MEMS Sensor Market for Automotive by Type (Inertial Sensor, Microphone, & Pressure Sensor), Application (ADAS, ECU, ESC, HVAC, Safety & Security, In-Car Navigation, OIS Camera, Microphone in Cabin, & TPMS), & Geography - Analysis & Forecast (2014 - 2020)

The increasing need for safety and security for the automobiles applications has increased the demand for automotive MEMS sensors. MEMS sensors are also called as micromachines, as they utilize the technology which is being used for very small devices. MEMS sensors bring out many advantages in the automobile industry. Safety in vehicles has become a major issue worldwide. The incorporation of MEMS sensors could be used in many applications likewise in vehicle navigation systems, rollover detection, and crash detection. The impact of automotive MEMS sensors is likely to be on electronic component manufacturers, automobile parts manufacturers, and end users. Governments of different countries have a keen interest in formulating the standards and regulations for the automotive MEMS sensor market.

This report is based on an in-depth research study on the automotive MEMS sensor market across the safety and security, advanced driver assistance, microphone in cabin, electronic stability control, and other automobile applications which consist of engine management system, oil pressure sensing and focus on the various types of emerging applications that are available commercially as well as the new market demand for the MEMS sensor market for automotive by 2020. The report provides the profiles of the major active companies in the market. The recent developments, adoption of technologies, and the agreements to strengthen the growth of this market are also briefly discussed. The report also provides the competitive landscapes of the key players, which indicate their growth strategies in terms of the automotive MEMS sensor market.

The report also presents the automotive MEMS sensor market dynamics such as the drivers, restraints, and opportunities. Apart from the in-depth view on market segmentation on the basis of components, applications, and geographies, the report also includes the critical market data and qualitative information for each type, along with the qualitative analysis such as the Porters five force analysis, value chain analysis, supply chain, and market breakdown analysis. The market is expected to reach $3.60 billion by 2020, at a CAGR of 4.7% between 2014 and 2020. The market covered under this report has been segmented as follows:

Market by type:

The automotive MEMS sensor market for automotive segmentation by type includes MEMS inertial sensors, MEMS microphone, and MEMS pressure sensor. The MEMS inertial sensor is further sub-segmented into MEMS accelerometer, inertial combo sensor, and MEMS gyroscope.

Market by application:

The MEMS sensor market for automotive by application is segmented on the basis of automotive applications. The major applications that are covered in the report are in advanced driver assistance system, electronic stability control, electronic control unit, heating, ventilation, and air conditioning system, safety and security, in-car navigation, OIS camera, microphone in cabin, tire pressure monitoring system, and others. Others consist of applications in engine management system, fuel injection systems, seat occupancy, peripheral pressure sensors, and oil pressure sensing. The others emerging applications are also expected to act as a good prospective for the market in the near future.

Market by geography:

The automotive MEMS sensor market for automotive by geography is divided into four major segments that include the Americas, Europe, Asia-Pacific, and the Rest of the World (RoW), and regional analysis is done further on the basis of countries.

Major players in this market include InvenSense, Inc. (U.S.), Analog Devices, Inc. (U.S.), Robert Bosch GmbH (Germany), General Electric Company (U.S.), Panasonic Corporation (Japan), Infineon Technologies AG (Germany), Sensata Technologies, Inc. (U.S.), Hitachi, Ltd. (Japan), Freescale Semiconductor, Inc. (U.S.), Harman International (U.S.), Murata Electronics Oy (Finland), STMicroelectronics (Switzerland), Freescale Semiconductor, Inc. (U.S.), and Delphi Automotive PLC (U.K.).

The MEMS technology is very well suited for producing micro machined actuators and sensors which could be used for combining signal processing capabilities on a single chip included within the same package. MEMS sensors are important components of the electronic systems used in the automobiles. The government regulations to provide safety, security, and reliability in the vehicles are acting as important factors for the growth of the MEMS sensor market for automotive. The automotive MEMS sensors help in improving the overall functionality of the vehicles by improving its stability and performance.

The MEMS sensors are important components of the electronic stability control system in the vehicles. This is because of its ability to determine whether the car is skidding and to check the stability of the vehicles. Many companies are engaged in providing advance technology products related to the MEMS sensor market for automotive. The growing demand for safety components in the vehicle systems is expected to gradually help in the growth of this market. According to the World Health Organization (U.S.), about 1.2 million people are killed in road accidents every year and about 50 million people get injuries. The automotive MEMS sensors play an important role in providing safety to the vehicles, which would act as a catalyst for the growth of this market. The market serves a vast range of industry verticals ranging from very small consumer electronic devices to very large automotive manufacturers.

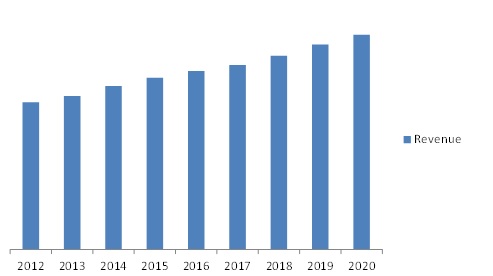

Automotive MEMS Sensor Market Size, by Value ($ million), 20132020

Source: MarketsandMarkets Analysis

The market size of the automotive MEMS sensor market is expected to grow at a CAGR of 4.7% between 2014 and 2020. This report focuses on detailed segmentations of the market, combined with qualitative and quantitative analyses of each and every aspect of the classification on the basis of type, application, and geography. All the numbers, at every level of detail, are forecasted till 2020 to give a glimpse of the potential market size in terms of value and volume in this market.

Major players in the MEMS sensor market for automotive include InvenSense, Inc. (U.S.), Analog Devices, Inc. (U.S.), Robert Bosch GmbH (Germany), General Electric Company (U.S.), Panasonic Corporation (Japan), Infineon Technologies AG (Germany), Sensata Technologies, Inc. (U.S.), Hitachi, Ltd. (Japan), Freescale Semiconductor, Inc. (U.S.), Harman International (U.S.), Murata Electronics Oy (Finland), STMicroelectronics (Switzerland), Freescale Semiconductor, Inc. (U.S.), and Delphi Automotive PLC (U.K.).

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Market Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of Primaries

2.2 Factor Analysis

2.2.1 Demand Side Analysis

2.2.1.1 A Broader Depiction of the Automotive Sensor industry

2.2.1.2 Historical Analysis of Target Market

2.2.2 Supply Side Analysis

2.2.2.1 Parent Market Analysis: Global Mems Market

2.2.2.2 Deep Dive At Component Level Analysis

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 top-Down Approach

2.3.3 Market Share Estimation

2.4 Market Breakdown and Data Triangulation

2.5 Research assumptions and Limitations

2.5.1 assumptions

2.5.2 Limitations

3 Executive Summary (Page No. - 34)

4.1 Attractive Market Opportunities in the Automotive Mems Sensor Market

4.2 Market top Three Applications

4.3 Market in the Americas Region

4.4 the Americas Accounted for Over One-Third of the Overall Market in 2013

4.5 Market, by Type

4.6 Market: asian Vs American Countries

4.7 Life Cycle Analysis, by Type in 2014

5 Market Overview (Page No. - 44)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Type

5.2.2 By Tracking Application

5.2.3 By Geography

5.3 Evolution

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Low Cost and Compact Size

5.4.1.2 Energy Efficient and Environment Friendly Technology

5.4.1.3 Government Regulations On Safety, Efficiency, and Driver assistance

5.4.1.4 Bulk Manufacturing Facility

5.4.2 Restraints

5.4.2.1 Difficult Packaging and integration Process

5.4.2.2 Lack of Standardized Fabrication Process

5.4.3 Opportunities

5.4.3.1 New Technologies Such as Electric and Hybrid Vehicles

5.4.3.2 New Applications for the Existing Mems Sensors

5.4.3.3 Research and Development of Emerging Mems Sensors

5.4.4 Challenges

5.4.4.1 Premium Applications Available Only in High-End Cars

5.5 Burning Issue

5.5.1 Continuous Optimisation of Component and Die Size

5.6 Winning Imperatives

5.6.1 Tapping the Potential of Emerging Markets

6 industry Trends (Page No. - 59)

6.2 introduction

6.3 Value Chain Analysis

6.4 Supply Chain Analysis

6.5 Porters Five forces Analysis

6.5.1 Threat From New Entrants

6.5.2 Threats From Substitutes

6.5.3 Bargaining Power of Suppliers

6.5.4 Bargaining Power of the Buyers

6.5.5 Degree of Competition

7 Market, by Type (Page No. - 70)

7.1 Introduction

7.2 Mems inertial Sensor

7.2.1 MEMS Accelerometer

7.2.2 MEMS Gyroscope

7.2.3 Inertial Combo Sensor

7.3 MEMS Microphones

7.4 MEMS Pressure Sensor

8 Market, by Application (Page No. - 90)

8.1 Introduction

8.2 Advanced Driver assistance System

8.3 Electronic Control Unit

8.4 Electronic Stability Control

8.5 Heating, Ventilation, and Air Conditioning System

8.6 Safety & Security

8.7 In-Car Navigation

8.8 OIS Cameras

8.9 Microphone in Cabin

8.1 Tire Pressure Monitoring System

8.11 Others

9 Geographic Analysis (Page No. - 118)

9.1 Introduction

9.2 The Americas

9.2.1 U.S.

9.2.2 Canada

9.2.3 Mexico

9.2.4 Others

9.3 Europe

9.3.1 France

9.3.2 Germany

9.3.3 Italy

9.3.4 Spain

9.3.5 U.K.

9.3.6 Others

9.4 APAC

9.4.1 China

9.4.2 india

9.4.3 Japan

9.4.4 Others

9.5 ROW

10 Competitive Landscape (Page No. - 138)

10.2 Overview

10.3 Market Share Analysis

10.4 Competitive Scenario

10.4.1 New Product Launches

10.4.2 Partnerships, Agreements, and Collaborations

10.4.3 Mergers and Acquisitions

10.4.4 Expansions

10.4.5 Other Developments

11 Company Profiles (Page No. - 148)

11.1 Introduction

11.2 Analog Devices, inc.

11.3 Delphi Automotive Plc

11.4 Denso Corporation

11.5 Freescale Semiconductors Ltd.

11.6 General Electric Co.

11.7 Harman international industries, inc.

11.8 Hitachi, Ltd.

11.9 infineon Technologies Ag

11.1 Invensense, inc.

11.11 Murata Electronics Oy

11.12 Panasonic Corporation

11.13 Robert Bosch Gmbh

11.14 Sensata Technologies, inc.

11.15 Stmicroelectronics N.V.

12 Appendix (Page No. - 184)

12.1 insights of industry Experts

12.2 Discussion Guide

12.3 introducing Rt: Real-Time Market intelligence

12.4 Available Customizations

12.5 Related Reports

List of Tables (68 Tables)

Table 1 Low Cost and Compact Size is the Major Demand Driver of the Automotive MEMS Sensor

Table 2 Difficult Packaging and Integration Process is Restraining the Growth of Market

Table 3 New Technologies Such as Electric and Hybrid Vehicles Are Generating New Opportunities for the Market

Table 4 Porters Five Forces Analysis With Its Weightage Impact

Table 5 Market Size, By Type, 20122020 ($ Million)

Table 6 Market Size, By Type, 20122020 (Million Units)

Table 7 Inertial Market Size, By Type, 20122020 ($ Million)

Table 8 Inertial Market Size, By Type, 20122020 (Million Units)

Table 9 MEMS Inertial Sensor Market Size, By Geography, 20122020 ($ Million)

Table 10 Market Size, By Application, 20122020 ($ Million)

Table 11 Market Size, By Application, 20122020 (Million Units)

Table 12 Market Size, By Geography, 20122020 ($ Million)

Table 13 Market Size, By Application, 20122020 ($ Million)

Table 14 MEMS Accelerometer Market Size, By Application, 20122020 (Million Units)

Table 15 Market Size, By Geography, 2012-2020 ($Million)

Table 16 Market Size, By Application, 20122020($ Million)

Table 17 Market Size, By Application, 20122020 (Million Units)

Table 18 MEMS Combo Sensor Market Size, By Geography, 20122020 ($ Million)

Table 19 MEMS Inertial Combo Sensor Market Size, By Application, 20122020 ($ Million)

Table 20 MEMS Inertial Combo Sensor Market Size, By Application, 20122020 (Million Units)

Table 21 Market Size, By Geography, 20122020 ($ Million)

Table 22 Market Size, By Application, 20122020 ($ Million)

Table 23 Market Size, By Application, 20122020 (Million Units)

Table 24 Market Size, By Geography, 20122020 ($ Million)

Table 25 Market Size, By Application, 20122020 $ Million)

Table 26 Market Size, By Application, 20122020 (Million Units)

Table 27 Market Size, By Application, 20122020 ($ Million)

Table 28 Market Size, By Application, 20122020 (Million Units)

Table 29 Market Size for Advanced Driver Assistance Application, By Geography, 20122020 ($ Million)

Table 30 Market Size for Electronic Control Unit Application, By Geography, 20122020 ($ Million)

Table 31 Market Size for Electronic Control Unit Application, By Type, 20122020 ($ Million)

Table 32 Market Size for Electronic Control Unit Application, By Type, 20122020 (Million Units)

Table 33 Market Size for Electronic Stability Control Application, By Geography, 20122020 ($ Million)

Table 34 Market Size for Heating, Ventilation, and Air Conditioning System Application, By Geography, 20122020 ($ Million)

Table 35 Market Size for Safety and Security Application, By Geography, 20122020 ($ Million)

Table 36 Market Size for Safety and Security Application, By Type, 20122020 ($ Million)

Table 37 Market Size for Safety and Security Application, By Type, 20122020 (Million Units)

Table 38 Market Size for In-Car Navigation Application, By Geography, 20122020 ($ Million)

Table 39 Market Size for OIS Camera Application, By Geography, 20122020 ($ Million)

Table 40 Market Size for Microphone in Cabin Application, By Geography, 20122020 ($ Million)

Table 41 Market Size for Tire Pressure Monitoring System Application, By Geography, 20122020 ($ Million)

Table 42 Market Size for Tire Pressure Monitoring System Application, By Type, 20122020 ($ Million)

Table 43 Market Size for Tire Pressure Monitoring System Application, By Type, 20122020 (Million Units)

Table 44 Market Size for Other Applications, By Geography, 20122020 ($ Million)

Table 45 Market Size for Other Applications, By Type, , 20122020 ($ Million)

Table 46 Market Size for Other Applications, By Type, 20122020 (Million Units)

Table 47 Market Size in the Americas, By Country, 20122020 ($ Million)

Table 48 Market in the Americas, By Type, 20122020 ($ Million)

Table 49 Market Size in the Americas, By Application, 20122020 ($Million)

Table 50 Inertial Sensor Market in the Americas, By Type, 20122020 ($ Million)

Table 51 Market Size in Europe, By Country, 20122020 ($ Million)

Table 52 Market in Europe, By Type, 20122020 ($ Million)

Table 53 Market Size in Europe, By Application, 20122020 ($ Million)

Table 54 Inertial Sensor Market in Europe, By Type, 20122020 ($ Million)

Table 55 Market Size in APAC, By Country, 20122020 ($ Million)

Table 56 Market in APAC, By Type, 20122020 ($ Million)

Table 57 Market Size in APAC, By Application, 20122020 ($ Million)

Table 58 Inertial Sensor Market in APAC, By Type, 20122020 ($ Million)

Table 59 Market in ROW, By Type, 20122020 ($ Million)

Table 60 Market Size in ROW, By Application, 20122020 ($ Million),

Table 61 Inertial Sensor Market in ROW, By Type, 20122020 ($ Million)

Table 62 Ranking of the Top 5 Automotive Semiconductor Suppliers in 2013

Table 63 Ranking of the Top 5 MEMS Manufacturers in 2013

Table 64 Most Significant New Product Launches in the Market, in 2014

Table 65 Most Significant Partnerships, Agreements, and Collaborations in the Market, in 2014

Table 66 Recent Mergers and Acquisitions of the Market

Table 67 Recent Expansions of the Market

Table 68 Other Recent Developments in the Market

List of Figures (107 Figures)

Figure 1 Research Methodology

Figure 2 Automotive Sensor Market Analysis, in 2013

Figure 3 Market, By Type (From 2009 to 2013)

Figure 4 Global MEMS Market Analysis: By Application, in 2013

Figure 5 MEMS Die Market Share Analysis in Terms of Volume, in 2013

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Market Breakdown & Data Triangulation

Figure 9 Assumptions of the Research Study

Figure 10 Limitations of the Research Study

Figure 11 Pressure Sensor Held the Largest Share in the Market in 2013

Figure 12 Microphone in Cabin Application is Expected to Be the Fastest-Growing Market

Figure 13 The Americas Accounted for the Largest Market Share in 2014, Whereas Asia-Pacific is Expected to Be the Fastest-Growing Region in the Market

Figure 14 The Market is Expected to Grow at A CAGR of 4.7% Between 2014 and 2020

Figure 15 Electronic Control Unit is Holding the Maximum Shares in the Market

Figure 16 U.S. is the Major Consumer of Automotive MEMS Sensor in the Americas

Figure 17 the Americas Accounts for the Largest Share of the Overall Market

Figure 18 Pressure Sensor is Expected to Continue to Dominate the Market in the Coming Six Years

Figure 19 Asian Countries Are Growing at A Faster Rate Than the American Countries

Figure 20 Emerging Sensor Types Such as Microphone and Combo Sensors Have Recorded the Fastest Growth Rate

Figure 21 Market Segmentation

Figure 22 Market Segmentation: By Type

Figure 23 Market Segmentation: By Application

Figure 24 Market Segmentation: By Geography

Figure 25 Evolution of the Automotive MEMS Sensor

Figure 26 Major Parameters Impacting the Market Dynamics

Figure 27 Automotive MEMS Sensor: Cost and Size Versus Performance Graph

Figure 28 Various Government Regulation for the Automotive Industry

Figure 29 List of Few Design Techniques Adopted By the Key Players of MEMS Industry

Figure 30 Value Chain Analysis: Major Value is Added During the Raw Material Supply and Original Equipment Manufacturing Phase

Figure 31 Manufacturers of MEMS Sensors and Automobile Parts Form the Supply Side of the Automotive MEMS Sensor Supply Chain

Figure 32 Porters Five Forces Analysis

Figure 33 Due to Large Number of Existing Players, the Buyers Bargaining Power and the Degree of Competition is Expected to Remain High From 2014 to 2020

Figure 34 Higher Market Growth Rate Expected to Attract New Entrants

Figure 35 Legislative Regulations is the Key Factor Giving Strength to the Substitutes Market

Figure 36 Technology Standards Associated With the Automotive Industry is Highly Impacting the Suppliers Power

Figure 37 Ratio of Size-Supplier to Buyer Pool is the Supporting Factor for the Buyers Bargaining Power

Figure 38 Large Number of Players Has Led to High Degree of Competition in the Market

Figure 39 Microphone is the Fastest Growing Automotive MEMS Sensor Type

Figure 40 Inertial Sensor Dominated the Market Throughout the Forecast Period

Figure 41 The Combo Sensor A Newly Introduced Technology, is Accounted as the Fastest-Growing Type of Inertial MEMS Sensor

Figure 42 The Accelerometer Accounted for the Maximum Share in the Automotive MEMS Inertial Sensor Market in 2013

Figure 43 MEMS Inertial Sensor Market Size Comparison in Terms of Value, in 2014 & 2020

Figure 44 MEMS Accelerometer Market Size Comparison in Terms of Value, in 2014 & 2020

Figure 45 MEMS Gyroscope Market Size Comparison in Terms of Value, in 2014 & 2020

Figure 46 MEMS Inertial Combo Sensor Market Size Comparison in Terms of Value, in 2014 & 2020

Figure 47 MEMS Microphone Market Size Comparison in Terms of Value, in 2014 & 2020

Figure 48 MEMS Pressure Sensor Market Size Comparison in Terms of Value, in 2014 & 2020

Figure 49 Microphone in Cabin is Expected to Be the Fastest-Growing Application Market

Figure 50 the Electronic Control Unit Application Has Been Contributing A Major Share in the Market

Figure 51 Advanced Driver Assistance Application Market Size Comparison in Terms of Value, in 2014 & 2020

Figure 52 Market Size for Advanced Driver Assistance Application, By Type ($ Million), 20122020

Figure 53 Market Size for Advanced Driver Assistance Application, By Type, 20122020 (Million Units)

Figure 54 Electronic Control Unit Application Market Size Comparison in Terms of Value, in 2014 & 2020

Figure 55 Electronic Stability Control Application Market Size Comparison in Terms of Value, in 2014 & 2020

Figure 56 Market Size for Electronic Stability Control Application, By Type 20122020 ($ Million)

Figure 57 Market Size for Electronic Stability Control Application, By Type, 20122020 (Million Units)

Figure 58 Heating, Ventilation and Air Conditioning System Application Market Size Comparison in Terms of Value, in 2014 & 2020

Figure 59 Market Size for Heating, Ventilation and Air Conditioning System Application, By Type, 20122020 ($ Million)

Figure 60 Market Size for Heating, Ventilation and Air Conditioning System Application, By Type, 20122020 (Million Units)

Figure 61 Safety and Security Application Market Size Comparison in Terms of Value, in 2014 & 2020

Figure 62 In-Car Navigation Application Market Size Comparison in Terms of Value, in 2014 & 2020

Figure 63 Market Size for In-Car Navigation Application, By Type, 20122020 ($ Million)

Figure 64 Market Size for In-Car Navigation Application, By Type, 20122020 (Million Units)

Figure 65 OIS Cameras Application Market Size Comparison in Terms of Value, in 2014 & 2020

Figure 66 Market Size for OIS Cameras Application, By Type, 20122020 ($ Million)

Figure 67 Market Size for OIS Cameras Application, By Type, 20122020 (Million Units)

Figure 68 Microphone in Cabin Application Market Size Comparison in Terms of Value, in 2014 & 2020

Figure 69 Market Size for Microphone in Cabin Application, By Type, 20122020 ($ Million)

Figure 70 Market Size for Microphone in Cabin Application, By Type, 20122020 (Million Units)

Figure 71 Tire Pressure Monitoring System Application Market Size Comparison in Terms of Value, in 2014 & 2020

Figure 72 Other Applications Market Size Comparison in Terms of Value, in 2014 & 2020

Figure 73 Geographic Snapshot (2013)

Figure 74 Americas Automotive MEMS Sensors Market Snapshot

Figure 75 The U.S. Dominated the Americas Market With the Highest Market Share

Figure 76 Europes Market Snapshot

Figure 77 Germany Accounted for the Highest Share in Europes Market

Figure 78 Asia-Pacific Market Snapshot

Figure 79 China Holds the Maximum Market Share of APACs Market in 2013

Figure 80 Rest of the World Market Snapshot

Figure 81 Companies Adopted Product Innovation as the Key Growth Strategy From 2012 to 2014

Figure 82 Analog Devices, Inc. Emerged as the Fastest-Growing Company From 2009 Till Date

Figure 83 Market Share of Top 5 Players in the Market, 2013

Figure 84 Market Evolution Framework

Figure 85 Battle for the Market Share: New Product Launches is the Key Strategy

Figure 86 Geographic Revenue Mix of Top 5 Market Players

Figure 87 Competitive Benchmarking of Key Market Players (2009-2013)

Figure 88 Analog Devices, Inc..: Business Overview

Figure 89 SWOT Analysis

Figure 90 Delphi Automotive PLC: Business Overview

Figure 91 Denso Corporation: Business Overview

Figure 92 SWOT Analysis

Figure 93 Free scale Semiconductors Ltd.: Business Overview

Figure 94 SWOT Analysis

Figure 95 GE Electric Co.: Business Overview

Figure 96 SWOT Analysis

Figure 97 Harman International Industries, Inc..: Business Overview

Figure 98 Hitachi, Ltd.: Business Overview

Figure 99 SWOT Analysis

Figure 100 Infineon Technologies AG: Business Overview

Figure 101 Invensense, Inc.: Business Overview

Figure 102 Murata Manufacturing Company, Ltd.: Business Overview

Figure 103 Panasonic Corporation: Business Overview

Figure 104 Robert Bosch GMBH: Business Overview

Figure 105 SWOT Analysis

Figure 106 Sensata Technologies, Inc.: Business Overview

Figure 107 Stmicroelectronics N.V.: Business Overview

Growth opportunities and latent adjacency in MEMS Sensor Market

Hello sir/mam, I did my M.Tech graduation in Sensors Systems Technology (in tie up with a reputed university). I am interested in R&D to continue my career in Sensors Systems Technology / Automotive Electronics / Automobile Industry. So need your assistance in approaching Automotive/Sensors/MEMS Technology companies in India / overseas.

I am a founder member of an automotive association. I would like to know your findings regarding the adoption of MEMS sensors for HVAC application in specific.

Does the report take into account the economic slowdown or recession in automotive industry? I would like to know the attractive countries for automotive MEMS sensors in next 510 years.

Hello, I'm a student doing a report on the driverless car market. Any info you could send or email to me about the MEMS sensors market for driverless cars would be very helpful.