Wi-Fi Market

Wi-Fi Market (Wi-Fi 5, Wi-Fi 6/6E, Wi-Fi 7), Density (High Density, Medium Density, Low Density), Deployment (indoor, outdoor), Solution (Access Point, Router, Controller, Network Management, Analytics & Monitoring, Security) - Global Forecast to 2029

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The Wi-Fi market is estimated to be worth USD 22.06 billion in 2024 and is projected to reach USD 45.12 billion by 2029 at a Compound Annual Growth Rate (CAGR) of 15.4%. The growing demand for fast and reliable Wi-Fi in public spaces, such as airports, hotels, and retail locations, is driving the Wi-Fi market.

KEY TAKEAWAYS

-

BY OFFERINGThe Wi-Fi market comprises hardware, software, and services. Wi-Fi hardware generates revenue through sales of routers, access points, controllers, and network equipment, driven by upgrades to Wi-Fi 6/6E/7 and expanding device density. Wi-Fi Software and Services focus on network management, security, analytics, and Wi-Fi-as-a-Service (WaaS), enabling enterprises and service providers to ensure reliable connectivity, optimize performance, and create new monetization streams.

-

BY TECHNOLOGYWi-Fi 6 and Wi-Fi 7 are transforming wireless connectivity by delivering faster speeds, lower latency, and greater efficiency to support today’s data-intensive applications. Wi-Fi 6 enables improved capacity, seamless multi-device performance, and enhanced security, making it ideal for enterprises, smart homes, and public networks. Building on this, Wi-Fi 7 promises ultra-high throughput, multi-link operations, and reduced congestion, unlocking use cases such as immersive AR/VR, 8K streaming, advanced IoT ecosystems, and real-time industrial automation.

-

BY DEPLOYMENTIndoor Wi-Fi ensures high-capacity, secure, and low-latency connectivity across homes, offices, schools, and retail spaces, supporting dense user traffic and a wide range of IoT devices. Outdoor Wi-Fi extends reliable coverage to campuses, transport hubs, smart cities, and industrial zones, enabling large-scale broadband access. Together, they deliver seamless connectivity, enhance user experiences, and power emerging applications in smart infrastructure and mobility.

-

BY DENSITYHigh-density Wi-Fi deployments cater to environments like stadiums, airports, and campuses, where thousands of users require simultaneous, high-speed connectivity. Medium-density Wi-Fi supports offices, schools, and retail spaces with balanced performance for moderate user loads. Low-density Wi-Fi, commonly found in homes and small businesses, prioritizes reliable coverage and cost efficiency. Together, these tiers ensure optimized connectivity tailored to user scale and application needs.

-

BY APPLICATIONIn residential applications, Wi-Fi enables seamless connectivity for streaming, gaming, remote work, and smart home devices, creating a connected living experience. In smart healthcare, Wi-Fi supports telemedicine, remote patient monitoring, connected medical equipment, and real-time data sharing, enhancing care delivery and operational efficiency. Together, these applications highlight Wi-Fi’s role in improving everyday convenience while driving innovation in critical healthcare services.

-

BY REGIONThe Wi-Fi market covers North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. In North America, the Wi-Fi market is driven by advanced infrastructure, widespread adoption of Wi-Fi 6, and strong demand from enterprises, smart homes, and public venues. In the Asia Pacific, rapid digitalization, growing smartphone penetration, and government-led smart city initiatives are fueling large-scale Wi-Fi deployments. Together, these regions represent mature and fast-growing markets, shaping global Wi-Fi innovation and adoption.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, in April 2024, Stc Bahrain and HPE Aruba Networking partnered to enhance Wi-Fi and networking technology offerings in Bahrain.

As travelers and shoppers increasingly rely on internet access for communication and transactions, businesses must offer seamless connectivity to enhance customer experience. Airports, hotels, and retail locations are upgrading their Wi-Fi infrastructure to meet these needs, ensuring high-speed and uninterrupted service to attract and retain customers.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. Hotbets are clients of Wi-Fi solution providers, and target applications are clients of Wi-Fi solution providers. Shifts, which are changing trends or disruptions, will impact the revenues of end users. The revenue impact on end users will affect the revenue of hotbets, which will further affect the revenues of Wi-Fi solution providers. As businesses embrace hybrid and remote work, there is a greater focus on secure, reliable connectivity. AI-driven optimization and cloud-based management are transforming network deployment and maintenance, making Wi-Fi solutions more scalable and cost-effective.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increase in smartphone and wireless device adoption

-

Growth in adoption of BYOD and CYOD trend among organizations

Level

-

Stringent government data regulations and guidelines

-

Contention loss and co-channel interference

Level

-

Rapid evolution of carrier Wi-Fi

-

Continuous upgrades in Wi-Fi standards

Level

-

Lack of technical expertise

-

Data security and privacy concerns

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increase in smartphone and wireless device adoption

The increasing number of smart devices and smartphone users represents the rising potential for Wi-Fi solutions, as the devices use Wi-Fi networks for better connectivity. Mobile subscribers worldwide are expected to grow significantly in the coming years. According to the Global System for Mobile Communications (GSMA) Mobile Economy 2024 report, there were approximately 5.6 billion subscribers to mobile services at the end of 2024. Smartphones, smart televisions, and smart office appliances, among other intelligent devices, are also being rapidly adopted by businesses. Smart and wireless devices that require Wi-Fi networks to remain connected via remote technology allow users to access and control the devices from any location. Smart wireless devices require Wi-Fi networks to ensure continuous connectivity and operational performance. The substantial growth in the development and shipment of wireless and smart devices would propel the expansion of the Wi-Fi market among enterprises.

Restraint: Contention loss and co-channel interference

Contention loss and co-channel interference are prominent restraints to market growth for Wi-Fi networks. This problem of contention loss occurs when multiple devices compete for limited resources on one access point (AP). This leads to congestion and degraded performance. Such environments can cause delays in data transmission and interruptions in service quality. Co-channel interference, in this case, is the interference between the signals of two or more access points within the same radio frequency RF channel, and it degrades the network. This problem is common in mature markets such as North America, Europe, and the Asia Pacific, with well-established Wi-Fi networks. In these regions, the introduction of new networks or upgrading the existing ones may result in overlapping channels and improper mapping to networks, which further affects performance.

Opportunity: The rapid evolution of carrier Wi-Fi

The carrier Wi-Fi sector is rapidly evolving, driven by the increasing wireless traffic from smartphones and tablets. Telecom operators are heavily investing in this space due to lower deployment costs compared to other services. With trends like BYOD and IoT, many providers are focused on maximizing benefits from carrier-grade Wi-Fi, which offers advantages such as effective monitoring and bundling. For instance, when a user with a smartphone enters a shopping mall, the telecom operator provides carrier Wi-Fi, sending an SMS notification. The phone automatically switches from mobile data to Wi-Fi and then back to cellular when the user leaves the area.

Challenge: Lack of technical expertise

Data privacy is a major concern for enterprises due to the rapid increase in data volumes. Organizations are seeking enhanced security measures to protect their networks from threats like corporate surveillance and data breaches. With more systems in place, every endpoint—including gateways, sensors, and smartphones—becomes a potential target for hackers.As WLAN networks access various smart devices, security is essential when deploying Wi-Fi solutions. These solutions must provide secure, reliable, and high-speed internet access. Disruptions to business processes can significantly impact operations, leading many organizations to hesitate in adopting Wi-Fi services. Therefore, strong security and privacy measures are crucial for successfully implementing these technologies, as they are vital to overcoming market challenges.

Wi-Fi Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

UniEuro faced issues with unprofessional network planning, such as signal interference between APs on the same and neighboring floors, leading to coverage gaps and degraded user experiences. Additionally, the existing Wi-Fi solutions could not deliver ROI beyond basic internet access and advertisements, failing to support advanced customer data analytics and marketing strategy assessments. | The deployment transformed free Wi-Fi into a value-added service, improving customer experiences and enabling targeted marketing strategies. The solution enhanced advertisement delivery efficiency and provided actionable insights for UniEuro’s marketing strategies, turning the Wi-Fi network into a high-ROI tool for online-offline integration and customer engagement. |

|

The district faced a rise in cyberattacks, posing significant risks to the protection of sensitive student information. Additionally, many students actively attempted to bypass network security protocols, creating potential vulnerabilities within the system. | The deployment of Extreme Networks solutions enhanced data protection by providing improved visibility into network activity and safeguarding sensitive student and administrative information. Advanced analytics tools allowed the district to proactively identify and mitigate risks, significantly improving network security. |

|

Oxford implemented Juniper’s AI-driven Wireless Access solution across key buildings and colleges. Juniper’s cloud services, including Mist Wi-Fi Assurance and Marvis Virtual Network Assistant, provided reliable performance and simplified issue resolution. The Wi-Fi 6 access points integrated smoothly into existing infrastructure, minimizing installation disruptions, even in historic locations, and allowed colleges to manage their Wi-Fi independently with a microservices architecture. | The AI-driven Juniper solution delivered improved network visibility, control, and faster issue resolution. Students gained secure, user-friendly personal wireless LANs in their dorm rooms for their devices. The system supported Oxford’s vision of a home-like campus experience while optimizing Wi-Fi for academic and recreational use. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Wi-Fi market consists of a complex ecosystem involving various technology vendors and government organizations that collaborate to provide secure and reliable connectivity for businesses, supporting their digital transformation initiatives. This ecosystem primarily comprises government regulatory bodies, system integrators (SIs), original equipment manufacturers (OEMs), customer premises equipment (CPE) and hardware vendors, cloud providers, mobile network operators (MNOs), solution providers, and service providers. Each vendor in the ecosystem is interconnected, either directly or indirectly, to facilitate the deployment of Wi-Fi networks across multiple industries, such as education, retail, banking, financial services and insurance (BFSI), manufacturing, government, and transportation & logistics.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Wi-Fi Market, By Technology

Wi-Fi 7 is emerging as the fastest-growing technology in the Wi-Fi ecosystem, offering ultra-high throughput, multi-link operation, and significantly reduced latency compared to previous generations. Its ability to support data-heavy applications, such as AR/VR, 8K streaming, cloud gaming, and industrial automation, positions it as a key enabler for next-generation digital experiences. With increasing adoption across enterprises, homes, and public networks, Wi-Fi 7 is set to drive rapid growth and become the cornerstone of future wireless connectivity.

Wi-Fi Market, By Application

Residential applications will dominate the Wi-Fi market, providing numerous smart home benefits that enhance convenience, security, and entertainment. Wi-Fi connects IoT devices like thermostats, lighting, and appliances, allowing residents to control energy use and comfort via mobile apps or voice commands. Smart lighting adjusts based on time or occupancy for energy efficiency and ambiance. Wi-Fi powers home security devices, such as video doorbells, motion sensors, and surveillance cameras, offering real-time alerts and remote monitoring. It supports ultra-HD streaming, lag-free gaming, and improves video conferencing and remote work, essential for virtual meetings. Additionally, Wi-Fi integrates emerging tech, like AR and VR for gaming and remote learning, connecting multiple devices simultaneously. This makes homes more efficient, secure, and versatile, meeting the demands of modern lifestyles and making smart living possible.

Wi-Fi Market, By Offering

By offering, the hardware segment is expected to have the largest market size during the forecast period. Wi-Fi hardware consists of access points, routers, controllers, and some other devices, including range extenders, antennas, and load balancers. Access points and routers establish a reliable wireless connection, while controllers simplify network management and optimize performance.

Wi-Fi Market, By Deployment

By deployment, the indoor segment is expected to hold the larger market size during the forecast period. Indoor Wi-Fi deployments are tailored for enclosed spaces, such as homes, offices, shopping malls, hospitals, and educational institutions, that require fast connectivity. These indoor setups ensure the strategic placement of access points to achieve the most effective coverage with minimal interference from walls and other obstacles. Such features as beamforming and MU-MIMO ensure optimal performance in high-density environments, such as open-plan offices or classrooms.

REGION

North America is expected to hold the largest market share during the forecast period.

North America's Wi-Fi market is evolving due to rising demands for reliable connectivity and rapid technological advancements. Gap Inc. has integrated Juniper's AI-driven Wi-Fi solutions to automate management, reduce tech support visits by 85%, and enhance performance in its stores. In Canada, a new Starlink Wi-Fi access point was launched near Fort Smith, improving connectivity in remote areas. Airlines like Air Canada are also offering in-flight Wi-Fi, reflecting the need for constant connectivity. The market is poised for growth with the adoption of Wi-Fi 6 and Wi-Fi 7, particularly in retail and travel sectors, while enhancing connectivity in both urban and rural regions.

Wi-Fi Market: COMPANY EVALUATION MATRIX

In the Wi-Fi market matrix, Cisco (Star) leads with a strong market share and an extensive product footprint, which is vital for enterprises seeking secure, scalable, and intelligent connectivity, featuring advanced features in automation, analytics, and seamless integration with cloud and security platforms. Alcatel Lucent Enterprise (Pervasive Player) delivers reliable, cost-efficient Wi-Fi tailored to business-critical applications, enabling organizations to enhance productivity, mobility, and user experiences across diverse environments.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 22.06 Billion |

| Market Forecast in 2029 (Value) | USD 45.12 Billion |

| Growth Rate | CAGR of 15.4% from 2024-2029 |

| Years Considered | 2018-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Wi-Fi Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Solution Provider | Product Analysis: Product Matrix, which gives a detailed comparison of the product portfolios of the top five companies | Enhanced understanding of competitive positioning and product offerings |

| Leading Solution Provider | Company Information: Detailed analysis and profiling of additional market players (up to 5) | Deeper insights into market dynamics and potential strategic partnerships |

| Leading Solution Provider | Geogaphic Analysis: Further breakdown of countries in Rest of Asia Pacific, Europe, Middle East & Africa, and Latin America | Deeper insights into remaining countries |

RECENT DEVELOPMENTS

- December 2024 : TP-Link partnered with Purdicom to deliver TP-Link's Omada products to Managed Service Providers (MSPs) across various sectors, including hospitality, education, and multiple dwelling units.

- November 2024 : Extreme Networks partnered with the NHL to prioritize improving fan experiences through technology and leveraging fan data. Many NHL clubs, including the Anaheim Ducks, Calgary Flames, Columbus Blue Jackets, and Nashville Predators, have deployed Extreme solutions to enhance in-arena Wi-Fi connectivity, deliver immersive fan experiences and create a backbone for a host of new digital services.

- September 2024 : NETGEAR and Samsung Electronics System LSI Business partnered to help create seamless interoperability and roaming between NETGEAR Business Wi-Fi 7 access points and Samsung’s Wi-Fi 7 client chipset solution.

- September 2024 : Nokia partnered with RUCKUS Networks, a CommScope business, to create an innovative solution for deploying seamless in-building and campus-wide connectivity, uniquely tailored to the needs of diverse industry verticals.

Table of Contents

Methodology

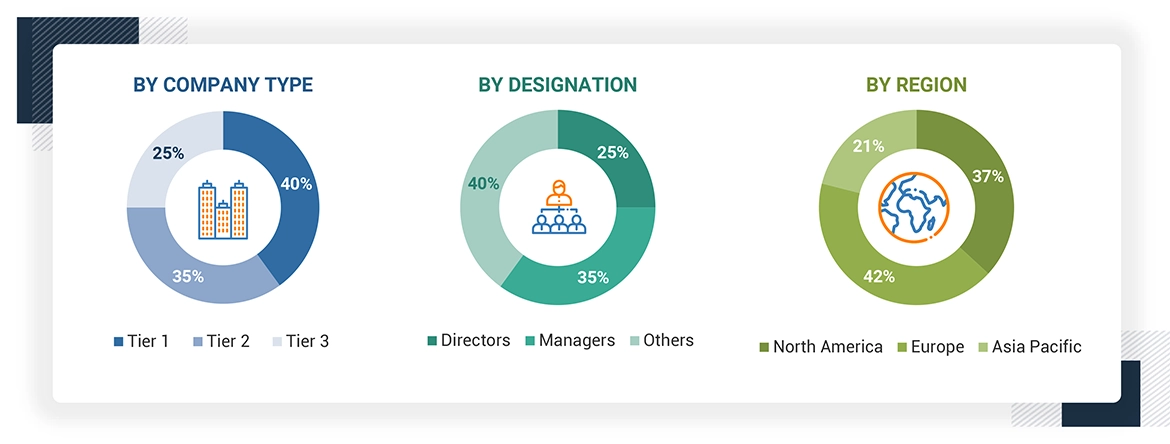

This research study involved extensive secondary sources, directories, and databases, such as Dun & Bradstreet (D&B) Hoovers and Bloomberg BusinessWeek, to identify and collect valuable information for a technical, market-oriented, and commercial study of the Wi-Fi market. The primary sources have been mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews have been conducted with primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information.

Secondary Research

The market for companies offering Wi-Fi solutions and services to different end users has been estimated and projected based on the secondary data made available through paid and unpaid sources and by analyzing their product portfolios in the ecosystem of the Wi-Fi market. In the secondary research process, various sources such as SDM Magazine and CIO Insider were referred to to identify and collect information on the Wi-Fi market for this study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles by recognized authors, directories, and databases. Secondary research has been mainly used to obtain essential information about the supply chain of the market, the total pool of key players, market classification, segmentation according to industry trends to the bottommost level, regional markets, and key developments from both market- and technology-oriented perspectives that primary sources have further validated.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related critical executives from Wi-Fi solutions vendors, System Integrators, professional service providers, and industry associations; and key opinion leaders. Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped me understand various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using Wi-Fi services, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of Wi-Fi services which would impact the overall Wi-Fi market.

Note: Others include sales managers, marketing managers, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

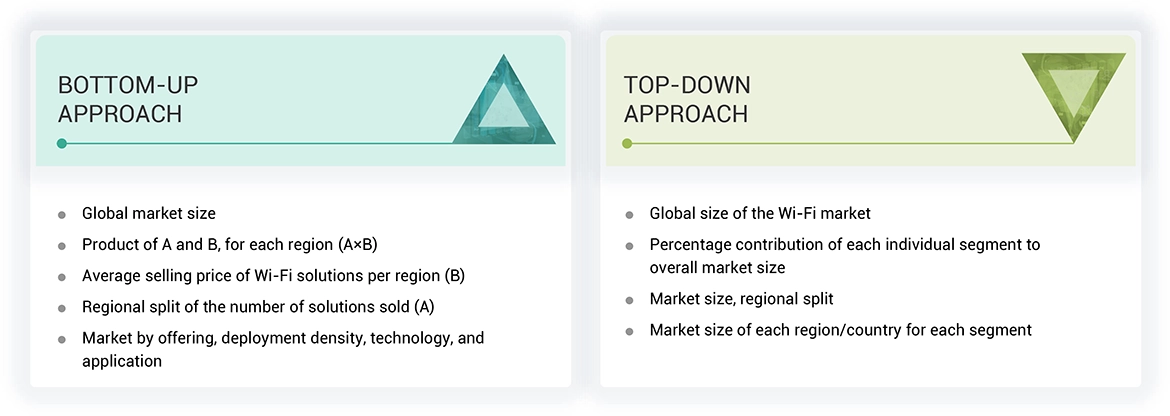

Multiple approaches were adopted to estimate and forecast the size of the Wi-Fi market. The first approach involves estimating market size by summing up the revenue generated by companies through the sale of Wi-Fi solutions and services.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Wi-Fi market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

- After arriving at the overall market size, the Wi-Fi market was divided into several segments and subsegments.

Wi-Fi Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size, the Wi-Fi market was divided into several segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

Wi-Fi is a wireless networking technology based on IEEE 802.11 standards, enabling devices to connect to the internet and each other without cables. It is widely used across homes, businesses, and industries for seamless data transfer and communication. Wi-Fi advancements like Wi-Fi 6 and 7 drive faster speeds, higher capacity, and improved connectivity.

Stakeholders

- Device Manufacturers

- Network Service Providers

- Internet Service Providers (ISPs)

- Cloud Service Providers

- Wi-Fi Standards Organizations (e.g., IEEE, Wi-Fi Alliance)

- Infrastructure Vendors

Report Objectives

- To determine, segment, and forecast the Wi-Fi market based on offering, deployment, technology, density, application, and region in terms of value.

- To forecast the segment’s size with respect to five regions: North America, Europe, Asia Pacific (Asia Pacific), Latin America, and the Middle East & Africa (Middle East & Africa)

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market

- To study the complete value chain and related industry segments and perform a value chain analysis

- To strategically analyze macro and micro-markets concerning individual growth trends, prospects, and contributions to the market

- To analyze industry trends, regulatory landscape, and patents & innovations

- To analyze opportunities for stakeholders by identifying the high growth segments

- To track and analyze competitive developments, such as agreements, partnerships, collaborations, and R&D activities

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the report:

Country-wise information

- Analysis for additional countries (up to five)

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Wi-Fi Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Wi-Fi Market