HVAC Insulation Market

HVAC Insulation Market by Product Type (Pipes, Ducts), Material Type (Mineral Wool (Glass Wool, Stone Wool)), Plastic Foam (Phenolic, Elastomeric Foam), End-use Industry (Commercial, Residential, Industrial), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

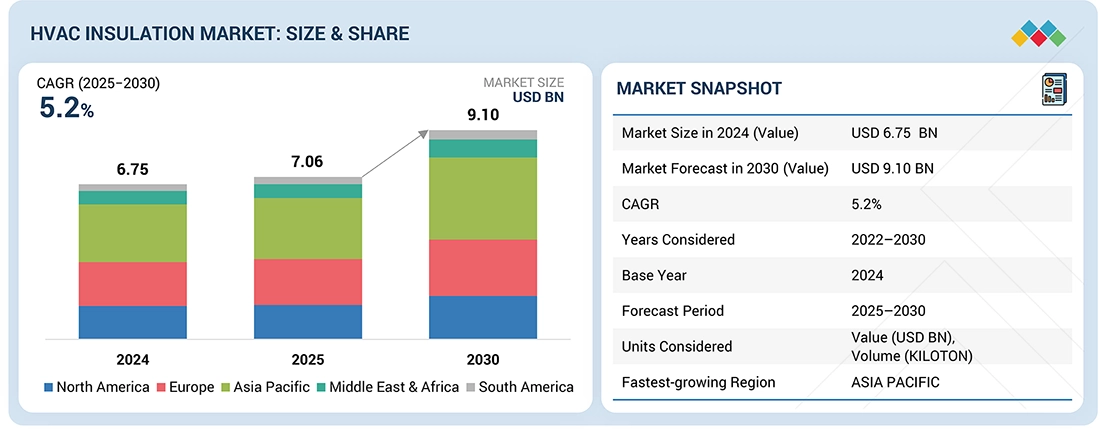

The HVAC insulation market is projected to reach USD 9.10 billion by 2030 from USD 7.06 billion in 2025, at a CAGR of 5.2% from 2025 to 2030. The global HVAC insulation market is growing due to rising energy efficiency standards and the push for sustainable, green buildings. Rapid urbanization and infrastructure development, especially in emerging economies, are fueling demand. Additionally, climate change and the need for optimized indoor comfort are accelerating HVAC insulation adoption worldwide.

KEY TAKEAWAYS

-

BY MATERIAL TYPEThe HVAC insulation market by material type includes mineral wool, & plastic foam. Plastic foam leads the HVAC insulation market by material type due to its excellent thermal resistance, lightweight properties, and ease of installation. Materials like polyurethane and polystyrene foams offer superior energy efficiency and moisture resistance. Their versatility and cost-effectiveness make them the preferred choice across residential, commercial, and industrial HVAC applications

-

BY PRODUCT TYPEThe HVAC insulation market by product type includes ducts, and pipes. Duct insulation is the leading product type in the HVAC insulation market due to its key role in energy efficiency and indoor air quality.

-

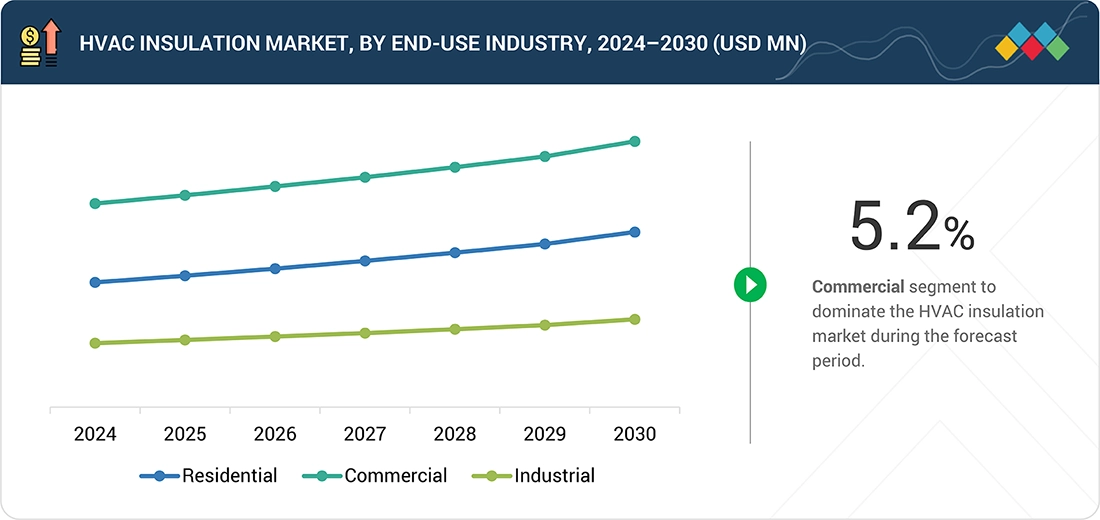

BY END-USE INDUSTRYThe HVAC insulation market by end-use industry includes industrial, residential, and commercial. The commercial sector leads the HVAC insulation market as the largest end-use segment, driven by the growing demand for energy-efficient buildings and large-scale HVAC systems. Offices, retail spaces, and industrial facilities require extensive insulation to maintain temperature control and reduce energy costs. This strong demand positions commercial applications as the primary growth driver in the market.

-

BY REGIONThe HVAC insulation market covers Europe, North America, Asia Pacific, South America, the Middle East, and Africa. APAC leads the HVAC insulation market due to rapid urbanization, industrialization, and increasing construction of commercial and residential buildings. Rising energy efficiency regulations, government initiatives for green buildings, and growing HVAC adoption in emerging economies like China and India further boost demand.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. Owens Corning Corporation (US), Saint-Gobain SA (France), Knauf Group (US), Kingspan Group PLC (Ireland), Rockwool Group (Denmark), Armacell International SA (Germany), Johns Manville (US), Ursa Insulation S.A. (Spain), Huntsman Corporation (US), Covestro (Germany), L’ISOLANTE K-FLEX SPA (Italy), Union Foam SPA (Italy), Arabian Fiberglass Insulation Company Ltd. (Saudi Arabia), Glassrock Insulation Company (Egypt), and Visionary Industrial Insulation (US). are some of the major players in the HVAC insulation market.

The global HVAC insulation market is expanding as stricter energy efficiency norms and sustainability initiatives drive adoption across building and industrial sectors. Rapid urbanization and infrastructure growth further boost demand for efficient climate control solutions. In the APAC region, rising construction activity, smart city projects, and government focus on green infrastructure are making it the fastest-growing market for HVAC insulation

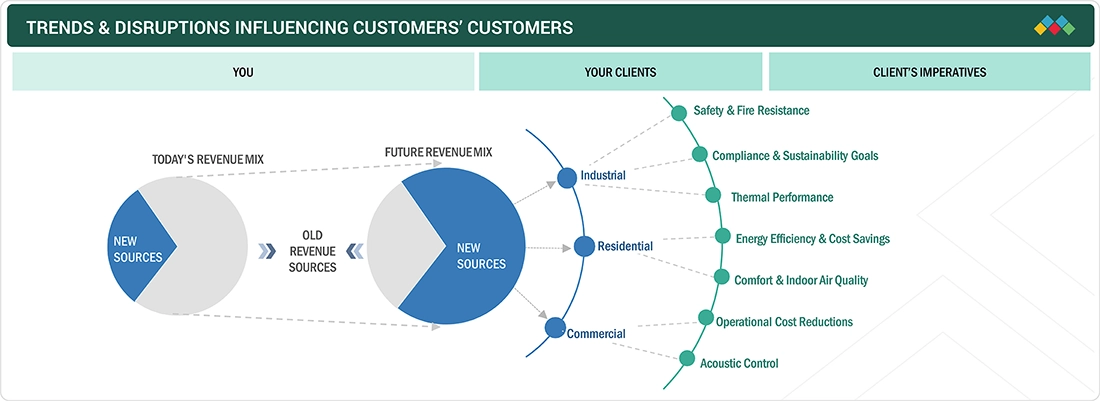

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in customer trends or disruptions impact consumers’ businesses. These shifts impact the revenues of end users. Consequently, the revenue impact on end users is expected to affect the revenues of HVAC insulation products suppliers, which, in turn, impacts the revenues of HVAC insulation products manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising growth in construction industry

-

Stringent energy efficiency regulations and government support

Level

-

Lack of awareness about energy efficiency

Level

-

Innovation in eco-friendly insulation materials

-

Technological advancements in HVAC systems

Level

-

Requirement of skilled workforce to hinder market growth

-

Fire safety & toxicity concerns

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver:Rising growth in construction industry.

The increasing expansion in the construction sector is one of the key drivers driving the HVAC insulation market. With residential, commercial, and industrial infrastructure continuing to grow, there is a corresponding surge in demand for efficient heating, ventilation, and air conditioning systems. New building & construction projects, especially in the emerging countries such as India, China, are focusing more on energy efficiency and sustainability, necessitating a high demand for insulation to control energy usage and preserve indoor comfort. HVAC insulation assists in reducing thermal losses, increasing the efficiency of the system, and lowering costs—a consideration for both new construction and retrofitting endeavors. Governments and regulating authorities across the globe are also enforcing strict building codes and energy standards that require thermal insulation as a necessity in HVAC systems. This regulatory impetus is particularly visible in markets like North America, Europe, and Asia-Pacific, where green building certifications like LEED and BREEAM are becoming increasingly popular. Furthermore, population growth and urbanization are contributing to increased high-rise structures and huge commercial areas needing sophisticated HVAC systems with high insulation. The shift towards sustainable and smart buildings further adds to the importance of HVAC insulation. Generally, the large construction industry serves as a pillar development driver, directly influencing the growth of the HVAC insulation industry in both developing and developed regions

Restraint:Lack of awareness about energy efficiency

One of the strict limitations among building owners, contractors, end-users, and in the HVAC insulation market is ignorance of the energy efficiency, which is universally common in under developing and developing countries. The majority of building owners, contractors, and end-users have no idea about cost savings through efficient HVAC insulation in the long run because either they are not aware of it or don't consider it during construction as it doesn't have suitable knowledge or they have a smaller budget plan. In some sectors, insulation is still not treated as an add-on or secondary element but rather as a core element of energy-efficient design. This is exacerbated by a lack of stricter policy requirements or incentives in some places, which hinders the adoption of energy-saving technologies. Additionally, lack of technical expertise or ignorance will discourage stakeholders from making rational decisions on insulation products and levels of installation. Therefore, the increase in the market for HVAC insulation is hindered even though there are certain economic and environmental advantages it has to offer. To overcome this barrier, greater emphasis needs to be given to education, public campaigns, and government programs focussed on the importance of HVAC insulation to reduce energy usage and increase the efficiency of a building

Opportunity: Innovation in eco-friendly insulation materials

Green innovations in insulation materials offers a very high growth potential for the HVAC insulation segment. As there is growing attention to sustainability and environmental responsibility, there is a much greater need for effective insulation that is not only energy-efficient but also environmentally friendly. Traditional insulation materials such as fiberglass and foam are effective but are often beset by environmental problems on manufacturing, waste management. As a reaction, producers are investing funds into the production of green, alternative substitutes made from recycled, biodegradable, or low-polluting materials. Materials like plant foams, aerogels, sheep's wool, recycled denim, and cellulose are increasingly being accepted due to their low environmental footprint, toxicity, and comparable thermal performance. They meet green building standards like LEED and BREEAM, which focus on green materials and energy efficiency. With tightening regulations and increasing consumer sensitivity towards the environment, the demand for such materials should grow tremendously. This trend offers new channels of commerce and allows HVAC insulation manufacturers to differentiate products, service green building developments, and accommodate modified building codes. In addition, the utilization of sustainable insulation products allows for additional applications such as carbon neutrality and circular economy conduct, strategic priorities for long-term competitiveness in the market and for ethical industry growth

Challenge:Requirement of skilled workforce to hinder market growth

The need for a trained workforce is the key challenge holding back the development of the HVAC insulation market. Effective installation of HVAC insulation is essential for energy efficiency, thermal comfort, and system performance. It necessitates trained professionals with knowledge of insulation materials, system designs, and industry standards. But most parts of the world, particularly developing countries, are plagued by a lack of skilled workers, whose improper installation causes thermal leaks, lessens the effectiveness of insulation, and incurs more energy expenses. This not only negates the use of insulation but also results in increased operating costs and more maintenance work, deterring end-users from spending on quality insulation systems. The challenge is also exacerbated by the growing use of complex and eco-friendly insulation products that require specialized expertise for proper handling and implementation. Without sufficient training, workers will not be able to meet energy codes as well as safety regulations, causing compliance issues and undermining the adoption of new solutions. Also, the lack of training programs or certifications in the majority of the globe is a limitation in preparing a harmonized skilled workforce to implement big projects. Delay in project implementation arises due to the shortage of skills, rising labor expenses, and limiting market growth. Solution to this scenario through training, certification programs, and partnership with industry is essential in order to attain the greatest potential of the HVAC insulation market

HVAC Insulation Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

HVAC insulation used in large commercial complexes, industrial facilities, and smart infrastructure projects to ensure energy-efficient temperature control and reduced HVAC load | Reduces energy consumption and operating costs. |

|

Insulation applied in store HVAC systems and distribution centers to maintain stable indoor climates and efficient cooling/heating performance | Lowers utility bills through improved energy efficiency. |

|

Used in large-scale warehouses and data centers to control temperature fluctuations and reduce cooling demand in server and storage areas | Improves cooling efficiency and equipment lifespan |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The HVAC insulation ecosystem analysis involves identifying and analyzing interconnected relationships among various stakeholders, including raw material supplies, equipment suppliers, manufacturers, distributors, and end users. The raw material suppliers provide mineral wool, foam, fiberglass and others to HVAC insulation manufacturers. The distributors and suppliers establish contact between the manufacturing companies and end users to streamline the supply chain, increasing operational efficiency and profitability.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

HVAC Insulation Market, By End-use Industry

The residential end-use segment is fastest growing end-use segment for the insulation market, spurred by increasing demand for energy-efficient housing, indoor comfort, and the rising use of sustainable building practices. With increasing urbanization and expansion of housing development worldwide, particularly in emerging economies such as China, India, there is an increased emphasis on optimized performance of HVAC in homes. As energy conservation becomes popular and energy prices rise, owners and builders are looking for safe & reliable insulation materials to comply with stringent regulatory requirements and green building ratings. Governments and different organizations in different parts of the world are also instituting various mandates and different incentive schemes to promote energy-efficient homes, further propelling demand for HVAC insulation for residential applications. Also, insulating materials utilized in this market segment—like plastic foam, mineral wool, and fiberglass—are being designed to provide easy installation, durability over the long term, and affordability. With more widespread adoption of smart homes and green construction, the residential industry will continue to play a central role in driving HVAC insulation industry growth

HVAC Insulation Market, By Material Type

Mineral wool is also emerging as one of the fastest-evolving products in the HVAC insulation market because of its improved thermal, sound, and fire-resistant properties. Based on natural or synthetic minerals such as basalt, slag, or glass, mineral wool has excellent insulation qualities, which render it extremely efficient in terms of offering temperature control and reducing energy loss in HVAC systems. Its fire-non-burning nature and resistance to high temperature make it particularly suited to commercial and industrial applications where fire prevention is the main concern. In addition to its thermal performance, mineral wool has excellent soundproofing characteristics as well, and it is thus ideal for use in buildings that require temperature regulation and also noise reduction, such as schools, hospitals, and offices. The product resists moisture and will not support microbial growth, which provides better indoor air quality and enhanced long-term system performance. The growing demand for environmentally friendly and energy-efficient buildings, especially in regions with strict environmental regulations like Europe and North American , is also driving the adoption of mineral wool. With stringent building codes continuing their emphasis on energy conservation and fire resistance, mineral wool is increasingly gaining popularity

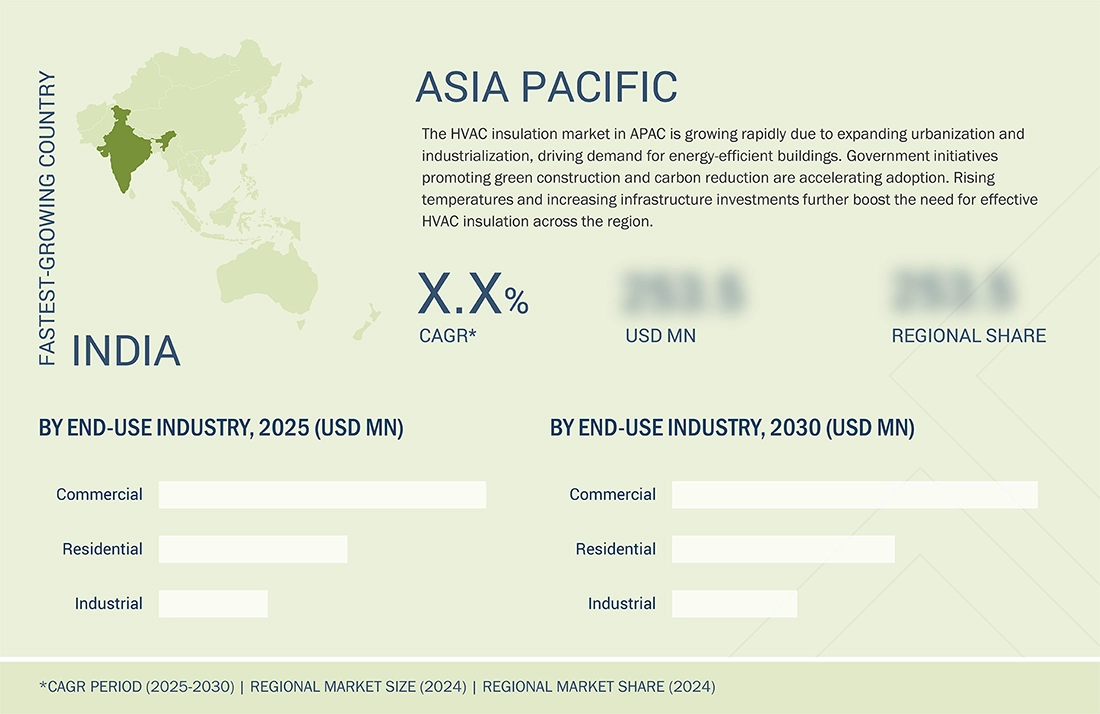

REGION

Asia Pacifi to be fastest-growing region in global medical filtration market during forecast period

The Asia-Pacific is the most rapidly expanding and largest market for HVAC insulation, spurred by high-speed urbanization, robust economic growth, and a growing construction industry in key economies. China, India, Japan, and South Korea are spearheading this growth, underpinned by rising investment in infrastructure, growth in demand for energy-efficient buildings, and government policies aimed at sustainability and climate resilience. The population explosion and growing middle class of the region are driving demand for residential and commercial buildings, each one of which needs efficient HVAC systems to provide comfort indoors and efficiency in terms of energy. With increasing awareness of energy conservation and sustainable building practices, insulation is becoming a necessary part of new buildings and retrofitting projects. The hot and humid weather in most areas of region also heightens the necessity for effective HVAC insulation to minimize cooling loads as well as enhance system performance. Regulations & government policies encouraging energy conservation, coupled with various incentives for green buildings, are further propelling the usage of HVAC insulation products. Growth & expansion in manufacturing, logistics, and data centers, are also increases the demand for HVAC insulation. With robust economic growth, a huge and expanding base of construction activity, and favourable policy environments, Asia-Pacific will continue to be the leading force in the worldwide HVAC insulation market in the foreseeable future

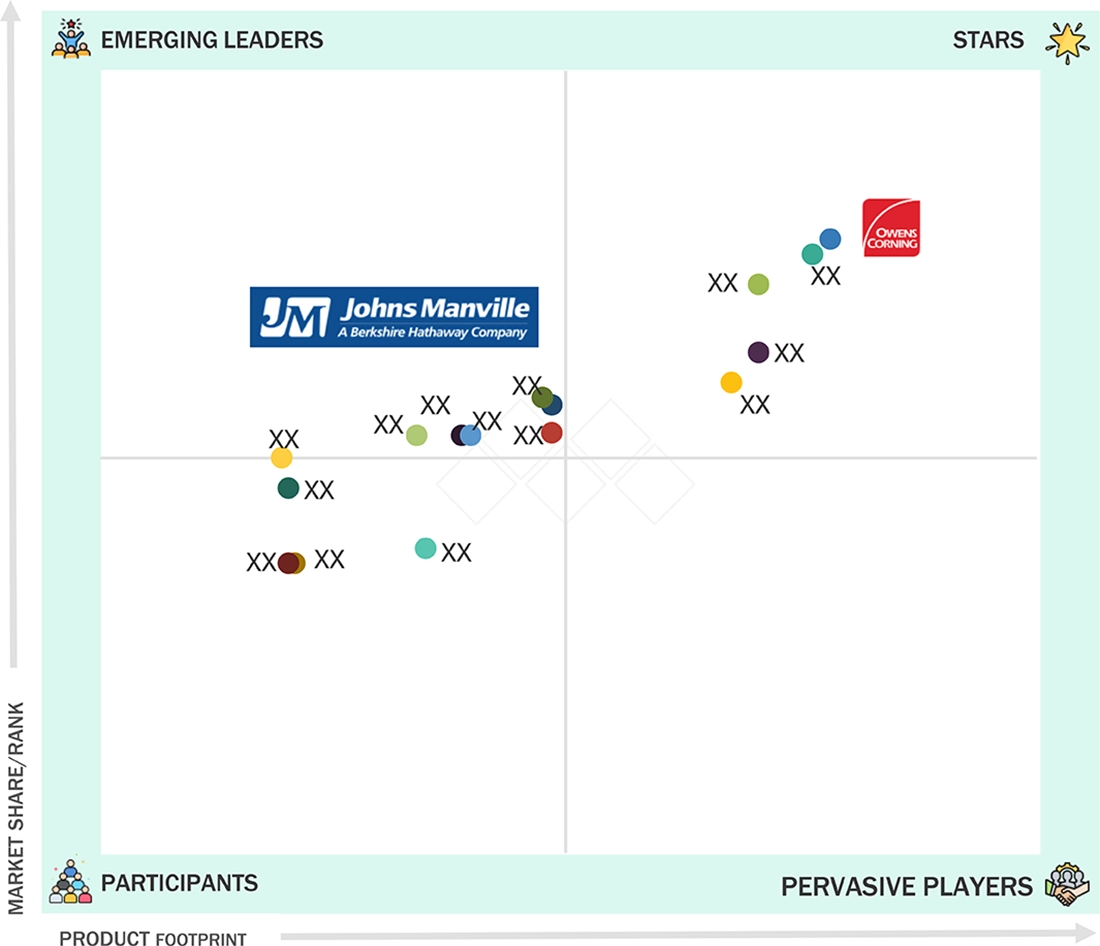

HVAC Insulation Market: COMPANY EVALUATION MATRIX

In the HVAC insulation market matrix, Owens Corning (Star), a US based company, leads the market through its high-quality HVAC insulation products, which find extensive applications in various end-use industries such as industrial, commercial and others.Johns Manville (Emerging Leader) is gaining traction with its technological advancements in HVAC insulation.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 6.75 Billion |

| Market Forecast in 2030 (Value) | USD 9.10 Billion |

| Growth Rate | CAGR of 5.2 % from 2025-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

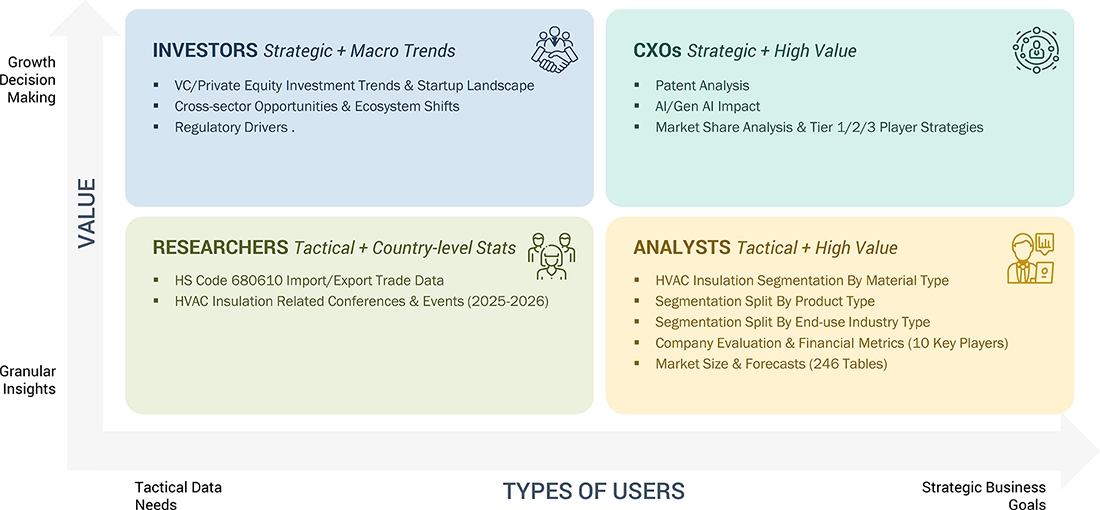

WHAT IS IN IT FOR YOU: HVAC Insulation Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading HVAC insulation Products Supplier |

|

Supported go-to-market strategy and positioning vs competitors |

| Country-level insights for high-growth regions | Provided detailed market sizing and forecasts for theNorth America , Asia Pacific market | Helped the client identify region-specific growth hotspots and investment opportunities |

| Evaluate regulatory compliance for new market entry | Compiled local emission, safety & efficiency standards per country | Ensured smooth market entry and minimized legal risks |

RECENT DEVELOPMENTS

- December 2024 : Rockwool has announced an investment of over USD 100 million to add a new production line at its existing facility in Marshall County, Mississippi. This expansion is aimed at strengthening ROCKWOOL’s position in the North American industrial insulation market, particularly to meet the growing demand from the Gulf of Mexico’s process industries

- August 2023 : Saint-Gobain acquired U.P. Twiga, a major Indian manufacturer of glass wool insulation. The deal strengthens ISOVER’s HVAC market presence in India, enhancing production capabilities and distribution reach in a fast-growing region

- August 2022 : Owens Corning announced the acquisition of Natural Polymers, LLC, a manufacturer of spray polyurethane foam insulation for building and construction applications, based in Cortland, Illinois

- May 2022 : Rockwool North America begun 460,000 sq. Ft. commercial production of stone wool insulation products at the US manufacturing facility, located in Jefferson County, West Virginia

- Feburary 2022 : Saint-Gobain acquired Rockwool India. Rockwool India operates two manufacturing facilities, one in Hyderabad and one in Silvassa, with a combined annual capacity of 50,000 MT.

Table of Contents

Methodology

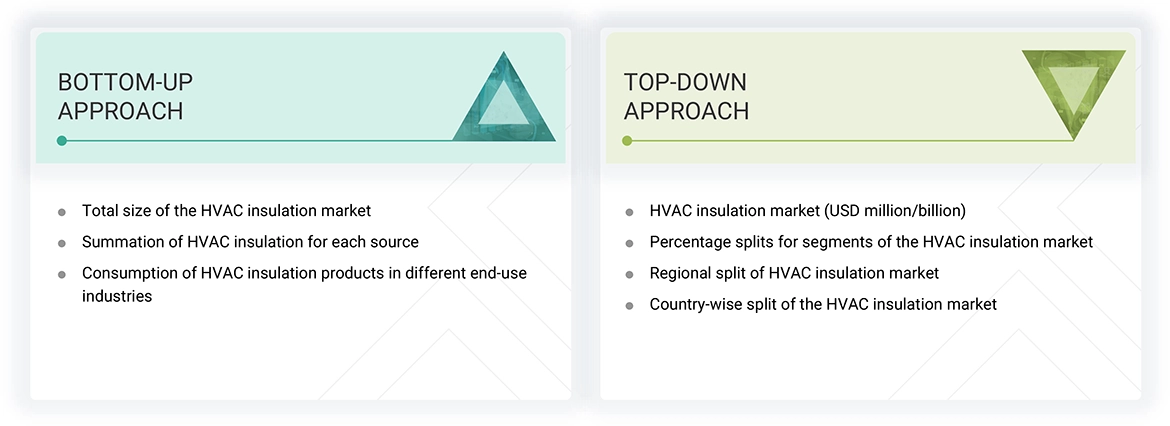

The study involved four major activities for estimating the current size of the global HVAC insulation market. Exhaustive secondary research was conducted to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of HVAC insulation through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the HVAC insulation market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred, to identify and collect information for this study on the HVAC insulation market. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; regulatory bodies, trade directories, and databases.

Primary Research

The HVAC insulation market comprises several stakeholders in the supply chain, which include raw material suppliers, equipment suppliers, distributors, end-product manufacturers, buyers, and regulatory organizations. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the HVAC insulation market. Primary sources from the supply side include associations and institutions involved in the HVAC insulation market, key opinion leaders, and processing players.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up and top-down approaches have been used to estimate the HVAC insulation market by material type, product type, end-use industry and region. The research methodology used to calculate the market size includes the following steps:

- The key players in the industry and markets were identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included studying reports, reviews, and newsletters of top market players and extensive interviews with leaders such as directors and marketing executives to obtain opinions.

The following figure illustrates the overall market size estimation process employed for this study.

Data Triangulation

After arriving at the overall size of the HVAC insulation market from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

HVAC insulation refers to the range of materials and solutions used to insulate heating, ventilation, and air conditioning (HVAC) systems to prevent heat loss or gain, enhance energy efficiency, and maintain desired indoor temperatures. It includes insulation for ducts, pipes, chillers, and other system components to optimize thermal performance, reduce energy consumption, minimize noise, and ensure occupant comfort. The HVAC insulation market encompasses products such as fiberglass, mineral wool, foam, elastomeric materials, and eco-friendly alternatives, used across residential, commercial, and industrial sectors. This market is driven by factors such as rising energy costs, stringent building codes, sustainability goals, and the growing demand for efficient and environmentally friendly building systems.

Stakeholders

- HVAC Insulation Manufacturers

- Raw Material Suppliers

- Equipment Suppliers

- Regulatory Bodies and Government Agencies

- Distributors and Suppliers

- End-Use Industries

- Associations and Industrial Bodies

Report Objectives

- To define, describe, and forecast the size of the HVAC insulation market in terms of value and volume

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To forecast the market size based on material type, product type, end-use industry, and region

- To forecast the market size for the five main regions—North America, Europe, Asia Pacific (APAC), South America, and the Middle East & Africa (MEA),—along with their key countries

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for the market leaders

- To strategically profile leading players and comprehensively analyze their key developments such as product launches, expansions, and deals in the HVAC insulation market

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To study the impact of AI/Gen AI on the market under study, along with the macroeconomic outlook

Key Questions Addressed by the Report

What primary factor is propelling the growth of the HVAC insulation market?

Rising growth in construction industry and industrial expansion are the primary factors propelling the HVAC insulation market.

How is the HVAC insulation market segmented?

This report segments the HVAC insulation market based on material type, product type, end-use industry, and region.

What are the major challenges in the HVAC insulation market?

Requirement of skilled workforce is the major challenge in the market.

What are the major opportunities in the HVAC insulation market?

Innovation in eco-friendly materials and growth in emerging regions are the major opportunities in the HVAC insulation market.

Which region has the largest demand?

Asia Pacific region stands out with the highest demand for HVAC insulation products.

Who are the major manufacturers of HVAC insulation products?

Major manufacturers in the HVAC insulation market are Owens Corning Corporation (US), Saint-Gobain SA (France), Knauf Group (US), Kingspan Group PLC (Ireland), Rockwool Group (Denmark), Armacell International SA (Germany), Johns Manville (US), Ursa Insulation S.A. (Spain), Huntsman Corporation (US), Covestro (Germany), L’ISOLANTE K-FLEX SPA (Italy), Union Foam SPA (Italy), Arabian Fiberglass Insulation Company Ltd. (Saudi Arabia).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the HVAC Insulation Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in HVAC Insulation Market