Beverage Processing Equipment Market by Type (Brewery, Filtration, Carbonation, Sugar Dissolvers, Blenders & Mixers and Heat Exchangers), Beverage Type (Alcoholic, Non-Alcoholic and Dairy), Mode of Operation and Region - Global Forecast to 2026

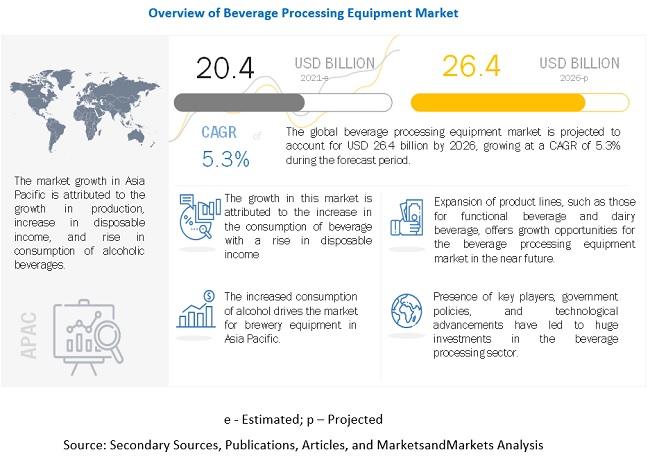

[258 Pages Report] According to MarketsandMarkets, the beverage processing equipment market is projected to grow from USD 20.4 billion in 2021 to USD 26.4 billion by 2026, recording a compound annual growth rate (CAGR) of 5.3% during the forecast period. The multi-dimensional beverage industry is growing on a global scale, and therefore, there is a visible increase in the demand for beverages, be it alcoholic, non-alcoholic, or dairy beverages. Though the beverage sector witnessed a revolutionary change in terms of shifting toward a healthier profile, the demand for equipment follows an increasing trend. An increasing processing industry, especially in the developing regions, growing craft breweries, and the development of new technologies in the beverage processing industry are prominent factors driving the beverage processing equipment industry. However, rising power & energy costs are a concern to the industry’s growth. Vertical integration serves as an opportunity for the beverage processing equipment market. The global market is highly impacted by innovations, as manufacturers are always introducing new processing techniques to produce complex beverage products of different types and flavors thereby focusing on catering to the increasing demand from the consumers. Development of new machinery and enhancement of the existing ones are the key strategies adopted by many players in this market. In addition, increasing focus on the expansion of facilities, marketing schemes, and information exchange programs to create awareness and enhance the applications of beverage processing equipment is projected to contribute to the growth of the market.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of Covid-19 on beverage processing equipment market

The COVID-19 pandemic is projected to have a significant impact on the beverage processing equipment market, as it has highlighted the significance of safe, healthy, and nutritive eating. Food security, food safety, and food sustainability have been considerably affected during the Covid-19 pandemic. Consumer behaviour related to the beverage consumed saw sharp shifts, with a higher preference for beverages with functional benefits and safety. These have further propelled the manufacturers to assess the safety parameters of their products to be able to sustain their product values in the market. Also, the Shortage of semiconductors has affected manufacturing and sales of many types of equipment, including beverage processing equipment.

Market Dynamics

Drivers: Increase in alcohol consumption

Increasing urbanization and rise in incomes have resulted in an exponential rise in demand for alcoholic beverages in India. According to WHO, with nearly 30% of men between the 15-65 age group addicted to drinking, alcohol consumption in India has increased from 4.3 liters per person in 2010 to 5.7 liters per person in 2016. An active domestic and international trade further promotes the consumption of alcoholic beverages. With growing product premiumization, consumption by middle- and low-income consumers has gone up phenomenally and hence, there is anticipated growth in production. There is an increase in alcohol consumption in China and India, which could potentially be linked to active marketing by the alcohol industry and increased income in these countries. This trend has a positive effect on the beverage processing equipment market as well. Young drinkers are developing a taste for flavored whiskey, beer, and vodka, due to which the beverage processing equipment market is also growing proportionally to meet the rising demand. Post-COVID-19, consumers have gained better awareness regarding the quality of the products they consume and are willing to pay extra for high-quality alcoholic beverages, creating an opportunity for liquor companies to offer premium price points. Diageo India launched and re-launched a plethora of options in its range of international as well as Indian liquor, also entering the crafts spirit’s segment. A moderation trend is round the corner, wherein there is a conscious shift toward no/low alcohol globally, predominantly no/low beer and cider.

Restraints: Increase in costs of power & energy

Rising costs of power and energy required for the operation of processing equipment are a key restraint for the beverage processing equipment market for beverage products. The beverage industry is growing at a considerable rate and has bright prospects. The beverage processing industry requires electricity for running the plants, refrigeration, lighting, and other mechanical processes. Thermal energy is required for processes such as pasteurization and evaporation in beverage processing. Pasteurization is an essential process that kills pathogens and inactivates enzymes. This process consumes a large amount of energy—mainly electricity and other fuels—compared to other processing equipment.

Beverage processors have several opportunities to reduce electricity consumption; these plants can become more energy-efficient by way of upgrading their older equipment, installing new technologies, and changing management policies. A beverage processor who is trying to comprehend the various ways of how energy is being used on the farm and knowing cost-saving opportunities will find energy audit to be a valuable tool. Furthermore, the high cost involved in running such types of processing equipment, as well as the scarcity of non-renewable resources, is deterring small beverage processors from installing such beverage processing systems.

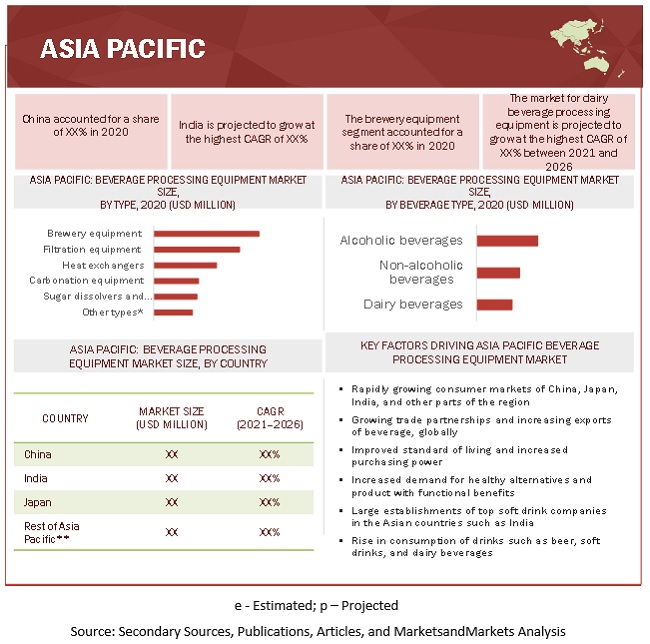

Opportunities: Growth in demand in emerging countries

The Asia Pacific region is a growing market for alcoholic as well as non-alcoholic beverages. China and India dominate in terms of consumption of beer and soft drinks. The increasing rate of population and globalization and an inclination toward western lifestyles have resulted in an increasing demand for beverages, especially for alcohol and soft drinks. Due to this, beverage firms are paying more attention to the emerging middle-classes in developing countries in regions such as Asia Pacific, the Middle East, and Africa. In an increasingly competitive marketplace where the consumption of both alcoholic and non-alcoholic beverages is growing rapidly, producers must have highly flexible and sustainable processes to meet this demand. For example, Alfa Laval equipment is also designed in such a way to help boost energy efficiency, as well as to roll back environmental impacts of all kinds.

Challenges: High capital investment

Beverage processing manufacturers require high capital investments to install various types of processing equipment. These have not only high installation costs but also require timely maintenance, which is a costly addition that affects the operating margins for beverage processors. Beverage processing manufacturers look for more economical options such as equipment rentals. Renting processing equipment requires less capital investment and also saves annual maintenance cost, which is usually taken care of by rental companies.

The beverage industry is highly volatile in terms of creating and maintaining an infrastructure that has flexibility in capacity and the capability to meet consumer demands on a periodic and sometimes instantaneous basis. The infrastructure constitutes the facilities, machinery and equipment, and logistics mechanisms required to produce and distribute quality, sellable products. Since to create such an operating format involves capital expenditures, the responsibility of ongoing maintenance, plus keeping up with technological changes. Equipment purchase decisions often rely on their ability to meet very short ROI demands, but limitations on depreciation periods can leave an asset with substantial book value for a product no longer viable.

Carbonated beverage segment is estimated to dominate the global beverage processing equipment market in 2021

By non-alcoholic beverage type, the carbonated beverage segment is estimated to dominate the global market in 2021. Among non-alcoholic beverages, soft drinks are among the highly consumed beverages. The increase in consumption has been among children and adolescents. A recent trend observed among the health-conscious generation X and Y is the increasing popularity of sparkling water with added flavors. Sparkling water contains magnesium, calcium, and vitamins with several health benefits. This allows consumers to maintain a healthy choice without missing out on fizz and taste.

The brewery equipment segment is estimated to account for the largest share in the global market in 2021

By type, the brewery equipment segment is estimated to account for the largest share in the beverage processing equipment market in 2021. The level of consumption of beer has witnessed exponential growth in India. This rising demand and popularity of craft beer in India has increased the number of microbreweries and has encouraged small craft brewers to scale up their production. Some of the factors that have worked in favor of this industry in India are-demand for better quality and varieties of beer by the millenniums, the increased number of social gatherings spots in the cities offering beer and the introduction of canned beer for on-the-go consumers. Technology has also influenced the beer-making process; one such example can be that of the introduction of AI technology in the brewing process. ‘AI-Brewed Beer’ is the use of artificial technology to expedite the brewing process.

To know about the assumptions considered for the study, download the pdf brochure

The Asia Pacific market is projected to grow at the highest CAGR during the forecast period

The beverage processing equipment market in the Asia Pacific region is projected to grow rapidly due to the enhanced economic growth in the last decade. The food industry has also played an important role in the region's economic development. Beverage consumption in the regions is also gradually increasing, owing to expanding population, rising income, and rapid urbanization. This growth can be attributed to the high demand for non-carbonated, low-calorie drinks, especially health drinks, fortified drinks, and the Indian government’s initiative for industrialization.

Key Market Players:

The beverage processing equipment market is diversified and competitive, with a large number of players. The key players in this market include Tetra Laval (Switzerland), GEA Group (Germany), Alfa Laval (Sweden), Krones Group (Germany), Bucher Industries (Switzerland), SPX FLOW (US), JBT Corporation (US), KHS GmbH (Germany), Pentair (US), and Praj Industries (India). The key market players have adopted strategies such as expansions & investments, acquisitions, new product & technology launches, agreements, collaborations, joint ventures, and partnerships to meet the growing demand for beverage processing equipment.

Scope of the report

|

Report Metric |

Details |

|

Market size estimation |

2017–2026 |

|

Base year considered |

2020 |

|

Forecast period considered |

2021–2026 |

|

Units considered |

Value (USD) |

|

Segments covered |

Type, beverage type, mode of operation and region |

|

Regions covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies studied |

Tetra Laval (Switzerland) |

This research report categorizes the beverage processing equipment market based on type, beverage type, mode of operation and region.

By Type

- Brewery

- Filtration

- Carbonation

- Sugar Dissolvers

- Blenders & Mixers

- Heat Exchanger

- Other types1

*Other types include cooling tunnel, storage tanks, pasteurizer, and crushers.

By Beverage Type

- Alcoholic

- Carbonated

- Non-Carbonated

- Dairy

By Mode of Operation

- Automatic

- Semi-automatic

By Region

- North America

- Europe

- Asia Pacific

-

Rest of the World (RoW)

- South America

- Middle East

- Africa

Recent Developments

- In January 2019, GEA Group launched DairyRobot R9500, which helps enhance the milking process. The launch of the product made the group a pioneer in the industry to launch Somatic Cell Count (SCC) monitors to continually analyze the milk flow from each quarter.

- In February 2019, Alfa Laval introduced a twin-screw pump added to the company’s hygienic pump portfolio for use in the dairy, food, and personal care industries. This launch aimed at simplifying the operation and leading to a reduction in the cost.

- In January 2018, GEA Group acquired Vipoll (Slovenia), a beverage filling technology and equipment company. This acquisition helped GEA in broadening and strengthening its position in the beverage industry by adding beverage packaging equipment & technology to its product portfolio.

Frequently Asked Questions (FAQ):

Who are the major market players in the beverage processing equipment market?

The key players in this market include Tetra Laval (Switzerland), GEA Group (Germany), Alfa Laval (Sweden), Krones Group (Germany), Bucher Industries (Switzerland), SPX FLOW (US), JBT Corporation (US), KHS GmbH (Germany), Pentair (US), and Praj Industries (India).

What is the impact of COVID-19 on the beverage processing equipment market?

The COVID-19 pandemic is projected to have a significant impact on the beverage processing equipment market, as it has highlighted the significance of safe, healthy, and nutritive eating. Food security, food safety, and food sustainability have been considerably affected during the Covid-19 pandemic. Consumer behaviour related to the beverage consumed saw sharp shifts, with a higher preference for beverages with functional benefits and safety. These have further propelled the manufacturers to assess the safety parameters of their products to be able to sustain their product values in the market. Also, the Shortage of semiconductors has affected manufacturing and sales of many types of equipment, including beverage processing equipment.

Which are the key regions that are projected to witness significant growth in the beverage processing equipment market?

The beverage processing equipment market was dominated by the Asia Pacific region in 2020, which accounted for the largest share. This region is a large market for beverages and is continuously growing due to improved standards of living and a rise in purchasing power. This growth can be attributed to the high demand for non-carbonated, low-calorie drinks, especially health drinks, fortified drinks, and the Indian government’s initiative for industrialization.

What are the major types of beverage processing equipment that are projected to gain maximum market revenue and share during the forecast period?

By type, the brewery equipment segment is estimated to account for the largest share in the beverage processing equipment market in 2021. The level of consumption of beer has witnessed exponential growth in India. Some of the factors that have worked in favor of this industry in India are-demand for better quality and varieties of beer by the millenniums, the increased number of social gatherings spots in the cities offering beer and the introduction of canned beer for on-the-go consumers. Other type of equipment’s to show growth during the forecasted period are filtration, heat exchangers and carbonation equipment.

What is the current size of the global beverage processing equipment market?

The global beverage processing equipment market is estimated to account for about USD 20.4 billion in 2021 and is projected to reach a value of nearly USD 26.4 billion by 2026, at a CAGR of 5.3%. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 BEVERAGE PROCESSING EQUIPMENT MARKET SEGMENTATION

1.3.1 INCLUSIONS AND EXCLUSIONS

FIGURE 2 GEOGRAPHIC SCOPE

1.3.2 PERIODIZATION CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2016–2020

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 3 BEVERAGE PROCESSING EQUIPMENT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 4 BEVERAGE PROCESSING EQUIPMENT MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 5 MARKET: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RESEARCH LIMITATIONS

2.6 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

2.7 SCENARIO-BASED MODELLING

2.8 INTRODUCTION TO COVID-19

2.9 COVID-19 HEALTH ASSESSMENT

FIGURE 7 COVID-19: GLOBAL PROPAGATION

FIGURE 8 COVID-19 PROPAGATION: SELECT COUNTRIES

2.10 COVID-19 ECONOMIC ASSESSMENT

FIGURE 9 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.10.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 10 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 11 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 12 MARKET FOR CARBONATION EQUIPMENT TO GROW AT THE HIGHEST CAGR

FIGURE 13 DAIRY BEVERAGES ARE PROJECTED TO FORM THE FASTEST-GROWING SEGMENT BETWEEN 2021 AND 2026

FIGURE 14 BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY MODE OF OPERATION, 2021 VS. 2026 (USD MILLION)

FIGURE 15 BEVERAGE PROCESSING EQUIPMENT MARKET SHARE, BY REGION, 2020

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 OPPORTUNITIES IN THE GLOBAL MARKET

FIGURE 16 INCREASE IN THE DEMAND FOR FUNCTIONAL BEVERAGES DRIVING THE MARKET FOR BEVERAGE PROCESSING EQUIPMENT

4.2 BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE

FIGURE 17 ASIA PACIFIC LED THE MARKET IN 2020

4.3 BEVERAGE PROCESSING EQUIPMENT MARKET, BY BEVERAGE TYPE

FIGURE 18 THE ALCOHOLIC BEVERAGES SEGMENT DOMINATED THE GLOBAL MARKET IN 2020

4.4 ASIA PACIFIC: BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE & COUNTRY

FIGURE 19 CHINA ACCOUNTED FOR THE LARGEST SHARE IN 2020

4.5 BEVERAGE PROCESSING EQUIPMENT MARKET: KEY COUNTRIES

FIGURE 20 INDIA TO DOMINATED IN TERMS OF GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 EXPANDING BEVERAGE PROCESSING INDUSTRY DRIVES THE GLOBAL MARKET

5.2.1 DRIVERS

5.2.1.1 Increase in alcohol consumption

FIGURE 22 GROWTH OF PER CAPITA CONSUMPTION OF ALCOHOL IN KEY COUNTRIES, 2015–2018

5.2.1.2 Mushrooming craft breweries drive the brewery equipment demand

FIGURE 23 EUROPE: GROWTH OF MICROBREWERIES, BY KEY COUNTRY, 2011–2017

5.2.1.3 Rise in need for pasteurized milk to combat the raw milk outbreaks

5.2.1.4 Emergence of new technologies to increase productivity

5.2.1.4.1 Upgradation of equipment & machinery

5.2.1.4.2 Innovative technologies such as encapsulation to boost the beverage industry

5.2.1.4.3 Emerging trends of UHT milk and milk products

5.2.2 RESTRAINTS

5.2.2.1 Increase in costs of power & energy

5.2.3 OPPORTUNITIES

5.2.3.1 Growth in demand in emerging countries

FIGURE 24 ASIAN COUNTRIES AMONG THE TOP TEN ECONOMIES BY 2050 (USD BILLION)

5.2.3.2 Asia’s share in global middle-class consumption is growing rapidly

5.2.3.3 Beverage processors’ demand for after-sales services to enhance operational efficiency

5.2.3.4 Vertical integration: An opportunity for the industry

5.2.4 CHALLENGES

5.2.4.1 High capital investment

5.2.4.2 Persistent regulatory environment

5.2.5 OVERVIEW OF THE BEVERAGE INDUSTRY

FIGURE 25 GLOBAL PACKAGED BEVERAGE CONSUMPTION SHARE, 2014

5.2.5.1 Alcohol industry

5.2.5.1.1 Brewery industry

FIGURE 26 GLOBAL BEER PRODUCTION IN TOP 10 COUNTRIES, 2018 (BILLION LITERS)

FIGURE 27 EUROPE: BEER PRODUCTION, BY KEY COUNTRY, 2016 (‘000 HL)

5.2.5.2 Soft drink industry

FIGURE 28 US: SOFT DRINKS IMPORT, 2010–2015 (USD MILLION)

FIGURE 29 EUROPE: SOFT DRINK SALES VOLUME, 2011–2016 (MILLION LITERS)

FIGURE 30 UK: SOFT DRINK CONSUMPTION SHARE, 2016

5.2.5.2.1 Fortified beverages: Water-soluble vitamins

5.2.5.3 Dairy industry

5.2.5.3.1 Dairy fortification: A major trend

FIGURE 31 US: MILK INDUSTRY SHARE (VALUE), BY PRODUCT TYPE, 2012

6 INDUSTRY TRENDS (Page No. - 63)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

FIGURE 32 BEVERAGE PROCESSING EQUIPMENT: VALUE CHAIN ANALYSIS

6.3 MARKET ECOSYSTEM & SUPPLY CHAIN

FIGURE 33 BEVERAGE PROCESSING EQUIPMENT: SUPPLY CHAIN ANALYSIS

6.3.1 RESEARCH & DEVELOPMENT

6.3.2 INPUTS

6.3.3 PRODUCTION

6.3.4 LOGISTICS & DISTRIBUTION

6.3.5 MARKETING & SALES

6.3.6 END-USER INDUSTRY

FIGURE 34 BEVERAGE PROCESSING EQUIPMENT: MARKET MAP

6.4 PRICING ANALYSIS: BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE

TABLE 2 PRICING ANALYSIS OF BEVERAGE PROCESSING EQUIPMENT TYPE, 2020 (‘000 USD/PIECE)

FIGURE 35 PRICING TREND OF BEVERAGE PROCESSING EQUIPMENT, BY TYPE, 2018–2020 (‘000 USD/PIECE)

6.4.1 COVID-19 IMPACT ON THE PRICING OF BEVERAGE PROCESSING EQUIPMENT

6.5 TECHNOLOGY ANALYSIS

6.5.1 TECHNOLOGICAL INNOVATION IN THE SOFT DRINKS INDUSTRY

6.5.1.1 Membrane technology

6.6 REGULATORY POLICIES FOR BEVERAGE PROCESSING EQUIPMENT

6.6.1 EUROPEAN UNION

6.6.1.1 EU regulation on milk and milk products

6.6.1.1.1 General dairy conditions

6.6.2 NORTH AMERICA (US AND CANADA)

6.6.2.1 USFDA - US Food and Drug Administration inspection guide

6.6.2.1.1 CFR - Code of Federal Regulations Title 21

6.6.2.1.2 Regulation for raw milk receiving

6.6.2.1.3 Regulation for raw milk processing

6.6.3 CANADA

6.6.4 ASIA PACIFIC (JAPAN AND CHINA)

6.7 TRENDS/DISRUPTIONS IMPACTING THE BUSINESS OF CUSTOMERS

FIGURE 36 TRENDS/DISRUPTIONS IMPACTING THE BUSINESS OF CUSTOMERS

6.8 PORTER’S FIVE FORCES ANALYSIS

6.8.1 BEVERAGE PROCESSING EQUIPMENT MARKET: PORTER’S FIVE FORCES ANALYSIS

6.8.2 THREAT OF NEW ENTRANTS

6.8.3 THREAT OF SUBSTITUTES

6.8.4 BARGAINING POWER OF SUPPLIERS

6.8.5 BARGAINING POWER OF BUYERS

6.8.6 INTENSITY OF COMPETITIVE RIVALRY

6.9 TRADE ANALYSIS

FIGURE 37 TOP EXPORTERS OF BEVERAGES, BY VALUE, 2016–2020 (USD BILLION)

FIGURE 38 TOP IMPORTERS OF BEVERAGES, BY VALUE, 2016–2020 (USD BILLION)

6.10 PATENT ANALYSIS

FIGURE 39 TOP 10 PATENT APPLICANTS IN THE LAST 10 YEARS

TABLE 3 PATENTS PERTAINING TO BEVERAGE PROCESSING EQUIPMENT, 2015–2021

6.11 CASE STUDIES

6.11.1 GROWTH IN DEMAND FOR BETTER PASTEURIZATION TECHNIQUES

TABLE 4 DEMAND FOR BETTER AUTOMATED BEVERAGE PROCESSING EQUIPMENT

7 BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE (Page No. - 81)

7.1 INTRODUCTION

FIGURE 40 BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY TYPE, 2021 VS. 2026 (USD MILLION)

TABLE 5 MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 6 MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

7.1.1 COVID-19 IMPACT ON THE BEVERAGE PROCESSING EQUIPMENT, BY TYPE

TABLE 7 REALISTIC SCENARIO: COVID-19 IMPACT ON THE BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 8 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 9 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

7.2 BREWERY EQUIPMENT

7.2.1 RAPID INCREASE IN DEMAND FOR CRAFT BEER TO DRIVE THE MARKET FOR MICROBREWERIES

7.2.2 MASH TUNS

7.2.3 BREW KETTLES

7.2.4 FERMENTATION TANKS

7.2.5 BRIGHT BEER TANKS

TABLE 10 BREWERY EQUIPMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 11 BREWERY EQUIPMENT MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3 FILTRATION EQUIPMENT

7.3.1 MEMBRANE FILTRATION TECHNOLOGY TO STAY POPULAR OWING TO GROWTH AND ADVANCES IN THE BEVERAGE INDUSTRY

7.3.2 MEMBRANE FILTRATION

TABLE 12 FILTRATION EQUIPMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 13 FILTRATION EQUIPMENT MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.4 CARBONATION EQUIPMENT

7.4.1 TASTE ENHANCEMENT TO DRIVE THE DEMAND FOR CARBONATION

TABLE 14 CARBONATION EQUIPMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 15 CARBONATION EQUIPMENT MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.5 SUGAR DISSOLVERS AND BLENDERS & MIXERS

7.5.1 SUGAR DISSOLVERS

7.5.2 BLENDERS & MIXERS

7.5.3 HOMOGENIZERS

TABLE 16 SUGAR DISSOLVERS AND BLENDERS & MIXERS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 17 SUGAR DISSOLVERS AND BLENDERS & MIXERS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.6 HEAT EXCHANGERS

7.6.1 GROWING NUMBER OF BEVERAGE PROCESSING UNITS TO DRIVE THE MARKET

7.6.2 PLATE-TYPE HEAT EXCHANGERS

7.6.3 TUBULAR HEAT EXCHANGERS

7.6.4 EXTENDED SURFACE HEAT EXCHANGERS

7.6.5 REGENERATIVE HEAT EXCHANGERS

TABLE 18 HEAT EXCHANGERS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 19 HEAT EXCHANGERS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.7 OTHER TYPES

TABLE 20 OTHER EQUIPMENT TYPES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 21 OTHER EQUIPMENT TYPES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8 BEVERAGE PROCESSING EQUIPMENT MARKET, BY BEVERAGE TYPE (Page No. - 94)

8.1 INTRODUCTION

FIGURE 41 BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY BEVERAGE TYPE, 2021 VS. 2026 (USD MILLION)

TABLE 22 MARKET SIZE, BY BEVERAGE TYPE, 2017–2020 (USD MILLION)

TABLE 23 MARKET SIZE, BY BEVERAGE TYPE, 2021–2026 (USD MILLION)

TABLE 24 NON-ALCOHOLIC BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY BEVERAGE TYPE, 2017–2020 (USD MILLION)

TABLE 25 MARKET SIZE FOR NON-ALCOHOLIC BEVERAGE PROCESSING EQUIPMENT, BY BEVERAGE TYPE, 2021–2026 (USD MILLION)

8.1.1 COVID-19 IMPACT ON THE BEVERAGE PROCESSING EQUIPMENT, BY BEVERAGE TYPE

TABLE 26 REALISTIC SCENARIO: COVID-19 IMPACT ON THE BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY BEVERAGE TYPE, 2018–2021 (USD MILLION)

TABLE 27 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY BEVERAGE TYPE, 2018–2021 (USD MILLION)

TABLE 28 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY BEVERAGE TYPE, 2018–2021 (USD MILLION)

8.2 ALCOHOLIC BEVERAGES

8.2.1 PREMIUMIZATION TO PAVE THE WAY FOR THE DEMAND FOR ALCOHOLIC BEVERAGES

8.2.2 BEER

TABLE 29 TOP 5 BEER EXPORTING AND IMPORTING COUNTRIES-2020

8.2.3 WINE

8.2.4 SPIRIT & CIDER

TABLE 30 ALCOHOLIC BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 31 MARKET SIZE FOR ALCOHOLIC BEVERAGE PROCESSING EQUIPMENT, BY REGION, 2021–2026 (USD MILLION)

8.3 NON-ALCOHOLIC BEVERAGES

TABLE 32 MARKET SIZE FOR NON-ALCOHOLIC BEVERAGE PROCESSING EQUIPMENT, BY REGION, 2017–2020 (USD MILLION)

TABLE 33 MARKET SIZE FOR NON-ALCOHOLIC BEVERAGE PROCESSING EQUIPMENT, BY REGION, 2021–2026 (USD MILLION)

8.3.1 CARBONATED BEVERAGES

8.3.1.1 Demand for carbonated water is gaining momentum

TABLE 34 CARBONATED BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 35 MARKET SIZE FOR CARBONATED BEVERAGE PROCESSING EQUIPMENT, BY REGION, 2021–2026 (USD MILLION)

8.3.2 NON-CARBONATED BEVERAGES

8.3.2.1 Consumer preference for functional beverages and ready-to-drink formats to continue on an upsurge

8.3.2.2 Juices

8.3.2.3 Tea & Coffee

8.3.2.4 Functional beverages

TABLE 36 NON-CARBONATED BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 37 MARKET SIZE FOR NON-CARBONATED BEVERAGE PROCESSING EQUIPMENT, BY REGION, 2021–2026 (USD MILLION)

8.4 DAIRY BEVERAGES

8.4.1 FLAVORED MILK IS GARNERING ATTENTION FOR THE HEALTH BENEFITS OF PROBIOTICS

TABLE 38 FUNCTIONAL COMPOUND IN VARIOUS PLANT-BASED MILK

TABLE 39 DAIRY BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 40 MARKET SIZE FOR DAIRY BEVERAGE PROCESSING EQUIPMENT, BY REGION, 2021–2026 (USD MILLION)

9 BEVERAGE PROCESSING EQUIPMENT MARKET, BY MODE OF OPERATION (Page No. - 106)

9.1 INTRODUCTION

FIGURE 42 BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY MODE OF OPERATION, 2021 VS. 2026 (USD MILLION)

TABLE 41 MARKET SIZE, BY MODE OF OPERATION, 2017–2020 (USD MILLION)

TABLE 42 MARKET SIZE, BY MODE OF OPERATION, 2021–2026 (USD MILLION)

9.2 IMPACT OF COVID-19 ON THE BEVERAGE PROCESSING EQUIPMENT, BY MODE OF OPERATION

TABLE 43 REALISTIC SCENARIO: COVID-19 IMPACT ON THE BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY MODE OF OPERATION, 2018–2021 (USD MILLION)

TABLE 44 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY MODE OF OPERATION, 2018–2021 (USD MILLION)

TABLE 45 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY MODE OF OPERATION, 2018–2021 (USD MILLION)

9.3 AUTOMATIC

9.3.1 ADOPTION OF AUTOMATION HAS MANY BENEFITS OTHER THAN TIMESAVING AND EFFICIENCY

TABLE 46 AUTOMATIC BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 47 AUTOMATIC: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.4 SEMI-AUTOMATIC

9.4.1 LINE FLEXIBILITY OFFERED BY SEMI-AUTOMATIC RETAINS ITS ROLE WITHIN THE PROCESSING INDUSTRY

TABLE 48 SEMI-AUTOMATIC BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 49 MARKET SIZE FOR SEMI-AUTOMATIC BEVERAGE PROCESSING EQUIPMENT, BY REGION, 2021–2026 (USD MILLION)

10 BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION (Page No. - 112)

10.1 INTRODUCTION

FIGURE 43 GEOGRAPHIC SNAPSHOT: BEVERAGE PROCESSING EQUIPMENT MARKET

FIGURE 44 ASIA PACIFIC IS PROJECTED TO WITNESS THE HIGHEST GROWTH BETWEEN 2021 AND 2026 (USD MILLION)

TABLE 50 MARKET SIZE FOR BEVERAGE PROCESSING EQUIPMENT, BY REGION, 2017–2020 (USD MILLION)

TABLE 51 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.2 COVID-19 IMPACT ON THE BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION

TABLE 52 REALISTIC SCENARIO: COVID-19 IMPACT ON THE BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 53 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 54 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

10.3 NORTH AMERICA

TABLE 55 NORTH AMERICA: BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET SIZE, BY MODE OF OPERATION, 2017–2020 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET SIZE, BY MODE OF OPERATION, 2021–2026 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET SIZE, BY BEVERAGE TYPE, 2017–2020 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET SIZE, BY BEVERAGE TYPE, 2021–2026 (USD MILLION)

TABLE 63 NORTH AMERICA: NON-ALCOHOLIC BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BEVERAGE TYPE, 2017–2020 (USD MILLION)

TABLE 64 NORTH AMERICA: NON-ALCOHOLIC BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BEVERAGE TYPE, 2021–2026 (USD MILLION)

10.3.1 US

10.3.1.1 Flavored water in high demand in the US

TABLE 65 US: MARKET SIZE FOR BEVERAGE PROCESSING EQUIPMENT, BY TYPE, 2017–2020 (USD MILLION)

TABLE 66 US: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

10.3.2 CANADA

10.3.2.1 Increasing nutritional beverage consumption to drive the market

TABLE 67 CANADA: BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 68 CANADA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

10.3.3 MEXICO

10.3.3.1 Processed milk and beer production to show positive growth in the country

TABLE 69 MEXICO: MARKET SIZE FOR BEVERAGE PROCESSING EQUIPMENT, BY TYPE, 2017–2020 (USD MILLION)

TABLE 70 MEXICO: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

10.4 EUROPE

TABLE 71 EUROPE: BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 72 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 73 EUROPE: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 74 EUROPE: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 75 EUROPE: MARKET SIZE, BY MODE OF OPERATION, 2017–2020 (USD MILLION)

TABLE 76 EUROPE: MARKET SIZE, BY MODE OF OPERATION, 2021–2026 (USD MILLION)

TABLE 77 EUROPE: MARKET SIZE, BY BEVERAGE TYPE, 2017–2020 (USD MILLION)

TABLE 78 EUROPE: MARKET SIZE, BY BEVERAGE TYPE, 2021–2026 (USD MILLION)

TABLE 79 EUROPE: NON-ALCOHOLIC BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BEVERAGE TYPE, 2017–2020 (USD MILLION)

TABLE 80 EUROPE: NON-ALCOHOLIC BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BEVERAGE TYPE, 2021–2026 (USD MILLION)

10.4.1 GERMANY

10.4.1.1 Presence of a large number of small and large enterprises driving the market for beverage equipment in Germany

TABLE 81 GERMANY: MARKET SIZE FOR BEVERAGE PROCESSING EQUIPMENT, BY TYPE, 2017–2020 (USD MILLION)

TABLE 82 GERMANY: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

10.4.2 FRANCE

10.4.2.1 France to be the fastest-growing in terms of beer production in the region

TABLE 83 FRANCE: MARKET SIZE FOR BEVERAGE PROCESSING EQUIPMENT, BY TYPE, 2017–2020 (USD MILLION)

TABLE 84 FRANCE: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

10.4.3 ITALY

10.4.3.1 Increased order values for food & beverage companies and increase in tourism to drive investment in new technology

TABLE 85 ITALY: BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 86 ITALY: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

10.4.4 SPAIN

10.4.4.1 The beverage equipment market in Spain is driven by its huge beer industry

TABLE 87 SPAIN: MARKET SIZE FOR BEVERAGE PROCESSING EQUIPMENT, BY TYPE, 2017–2020 (USD MILLION)

TABLE 88 SPAIN: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

10.4.5 UK

10.4.5.1 Rising demand for functional beverages in the UK to drive the market for beverage equipment

TABLE 89 UK: BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 90 UK: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

10.4.6 REST OF EUROPE

TABLE 91 REST OF EUROPE: MARKET SIZE FOR BEVERAGE PROCESSING EQUIPMENT, BY TYPE, 2017–2020 (USD MILLION)

TABLE 92 REST OF EUROPE: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

10.5 ASIA PACIFIC

FIGURE 45 ASIA PACIFIC: BEVERAGE PROCESSING EQUIPMENT MARKET SNAPSHOT

TABLE 93 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 94 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 95 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 96 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 97 ASIA PACIFIC: MARKET SIZE, BY MODE OF OPERATION, 2017–2020 (USD MILLION)

TABLE 98 ASIA PACIFIC: MARKET SIZE, BY MODE OF OPERATION, 2021–2026 (USD MILLION)

TABLE 99 ASIA PACIFIC: MARKET SIZE, BY BEVERAGE TYPE, 2017–2020 (USD MILLION)

TABLE 100 ASIA PACIFIC: MARKET SIZE, BY BEVERAGE TYPE, 2021–2026 (USD MILLION)

TABLE 101 ASIA PACIFIC: NON-ALCOHOLIC BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY BEVERAGE TYPE, 2017–2020 (USD MILLION)

TABLE 102 ASIA PACIFIC: NON-ALCOHOLIC BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY BEVERAGE TYPE, 2021–2026 (USD MILLION)

10.5.1 CHINA

10.5.1.1 Changes in beverage trends in the country to provide an opportunity for growth of functional beverages

TABLE 103 CHINA: BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 104 CHINA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

10.5.2 INDIA

10.5.2.1 Expansions and investments in the country by leading beverage manufacturers led the market

TABLE 105 INDIA: BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 106 INDIA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

10.5.3 JAPAN

10.5.3.1 Increase in consumption of functional beverages to drive the market

TABLE 107 JAPAN: MARKET SIZE FOR BEVERAGE PROCESSING EQUIPMENT, BY TYPE, 2017–2020 (USD MILLION)

TABLE 108 JAPAN: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

10.5.4 REST OF ASIA PACIFIC

TABLE 109 REST OF ASIA PACIFIC: MARKET SIZE FOR BEVERAGE PROCESSING EQUIPMENT, BY TYPE, 2017–2020 (USD MILLION)

TABLE 110 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

10.6 REST OF THE WORLD (ROW)

TABLE 111 ROW: BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 112 ROW: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 113 ROW: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 114 ROW: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 115 ROW: BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY MODE OF OPERATION, 2017–2020 (USD MILLION)

TABLE 116 ROW: MARKET SIZE, BY MODE OF OPERATION, 2021–2026 (USD MILLION)

TABLE 117 ROW: MARKET SIZE, BY BEVERAGE TYPE, 2017–2020 (USD MILLION)

TABLE 118 ROW: MARKET SIZE, BY BEVERAGE TYPE, 2021–2026 (USD MILLION)

TABLE 119 ROW: NON-ALCOHOLIC BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY BEVERAGE TYPE, 2017–2020 (USD MILLION)

TABLE 120 ROW: MARKET SIZE FOR NON-ALCOHOLIC BEVERAGE PROCESSING EQUIPMENT, BY BEVERAGE TYPE, 2021–2026 (USD MILLION)

10.6.1 SOUTH AMERICA

10.6.1.1 Growth of the alcohol industry to drive the beverage processing equipment market in the region

TABLE 121 SOUTH AMERICA: BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 122 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

10.6.2 MIDDLE EAST

10.6.2.1 Significant demand from the non-alcoholic beverage industry in the Middle Eastern countries

TABLE 123 MIDDLE EAST: BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 124 MIDDLE EAST: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

10.6.3 AFRICA

10.6.3.1 Increase in popularity of energy drinks witnessed in South Africa

TABLE 125 AFRICA: BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 126 AFRICA: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 155)

11.1 OVERVIEW

11.2 MARKET SHARE ANALYSIS

TABLE 127 BEVERAGE PROCESSING EQUIPMENT MARKET: DEGREE OF COMPETITION (CONSOLIDATED)

11.3 KEY PLAYER STRATEGIES

11.4 REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 46 REVENUE ANALYSIS (SEGMENTAL) OF KEY PLAYERS IN THE MARKET, 2016–2020 (USD BILLION)

11.5 COVID-19-SPECIFIC COMPANY RESPONSE

11.5.1 TETRA LAVAL (SWITZERLAND)

11.5.2 GEA GROUP (GERMANY)

11.5.3 JBT CORPORATION (US)

11.6 COMPANY EVALUATION QUADRANT

11.6.1 STARS

11.6.2 EMERGING LEADERS

11.6.3 PERVASIVE PLAYERS

11.6.4 PARTICIPANTS

FIGURE 47 BEVERAGE PROCESSING EQUIPMENT MARKET: COMPANY EVALUATION QUADRANT, 2020 (KEY PLAYERS)

11.6.5 PRODUCT FOOTPRINT

TABLE 128 COMPANY APPLICATION FOOTPRINT

TABLE 129 COMPANY MODE OF OPERATION FOOTPRINT

TABLE 130 COMPANY REGION FOOTPRINT

TABLE 131 COMPANY OVERALL FOOTPRINT

11.7 COMPETITIVE EVALUATION QUADRANT (OTHER PLAYERS)

11.7.1 PROGRESSIVE COMPANIES

11.7.2 STARTING BLOCKS

11.7.3 RESPONSIVE COMPANIES

11.7.4 DYNAMIC COMPANIES

FIGURE 48 BEVERAGE PROCESSING EQUIPMENT MARKET: COMPANY EVALUATION QUADRANT, 2020 (OTHER PLAYERS)

11.8 PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTS

11.8.1 PRODUCT LAUNCHES

TABLE 132 PRODUCT LAUNCHES, 2019–2020

11.8.2 DEALS

TABLE 133 DEALS, 2018–2021

11.8.3 OTHERS

TABLE 134 OTHERS, 2021

12 COMPANY PROFILES (Page No. - 169)

(Business overview, Products offered, Recent developments & MnM View)*

12.1 SUPPLIERS

12.1.1 TETRA LAVAL

TABLE 135 TETRA LAVAL: BUSINESS OVERVIEW

FIGURE 49 TETRA LAVAL: COMPANY SNAPSHOT

TABLE 136 TETRA LAVAL: DEALS

TABLE 137 TETRA LAVAL: PRODUCT LAUNCHES

TABLE 138 TETRA LAVAL: OTHERS

12.1.2 GEA GROUP

TABLE 139 GEA: BUSINESS OVERVIEW

FIGURE 50 GEA GROUP: COMPANY SNAPSHOT

TABLE 140 GEA GROUP: DEALS

TABLE 141 GEA GROUP: PRODUCT LAUNCHES

12.1.3 ALFA LAVAL

TABLE 142 ALFA LAVAL: BUSINESS OVERVIEW

FIGURE 51 ALFA LAVAL: COMPANY SNAPSHOT

TABLE 143 ALFA LAVAL: DEALS

TABLE 144 ALFA LAVAL: PRODUCT LAUNCHES

TABLE 145 ALFA LAVAL: OTHERS

12.1.4 KRONES GROUP

TABLE 146 KRONES GROUP: BUSINESS OVERVIEW

FIGURE 52 KRONES GROUP: COMPANY SNAPSHOT

TABLE 147 KRONES GROUP: DEALS

12.1.5 BUCHER INDUSTRIES

TABLE 148 BUCHER INDUSTRIES: BUSINESS OVERVIEW

FIGURE 53 BUCHER INDUSTRIES: COMPANY SNAPSHOT

12.1.6 SPX FLOW

TABLE 149 SPX FLOW: BUSINESS OVERVIEW

FIGURE 54 SPX FLOW: COMPANY SNAPSHOT

TABLE 150 SPX FLOW: DEALS

TABLE 151 SPX FLOW: PRODUCT LAUNCHES

12.1.7 JBT CORPORATION

TABLE 152 JBT CORPORATION: BUSINESS OVERVIEW

FIGURE 55 JBT CORPORATION: COMPANY SNAPSHOT

TABLE 153 JBT CORPORATION: DEALS

12.1.8 KHS GMBH

TABLE 154 KHS GMBH: BUSINESS OVERVIEW

TABLE 155 KHS GMBH: PRODUCT LAUNCHES

12.1.9 PENTAIR PLC

TABLE 156 PENTAIR PLC: BUSINESS OVERVIEW

FIGURE 56 PENTAIR PLC: COMPANY SNAPSHOT

TABLE 157 PENTAIR PLC: DEALS

TABLE 158 PENTAIR PLC: PRODUCT LAUNCHES

12.1.10 PRAJ INDUSTRIES

TABLE 159 PRAJ INDUSTRIES: BUSINESS OVERVIEW

FIGURE 57 PRAJ INDUSTRIES: COMPANY SNAPSHOT

12.2 END USERS

12.2.1 THE WHITEWAVE FOODS COMPANY

TABLE 160 THE WHITEWAVE FOODS COMPANY: BUSINESS OVERVIEW

TABLE 161 THE WHITEWAVE FOODS COMPANY: DEALS

TABLE 162 THE WHITEWAVE FOOD COMPANY: PRODUCT LAUNCHES

12.2.2 STARBUCKS CORPORATION

TABLE 163 STARBUCKS CORPORATION: BUSINESS OVERVIEW

FIGURE 58 STARBUCKS CORPORATION: COMPANY SNAPSHOT

TABLE 164 STARBUCKS CORPORATION: DEALS

TABLE 165 STARBUCKS CORPORATION: OTHERS

12.2.3 CAMPBELL SOUP COMPANY

TABLE 166 CAMPBELL SOUP COMPANY: BUSINESS OVERVIEW

FIGURE 59 CAMPBELL SOUP COMPANY: COMPANY SNAPSHOT

TABLE 167 CAMPBELL SOUP COMPANY: DEALS

TABLE 168 CAMPBELL SOUP COMPANY: PRODUCT LAUNCHES

12.2.4 LANGER JUICE COMPANY

TABLE 169 LANGER JUICE COMPANY: BUSINESS OVERVIEW

12.2.5 MOLSON COORS BEVERAGE COMPANY

TABLE 170 MOLSON COORS BEVERAGE COMPANY: BUSINESS OVERVIEW

FIGURE 60 MOLSON COORS BEVERAGE COMPANY: COMPANY SNAPSHOT

TABLE 171 MOLSON COORS BEVERAGE COMPANY: DEALS

12.2.6 ANHEUSER-BUSCH INBEV

TABLE 172 ANHEUSER-BUSCH INBEV: BUSINESS OVERVIEW

FIGURE 61 ANHEUSER-BUSCH INBEV: COMPANY SNAPSHOT

TABLE 173 ANHEUSER-BUSCH INBEV: PRODUCT LAUNCHES

12.2.7 KEURIG DR PEPPER

TABLE 174 KEURIG DR PEPPER: BUSINESS OVERVIEW

FIGURE 62 KEURIG DR PEPPER: COMPANY SNAPSHOT

12.2.8 THE COCA-COLA COMPANY

TABLE 175 THE COCO-COLA COMPANY: BUSINESS OVERVIEW

FIGURE 63 THE COCO-COLA COMPANY: COMPANY SNAPSHOT

TABLE 176 THE COCO-COLA COMPANY: DEALS

12.2.9 PEPSICO INC.

TABLE 177 PEPSICO INC: BUSINESS OVERVIEW

FIGURE 64 PEPSICO INC.: COMPANY SNAPSHOT

TABLE 178 PEPSICO INC: DEALS

TABLE 179 PEPSICO INC: PRODUCT LAUNCHES

12.2.10 DR PEPPER SNAPPLE GROUP, INC.

TABLE 180 DR PEPPER SNAPPLE GROUP, INC: BUSINESS OVERVIEW

12.2.11 UNILEVER GROUP

TABLE 181 UNILEVER GROUP: BUSINESS OVERVIEW

FIGURE 65 UNILEVER GROUP: COMPANY SNAPSHOT

12.2.12 THE J. M. SMUCKER COMPANY

TABLE 182 J.M. SMUCKER COMPANY: BUSINESS OVERVIEW

FIGURE 66 J. M. SMUCKER COMPANY: COMPANY SNAPSHOT

TABLE 183 J.M. SMUCKER: PRODUCT LAUNCHES

12.2.13 NATIONAL BEVERAGE CORPORATION

12.2.14 ARIZONA BEVERAGES

12.2.15 C&C COLA BEVERAGES

12.2.16 OCEAN SPRAY

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

13 ADJACENT AND RELATED MARKETS (Page No. - 245)

13.1 INTRODUCTION

TABLE 184 ADJACENT MARKETS TO BEVERAGE PROCESSING EQUIPMENT

13.2 LIMITATIONS

13.3 DAIRY PROCESSING EQUIPMENT MARKET

13.3.1 MARKET DEFINITION

13.3.2 MARKET OVERVIEW

TABLE 185 DAIRY PROCESSING EQUIPMENT MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 186 DAIRY PROCESSING EQUIPMENT MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

13.4 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET

13.4.1 MARKET DEFINITION

13.4.2 MARKET OVERVIEW

TABLE 187 FOOD & BEVERAGE PROCESSING EQUIPMENT MARKET SIZE, BY TYPE, 2016–2023 (USD BILLION)

13.5 BAKERY PROCESSING EQUIPMENT MARKET

13.5.1 MARKET DEFINITION

13.5.2 MARKET OVERVIEW

TABLE 188 BAKERY PROCESSING EQUIPMENT MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 189 BAKERY PROCESSING EQUIPMENT MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

14 APPENDIX (Page No. - 250)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

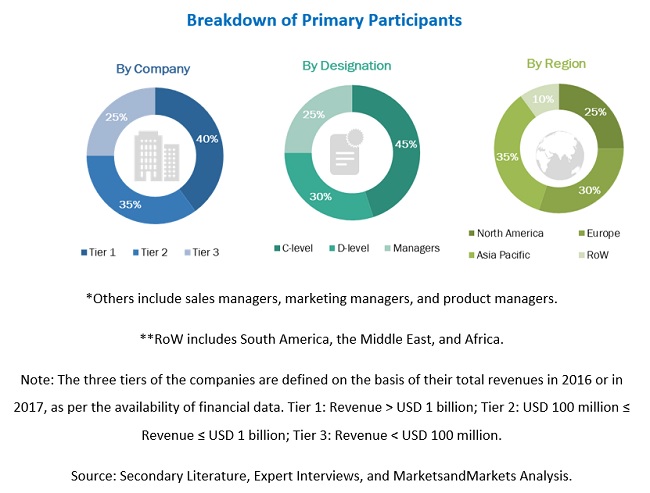

The study involves four major activities to estimate the current market size for the beverage processing equipment market. Exhaustive secondary research was done to collect information on the market as well as its peer and parent markets. The findings, assumptions, and market size were validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to, so as to identify and collect information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Secondary research was mainly used to obtain key information about the industry’s value chain and supply chain, the total pool of key customers, market classification, and segmentation according to industry trends to the bottom-most level and geographical markets. It was also used to obtain information on the key developments from a market-oriented perspective.

Primary Research

The market includes several stakeholders in the supply chain—suppliers, R&D institutes, and end-product manufacturers. The demand side of the market is characterized by the presence of beverage manufacturers and the foodservice sector. The supply side is characterized by the presence of key providers of raw materials. Various primary sources from the supply and demand sides of both markets were interviewed to obtain qualitative and quantitative information.

Given below is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the market. These approaches were also used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following details:

- The key customers in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market customers, along with extensive interviews for opinions from leaders such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both top-down and bottom-up approaches.

Target Audience:

- Government organizations

- Service providing company officials

- Government and research organizations

- Research officers

- CEOs and vice presidents

- Marketing directors

- Product innovation directors and related key executives from manufacturing companies and organizations operating in the market

- Manufacturing and marketing companies

Report Objectives

- Determining and projecting the size of the beverage processing equipment market, with respect to type, beverage product, mode of operation regional markets, over seven years, ranging from 2019 to 2026

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyzing the micromarkets, with respect to individual growth trends, future prospects, and their contribution to the total market

- Identifying and profiling the key market players in the beverage processing equipment market

-

Providing a comparative analysis of the market leaders based on the following parameters:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions

- Analyzing the value chain, products, and regulatory frameworks across key regions and their impact on the prominent market players

- Providing insights on key product innovations and investments in the beverage processing equipment market

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to client-specific requirements. The available customization options are as follows:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of Europe beverage processing equipment market

- Further breakdown of the Rest of Asia Pacific beverage processing equipment market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Beverage Processing Equipment Market