The study involved four major activities in estimating the size of the Fiber laser market . Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. Validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the global market size. After that, market breakdown and data triangulation have been used to estimate the market sizes of segments and subsegments.

Secondary Research

Various secondary sources were referred to in the secondary research process to identify and collect information pertinent to this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles by recognized authors; directories; and databases. Secondary research has been mainly carried out to obtain key information about the supply chain of the fiber laser industry, the value chain of the market, the total pool of the key players, market classification, and segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both market- and technology oriented perspectives.

Primary Research

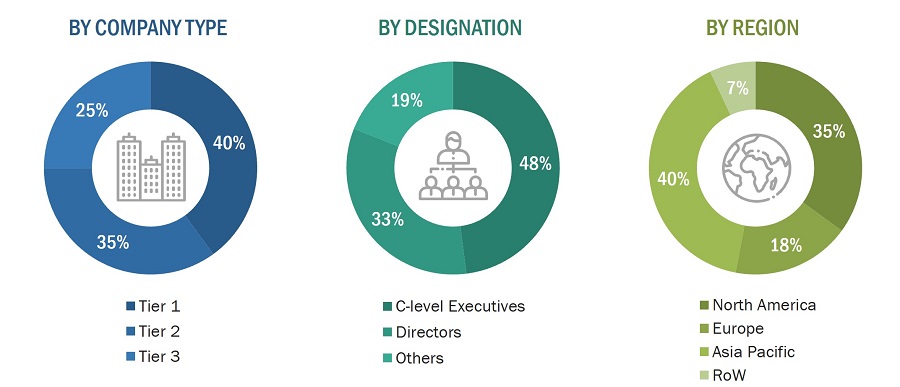

In the primary research process, various primary sources, from both supply and demand sides, were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included experts such as chief executive officers (CEOs), vice presidents, marketing directors, technology and innovation directors, SMEs, consultants, and related key executives from the major companies and organizations operating in the fiber laser market share .

After the complete market engineering process (which includes market statistics calculations, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical market numbers.

Several primary interviews were conducted with experts from both the demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

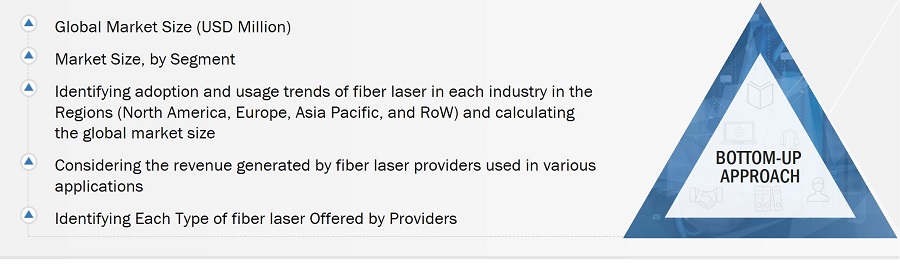

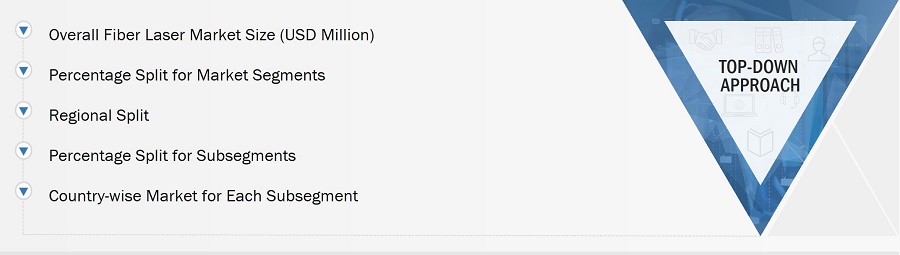

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the fiber laser market. These methods have also been extensively used to estimate the sizes of various market subsegments. The research methodology used to estimate the market sizes includes the following:

-

Information related to the revenue of key manufacturers and providers of fiber laser type was studied and analyzed to estimate the global size of the fiber laser market

-

Multiple discussions were conducted with key opinion leaders to understand the demand for fiber laser products and analyze the break-up of the scope of work carried out by each major company

-

Revenue, geographic presence, key industries served, and the diverse offerings of all identified players in the fiber laser market size were studied to estimate and arrive at the percentage split of different market segments

-

All major players in the fiber laser market size were identified through secondary research and verified through brief discussions with industry experts

-

Multiple discussions were conducted with key opinion leaders of all major companies involved in developing fiber laser solutions to validate the market split based on operation mode, type, output power, industry, and region

-

Geographic splits were estimated using secondary sources on the basis of factors such as the number of players offering fiber laser in a specific country or region and the industries for which these players offer the solutions.

Market Size Estimation Methodology-Bottom-up Approach

Market Size Estimation Methodology-Top-Down Approach

Data Triangulation

The total market was split into several segments after arriving at the overall market size from the market size estimation process explained in the sections above. Market breakdown and data triangulation procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments, wherever applicable. The data was triangulated by studying several factors and trends from both the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

Fiber lasers are a type of solid-state laser which uses optical fiber, doped with rare earth elements which acts as the active gain medium. Optical fiber converts light from pump laser diodes into a laser beam with specific wavelengths. Neodymium, ytterbium, praseodymium, erbium, thulium, holmium, and dysprosium are used as doping elements. Due to this wide range of produced wavelengths, fiber lasers are ideal for a variety of applications such as laser cutting, texturing, cleaning, engraving, drilling, marking, and welding. The industries that use fiber laser technology include commercial, telecommunications, research, aerospace, healthcare, automotive, semiconductor & electronics, industrial, and others (oil & gas, iron & steel, tobacco, glass, wood, retail, and plastics).

Stakeholders

-

End users

-

Government bodies, venture capitalists, and private equity firms

-

Fiber laser manufacturers

-

Fiber laser distributors

-

Fiber laser industry associations

-

Professional service/solution providers

-

Research institutions and organizations

-

Standards organizations and regulatory authorities related to the fiber Laser market

-

System integrators

-

Technology consultants

Research Objectives

-

To define, describe, and project the size of the global fiber laser market, in terms of value, segmented based on type, industry, operation mode, output power and region

-

To project the market size of fiber lasers in terms of volume

-

To forecast the market size for various segments with respect to four main regions—North America, Europe, Asia Pacific, and RoW

-

To provide detailed information regarding the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

-

To analyze the micro markets with respect to individual growth trends, prospects, and contributions to the total market

-

To profile the key market players and comprehensively analyze their market ranking and core competencies.

-

To analyze competitive developments, such as joint ventures, mergers & acquisitions, product launches, and research & development (R&D) activities, in the fiber laser market

-

To provide leadership mapping based on company profiles and key player strategies such as product launches and development, collaborations, expansions, and acquisitions

-

To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market

-

To provide ecosystem analysis, case study analysis, patent analysis, pricing analysis, Porter’s five forces analysis, key stakeholders & buying criteria, key conferences and events, and regulatory bodies, government agencies, and regulations pertaining to the market under study

Available Customizations:

MarketsandMarkets offers the following customizations for this market report:

-

Further breakdown of the market in different regions to the country level

-

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Fiber Laser Market