The study involved four major activities for estimating the retimer market size. Exhaustive secondary research has been conducted to collect information relevant to the market, its peer markets, and its child market. Primary research has been undertaken to validate key findings, assumptions, and sizing with industry experts across the value chain of the retimer market. Both top-down and bottom-up approaches have been employed to estimate the complete market size. It has been followed by the market breakdown and data triangulation methods to estimate the size of different segments and subsegments of the market.

Secondary Research

The research methodology used to estimate and forecast the size of the retimer market began with the acquisition of data related to the revenues of key vendors in the market through secondary research. Various secondary sources have been referred to in the secondary research process for identifying and collecting information for this study. Secondary sources include annual reports, press releases, and investor presentations of companies; white papers, journals, certified publications, and articles by recognized authors; websites; directories; and databases. Secondary research has mainly been used to obtain key information about the value chain of the retimer market, key players, market classification, and segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both market and technology-oriented perspectives. Secondary data has been collected and analyzed to determine the overall market size, further validated through primary research. The secondary research referred to for this research study involves the Semiconductor Industry Association (SIA), Electronic System Design Alliance (ESD Alliance), Institute of Electrical and Electronics Engineers (IEEE), Taiwan Semiconductor Industry Association (TSIA), European Semiconductor Industry Association (ESIA), and Korea Semiconductor Industry Association (KSIA). Moreover, the study involved extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource, to identify and collect valuable information for a technical, market-oriented, and commercial study of the retimer market. Vendor offerings have been taken into consideration to determine market segmentation.

Primary Research

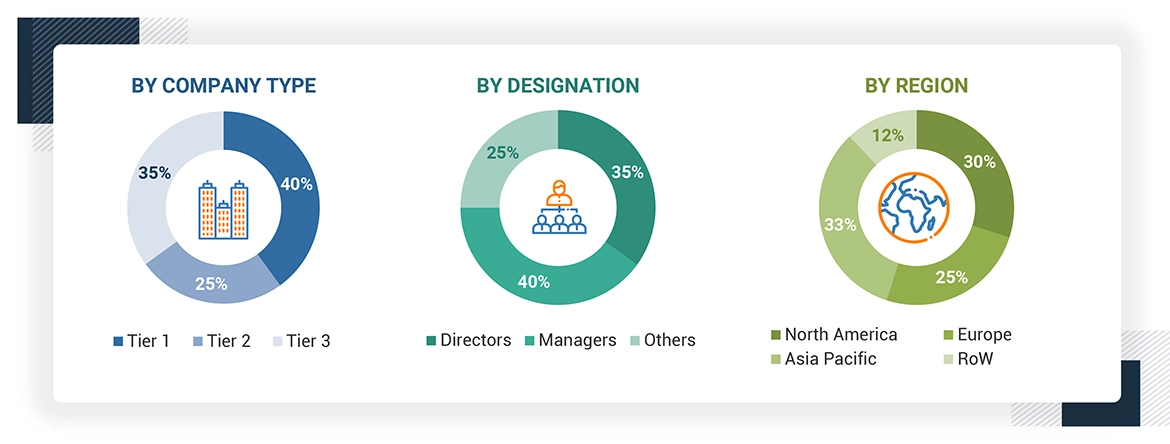

In the primary research, various primary sources from both the supply and demand sides have been interviewed to obtain the qualitative and quantitative information relevant to this report. Primary sources from the supply side include the key industry participants, subject-matter experts (SMEs), and C-level executives and consultants from various key companies and organizations in the retimer ecosystem. After the complete market engineering (including calculations for the market statistics, the market breakdown, the market size estimations, the market forecasting, and the data triangulation), extensive primary research has been conducted to verify and validate the critical market numbers obtained. Extensive qualitative and quantitative analyses have been performed during the market engineering process to list key information/insights throughout the report. Extensive primary research has been conducted after understanding the retimer market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand and supply-side players across key regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (Middle East, Africa, and South America). Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents.

Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This and the in-house subject matter experts’ opinions have led us to the findings described in the remainder of this report.

Note: The three tiers of the companies are defined based on their total revenue in 2023: Tier 1 - revenue greater than or equal to USD 1 billion; Tier 2 - revenue between USD 100 million and USD 1 billion; and Tier 3 revenue less than or equal to USD 100 million. Other designations include sales managers, marketing managers, and product managers.

About the assumptions considered for the study, To know download the pdf brochure

Market Size Estimation

The total size of the retimer market has been estimated and validated using both top-down and bottom-up approaches. Furthermore, these methods have also been used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size is as follows:

Data Triangulation

After arriving at the overall size of the retimer market from the market size estimation process explained above, the total market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using both top-down and bottom-up approaches.

Market Definition

A retimer is a specialized electronic device that regenerates digital signals by extracting the embedded clock, recovering the data, and retransmitting a fresh copy with a clean clock. It amplifies the signal, reshapes it, and ensures data integrity over long distances or through channels with high attenuation.

A retimer extracts the embedded clock from the incoming data stream, which allows it to synchronize the timing of the data signals accurately. They enhance the quality of the signal by compensating for losses and distortions that occur during transmission. This includes equalization functions that help restore the amplitude and clarity of the signal, making it suitable for high-speed applications. They are designed to be aware of the communication protocols they are handling, enabling them to adapt to various standards such as PCIe, USB4, and others. This feature allows for automatic configuration and optimization of the signal transmission without manual tuning, simplifying system integration. Unlike simple redrivers that amplify signals (including noise), they recreate the original signal by generating a clean copy, which helps maintain a high signal-to-noise ratio. This process is crucial for maintaining data integrity, especially at higher data rates where noise can significantly impact performance.

Stakeholders

-

Data center networking vendors

-

Technology partners

-

Enterprises users

-

End--users

-

Government Bodies and Policymakers

-

Standards Organizations, Forums, Alliances, and Associations

-

Market Research and Consulting Firms

-

System Integrators

-

Telecom Operators

-

Cloud Providers

-

Network Service Providers

Report Objectives

-

To define, describe, and forecast the retimer market, by interface, applications, and industry, in terms of value

-

To forecast the market size for the by interface segment, in terms of volume

-

To describe and forecast the size of the retimer market, by four regions: North America, Europe, Asia Pacific, and the Rest of the World (RoW), along with their respective countries, in terms of value

-

To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the market growth

-

To provide ecosystem analysis, case study analysis, patent analysis, technology analysis, pricing analysis, Porter’s five forces analysis, key stakeholders & buying criteria, key conferences & events, regulatory bodies, government agencies, and regulations pertaining to the market under study

-

To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market size

-

To study the complete value chain of the retimer market

-

To analyze opportunities for stakeholders by identifying high-growth segments of the retimer market

-

To strategically profile the key players and comprehensively analyze their market positions in terms of their ranking and core competencies2

-

To analyze competitive developments, such as product launches, acquisitions, agreements, and partnerships, in the retimer market

-

To study the macroeconomic impact on the retimer market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

-

Detailed analysis and profiling of additional market players based on various blocks of the value chain.

Growth opportunities and latent adjacency in Retimer Market