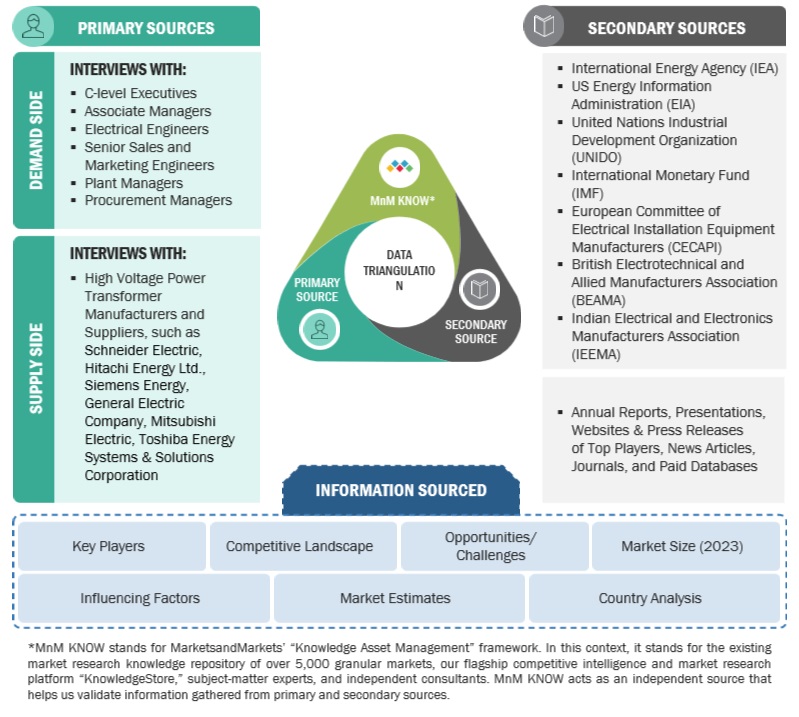

This study undertook an extensive process to determine the current dimensions of the high voltage power transformer market, beginning with an in-depth secondary research phase focused on gathering data from the market, related markets, and the overall industry context. This initial data collection was followed by a thorough validation using primary research, which included discussions with industry experts across the value chain. Market size evaluations were then conducted for each country through a tailored analysis, leading to a detailed breakdown of the market. Data from these analyses were cross-checked to estimate the sizes of different segments and sub-segments. By integrating both secondary and primary research methods, the study ensures the findings are both accurate and reliable.

Secondary Research

Secondary sources referred to for this research study include annual reports, press releases, investor presentations of companies, white papers, certified publications, articles from recognized authors, and databases of various companies and associations. Secondary research has been mainly used to obtain key information about the industry’s supply chain to identify the key players of various products and services, market classification and segmentation according to the offerings of major players, industry trends to the bottom-most level, regional markets, and key developments from market- and technology-oriented perspectives.

Primary Research

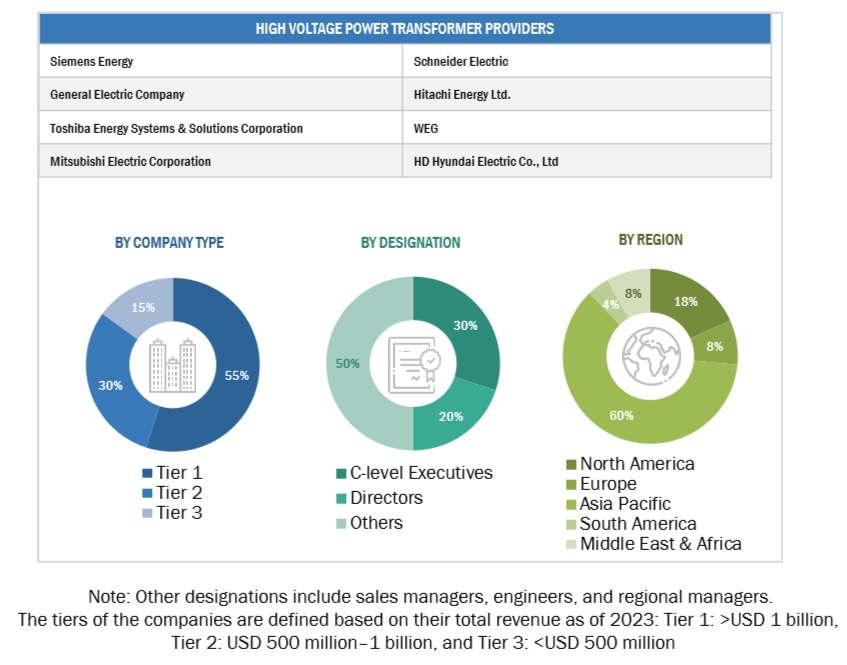

In the primary research process, various primary sources from the supply and demand sides have been interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts, such as chief executive officers (CEO), vice presidents, marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the market.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods have been extensively used to perform the market size estimations and forecasts for all segments and sub-segments listed in this report. Extensive qualitative and quantitative analyses have been conducted to complete the market engineering process and list key information/insights throughout the report.

After the complete market engineering process (which includes calculations for market statistics, breakdown, size estimation, forecasts, and data triangulation), extensive primary research has been conducted to gather information and verify and validate the critical numbers obtained. Primary research has also been conducted to identify segments, industry trends, and the competitive landscape of the HV power transformer market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

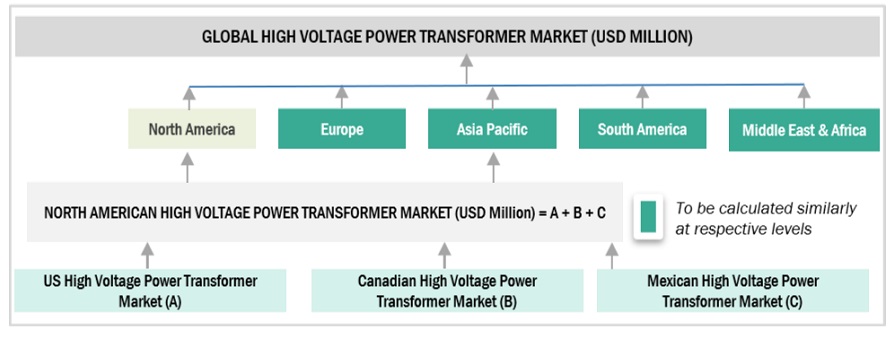

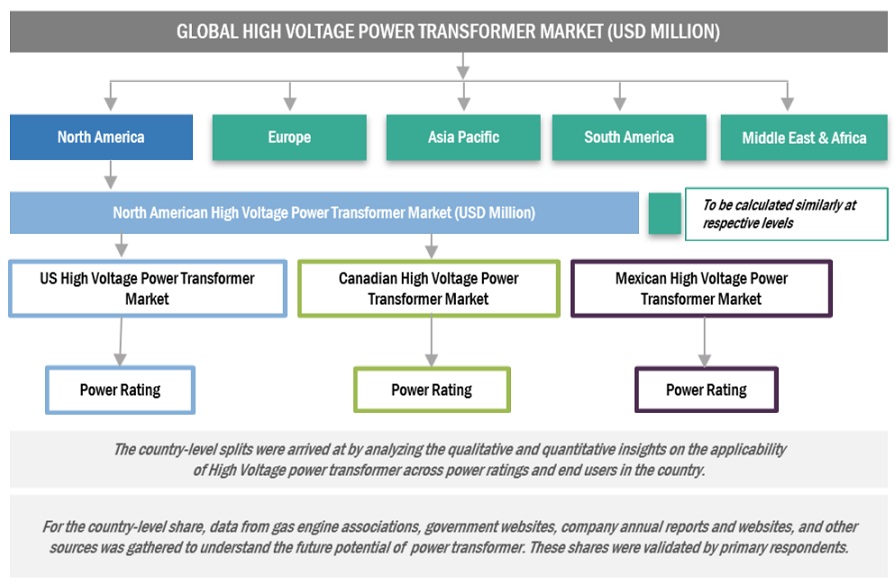

Using a bottom-up & top-down methodology, the high voltage power transformer market size has been carefully estimated and validated. This approach was used extensively to determine the size of several market subsegments. The following crucial phases are included in the research process.

This method has examined national and regional manufacturing statistics for all types of high voltage power transformers.

A significant amount of primary and secondary research has been conducted in order to fully understand the global market situation for various transformer types.

Prominent HV power transformer system development specialists, including major OEMs and Tier I suppliers, have been interviewed in several primary interviews.

When evaluating and projecting the market size, qualitative factors such as market drivers, restraints, opportunities, and challenges have been taken into account.

Global High voltage power transformer Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global High voltage power transformer Market Size: Top-Down Approach

Data Triangulation

The determination of the overall market size was conducted using the outlined methodologies, which involved dividing the market into various segments and subsegments. To finalize the comprehensive market analysis and obtain accurate statistics for each segment and subsegment, techniques such as data triangulation and market segmentation were employed as needed. Data triangulation included a detailed analysis of different factors and trends from both demand and supply sides within the market ecosystem.

Global High voltage power transformer Market Size: Data Triangulation

Market Definition

High Voltage Power transformers are essential components of electrical infrastructure, facilitating the efficient transmission and distribution of electricity across grids of various scales. These devices are crucial in converting voltage levels to enable electricity transmission over long distances with minimal loss. At their core, these transformers function by inducing changes in voltage through electromagnetic induction, allowing the transfer of electrical energy from one circuit to another. They are integral to the functioning of power systems, enabling the safe and reliable delivery of electricity to homes, businesses, and industries worldwide.

A high volage power transformer which operates at voltage above 69kV consists of two or more coils of insulated wire, known as windings, wound around a ferromagnetic core typically made of laminated steel. The primary winding receives electrical energy from the input voltage source, while the secondary winding delivers the transformed voltage to the output circuit. By varying the number of turns in each winding and the magnetic properties of the core material, transformers can step up or down voltage levels as required for efficient transmission and distribution. This ability to manipulate voltage is essential for balancing load demands, maintaining grid stability, and ensuring optimal performance of electrical systems.

These transformers are classified based on their end user, by power rating, cooling type. Regardless of their size or configuration, they are fundamental to the functioning of electrical grids, serving as indispensable components in the generation and transmission of electricity to meet the necessary demands.

The high voltage power transformer market refers to the year-on-year investments in high voltage power transformer across the five main regions, namely, North America, South America, Europe, Asia Pacific, and Middle East & Africa.

Key Stakeholders

-

Field device manufacturers

-

Public and private electric utilities

-

Distribution companies (DISCOMS)

-

Energy & power sector consulting companies

-

Government & research organizations

-

Independent power producers

-

Investment banks

-

Electrical equipment associations

-

Network and communication service providers.

-

Support and maintenance service providers

-

Smart grid players

Objectives of the Study

-

To describe and forecast the high voltage power transformer market based on component, communication technology, utility and region in terms of value.

-

To describe and forecast the market for five key regions: Asia Pacific, North America, Europe, Latin America, and Middle East & Africa, along with their country-level market sizes in terms of value.

-

To forecast the hv power transformer market by component and region in terms of volume

-

To provide detailed information regarding key drivers, restraints, opportunities, and challenges influencing the growth of the market

-

To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market size

-

To provide the supply chain analysis, trends/disruptions impacting customers’ businesses, market map, ecosystem analysis, tariffs and regulations, pricing analysis, patent analysis, case study analysis, technology analysis, key conferences and events, trade analysis, Porter’s five forces analysis, key stakeholders and buying criteria, and regulatory analysis of the market

-

To analyze opportunities for stakeholders in the high voltage power transformer and draw a competitive landscape of the market.

-

To benchmark market players using the company evaluation matrix, which analyzes market players on broad categories of business and product strategies adopted by them.

-

To compare key market players with respect to product specifications and applications

-

To strategically profile key players and comprehensively analyze their market rankings and core competencies

-

To analyze competitive developments, such as contracts & agreements, investments & expansions, mergers & acquisitions, new product launches, partnerships, joint ventures & collaborations, in the market

Available Customization

With the given market data, MarketsandMarkets offers customizations based on the company’s specific needs. The following customization options are available for the report:

Product Analysis

-

Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

-

Detailed analyses and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in High Voltage Power Transformer Market