High-Purity Sulfuric Acid Market

High-Purity Sulfuric Acid Market by Grade (PPB, PPT), Application (Cleaning, Etching), End-Use Industry (Semiconductor & Electronics, Pharmaceuticals) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The High-Purity Sulfuric Acid market is projected to reach USD 0.67 billion by 2030 from USD 0.50 billion in 2025, at a CAGR of 6.1% from 2025 to 2030. The semiconductor, electronics, and pharmaceutical industries play a vital role in the global high-purity sulfuric acid market, propelling it into an important steep rise.

KEY TAKEAWAYS

-

BY GRADEThe high-purity sulfuric acid market comprises PPT and PPB. The biggest segment is the expected Parts Per Trillion (PPT) grade of high purity sulfuric acid, because of its important role in advanced fabrication of semiconductors, precision electronics, and high-tech industries that require ultra-low levels of contamination.

-

BY APPLICATIONKey applications include cleaning, etcing, striping,trace analysis and others.The cleaning application is anticipated to be the fastest growing segment in the market for high-purity sulfuric acid owing to the rising demands in the high-tech industries that require ultra-clean surfaces. This acid has been extensively used in wafer cleaning during semiconductor and electronics manufacturing processes.

-

BY END-USE INDSTRYKey end-use industries are semiconductor & electronics, pharmaceutical and others. The semiconductor and electronics industry, currently undergoing rapid advancement in chip manufacturing, PCBs, and display technologies, is expected to emerge as the biggest end-use sector for high-purity sulfuric acid. Due to the accelerating demand for advanced logic and memory chips for AI, 5G, IoT, semiconductor manufacturers have begun heavy investments in new advanced-generation fabrication facilities (fabs).

-

BY REGIONThe high-purity sulfuric acid market covers Europe, North America, Asia Pacific, South America, the Middle East, and Africa. Asia-Pacific is the leading market for high-purity sulfuric acid owing to the semiconductor manufacturing, the consumer electronics industry, and industrialization. Countries like Taiwan, South Korea, China, and Japan are a nest to those with high semiconductor foundries and electronics manufacturers, generating huge demand for ultra-high-purity chemicals used in wafer cleaning, etching, and circuit boards.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, BASF, Zhejiang Jiahua Energy Chemical Industry Co. Ltd., and its wholly owned subsidiary, Zhejiang Jiafu New Material Technology Co. Ltd., have signed an agreement to expand the production capacity of electronic-grade sulfuric acid in Jiaxing, China.

The high-purity sulfuric acid market is experiencing steady growth, driven by its increasing use in the semiconductor, electronics industries for precision cleaning, etching applications. Rising demand for high-performance electronic devices, expansion of semiconductor fabrication facilities, re key factors propelling market expansion. Additionally, ongoing investments in ultra-pure chemical manufacturing, technological advancements in purification processes are reshaping the industry landscape.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ business in the high-purity sulfuric acid market arises from evolving customer trends and technological disruptions. Hotbets are semiconductor and electronics manufacturers — the key clients of high-purity sulfuric acid producers target applications include wafer cleaning, etching. Shifts such as the rapid advancement of semiconductor technologies, and stricter purity standards influence end-user revenues. These revenue changes in end-user industries directly affect the demand from hotbets, which in turn impacts the sales and profitability of high-purity sulfuric acid manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Surge in demand from semiconductor and electronics industries

-

Rise in demand from Pharmaceuticals and renewable energy industries

Level

-

Complex production, high manufacturing costs, and stringent safety and environmental regulations

Level

-

Advancements in production processes

Level

-

Contamination risks due to penetration of metallic ions

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Surge in demand from semiconductor and electronics industries

The semiconductor and electronics industries continue to be major drivers of the high-purity sulfuric acid market, as the chemical is essential for manufacturing integrated circuits, microchips, and other electronic components. With the rapid advancements in 5G technology, artificial intelligence (AI), cloud computing, and the Internet of Things (IoT), the demand for smaller, more powerful, and energy-efficient chips has surged, increasing the need for ultra-clean chemicals like high-purity sulfuric acid.

Restraint: Complex production, high manufacturing costs, and stringent safety and environmental regulations

High- purity sulfuric acid market is essential for various industries, including semiconductors, photovoltaics, and pharmaceuticals. However, its growth is impeded by several significant restraints, notably the complex production process and high manufacturing costs. Producing electronic-grade sulfuric acid requires stringent purification processes to eliminate impurities, ensuring the acid meets the exacting standards necessary for sensitive applications. This purification involves advanced techniques and specialized equipment, leading to increased operational complexity and elevated production expense. The production, handling, and disposal of high- purity sulfuric acid are also subject to strict environmental and safety regulations due to its highly corrosive nature and potential environmental hazards.

Opportunity: Advancements in production processes

The high-purity sulfuric acid market is experiencing significant growth, driven by advancements in production processes that have led to increased purity and capacity. One of the key technological advancements in sulfuric acid production is the application of Aspen Plus modeling and optimization techniques, which have successfully enhanced the efficiency of the contact process, a method for producing high-purity sulfuric acid. These process optimizations improve reaction kinetics, reduce energy consumption, and enhance purification techniques, leading to higher acid purity levels and increased production capacity

Challenge: Volatility in raw material prices and supply chain disruptions.

One of the critical challenges in the production and storage of high-purity sulfuric acid is the permeation of metallic ions, which can introduce impurities and compromise its quality. Maintaining ultra-high purity is essential, particularly for industries such as semiconductors, photovoltaics, and pharmaceuticals, where even trace contamination can disrupt manufacturing processes and reduce product performance. A significant source of metallic ion contamination is the leaching and permeation of metals from equipment, piping, and storage materials used in sulfuric acid production.

High-Purity Sulfuric Acid Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Utilized in wafer cleaning and surface preparation during semiconductor fabrication to remove metal ions, organic residues, and contaminants from silicon wafers. | Ensures ultra-clean wafer surfaces, improves chip yield, and maintains process purity required for advanced nodes (≤3nm). |

|

Applied in the etching and cleaning stages of integrated circuit (IC) and memory chip production, especially for DRAM and NAND manufacturing. | Enhances precision in patterning, prevents particle contamination, and supports high device reliability and performance. |

|

Used in the production and purification of battery electrolytes and cathode materials for lithium-ion batteries. | Improves purity of active materials, enhances battery performance, and extends cycle life through minimized impurity levels. |

|

In semiconductor fabrication, it’s employed for wafer cleaning, photomask treatment, and etching of metal layers in analog and RF chip production. | Provides consistent surface quality, supports high-frequency device stability, and ensures process uniformity. |

|

Used for high-precision wafer cleaning and oxidation processes in microprocessor and logic chip manufacturing. | Enables sub-nanometer defect control, enhances transistor performance, and supports next-generation process integration. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The high-purity sulfuric acid market ecosystem consists of raw material suppliers (e.g., PVS Chemicals), manufacturers (e.g., BASF, Sumitomo Chemical), distributors and compounders (e.g., Chemtrade Logistics), and end users (e.g., Samsung Electronics, Taiwan Semiconductor Manufacturing Company Limited). Raw materials and intermediates are processed using advanced refining and purification technologies to produce electronic-grade sulfuric acid. Distributors manage regional demand and logistics, while end users in semiconductors and electronics leverage the acid for wafer cleaning, etching, and microfabrication. Collaboration across the supply chain ensures product purity, performance consistency, and market growth.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

High-Purity Sulfuric Acid Market, By Grade

PPT grade, held the largest market share, in terms of value, in the global market in 2024. The Parts Per Trillion (PPT) grade is expected to be the largest segment of the high-purity sulfuric acid market, as the end-use industries like semiconductor, advanced electronics, and high-precision pharmaceutical increasingly need high-purity chemicals with lowest levels of contaminants. As the demand for chemical purity grows in these industries, the PPT-grade will be the go-to grade. In the semiconductor sector, rapid expansion of wafer fabrication, etching, and cleaning processes can be seen leading demand for high-purity sulfuric acid.

High-Purity Sulfuric Acid Market, By End-use Industry

Semiconductor & Electronics held the largest market share, in terms of value, in the global market in 2024. The semiconductor and electronics sector is expected to be the largest end-use sector of the high-purity sulfuric acid market owing to the growth in advanced semiconductor production, increased production of consumer electronics, and the expansion of data centers. High-purity sulfuric acid is used in the semiconductor fabrication clearing, etching, and surface preparation processes, and it is critical to keep contamination to a minimum while maintaining high yields in microchip production.

High-Purity Sulfuric Acid Market, By Application

Cleaning held the largest market share, in terms of value, in the global market in 2024. Due to its essential role in manufacturing semiconductors and electronics, the cleaning application is expected to gain prominent share in the high-purity sulfuric acid market. In fact, ultra-clean surfaces are critical in semiconductor fabrication for defect-free chip production. Extensive usage of high-purity sulfuric acid in wafer cleaning is employed to eliminate both organic and inorganic contaminants so that semiconductor devices may perform at their best and have the widest reliability window.

REGION

Asia Pacific to be fastest-growing region in global High-Purity Sulfuric Acid market during forecast period

Asia-Pacific is the leading market for high-purity sulfuric acid owing to the semiconductor manufacturing, the consumer electronics industry, and industrialization. Countries like Taiwan, South Korea, China, and Japan are a nest to those with high semiconductor foundries and electronics manufacturers, generating huge demand for ultra-high-purity chemicals used in wafer cleaning, etching, and circuit boards. The presence of TSMC, Samsung, and SK Hynix, among other semiconductor giants, increases the need for high-purity sulfuric acid for contamination-free and high-precision microchip fabrication.

High-Purity Sulfuric Acid Market: COMPANY EVALUATION MATRIX

In the high-purity sulfuric acid market matrix, BASF (Star) leads with a strong global presence, advanced purification technologies, and a diversified end-user base across semiconductors, electronics, and other industries. Its extensive R&D capabilities and integrated production systems enable consistent ultra-high purity standards and reliable global supply. LS MnM (Emerging Leader), on the other hand, is gaining traction with its growing focus on high-purity sulfuric acid production for semiconductor applications, primarily serving the Asian market. However, its limited geographic reach currently constrain its position, though continued investments and regional partnerships could help it advance toward the leaders’ quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 0.47 Billion |

| Market Forecast in 2030 (Value) | USD 0.67 Billion |

| Growth Rate | CAGR of 6.1% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: High-Purity Sulfuric Acid Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Asia based Semiconductor Manufacturer |

|

|

| High Purity Sulfuric Acid Supplier |

|

|

RECENT DEVELOPMENTS

- October 2023 : FUJIFILM Corporation has officially completed the acquisition of the electronic chemicals business from Entegris, Inc.

- Ju 2022 : Chemtrade Logistics Income Fund has partnered with the privately held Kanto Group to establish a joint venture for the construction of a greenfield high-purity sulfuric acid plant. The newly formed entity, KPCT Advanced Chemicals LLC, is set to develop the facility in Casa Grande, Arizona, with operations expected to commence in 2024.

- July 2021 : BASF, Zhejiang Jiahua Energy Chemical Industry Co. Ltd., and its wholly owned subsidiary, Zhejiang Jiafu New Material Technology Co. Ltd., have signed an agreement to expand the production capacity of electronic-grade sulfuric acid in Jiaxing, China. This multi-million-euro investment will more than double the company's current sulfuric acid production capacity in China to support the rapidly growing semiconductor industry. The expansion is scheduled for completion by 2023.

Table of Contents

Methodology

The study involved four major activities in estimating the market size of the High-Purity Sulfuric Acid market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key High-Purity Sulfuric Acid, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The High-Purity Sulfuric Acid market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, and end users. Various primary sources from the supply and demand sides of the High-Purity Sulfuric Acid market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the High-Purity Sulfuric Acid industry.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to chemistry, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of High-Purity Sulfuric Acid and future outlook of their business which will affect the overall market.

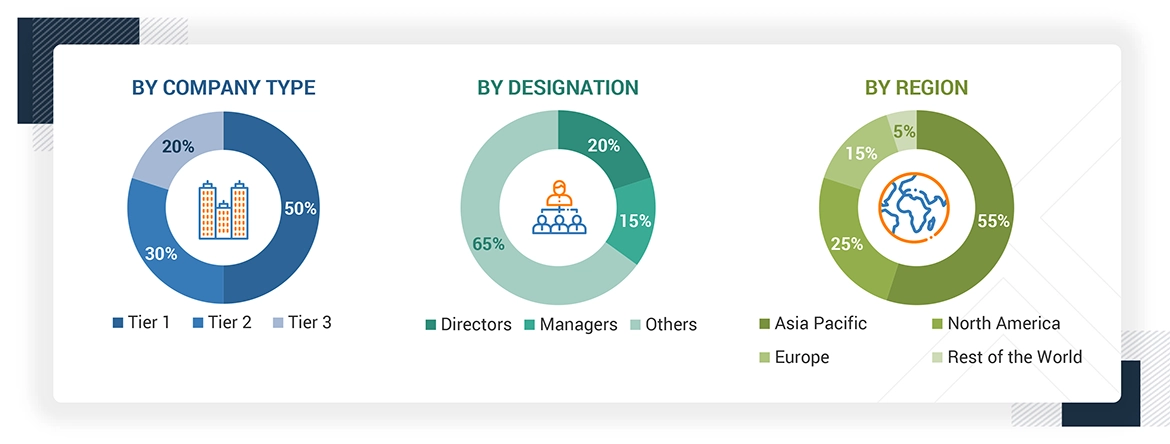

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2024 available in the public domain, product portfolios, and geographical presence.

Other designations include sales representatives, production heads, and technicians.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the size of various submarkets for High-Purity Sulfuric Acid for each region. The research methodology used to estimate the market size included the following steps:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- The global market was then segmented into five major regions and validated by industry experts.

- All percentage shares, splits, and breakdowns based on grade, application, end-use industry, and regions were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed inputs and analysis and presented in this report.

High-Purity Sulfuric Acid Market: Bottum-Up and Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process High-Purity Sulfuric Acid above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

High-purity sulfuric acid is a highly pure form of sulfuric acid (H2SO4) that has few metal and non-metal impurities and is of absolutely vital necessity in industries which require ultra-clean environments. Sulfuric acid, by itself, is a strongly corrosive, dense, colorless liquid distinguished by its exceedingly acidic properties and is an extremely essential ingredient of the majority of chemical reactions. It is basically produced in the Contact Process, whereby the elemental sulfur is burned to produce sulfur dioxide (SO2), and it is then oxidized to form sulfur trioxide (SO3) by the use of a vanadium pentoxide (V2O5) catalyst. The SO3 is later dissolved in water to produce sulfuric acid. But for high purity, advanced purification methods like distillation, filtration, and chemical treatment are employed to remove minute amounts of metal ions, organic substances, and residues of sulfurous acid. High-purity sulfuric acid finds its most significant application in the semiconductor industry, where it is applied for wafer cleaning and etching to yield defect-free production of microchips. Apart from semiconductors, it is also a critical ingredient in pharmaceuticals, catalyst regeneration, and chemical synthesis for laboratory-grade use, where contamination must be eliminated at all costs. Its advantages to end-use industries include superior cleaning efficiency, elimination of microscopic contaminants, and enhanced process reliability through stable chemical properties. The demand for high-purity sulfuric acid is driven primarily by the growing requirement for miniaturized electronic devices, enhanced pharma synthesis, and increasing application of precision chemical processing. As industries move towards tighter quality and environmental regulations, the development of eco-friendly production processes such as acid recycling and ultra-pure extraction techniques is increasing its importance. This transformation makes sure that high-purity sulfuric acid remains to be a main ingredient in high-tech processes as well as addressing environmental sustainability concerns.

Stakeholders

- High-Purity Sulfuric Acid Manufacturers

- High-Purity Sulfuric Acid Traders, Distributors, and Suppliers

- Raw Type Suppliers

- Government and Private Research Organizations

- Associations and Industrial Bodies

- R&D Institutions

- Environmental Support Agencies

Report Objectives

- To define, describe, and forecast the size of the High-Purity Sulfuric Acid market, in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market.

- To estimate and forecast the market size based on product grade, application, end-use industry, and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Rest of the World, along with their key countries.

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent development such as product launch, partnership, acquisition, and expansion in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the High-Purity Sulfuric Acid Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in High-Purity Sulfuric Acid Market