Radio Modem Market for ITS Application by Frequency Band (License Free, UHF, Wi-Fi, VHF), Communication Channel (Point to Multi-Point, Point to Point), Operating Range (Short, Long), Application and Geography - Global Forecast to 2020

The global radio modem market for ITS application is expected to grow at a CAGR of 8.9% during the forecast period to reach USD 160.8 Million. Wireless communication has revolutionized the traditional means of communication. Radio modems play a crucial role in this revolution, owing to their ability to encode, transmit, and decode the data over long distances. These modems use radio waves for data transmission that give user an added advantage over wired data transfer. The report aims at estimating the market size and future growth potential of the radio modem market for ITS application across different segments such as frequency band, communication channel, operating range, application, and geography. The base year considered for the study is 2014 and the market size is forecasted for the period between 2015 and 2020. Increasing government funding toward the deployment of various ITS systems such as electronic toll collection systems, advanced transportation management systems, and others is also driving the growth of the radio modems market for ITS application.

MarketsandMarkets forecasts the global radio modem market for ITS application to grow at a CAGR of 8.9% during the forecast period to reach USD 160.8 Million by 2020. Wireless communication has revolutionized the traditional means of communication. Radio modems play a crucial role in this revolution, owing to their ability to encode, transmit, and decode data over long distances. Radio modems use radio waves for data transmission, which give users an added advantage over wired data transfer.

Radio modems have numerous applications in the transportation and logistics sector such as remote data acquisition, supervisory control and data acquisition (SCADA), telemetry, and automatic vehicle location (AVL) among others.

The scope of this report covers the radio modem market for ITS application by frequency band, communication channel, operating range, application, and region. The market for Wi-Fi frequency band is estimated to grow at the highest CAGR during the forecast period. Wi-Fi modems are used in dedicated short range communications (DSRC) for executing two-way short to medium-range wireless communications through high data transmission for safety driving applications. The point to multi-point market for ITS application is expected to grow at a high CAGR during the forecast period.

The short range radio modem for ITS application is estimated to record higher revenue compared to the long range market for ITS application during the forecast period. Short range radio modems transmit data at a higher rate. Short-range radios or short-range devices (SRD) are highly integrated transceivers, typically on a single chip, that are used in a wide range of wireless data applications.

The vehicle to vehicle (V2V) communication segment of the global radio modem market for ITS application is estimated to grow at the highest CAGR during the forecast period. It is an automobile technology comprising a wireless network that allows automobiles to communicate their speed, brake status, position, steering-wheel position, direction of travel, and other important data with another vehicle within 1,000 meters. The V2V automobile technology for communication uses dedicated short-range communications (DSRC).

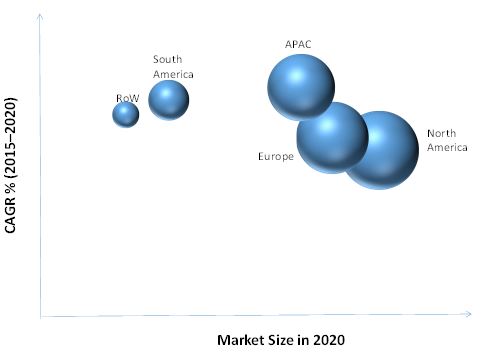

North America, comprising the U.S., Mexico, and Canada, dominates the global radio modem market for ITS applications and is expected to exhibit the same trend during the forecast period. The U.S. is driving factor the growth of this market. In addition, increasing number of four wheelers and heavy vehicles in this region is expected to drive the growth of this market in North America since there is a high requirement for an effective transportation system in North American countries. The region ranked first in 2014 in the deployment of various ITS systems such as advanced transportation management systems, advanced traveler information systems, ITS-enabled pricing systems, and commercial vehicle operation among others.

The initial cost involved in purchasing radio modems and related hardware is significantly higher. This factor is hindering the growth of the overall radio modem market for ITS application. However, researches are being carried out to develop cheaper modems.

Some of the key players in the radio modem market for ITS application that are covered in this report include Adeunis RF (France), Arada Systems, Inc. (U.S.), ATIM Radiocommunications (France), Autotalks Ltd. (Israel), B&B Electronics Manufacturing Co. (U.S.), Campbell Scientific Inc. (U.S.), Cohda Wireless (Australia), Kapsch TrafficCom AG (Austria), Motorola Solutions, Inc. (U.S.), Q Free ASA (Norway), Satel Oy (Finland), Schneider Electric SE (France), and Wood & Douglas Ltd. (U.K.) among others. These players have adopted various strategies such as new product developments, mergers, partnerships, collaborations, and business expansion to grow in the market for ITS application.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Segmentation & Coverage

1.3 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Integrated Ecosystem of Radio Modem Market for Its Application

2.2 Arriving at Global Market Size of Market in Its

2.2.1 Top-Down Approach

2.2.2 Bottom-Up Approach

2.2.3 Demand-Side Approach

2.2.4 Macroindicator-Based Approach

2.2.4.1 R&D Expenditure

2.3 Assumptions

3 Executive Summary (Page No. - 22)

4 Market Overview (Page No. - 24)

4.1 Introduction

4.2 Market Drivers and Inhibitors

4.3 Key Market Dynamics

4.4 Its America (Transportation Center System Specialist Certification Programs Level I and Level II)

4.5 European Commission’s Its Directive

4.6 Regulatory Bodies

4.6.1 ETSI

4.6.2 FCC

5 Radio Modem Market for Its Application, By Frequency Band (Page No. - 30)

5.1 Introduction

5.2 License Free Frequency

5.3 UHF

5.4 Wi-Fi

5.5 VHF

6 Radio Modem Market for Its Application, By Communication Channel (Page No. - 39)

6.1 Introduction

6.2 Point to Multi-Point

6.3 Point to Point

7 Radio Modem Market for Its Application, By Operating Range (Page No. - 43)

7.1 Introduction

7.2 Short Range

7.3 Long Range

8 Radio Modem Market for Its, By Application (Page No. - 47)

8.1 Introduction

8.2 Vehicle to Infrastructure Communication

8.3 Traffic Management System

8.4 Electronic Fee Collection

8.5 Vehicle to Vehicle Communication

8.6 Emergency Management System

9 Radio Modem Market for Its Application, By Geography (Page No. - 55)

9.1 Introduction

9.2 North America

9.3 Europe

9.4 Asia-Pacific

9.5 South America

9.6 RoW

10 Competitive Landscape (Page No. - 64)

10.1 Radio Modem Market for Its Application: Company Share Analysis

10.2 Company Presence in Market for Its Application, By Frequency Band

10.3 New Product Developments

10.4 Contracts

10.5 Acquisitions

10.6 Partnership and Expansions

11 Company Profiles (Page No. - 73)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

11.1 Adeunis RF

11.2 Arada Systems Inc.

11.3 Atim Radiocommunications

11.4 Autotalks Ltd.

11.5 B&B Electronics MFG

11.6 Campbell Scientific Inc.

11.7 Cohda Wireless

11.8 Commsignia Ltd.

11.9 Encom Wireless Data Solutions

11.10 Harris Corporation

11.11 Intuicom Inc.

11.12 Kapsch Trafficcom AG

11.13 Motorola Solutions, Inc.

11.14 Pro4 Wireless

11.15 Q-Free ASA

11.16 Satel OY

11.17 Savari Inc.

11.18 Schneider Electric Se

11.19 Simrex Corporation

11.20 Wood & Douglas Limited

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 109)

12.1 Customization Options

12.1.1 Product Portfolio Analysis

12.1.2 Country-Level Data Analysis

12.1.3 Product Comparison of Various Competitors

12.1.4 Trade Analysis

12.2 Introducing RT: Real Time Market Intelligence

12.3 Related Reports

List of Tables (46 Tables)

Table 1 Radio Modem Market for Its Application: Assumptions

Table 2 Market for Its Application: Drivers and Inhibitors

Table 3 Market for Its Application, By Frequency Band, 2014-2020 (USD MN)

Table 4 License Free Frequency Market, By Communication Channel, 2014–2020 (USD MN)

Table 5 License Free Market, By Operating Range, 2014–2020 (USD MN)

Table 6 UHF Market, By Communication Channel, 2014-2020 (USD MN)

Table 7 UHF Market, By Operating Range, 2014-2020 (USD MN)

Table 8 Wi-Fi Market, By Communication Channel, 2014-2020 (USD MN)

Table 9 VHF Market, By Communication Channel, 2014-2020 (USD MN)

Table 10 VHF Market, By Operating Range, 2014-2020 (USD MN)

Table 11 Market for Its Application, By Communication Channel, 2014-2020 (USD MN)

Table 12 Point to Multi-Point Market, By Frequency Band, 2014–2020 (USD MN)

Table 13 Point to Point Market, By Frequency Band, 2014-2020 (USD MN)

Table 14 Market for Its Application, By Operating Range, 2014-2020 (USD MN)

Table 15 Short Range Market, By Frequency Band, 2014–2020 (USD MN)

Table 16 Long Range Market, By Frequency Band, 2014-2020 (USD MN)

Table 17 Market, By Application, 2014-2020 (USD MN)

Table 18 Vehicle to Infrastructure Communication Radio Modem Market, By Geography, 2014-2020 (USD MN)

Table 19 Traffic Management System Radio Modem Market, By Geography, 2014-2020 (USD MN)

Table 20 Electronic Fee Collection Market, By Geography, 2014-2020 (USD MN)

Table 21 Vehicle to Vehicle Communication Radio Modem Market, By Geography, 2014-2020 (USD MN)

Table 22 Emergency Management System Radio Modem Market, By Geography, 2014-2020 (USD MN)

Table 23 Market for Its Application, By Geography, 2014-2020 (USD MN)

Table 24 North America Market for Its Application, 2014-2020 (USD MN)

Table 25 Europe Market for Its Application, 2014-2020 (USD MN)

Table 26 Asia-Pacific Market for Its Application, 2014-2020 (USD MN)

Table 27 South America Market for Its Application, 2014-2020 (USD MN)

Table 28 RoW Market for Its Application, 2014-2020 (USD MN)

Table 29 Market for Its Application: Company Share Analysis, 2014(%)

Table 30 Market for Its Application: New Product Developments

Table 31 Market for Its Application: Contracts

Table 32 Market for Its Application: Acquisitions

Table 33 Market for Its Application: Partnership and Expansions

Table 34 Harris Corporation: Key Operating Data, 2010-2014 (USD MN)

Table 35 Harris Corporation: Revenue, By Business Segment, 2010-2014 (USD MN)

Table 36 Harris Corporation: Revenue, By Geographic Segment, 2010-2014 (USD MN)

Table 37 Kapsch Trafficcom AG: Key Operating Data, 2011-2015 (USD MN)

Table 38 Kapsch Trafficcom AG: Revenue, By Business Segment, 2011-2015 (USD MN)

Table 39 Kapsch Trafficcom AG: Revenue, By Geographic Segment, 2011-2015 (USD MN)

Table 40 Motorola Solutions, Inc.: Revenue, By Business Segment, 2010-2014 (USD MN)

Table 41 Motorola Solutions, Inc.: Revenue, By Geographic Segment, 2010-2014 (USD MN)

Table 42 Q-Free ASA: Revenue, By Business Segment, 2010-2014 (USD MN)

Table 43 Q-Free ASA: Revenue, By Geographic Segment, 2010-2014 (USD MN)

Table 44 Schneider Electric Se: Key Operating Data, 2010-2014 (USD MN)

Table 45 Schneider Electric Se: Revenue, By Business Segment, 2010-2014 (USD MN)

Table 46 Schneider Se: Revenue, By Geographic Segment, 2010-2014 (USD MN)

List of Figures (38 Figures)

Figure 1 Global Radio Modem Market for Its Application: Segmentation & Coverage

Figure 2 Market for Its Application: Integrated Ecosystem

Figure 3 Arriving at Global Market Size: Top-Down Approach

Figure 4 Arriving at Global Market Size: Bottom-Up Approach

Figure 5 Arriving at Global Market Size: Demand-Side Approach

Figure 6 Global R&D Expenditure, By Region (USD MN)

Figure 7 Market for Its Application: Snapshot

Figure 8 Market for Its Application: Growth Aspects

Figure 9 Market for Its Application: Frequency Band, By Communication Channel, 2015 (USD MN)

Figure 10 Market for Its Application: Geography, By Application, 2015 (USD MN)

Figure 11 Market for Its Application, By Frequency Band, 2015 & 2020 (USD MN)

Figure 12 License Free Frequency Market, By Communication Channel, 2015 & 2020 (USD MN)

Figure 13 License Free Frequency Market, By Operating Range, 2015 & 2020 (USD MN)

Figure 14 UHF Radio Modem Market, By Communication Channel, 2015 & 2020 (USD MN)

Figure 15 UHF Market, By Operating Range, 2015 & 2020 (USD MN)

Figure 16 Wi-Fi Radio Modem Market, By Communication Channel, 2015 & 2020 (USD MN)

Figure 17 VHF Market, By Communication Channel, 2015 & 2020 (USD MN)

Figure 18 VHF Market, By Operating Range, 2015 & 2020 (USD MN)

Figure 19 Market for Its Application, By Communication Channel, 2015 & 2020 (USD MN)

Figure 20 Point to Multi-Point Market, By Frequency Band, 2015 & 2020 (USD MN)

Figure 21 Point to Point Market, By Frequency Band, 2015 & 2020 (USD MN)

Figure 22 Market for Its Application, By Operating Range, 2015 & 2020 (USD MN)

Figure 23 Market, By Frequency Band, 2015 & 2020 (USD MN)

Figure 24 Long Range Market, By Frequency Band, 2015 & 2020 (USD MN)

Figure 25 Market, By Application, 2015 & 2020 (USD MN)

Figure 26 Vehicle to Infrastructure Communication Market, By Geography, 2015 & 2020 (USD MN)

Figure 27 Traffic Management System Market, By Geography, 2015-2020 (USD MN)

Figure 28 Electronic Fee Collection Market, By Geography, 2015 & 2020 (USD MN)

Figure 29 Vehicle to Vehicle Communication Market, By Geography, 2015 & 2020 (USD MN)

Figure 30 Emergency Management System , By Geography, 2015 & 2020 (USD MN)

Figure 31 Market for Its Application: Growth Analysis, By Geography, 2015 & 2020 (USD MN)

Figure 32 North America Market for Its Application, 2015 & 2020 (USD MN)

Figure 33 Europe Market for Its Application, 2015 & 2020 (USD MN)

Figure 34 Asia-Pacific Market for Its Application, 2015 & 2020 (USD MN)

Figure 35 South America Market for Its Application, 2015 & 2020 (USD MN)

Figure 36 RoW Market for Its Application, 2015 & 2020 (USD MN)

Figure 37 Market for Its Application: Company Share Analysis, 2014 (%)

Figure 38 Market for Its Application: Company Product Coverage, By Frequency Band, 2015

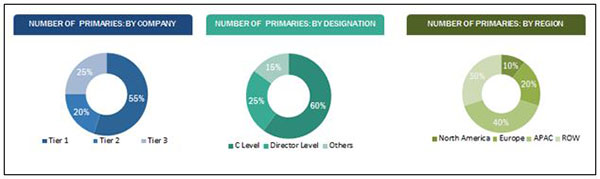

The research methodology used to estimate and forecast the radio modem market for ITS application begins with obtaining data on key vendor revenues through secondary research. The vendor offerings have also been taken into consideration to determine the market segmentation. The bottom-up procedure has been employed to arrive at the overall market size of the global radio modem market for ITS application from the revenue of the key market players. After arriving at the overall market size, the total market has been split into several segments and subsegments, which are then verified through primary research by conducting extensive interviews with key people such as CEOs, VPs, directors, and executives. Data triangulation and market breakdown procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primaries is depicted in the below figure.

To know about the assumptions considered for the study, download the pdf brochure

The radio modem ecosystem comprises of vendors such as Adeunis RF (France), Arada Systems, Inc. (U.S.), ATIM Radiocommunications (France), Autotalks Ltd. (Israel), B&B Electronics Manufacturing Co. (U.S.), Campbell Scientific Inc. (U.S.), Cohda Wireless (Australia), Kapsch TrafficCom AG (Austria), Motorola Solutions, Inc. (U.S.) Q Free ASA (Norway), Satel Oy (Finland), Schneider Electric SE (France), and Wood & Douglas Ltd. (U.K.).

Key Target Audience

- Radio modem manufacturers and suppliers

- Research and development (R&D) companies

- Business research and consulting service providers

- Research organizations

- Academic centers and universities

- Associations and industrial bodies

- Electronics and semiconductor companies

- Technology investors

Scope of the Report

The radio modem market for ITS application in this research report has been segmented into the following submarkets:

By Frequency Band:

- License-free frequency

- UHF

- Wi-Fi

- VHF

By Communication Channel:

- Point to multi-point

- Point to point

By Operating Range:

- Short range

- Long range

By Application:

- Vehicle to infrastructure

- Communication

- Traffic management systems

- Electronic fee collection

- Vehicle to vehicle

- Communication

- Emergency management

- Systems

- Others

By Geography:

- North America

- Europe

- APAC

- South America

- RoW

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- A detailed analysis of different products by various competitors in the radio modem market for ITS application would be carried out. This analysis will help devise strategies for the company.

Geographic Analysis

- Further breakdown of the radio modem market for ITS application in North America

- Further breakdown of the market for ITS application in Europe

- Further breakdown of the market for ITS application in APAC

- Further breakdown of the market for ITS application in South America

Company Information

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Radio Modem Market