputs include industrial gas companies like Linde plc, Air Liquide, Air Products and Chemicals, Messer Group as well as Nippon Sanso Corporation who utilize modern production technologies into converting these inputs into oxygen, nitrogen, argon, hydrogen, carbon dioxide and blends of specialty gas. These delivery channels are bulk tankers, on-site pipeline delivery, cylinder delivery, and microbulk which assure the delivery of the products to the end-users in a timely and dependable way. End-use applications are in chemicals, electronics, food and beverages, healthcare, manufacturing, metallurgy and refining among other industrial applications. High-purity gases, traceability, sustainability, and process efficiency are becoming the main drivers of the market, whereas the regulatory compliance and optimization of supply chains become major aspects of operational consideration

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Industrial Gases Market, By Type Expanding oxygen production to meet rising healthcare, industrial, and green energy demand

In 2024, oxygen accounted for the largest share in the industrial gases market, reflecting its critical role across multiple sectors. The medical sector remains a market driver, and healthcare facilities and hospitals are consuming medical grade oxygen in large quantities in providing medical care to their patients, especially in emergency and critical care units. In addition to healthcare, the usage of oxygen in fabrication, welding, and cutting metals is irreplaceable, and it aids in the processes that involve manufacturing and construction all over the world. Also, the chemical and petrochemical sectors are progressively utilizing oxygen in the oxidation processes and the conversion to important chemicals. The emerging uses of energy, such as the production of green hydrogen and decarbonization projects in industries, are also sources of demand support. All these factors make oxygen to be the most dominant gas, both in volume and in market value

Industrial Gases Market, By End-use Industry Strengthening Industrial Gas Supply for the Chemicals Sector to Support Expanding and Sustainable Production

The chemicals end-use industry contributed the largest share in the industrial gases market in 2024 due to its overwhelming use of the gases which include oxygen, nitrogen, hydrogen, and carbon dioxide in various chemical activities. Industrial gases play an important role in the oxidation, hydrogenation, and synthesis reactions, and in the manufacture of fertilizers, polymers, and specialty chemicals. The growth in the worldwide chemical production especially in Asia-Pacific has increased the demand with more attention on high-purity gases to meet the performance-critical applications. Also, the tightening of environmental laws and the transition to the production of chemicals with the goal of sustainability have encouraged increased usage of industrial gases in the processes with the purpose of achieving a decrease in emissions and an increase in efficiency. All these make the chemicals industry a solid end-user of the industrial gases market

REGION

North America leads in industrial gas consumption, while Asia Pacific emerges as the fastest-growing market

In 2024, North America accounted for the largest share in the industrial gases, driven by the developed industrial base in the region, strong healthcare, and well-established chemical and manufacturing industries. The demand of medical oxygen in hospitals is high, and the gases such as nitrogen, hydrogen, and argon are widely used in chemical production, metal fabrication, and electronic manufacturing, which has strengthened the leading role in the region. The availability of major industrial gas manufacturers, which have strong distribution networks and technological potential has enhanced the stability in the market and reliability in the supply. Comparatively, Asia Pacific will be the fastest-growing market in the forecast period fueled by the rapid industrialization, growing chemical and pharmaceutical production, and urbanization. Increasing investments in energy and steel sectors and electronic sectors as well as increasing infrastructure in healthcare are stimulating industrial gas demand in the region. Moreover, the government projects to enhance clean energy and efficiency of industries are enhancing the demand of high purity gases, which makes Asia Pacific a hot development center in the world industrial gases market

Industrial Gases Market: COMPANY EVALUATION MATRIX

The industrial gases market matrix shows that Linde Plc (Star) is a strong player with the market presence and broader network of operations that allow the company to impact the key spheres, including healthcare, chemicals, male fabrication, and energy sectors. Ellenbarrie Industrial Gases Ltd (Emerging Leader) is on the rise with new gas solutions and is concerned with the reliability of supply, technological effectiveness and strategic alliance. Although Linde supports its leading position by the well-established production capacity, global distribution system, and diversified portfolio of end-use, Ellenbarrie shows a potential of significant growth and operational differentiation that would put the company in the position of advancing to the leaders quadrant. Other competitors in pervasive players and participants quadrants have emerging capabilities and niche-based strategies especially in regional supply and specialty gases, which may redefine competitive forces as well as market share allocation over the next several years

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 94.03Billion |

| Market Forecast in 2030 (value) | USD 126.53 Billion |

| Growth Rate | CAGR of 5.1% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered | • By Type: Oxygen, Nitrogen, Carbon Dioxide, Hydrogen, Acetylene, Inert Gases, and Other Gases • By End-use Industry: Chemical, Electronics, Food & Beverages, Healthcare, Manufacturing, Metallurgy, Refining, and Other End-use Industries |

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Industrial Gases Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Industrial Nitrogen Market | • Detailed company profiles of Industrial Nitrogen competitors (financials, product portfolio) • Market segmentation by type (Oxygen, Nitrogen, Carbon Dioxide, Hydrogen, Acetylene, Inert Gases, Other Types) • Customer landscape mapping by end-use industry (Chemical, Electronics, Food & Beverages, Healthcare, Manufacturing, Metallurgy, Refining, other end-use industries) | • Identified & profiled 20+ Industrial Nitrogen companies • Track adoption trends in high-growth industries |

RECENT DEVELOPMENTS

- June 2025 : Air?Liquide signed a long-term gas supply agreement with VisionPower Semiconductor Manufacturing Company (VSMC) on June?2,?2025. Under the deal, Air?Liquide committed to investing approximately €70?million (USD 75.7 million) to build, own, and operate a new industrial gas production facility in Singapore

- June 2025 : Linde PLC announced plans to significantly increase its supply of industrial gases to Samsung at its semiconductor manufacturing facilities in South Korea

- February 2025 : Air?Liquide announced it had launched a major project with TotalEnergies to support European decarbonization. The companies committed over €1?billion to two large-scale electrolyzer projects: a 200?MW “ELYgator” unit in Rotterdam and a 250?MW plant in Zeeland through a new 50/50 joint venture

- July 2024 : Messer SE & Co. KGaA partnered with the Düren district to create a green hydrogen plant through the newly established HyDN GmbH. The facility will produce green hydrogen using renewable energy and aid regional decarbonization efforts

- October 2023 : Air Products & Chemicals, Inc. signed an agreement with Aers Energy to develop a multi-fuel, hydrogen refuelling station for trucks in Belgium

Table of Contents

Methodology

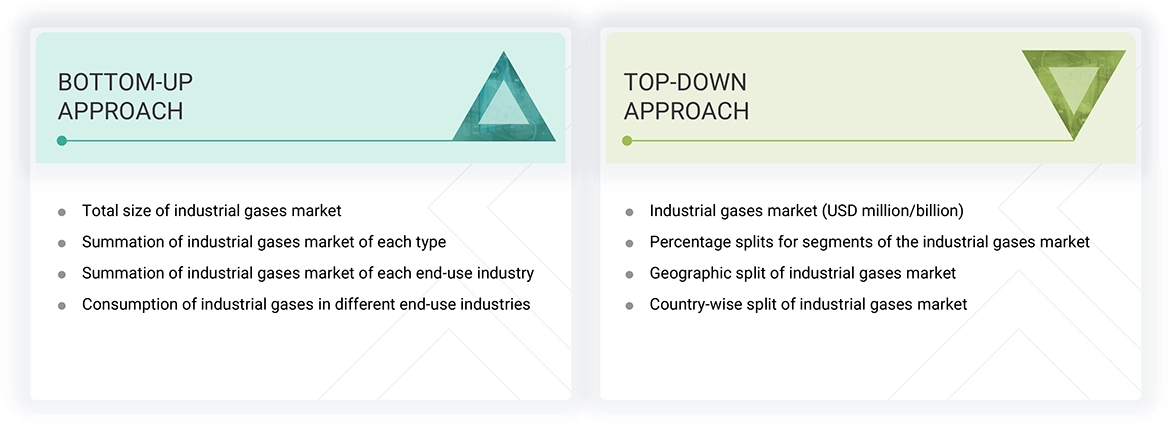

The study involved four key activities to estimate the current global size of the industrial gases market. Extensive secondary research was conducted to collect information on the market, its peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizes with industry experts across the entire industrial gases value chain through primary research. Both the top-down and bottom-up methods were used to estimate the overall market size. Following that, market segmentation and data triangulation techniques were applied to determine the size of various segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Business Standard, Bloomberg, World Bank, and Factiva were used to identify and gather information for this study on the industrial gases market. These sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

Various primary sources from the supply and demand sides of the industrial gases market were interviewed to gather qualitative and quantitative information. The primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and other key executives from leading companies and organizations operating in the industrial gases industry. The breakdown of the profiles of primary respondents is as follows:

The following is a breakdown of the primary respondents:

Notes: Companies are classified based on their revenue–Tier 1 = >USD 7 billion, Tier 2 = USD 500 million to USD 7 billion, and Tier 3 = < USD 500 million.

Other designations include sales, marketing, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the global size of the industrial gases market. These methods were also extensively employed to determine the size of various related market segments. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size were determined through primary and secondary research methods.

- All percentage shares, splits, and breakdowns were calculated using secondary sources and verified through primary sources.

- All relevant parameters influencing the markets covered in this study were considered, analyzed in detail, verified through primary research, and used to derive both final quantitative and qualitative data.

- The research includes an evaluation of reports, reviews, and newsletters of key industry players, along with extensive interviews with key officials, such as directors and marketing executives.

Data Triangulation

After estimating the overall market size using the process described above, the total market was divided into several segments and sub-segments. Data triangulation and market breakdown methods were used, where applicable, to complete the overall market analysis and determine accurate statistics for all segments and sub-segments of the industrial gases market. The data was triangulated by examining various factors and trends from both the demand and supply sides. Additionally, the market size was validated using both top-down and bottom-up approaches and confirmed through primary interviews. Therefore, three sources were used for each data segment—top-down approach, bottom-up approach, and expert interviews. The data was considered accurate when the values from all three sources matched.

Market Definition

Industrial gases are gaseous substances created and used for various industrial and commercial activities. Much of the manufacturing and delivery of industrial gases involves large-scale processes, typically through air separation, chemical reactions, or purifying natural gas sources and then separating the desired gases. Industrial gases can be delivered compressed, in liquid form, or cryogenically. They are vital to many sectors, supporting production efficiency, quality, and innovation. The delivery, handling, and supply of industrial gases require specialized equipment, infrastructure, and processes, along with strict safety, purity, and quality standards. Industrial gases play a crucial role in modern industry, enabling technological advancement, supporting economic growth, and powering various sectors worldwide.

Stakeholders

- Industrial gases producers

- Industrial gases distributors

- Raw material suppliers

- Research & development entities

- Industry associations and regulatory bodies

- End users

Report Objectives

- To estimate and forecast the industrial gases market, in terms of value

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To define, describe, and forecast the market size based on type, end-use industry, and region

- To forecast the market size along with segments and submarkets, in key regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South America, along with their key countries

- To strategically analyze micromarkets for individual growth trends, prospects, and their contribution to the total market

- To analyze growth opportunities in the market for stakeholders and provide details on the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments, such as mergers & acquisitions, expansions & investments, and agreements in the industrial gases market

Key Questions Addressed by the Report

What are the major drivers influencing the growth of the industrial gases market?

The major drivers influencing the growth of the industrial gases market are the growing demand from the electronics industry and green hydrogen scale-up.

What are the major challenges in the industrial gases market?

Hazardous material handling, safety regulations, and geopolitical disruptions in critical supply regions pose challenges for the industrial gases market.

What are the restraining factors in the industrial gases market?

Strict regulatory compliance and the capex-heavy nature of gas production and storage facilities restrain the industrial gases market.

What is the key opportunity in the industrial gases market?

Advanced semiconductor manufacturing expansion presents significant opportunities for the industrial gases market.

Who are the key players in the industrial gases market?

Air Liquide (France), Linde PLC (UK), Air Products and Chemicals, Inc. (US), Messer SE & Co. KGaA (Germany), NIPPON SANSO HOLDINGS CORPORATION (Japan), BASF SE (Germany), Bhoruka Specialty Gases Pvt Ltd (India), Ellenbarrie Industrial Gases Limited (India), Gruppo SIAD (Italy), Iwatani Corporation (Japan), AIR WATER INC (Japan), and AirPower Technologies Limited (China).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Industrial Gases Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Industrial Gases Market