The research study involved the wide use of secondary sources, directories, and databases to identify and collect valuable information for the analysis of the global halal empty capsules market. Extensive interviews were conducted with various primary participants, including key industry members, subject-matter experts (SMEs), C-level managers of leading market players, and industry consultants, to obtain and verify qualitative and quantitative information and evaluate the growth scenarios of the market. The global market size estimated through secondary research (top down and bottom-up) followed by data triangulation with inputs from industry experts to arrive at the final market size.

Secondary Research

Secondary research was used mainly to identify and collect information for the technical, market-oriented, and commercial study of the halal empty capsules market. The secondary sources used for this study include Food and Drug Administration (FDA), Islamic Food and Nutrition Council of America (IFANCA), Halal Industry Development Corporation (HIDC), The Association of Southeast Asian Nations (ASEAN), Malaysia’s Department of Islamic Development (JAKIM), Halal Certification Europe (HCE), research journals; corporate filings such as annual reports, SEC filings, investor presentations, and financial statements; press releases; trade, business, professional associations and among others. These secondary sources were also used to obtain major information about key market players, and market segmentation corresponding to industry trends, regional/country-level markets, market developments, and technology prospects. Secondary data was collected and analysed to arrive at the market size of the global halal empty capsules market, which was further validated through primary research.

Primary Research

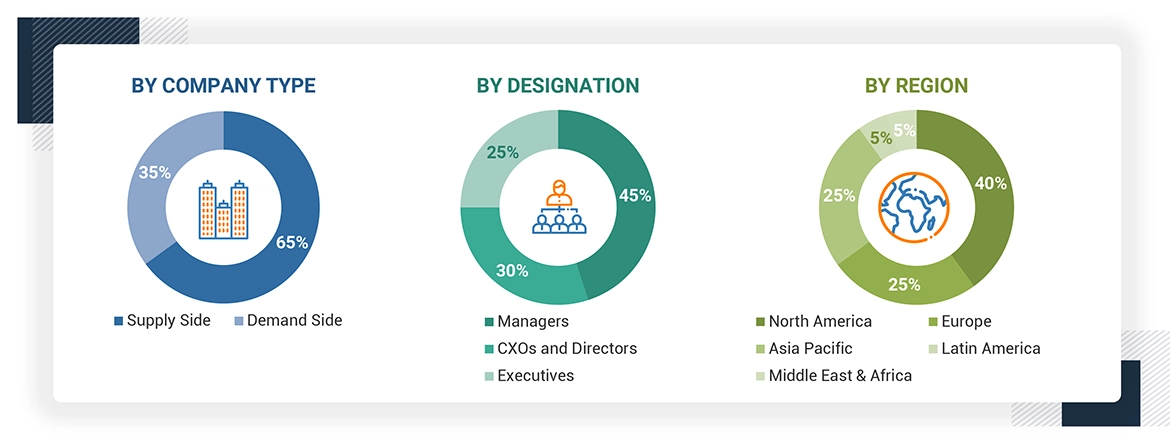

Extensive primary research was conducted after acquiring basic knowledge about the global halal empty capsules market scenario through secondary research. Several primary interviews were conducted with market experts from the demand side, such as pharmaceutical industry, nutraceutical industry, cosmetic industry from the supply side, such as C-level and D-level executives, product managers, marketing & sales managers of key manufacturers, distributors, and channel partners. The primary interviews were conducted across five major regions, including the North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Approximately 65% and 35% of the primary interviews were conducted with supply-side and demand-side participants, respectively. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the halal empty capsules market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Data Triangulation

After arriving at the market size from the market size estimation process explained above, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Halal empty capsules are capsules that meet Islamic dietary laws and are suitable for consumption. The ingredients used for halal empty capsules production are derived from halal sources. The capsules should not contain any components from forbidden (haram) animals or materials. The scope of the report covers halal certified empty capsules (gelatin and non-gelatin).

Stakeholders

-

Halal Empty Capsules Manufacturing Companies

-

Suppliers and distributors of halal empty capsules

-

Raw Material Suppliers

-

Government bodies/Certification Bodies

-

Regulatory bodies

-

Pharmaceutical Companies

-

Nutraceutical Companies

-

Cosmetic Companies

-

Business research and consulting service providers

-

Venture capitalists

-

Market research and consulting firms

Report Objectives

-

To define, describe, analyze, and forecast the halal empty capsules market by type, end user, and region

-

To provide detailed information regarding the major factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

-

To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the halal empty capsules market

-

To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

-

To forecast the size of the market segments with respect to five main regions: North America, Europe, the Asia Pacific, Latin America, and Middle East & Africa

-

To profile the key players in the halal empty capsules market and comprehensively analyze their product portfolios, market positions, and core competencies

-

To track and analyze competitive developments in the halal empty capsules market, such as acquisitions, product launches, expansions, agreements, partnerships, and collaborations

-

To benchmark players within the halal halal empty capsules market using the ‘Company Evaluation Matrix' framework, which analyzes market players based on various parameters within the broad categories of business strategy and product strategy

Growth opportunities and latent adjacency in Halal Empty Capsules Market