The study involved analyzing the recent developments, trends, and performance of the players and the electric vehicle market in 2024, along with the projections for 2035. The analysis was based on the sales volume of the EVs around the world. The study also analyzes the primary targets for EVs, market adoption, advancement in EV manufacturing techniques, and government electrification goals—exhaustive secondary research collected information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with the industry experts. The bottom-up approaches were employed to estimate the market size in EV sales for the segments considered.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications such as Society Of Manufacturers Of Electric Vehicles (SMEV), European Automobile Manufacturers’ Association (ACEA), Electric Vehicle Association (EVA), California Department of Motor Vehicles, White papers published by various industry experts, Corporate filings (such as annual reports, investor presentations, and financial statements), Trade, business, and related associations, International Organization for Standardization (ISO), articles, directories, technical handbooks, World Economic Outlook, trade websites, and technical articles are used to identify and collect information useful for an extensive commercial study of future of EV manufacturing.

Primary Research

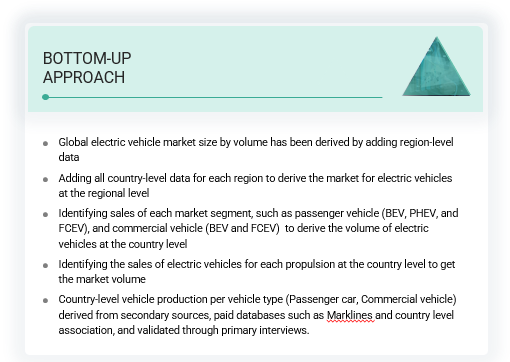

The bottom-up approaches were used to estimate and validate the size of the electric vehicle market. Country-level vehicle production per vehicle type (Passenger car, Commercial vehicle) derived from secondary sources, paid databases such as Marklines and country level association, and validated through primary interviews. The market for electric vehicles was projected based on factors such as government and OEM targets, emission regulations, and investments by OEMs & Tier-1 companies. These projections were further validated through primary research.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approaches were used to estimate and validate the size of the electric vehicle market. Country-level vehicle production per vehicle type (Passenger car, Commercial vehicle) derived from secondary sources, paid databases such as Marklines and country level association, and validated through primary interviews. The market for electric vehicles was projected based on factors such as government and OEM targets, emission regulations, and investments by OEMs & Tier-1 companies. These projections were further validated through primary research.

Future of EV Manufacturing Market Size: Bottom-UP Approach

Market Definition

EV Manufacturing refers to the process of designing, developing, and producing electric vehicles (EVs), which are vehicles powered by electric motors and rechargeable batteries instead of traditional internal combustion engines. This process encompasses the integration of innovative technologies, advanced materials, and efficient production systems to meet the growing demand for sustainable and environmentally friendly transportation solutions

Key Stakeholders

-

Automobile Organizations/Associations

-

Electric vehicle manufacturers and suppliers

-

Regional manufacturing associations and automobile associations

-

Component suppliers for electric vehicles

-

Regional emission standard regulatory authorities

-

Research Professionals

Report Objectives

-

To analyze the electric vehicle market performance till 2035

-

To analysis government and OEMs targets of ZEVs.

-

To provide critical developments expected to take place till 2035 and beyond.

-

Identify the technological trends likely to impact the market during the forecast period.

-

To identify significant growth segments and growth opportunities till 2035.

-

To project the electric vehicle sales from 2024 to 2035.

-

To analysis EV manufacturing ecosystem

-

To provide current and future trend of EV manufacturing.

-

To track and analyze various strategies such as circular economy, platformization, smart manufacturing and other strategies by key industry participants.

Growth opportunities and latent adjacency in Global EV Manufacturing Ecosystem Market