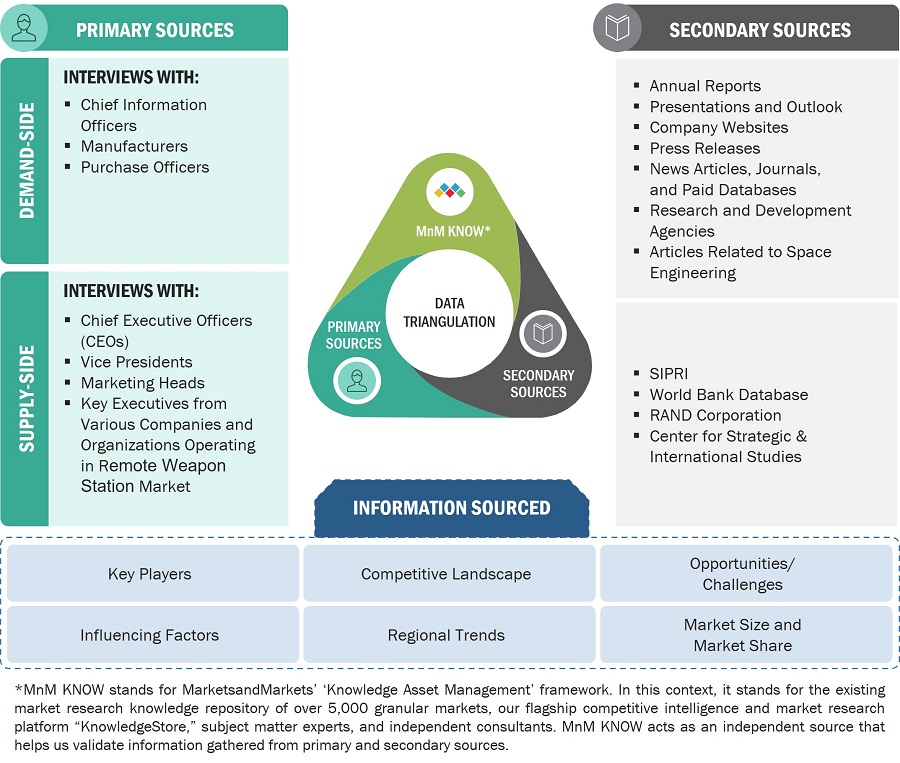

The research study conducted on the hypersonic weapons market involved extensive use of secondary sources, including directories, databases of articles, journals on hypersonic weapons, company newsletters, and information portals such as Hoover’s, Bloomberg, and Factiva to identify and collect information useful for this extensive, technical, market-oriented, and commercial study of the hypersonic weapons market. Primary sources are several industry experts from the core and related industries, alliances, organizations, Original Equipment Manufacturers (OEMs), vendors, suppliers, and technology developers. These sources relate to all segments of the value chain of the hypersonic weapons market.

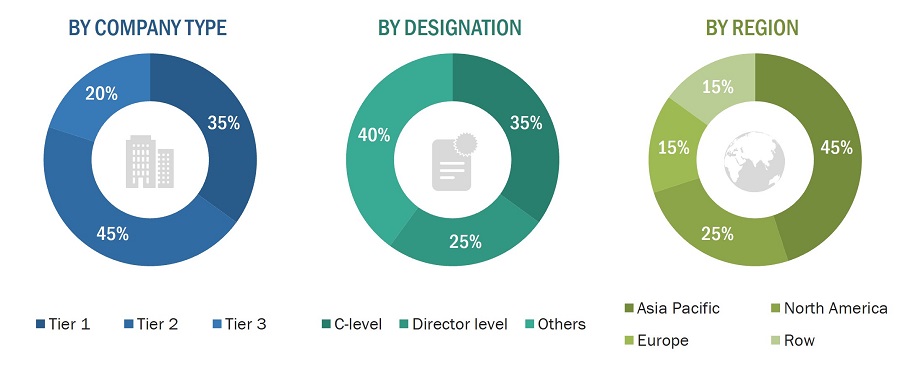

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among others, to obtain and verify critical qualitative and quantitative information and to assess prospects of the market.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information for this study on the hypersonic weapons market. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers and certified publications; articles from recognized authors; manufacturer's associations; directories; and databases. Secondary research was mainly used to obtain key information about the supply chain of the hypersonic weapons industry, the monetary chain of the market, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted to obtain qualitative and quantitative information for this report on the hypersonic weapons market. Several primary interviews were conducted with the market experts from both demand- and supply-side across major regions, namely, North America, Europe, Asia Pacific, the Middle East, Latin America, and Africa. Primary sources from the supply-side included industry experts such as business development managers, sales heads, technology and innovation directors, and related key executives from various key companies and organizations operating in the hypersonic weapons market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

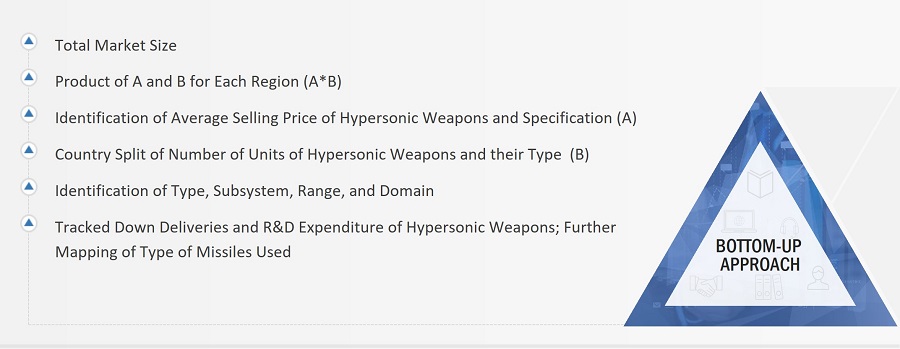

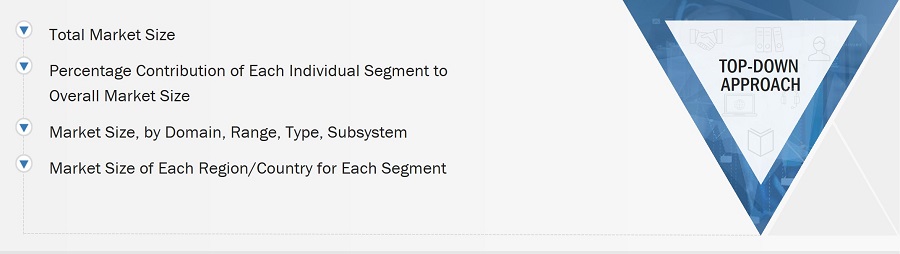

Both the top-down and bottom-up approaches were used to estimate and validate the size of the hypersonic weapons market. The following figure represents the overall market size estimation process employed for this study on the market.

The research methodology used to estimate the market size included the following details:

-

Secondary research identified key players in the hypersonic weapons market, and their market share was determined through primary and secondary research. This included a study of annual and financial reports of top market players and extensive interviews of leaders such as Chief Executive Officers (CEOs), directors, and marketing executives of leading companies operating in the market.

-

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

-

All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the hypersonic weapons market.

This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Market size estimation methodology: Bottom-up Approach

Market size estimation methodology: Top-Down Approach

In the top-down approach, the overall size of the hypersonic weapons market was used to estimate the size of individual markets (mentioned in the market segmentation) through percentage splits obtained from secondary and primary research. The size of the most appropriate, immediate parent market was used to implement the top-down approach to calculate the sizes of specific market segments. The approach was also implemented to validate the revenues obtained for various market segments.

Market share was estimated for each company to verify the revenue share used earlier in the bottom-up approach. With the data triangulation procedure and data validation through primary, this study determined and confirmed the overall size of the parent market and each market segment. The following figure shows the overall market size estimation process employed for this study.

The overall market size derived through the primary-based approach was used in the top-down procedure to estimate the market size of the hyperspectral imaging systems market by product, technology, and application. The percentage contributions of each region were derived and evaluated to arrive at the market size for each country. Further percentage splits were applied to derive country-level markets in each region. Percentage contributions of the respective markets were obtained based on extensive secondary research and insights from industry experts.

Data Triangulation

After arriving at the total market size, the market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated market numbers for hypersonic weapons segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market size was also validated using the top-down and bottom-up approaches.

The following figure indicates the market breakdown structure and the data triangulation procedure implemented in the market engineering process used to develop this report.

Market Definition

Hypersonic weapons are advanced missiles or other types of projectiles that can travel at speeds exceeding Mach 5, or five times the speed of sound (approximately 3,800 miles per hour or 6,100 kilometres per hour) or more. These weapons use advanced technologies, such as scramjet engines and specialized materials, to achieve their high speeds and maneuverability.

Hypersonic weapons are designed to be highly maneuverable and difficult to detect and intercept, making them potentially effective in a variety of military scenarios. They have the ability to hit targets with high accuracy and very high speed, making them capable of delivering gigantic amounts of kinetic energy. The potential applications for hypersonic weapons are vast, and they can be used in various military scenarios, including long-range precision strikes, anti-ship warfare, and anti-aircraft defense. Hypersonic weapons pose a significant challenge to radar systems due to their high speeds and maneuverability. Traditional radar systems are designed to detect and track objects traveling at subsonic or supersonic speeds, making it difficult to detect hypersonic weapons. Hypersonic weapons are currently in demand and are considered a significant area of investment and research for several countries around the world, particularly in the field of military technology.

Key Stakeholders

-

Senior Management

-

End User

-

Finance/Procurement Department

-

R&D Department

-

Ministry of Defense

-

Regulatory Bodies

-

R&D Companies

-

Providers of hypersonic weapons Subsystem and Sub-components

-

Armed Forces

-

Intelligence Agencies

Report Objectives

-

To define, describe, and forecast the size of the hypersonic weapons market based on type, domain, range, subsystem, and region from 2023 to 2030.

-

To forecast the size of various segments of the market with respect to major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW), which comprises the Middle East & Africa, Latin America

-

To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the hypersonic weapons market across the globe.

-

To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the hypersonic weapons market.

-

To analyze opportunities for stakeholders in the market by identifying key market trends

-

To analyze competitive developments such as contracts, acquisitions and expansions, agreements, joint ventures and partnerships, new product launches, and Research & Development (R&D) activities in the hypersonic weapons market.

-

To provide a detailed competitive landscape of the -market, in addition to an analysis of business and corporate strategies adopted by leading market players.

-

To strategically profile key market players and comprehensively analyze their core competencies2.

1. Micro markets refer to further segments and subsegments of the hypersonic weapons market included in the report.

2. Core competencies of the companies were captured in terms of their key developments and strategies adopted by them to sustain their position in the market.

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

-

Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

-

Further breakdown of the market segments at country-level

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Hypersonic Weapons, Missiles, and Glide Vehicles Market