Hindered Amine Light Stabilizers (HALS) Market

Hindered Amine Light Stabilizers (HALS) Market by Type (Polymeric, Monomeric, Oligomeric), End-use Industry (Automotive, Building & Construction, Packaging, Agriculture), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

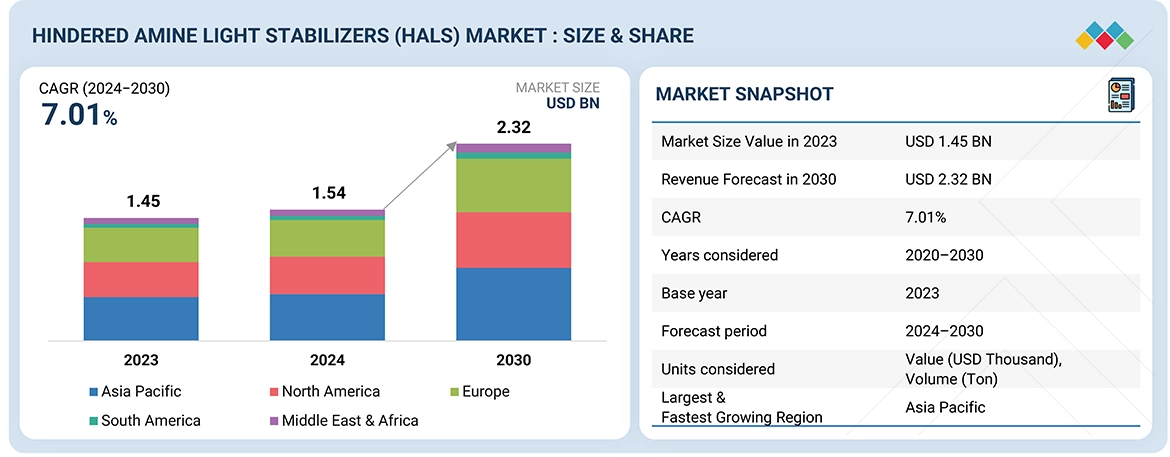

The HALS market is projected to grow from USD 1.54 billion in 2024 to USD 2.32 billion by 2030, at a CAGR of 7.01%, in terms of value. This growth is led by the increasing demand for high-performance polymer additives that enhance polymer life span and reduce maintenance and replacement expenses. HALS offer protection against UV-induced degradation, contributing significantly to product life cycle extension in severe climatic conditions.

KEY TAKEAWAYS

-

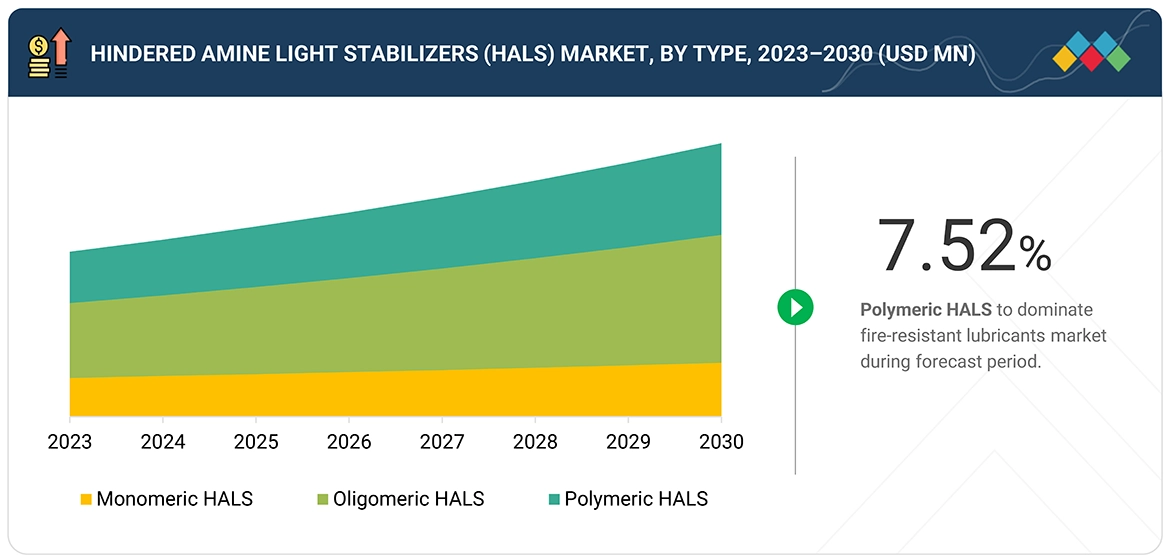

BY TYPEThe HALS market is segmented as polymeric, monomeric, and oligomeric based on type. Among these types, polymeric HALS accounted for the largest market share in terms of value in 2023 and will continue to dominate during the forecast period. This dominance is attributed to their lower volatility, long-term UV protection, and superior thermal stability. These properties make them highly suitable for the automotive, building & construction, packaging, and agriculture industries. Reduced migration of polymeric HALS during processing and their compatibility with a wide range of polymers contribute to their rising demand across end-use industries.

-

BY END-USE INDUSTRYThe HALS market is segmented into automotive, building & construction, packaging, agriculture, and others based on industry. The automotive industry was the largest end-use industry in terms of value in 2023, mainly driven by the increasing industrial need for high-performance materials that endure long exposure to UV radiation, heat, and environmental stress. HALS are used across various applications, such as plastic parts, coatings, and interior components, to improve durability, maintain appearance, and prolong service life.

-

BY REGIONAsia Pacific is the fastest-growing market for HALS and is projected to register the highest CAGR during the forecast period. This dominance is mainly led by rapid urbanization and industrialization across China, India, and Southeast Asian countries. The automotive and building & construction industry growth has contributed to the rising demand for UV-resistant, durable materials. HALS are widely used in automotive components and construction materials to increase longevity and performance in harsh environmental conditions. Moreover, the favorable economic policies and growing manufacturing base drive HALS market within the region.

-

COMPETITIVE LANDSCAPELeading market participants focus on innovation, sustainable product development, and strategic collaborations through partnerships, acquisitions, and new product introductions. Major players such as BASF SE, Rianlon Corporation, Sabo S.p.A, Syensqo, and ADEKA Corporation are expanding their portfolios of Hindered Amine Light Stabilizers (HALS) to address the growing demand for high-performance, durable, and environmentally friendly UV stabilization solutions across automotive, construction, agricultural films, and packaging applications.

The market is expanding due to the rising trend of durable and weather-resistant materials in the automotive industry. HALS plays a crucial role in extending the lifespan of vehicles exposed to harsh climates. Advanced polymers enhanced with HALS are preferred to enhance the crystallization rate and mechanical strength of materials

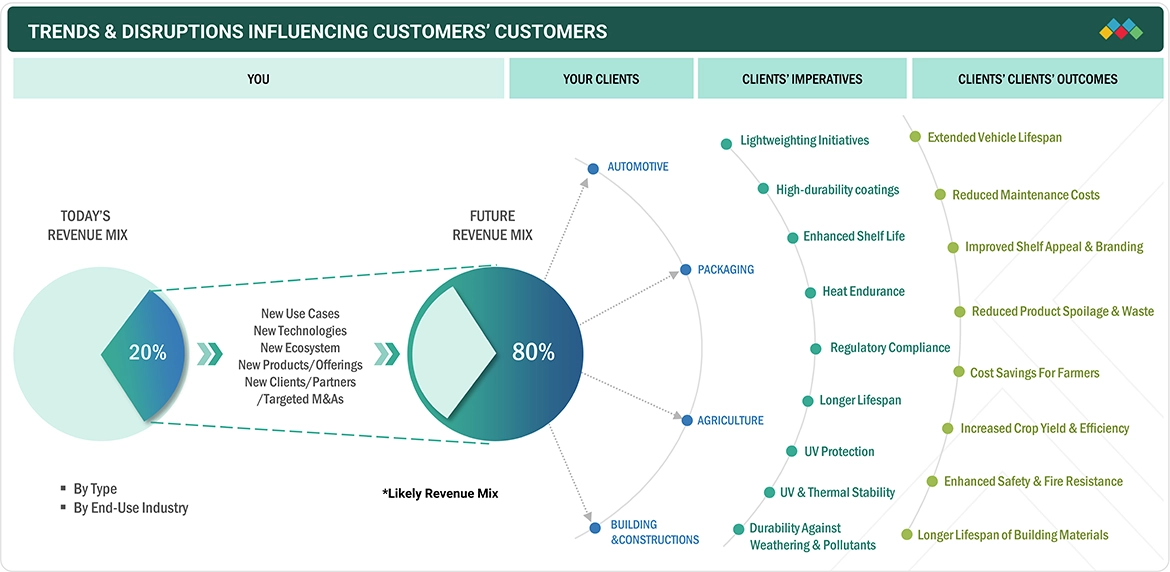

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ business in the Hindered Amine Light Stabilizers (HALS) market is influenced by increasing regulatory standards, sustainability initiatives, and material innovation across end-use industries. Consumers of HALS include automotive manufacturers, coatings and paints producers, plastics and polymer processors, and packaging companies, which rely on HALS for UV protection, enhanced durability, color retention, and extended service life of materials. Factors such as stricter environmental and VOC regulations, rising demand for high-performance and eco-friendly formulations, and advances in polymer and coating technologies shape procurement decisions, production costs, and compliance strategies for these end users. Consequently, trends in downstream sectors including infrastructure development, automotive production growth, and expansion of packaging and consumer goods industries directly affect HALS consumption volumes, product preferences, and revenue flows, thereby guiding the strategic focus and innovation priorities of HALS manufacturers and suppliers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising market demand in plastics industry

-

Technological advancement driving market

Level

-

Supply chain disruptions and price volatility

-

Competition from alternative stabilization technologies

Level

-

Customized solutions for specific applications

Level

-

Stringent environmental and regulatory compliance

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising market demand in plastics industry

The increasing demand in the plastic industry drives the HALS market. The global plastic industry has grown rapidly because of its versatility, wide applications, and increased consumption in packaging, automotive, building & construction, and consumer goods sectors. The widespread use of plastics is attributed to their durability, flexibility, and lightweight properties, making them an essential component in modern manufacturing processes. The automotive and construction industries use plastic materials for their parts and components as they are lightweight and easy to manufacture. The growing development of infrastructure and innovation in the automotive sector across different countries.

Restraints: Supply chain disruptions and price volatility

Raw material price fluctuations are a major concern for the HALS market as they directly affect manufacturers’ production costs and profit margins. The primary raw materials of HALS include specialty amines, acetone, and other organic intermediates, all sourced from petrochemical derivatives. This reliance underscores a substantial sensitivity to fluctuations in crude oil prices. Any disruption in the global oil supply, geopolitical instability, or changes in energy policies can result in unpredictable cost spikes. Manufacturers are compelled to alter their pricing strategies or absorb losses to remain competitive. This cost volatility introduces uncertainty in long-term contracts and supply chain planning, particularly for packaging, construction, and automotive sectors that rely on HALS-stabilized polymers

Opportunities: Customized solutions for specific applications

HALS can be customized to meet the requirements of specific applications such as automotive paints and coatings, agricultural films, construction materials, and packaging materials. Various polymers, coatings, and end-use applications require different stabilizations due to their distinct processing conditions, environmental exposure, and anticipated performance. Customized HALS are more effective in addressing distinct needs that improve product durability, extend the life cycle, and perform better in the targeted markets for manufacturers. For instance, in the automotive industry, where polymers are exposed to severe weather conditions, specific HALS formulations are required to meet stringent weathering stability requirements.

Challenges: Strict environmental and regulatory compliance

The HALS market is subject to regulatory pressure, particularly in Europe and North America, where strict environmental regulations transform chemical manufacturing and formulation standards. Meeting such changing standards requires massive investment in R&D, with new product developments that meet regulatory requirements and product performance specifications. Manufacturers are also expected to make their production processes environmentally friendly, building more operational expenses into their profit margin. The challenge of compliance goes beyond production and extends to end-use applications. HALS are widely used in plastics, coatings, and adhesives—industries increasingly facing environmental scrutiny. Due to the demands from various sectors, especially automotive, packaging, and construction, manufacturers of HALS have been compelled to redesign their products to reduce toxicity and minimize environmental impact

hindered-amine-light-stabilizers-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

HALS and UV packages for plastics and coatings to extend service life and color/gloss retention in automotive interiors/exteriors, films, and molded parts | HALS inhibit radical degradation rather than absorb UV, delivering long-term stabilization at low dosages; liquid HALS such as Tinuvin 292 improve cracking and gloss retention in coatings |

|

Liquid and dispersed HALS for solventborne and waterborne coatings, plus grades for plastics including PMMA, PUR, styrenics, and polyolefins | Low volatility, good solubility, and waterborne-ready dispersions (Hostavin 3070 DISP) that boost gloss retention and reduce color change with improved toxicological profile |

|

Acid/sulfur-resistant HALS for agricultural films, artificial turf, and WPC; high-durability HALS packages for TPO roofing with 20-year weathering targets | Low-basic HALS such as LA-811 maintain stabilization under sulfur fumigation and acidic conditions, while LA-458XP improves both UV and heat resistance in TPO roofing |

|

Masterbatch solutions blending HALS and UV absorbers for polyolefins, polyamides, PC, TPU, and styrenics with application-specific loading guidance | UVA+HALS synergy protects bulk and surface to reduce chalking, cracking, and yellowing while maintaining mechanical properties over outdoor exposure |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

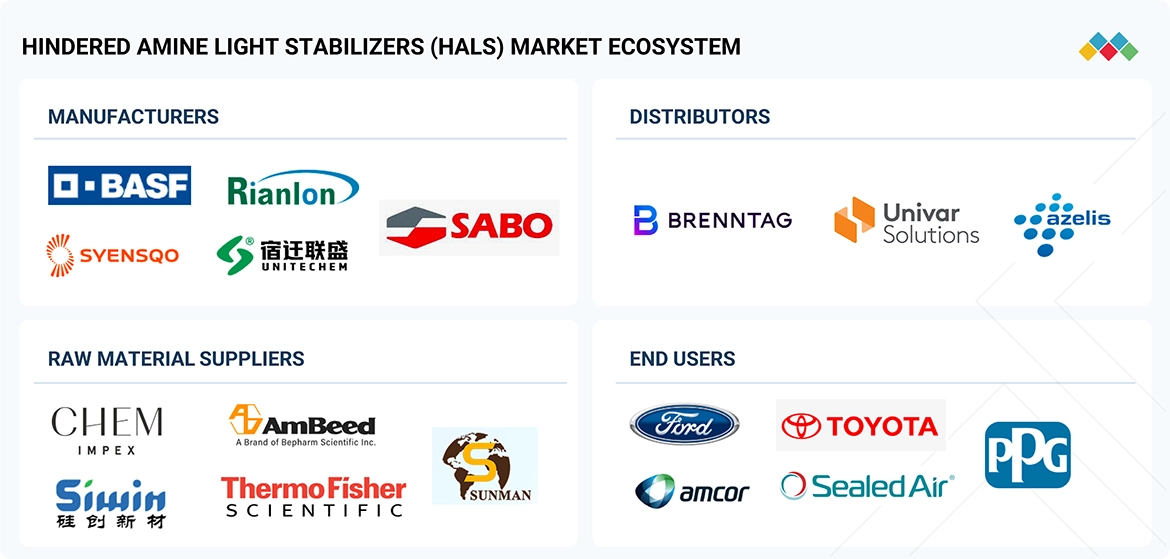

MARKET ECOSYSTEM

The Hindered Amine Light Stabilizers (HALS) ecosystem comprises raw material suppliers, HALS formulators, distributors, and end users. Raw material suppliers provide amines, antioxidants, and other specialty chemicals, which formulators use to develop HALS products through advanced synthesis, stabilization, and dispersion technologies that protect polymers and coatings from UV-induced degradation, discoloration, and loss of mechanical properties. Distributors bridge HALS manufacturers with key industries such as automotive, construction, packaging, electrical & electronics, and coatings, ensuring consistent supply, technical support, and compliance with environmental and regulatory standards. End users incorporate HALS into plastics, coatings, and other polymer-based materials to enhance durability, longevity, and performance under harsh environmental conditions. The value chain is shaped by growing demand for long-lasting materials, sustainability initiatives, and ongoing innovations in light stabilization technologies that improve efficiency and reduce environmental impact.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Hindered Amine Light Stabilizers (HALS) Market , By Type

The polymeric HALS segment accounted for the largest share of the HALS market in 2023. Market demand for polymeric HALS has increased due to its superior performance in enhancing UV stability and extending the lifespan of polymers. Compared to monomeric HALS, polymeric HALS offer better compatibility with polymer matrices and reduced volatility, making them ideal for high-performance applications in the automotive, construction, and agriculture industries. This functional benefit and increasing demand for weather-resistant and durable materials propel the segment’s growth.

Hindered Amine Light Stabilizers (HALS) Market, By End-Use

The automotive industry is expected to be the fastest-growing end-use segment in the HALS market during the forecast period. The demand for HALS has increased in the automotive industry due to the rising integration of UV-stabilized plastics in bumpers, trims, and headlights. As automotive manufacturers demand long-lasting exterior and interior parts, specifically sun-exposed plastics, HALS provides an affordable solution by increasing durability and aesthetics. Moreover, the global trend toward lightweight and polymer-based components to enhance fuel efficiency further accelerates HALS adoption in this industry.

REGION

Asia Pacific to be the largest & fastest growing region in global fire-resistant lubricants market during forecast period

Asia Pacific is the largest consumer of HALS. Due to the high manufacturing base in China, India, and Southeast Asia, demand for UV-stabilized plastics is growing in the automotive, construction, and agriculture industries. Rapid industrialization, the growth in polymer production, and the expansion in infrastructure projects are driving large-scale consumption of HALS. Moreover, supportive government policies for local manufacturing and rising exports of plastic-based goods further support the region’s dominant market position. Driven by rapid economic development, increasing urbanization, and expanding industrial activity, the automotive sector continues to grow with rising domestic vehicle production and foreign investment in local manufacturing plants, further boosting the demand for high-performance HALS.

hindered-amine-light-stabilizers-market: COMPANY EVALUATION MATRIX

In the HALS market, BASF SE leads with a strong global footprint and a comprehensive portfolio of high-performance light stabilizers designed to protect polymers and coatings from UV-induced degradation, discoloration, and surface cracking. The company’s focus on long-term weatherability, material durability, and environmental compatibility, supported by continuous innovation, has positioned it as a preferred partner across key industries such as automotive, construction, packaging, and agricultural films. BASF’s advancements in next-generation HALS chemistries, offering enhanced stabilization efficiency and reduced volatility, help customers achieve superior performance even under extreme outdoor exposure. Through its commitment to sustainability, circular economy initiatives, and customized additive solutions, along with strategic collaborations with polymer producers, compounders, and coating formulators, BASF continues to strengthen its leadership in the HALS market and drive innovation in UV protection technologies worldwide.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 1.45 Billion |

| Revenue Forecast in 2030 | USD 2.32 Billion |

| Growth Rate | CAGR of 7.01% from 2025-2030 |

| Actual data | 2020-2030 |

| Base year | 2023 |

| Forecast period | 2024-2030 |

| Units considered | Value (USD Thousand), Volume (Ton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Type: Polymeric, Monomeric, And Oligomeric By End-Use: Automotive, Building & Construction, Packaging, Agriculture, And Others |

| Regional Scope | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

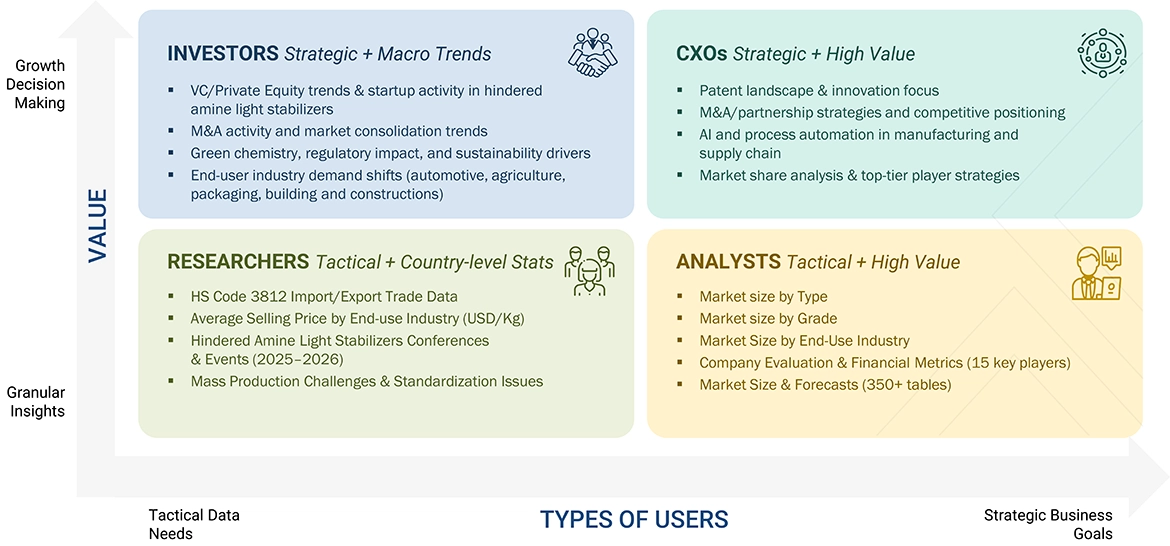

WHAT IS IN IT FOR YOU: hindered-amine-light-stabilizers-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global Specialty Chemicals Company |

|

|

| North America-based Coating & Masterbatch Producer |

|

|

RECENT DEVELOPMENTS

- January 2024 : BASF SE introduced its new product Tinuvin NOR 211 AR. It is the latest innovation in its Tinuvin (HALS) product range.

- July 2023 : Songwon Industrial Co., Ltd. signed a distribution agreement with Krahn Italia S.p.A. to expand its reach in Italy. This partnership aims to strengthen Songwon’s presence in the Italian HALS market and enhance customer service.

- October 2022 : SABO S.p.A. acquired Evonik Industries AG’s TAA (triacetone amine) and derivatives business.

- July 2022 : Songwon Industrial Co., Ltd. and SABO S.p.A. extended their partnership to distribute the SABOSTAB HALS portfolio globally, maintaining exclusivity worldwide.

- July 2021 : Clariant AG inaugurated a new joint venture facility in Cangzhou with Beijing Tiangang Auxiliary Co., Ltd. The facility focuses on producing light stabilizers to meet the increasing demand from Chinese industries like automotive, textiles, and coatings.

Table of Contents

Methodology

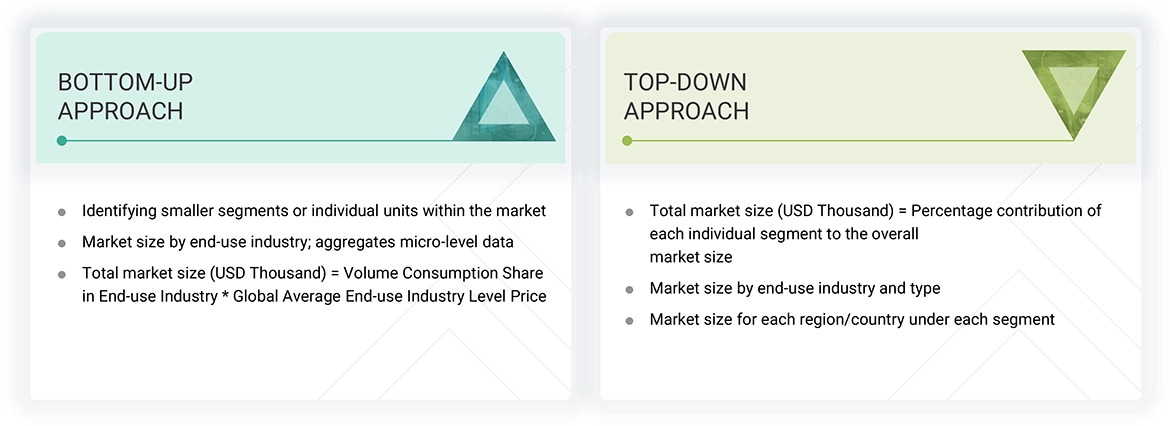

The study involved four major activities in estimating the market size of the HALS market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

Primary Research

The HALS market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by key opinion leaders in various applications for the HALS market. The supply side is characterized by technological advancements and diverse applications. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Breakdown of Primary Participants

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022/2023, available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME | DESIGNATION | |

|---|---|---|

| BASF SE | Senior Manager | |

| Rianlon Corporation | Innovation Manager | |

| SABO S.p.A. | Marketing Manager | |

| Syensqo SA/NV | Production Supervisor | |

| Suqian Unitech Corp., Ltd. | Sales Manager | |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the HALS market. These methods were also used extensively to predict the size of various subsegments in the market. The research methodology used to evaluate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The industry’s supply chain was determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

The market was split into several segments and subsegments after arriving at the overall market size using the market size estimation processes as explained above. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and determine the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from the demand and supply sides in the HALS industry.

Market Definition

According to the American Coatings Association, HALS are a group of chemical additives based on 2,2,6,6-tetramethyl piperidine (TMP) that function as radical scavengers to prevent photo-oxidative degradation of polymers. They are widely employed in coatings, adhesives, and sealants to resist surface defects such as loss of gloss, cracking, and discoloration. In contrast to UV absorbers, HALS deliver long-term stabilization by functioning independently of film thickness and regenerating their active species during the stabilization process.

Stakeholders

- HALS Manufacturers

- HALS Distributors

- Raw Material Suppliers

- Government and Research Organizations

- Investment Banks and Private Equity Firms

Report Objectives

- To define, describe, and segment the market based on type, end-use industry, and region

- To analyze and forecast the size of the global hindered amine light stabilizers (HALS) market in terms of value and volume

- To provide detailed information about the important drivers, restraints, challenges, and opportunities influencing market growth

- To forecast the size of the market segments based on regions such as Asia Pacific, North America, Europe, the Middle East & Africa, and South America

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contributions to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To assess competitive developments such as expansions, partnerships & collaborations, mergers & acquisitions, agreements, and product launches in the market

- To strategically profile the key companies and comprehensively evaluate their core competencies

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Hindered Amine Light Stabilizers (HALS) Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Hindered Amine Light Stabilizers (HALS) Market