The study involved four major activities to estimate the current size of the gastroenterology products market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to to identify and collect information for the study of Gastrointestinal Products Market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

Extensive primary research was conducted after obtaining information regarding the Gastroenterology Products Market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from manufacturers; distributors operating in the gastrointestinal products market.; and key opinion leaders.

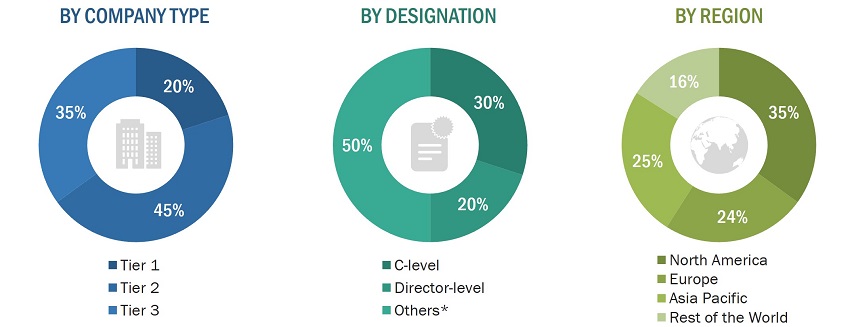

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side customers/end users who are using infection control products were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage and the future outlook of their business, which will affect the overall market. the following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the gastrointestinal products market includes the following details. The market sizing of the market was undertaken from the global side.

Country-Level Analysis

The size of the gastrointestinal products market was obtained from the annual presentations of leading players and secondary data available in the public domain. The share of products in the overall gastrointestinal products market was obtained from secondary data and validated by primary participants to arrive at the total gastroenterology products market. Primary participants further validated the numbers.

Geographic Market Assessment (By Region & Country)

-

Approach 1:

-

Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends.

-

Approach 2:

-

Geographic adoption trends for individual product segments by end users and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews).

At each point, the assumptions and approaches were validated through industry experts contacted during primary research. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall Gastroenterology/Gastrointestinal Products Market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of the leading players in a particular region or country.

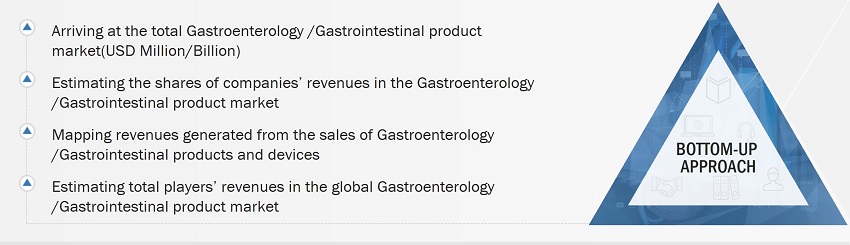

Global Gastrointestinal Products Market Size: Bottom-Up Approach

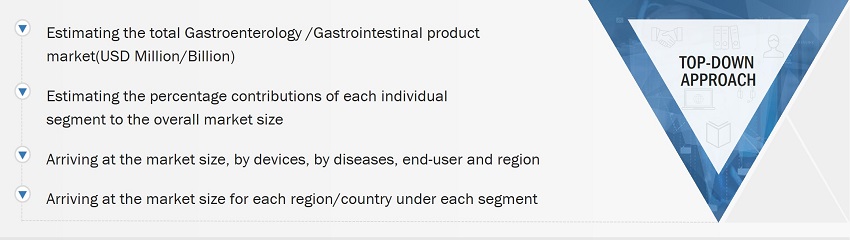

Global Gastrointestinal Products Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the gastrointestinal products market.

Market Definition

Gastroenterology products encompass a variety of medical devices, diagnostic tools, and pharmaceuticals designed to diagnose, treat, and manage diseases and disorders of the gastrointestinal tract. These products include endoscopes, capsule endoscopy systems, ablation devices, stents, and specialized medications aimed at conditions like GERD, IBD, and colorectal cancer. Their purpose is to improve patient outcomes by offering advanced solutions for both diagnostic and therapeutic procedures within the GI tract.

Key Stakeholders

-

Medical Device Manufacturers

-

Healthcare Institutions (hospitals and outpatient clinics)

-

Distributors and Suppliers

-

Research Institutes

-

Health Insurance Payers

-

Market Research and Consulting Firms

Report Objectives

-

To define, describe, segment, and forecast the global gastrointestinal Products Market by devices, diseases end users, and region.

-

To provide detailed information about the factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

-

To analyze micromarkets1 concerning individual growth trends, prospects, and contributions to the overall gastrointestinal products market.

-

To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players.

-

To forecast the size of the gastroenterology products market in five main regions along with their respective key countries, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

-

To profile key players in the global gastrointestinal products market and comprehensively analyze their core competencies2 and market shares.

-

To track and analyze competitive developments such as acquisitions, expansions, partnerships, agreements, and collaborations; and product launches and approvals.

-

To benchmark players within the gastrointestinal products market using the "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

-

Product matrix, which gives a detailed comparison of the product portfolios of each company

Geographic Analysis

-

Further breakdown of the Latin American apheresis into specific countries and, the Middle East, and Africa apheresis into specific countries and further breakdown of the European apheresis into specific countries

Growth opportunities and latent adjacency in Gastrointestinal Products Market