Food & Beverage Industry Pumps Market

Food & Beverage Industry Pumps Market by Type (Pumps, Agitators, Mixers, Compressors), Application (Beverages, Dairy & Chocolate, Meat & Poultry, Bakery & Confectionery), Degree of Engineering, Flow, Pressure, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

According to MarketsandMarkets, the food & beverage industry pumps market is estimated at USD 11.34 billion in 2025 and is projected to reach USD 13.84 billion by 2030, at a CAGR of 4.1% during the same period. Short-term trends in the food & beverage industry pumps market show that there are strict regulations as far as hygiene is concerned and that there is rising automation in food processing.

KEY TAKEAWAYS

-

BY TYPEPumps dominate the food and beverage industry, offering efficient transfer of liquids, semi-solids, and viscous products. Their hygienic design, reliability, and compatibility with CIP systems make them essential for maintaining product integrity in dairy, beverage, and confectionery processing

-

BY APPLICATIONThe dairy and chocolate processing sectors are the leading users of pumps, driven by the need for precise flow control and hygienic transfer of viscous and temperature-sensitive products. Pumps ensure smooth mixing, transfer, and filling operations, maintaining consistent product texture and quality in these high-value applications.

-

BY DEGREE OF ENGINEERINGConfigured pumps hold the largest share, offering flexibility and customization to meet specific processing requirements across various food and beverage operations. Their modular design enables easy integration into existing systems, reducing maintenance complexity while improving overall plant efficiency.

-

BY FLOWFlow rate between 10–100 liters per second are the most widely used, as they provide optimal efficiency for medium to large-scale food and beverage production lines. This range supports smooth and continuous product transfer, reducing energy consumption and operational downtime in high-throughput environments.

-

BY PRESSURE<15 bar dominate the market due to their suitability for gentle handling of sensitive food materials. They ensure consistent flow without damaging product texture, making them ideal for dairy, beverage, and chocolate processing applications where maintaining product quality is critical.

-

BY REGIONThe food & beverages industry pumps market covers North America, Europe, Asia Pacific, South America, and the Rest of the World. North America holds a major share of the market owing to the strong presence of leading food processing and beverage manufacturing industries. Additionally, the growing demand for hygienic and energy-efficient pump solutions, along with advancements in automation and fluid handling technologies, is driving regional market growth.

-

COMPETITIVE LANDSCAPELeading companies in the food & beverages industry pumps market are adopting both organic and inorganic growth strategies, including product launches, acquisitions, and strategic partnerships. For instance, companies such as Alfa Laval (Sweden), GEA Group (Germany), Xylem (US), Grundfos (Denmark), and SPX FLOW (US) are actively expanding their product portfolios and collaborating to develop high-performance, sustainable pumping solutions that meet stringent food safety and hygiene standards.

The demand for pumps, as called for by different organizations worldwide, such as FDA, EHEDG, and 3-A Sanitary Standards, arises out of strict requirements for pumps in hygiene compliance. End users in the markets are now leaning towards the adoption of hygienic and CIP (Clean-in-Place) and SIP (Sterilize-in-Place)-compatible pumps to eliminate contamination and comply with regulations. This is especially important in dairy, beverage, and meat processing.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The food & beverages industry pumps market is witnessing notable trends and disruptions driven by evolving consumer demands, stricter hygiene regulations, and the digital transformation of processing facilities. Manufacturers of pumps are increasingly aligning their innovations with their clients’ customers’ expectations for cleaner, safer, and more sustainable products. Beverage producers and food processors are adopting hygienic, energy-efficient, and automated pump systems that ensure product consistency, minimize contamination, and support sustainability goals. Smart pumping technologies integrated with IoT and predictive maintenance are gaining traction, enabling real-time monitoring and reduced downtime. In addition, the rise of plant-based, functional, and clean-label products is pushing food and beverage companies to seek pumps capable of handling viscous and shear-sensitive ingredients without compromising quality. These trends are collectively reshaping the market, positioning advanced, hygienic, and digitally enabled pumping solutions as critical enablers of efficiency, compliance, and consumer trust across the global food and beverages industry.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

•Reduced operating time and improved quality of food products

-

•Demand for advanced machinery with high productivity and efficiency

Level

-

•Fluctuating raw material costs and rising operating costs of equipment

-

•Cavitation effect in industrial pumps

Level

-

•Influx of investment in food & beverage industry

-

•Rise in regulations to meet food safety standards

Level

-

•New kinds of tubing with better durability, chemical resistance, and pump efficiency

-

•Increased competition from local players and unorganized sector

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Reduced operating time and improved quality of food products

The pump must not only handle the product but also comply with food-handling equipment requirements, including clean-in-place and sterilize-in-place operations. The food & beverage industry presents several challenges, such as abrasive media, high viscosities, temperature, corrosion, and entrained air. For example, sugar production from cane or beet sugars poses a challenge to equipment processing—from raw material to finished end-products. The abrasive suspension process will need pumps designed with excellent wear resistance properties and seals designed to perform reliably in even the most hostile environments. New advances in materials, coating systems, sealing components, and impeller designs have given process engineers the ability to tailor a pump specification for a very specific application. This has led equipment manufacturers to design and manufacture customer-oriented pumps. The food& beverage industry has gained significant advantages from the use of duplex stainless steel, which offers enhanced resistance to corrosion, abrasion, and pitting—key factors that contribute to the durability and efficiency of equipment in this sector. Advanced equipment used in food production is designed to reduce the time taken to perform operations while maintaining the quality of end products. Such advances in technology enable the food industry to cater to the demands for food & beverage equipment in shorter production times.

Restraint: Fluctuating raw material costs and rising operating costs of equipment

The rising cost of raw material has pushed food manufacturers to focus on enhancing production efficiency and minimizing waste throughout the food production process. In addition to reducing production costs, they are also scaling up food & beverage production capacity to meet the demands of a growing consumer base. To ensure long-term reliability and increased productivity, production managers are under constant pressure to minimize downtime and maintain a continuous flow of operations. The most difficult design process is to match the pump and motor characteristics to the system needs most cost-effectively. This process is frequently complicated by wide variations in flow and pressure needs, requiring careful selection to balance performance and efficiency. Being assured that the requirements of the system are met during worst-case conditions can lead to oversized equipment design, which not only increases capital investment but also results in inefficiencies during normal operation. Oversizing pumps can lead to increased energy consumption, higher wear and tear, and unnecessary operational complexity. Increased material, installation, and operating costs may occur due to the need for larger piping, valves, and structural support to accommodate oversized pumps. This can also result in cavitation, reduced pump lifespan, and inefficient energy use, impacting long-term operational sustainability. To mitigate these challenges, engineers must carefully analyze system demand, employ variable speed drives (VSDs), and optimize pump selection through computational fluid dynamics (CFD) simulations or real-time monitoring. Proper system design not only ensures reliable performance under varying conditions but also minimizes costs and maximizes efficiency over the pump’s lifecycle

Opportunity: Influx of investment in food & beverage industry

The food & beverage industry represents one of the most flourishing industries across the globe. It incorporates restaurants, cafeterias, cafés, fast-food eateries, pubs, delis, food manufacturing organizations, catering services, and food transportation services. The industry includes everything—from preparing, packaging, and transporting food to serving it. The International Labor Office classifies beverages into two main categories. The first category is non-alcoholic beverages, which include soft drink syrups, soft drinks, bottled and canned water, fruit juice bottling, and boxing, as well as the coffee and tea industries. The second category is alcoholic beverages, which encompasses distilled spirits, wines, and brewed products. There has always been a continuous rise in liquor and ready-to-drink beverages since the early 1990s. In 1990, global consumption differed as the amount of alcohol consumed per adult was 10% higher compared to 2017. The World Health Organization (WHO) estimates that the rise in the consumption of alcohol in 189 countries from 1990 to 2017 is very large, and even in the years ahead, it is expected to see higher growth by 2030. This translates to a planned capital expenditure increase of 21.4% in 2023 for the food & beverage industry, reaching beyond USD 23 billion with participation from PepsiCo (USD 5.47 billion), Tyson Foods (USD 2.5 billion), and Coca-Cola (USD 1.9 billion).

Challenge: New kinds of tubing with better durability, chemical resistance, and pump efficiency

Advanced elastomers like silicone and thermoplastic elastomers (TPE) are key drivers of innovation in tube materials, offering enhanced chemical resistance and durability. These properties enable tubes to withstand the demanding conditions of food processing while extending the lifespan and reliability of pumps. As a result, manufacturers handling a wide range of food products—from acidic beverages to dairy—benefit from lower maintenance costs and improved operational efficiency. Energy efficiency is another major factor driving growth in the pumping industry. Pump systems, constructed under VFD (Variable Frequency Drive) controls, can accurately control all overflow rates while minimizing energy use. It is even more beneficial in large-scale food & beverage production, where big amounts of energy can lead to losses in profitability. Therefore, optimizing energy use will permit lower costs on operations while performance output remains secure, thus economically making pumps attractive to companies wishing to organize their operations for an improved bottom line. With more integration of automation into pumps, food and beverage manufacturers will have more efficiency and consistency in their production. Real-time monitoring and adjustment of pump settings through automated systems are useful not only in providing consistently good flow rates but also in enhancing product quality. Such insights into better decision-making and optimum processes are the areas data analytics provides. For example, Watson-Marlow Fluid Technology Group (WMFTG) designs pumps that have hygienic features, low-sheer handling capabilities, and easy maintenance, which are highly suitable for juices or dairy because they are case-specific

Food Beverage Industry Pumps Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Manufactures hygienic centrifugal and positive displacement pumps for dairy, beverage, brewery, and processed foods (e.g., de-alcoholized beer, plant-based beverages). Integrated modules and plate heat exchangers support sustainability and automation in both large and mid-size processing plants | Maximizes energy recovery, achieves substantial water and energy savings (up to 90%), enables minimal maintenance and wastewater, supports regulatory compliance, and boosts throughput/efficiency for rapid product changeovers |

|

Delivers centrifugal and positive displacement pumps tailored for low- to high-viscosity food and beverage products, including the APV DW+ Series for gentle, pulsation-free transfer. Focuses on flexible configuration and digital integration for demanding applications | Gentle handling preserves product texture and sensory attributes, minimizes shear, reduces vibration/pressure surges, improves operational stability, enables energy-efficient performance, and simplifies maintenance |

|

Provides advanced hygienic pumps for beverage, brewing, dairy, and processed foods, from ingredient unloading to high-speed mixing and blending. Focuses on sanitary design, reliability, and versatility—including positive displacement pumps for sticky, abrasive, and shear-sensitive media. | Ensures product integrity, rapid transfer, unmatched reliability in ingredient handling, superior clean-in-place (CIP) performance, gentle and efficient mixing for uniform results, adaptable to a wide range of liquid and viscous materials. |

|

Offers progressive cavity and rotary pumps for viscous fluids processing (tomato sauces, honey, fruit pulp), featuring food-grade stainless steel and aseptic elastomers. Specializes in applications requiring gentle handling, hygiene, and high-temperature fluid transfers—including grape must and wine clarification | Maintains highest hygiene/safety, easy cleaning and maintenance, robust handling of thick, abrasive, and shear-sensitive foods, reliable operation in high-temperature filling and pasteurization, supports continuous and batch production lines |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The ecosystem of the food & beverages industry pumps market comprises a diverse network of stakeholders, including pump manufacturers, component suppliers, system integrators, automation technology providers, and end users such as food processors, beverage producers, and meat and dairy companies. This interconnected ecosystem functions around delivering hygienic, energy-efficient, and sustainable fluid-handling solutions that meet strict regulatory and safety standards. Collaborations with automation and sensor technology firms are enhancing process control and traceability, while material and seal suppliers ensure compliance with sanitary norms. Together, these participants drive innovation, optimize production efficiency, and enable sustainable growth across the global food and beverage value chain.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Food & Beverages Industry Pumps Market, By Type

Increasing production of dairy, confectionery, and plant-based beverages drives the adoption of high-shear, static, and dynamic mixers for uniform texture and stability of final products. An important driving factor is the greater adoption of inline mixers for the continuous processing of various materials, which lessens batch-to-batch inconsistencies and offers enhanced energy efficiency over traditional batch mixing. As an example, companies in the already-mentioned dairy industry are now substituting high-shear inline mixers for batch mixers to allow homogeneous mixing of stabilizers and emulsifiers that are added at the last moment to yogurts and ice cream to ensure homogeneous dispersion of stabilizers and emulsifiers in yogurts and ice cream, preventing phase separation. The plant-based food industry is witnessing an increase in demand for specialized mixers designed to mix efficiently pea or soy protein concentrates with oils and hydrocolloids for dairy alternatives like oat milk and vegan cheese. SPX FLOW (US) and GEA Group (Germany) are extending their mixer portfolio, providing sanitary energy-efficient automated mixing solutions to cater to this growing market demand. Therefore, mixers are the fastest-growing segment in the industry

Food & Beverages Industry Pumps Market, By Application

The rising demand for functional drinks, plant-based alternatives, and carbonated beverages is driven by changing consumer preferences, increasing health consciousness, and a growing focus on sustainability. Consumers are seeking beverages that offer nutritional benefits, natural ingredients, and innovative flavors, leading to the expansion of fortified juices, sports drinks, and probiotic beverages. This trend necessitates specialized pumping solutions for accurate ingredient dosing, aseptic handling, and efficient high-viscosity liquid transfer in beverage production. Concrete increases in the production of ready-to-drink (RTD) beverages, especially cold brew coffee as well as kombucha and herbal infusions, are driving a strong requirement for hygienic energy-efficient pump systems supporting the integrity of the product and prevention from contamination. For example, a high demand for sanitary diaphragm and centrifugal pumps for gently transferring cold-pressed juices has been fueled by the growing acceptance of high-pressure processing (HPP) without compromising the texture and nutrients in these beverages. Beverage production sustainability schemes further the demand for low-maintenance, energy-efficient pumps that will encourage water recycling efforts and its minimum consumption. JBT and Alfa Laval are increasing their pump offerings to meet growing production requirements for functional beverages, consolidating non-alcoholic beverages as the fastest-growing application segment in the market

Food & Beverages Industry Pumps Market, By Flow

The 10–100 liters per second flow rate segment holds a dominant share in the food & beverages industry pumps market due to its versatility and suitability across a wide range of processing applications. This flow rate range offers an optimal balance between efficiency, precision, and energy consumption, making it ideal for medium to large-scale operations such as beverage filling, dairy processing, sauce and paste transfer, and meat processing applications. Pumps in this category are preferred for their ability to handle both low- and high-viscosity fluids while maintaining hygienic conditions and consistent output. Moreover, the growing automation in food manufacturing facilities and the emphasis on maintaining continuous, contamination-free production lines further strengthen the dominance of the 10–100 liters per second segment within the market.

Food & Beverages Industry Pumps Market, By Pressure

The <15 bar pressure segment dominates the food & beverages industry pumps market due to its extensive use in low- to medium-pressure applications, which account for a major share of food and beverage processing operations. This pressure range is ideal for handling delicate and shear-sensitive products such as dairy, beverages, sauces, and liquid foods, ensuring gentle transfer without compromising product texture or quality. Pumps operating below 15 bar are also preferred for their lower energy consumption, ease of maintenance, and compliance with hygienic design standards. Additionally, their suitability for clean-in-place (CIP) systems and compatibility with automated processing lines make them the most widely adopted pressure category across the food and beverage industry.

REGION

Asia Pacific to be fastest-growing region in global food & beverages industry pumps market during forecast period

The Asia Pacific region is the fastest-growing market for food & beverage industry pumps due to fast industrialization, increasing disposable income, and expanding food processing industries in countries like China, India, and Indonesia. Urbanization and habitation changes are likely contributing factors to elevated demand for processed foods, dairy products, and non-alcoholic beverages, thus emphasizing the requirement for efficient, high production efficiency pumping systems. Two major growth sectors involved are dairy and beverage segmentation in India and China, notably with increasing demand among the populace for beverages based on milk, plant alternative beverages, and fortified beverages. For example, today, the dairy market in China is flooded with high-protein yogurt and lactose-free milk that is going to require top-notch centrifugal and positive displacement pumps for gentle fluid transfer and longer shelf-life processing. Supporting food safety and automation initiatives are securing food producers to invest in hygienic energy-efficient pumping solutions. Grundfos, NETZSCH, and their contemporaries are venturing towards building their domination in the fast-growing market segment-cum-region because more people seek high-performance products in Asia Pacific

Food Beverage Industry Pumps Market: COMPANY EVALUATION MATRIX

In the food & beverages industry pumps market, KSB SE is recognized as a star player due to its extensive portfolio of high-performance pumps and valves tailored for hygienic and industrial food processing applications. With decades of engineering expertise, the company is known for delivering reliable, energy-efficient, and compliant pumping solutions that cater to large-scale operations worldwide. Grundfos, positioned as an emerging player, is gaining momentum by focusing on sustainable and smart pumping technologies. The company’s strategic expansion into food-safe and energy-optimized pumps is meeting the rising demand for efficient, automated, and hygienic fluid handling solutions in the global food and beverages sector.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 10.84 Billion |

| Market Forecast in 2030 (value) | USD 13.84 Billion |

| Growth Rate | CAGR of 4.1% from 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Thousand Unit) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, RoW |

WHAT IS IN IT FOR YOU: Food Beverage Industry Pumps Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Market sizing of food & beverage pumps by type across regions | Provided global and regional breakdown (North America, Europe, Asia-Pacific, South America, RoW) with CAGR forecasts | Clear understanding of high-demand regions, segment growth, and investment hotspots |

| Competitive landscape of key players (KSB SE, Grundfos, Alfa Laval, SPX Flow, IDEX Corporation) | Delivered benchmarking on production capacity, product portfolios, technological innovations, and market positioning | Identifies market leaders, emerging players, and strategic partnership or acquisition opportunities |

| Application analysis of pumps in F&B operations | Segmentation by dairy, beverages, bakery, meat processing, sauces & dressings, and brewing | Helps clients prioritize high-growth applications and align product offerings with industry needs |

| Price trend analysis (USD/unit) for pumps across types and regions | Customized database with average selling prices, historical trends, and raw material/energy cost impact | Supports pricing strategies, procurement planning, and cost optimization |

| Insights on adoption of advanced pump technologies | Delivered surveys & secondary research on smart, hygienic, and energy-efficient pump adoption in F&B | Enables clients to target modernization opportunities, product positioning, and technology investments |

RECENT DEVELOPMENTS

- December 2024 : Fristam Pumpen KG (GmbH & Co.) opened a new state-of-the-art manufacturing facility in Taicang, China, enhancing its presence in the Asian market. The facility, located in the Taicang Sino-German Life Science Park, ensures faster deliveries and high-quality pump production for the food and beverage industry while adhering to sustainable manufacturing practices

- November 2024 : SPX FLOW launched the CU4plus ASi-5 control unit, revolutionizing valve management in food & beverage processing. Featuring IoT integration, real-time diagnostics, and improved efficiency, it enables faster operations, reduced costs, and enhanced sustainability. With advanced seat-lifting technology, it cuts CIP fluid loss by up to 80%, optimizing cleaning and maintenance processes.

- November 2024 : Fristam Pumps introduced the FDS Nano Twin Screw Pump, the world's smallest of its kind, designed for precise low-volume transfer of shear-sensitive products. Handling viscosities up to 1 million cP and 70% entrained air, it also pumps CIP fluids at 4,000 RPM, eliminating extra pumps and optimizing efficiency in food and beverage processing

- October 2024 : Atlas Copco Group acquired Pomac BV, a Dutch manufacturer of hygienic pumps primarily serving the food & beverage industry. This acquisition strengthens Atlas Copco’s industrial pump portfolio with advanced technology. Pomac, with 23 employees and 2023 revenues of MEUR 8.3, will join the power and flow division within the Power Technique Business Area

- October 2024 : SPX FLOW invested USD 2.5 million to expand its Bydgoszcz, Poland, facility, launching the EMEA distribution center. This strategic hub accelerates aftermarket parts delivery for APV and other brands, optimizing supply chains for food & beverage industry pumps. Customers benefit from faster response times, improved order accuracy, and up to 30% reduced shipping delays.

Table of Contents

Methodology

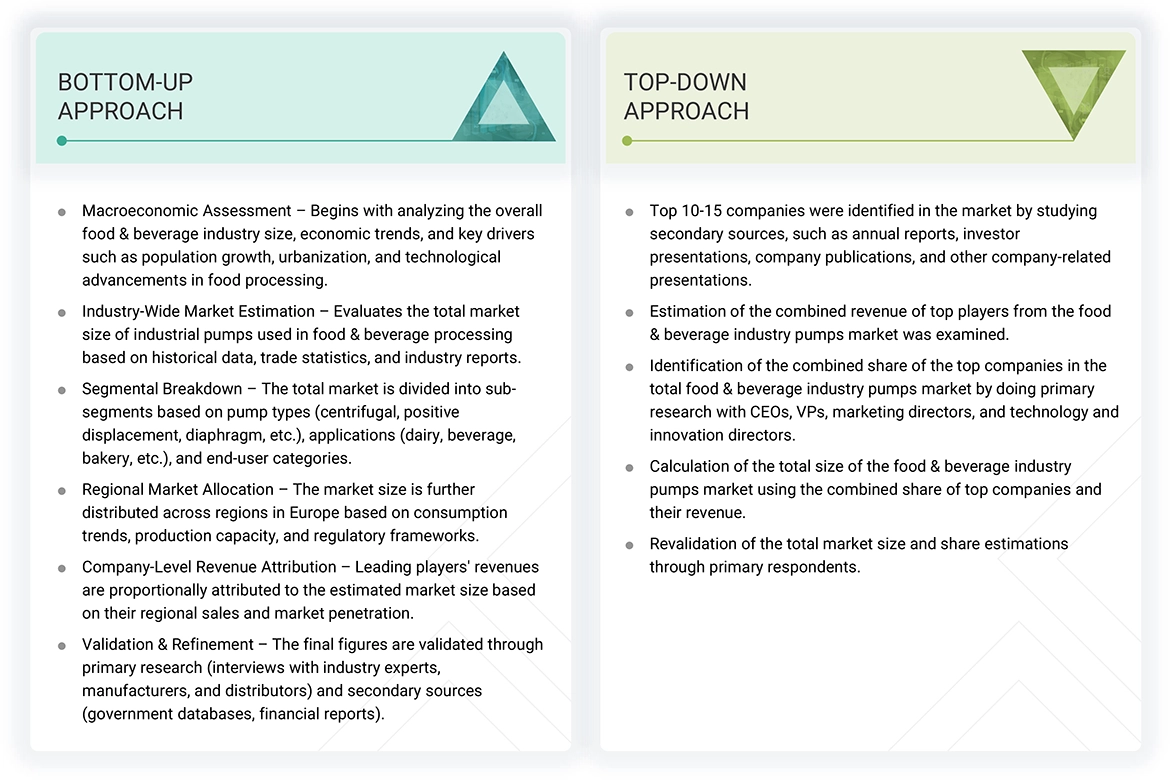

The study involved two major approaches in estimating the current size of the food & beverage industry pumps market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the market.

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, directories, and databases were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after obtaining information regarding the food & beverage industry pumps market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, research, and development teams, and related key executives from distributors and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to core material, core material form, shell material type, technology, end-user industry, functionality, and region. Stakeholders from the demand side, such as food and beverage manufacturers, were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage of feeding systems and the outlook of their business, which will affect the overall market.

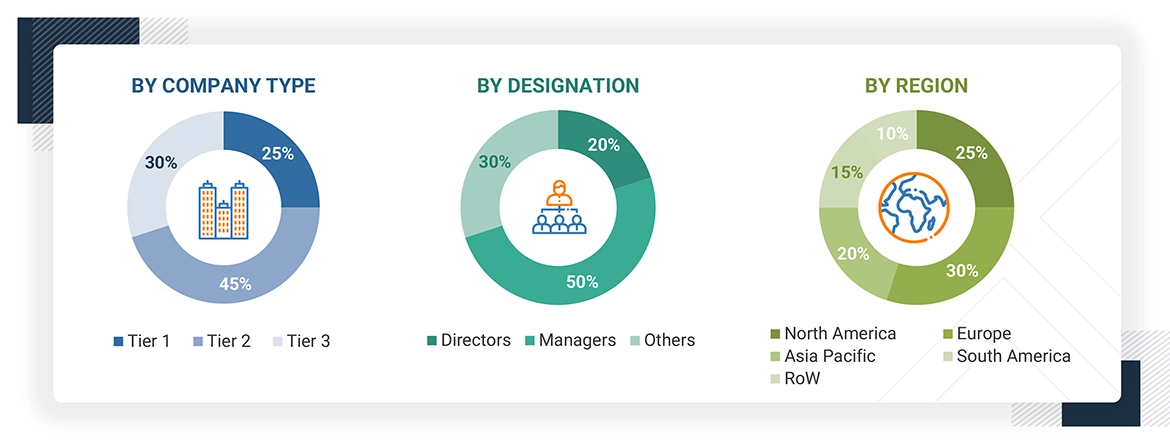

Breakdown of Primary Interviews

Note: The three tiers of the companies are defined based on their total revenues in 2022 or 2023, as per the availability of financial data: Tier 1: Revenue > USD 1 billion; Tier 2: USD 100 million ≤ Revenue ≤ USD 1 billion; Tier 3: Revenue < USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME | DESIGNATION | |

|---|---|---|

| GEA Group (Germany) | Product Development Manager | |

| ALFA LAVAL (Germany) | Senior R&D Scientist | |

| KSB SE & CoKGaA (Germany) | Global Marketing Director | |

| JBT (US) | Head of Food & beverage industry pumps Technology | |

| Atlas Copco (Sweden) | Senior Research Scientist | |

| Graco Inc. (US) | Business Development Manager | |

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the food & beverage industry pumps market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CEOs, directors, and marketing executives.

Global Food & beverage industry pumps Market: Bottom Up & Top Down Approach.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall food & beverage industry pumps market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

Pumps are an integral part of the food & beverage industry. In the food processing plants, pumps are used for a variety of substances and processes: to transport food and beverages of any viscosity; to disperse, mix, or homogenize products; for treatment of beverage with additives; and for drying of food. The mixing or agitation processes in the food & beverage industry require an agitator, a machine used in a tank, for mixing various process media. An agitator works by rotating an impeller to impart energy to the media, which interacts and mixes. An industrial mixer is bulk processing equipment designed to mix or blend homogenous materials to form a homogenous end-product. Air compressors are used in the food & beverage industry because of their capability to provide a clean and efficient tool for packaging and processing. Aerators are mechanical devices used for aeration or mixing air with another substance.

Stakeholders

- Food & beverage pumps, technology, and equipment manufacturers and suppliers

- Food & beverage product manufacturers, suppliers, and distributors

- Food & beverage pumps’ spare part suppliers and distributors

- Food & beverage raw material suppliers and distributors

- Regulatory and research organizations

- Food and agriculture organizations, such as the Food and Drug Administration (FDA), European Food Safety Authority (EFSA), United States Department of Agriculture (USDA), and Food Standards Australia New Zealand (FSANZ)

- Associations and industry bodies

- Government agencies and NGOs

- Food safety agencies

- Logistics providers and transporters

- Research institutes and organizations

Report Objectives

- To determine and project the size of the food & beverage industry pumps market with respect to the type, application, degree of engineering, flow rate capacity, pressure, and regions in terms of value over five years, ranging from 2025 to 2030.

- To identify the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- To provide detailed information about the key factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To analyze the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market.

- To identify and profile the key players in the food & beverage industry pumps market.

- To understand the competitive landscape and identify the major growth strategies adopted by players across the key regions.

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Food & Beverage Industry Pumps Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Food & Beverage Industry Pumps Market